The global lubricating oil market is experiencing steady expansion, driven by increasing demand from the automotive, industrial, and manufacturing sectors. According to a report by Mordor Intelligence, the market was valued at USD 135.6 billion in 2023 and is projected to grow at a CAGR of over 3.8% from 2024 to 2029. This growth is fueled by rising vehicle production, extended oil drain intervals, and the growing adoption of synthetic lubricants for enhanced performance and efficiency. Additionally, Grand View Research highlights the impact of stringent environmental regulations pushing manufacturers toward eco-friendly and high-performance formulations. In this evolving landscape, key players are intensifying investments in R&D and strategic partnerships to strengthen their market position. As competition heats up, the top lubricating oil manufacturers are not only leading in production volume but also in innovation, sustainability, and global reach—shaping the future of the industry.

Top 10 Lubricating Oil Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 JAX INC.

Domain Est. 1995

Website: jax.com

Key Highlights: JAX is a US-based industrial lubricant manufacturer with expertise formulating high-performance synthetic lubricants, fleet and heavy-duty lubricants ……

#2 Schaeffer Oil

Domain Est. 1998

Website: schaefferoil.com

Key Highlights: The official website of Schaeffer’s Specialized Lubricants, manufacturer of Schaeffer’s Oil, industrial lubricants, synthetic engine oils, fuel additives, ……

#3 lubricants & base oils

Domain Est. 1990

Website: chevron.com

Key Highlights: Chevron provides lubricants and premium base oils to commercial, consumer and industrial customers. Sold worldwide under Chevron®, Texaco® & Caltex® brands….

#4 Personal vehicle, Industrial lubricants, and oil filters

Domain Est. 1991

Website: mobil.com

Key Highlights: Heavy-duty lubricants. Explore Mobil Delvac 1™ and Mobil Delvac™ products, including diesel engine oils, transmission fluids, gear oils and antifreeze/coolant….

#5 The Independent Lubricant Manufacturers Association

Domain Est. 1996

Website: ilma.org

Key Highlights: Our members make specialized lubricants for everything from backhoes to bone screws, keeping planes in the air; cars on the road; and the machines in businesses ……

#6 Industrial Food Grade Lubricants

Domain Est. 1996

Website: lubriplate.com

Key Highlights: The highest quality food grade, synthetic, and petroleum-based lubricants that meet and exceed your expectations….

#7 WD-40 Lubricants, Degreasers & Rust Removal Products

Domain Est. 1994

Website: wd40.com

Key Highlights: WD-40 Multi-Use Product protects metal from rust and corrosion, penetrates stuck parts, displaces moisture and lubricates almost anything. WD-40 Multi-Use ……

#8 ELF Lubricants A Brand of Passion

Domain Est. 1999

Website: elf.com

Key Highlights: ELF offers a wide range of lubricants, including competition oils. Our products are designed to cater to the needs of the most up-to-date engines, enabling ……

#9 TotalEnergies Lubricants

Domain Est. 2014

Website: lubricants.totalenergies.com

Key Highlights: TotalEnergies Lubrifiants offers a wide range of products and services:oil analysis, adblue, engine oil, transmission fluids, brake fluids, coolants &…

#10 Ridgeline Lubricants

Domain Est. 2019

Website: ridgelinelubricants.com

Key Highlights: Ridgeline™ transmission fluids are designed for improved performance and protection against oxidation, varnish, and sludge at high temperatures. Learn more >….

Expert Sourcing Insights for Lubricating Oil

H2: Projected Market Trends in the Global Lubricating Oil Industry for 2026

The global lubricating oil market is poised for substantial transformation by 2026, driven by technological advancements, regulatory shifts, and evolving industrial and consumer demand. Several key trends are expected to shape the industry landscape in the coming years:

-

Growth in Industrial and Automotive Demand

By 2026, rising industrialization in emerging economies—particularly in Asia-Pacific (China, India, and Southeast Asia)—will continue to fuel demand for lubricating oils. The expansion of manufacturing, construction, and mining sectors will require high-performance lubricants for machinery and equipment. Additionally, despite the growth of electric vehicles (EVs), the internal combustion engine (ICE) vehicle fleet will remain significant, especially in developing regions, sustaining demand for engine oils. However, the overall demand growth may moderate due to increasing vehicle efficiency and longer oil-change intervals. -

