The global Luer lock IV connectors market is experiencing steady growth, driven by rising hospital admissions, increased use of intravenous therapies, and stringent safety regulations favoring secure connections in medical settings. According to Grand View Research, the global IV connectors market size was valued at USD 2.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. This growth trajectory underscores the critical role of reliable, leak-proof connector systems like Luer lock devices in modern healthcare delivery. As demand surges across hospitals, home care, and outpatient facilities, manufacturers are intensifying innovation in design, infection control, and compatibility. In this competitive landscape, a select group of medical device companies has emerged as leaders—combining regulatory compliance, large-scale production capabilities, and a focus on patient safety. Below are the top 10 Luer lock IV manufacturers shaping the market today.

Top 10 Luer Lock Iv Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Small Diameter Tubing & Cannula Needle Manufacturer

Domain Est. 1999

Website: vitaneedle.com

Key Highlights: Vita Needle is a small diameter tubing and cannula needle manufacturer, and our company provides tube products for a wide range of industries….

#2 Product Catalog

Domain Est. 2016

Website: codanusa.com

Key Highlights: IV Administration Set with ProTract™ peel away coil technology, 10d non-vented spike, Y-injection site, (2) needle-free valves, pinch clamp, rotating luer-lock….

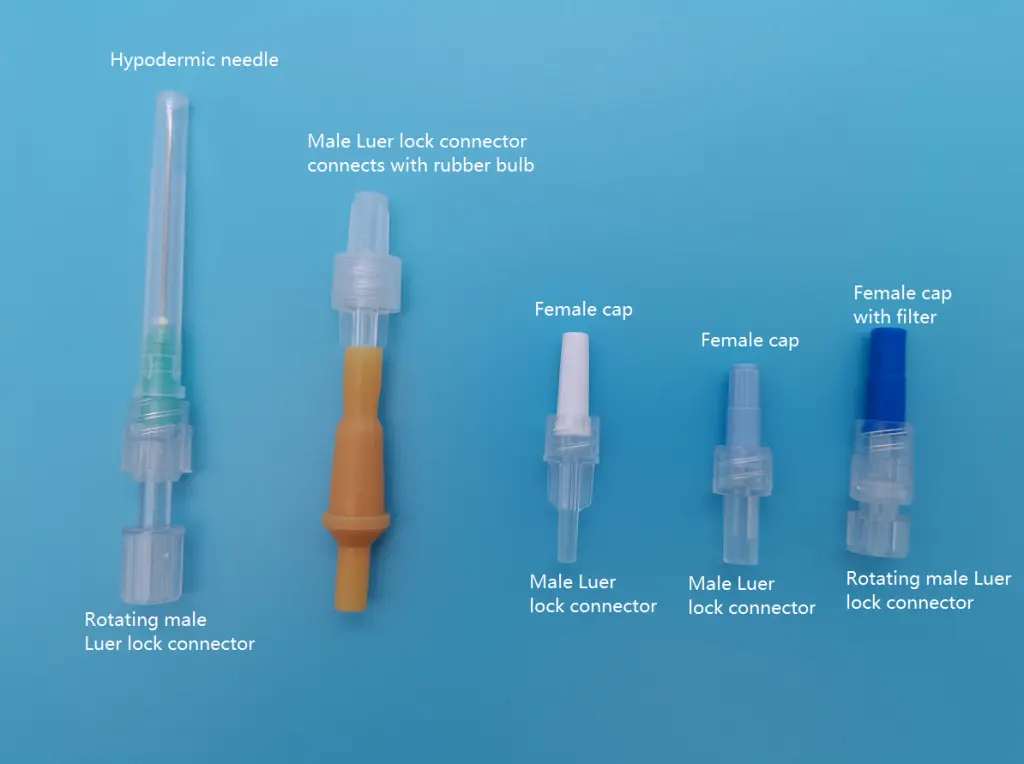

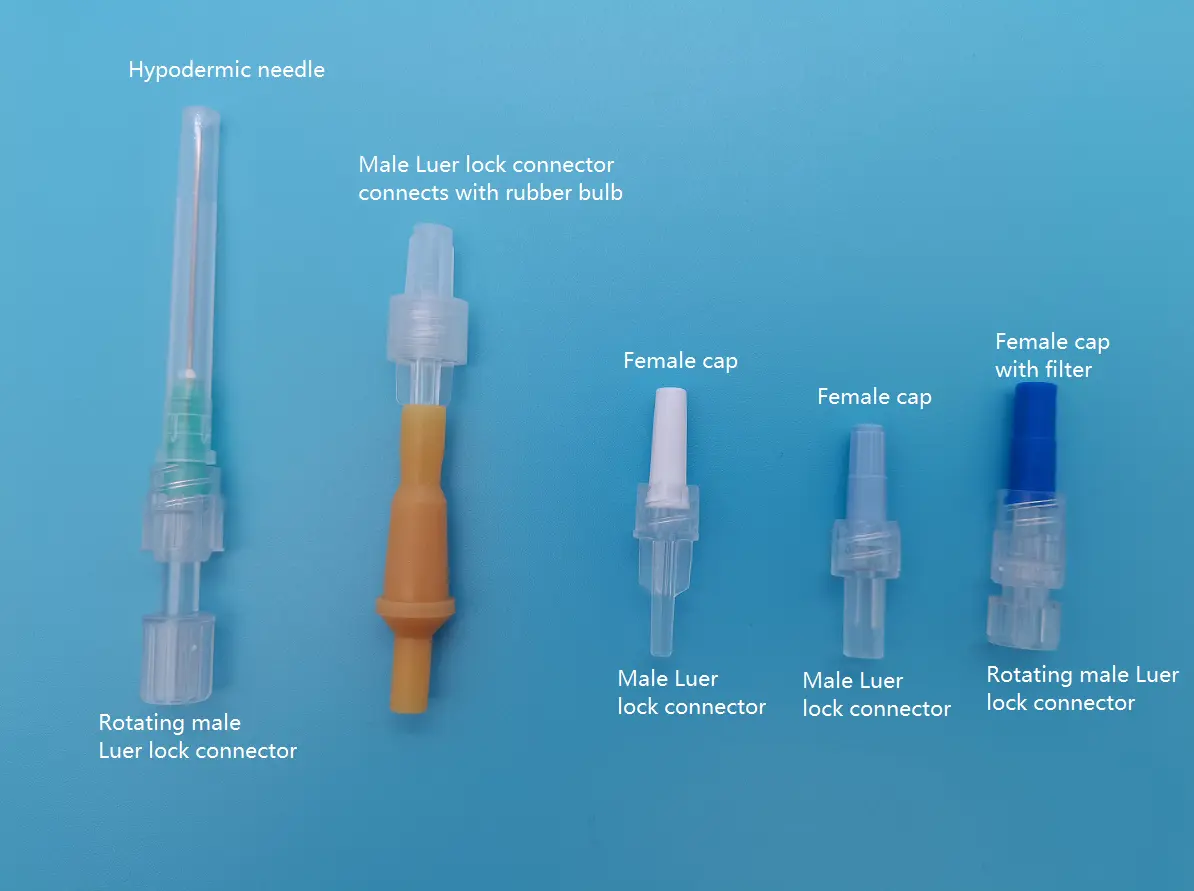

#3 Luer Lock Connectors Manufacturers & Suppliers

Domain Est. 2018

Website: bqplusmedical.com

Key Highlights: BQ Medical produces a variety of standard luer-lock connectors including female luer lock, male luer lock, fluid dispensing connector,luer slip and detachable ……

#4 Luer

Domain Est. 1994

Website: qosina.com

Key Highlights: SmartSite™ Needle-Free Valve T Connector, Female Luer Lock, Male Luer with Spin Lock. 0.096 inch – 0.089 inch ID (2.44 mm – 2.26 mm)….

#5 IV Parts

Domain Est. 1996

Website: boundtree.com

Key Highlights: 1–2 day delivery 7-day returnsShop a variety of IV components including leur lock components, IV cannulas, adapters, connectors, stopcocks, and more from Bound Tree….

