The global engineered wood market has seen consistent expansion, with laminated panels—commonly known as Luan panels—playing a key role in furniture, cabinetry, and interior construction. According to Mordor Intelligence, the engineered wood market was valued at USD 172.3 billion in 2023 and is projected to grow at a CAGR of 6.8% through 2029, driven by rising demand for cost-effective, sustainable, and lightweight wood solutions across residential and commercial applications. Luan panels, derived primarily from tropical hardwood veneers like Shorea, are favored for their excellent strength-to-weight ratio and ease of finishing. As construction and remodeling activities accelerate globally, especially in Asia-Pacific and North America, manufacturers that ensure sustainable sourcing, consistent quality, and scalability are gaining competitive advantage. Based on market presence, production capacity, and sustainability practices, the following four companies have emerged as leading Luan panel manufacturers shaping the industry’s trajectory.

Top 4 Luan Panels Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 84 Lumber: Lumber Yard

Domain Est. 1996

Website: 84lumber.com

Key Highlights: 84 Lumber is an industry leader in building supplies, manufactured components, and services for single- and multifamily residences and commercial buildings….

#2 Patriot Timber

Domain Est. 2002

Website: patriottimber.com

Key Highlights: We produce premium underlayment plywood, multi-purpose plywood, specialty plywood, and beadboard under our Patriot Timber Family of Panel Products….

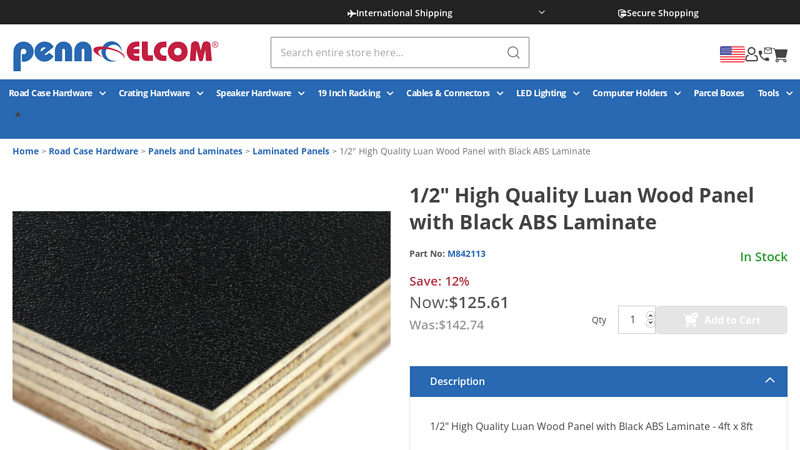

#3 1/2″ High Quality Luan Wood Panel with Black ABS Laminate

Domain Est. 2003

Website: penn-elcom.com

Key Highlights: In stock Free delivery1/2″ High Quality Luan Wood Panel with Black ABS Laminate – 4ft x 8ft. Width: 48″ Length: 96″ Thickness: 1/2″ Wood Panel + 0.04″ Laminate…

#4 Luan Plywood: A Comprehensive Guide

Domain Est. 2022

Website: onsungroup.com

Key Highlights: Luan plywood is lightweight and easy to work with. As this plywood comes in different shades and colors, you can make multiple designs and surfaces easily….

Expert Sourcing Insights for Luan Panels

H2: Market Trends for Luan Panels in 2026

As we look toward 2026, the market for Luan panels—thin, lightweight plywood typically made from tropical hardwoods like Shorea species—is expected to undergo significant shifts driven by environmental, regulatory, economic, and technological factors. While Luan has traditionally been popular in applications such as underlayment, cabinetry, and DIY projects due to its low cost and ease of use, several emerging trends will likely reshape its role and availability in the global market.

1. Increased Regulatory Pressure and Sustainability Concerns

One of the most defining trends for Luan panels in 2026 will be heightened scrutiny over sustainable forestry practices. Much of the world’s Luan is sourced from Southeast Asia, particularly Indonesia and Malaysia, where deforestation and illegal logging have raised environmental alarms. By 2026, stricter import regulations—such as expanded enforcement of the U.S. Lacey Act and EU Deforestation Regulation (EUDR)—will likely restrict the entry of non-certified tropical hardwoods. This will pressure suppliers to provide verifiable chain-of-custody documentation, increasing compliance costs and reducing the availability of uncertified Luan.

Consequently, demand may shift toward FSC- or PEFC-certified Luan or alternative materials perceived as more sustainable.