Shift Toward High-Performance and Synthetic Lubricants

There is a marked shift from conventional mineral-based lubricants to synthetic and semi-synthetic variants. Synthetic lubricants offer superior thermal stability, oxidation resistance, and longer service life, making them ideal for advanced engines and heavy-duty applications. By 2026, the synthetic lubricant segment is expected to grow at a CAGR exceeding 5%, driven by stricter OEM specifications and performance requirements in automotive and industrial sectors. -

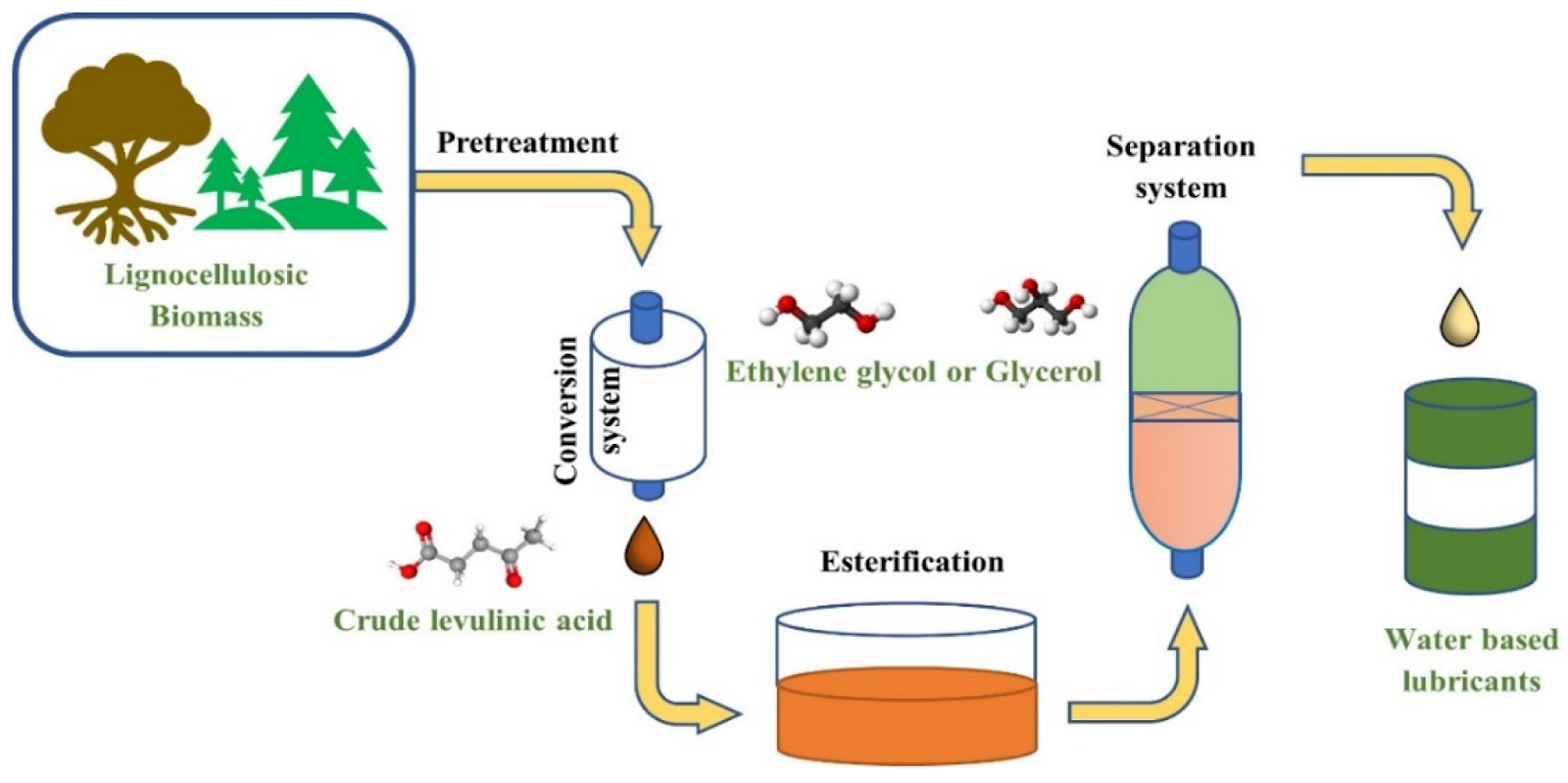

Sustainability and Bio-Based Lubricants

Environmental regulations and corporate sustainability goals are accelerating the adoption of bio-based and biodegradable lubricants. Derived from renewable sources such as vegetable oils, these eco-friendly alternatives are gaining traction in sensitive applications like marine, agriculture, and forestry. By 2026, the bio-lubricants market is projected to expand significantly, supported by government incentives and growing environmental consciousness. -

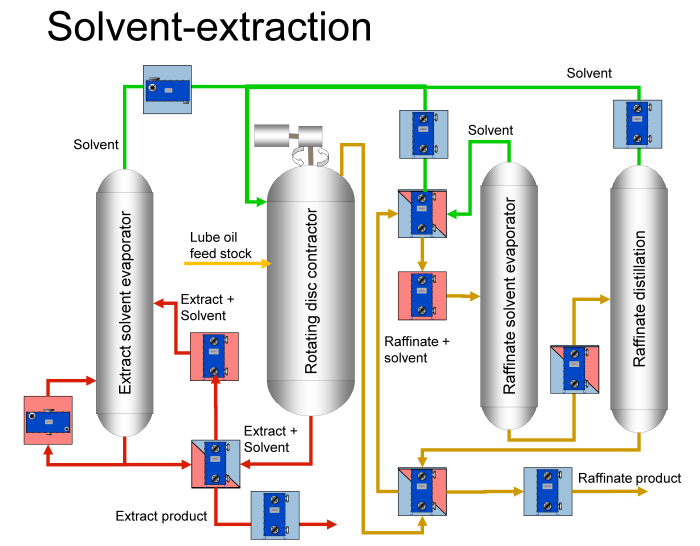

Circular Economy and Oil Re-Refining

The push for a circular economy is enhancing the importance of used oil collection and re-refining. Regenerated base oils produced through advanced re-refining technologies offer a sustainable alternative to virgin base oils, reducing dependence on crude oil and minimizing environmental impact. By 2026, regulatory frameworks in North America and Europe are expected to mandate higher recycling rates, boosting investment in re-refining infrastructure. -

Digitalization and Smart Lubrication Solutions