#6 IV. Accessories

Domain Est. 1997

Website: us.vygon.com

Key Highlights: A comprehensive range of IV accessories, designed to meet all your medical infusion needs. Our product range includes needle-free connectors, one-way valves ……

#7 ICU Medical

Domain Est. 1997

Website: icumed.com

Key Highlights: Epidural Flat Filter with Rotating Collar – Luer Lock · Peripheral Nerve Block Anesthesia · EchoGlo™ Peripheral Nerve Block Kits and Trays – Continuous ……

#8 I.V. Infusion Sets

Domain Est. 1998

Website: polymedicure.com

Key Highlights: Precise flow rate control of I.V. fluids with range of 5 to 250 ml/hr; With “Y” injection port for intermittent medication; Also available with thumb ……

#9 Air

Domain Est. 2007

Website: air-tite-shop.com

Key Highlights: 4-day delivery 540-day returnsOur catalog and website feature high-quality B. Braun Omnifix® Luer Lock Syringes made in Germany. Slow aspiration and injections are made easy by the…

#10 EQUASHIELD®’s IV Tubing Sets

Domain Est. 2008

Website: equashield.com

Key Highlights: EQUASHIELD® Tubing Sets integrate our Spike Adaptor or Luer-Lock Adaptor. They fit standard IV bags, enabling safe & efficient administration….

Expert Sourcing Insights for Luer Lock Iv

H2: 2026 Market Trends for Luer Lock IV Devices

The global Luer Lock IV devices market is poised for steady growth and transformation by 2026, driven by evolving healthcare needs, technological advancements, and regulatory developments. Luer Lock connectors, known for their secure, threaded design that prevents disconnection in intravenous (IV) applications, remain a critical component in infusion therapy, anesthesia delivery, and diagnostic procedures. The following key trends are expected to shape the market landscape in 2026:

1. Rising Demand in Chronic Disease Management

The increasing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular conditions continues to drive the need for reliable IV access solutions. As outpatient and home-based infusion therapies become more common, the demand for safe, secure Luer Lock connectors is expected to grow, particularly in ambulatory care settings.

2. Focus on Patient Safety and Standardization

With global attention on medical device safety, regulatory bodies like the FDA and EU MDR are reinforcing standards to reduce misconnections. The ISO 80369-7 standard for small-bore connectors, which specifies Luer Lock for IV applications, is being more widely adopted. By 2026, compliance with these standards will likely be a market differentiator, pushing manufacturers to innovate while ensuring compatibility and safety.

3. Growth in Home Healthcare and Telemedicine

The expansion of home healthcare services, accelerated by the pandemic and supported by remote monitoring technologies, is increasing the use of IV therapies outside hospitals. Luer Lock devices are favored in these settings due to their secure connection, reducing the risk of accidental dislodgement. This trend is expected to fuel market growth, especially in North America and Europe.

4. Technological Integration and Smart IV Systems

By 2026, integration of Luer Lock connectors with smart infusion pumps and IoT-enabled devices is anticipated to rise. These systems offer real-time monitoring, dose accuracy, and connectivity with electronic health records (EHRs), enhancing clinical outcomes. Manufacturers are likely to focus on developing Luer Lock-compatible smart solutions that support digital health ecosystems.

5. Emerging Markets Driving Volume Growth

Asia-Pacific and Latin America are expected to show strong market expansion due to improving healthcare infrastructure, rising medical tourism, and increased government spending on healthcare. Local production and partnerships with global suppliers will play a key role in meeting demand for cost-effective, high-quality Luer Lock IV components.

6. Sustainability and Single-Use Device Innovation

Environmental concerns are prompting manufacturers to explore sustainable materials and reprocessing options for certain IV components. While Luer Lock connectors are typically single-use, innovations in biodegradable polymers and recycling programs may gain traction by 2026, aligning with broader ESG (Environmental, Social, and Governance) goals in healthcare.

7. Competitive Landscape and Strategic Consolidation

The market is expected to see continued consolidation, with major players acquiring niche innovators to expand their portfolios in IV safety and connectivity. Companies such as B. Braun, BD (Becton Dickinson), and Smiths Medical are likely to lead in product development and regulatory compliance.

