The global longwall mining equipment market is experiencing steady growth, driven by rising coal production demands, particularly in Asia-Pacific and North America. According to Mordor Intelligence, the Longwall Mining Equipment Market is projected to grow at a CAGR of over 5.2% during the forecast period of 2024–2029. With underground coal extraction becoming increasingly reliant on high-efficiency systems, longwall mining technology has become a cornerstone of modern mining operations. As automation, remote monitoring, and smart systems integrate into mining machinery, leading manufacturers are investing heavily in R&D to improve productivity, safety, and reliability. In this evolving landscape, a select group of manufacturers dominate the global supply of longwall shearers, powered roof supports, and armored face conveyors. Based on market presence, technological innovation, and operational scale, the following overview identifies the top 10 longwall miner manufacturers shaping the future of underground coal extraction.

Top 10 Longwall Miner Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 SUFCO Longwall Coal Mine, Utah

Domain Est. 1996

Website: mining-technology.com

Key Highlights: The SUFCO longwall coal mine is located 50km north-east of Salina, Utah, and 200km south of Salt Lake City, US….

#2 Mining Machines & Coal Mining Equipment

Domain Est. 2021

Website: gainwellengineering.com

Key Highlights: Gainwell Engineering is a leading manufacturer of mining machines, coal mining equipment, and underground mining machinery … longwall installations and ……

#3 Longwall Mining

Domain Est. 1994

Website: gates.com

Key Highlights: Gates combines world-class material science and expert engineering to manufacture products for the longwall mining industry that can take on the challenges of ……

#4 Longwall

Domain Est. 1995

Website: komatsu.com

Key Highlights: Joy longwall systems incorporate shearers, roof supports, face conveyors and more into one system that can be tightly orchestrated by advanced electronics….

#5 Foresight Energy

Domain Est. 1997

Website: foresight.com

Key Highlights: Our mining complexes use highly efficient longwall mining systems. This highly productive mining method coupled with the favorable geology of our coal has ……

#6 Underground

Domain Est. 2002

Website: teknoxgroup.com

Key Highlights: Cat customized systems for longwall mining range from hydraulic roof supports and automated plow systems to shearers, face conveyors and roof support carriers….

#7 Longwall

Domain Est. 2004

Website: longwallassociates.com

Key Highlights: Many of the world’s most productive, record-breaking longwall operations choose Longwall Associates’ custom designs for hard-working, reliable, long-lasting ……

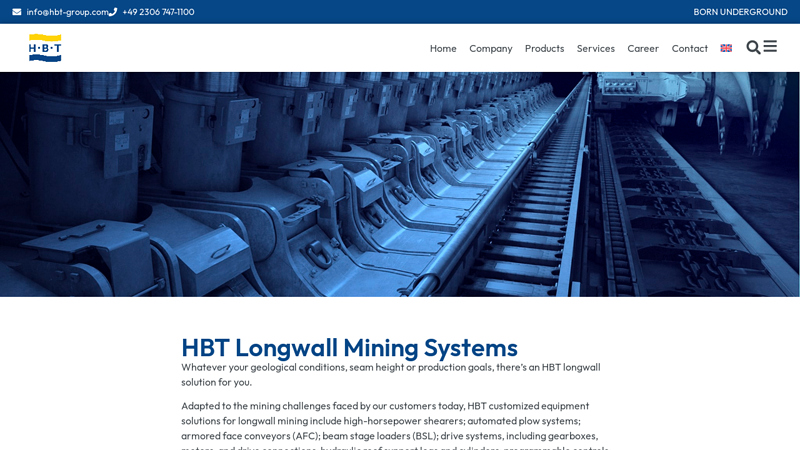

#8 Longwall Mining Solutions

Domain Est. 2020

Website: hbt-group.com

Key Highlights: The HBT PMC family of Programmable Mining Controls offers one-stop shopping for all the controls, sensors and components a successful longwall system needs. ……

#9 Core Natural Resources Announces Resumption of Longwall …

Domain Est. 2024

Website: investors.corenaturalresources.com

Key Highlights: Core’s highly skilled workforce operates a best-in-sector portfolio of large-scale, low-cost longwall mines, including the Pennsylvania Mining ……

#10 Mining Equipment, Parts & Services

Website: mining.sandvik

Key Highlights: Our range of rock tools, ground support products and parts and components ensure your equipment operates at peak performance whilst maximising project safety ……

Expert Sourcing Insights for Longwall Miner

H2 2026 Market Trends for Longwall Miners

The global longwall mining market in the second half of 2026 is expected to be shaped by a complex interplay of sustained energy demand, technological evolution, regional policy shifts, and intensifying cost pressures. While the long-term trajectory faces headwinds from the energy transition, H2 2026 will likely see continued operational demand, particularly in key coal-producing regions, alongside significant advancements in automation and efficiency.

