The global LPG gas tank market is experiencing robust expansion, driven by increasing demand for clean and portable energy across residential, commercial, and industrial sectors. According to Mordor Intelligence, the LPG market was valued at USD 104.7 billion in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2029. This growth is supported by rising urbanization, infrastructure development, and the global shift toward alternative fuels to reduce carbon emissions. Additionally, expanding petrochemical industries and the adoption of LPG in emerging economies are fueling the need for reliable and high-capacity storage solutions. As demand surges, manufacturers of LPG gas tanks are scaling production, enhancing safety standards, and investing in innovative designs to meet stringent international regulations. In this competitive landscape, a select group of manufacturers have emerged as leaders, combining advanced engineering with global supply capabilities. Below are the top 10 LPG gas tank manufacturers shaping the future of energy storage.

Top 10 Lpg Gas Tank Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1

Domain Est. 1999

Website: cavagnagroup.com

Key Highlights: Cavagna Group is a world leading manufacturer in all sectors in which gas fuels work and life: LPG, energy gas, medical gas, industrial gas….

#2 Highland Tank

Domain Est. 1996

Website: highlandtank.com

Key Highlights: Manufacturing high-quality steel storage tank products accommodating commercial and industrial customers. Proven manufacturing and exceptional quality….

#3 Ragasco

Domain Est. 2001

Website: ragasco.com

Key Highlights: Transforming the use of liquid gas with lighter and safer cylinders. We are a leading global manufacturer of composite cylinders for liquid gas applications….

#4 LPG Tank, Auto LPG Tanks, LPG Skid, Supplier, Pune, India

Domain Est. 2009

Website: bnhgastank.com

Key Highlights: We are Manufacturer, Supplier & Exporter of LPG Semitrailer Tanks, LPG Transport Truck Tanks of various capacities ranging from 7500 Liters to 57000 Liters….

#5 AmeriGas Propane

Domain Est. 1995

Website: amerigas.com

Key Highlights: AmeriGas Propane provides propane delivery, tank installation, & more for your home or business. Find a location or request a quote….

#6 Blossman Gas

Domain Est. 1996

Website: blossmangas.com

Key Highlights: From gas delivery to appliances and installation, Blossman Gas is your one-stop shop for all things propane….

#7 Manchester Tank

Domain Est. 1998

Website: mantank.com

Key Highlights: Manchester Tank is dedicated to providing excellent customer service, with knowledgeable representatives ready to assist with inquiries and support….

#8 United Propane Gas

Domain Est. 1998

Website: upgas.com

Key Highlights: Affordable propane, first-class customer service, and trustworthy delivery. This is what you can expect with UPG by your side….

#9 Homepage

Domain Est. 2014 | Founded: 2014

Website: harsantanker.com

Key Highlights: Harsan Tanker & Cryogenic is a company established in 2014 in Kocaeli, specializing in the manufacture of LPG and Fuel Tanks, LPG projects, and Cryogenic ……

