The global market for industrial fasteners, including M20 nuts, is experiencing steady expansion driven by growing demand across construction, automotive, and infrastructure sectors. According to Mordor Intelligence, the Fasteners Market was valued at USD 103.9 billion in 2023 and is projected to reach USD 137.6 billion by 2029, growing at a CAGR of 4.82% during the forecast period. This growth is fueled by rising industrialization, particularly in Asia-Pacific and emerging economies, where infrastructure development and manufacturing activities are accelerating. As a standard metric heavy hex nut, the M20 nut is critical in high-tensile applications, making it a key component in machinery, structural assembly, and transportation equipment. With increasing quality demands and tighter safety regulations, OEMs and procurement managers are turning to reliable manufacturers who offer precision-engineered, ISO-certified products. In this competitive landscape, the top eight M20 nut manufacturers have distinguished themselves through scale, material innovation, export reach, and compliance with international standards such as DIN, ISO, and ASTM, positioning them at the forefront of a rapidly evolving market.

Top 8 M20 Nut Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 China M20 Hex Bolt Manufacturers and Suppliers, Factory

Domain Est. 2022

Website: hongjifasteners.com

Key Highlights: M20 Hex Bolt Manufacturers, Factory, Suppliers From China, We will supply best quality, the most market competitive price, for every new and old customers ……

#2 M20-2.5 Zinc Plated Finish Hex Nut DIN 934 Class 8

Domain Est. 1998

Website: kljack.com

Key Highlights: In stock $5 deliveryManufacturer, KL Jack Quality Vendor. Item Type, Finish Hex Nut – Metric. System of Measurement, Metric. Diameter, M20. Finish, Zinc Plated. Grade, Class 8….

#3 MJNR20S Steel Jam Nut, M20

Domain Est. 1999

Website: qa1.net

Key Highlights: In stock Free delivery over $350QA1 offers steel jam nuts for industrial markets. Jam nuts are usually half the width of a standard nut and are commonly jammed up against a rod end…

#4 M20

Domain Est. 2008

Website: aftfasteners.com

Key Highlights: In stock Free delivery over $200M20-2.50 Hex Nut, Class 6, Coarse DIN 934 Zinc Cr+3 (30/Pkg.) ; Manufacturer Part #:: 572058 ; Diameter-Thread Size: M20-2.50 ; Material: Steel ; Fi…

#5 m20 stainless steel nut online manufacture

Domain Est. 2020

Website: steelnutbolts.com

Key Highlights: Good quality m20 stainless steel nut from m20 stainless steel nut manufacturers, We sell m20 stainless steel nut online from China….

