The Low Noise Amplifier (LNA) market is experiencing robust growth, driven by rising demand for high-performance signal amplification in telecommunications, aerospace & defense, and consumer electronics. According to a report by Mordor Intelligence, the global LNA market was valued at USD 2.8 billion in 2023 and is projected to grow at a CAGR of over 9.5% during the forecast period from 2024 to 2029. This expansion is fueled by the proliferation of 5G networks, increasing adoption of satellite communication systems, and the need for enhanced signal clarity in radar and IoT applications. As signal integrity becomes increasingly critical across high-frequency applications, manufacturers are focusing on innovation in noise figure reduction, power efficiency, and integration capabilities. In this competitive landscape, nine key players have emerged as leaders, combining technological expertise, global reach, and strong R&D investments to shape the future of low noise amplification.

Top 9 Low Noise Amplifiers Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

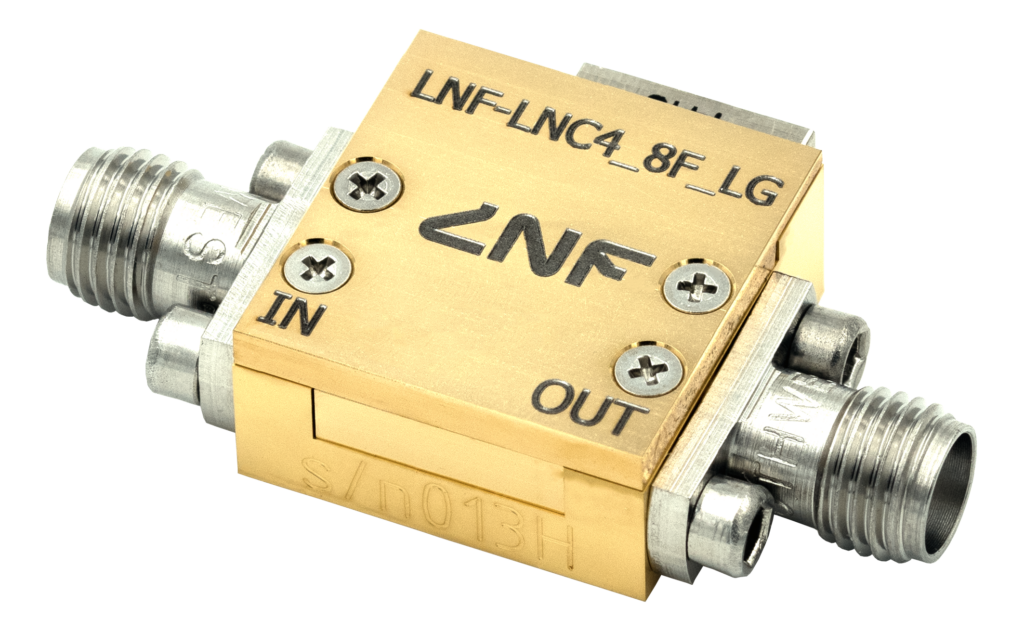

#1 Low Noise Factory

Domain Est. 2005 | Founded: 2005

Website: lownoisefactory.com

Key Highlights: Amplifying the future since 2005 … Developing solutions for cryogenic microwave components for the most demanding applications. Products · About · The InP HEMT ……

#2 Low Noise Factory

Domain Est. 2016

Website: quantummicrowave.com

Key Highlights: Experts in Cryogenic, Microwave & Millimeter Wave Solutions, when only the best performance matters Quantum Microwave is here for your ……