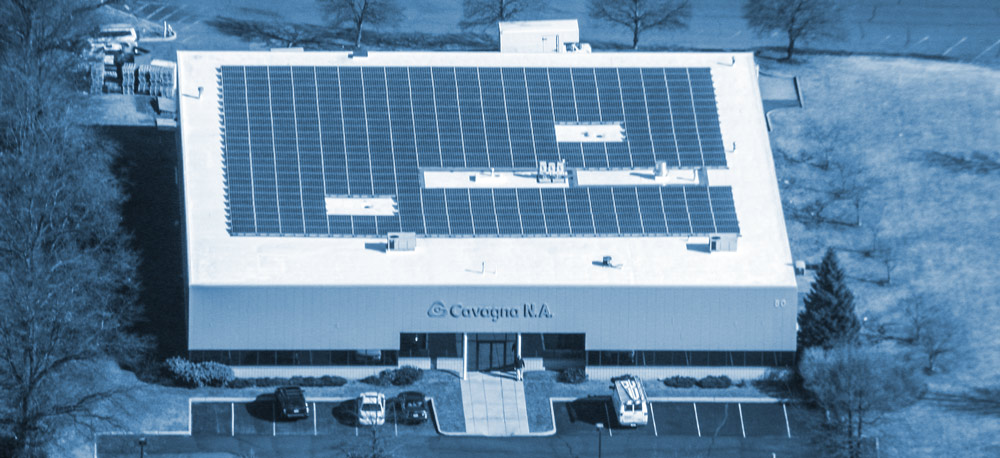

#10 Cavagna Group North America

Domain Est. 2017

Website: cavagnana.com

Key Highlights: LPG Valves & Tank Equipment · LPG Regulators · LPG Filling Equipment · Bulk Storage & Truck Equipment · High Pressure Equipment · Gas Meters · Natural Gas ……

Expert Sourcing Insights for Lpg Gas Tank

H2: 2026 Market Trends for LPG Gas Tanks

The global LPG (Liquefied Petroleum Gas) gas tank market is poised for significant transformation by 2026, driven by evolving energy demands, regulatory shifts, technological innovation, and regional economic developments. As countries continue to seek cleaner alternatives to traditional fossil fuels, LPG remains a transitional energy solution, particularly in developing economies and off-grid applications. The following analysis outlines key market trends expected to shape the LPG gas tank industry through 2026.

1. Increasing Demand in Emerging Economies

Emerging markets in Asia-Pacific, Africa, and Latin America are witnessing rising adoption of LPG for both residential and commercial use. Urbanization, government clean cooking initiatives (e.g., India’s Ujjwala Scheme), and efforts to reduce indoor air pollution are accelerating the need for reliable LPG storage solutions. This surge is driving demand for affordable, durable, and safe LPG gas tanks, particularly in rural and semi-urban areas.

2. Shift Toward Portable and Smart Tanks

By 2026, manufacturers are expected to increasingly integrate smart technologies into LPG gas tanks. Innovations such as IoT-enabled sensors, remote monitoring, and automated refill alerts are enhancing safety, convenience, and supply chain efficiency. Portable and lightweight composite tanks are also gaining traction, especially in recreational and mobile applications (e.g., camping, RVs, food trucks), due to their high strength-to-weight ratio and corrosion resistance.

3. Growth in Industrial and Automotive Applications

Industrial sectors—including food processing, ceramics, and metal fabrication—are relying on LPG for its clean combustion and high thermal efficiency. Additionally, the automotive sector continues to explore autogas (LPG-powered vehicles) as a cost-effective and lower-emission alternative to gasoline and diesel, particularly in regions like Europe, Turkey, and South Korea. This is expected to boost demand for specialized LPG tanks compliant with international safety standards (e.g., ISO 11439).

4. Regulatory Compliance and Safety Standards

Stringent safety regulations are shaping tank design and manufacturing. By 2026, global standards such as the European Pressure Equipment Directive (PED), ASME codes in the U.S., and local certifications will remain critical. Manufacturers are investing in advanced materials (e.g., corrosion-resistant steels, fiber-reinforced composites) and rigorous testing to ensure compliance and reduce accident risks, thereby building consumer trust.

5. Sustainability and Circular Economy Initiatives

Environmental concerns are pushing the industry toward sustainable practices. The lifecycle management of LPG tanks—including recycling, refurbishment, and leak detection—is gaining attention. Some manufacturers are adopting circular economy models, offering tank leasing and take-back programs to reduce waste and enhance customer retention.

6. Supply Chain Resilience and Localization

Geopolitical volatility and supply chain disruptions (e.g., from past global events) have prompted companies to localize production and diversify sourcing. By 2026, regional manufacturing hubs in Southeast Asia, India, and Eastern Europe are expected to play a crucial role in meeting local demand and reducing import dependency.

7. Competitive Landscape and Market Consolidation

The LPG gas tank market is becoming increasingly consolidated, with major players expanding through mergers, acquisitions, and strategic partnerships. Companies like Worthington Industries, Aceros del Nayar, and Fagerdala World Foams are investing in R&D and capacity expansion to capture market share, especially in high-growth regions.

In conclusion, the 2026 LPG gas tank market will be characterized by innovation, regional diversification, and a strong emphasis on safety and sustainability. While the long-term energy transition may challenge LPG’s dominance, its role as a versatile, clean-burning fuel ensures continued relevance—particularly in markets where infrastructure and affordability are key constraints.