1. Sustained Thermal Coal Demand Driving Replacement & Maintenance:

* Asia-Pacific Dominance: Demand from power-hungry nations like India, Indonesia, and Vietnam will remain the primary driver. India’s ambitious power capacity additions and reliance on domestic coal will necessitate high-capacity longwall systems in new and existing mines. Indonesia’s export focus will sustain demand for efficient longwall operations.

* Replacement Cycle: A significant portion of the market activity will stem from replacing aging longwall systems (shearer loaders, armored face conveyors – AFCs, powered roof supports – PRS) installed in the 2010s boom. Operators will prioritize reliability and reduced downtime over radical innovation.

* Metallurgical Coal Volatility: Demand for coking coal (used in steelmaking) will remain sensitive to global steel production, particularly in China and India. While H2 2026 might see moderate growth, it will be less dynamic than thermal coal, acting as a supporting factor rather than the primary driver.

2. Acceleration of Automation and Digitalization:

* Beyond Remote Operation: H2 2026 will see wider adoption of autonomous longwall systems. Key focus areas include:

* Automated Shearer Navigation: Improved AI and sensor fusion (LiDAR, radar, inertial navigation) enabling shearer to follow the coal seam contour with minimal human intervention, enhancing safety and cutting efficiency.

* Predictive Maintenance: Advanced analytics using real-time data from sensors on AFCs, PRS, and pumps to predict failures before they occur, minimizing costly unplanned downtime. This becomes critical as labor costs rise and skilled technician shortages persist.

* Integrated Digital Platforms: Mine-wide digital twins and centralized control systems will allow for better monitoring, optimization, and remote oversight of longwall operations from surface control rooms.

* Cybersecurity Focus: As connectivity increases, investment in robust cybersecurity for longwall control systems will become non-negotiable, driving demand for secure hardware and software solutions.

3. Intensifying Cost and Labor Pressures:

* High Capital & Operating Costs: The significant upfront investment for new longwall systems and the ongoing costs of maintenance, power, and consumables remain major challenges. This will favor:

* Lifecycle Cost Focus: Buyers will prioritize systems with lower total cost of ownership (TCO), emphasizing durability, fuel/energy efficiency, and ease of maintenance.

* Refurbishment & Remanufacturing: A growing market for high-quality refurbished AFCs, PRS, and shearers will offer cost-effective alternatives, especially for smaller or mid-tier miners.

* Labor Shortages & Safety: The persistent difficulty in recruiting and retaining skilled underground miners will accelerate automation adoption (as above) and drive demand for:

* Simpler Operation Interfaces: Systems designed for easier operation by less experienced personnel.

* Enhanced Safety Systems: Continued integration of collision avoidance, gas monitoring, and automated emergency stop systems.

4. Regional Policy & Environmental Pressures:

* “Just Transition” vs. Energy Security: While climate policies (e.g., EU Green Deal, net-zero targets) create long-term uncertainty, H2 2026 will likely see governments balancing decarbonization goals with immediate energy security concerns (highlighted by recent global events). This may slow, but not halt, coal production in major economies like China, India, and Australia in the short term.

* Methane Emissions Focus: Increasing regulatory scrutiny on methane (a potent greenhouse gas) emissions from coal mines will drive investment in:

* Enhanced Ventilation & Monitoring: More sophisticated gas monitoring systems integrated with longwall controls.

* Methane Capture: Increased interest in projects to capture and utilize coal mine methane (CMM), potentially creating new revenue streams but requiring associated infrastructure.

5. Supply Chain Resilience & Geopolitics:

* Localization & Diversification: Lessons from recent supply chain disruptions will lead major manufacturers and miners to seek greater regionalization of component supply and inventory. This could benefit manufacturers with strong local service networks in key mining regions (APAC, North America).