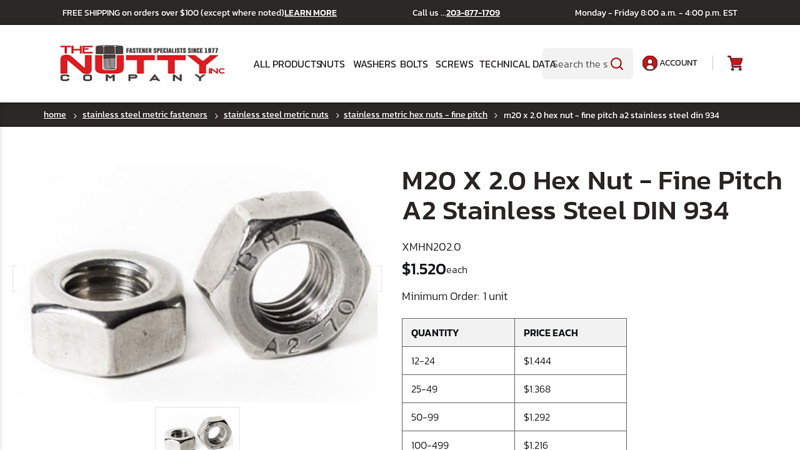

#6 M20 x 2.0 Hex Nut

Domain Est. 1996

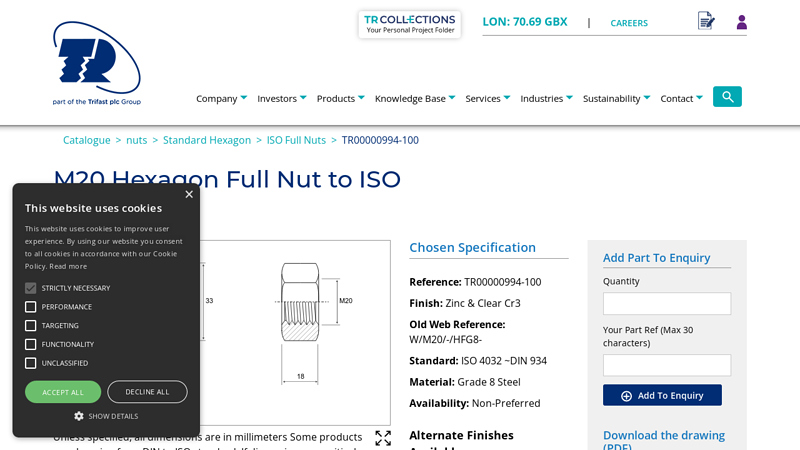

#7 M20 Hexagon Full Nut to ISO

Domain Est. 2000

Website: trfastenings.com

Key Highlights: M20 Hexagon Full Nut to ISO in Grade 8 Steel Zinc & Clear Cr3 with dimensional measurements and 3D model, in a range of finishes….

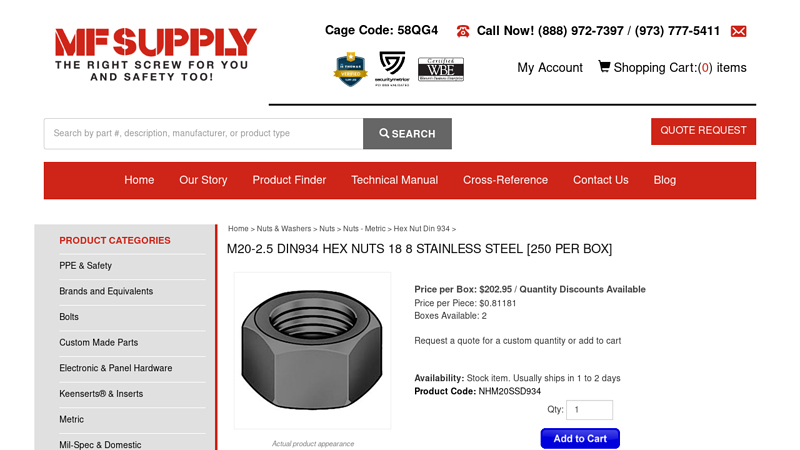

#8 M20

Domain Est. 2004

Website: mfsupply.com

Key Highlights: In stock 8–13 day deliveryMF Supply is a leading supplier of M20-2.5 Din 934 Metric Hex Nuts 18 8 Stainless Steel. Buy online or request a custom quote today!…

Expert Sourcing Insights for M20 Nut

H2 2026 Market Trends for M20 Nuts

The M20 nut market in H2 2026 is expected to be shaped by several key trends, driven by macroeconomic conditions, technological advancements, and evolving industry demands. While precise forecasting carries inherent uncertainty, analysis of current trajectories points to the following developments:

1. Continued Demand in Core Sectors with Selective Growth:

* Infrastructure & Construction: Significant government and private investment in infrastructure projects (bridges, highways, renewable energy installations like wind turbine foundations) will remain the primary driver for standard and high-tensile M20 nuts. Demand will be robust but potentially tempered by project financing delays.

* Automotive & Heavy Equipment: Demand will be steady, particularly for high-grade (e.g., Grade 8, 10.9) M20 nuts used in chassis, suspension, and drivetrain components. Growth will be linked to the pace of EV production ramp-up and heavy machinery demand in emerging markets.

* Energy (Oil & Gas, Renewables): Demand will be mixed. While traditional O&G projects may see cautious spending, the strongest growth is anticipated in renewable energy, especially large-scale solar farms and offshore/onshore wind turbines, where M20 nuts are critical for structural connections. Demand for corrosion-resistant coatings (e.g., hot-dip galvanized, Dacromet) will surge here.

* Aerospace & Defense: Stable demand for specialized, high-precision M20 nuts (often custom alloys, strict certifications) will persist, less susceptible to broader economic fluctuations.

2. Intensifying Focus on Sustainability & Supply Chain Resilience:

* Material Sourcing & Recycling: Pressure will increase for manufacturers to use recycled steel and demonstrate lower carbon footprints. “Green steel” initiatives will gain importance in supplier selection.

* Local Sourcing & Nearshoring: Geopolitical tensions and supply chain disruptions will continue to push major OEMs and EPC contractors towards regional sourcing. Manufacturers with production facilities close to key markets (North America, EU, specific Asian hubs) will gain an advantage. Expect growth in regional manufacturing capacity for standard M20 nuts.

* Circular Economy: Interest in returnable/reusable packaging and end-of-life material recovery programs will grow, though implementation for standard fasteners like M20 nuts remains a challenge.

3. Technological Advancements & Value-Added Offerings:

* Smart Fasteners (Emerging): While not mainstream for standard M20 nuts, R&D in integrated sensors (for torque, tension, corrosion monitoring) will progress. Initial adoption will likely be in high-value, critical applications within aerospace, energy, or large infrastructure.

