The global lithium-ion uninterruptible power supply (UPS) market is experiencing robust growth, driven by rising demand for reliable backup power solutions in data centers, healthcare, telecommunications, and industrial sectors. According to a report by Mordor Intelligence, the lithium-ion UPS market was valued at USD 3.8 billion in 2023 and is projected to reach USD 7.6 billion by 2029, growing at a compound annual growth rate (CAGR) of approximately 12.3% during the forecast period. This expansion is fueled by the superior energy density, longer lifespan, and reduced maintenance requirements of lithium-ion batteries compared to traditional valve-regulated lead-acid (VRLA) systems. As organizations increasingly prioritize energy efficiency and space optimization, manufacturers are investing heavily in next-generation lithium-ion UPS technologies. In this evolving landscape, key players are distinguished by innovation, scalability, and global reach—making it essential to identify the top 10 manufacturers shaping the future of uninterrupted power.

Top 10 Lithium Ion Uninterruptible Power Supply Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 UPS Systems

Domain Est. 1990

Website: new.abb.com

Key Highlights: ABB has the UPS technology for every need. Protection against all power failures, voltage regulation, power factor correction and harmonics is guaranteed….

#2 Uninterruptible Power Supply Company

Domain Est. 1997

Website: dc-group.com

Key Highlights: DC Group is a leading UPS service center and uninterruptible power supply company, offering reliable industrial uninterrupted power supply solutions….

#3 Backup Power UPS

Domain Est. 1996

Website: eaton.com

Key Highlights: Eaton is a leading provider of backup power UPS, or uninterruptible power supply. Eaton UPSs deliver high quality, reliable backup power for everything….

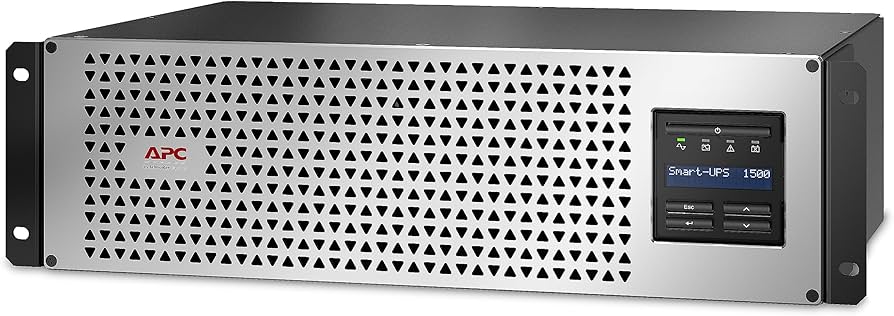

#4 Uninterruptible Power Supplies

Domain Est. 1996

Website: chatsworth.com

Key Highlights: Browse Uninterruptible Power Supplies (6 Products) ; Lithium Ion Standby UPS 350VA-600VA. 4 Options. Starting at $629.82 USD MSRP ; Lead Acid Line-Interactive UPS ……

#5 UPS Battery Backups

Domain Est. 1997

Website: cyberpowersystems.com

Key Highlights: CyberPower designs and manufactures a complete line of uninterruptible power supply (UPS) systems to meet the full spectrum of power protection needs from ……

#6 Uninterruptible Power Supply by Riello UPS

Domain Est. 1998

Website: riello-ups.com

Key Highlights: Riello UPS power supply solutions, producing high‐grade, low‐impact UPS power delivery units. Delivering uninterrupted and unbreachable power to work and……

#7 Lithium-Ion UPS

Domain Est. 2011

Website: vertiv.com

Key Highlights: Lithium-ion UPS batteries have longer life, longer runtime, and lower total cost of ownership compared to valve-regulated lead-acid (VRLA) batteries….