The integration of digital technologies—such as IoT-enabled sensors, predictive analytics, and condition monitoring—is transforming lubrication management. Smart lubrication systems allow real-time tracking of oil condition, enabling predictive maintenance and optimized oil usage. By 2026, these technologies will be increasingly adopted in industrial and transportation sectors to improve efficiency and reduce operational costs. -

Geopolitical and Feedstock Volatility

The lubricating oil market remains sensitive to fluctuations in crude oil prices and geopolitical tensions affecting supply chains. Base oil production, particularly Group II and Group III, is concentrated in specific regions (e.g., Middle East, Asia, and North America), making the market vulnerable to supply disruptions. By 2026, companies are expected to diversify sourcing strategies and invest in resilient supply chains to mitigate such risks. -

Regional Market Dynamics

- Asia-Pacific: Expected to remain the largest and fastest-growing market due to industrial expansion and automotive production.

- North America and Europe: Mature markets focusing on premium, synthetic, and sustainable lubricants, with steady growth driven by replacement demand and regulatory compliance.

- Latin America, Middle East, and Africa: Moderate growth supported by infrastructure development and energy sector activities, though constrained by economic volatility in some regions.

In conclusion, by 2026, the lubricating oil market will be characterized by innovation, sustainability, and digital integration. Companies that invest in high-performance formulations, circular economy models, and digital lubrication solutions will be best positioned to capitalize on emerging opportunities in a competitive and evolving global landscape.