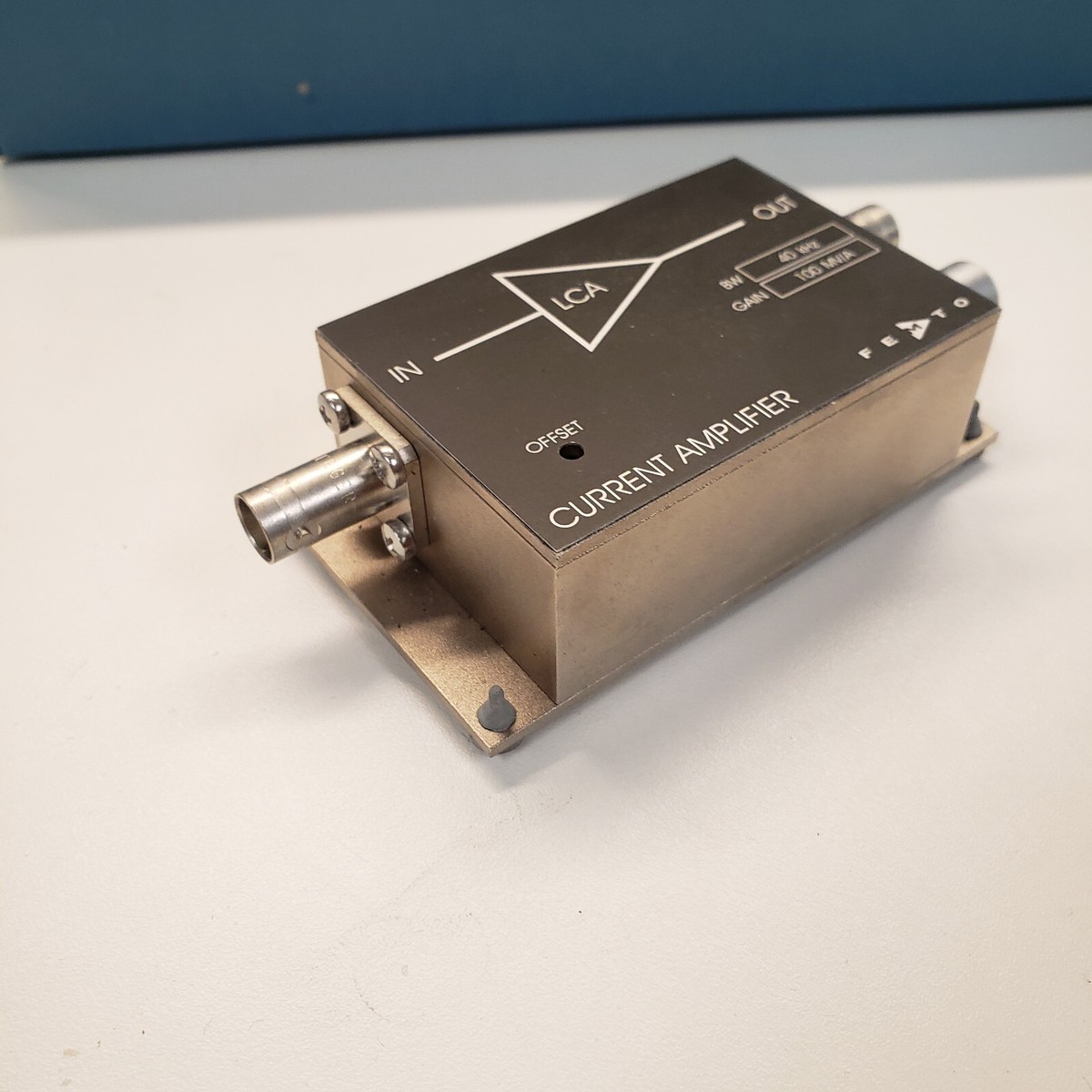

#3 FEMTO®

Website: femto.de

Key Highlights: FEMTO offers low-noise amplifiers and photoreceivers with outstanding frequency response for scientific and industrial applications….

#4 Low Noise Amplifiers

Domain Est. 1991

Website: macom.com

Key Highlights: MACOMs portfolio of low noise amplifiers offer a broad array of noise figures, input IP3, and input power in bare die and a variety of package types….

#5 RF Low Noise Amplifiers (LNAs)

Domain Est. 1995

Website: minicircuits.com

Key Highlights: RF low noise amplifiers (LNAs) from Mini-Circuits provide noise figure as low as 0.38 dB with wideband / broadband coverage up to 21 GHz….