In summary, the 2026 Luer Lock IV market will be characterized by a strong emphasis on safety, technological integration, and expanding access to care. Stakeholders who align with global standards, invest in smart health integration, and respond to regional healthcare dynamics will be well-positioned for success.

Common Pitfalls Sourcing Luer Lock IV Components (Quality, IP)

Sourcing Luer Lock IV components—such as connectors, syringes, and fittings—requires careful attention to both quality and intellectual property (IP) considerations. Overlooking these aspects can lead to regulatory non-compliance, product failure, legal disputes, and reputational damage. Below are the most common pitfalls in these two critical areas:

Quality-Related Pitfalls

1. Inadequate Material Biocompatibility and Regulatory Compliance

A frequent oversight is selecting materials that do not meet biocompatibility standards such as ISO 10993 or USP Class VI. Using non-compliant plastics or elastomers can result in patient safety risks, including toxic leachables or allergic reactions. Additionally, components may not meet FDA, CE, or other regional medical device regulations, leading to market access delays or recalls.

2. Poor Dimensional Accuracy and Interoperability

Luer Lock connectors must adhere strictly to ISO 80369 and ISO 594 standards to ensure compatibility across devices. Sourcing from suppliers with inconsistent tolerances or inadequate quality control can result in leaks, disconnections, or cross-threading—posing serious clinical risks.

3. Inconsistent Manufacturing Processes and Lack of Traceability

Suppliers without robust quality management systems (e.g., ISO 13485 certification) may deliver inconsistent batches. Missing serialization, lot traceability, or inadequate documentation undermines product reliability and complicates recalls or audits.

4. Insufficient Testing and Validation Data

Some suppliers provide limited or no validation data (e.g., leak testing, pull-off force, torque resistance). Relying on components without verified performance data increases the risk of field failures and regulatory scrutiny during submissions.

Intellectual Property (IP) Pitfalls

1. Inadvertent Use of Patented Designs or Features

Many Luer Lock configurations, especially safety-engineered or specialty variants (e.g., needle-free valves), are protected by patents. Sourcing generic copies without conducting a freedom-to-operate (FTO) analysis can expose the buyer to infringement claims, litigation, or forced product redesigns.

2. Counterfeit or Unauthorized OEM Components

Purchasing from unauthorized distributors or gray-market suppliers increases the risk of receiving counterfeit parts that mimic branded designs. These may not only violate IP rights but also compromise performance and safety due to substandard materials or manufacturing.

3. Lack of Clear IP Ownership in Custom Tooling

When developing custom Luer Lock components, the ownership of molds, designs, and technical specifications is often not clearly defined in supplier contracts. This can lead to disputes over tooling rights, restrict manufacturing flexibility, or enable the supplier to replicate the design for competitors.

4. Inadequate Supplier Agreements on IP Indemnification

Many sourcing agreements fail to include clauses where the supplier indemnifies the buyer against IP infringement claims. Without this protection, the buyer may bear full legal and financial liability even if the component was sourced in good faith.

Conclusion

To mitigate these risks, medical device companies should conduct thorough due diligence on suppliers, verify regulatory and quality certifications, perform IP landscape analyses, and establish clear contractual terms. Partnering with reputable, certified manufacturers and involving legal and regulatory teams early in the sourcing process is essential to ensure both product safety and IP compliance.

Logistics & Compliance Guide for Luer Lock IV Devices

Overview

Luer lock intravenous (IV) devices are critical components in medical settings, providing secure connections for fluid, medication, and blood product delivery. Ensuring proper logistics and compliance throughout the supply chain is essential for patient safety, regulatory adherence, and operational efficiency.

Regulatory Compliance Requirements

FDA Regulations (U.S.)

Luer lock IV devices are classified as medical devices under 21 CFR Part 880 (General Hospital and Personal Use Devices). Key compliance considerations include:

– 510(k) Clearance: Most Luer lock connectors require premarket notification unless exempt.

– Unique Device Identification (UDI): Devices must bear a UDI barcode compliant with FDA standards for traceability.