When sourcing LPG (Liquefied Petroleum Gas) tanks—especially when considering hydrogen (H₂) compatibility or repurposing for hydrogen service—there are several critical pitfalls related to quality assurance and pressure integrity (IP – In-Service Pressure or Integrity Performance). Using equipment designed for LPG in hydrogen applications introduces additional risks due to hydrogen’s unique properties. Below is a breakdown of common pitfalls, with specific emphasis on H₂ considerations:

🔴 1. Assuming LPG Tanks Are Suitable for Hydrogen Service (Material Compatibility)

Pitfall: Using an LPG tank for hydrogen without verifying material compatibility.

Why It’s Critical:

– Hydrogen Embrittlement: Hydrogen molecules are extremely small and can diffuse into certain metals (especially high-strength steels), causing embrittlement, microcracking, and catastrophic failure over time.

– LPG tanks are typically made from carbon steel or low-alloy steel — materials not suitable for long-term H₂ exposure unless specifically designed and certified.

✅ Solution:

– Use only tanks made from H₂-compatible materials (e.g., austenitic stainless steels like 316L, or composites like Type III/IV tanks).

– Ensure compliance with ISO 11439 (for compressed natural gas, often referenced), ISO 15869 (for hydrogen), or DOT/ADR regulations for H₂ service.

🔴 2. Inadequate Pressure Rating and Design Standards (IP – Integrity Pressure)

Pitfall: Assuming the pressure rating for LPG applies to compressed hydrogen.

Why It’s Critical:

– LPG is stored as a liquid under moderate pressure (typically 5–15 bar at ambient temperature).

– Hydrogen is stored as a high-pressure gas (often 350–700 bar), requiring far more robust design.

✅ Solution:

– Never repressurize LPG tanks for H₂ use.

– Source only tanks specifically rated and certified for high-pressure hydrogen (e.g., ASME BPVC Section VIII, ISO 11439, or CGH2R-1).

– Verify working pressure (WP) and burst pressure meet H₂ service standards.

🔴 3. Lack of Certification and Traceability (Quality Assurance)

Pitfall: Procuring tanks without proper documentation or third-party certification.

Why It’s Critical:

– LPG tanks may have local or outdated certifications that don’t meet international H₂ safety standards.

– No traceability (e.g., material test reports, weld logs, NDT records) increases risk of undetected flaws.

✅ Solution:

– Require full material certification (MTRs), NDT reports, and design calculations.

– Insist on certification to ISO 9001, ISO 11114-3 (gaseous hydrogen compatibility), and PED (Pressure Equipment Directive) or ASME U/U2 stamps.

🔴 4. Poor Welding and Fabrication Quality

Pitfall: Accepting tanks with substandard welds or lack of inspection.

Why It’s Critical:

– Hydrogen leakage through micro-porosity or cracks can lead to fires or explosions.

– Poor welds increase susceptibility to hydrogen-assisted cracking.

✅ Solution:

– Mandate 100% NDT (Non-Destructive Testing): radiography (RT), ultrasonic (UT), or phased array for critical welds.

– Prefer tanks with automated orbital welding and documented WPS (Welding Procedure Specifications).

🔴 5. Incorrect Valve and Fitting Specifications

Pitfall: Using LPG-compatible valves/fittings for hydrogen.

Why It’s Critical:

– Standard LPG valves may use elastomers or metals that degrade in H₂ environments.

– Thread standards (e.g., NPT vs. CGA 350) differ; mismatched fittings increase leak risk.

✅ Solution:

– Use hydrogen-rated valves and regulators (e.g., CGA 350 or SAE J2600).

– Ensure seals are made from H₂-compatible materials (e.g., PTFE, PCTFE, or Kalrez).

🔴 6. Neglecting Temperature and Cycling Effects

Pitfall: Overlooking thermal and pressure cycling durability.

Why It’s Critical:

– Hydrogen systems undergo frequent pressure cycling, leading to fatigue.

– Cryogenic hydrogen (if used) requires low-temperature toughness (LPG tanks are not tested for this).

