The global log skidder market is experiencing steady growth, driven by increasing demand for efficient forestry equipment in timber harvesting operations. According to Mordor Intelligence, the forestry equipment market—which includes log skidders—is projected to grow at a CAGR of approximately 4.3% from 2023 to 2028. This expansion is fueled by rising timber production, particularly in North America and Europe, alongside advancements in machine automation and emissions standards. Additionally, growing investments in sustainable forest management and the need for high-productivity machinery in remote terrains are prompting forestry operators to adopt more advanced skidding solutions. As demand climbs, a select group of manufacturers have emerged as industry leaders, combining innovation, durability, and performance to dominate the competitive landscape. Here are the top 8 log skidder manufacturers shaping the future of timber extraction.

Top 8 Log Skidders Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Skidders

Domain Est. 1996

Website: tigercat.com

Key Highlights: Tigercat’s unique skidder drive system combines hydrostatics with electronic control technology, resulting in unparalleled productivity and efficiency….

#2 Forestry & Logging Equipment

Domain Est. 1990

Website: deere.com

Key Highlights: Explore the full line of John Deere forestry equipment, including skidders, feller bunchers, harvesters, forwarders, knuckleboom loaders and attachments….

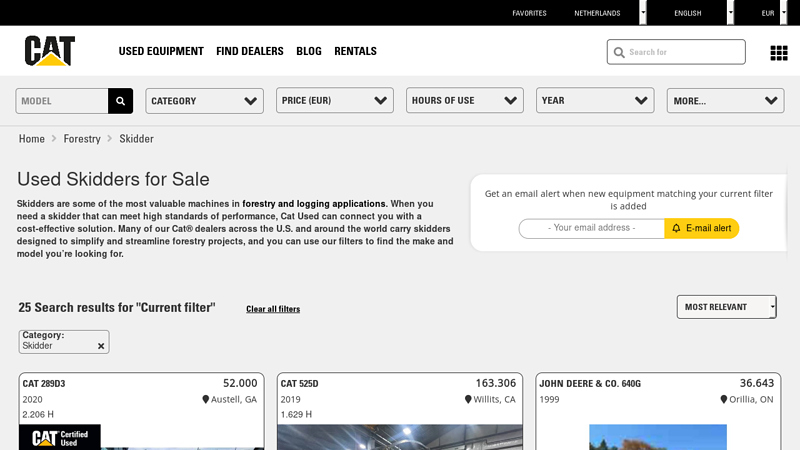

#3 Used Skidders For Sale – Used Forestry Log Skidders

Domain Est. 1993

Website: catused.cat.com

Key Highlights: Cat Used is your online source for quality Used Forestry Skidders. View our large inventory of Used Skidders For Sale from top brands at your local dealer!…

#4 L

Domain Est. 2000

Website: brandt.ca

Key Highlights: Backed by over a half-century of experience, inspired by loggers and proven in the toughest conditions imaginable, the new John Deere L-Series ……

#5 Skidders

Domain Est. 2002

Website: construction.papemachinery.com

Key Highlights: At Papé Machinery, we offer a large selection of new and used John Deere skidders for forestry companies across the western U.S…..

#6 Awassos

Domain Est. 2005

Website: awassos.com

Key Highlights: Like black bears, our skidders are robust, but their lightness and their litheness allow them to move freely through tough terrain. Awassos in brief. Since its ……

#7 CJ Logging Equipment

Domain Est. 2015

Website: cjloggingequipment.com

Key Highlights: CJ Logging Equipment is a leading supplier of logging and forestry equipment serving New York, Pennsylvania, and New Hampshire. Family-owned and operated since ……

#8 Wheel Skidders

Domain Est. 2018

Website: weilerforestry.com

Key Highlights: Based in LaGrange, Georgia, Weiler designs, engineers and manufactures equipment for the forestry industry….

Expert Sourcing Insights for Log Skidders

2026 Market Trends for Log Skidders

The global log skidder market is poised for notable evolution by 2026, driven by technological innovation, sustainability demands, and shifting forestry practices. Key trends shaping the industry include:

H2: Increased Adoption of Technological Advancements

By 2026, technology integration will be a defining factor in log skidder development. Manufacturers are prioritizing smart machinery equipped with telematics, GPS-guided navigation, and real-time performance monitoring. These systems enhance operational efficiency, reduce fuel consumption, and allow for remote diagnostics and fleet management. Additionally, the rise of semi-automated and autonomous functions—such as automated winch control and terrain-adaptive traction systems—will improve operator safety and productivity, especially in challenging terrains. Investment in electric and hybrid-electric skidder prototypes is also gaining momentum, signaling a shift toward cleaner, quieter operations in sensitive forest environments.