* Raw Material Costs: Fluctuations in steel prices (critical for AFCs and PRS) and rare earth elements (for motors and sensors) will impact equipment costs and require effective sourcing strategies.

Conclusion for H2 2026:

The longwall miner market in the second half of 2026 will be characterized by resilient demand driven by Asian power needs and replacement cycles, coupled with an accelerated push towards automation and digitalization to combat rising costs and labor challenges. While the long-term energy transition casts a shadow, near-term energy security imperatives will sustain operations. Success for equipment suppliers will depend on offering reliable, efficient systems with lower TCO, robust automation capabilities, strong digital services (predictive maintenance, remote support), and resilient supply chains. The focus will be on optimizing existing operations rather than explosive growth in new longwall installations.

Common Pitfalls Sourcing Longwall Miners: Quality and Intellectual Property Risks

Sourcing longwall mining systems—complex, high-value capital equipment critical to underground coal production—presents significant challenges, particularly concerning quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to operational failures, safety hazards, costly downtime, legal disputes, and loss of competitive advantage.

Quality-Related Pitfalls

Inadequate Supplier Vetting and Track Record Assessment

Failing to thoroughly evaluate a supplier’s history, technical expertise, and proven performance in delivering longwall systems can result in acquiring substandard or unreliable equipment. Suppliers without a demonstrable record of successful installations in similar geological conditions may lack the engineering rigor needed for high-stress mining environments. This can lead to premature component failures, unplanned maintenance, and reduced production efficiency.

Compromised Materials and Manufacturing Standards

To reduce costs, some suppliers may use inferior materials or outsource manufacturing to facilities with inconsistent quality controls. Critical components such as armored face conveyors (AFC), powered roof supports (chocks), and shearer gearboxes must meet stringent durability and safety standards. Poor metallurgy, imprecise machining, or inadequate welding can result in catastrophic failures under load, endangering personnel and disrupting operations.

Insufficient Factory Acceptance Testing (FAT) and Documentation

Skipping or inadequately performing FATs—where systems are tested under simulated conditions before shipment—can allow undetected design or assembly defects to reach the mine site. Lack of comprehensive test reports, material certifications, and as-built drawings hampers troubleshooting, maintenance, and compliance with safety regulations.

Mismatched System Integration and Compatibility

Longwall systems comprise multiple interdependent components from different manufacturers (e.g., shearers, AFCs, stage loaders, pump stations). Poor integration due to non-standard interfaces, incompatible control systems, or lack of vendor coordination can lead to operational inefficiencies, control system conflicts, and increased downtime.

Intellectual Property (IP)-Related Pitfalls

Unprotected or Poorly Defined IP Ownership

Negotiating contracts without clearly defining IP ownership—especially for custom designs, control software, or system configurations—can result in disputes. Suppliers may retain rights to key innovations, limiting the buyer’s ability to modify, repair, or upgrade systems without vendor dependency or licensing fees.

Risk of IP Infringement through Third-Party Components

Sourcing longwall systems from suppliers who use unlicensed or copied technology in critical subsystems (e.g., automation software, sensor systems, hydraulic components) exposes buyers to legal liability. If the final system incorporates infringing IP, the mining company may face injunctions, fines, or forced equipment decommissioning.

Loss of Trade Secrets and Technical Know-How

Sharing detailed site-specific data (e.g., seam profiles, geological models, operational parameters) during the procurement process without robust confidentiality agreements can compromise proprietary mining strategies. Unscrupulous suppliers may reuse this knowledge for competitive bidding on other projects or sell insights to third parties.

Vendor Lock-In Through Proprietary Software and Diagnostics

Many modern longwall systems rely on proprietary software for monitoring, control, and diagnostics. Suppliers may restrict access to source code, APIs, or diagnostic tools, making it difficult to perform in-house maintenance, integrate with existing mine-wide systems, or switch service providers. This creates long-term dependency and inflates lifecycle costs.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct rigorous due diligence on suppliers, including site visits and reference checks.

– Enforce strict quality control protocols with independent third-party inspections.

– Require comprehensive FATs and full technical documentation.