#8 Lithium Ion Battery UPS Solution

Domain Est. 2013

Website: scupower.com

Key Highlights: SCU offers lithium-ion battery UPS solutions for customers. The latest UPS li ion battery features longer lifespan, smaller size and weight. The li ion UPS ……

#9 Battle Born Batteries

Domain Est. 2016

Website: battlebornbatteries.com

Key Highlights: Free delivery · 30-day returnsShop premium LiFePO4 lithium batteries from Battle Born for unmatched power, reliability, and a 10-year warranty. Get started today!…

#10 Mitsubishi Electric: Critical Power Solutions

Domain Est. 2017

Website: mitsubishicritical.com

Key Highlights: Avoid catastrophic downtime with highly reliable and efficient critical power solutions like UPS systems and IT Cooling solutions from Mitsubishi Electric….

Expert Sourcing Insights for Lithium Ion Uninterruptible Power Supply

H2: 2026 Market Trends for Lithium-Ion Uninterruptible Power Supply (UPS)

The Lithium-Ion Uninterruptible Power Supply (UPS) market is poised for significant transformation and robust growth by 2026, driven by technological advancements, evolving energy demands, and shifting industry priorities. Key trends shaping the landscape include:

-

Dominant Shift from VRLA to Lithium-Ion:

- Accelerated Adoption: By 2026, lithium-ion (Li-ion) will be the dominant chemistry in new UPS deployments, particularly in data centers, telecom, and industrial applications. Cost parity with Valve-Regulated Lead-Acid (VRLA) batteries has been largely achieved or surpassed when considering the Total Cost of Ownership (TCO).

- TCO Advantage: The significantly longer lifespan (10-15 years vs. 3-5 years for VRLA), higher energy density (saving up to 70% space), faster recharge times, wider operating temperature tolerance, and minimal maintenance requirements make Li-ion the clear TCO winner, driving replacement cycles.

-

Focus on Scalability and Modularity:

- Modular UPS Systems: Demand for highly scalable, modular UPS architectures will soar. Li-ion’s inherent characteristics (smaller footprint, lighter weight, longer life) perfectly complement modular designs, enabling “pay-as-you-grow” capacity expansion and seamless integration into containerized or micro-module data centers.

- Containerized Solutions: Growth in edge computing and distributed infrastructure will boost demand for pre-integrated, containerized UPS solutions with Li-ion batteries, offering rapid deployment and standardized power protection.

-

Integration with Renewable Energy & Microgrids:

- Hybrid Systems: UPS systems will increasingly function as integral components of building-level or campus-wide microgrids. Li-ion UPS will not only provide backup but also participate in energy arbitrage (charging during off-peak, discharging during peak), frequency regulation, and seamless integration with solar PV and wind generation.

- Grid Services: Advanced UPS systems with Li-ion batteries will offer grid support services (peak shaving, demand charge management, voltage support), blurring the lines between traditional UPS and energy storage systems (ESS).

-

Advancements in Battery Chemistry and Safety:

- Beyond NMC: While NMC (Nickel Manganese Cobalt) dominates, alternatives like LFP (Lithium Iron Phosphate) will gain significant traction due to superior safety (thermal stability), longer cycle life, lower cobalt dependency (improving ESG profile), and reduced cost. LFP will become the preferred choice for many applications prioritizing safety and longevity over maximum energy density.

- Enhanced BMS & Safety: Sophisticated Battery Management Systems (BMS) with advanced monitoring, predictive analytics, and fail-safe mechanisms will be standard, ensuring safety and maximizing battery health and lifespan. Focus on fire detection and suppression integration will intensify.

-

Digitalization and Smart Management:

- IoT & AI Integration: UPS systems will be deeply integrated into IoT platforms. Real-time remote monitoring of battery health (State of Health – SoH, State of Charge – SoC), environmental conditions, and system performance will be ubiquitous. AI and machine learning will enable predictive maintenance, optimizing replacement schedules and preventing failures.

- Cloud-Based Platforms: Cloud-based management platforms will provide centralized visibility and control over distributed UPS fleets, enabling efficient operations and data-driven decision-making.