2. Growing Competition from Alternative Panel Materials

Luan’s market share is expected to face increasing competition from engineered wood products and alternative underlayment materials. Oriented Strand Board (OSB), medium-density fiberboard (MDF), and bamboo-based panels are being enhanced with improved moisture resistance and dimensional stability. In particular, advancements in recycled wood composites and agricultural fiber panels (e.g., wheatboard, hemp-based boards) are offering eco-friendly substitutes that align with green building standards such as LEED and BREEAM.

Additionally, phenolic-backed plywood and moisture-resistant particleboard are gaining traction in cabinetry and furniture applications, where Luan’s susceptibility to warping and moisture damage is a key limitation.

3. Supply Chain Diversification and Price Volatility

Geopolitical instability, trade tariffs, and transportation costs will continue to affect Luan supply chains. With primary production concentrated in a few Southeast Asian countries, disruptions from climate events (e.g., flooding, fires) or political changes could lead to price volatility. By 2026, importers and manufacturers may increasingly seek regional sourcing alternatives or invest in nearshoring production using fast-growing plantation species to reduce dependency on traditional Luan exporters.

This may lead to the development of Luan-like substitutes from species such as acacia or eucalyptus, especially in Latin America and Africa, where plantation forestry is expanding.

4. Rise of Green Building and Consumer Awareness

The construction and remodeling sectors are placing greater emphasis on sustainability and indoor air quality. Luan panels, often bonded with urea-formaldehyde adhesives, may fall out of favor in premium markets due to VOC emissions. In response, manufacturers may pivot toward low-emission or no-added-formaldehyde (NAF) Luan, though this could increase costs and narrow profit margins.

Consumers and contractors are increasingly choosing materials with transparent environmental footprints. As a result, Luan may be relegated to temporary or non-structural applications, while higher-end projects opt for greener alternatives.

5. Technological Innovation and Niche Applications

Despite challenges, innovation may help sustain Luan in specialized markets. For example, treated or hybrid Luan panels with enhanced fire resistance, moisture barriers, or acoustic properties could find use in modular construction and prefabricated housing—sectors expected to grow through 2026.

Additionally, in emerging markets with lower regulatory barriers and cost-sensitive construction sectors (e.g., parts of Africa, South Asia), Luan may retain strong demand due to its affordability and workability.

Conclusion:

By 2026, the Luan panel market will be shaped by a complex interplay of environmental regulation, material innovation, and shifting consumer values. While demand may decline in environmentally conscious and developed markets, opportunities remain in cost-driven regions and through product differentiation. To remain competitive, suppliers will need to prioritize sustainable sourcing, supply chain transparency, and product enhancement—or risk being displaced by more resilient and eco-friendly alternatives.

Common Pitfalls Sourcing Luan Panels (Quality, IP)

Sourcing Luan panels—thin plywood typically made from tropical hardwoods like Shorea species—can present several challenges, particularly concerning quality consistency and intellectual property (IP) or compliance issues. Being aware of these pitfalls helps ensure reliable supply and avoids legal or reputational risks.

Inconsistent Material Quality

One of the most frequent issues with Luan panels is variability in quality. Since Luan is often sourced from fast-growing tropical trees primarily in Southeast Asia, manufacturers may use different grades of veneer, adhesives, and production standards. Buyers may receive panels with voids, delamination, inconsistent thickness, or soft spots—especially when sourcing from low-cost suppliers. This inconsistency can disrupt manufacturing processes and compromise the final product’s integrity.

Mislabeling and Species Substitution

“Luan” is a commercial name, not a botanical one, and is frequently used as a catch-all term for various light hardwoods from the Shorea genus. However, some suppliers may substitute lower-grade or non-compliant wood species while still labeling the product as Luan. This misrepresentation can lead to performance issues and raise concerns about transparency and traceability in the supply chain.

Lack of Sustainable Sourcing Certification

Many Luan-producing regions have faced deforestation and illegal logging concerns. Panels sourced without proper certification (such as FSC or PEFC) may come from unsustainable or illegal logging operations. This not only harms the environment but also exposes companies to reputational damage and potential violations of regulations like the U.S. Lacey Act or the EU Timber Regulation.

Intellectual Property and Brand Infringement Risks

When incorporating Luan into finished goods (e.g., furniture, cabinetry, or decorative panels), there’s a risk of inadvertently using designs, patterns, or veneer finishes that infringe on existing trademarks or design patents. Additionally, sourcing from manufacturers that produce counterfeit or knock-off branded panel products can expose buyers to IP liability, especially in regulated markets.

Poor Traceability and Documentation

Suppliers may lack transparent documentation regarding the wood’s origin, chain of custody, or compliance with international trade laws. Without verifiable paperwork, companies risk importing panels made from illegally harvested timber, which can result in customs seizures, fines, or supply chain disruptions.