✅ Solution:

– Verify fatigue life testing per ISO 15869 or ECE R134.

– For cryogenic H₂, use tanks designed for -253°C (e.g., double-walled vacuum-insulated vessels).

🔴 7. Inadequate Corrosion Protection

Pitfall: Assuming external coating on LPG tank suffices for H₂ environment.

Why It’s Critical:

– Corrosion under insulation (CUI) or at supports can compromise structural integrity.

– Hydrogen can exacerbate stress corrosion in impure environments.

✅ Solution:

– Use corrosion-resistant coatings or stainless steel construction.

– Implement regular in-service inspection (ISI) programs.

🔴 8. Reusing or Retrofitting LPG Tanks for H₂

Pitfall: Attempting to convert an LPG tank for hydrogen use.

Why It’s Dangerous:

– Not permitted under most safety codes (e.g., ASME, ISO, ADR).

– Residual hydrocarbons can react with hydrogen or compromise purity.

– Internal inspection and cleaning may not eliminate contamination or microcracks.

✅ Solution:

– Never retrofit LPG tanks for hydrogen.

– Source new, purpose-built hydrogen storage vessels.

✅ Best Practices Summary: Sourcing Hydrogen-Ready Tanks (Instead of LPG)

| Factor | Recommendation |

|——-|—————-|

| Material | Austenitic stainless steel, aluminum liners, or composite (Type IV) |

| Design Standard | ISO 11439, ISO 15869, ASME BPVC, CGH2R-1 |

| Pressure Rating | Minimum 350 bar for mobile, 700 bar for advanced systems |

| Certification | PED, ASME U-Stamp, ISO 9001, H2 compatibility (ISO 11114-3) |

| Testing | Hydrostatic test, burst test, cycle testing (10k+ cycles) |

| Valves/Fittings | CGA 350, SAE J2600, H2-compatible seals |

| Inspection | Full NDT, traceable documentation, third-party verification |

Conclusion:

Sourcing LPG tanks for hydrogen service is inherently risky and generally non-compliant. The quality and integrity (IP) requirements for hydrogen are significantly more stringent due to hydrogen embrittlement, high pressure, and flammability. Always source purpose-built, certified hydrogen storage systems and avoid repurposing LPG infrastructure.

❗ Bottom Line: Do not use LPG tanks for hydrogen. Invest in certified H₂-compliant storage to ensure safety, regulatory compliance, and long-term reliability.

H2: Logistics & Compliance Guide for LPG Gas Tanks

Transporting and handling Liquefied Petroleum Gas (LPG) tanks involves strict adherence to logistics protocols and regulatory compliance to ensure safety, environmental protection, and legal conformity. This guide outlines key considerations under the H2 structure for the safe and compliant logistics of LPG gas tanks.

H2: Regulatory Framework and Standards

LPG transportation and storage are governed by international, national, and regional regulations. Compliance with these standards is mandatory to prevent accidents and legal penalties.

- International Maritime Dangerous Goods (IMDG) Code: Governs the sea transport of LPG in cylinders or bulk. Requires proper classification, packaging, labeling, and documentation.

- ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road): Applies to road transport in Europe. Specifies vehicle requirements, driver training, and tank labeling.

- DOT 49 CFR (U.S. Department of Transportation): Regulates the transport of hazardous materials in the U.S., including LPG. Covers tank specifications, markings, and operational procedures.

- ISO 9809 and ISO 11114: Standards for gas cylinder construction, testing, and materials compatibility.

- OSHA and EPA Regulations (U.S.): Address workplace safety and environmental impact, including leak detection and emergency response.

H2: Tank Design, Certification, and Maintenance

Only approved and certified LPG tanks should be used in logistics operations.

- Certification: Tanks must be certified by recognized bodies (e.g., NB registered in North America, TPED in Europe) and display valid test dates.

- Design Standards: Must comply with pressure vessel codes (e.g., ASME, EN 1442 or EN 12818).

- Inspection & Testing: Periodic hydrostatic and visual inspections are required (typically every 5–10 years, depending on jurisdiction).

- Valve Protection: Must include safety relief valves, overfill prevention devices, and protective collars.