-

Sustainability and ESG Drivers:

- Circular Economy: Pressure for sustainable solutions will drive initiatives in Li-ion battery recycling and second-life applications (e.g., repurposing used UPS batteries for less demanding ESS roles). Manufacturers will emphasize recyclability and reduced environmental impact.

- Carbon Footprint Reduction: The energy efficiency gains (higher efficiency, less cooling due to smaller footprint/heat output) and integration with renewables position Li-ion UPS as a key tool for organizations aiming to reduce their carbon footprint and meet ESG goals.

-

Supply Chain Resilience and Localization:

- Reduced Geopolitical Risk: Efforts to diversify Li-ion battery supply chains away from concentrated regions will continue, with increased investment in manufacturing capacity in North America and Europe to mitigate geopolitical risks and ensure supply security.

- Raw Material Sourcing: Focus on ethical and sustainable sourcing of critical minerals (lithium, nickel, cobalt) will intensify, influencing procurement decisions.

Conclusion for 2026:

By 2026, the Lithium-Ion UPS market will be characterized by maturity in core technology, widespread displacement of VRLA, and a strategic shift towards intelligent, integrated energy systems. Success will depend on offering solutions that deliver superior TCO, enhance energy resilience through renewable integration, leverage digital intelligence for optimization, and meet stringent sustainability requirements. Li-ion UPS will evolve from a simple backup power device to a critical, intelligent node within the broader energy infrastructure.

Common Pitfalls When Sourcing Lithium-Ion Uninterruptible Power Supply (Quality, IP)

Sourcing lithium-ion uninterruptible power supplies (Li-ion UPS) offers advantages like longer lifespan, faster charging, and smaller footprint compared to traditional valve-regulated lead-acid (VRLA) systems. However, organizations often encounter critical pitfalls related to quality and intellectual property (IP) that can compromise reliability, safety, and legal compliance. Being aware of these common issues helps ensure a successful procurement process.

Poor Battery Quality and Cell Sourcing

One of the most significant risks is acquiring Li-ion UPS systems built with low-quality or counterfeit battery cells. Reputable manufacturers use Grade A cells from established suppliers (e.g., LG, Panasonic, Samsung SDI), whereas lower-tier vendors may use recycled, reconditioned, or inferior-grade cells. These substandard cells degrade quickly, have inconsistent performance, and pose serious safety hazards such as thermal runaway. Buyers should verify cell specifications and demand transparency about cell origin and battery management system (BMS) design.

Inadequate or Non-Compliant Battery Management System (BMS)

The BMS is critical for monitoring cell voltage, temperature, and state of charge, preventing overcharging, deep discharging, and overheating. Subpar Li-ion UPS units often feature poorly designed or non-certified BMS implementations. This increases the risk of fire, reduced battery life, and system failure during outages. Ensure the BMS complies with international safety standards such as UL 1973, IEC 62619, or UN 38.3, and request third-party test reports to validate performance and safety claims.

Lack of IP Protection and Risk of Counterfeiting

Lithium-ion technology is heavily protected by patents related to cell chemistry, battery pack design, thermal management, and software algorithms. When sourcing from unknown or offshore manufacturers, there is a real risk of inadvertently procuring systems that infringe on existing IP. This exposes the buyer to legal liability, product seizure, or forced recall. Always require suppliers to certify that their products do not violate any intellectual property rights and, where possible, source from original equipment manufacturers (OEMs) with established IP portfolios.

Misrepresentation of Specifications and Performance

Some vendors exaggerate key performance metrics such as cycle life, energy density, or operating temperature range. For example, claiming 5,000+ charge cycles without specifying depth of discharge (DoD) conditions can be misleading. Similarly, runtime estimates may not reflect real-world loads or aging effects. Request detailed technical documentation, third-party certifications (e.g., CE, FCC, RoHS), and, if feasible, conduct pilot testing before large-scale deployment.