* Advanced Coatings: Demand for superior corrosion protection beyond basic zinc plating will accelerate. Coatings like zinc-nickel, Dacromet (GEOMET), and duplex systems will see increased adoption, driven by renewable energy and harsh environment applications.

* Digitalization & Traceability: Enhanced digital supply chains, including blockchain for material traceability and QR codes on packaging for certification verification, will become more common, driven by quality and compliance requirements.

4. Pricing and Competitive Dynamics:

* Cost Volatility: Raw material (steel, zinc) prices will remain a key factor. Prices may stabilize somewhat compared to 2022-2023 peaks but are unlikely to return to pre-2021 lows. Energy costs will also impact manufacturing.

* Consolidation & Competition: The market will remain competitive. Larger, integrated manufacturers will compete on scale, quality, and technical support, while specialized players will focus on high-grade, coated, or custom solutions. Price pressure will exist for standard products, pushing innovation towards value-added services.

* Quality & Certification: Stringent quality standards (ISO 898-2, ASTM A563) and material traceability (MTRs) will be non-negotiable. Counterfeit or substandard products will face stronger market resistance.

5. Regional Variations:

* APAC: Expected to be the largest and fastest-growing market, driven by massive infrastructure spending (especially in India, Southeast Asia) and manufacturing output. Competition will be fierce, with a mix of large domestic players and international manufacturers.

* North America & EU: Steady demand driven by infrastructure renewal, energy transition, and manufacturing. Regulations (e.g., REACH, environmental standards) will significantly influence material and coating choices. Focus on nearshoring will benefit regional producers.

* Middle East & Africa: Demand tied to large-scale infrastructure and energy projects. Potential for growth, but dependent on project financing and geopolitical stability.

Conclusion for H2 2026:

The M20 nut market in H2 2026 will be characterized by stable core demand from construction and heavy industry, accelerated growth in renewable energy applications, and a pervasive focus on supply chain resilience, sustainability, and advanced materials. Success will favor manufacturers who offer reliable quality, robust regional supply, innovative corrosion protection, and transparent, sustainable practices. While standard nuts remain a commodity, differentiation through value-added services, technical expertise, and meeting ESG criteria will be increasingly critical for market positioning.

Common Pitfalls When Sourcing M20 Nuts (Quality, IP)

Sourcing M20 nuts, especially for critical applications, requires careful attention to quality standards and intellectual property (IP) considerations. Failure to address these aspects can lead to performance failures, safety hazards, and legal complications. Below are common pitfalls to avoid:

1. Overlooking Material and Grade Specifications

One of the most frequent mistakes is assuming all M20 nuts are the same. Nuts are manufactured in various grades (e.g., Grade 8, 10, or ISO Class 8, 10, and 12), each with different tensile strength and hardness. Using a lower-grade nut than required can result in thread stripping or structural failure under load. Always verify the nut’s compliance with recognized standards such as ISO 4032, DIN 934, or ASTM A563.

2. Ignoring Surface Treatment and Corrosion Resistance

The absence of proper surface coatings (e.g., zinc plating, hot-dip galvanizing, or Dacromet) can lead to premature corrosion, especially in outdoor or high-moisture environments. Sourcing nuts without confirming their environmental suitability increases long-term maintenance costs and risks equipment failure.

3. Procuring Counterfeit or Non-Compliant Products

Low-cost suppliers may offer M20 nuts that mimic reputable brands but fail to meet mechanical or dimensional standards. These counterfeit products often lack proper testing documentation and traceability. Always request mill test certificates (MTCs) and verify third-party certifications like ISO 9001 or CE marking.

4. Neglecting Intellectual Property and Brand Licensing

Some high-performance M20 nuts (e.g., those with proprietary locking mechanisms like Nyloc, Nord-Lock, or Huck) are protected by patents and trademarks. Sourcing imitation versions infringes on IP rights and may compromise performance. Using unlicensed copies can expose companies to legal action and void equipment warranties.

5. Inadequate Supply Chain Traceability

Without clear traceability from raw material to finished product, it becomes difficult to verify quality or respond to failures. Reputable suppliers provide lot numbering and full documentation. Skipping this step increases the risk of inconsistent batches or difficulty in recalls.

6. Focusing Solely on Price

While cost is important, prioritizing the lowest price often leads to compromised quality. Substandard nuts may save money upfront but result in higher total costs due to downtime, repairs, or safety incidents. Invest in quality from trusted suppliers with proven track records.

7. Misalignment with Bolt Grade (Mismatched Pairing)

An M20 nut must be paired with a compatible bolt grade. For example, a Grade 8.8 bolt requires at least a Class 8 nut. Using an under-rated nut can create a weak point in the assembly. Always ensure compatibility between nut and bolt strength classes.