Adhesive and Emissions Compliance

Luan panels are often bonded with urea-formaldehyde resins, which can emit volatile organic compounds (VOCs). Panels intended for indoor use—especially in the U.S. or EU—must comply with emissions standards like CARB (California Air Resources Board) or E0/E1 formaldehyde limits. Sourcing non-compliant panels can lead to product recalls or market access issues.

Conclusion

To mitigate these pitfalls, buyers should prioritize suppliers with strong quality control, third-party certifications, and transparent sourcing practices. Conducting supplier audits, requesting material test reports, and verifying compliance with environmental and IP regulations are essential steps in responsibly sourcing Luan panels.

Logistics & Compliance Guide for Luan Panels

This guide outlines key logistics and compliance considerations when sourcing, shipping, handling, and using Luan panels (also known as Lauan or Philippine Mahogany), a lightweight tropical hardwood plywood commonly used in furniture, cabinetry, and interior applications.

Sourcing & Legal Compliance

Ensure all Luan panels are sourced from legal and sustainable forestry operations. Due to past concerns over illegal logging in the Philippines and Southeast Asia, verify compliance with international regulations:

- Lacey Act Compliance (USA): Requires importers to declare the species and country of harvest. Use the scientific name Shorea spp. or Parashorea spp. instead of generic “Luan” for accurate reporting.

- CITES Regulations: While most Luan species are not listed under CITES, confirm the specific species used by your supplier to ensure no restrictions apply.

- Chain-of-Custody Certification: Prefer suppliers with FSC (Forest Stewardship Council) or PEFC certification to support responsible forest management and meet sustainability requirements.

Import & Customs Documentation

Prepare accurate documentation to avoid delays at customs:

- Commercial Invoice with detailed product description (e.g., “Plywood made from Shorea spp., tropical hardwood, 4’x8′ sheets, 1/4 inch thick”)

- Packing List specifying quantity, dimensions, weight, and country of origin

- Bill of Lading or Air Waybill

- Lacey Act Declaration (for U.S. imports)

- Phytosanitary Certificate (if required by destination country to prevent pest spread)

Packaging & Handling

Proper packaging and handling preserve panel quality during transit:

- Panels should be bundled securely with edge protectors to prevent chipping

- Use moisture-resistant wrapping to prevent water damage

- Store and transport in a dry, climate-controlled environment to avoid warping or delamination

- Handle with care to avoid surface scratches and dents; use mechanical lifting for large quantities

Shipping & Transportation

- Choose carriers experienced in handling wood products and international customs

- Clearly label shipments with handling instructions (e.g., “This Side Up”, “Protect from Moisture”)

- Consider sea freight for large volumes; air freight for urgent, smaller orders

- Insure shipments against damage, loss, or customs-related issues

Environmental & Safety Regulations

- Formaldehyde Emissions: Ensure panels meet formaldehyde emission standards such as CARB Phase 2 (California Air Resources Board) or EPA TSCA Title VI (USA), especially for indoor use.

- VOC Content: Comply with indoor air quality standards (e.g., GREENGUARD, LEED) if used in sensitive environments like schools or healthcare facilities.

- Disposal & Recycling: Follow local regulations for disposal of wood waste; Luan panels may be recyclable or suitable for biomass energy depending on treatment and coatings.

Quality Assurance & Inspection

- Conduct pre-shipment inspections for panel thickness, glue line integrity, surface defects, and moisture content (ideal range: 6–10%)

- Verify compliance with industry standards (e.g., APA – The Engineered Wood Association standards for plywood)

- Maintain records of inspections and certifications for audit purposes

Final Recommendations

- Build relationships with reputable, transparent suppliers who provide full documentation

- Stay updated on changing import regulations and environmental policies

- Train logistics teams on wood product handling and compliance requirements

Adhering to this guide ensures smooth logistics operations and helps maintain compliance with legal, environmental, and safety standards when working with Luan panels globally.

In conclusion, sourcing luan panels requires careful consideration of several key factors to ensure quality, sustainability, and cost-effectiveness. It is essential to evaluate suppliers based on their ability to provide consistent thickness, durability, and moisture resistance, especially since luan is often used in applications like cabinetry, underlayment, and crafts where performance matters. Verifying the origin of the wood and confirming compliance with environmental and forestry standards—such as FSC certification—supports responsible sourcing and helps mitigate risks associated with deforestation and illegal logging. Additionally, comparing pricing, lead times, and minimum order requirements across suppliers can lead to more favorable terms and reliable supply chain continuity. By establishing strong relationships with reputable suppliers and conducting periodic quality audits, businesses can secure high-quality luan panels that meet project specifications while aligning with sustainability and budgetary goals.