#6 Low Noise Amplifiers

Domain Est. 1997

Website: pasternack.com

Key Highlights: 2–3 day delivery 30-day returnsPasternack’s low noise amplifiers provide customers with a choice of noise figures, gain levels, frequency ranges and power outputs depending on the …

#7 Low Noise Amplifiers

Domain Est. 1999

Website: mrcy.com

Key Highlights: Broadband, narrowband, high-frequency, our extensive portfolio of low noise amplifiers is ready to tackle the toughest requirements….

#8 Low Noise Amplifiers

Domain Est. 2002

Website: skyworksinc.com

Key Highlights: Low Noise Amplifiers. ×. Low Noise Amplifiers. Product Filters. Categories. Front-end Modules. BDS/GPS/GNSS Front-end Modules. CATV Front-end Modules….

#9 Low Noise Amplifiers: LNA and Ultra Low Noise Amps

Domain Est. 2014

Website: nardamiteq.com

Key Highlights: We have an extensive family of narrow-band and wide-band low noise amplifiers and ultra low noise amplifiers. Designs range in frequency from 1 kHz to 67 GHz….

Expert Sourcing Insights for Low Noise Amplifiers

H2: Market Trends for Low Noise Amplifiers in 2026

By 2026, the Low Noise Amplifier (LNA) market is poised for significant growth and transformation, driven by evolving technological demands across key industries. Several interconnected trends are expected to shape the market landscape:

1. Surge in 5G and Beyond-5G Infrastructure Deployment

The global rollout of 5G networks will reach maturity by 2026, with a growing focus on millimeter wave (mmWave) frequencies and network densification. LNAs are critical in base stations, small cells, and user equipment for maintaining signal integrity in high-frequency, low-signal environments. Demand will rise for LNAs with ultra-low noise figures (<1 dB), high linearity, and efficiency at frequencies above 24 GHz. Additionally, early development for 6G will begin to influence LNA design requirements, pushing performance boundaries in the sub-THz range.

2. Expansion in Aerospace, Defense, and Satellite Communications

Defense modernization programs and the proliferation of LEO (Low Earth Orbit) satellite constellations (e.g., Starlink, OneWeb) will drive demand for high-reliability, radiation-hardened LNAs. These applications require LNAs capable of operating in extreme environments with stringent power and size constraints. Integration with phased array antennas and electronic warfare systems will fuel demand for GaN- and GaAs-based LNAs offering high power-added efficiency and wide bandwidth.

3. Growth in Automotive Radar and ADAS

Autonomous and semi-autonomous vehicles will increasingly rely on advanced radar systems (77–81 GHz) for object detection and collision avoidance. LNAs are essential components in radar front-ends, where they amplify weak return signals with minimal added noise. The push for higher resolution and longer detection ranges will increase demand for compact, low-power, and temperature-stable LNAs, particularly those based on SiGe and RF CMOS technologies.

4. Advancements in Semiconductor Technologies

Material innovation will continue to redefine LNA performance. While GaAs remains dominant in high-frequency applications, GaN-on-SiC is gaining traction for high-power, high-efficiency LNAs in defense and telecom. Simultaneously, advancements in RF CMOS and SiGe BiCMOS will enable more integrated, cost-effective LNAs for consumer electronics and automotive applications. The integration of LNAs with other RF components (e.g., switches, mixers) into highly compact MMICs (Monolithic Microwave Integrated Circuits) will be a key trend to reduce size and improve system performance.

5. Emphasis on Energy Efficiency and Miniaturization

With the proliferation of IoT devices and portable electronics, power consumption and footprint are critical design constraints. LNAs will need to deliver high gain and low noise while operating at ultra-low supply voltages and currents. This will drive innovation in circuit topologies (e.g., inductive source degeneration, feedback techniques) and packaging technologies such as wafer-level packaging (WLP) and system-in-package (SiP) solutions.