Common Pitfalls in Sourcing Lubricating Oil: Quality and Intellectual Property (IP) Risks

Sourcing lubricating oil involves complex technical and legal considerations. Overlooking key quality and intellectual property (IP) aspects can lead to equipment failure, safety hazards, financial loss, and legal exposure. Below are the most common pitfalls organizations encounter:

1. Inadequate Quality Verification and Specification Compliance

One of the most frequent issues is assuming that supplier claims match actual product performance.

- Reliance on Supplier Data Sheets Alone: Accepting product specifications based solely on manufacturer-provided documents without independent verification can be risky. Some suppliers may exaggerate performance or use outdated test data.

- Lack of Third-Party Testing: Failing to conduct or require independent lab testing (e.g., ASTM or ISO standard verification) upon delivery increases the risk of receiving off-spec or contaminated oil.

- Mismatched Performance Standards: Procuring oil that meets generic industry standards (e.g., API or ACEA) without ensuring it aligns with the original equipment manufacturer (OEM) requirements can void warranties or reduce equipment lifespan.

Best Practice: Enforce strict incoming inspection protocols, require Certificates of Analysis (CoA), and conduct periodic batch testing through accredited laboratories.

2. Counterfeit or Adulterated Products

The lubricant market is vulnerable to counterfeit and diluted oils, especially in regions with weak regulatory enforcement.

- Substandard Base Oils or Additive Packages: Some suppliers cut costs by using lower-grade base oils or reducing additive concentrations, resulting in poor oxidation stability, reduced viscosity, or inadequate wear protection.

- Relabeling and Gray Market Goods: Unauthorized resellers may repackage or relabel oils, leading to misidentification and inconsistent quality.

Best Practice: Source only from authorized distributors or directly from reputable manufacturers. Verify batch traceability and use tamper-evident packaging where possible.

3. Intellectual Property Infringement Risks

Lubricant formulations are often protected by patents, trademarks, and trade secrets. Ignoring IP can expose buyers to legal liability.

- Use of Imitation or “Equivalent” Products: Some suppliers market “compatible” or “equivalent” oils that may infringe on patented formulations or misrepresent OEM approvals.

- Unauthorized OEM Branding: Using oils labeled with OEM names (e.g., “Meets Ford WSS-M2C949-A specification”) without proper licensing or validation may constitute trademark misuse.

Best Practice: Ensure that any claimed OEM approvals are officially licensed or verified. Avoid products making unverified equivalence claims and consult legal counsel when in doubt.

4. Lack of Traceability and Documentation

Poor documentation undermines quality assurance and regulatory compliance.

- Incomplete Batch Records: Missing or falsified batch numbers, manufacturing dates, or origin details make it difficult to trace contamination or performance issues.

- Non-Compliant Safety Data Sheets (SDS): Inaccurate or outdated SDS can lead to non-compliance with OSHA, REACH, or other regulatory frameworks.

Best Practice: Require full traceability from raw material sourcing to final product. Maintain digital records of CoAs, SDS, and shipment logs.

5. Overlooking Environmental and Regulatory Compliance

Environmental regulations increasingly govern lubricant composition and disposal.

- Restricted Substances: Some oils may contain banned or regulated substances (e.g., certain heavy metals or PCBs) in violation of RoHS, REACH, or TSCA.

- Biodegradability and Toxicity Misrepresentation: Claims of “eco-friendly” or “biodegradable” oils may be unsubstantiated, leading to environmental penalties.

Best Practice: Verify compliance with all relevant environmental regulations and request supporting documentation for green claims.

6. Supplier Vetting and Relationship Management Failures

Choosing suppliers based solely on price, without due diligence, increases exposure to quality and IP risks.

- Unverified Supplier Credentials: Working with uncertified or unaccredited suppliers increases the risk of receiving substandard or counterfeit products.

- Weak Contractual Protections: Contracts that lack clear quality clauses, IP indemnification, or audit rights leave the buyer vulnerable.

Best Practice: Conduct thorough supplier audits, including facility inspections and quality management system reviews (e.g., ISO 9001). Include IP warranties and audit rights in procurement contracts.

By proactively addressing these pitfalls, organizations can ensure reliable lubricant performance, maintain equipment integrity, and mitigate legal and financial risks associated with quality and intellectual property.