Insufficient Safety Certifications and Regulatory Compliance

Not all Li-ion UPS systems meet regional safety and transport regulations. For instance, systems lacking UL 924 (for emergency lighting and power equipment) or UN 38.3 (for safe transportation of lithium batteries) may fail inspections or be denied entry at customs. Additionally, fire safety standards such as NFPA 855 (for energy storage systems) may apply depending on installation scale. Confirm that the product carries all necessary certifications for your region and use case.

Hidden Costs from Proprietary Lock-In and Lack of Interoperability

Some manufacturers use proprietary communication protocols or battery modules, locking customers into a single vendor for replacements and upgrades. This reduces flexibility, increases lifecycle costs, and may lead to obsolescence. Evaluate whether the Li-ion UPS supports open standards (e.g., SNMP, Modbus) and whether battery packs are modular and replaceable across vendors.

Inadequate Warranty and After-Sales Support

A short or narrowly defined warranty—especially one that excludes battery degradation or thermal incidents—can signal poor product confidence. Additionally, limited technical support or spare parts availability can lead to extended downtime. Evaluate the supplier’s service network, warranty terms (including end-of-life capacity guarantees), and availability of firmware updates.

By addressing these quality and IP-related pitfalls proactively, organizations can select a reliable, safe, and legally sound lithium-ion UPS solution that delivers long-term value and operational resilience.

Logistics & Compliance Guide for Lithium-Ion Uninterruptible Power Supply (UPS)

Overview

Lithium-ion (Li-ion) Uninterruptible Power Supply (UPS) systems are critical for protecting sensitive electronic equipment during power outages. However, due to the inherent risks associated with lithium-ion batteries—such as thermal runaway and fire—strict international and national regulations govern their transport, storage, and handling. This guide outlines key logistics and compliance requirements for shipping, storing, and managing Li-ion UPS units safely and legally.

Regulatory Framework

Li-ion UPS systems are classified as dangerous goods under international transportation regulations due to their lithium-ion battery content. The primary regulatory standards include:

– International Air Transport Association (IATA) Dangerous Goods Regulations (DGR) – For air transport

– International Maritime Dangerous Goods (IMDG) Code – For sea transport

– ADR (Accord européen relatif au transport international des marchandises Dangereuses par Route) – For road transport in Europe

– 49 CFR (Code of Federal Regulations) – For domestic transport in the United States

These regulations classify lithium-ion batteries under UN 3480 (lithium-ion batteries alone) or UN 3481 (lithium-ion batteries contained in or packed with equipment), depending on configuration.

Classification & Packaging Requirements

- Classification: A Li-ion UPS is typically shipped as “UN 3481, Lithium ion batteries contained in equipment,” Class 9 – Miscellaneous Dangerous Goods.

- State of Charge (SoC): Batteries must not exceed 30% state of charge during transport, unless specifically exempted by regulation (e.g., prototype or low-volume batteries).

- Packaging:

- Must be packaged to prevent short circuits and physical damage.

- Use rigid, non-conductive inner packaging to separate terminals.

- Outer packaging must pass drop and stacking tests per UN performance standards.

- Prevent movement within the package during transit.

- Marking & Labeling:

- Proper shipping name: “LITHIUM ION BATTERIES CONTAINED IN EQUIPMENT”

- UN number: UN 3481

- Class 9 Miscellaneous Dangerous Goods label

- Lithium battery handling label (with telephone number and UN number)

- Cargo aircraft only label (if applicable)

Documentation

- Shipper’s Declaration for Dangerous Goods: Required for air transport (IATA DGR 8.6)

- Material Safety Data Sheet (MSDS/SDS): Recommended for emergency response information

- Battery Test Summary: Required under certain conditions (e.g., new cell designs or non-exempt shipments) per UN Manual of Tests and Criteria, Part III, Subsection 38.3