6. Rising Demand in Test & Measurement and Medical Imaging

High-precision applications in quantum computing, radio astronomy, and medical diagnostics (e.g., MRI, PET scanners) require LNAs with near-theoretical noise performance. Cryogenic LNAs and ultra-low-noise amplifiers operating at microwave and sub-millimeter frequencies will see niche but growing demand, supported by advances in superconducting and low-temperature semiconductor technologies.

7. Regional Market Shifts and Supply Chain Dynamics

Asia-Pacific, particularly China, South Korea, and Japan, will remain the largest market due to robust electronics manufacturing and 5G adoption. However, geopolitical factors and supply chain resilience concerns may lead to increased regionalization of LNA production, especially in North America and Europe, driven by defense and critical infrastructure needs.

In summary, the 2026 LNA market will be characterized by escalating performance requirements, technology convergence, and diversification across high-growth sectors. Innovation in materials, integration, and energy efficiency will be central to capturing market share in this increasingly competitive landscape.

Common Pitfalls Sourcing Low Noise Amplifiers (Quality, IP)

Sourcing Low Noise Amplifiers (LNAs) requires careful consideration to ensure performance, reliability, and legal compliance. Overlooking key aspects can lead to signal integrity issues, project delays, or intellectual property (IP) risks. Below are common pitfalls related to quality and IP when procuring LNAs.

Inadequate Performance Verification

Many suppliers provide datasheet specifications under ideal conditions. Relying solely on published noise figure, gain, or linearity metrics without independent verification or application-specific testing can result in underperforming systems. Real-world factors like temperature drift, power supply noise, and PCB layout effects are often not fully captured in standard specs.

Overlooking Long-Term Supply Stability

LNAs used in commercial or industrial applications require stable supply chains. Sourcing from vendors without long-term availability guarantees or who use obsolete or end-of-life components risks production interruptions. Lack of second sourcing options further exacerbates this risk.

Insufficient Quality Assurance and Testing

Low-cost or unverified manufacturers may lack rigorous quality control processes. This includes insufficient screening for parametric spread, reliability testing (e.g., temperature cycling, burn-in), or traceability. Such deficiencies can lead to high field failure rates, especially in mission-critical applications like aerospace or medical devices.

Poor Packaging and Thermal Management

Some LNAs, especially high-frequency or high-gain models, are sensitive to thermal performance and mechanical stress. Selecting packages without appropriate thermal pads, shielding, or mechanical robustness can degrade noise performance or lead to reliability issues in harsh environments.

IP and Design Infringement Risks

Using reference designs or application circuits from third parties without proper licensing can expose companies to intellectual property disputes. This is especially critical when integrating LNAs into proprietary systems where the amplifier’s circuit topology or matching network may be protected by patents.

Lack of IP Clearance in Integrated LNAs

Some LNAs—particularly monolithic microwave integrated circuits (MMICs)—embed patented technologies (e.g., feedback topologies, biasing schemes). Sourcing from manufacturers without transparent IP indemnification policies may expose end-users to infringement claims, particularly in competitive markets.

Dependency on Proprietary or Non-Standard Interfaces

Certain LNAs include integrated control interfaces (e.g., digital bias, gain control) that rely on proprietary protocols. Without access to full interface specifications or software drivers, integration becomes challenging and may lock designers into a single vendor, increasing long-term IP and supply risks.

Inadequate ESD and Handling Specifications

LNAs, particularly GaAs or GaN-based devices, are highly sensitive to electrostatic discharge (ESD). Sourcing components without clearly defined ESD protection ratings or handling guidelines can result in high failure rates during assembly, increasing costs and quality issues.

Avoiding these pitfalls requires thorough due diligence, including supplier audits, independent performance validation, and legal review of IP terms—especially when designing products for regulated or high-reliability markets.

Logistics & Compliance Guide for Low Noise Amplifiers (LNAs)

Overview of Low Noise Amplifiers

Low Noise Amplifiers (LNAs) are critical components in radio frequency (RF) systems, designed to amplify weak signals with minimal additional noise. They are widely used in telecommunications, satellite communications, radar, and wireless infrastructure. Due to their technical specifications and international applications, shipping and handling LNAs require adherence to specific logistics and regulatory compliance standards.