H2: Transportation Requirements

Safe transportation minimizes the risk of leaks, fire, or explosion.

- Vehicle Specifications:

- Must be marked with hazard placards (Class 2.1 Flammable Gas).

- Equipped with fire extinguishers, spill kits, and grounding/bonding equipment.

- Ventilated cargo areas to prevent gas accumulation.

- Loading & Unloading:

- Tanks must be secured upright and protected from impact.

- No smoking, open flames, or unauthorized personnel in loading zones.

- Use of non-sparking tools and conductive hoses where applicable.

- Quantity Limits:

- Limits apply based on vehicle type and tank size (e.g., ADR allows up to 1,000 kg LPG in EX/II vehicles without full ADR compliance).

- Route Planning:

- Avoid densely populated areas, tunnels, and environmentally sensitive zones.

- Pre-plan emergency response routes.

H2: Documentation and Labeling

Accurate documentation ensures regulatory compliance and supports emergency response.

- Shipping Papers: Include proper shipping name (e.g., “Liquefied Petroleum Gas”), UN number (UN 1075), hazard class (2.1), and quantity.

- Safety Data Sheet (SDS): Must accompany shipments and be accessible to handlers.

- Labels and Placards:

- Diamond-shaped hazard labels (Class 2.1 Flammable Gas).

- Orientation arrows and “DO NOT DROP” markings.

- Tank identification numbers and test dates clearly visible.

H2: Personnel Training and Safety Procedures

All personnel involved in LPG logistics must be trained and equipped to handle emergencies.

- Required Training:

- Hazardous materials handling (DOT HAZMAT or ADR training).

- Emergency response, fire safety, and use of PPE.

- Leak detection and evacuation procedures.

- Personal Protective Equipment (PPE):

- Flame-resistant clothing, gloves, face shields, and eye protection.

- Emergency Protocols:

- Immediate evacuation and isolation in case of leaks.

- Contact emergency services and provide SDS.

- Use of remote shutoffs and vapor dispersion techniques.

H2: Storage and Handling at Facilities

Safe storage practices prevent accidents during warehousing or distribution.

- Ventilation: Storage areas must be well-ventilated and away from ignition sources.

- Segregation: Store separately from oxidizers and combustible materials.

- Temperature Control: Avoid exposure to direct sunlight or extreme heat (max 50°C/122°F).

- Security: Restrict access and use fencing or lockable cages.

- Inventory Management: Rotate stock (FIFO) and inspect tanks regularly for damage or corrosion.

H2: Environmental and Incident Reporting

Environmental protection and incident transparency are critical.

- Leak Prevention: Implement secondary containment and regular leak checks.

- Spill Response: Use absorbent materials and vapor suppression techniques. Report significant releases.

- Reporting Obligations:

- Notify authorities of accidents involving fire, explosion, or major leaks.

- Submit incident reports as required by EPA, DOT, or local agencies.

- Sustainability: Explore options for recycling damaged tanks and reducing carbon footprint in transport.

H2: International Considerations

Cross-border transport involves additional compliance layers.

- Customs Documentation: Include commercial invoices, permits, and dangerous goods declarations.

- Harmonization: Align with destination country regulations (e.g., GCC Standardization Organization in the Middle East).

- Language Requirements: Safety labels and documents may need translation.

Adhering to this logistics and compliance guide ensures the safe, legal, and efficient handling of LPG gas tanks across the supply chain. Regular audits, staff training, and updates to regulatory changes are essential for ongoing compliance.

Conclusion for Sourcing LPG Gas Tank

In conclusion, sourcing an LPG gas tank requires careful consideration of several critical factors, including tank capacity, material quality, safety certifications, compliance with local regulations, supplier reliability, and cost-effectiveness. Evaluating both above-ground and underground tank options based on site requirements, environmental conditions, and intended usage ensures optimal performance and long-term safety. Engaging with reputable suppliers who provide proper documentation, installation support, and after-sales service further enhances the value and reliability of the procurement. By conducting thorough research and due diligence, organizations can secure an LPG tank solution that is safe, efficient, and aligned with operational needs, contributing to sustainable and uninterrupted energy supply.