– Quality System Regulation (QSR): Manufacturers must adhere to 21 CFR Part 820, including design controls, production, and process validation.

ISO Standards

- ISO 80369-7: Specifies small-bore connectors for intravascular applications to prevent misconnections.

- ISO 594-1 and ISO 594-2: Define requirements and testing methods for Luer lock fittings (now superseded by ISO 80369 series but still referenced).

- ISO 13485: Quality management system standard for medical device manufacturers.

EU MDR Compliance

Under the EU Medical Device Regulation (EU) 2017/745:

– Devices must have CE marking.

– Full conformity assessment may be required based on classification.

– UDI implementation via EUDAMED is mandatory.

– Notified Body involvement is often required for Class IIa and higher devices.

Supply Chain & Logistics Management

Procurement & Sourcing

- Source only from ISO 13485-certified suppliers.

- Verify device compliance with regional regulations (FDA, CE, etc.).

- Ensure packaging includes UDI, lot number, and expiration date.

- Maintain documentation for audit trails (Certificates of Conformance, test reports).

Storage Conditions

- Store in a clean, dry environment with controlled temperature (typically 15–30°C).

- Protect from direct sunlight and excessive humidity.

- Follow manufacturer’s shelf-life guidelines; avoid expired inventory.

- Use first-expiry, first-out (FEFO) inventory rotation.

Transportation

- Use validated packaging to prevent damage during transit.

- Ensure temperature control if required (e.g., for sterile barrier integrity).

- Partner with carriers experienced in medical device logistics.

- Monitor shipments using track-and-trace systems with UDI integration.

Inventory Control

- Implement barcode/RFID scanning systems aligned with UDI.

- Conduct regular audits to reconcile physical stock with records.

- Segregate non-conforming or recalled products immediately.

- Maintain lot traceability from receipt to point of use.

Quality Assurance & Risk Mitigation

Incoming Inspection

- Verify labeling accuracy (UDI, sterilization status, lot number).

- Inspect packaging for damage or tampering.

- Perform functional checks if required (e.g., leak testing for sample units).

Recall Preparedness

- Establish a recall protocol aligned with FDA and EU MDR requirements.

- Maintain up-to-date customer and distributor contact lists.

- Conduct mock recalls annually to test traceability and response time.

Training & Documentation

- Train staff on proper handling, storage, and identification of Luer lock devices.

- Document all logistics processes, including deviations and corrective actions.

- Keep training records and standard operating procedures (SOPs) accessible.

Best Practices for Compliance & Efficiency

- Integrate UDI data into hospital and distributor inventory systems.

- Monitor regulatory updates (e.g., FDA guidance, EU MDR amendments).

- Collaborate with suppliers on sustainability and labeling harmonization.

- Use automated systems for expiration date alerts and stock reordering.

Conclusion

Effective logistics and compliance for Luer lock IV devices require a proactive approach grounded in regulatory adherence, robust quality systems, and transparent supply chain management. By aligning with FDA, ISO, and EU MDR standards, healthcare providers and distributors can ensure patient safety and operational reliability.

Conclusion for Sourcing Luer Lock IV Devices

Sourcing Luer Lock IV devices requires careful evaluation of quality, regulatory compliance, supplier reliability, and cost-effectiveness. These critical medical components must meet strict international standards such as ISO 80369-7 and ISO 594 to ensure compatibility, safety, and prevention of misconnections in clinical settings. When selecting suppliers, it is essential to prioritize those with proven adherence to Good Manufacturing Practices (GMP), full traceability, and certifications from recognized bodies like FDA, CE, or other national regulatory authorities.

Additionally, conducting thorough due diligence—such as assessing production capabilities, quality control processes, and supply chain resilience—helps mitigate risks related to product failure or supply disruptions. Building long-term partnerships with reputable manufacturers not only ensures consistent product quality but also supports compliance and patient safety. Ultimately, a strategic sourcing approach for Luer Lock IV devices balances cost considerations with uncompromising quality, contributing to improved clinical outcomes and operational efficiency in healthcare delivery.