H2: Emphasis on Sustainability and Environmental Compliance

Sustainability will be a core driver in the 2026 log skidder market. Regulatory pressures and consumer demand for responsibly sourced timber are pushing forestry operations to adopt low-impact harvesting methods. Modern skidders are being engineered with reduced ground pressure, precision steering, and eco-mode engine settings to minimize soil compaction and ecosystem disruption. Emissions standards, particularly in North America and Europe, will continue to influence engine design, favoring Tier 5/Stage V compliant diesel engines and paving the way for alternative fuel models. Forest certification programs like FSC and PEFC will further incentivize the use of sustainable machinery, impacting purchasing decisions.

H2: Regional Market Diversification and Demand Shifts

While North America and Europe remain key markets due to mature forestry sectors and high mechanization rates, growth in 2026 will increasingly come from emerging regions such as Eastern Europe, Southeast Asia, and South America. These areas are expanding timber production and modernizing equipment fleets, creating demand for cost-effective, durable skidders. In contrast, developed markets will focus on equipment upgrades and replacement cycles, favoring high-capacity, technologically advanced models. Rental and fleet-sharing models may also grow, especially among small to mid-sized logging contractors seeking flexibility and lower capital investment.

H2: Focus on Operator Comfort and Safety

By 2026, ergonomics and safety features will be critical selling points. Log skidder cabins are expected to feature enhanced roll-over protection (ROPS/FOPS), advanced climate control, noise reduction technologies, and intuitive control interfaces. Integration with wearable safety devices and fatigue-monitoring systems will become more common, reducing accident risks in remote and hazardous logging environments. Training simulators and augmented reality (AR) tools may also be adopted to improve operator preparedness and reduce onboarding time.

H2: Supply Chain Resilience and Aftermarket Services

The log skidder industry will place greater emphasis on supply chain stability and comprehensive aftermarket support. Post-pandemic disruptions have highlighted the need for localized manufacturing and robust spare parts networks. Leading manufacturers are likely to expand service centers and digital support platforms to offer predictive maintenance and remote troubleshooting. Extended warranties, service contracts, and refurbished equipment programs will gain traction, helping operators manage costs and extend equipment lifecycles in an increasingly competitive market.

Common Pitfalls When Sourcing Log Skidders: Quality and Intellectual Property Concerns

Sourcing log skidders—especially from unfamiliar suppliers or international markets—exposes buyers to several risks. Two of the most critical areas of concern are product quality and intellectual property (IP) issues. Failing to address these can lead to operational inefficiencies, legal complications, and financial losses.

Poor Build Quality and Substandard Components

One of the most frequent pitfalls in sourcing log skidders is receiving machines built with inferior materials or lacking proper engineering standards. Low-cost suppliers may cut corners by using substandard steel, unreliable hydraulics, or underpowered engines to reduce manufacturing costs. These compromises often result in frequent breakdowns, higher maintenance costs, and reduced operational lifespan. Additionally, inadequate welding, poor fit-and-finish, or non-compliance with regional safety standards (such as ISO or OSHA) can create hazardous working conditions and expose the buyer to liability.

Non-Compliance with Emissions and Safety Regulations

Many budget log skidders—particularly those from certain manufacturing regions—do not meet emissions standards such as EPA Tier 4 or EU Stage V. Importing or operating such machines in regulated markets can lead to fines, import denials, or forced machinery modifications. Similarly, lacking essential safety features like rollover protection structures (ROPS), fire suppression systems, or emergency shut-offs can result in workplace accidents and regulatory penalties.

Lack of After-Sales Support and Spare Parts Availability

Even if a log skidder appears well-built initially, long-term performance depends on serviceability. Sourcing from suppliers with limited global service networks or poor spare parts logistics can lead to extended downtime. Some manufacturers may also discontinue models quickly or lack local technical documentation, making repairs difficult and costly.

Intellectual Property Infringement Risks

Another significant risk involves IP violations. Some manufacturers produce “copycat” skidders that closely mimic the design, branding, or patented technologies of established brands (e.g., Tigercat, John Deere, or Komatsu). Purchasing such equipment may expose the buyer to legal action, especially if the machines are imported into jurisdictions with strict IP enforcement. Customs authorities may seize infringing goods, and end-users could face claims for contributory infringement or damage to reputation.

Misleading or Inaccurate Specifications

Suppliers—particularly online or through third-party marketplaces—may exaggerate performance specs such as engine horsepower, winch pulling capacity, or fuel efficiency. Without independent verification or third-party testing reports, buyers risk acquiring a machine that cannot handle the intended workload, leading to project delays and increased operating costs.