H2: Logistics & Compliance Guide for Lubricating Oil

Transporting, storing, and handling lubricating oils requires strict adherence to safety, environmental, and regulatory standards. This guide outlines key logistics considerations and compliance requirements to ensure safe and legal operations.

H2: Regulatory Classification & Documentation

- UN Number & Hazard Class: Most lubricating oils are classified under UN 1202, FUELS, OIL, N.O.S. (e.g., lubricating oil). They are typically Class 3 Flammable Liquids due to flash points often between 60°C and 93°C (140°F – 200°F), though some heavier oils may be non-regulated for transport if the flash point is ≥ 93°C (200°F). Always verify the specific product’s Safety Data Sheet (SDS).

- GHS/CLP Classification: Lubricating oils are commonly classified as:

- Flammable Liquid (Category 4) if flash point is between 60°C and 93°C.

- Specific Target Organ Toxicity – Repeated Exposure (Category 2) (STOT RE 2) due to potential aspiration hazard and long-term health effects (e.g., skin irritation, potential carcinogenicity of some base stocks/additives).

- Hazardous to the Aquatic Environment (Acute and Chronic, Category 1 or 2).

- Mandatory Documentation:

- Safety Data Sheet (SDS): Required under GHS/CLP/OSHA HazCom. Must be provided with shipment and accessible to handlers.

- Transport Documents: For road/rail/sea/air, include UN number, proper shipping name, hazard class, packing group (usually PG III for flammable liquids), total quantity, and emergency contact information.

- Bill of Lading/Air Waybill: Must accurately reflect hazardous material information.

- Permits: May be required for bulk transport (e.g., DOT Hazardous Materials Endorsement for drivers in the US).

H2: Packaging, Labeling & Marking

- Packaging: Must be UN-certified and suitable for Class 3 liquids.

- Drums: Typically 200L (55-gallon) steel drums with secure, leak-proof closures. IBCs (Intermediate Bulk Containers) like 1000L totes are common for larger volumes.

- Bulk: Tank trucks, rail tank cars, or marine tankers require specific design, construction, and inspection certifications (e.g., DOT 407, ADR/RID tank codes).

- Small Containers: Pails, jerry cans, or bottles must be tightly sealed and packed in outer packaging.

- Labeling:

- Primary Hazard Label: Class 3 Flammable Liquid diamond label (red with flame symbol).

- Subsidiary Hazard Labels: May include Environment Hazard (dead fish/tree) and/or Health Hazard (exclamation mark or health hazard pictogram for STOT RE 2).

- GHS Pictograms: Flammable, Health Hazard, and Environmental Hazard pictograms as per SDS classification.

- Marking: Packages must be durably marked with:

- UN number (UN 1202)

- Proper Shipping Name (FUELS, OIL, N.O.S. (lubricating oil))

- Name and address of shipper/consignee

- Net quantity

- UN certification mark on packaging (e.g., UN 1A2/Y)

H2: Transport Requirements (Road, Rail, Air, Sea)

- Road (e.g., ADR in Europe, 49 CFR in USA):

- Vehicles must display Class 3 orange placards front, rear, and both sides if quantity exceeds reporting thresholds (varies by jurisdiction, e.g., ~333 L in US).

- Drivers require hazardous materials endorsement (HME) on commercial license (e.g., CDL in US).

- Vehicles must carry Emergency Response Information (e.g., ERG guide pages).

- Segregation: Keep away from strong oxidizers, acids, alkalis.

- Rail (e.g., AAR/OS/7, RID): Similar requirements to road transport. Tank cars must meet specific design standards. Shipper must provide accurate manifest.

- Air (IATA DGR):

- More restrictive: Generally prohibited from passenger aircraft. May be permitted on cargo aircraft under “Forbidden” with specific exceptions (e.g., UN 1202, PG III, limited quantities). Always check latest IATA DGR.

- Requires Shipper’s Declaration for Dangerous Goods, specific packaging, and labeling.

- Sea (IMDG Code):

- Requires Dangerous Goods Manifest and Stowage Plan.

- Segregation: Keep away from foodstuffs, living quarters, heat sources. Specific stowage codes apply (e.g., “Keep away from living quarters,” “Protect from sunlight”).