- Commercial Invoice & Packing List: Must clearly describe contents and include UN number and proper shipping name

Transport Mode Specifics

Air Transport (IATA DGR)

- Prohibited in passenger aircraft if SoC exceeds 30% and total lithium content exceeds limits

- Limited to cargo aircraft for larger shipments

- Quantity limits apply per package and per aircraft

- Prior notification to airline required

Sea Transport (IMDG Code)

- Must be stowed away from heat sources and incompatible materials

- Ventilation and segregation requirements apply based on container type

- Container packing certificate required for consolidated shipments

Road Transport (ADR, 49 CFR)

- Requires appropriate placarding on vehicles for large quantities

- Drivers must have dangerous goods training (ADR training certificate in Europe)

- Emergency response information must be carried in the vehicle

Storage & Handling

- Storage Environment:

- Store in cool, dry, well-ventilated areas away from flammable materials

- Avoid direct sunlight and extreme temperatures (recommended: 15–25°C / 59–77°F)

- Stacking: Follow manufacturer guidelines; do not exceed maximum stack height

- Fire Protection: Install appropriate fire suppression systems (e.g., aerosol or gas-based systems suitable for lithium fires)

- Inspection: Regularly inspect for damage, swelling, leakage, or overheating

Compliance & Training

- Personnel involved in handling, packing, or shipping Li-ion UPS systems must undergo dangerous goods training compliant with IATA, IMDG, or ADR requirements.

- Training must be refreshed every 24 months.

- Maintain records of training, shipping declarations, and compliance audits.

Exemptions & Exceptions

- Small lithium-ion batteries (e.g., under certain watt-hour thresholds) may be eligible for limited quantity or excepted provisions.

- Equipment with batteries installed may qualify for exceptions if SoC ≤30% and packaging meets regulatory criteria (e.g., IATA Special Provision A48 or A154).

- Always verify current regulations, as exemptions are subject to change.

Emergency Response

- In case of fire, thermal runaway, or leakage:

- Evacuate area and alert emergency services

- Use Class D fire extinguishers or large quantities of water to cool the unit

- Do not use standard ABC extinguishers alone—cooling is critical

- Refer to SDS and emergency response guide (ERG) for specific actions

Conclusion

Shipping and managing lithium-ion UPS systems requires strict adherence to international dangerous goods regulations. Proper classification, packaging, documentation, and training are essential to ensure safety and regulatory compliance. Always consult the latest edition of IATA DGR, IMDG Code, ADR, or 49 CFR based on your shipping route and jurisdiction. When in doubt, partner with certified dangerous goods specialists or freight forwarders experienced in lithium battery logistics.

Conclusion:

Sourcing a lithium-ion uninterruptible power supply (Li-ion UPS) represents a strategic investment in reliability, efficiency, and long-term cost savings. Compared to traditional valve-regulated lead-acid (VRLA) UPS systems, lithium-ion technology offers significant advantages, including a longer lifespan, reduced footprint and weight, faster charging times, and lower total cost of ownership despite a higher initial purchase price. These benefits make Li-ion UPS systems particularly well-suited for data centers, telecom installations, healthcare facilities, and industrial applications where space, uptime, and energy efficiency are critical.

When sourcing a lithium-ion UPS, it is essential to evaluate key factors such as battery chemistry (e.g., NMC or LFP), scalability, integration capabilities, safety certifications, and manufacturer support. Selecting reputable suppliers with proven track records ensures system reliability and compliance with international standards. Additionally, considering sustainability aspects—such as recyclability and environmental impact—aligns with corporate social responsibility goals.

In conclusion, the transition to lithium-ion UPS technology is not only a forward-thinking upgrade in power protection but also a necessary step toward building resilient, energy-efficient, and future-ready infrastructure. As lithium-ion costs continue to decline and technology advances, now is an opportune time to adopt this superior solution for uninterrupted power needs.