Absence of Warranty or Voided Coverage Due to IP Issues

Even if a warranty is offered, it may be difficult to enforce internationally or may be voided if the equipment is found to infringe on IP rights. Additionally, using counterfeit or unlicensed components (e.g., in hydraulic systems or control modules) can invalidate warranties on legitimate parts and deter authorized service providers from offering support.

How to Mitigate These Risks

To avoid these pitfalls, buyers should:

– Conduct thorough due diligence on suppliers, including site visits and reference checks.

– Request independent quality certifications and test reports.

– Verify compliance with local emissions and safety regulations.

– Consult legal experts to assess IP risks, especially when considering lower-cost replicas.

– Ensure service agreements and spare parts availability are contractually guaranteed.

– Work with reputable dealers or authorized distributors whenever possible.

Proactively addressing quality and IP concerns during the sourcing process significantly reduces the risk of operational disruption and legal exposure.

Logistics & Compliance Guide for Log Skidders

Operating log skidders involves complex logistical planning and strict adherence to regulatory compliance. This guide outlines key considerations to ensure efficient operations while meeting safety, environmental, and legal standards.

Equipment Transport and Site Access

Transporting log skidders to and from logging sites requires careful coordination. Skidders are heavy and often exceed standard road vehicle dimensions, necessitating special permits for oversize/overweight loads. Route planning must account for road conditions, bridge weight limits, and clearance issues. Secure loading and proper tie-down procedures are essential during transit to prevent damage or accidents. Upon arrival, site access must be evaluated for terrain stability, slope safety, and proximity to environmentally sensitive areas.

Operator Licensing and Training Requirements

All log skidder operators must possess appropriate licenses and certifications. In most jurisdictions, this includes a valid commercial driver’s license (CDL) and specialized training in heavy equipment operation. Employers must ensure compliance with OSHA (Occupational Safety and Health Administration) and MSHA (Mine Safety and Health Administration) standards, where applicable. Mandatory training programs should cover machine-specific operation, emergency procedures, rollover protection, and hazard recognition. Documentation of training and regular refresher courses are critical for compliance audits.

Environmental Regulations and Best Practices

Logging operations using skidders must comply with federal, state, and local environmental laws. This includes adherence to the Clean Water Act, particularly in preventing sediment runoff into waterways through proper use of stream buffers and erosion controls. Operators must follow Forest Stewardship Council (FSC) or Sustainable Forestry Initiative (SFI) guidelines where certification is required. Minimizing soil compaction, avoiding skidding during wet conditions, and using designated trails help reduce long-term ecological impact.

Maintenance and Safety Inspections

Regular maintenance of log skidders is required by both manufacturer recommendations and safety regulations. Daily pre-operation inspections should check hydraulic systems, brakes, tires/tracks, winches, and safety features such as rollover protective structures (ROPS) and fire suppression systems. Maintenance records must be kept up to date to demonstrate compliance during inspections. Scheduled servicing helps prevent breakdowns and ensures equipment operates safely and efficiently.

Documentation and Recordkeeping

Proper documentation is vital for regulatory compliance and operational transparency. Required records include equipment logs, operator certifications, maintenance schedules, incident reports, and transportation permits. In regulated forests, haul logs may require detailed tracking through state or federal timber scaling and auditing systems. Digital logging platforms can streamline data collection and reporting for audits by agencies such as the Department of Natural Resources (DNR) or Environmental Protection Agency (EPA).

Noise, Emissions, and Air Quality Standards

Log skidders must comply with emissions regulations set by the Environmental Protection Agency (EPA), particularly Tier 4 engine standards for new equipment. Operators should monitor exhaust systems and use approved diesel fuels or biofuels as required. Noise levels must adhere to local ordinances, especially near residential zones or protected areas. Regular emissions testing and maintenance help ensure ongoing compliance and reduce environmental impact.

By following this logistics and compliance framework, logging companies can operate log skidders efficiently, safely, and in full alignment with applicable laws and industry standards.

In conclusion, sourcing log skidders requires a careful evaluation of several key factors to ensure efficiency, durability, and cost-effectiveness in forestry operations. Buyers should consider the type of skidder (e.g., farm-based, purpose-built, grapple vs. clambunk), operational terrain, logging scale, and maintenance requirements. Sourcing from reputable manufacturers or suppliers—whether new or used—ensures reliability and access to after-sales support, spare parts, and warranties. Additionally, evaluating total cost of ownership, operator safety features, and environmental impact contributes to a sustainable and productive investment. By aligning equipment specifications with specific logging needs and conducting thorough market research, forestry operators can make informed sourcing decisions that enhance productivity and long-term operational success.