- Vessels display Class 3 placards.

H2: Storage & Handling

- Location: Store in a well-ventilated, cool, dry area away from direct sunlight, heat sources, and ignition sources. Flammable Storage Cabinets (UL/EN certified) are mandatory for quantities exceeding local limits (e.g., > 60L in many jurisdictions). Secondary containment (bunds/dikes) is essential for bulk storage.

- Containment: Use spill pallets for drums/IBCs. Bunds must hold 110% of the largest container or 25% of total stored volume. Regularly inspect for leaks.

- Handling:

- Use appropriate PPE: Chemical-resistant gloves, safety glasses/goggles, protective clothing, and respiratory protection if vapors/aerosols are present.

- Use pumps or dedicated funnels; NEVER siphon by mouth.

- Prevent static discharge during transfer (bonding & grounding for bulk transfers).

- Minimize dust generation when handling powders (additives).

- Segregation: Store away from incompatible materials (oxidizers, acids, alkalis, foodstuffs).

H2: Spill Response & Emergency Preparedness

- Spill Kits: Maintain readily accessible spill kits (absorbents, PPE, disposal bags, containment booms) appropriate for oil volumes.

- Response Procedures:

- Evacuate & Alert: Clear area, eliminate ignition sources, notify supervisor/emergency services.

- Contain: Prevent spread using absorbents, booms, or diking.

- Clean Up: Use oil-only absorbents (pads, socks, granular). Collect contaminated material in sealed, labeled containers.

- Decontaminate: Clean surfaces with appropriate degreasers.

- Dispose: Treat as hazardous waste (consult SDS and local regulations).

- Emergency Equipment: Ensure fire extinguishers (Class B: foam, CO2, dry chemical) are available and accessible. Eyewash stations and safety showers required where handling occurs.

- Training: Personnel must be trained in SDS understanding, spill response, fire procedures, and use of PPE/emergency equipment.

H2: Waste Management & Disposal

- Used Oil: Classified as Hazardous Waste in most jurisdictions due to contamination (heavy metals, additives, PAHs). Never dispose of down drains or on the ground.

- Regulations: Strictly regulated (e.g., US EPA 40 CFR Part 279, EU Waste Framework Directive). Requires proper storage (labeled containers, secondary containment) and disposal via licensed hazardous waste contractors.

- Recycling: Strongly encouraged. Used oil can often be re-refined into base stock. Partner with certified recyclers.

- Containers: Empty containers (drums, IBCs) may still contain hazardous residues. Must be properly emptied (triple-rinsed or drained), labeled, and disposed of as hazardous waste or recycled through specialized programs. “Empty” does not mean residue-free.

H2: Key Compliance Agencies & Standards

- Transport: DOT (USA), ECHA/ADR/RID/IMDG/IATA (Global/Europe), Transport Canada (Canada).

- Chemical Safety: OSHA (USA – HazCom), HSE (UK), EU CLP Regulation.

- Environmental: EPA (USA – RCRA, SPCC), Environment Agency (UK), EU REACH/CLP.

- Spill Prevention: EPA SPCC Rule (USA – for large on-site storage).

- Standards: NFPA 30 (Flammable & Combustible Liquids Code), API standards.

Disclaimer: Regulations vary significantly by country, region, and specific product formulation. Always consult the product SDS and the latest applicable national, state/provincial, and local regulations before transport, storage, or disposal. This guide provides general principles but is not a substitute for expert advice.

Conclusion for Sourcing Lubricating Oil

In conclusion, sourcing high-quality lubricating oil is a critical component in ensuring the efficient, reliable, and long-term performance of industrial machinery and automotive systems. A strategic sourcing approach should prioritize product specifications, supplier reliability, cost-effectiveness, and compliance with industry standards and environmental regulations. Evaluating viscosity, thermal stability, oxidation resistance, and additive composition ensures compatibility with specific operational demands. Additionally, selecting reputable suppliers with consistent quality control, technical support, and sustainable practices contributes to operational efficiency and reduced downtime. By balancing performance requirements with economic and environmental considerations, organizations can optimize their lubricant sourcing strategy, leading to improved equipment longevity, reduced maintenance costs, and enhanced overall productivity.