– Clearly define IP ownership, usage rights, and restrictions in contracts.

– Use non-disclosure agreements (NDAs) and data protection clauses.

– Demand open or licensed access to critical software and interfaces.

– Engage legal and technical experts during procurement and contract negotiation.

Proactively addressing quality and IP concerns ensures reliable operations, protects innovation, and safeguards long-term project viability when sourcing longwall mining systems.

Logistics & Compliance Guide for Longwall Miner

Equipment Transport and Site Delivery

Transporting a longwall mining system—comprising the shearer, armored face conveyor (AFC), hydraulic roof supports (chocks), and associated components—requires meticulous logistics planning. Due to oversized and heavy loads, coordination with transportation authorities is essential for route permits, escort vehicles, and off-peak travel scheduling. Components are typically shipped in modular sections and must be sequenced according to the installation plan to avoid bottlenecks at the mine site. Proper crating, moisture protection, and secure lashing during transit are critical to prevent damage. Upon delivery, a comprehensive inspection must be conducted to verify integrity before unloading and assembly.

Site Installation and Commissioning

Installation of a longwall system must follow the manufacturer’s technical specifications and mine engineering plans. This includes precise alignment of roof supports and conveyor sections, connection of hydraulic and electrical systems, and integration with mine ventilation and monitoring infrastructure. All installation activities must comply with site-specific safety protocols and relevant standards such as MSHA (Mine Safety and Health Administration) in the U.S. or equivalent regulatory bodies internationally. Pre-commissioning checks, including pressure testing of hydraulic lines and functional testing of control systems, are mandatory. A formal commissioning report must be prepared and signed off by qualified engineers before operational commencement.

Regulatory Compliance and Safety Standards

Longwall mining operations must adhere to strict regulatory frameworks governing underground coal extraction. Key compliance areas include roof control plans approved by regulatory agencies, dust suppression systems to meet respirable dust exposure limits, methane monitoring and ventilation requirements, and emergency response preparedness. All personnel must be trained and certified in longwall operations, hazard recognition, and emergency procedures. Regular audits and inspections by internal safety teams and external regulators (e.g., MSHA, DMRE in South Africa) are required to maintain compliance. Documentation, including maintenance logs, safety inspections, and incident reports, must be retained as per statutory requirements.

Maintenance and Operational Compliance

Scheduled preventative maintenance (SPM) of longwall equipment is essential for reliability and regulatory compliance. Maintenance activities must follow OEM guidelines and be documented in a centralized maintenance management system. Critical components such as shearer motors, AFC chain tensioners, and electro-hydraulic control (EHC) systems require routine inspection and calibration. Any modifications or repairs must be assessed for compliance with original design safety standards. Use of certified replacement parts and adherence to lockout/tagout (LOTO) procedures during maintenance are mandatory to ensure worker safety and regulatory alignment.

Environmental and Reclamation Obligations

Longwall mining operations must comply with environmental regulations related to subsidence management, water discharge, and waste handling. Pre-mining baseline surveys and ongoing monitoring of surface impacts are required. Mitigation plans for potential groundwater disruption or land subsidence must be submitted to and approved by environmental authorities. Post-mining reclamation, including surface contouring, soil stabilization, and revegetation, must follow approved closure plans. Regular environmental reporting and community engagement are essential components of compliance, particularly in regions with strict environmental legislation.

Conclusion for Sourcing a Longwall Miner:

Sourcing a longwall miner is a critical strategic decision that significantly impacts the productivity, safety, and long-term viability of an underground coal mining operation. It requires a comprehensive evaluation of technical specifications, reliability, after-sales support, and total cost of ownership. Engaging with reputable manufacturers and suppliers with proven experience in longwall technology ensures access to advanced, efficient, and durable equipment tailored to specific geological and operational conditions.

Key considerations such as automation capabilities, spare parts availability, maintenance requirements, and training support must be thoroughly assessed during the procurement process. Additionally, forming long-term partnerships with suppliers fosters better service integration, faster response times, and continuous improvement through technological upgrades.

Ultimately, a well-informed sourcing decision—based on technical due diligence, lifecycle cost analysis, and alignment with mine planning objectives—will deliver enhanced extraction efficiency, improved safety outcomes, and a strong return on investment over the operational life of the longwall system.