Export Classification and Controls

LNAs may be subject to export control regulations due to their potential use in military or dual-use applications. Key considerations include:

– Export Control Classification Number (ECCN): Determine the appropriate ECCN under the U.S. Commerce Control List (CCL) or equivalent national export control lists. Many LNAs fall under ECCN 5A991 (telecommunications equipment) or 3A001 (electronic components), depending on frequency, gain, and noise figure.

– ITAR vs. EAR: Verify whether the LNA is subject to the International Traffic in Arms Regulations (ITAR) or the Export Administration Regulations (EAR). Most commercial LNAs are governed by EAR, but high-performance or defense-related models may require ITAR compliance.

– Licensing Requirements: Assess the need for export licenses based on destination country, end-user, and end-use. Countries under sanctions or embargoes (e.g., Iran, North Korea) may require special review or prohibit export altogether.

International Shipping and Documentation

Ensure compliance with international shipping standards and documentation requirements:

– Commercial Invoice: Must include accurate technical specifications (frequency range, gain, noise figure), Harmonized System (HS) code, country of origin, and ECCN or license exception code.

– Packing List: Detail item quantities, weights, dimensions, and packaging materials. LNAs should be packed in anti-static, shock-resistant containers to prevent damage.

– Certificate of Origin: Required by some countries for customs clearance and tariff determination.

– Export Declaration: File Electronic Export Information (EEI) via the Automated Export System (AES) in the U.S. for shipments exceeding de minimis value or requiring a license.

Regulatory Compliance by Region

Different regions have specific regulatory requirements for electronic components:

– United States (FCC): While LNAs themselves are typically not FCC-certified, they must comply with electromagnetic compatibility (EMC) standards when integrated into final devices. Ensure no interference with licensed spectrum bands.

– European Union (CE Marking): LNAs placed on the EU market must comply with the Radio Equipment Directive (RED) 2014/53/EU, EMC Directive, and RoHS (Restriction of Hazardous Substances).

– China (CCC): Certain RF components may require China Compulsory Certification; verify based on application and integration.

– Other Markets: Check local requirements in countries such as Japan (MIC), South Korea (KC), and Canada (ISED) for frequency band usage and technical standards.

Handling, Storage, and Environmental Precautions

Proper logistics handling ensures product integrity:

– ESD Protection: Use grounded packaging, conductive foam, and ESD-safe containers to prevent electrostatic discharge damage.

– Temperature and Humidity Control: Store and ship within manufacturer-specified ranges (typically -40°C to +85°C, <80% non-condensing humidity). Avoid exposure to extreme environments.

– Shock and Vibration: Use cushioned packaging and avoid rough handling during transit, especially for surface-mount or fragile LNAs.

Recordkeeping and Audit Readiness

Maintain detailed records to support compliance audits:

– Retain export documentation (invoices, licenses, EEI filings) for a minimum of five years (or as required by local law).

– Track end-user information and ensure no restricted parties are involved using tools like the U.S. Department of Commerce’s Denied Persons List.

– Conduct periodic internal compliance reviews to ensure adherence to export control policies.

Conclusion

Effective logistics and compliance management for Low Noise Amplifiers ensures legal shipment, protects product integrity, and mitigates regulatory risk. Always consult with legal or compliance experts when uncertain about classification or destination-specific requirements.

In conclusion, sourcing low noise amplifiers (LNAs) requires a careful balance of technical specifications, application requirements, cost, and supplier reliability. Key parameters such as noise figure, gain, linearity, frequency range, and power consumption must align precisely with the intended use—whether in telecommunications, radio astronomy, medical devices, or defense systems. Additionally, evaluating packaging, impedance matching, stability, and environmental robustness ensures long-term performance and integration success. Partnering with reputable manufacturers and distributors, considering lead times, certifications, and support services further mitigates risk. Ultimately, a thorough and application-driven sourcing strategy enables optimal system sensitivity and signal integrity, making the selection of the right LNA a critical step in high-performance electronic design.