By addressing these pitfalls proactively—through supplier vetting, specification adherence, and IP compliance—organizations can ensure the reliability, safety, and legality of their fastener sourcing.

H2: Logistics & Compliance Guide for M20 Nuts

1. Product Specifications

- Designation: M20 Nut

- Thread Size: Metric M20 (20 mm nominal diameter)

- Pitch: Standard coarse pitch (2.5 mm) unless otherwise specified; fine pitch options (e.g., 1.5 mm) available

- Material: Typically steel (grade 8, 10, or stainless steel A2/A4)

- Standards Compliance: ISO 4032 (regular hex nut), DIN 934, or equivalent

- Finish: Plain, zinc-plated, hot-dip galvanized, or stainless steel (corrosion-resistant)

- Weight (approx.): 55–70 grams per nut (varies by material and plating)

2. Packaging & Unit Load

- Inner Packaging:

- Small quantities: Polybags or blister packs (e.g., 10–100 pcs per bag)

- Medium: Boxed (e.g., 250–500 pcs per cardboard box)

- Outer Packaging:

- Master cartons: Corrugated fiberboard (30–50 kg max gross weight)

- Palletized loads: EUR/ISO pallets (1200 × 800 mm or 1200 × 1000 mm)

- Typical pallet configuration: 40–60 boxes per pallet (20,000–30,000 pcs)

- Labeling:

- Include part number, material grade, finish, quantity, batch/lot number, and compliance marks (e.g., CE, ISO)

- Barcodes (GS1-128) for inventory tracking

3. Transportation & Handling

- Mode of Transport:

- Road: Standard dry freight containers or box trucks

- Sea: 20’ or 40’ dry containers (palletized, secured with straps)

- Air: For urgent shipments (limited by weight and cost)

- Handling Precautions:

- Protect from moisture and corrosive environments during transit

- Use forklifts or pallet jacks; avoid dropping pallets

- Stack no higher than 2–3 layers in storage to prevent crushing

4. Storage Requirements

- Environment:

- Dry, temperature-controlled warehouse (10–30°C)

- Relative humidity < 60% to prevent rust (critical for non-stainless variants)

- Shelving:

- Pallet racking with 15 cm clearance from floor

- Separate storage by material/finish to avoid cross-contamination

- Shelf Life: Indefinite if stored properly; inspect annually for corrosion

5. Regulatory & Compliance

- Certifications:

- ISO 9001 (Quality Management)

- ISO 14001 (Environmental Management) – if applicable

- REACH & RoHS compliance (for EU markets; confirm no restricted substances in plating)

- Import/Export:

- HS Code: 7318.15 (Steel nuts)

- Required documentation: Commercial invoice, packing list, CoO (Certificate of Origin)

- Tariff rates vary by destination (e.g., 2–5% in EU/US)

- Safety & Labeling:

- No hazardous classification under GHS (non-toxic, non-flammable)

- Mark with traceable batch number for quality control

6. Quality Assurance

- Inspection:

- Dimensional checks (thread gauge, caliper) per ISO 2309

- Torque and proof load testing per ISO 898-2

- Salt spray test (e.g., 48–500 hours) for plating durability

- Documentation:

- Mill test certificates (EN 10204 2.2 or 3.1)

- Inspection reports available on request

7. Sustainability & Disposal

- Recyclability: 100% recyclable (ferrous or stainless steel)

- Waste Handling:

- Scrap metal to certified recycling facilities

- Packaging: Recyclable cardboard and plastic (separate streams)

- Carbon Footprint:

- Opt for regional suppliers to reduce transport emissions

- Use recycled content materials where possible

Note: Always verify project-specific requirements (e.g., ASTM, customer engineering specs). Update logistics plans for regional regulations (e.g., UKCA post-Brexit, Inmetro for Brazil).

Conclusion for Sourcing M20 Nuts:

After evaluating various suppliers, material options, quality standards, and cost considerations, the sourcing of M20 nuts should prioritize compliance with international standards such as ISO 4032 or DIN 934 to ensure compatibility and reliability. It is recommended to partner with reputable suppliers offering certified materials (e.g., Grade 8.8, A2/A4 stainless steel) based on the application environment—especially for corrosion resistance or high-stress conditions. Factors such as price competitiveness, lead times, minimum order quantities, and consistent quality control processes are critical in selecting the right vendor. Additionally, establishing long-term agreements with audited suppliers can enhance supply chain stability and reduce procurement risks. In summary, a balanced approach focusing on quality, cost-efficiency, and supplier reliability will ensure successful and sustainable sourcing of M20 nuts for your operational needs.