The global lithium compounds market is experiencing robust expansion, driven by surging demand for rechargeable batteries in electric vehicles (EVs), consumer electronics, and energy storage systems. According to Grand View Research, the market was valued at USD 8.6 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 10.4% from 2024 to 2030. This growth trajectory is further fueled by government initiatives promoting clean energy and the rapid electrification of transportation. As demand intensifies, a handful of key players have emerged as dominant forces in the production of critical lithium compounds such as lithium carbonate, lithium hydroxide, and lithium chloride. These manufacturers are not only scaling capacity but also investing in technological advancements and vertical integration to secure supply chain resilience. The following analysis highlights the top 8 lithium compounds manufacturers shaping the future of the global lithium industry.

Top 8 Lithium Compounds Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Lithium Compounds

Domain Est. 2003

Website: ganfenglithium.com

Key Highlights: We are the world’s third largest and China’s largest lithium compounds producer and the world’s largest lithium metals producer in terms of production ……

#2 Pure Lithium

Domain Est. 2019

Website: purelithium.io

Key Highlights: At Pure Lithium’s lab Chicago, we produce a pure lithium metal anode from brine using our transformational Brine to Battery™ technology. We pair it with a ……

#3 Zinnwald Lithium, producer of battery

Domain Est. 2020

Website: zinnwaldlithium.com

Key Highlights: Zinnwald Lithium – a leading domestic supplier to the European battery industry with decades of global mining and chemical industry expertise….

#4 United States

Domain Est. 1995

Website: albemarle.com

Key Highlights: A reliable and high-quality global supply of lithium, bromine and other essential elements, allows us to deliver advanced solutions for our customers….

#5 Lithium

Domain Est. 1999

Website: imerys.com

Key Highlights: Lithium is a very light alkali element that is a critical component in the manufacture of batteries for the automotive industry….

#6 Lithium Americas

Domain Est. 2009

Website: lithiumamericas.com

Key Highlights: Lithium Americas is focused on advancing Thacker Pass to production to supply battery-quality lithium carbonate for the North American critical minerals supply ……

#7 Mangrove Lithium

Domain Est. 2021

Website: mangrovelithium.com

Key Highlights: Mangrove is an innovative lithium refining platform that operates in the space between lithium extraction and cathode manufacturing and redefines the industry ……

#8 Century Lithium Corp

Domain Est. 2022

Website: centurylithium.com

Key Highlights: Century Lithium Corp. is a Canadian based advanced stage lithium Company, focused on developing its 100%-owned Clayton Valley Lithium Project in Nevada, ……

Expert Sourcing Insights for Lithium Compounds

H2: 2026 Market Trends for Lithium Compounds

The global lithium compounds market is poised for significant expansion by 2026, driven primarily by the accelerating transition to clean energy and electric mobility. Lithium compounds—such as lithium carbonate, lithium hydroxide, and lithium chloride—are essential materials in the production of lithium-ion batteries, which power electric vehicles (EVs), consumer electronics, and energy storage systems (ESS). The following analysis outlines key market trends expected to shape the lithium compounds sector in 2026.

1. Surging Demand from the Electric Vehicle (EV) Sector

By 2026, the EV market is projected to be the dominant driver of lithium compound demand. Governments worldwide are enforcing stricter emissions regulations and offering incentives to phase out internal combustion engine vehicles. As a result, automakers are scaling up EV production, with many targeting 20-50% of total sales to be electric by 2030. This shift significantly increases demand for lithium hydroxide, preferred for high-performance nickel-rich cathodes (e.g., NMC 811 and NCA), which offer higher energy density and longer range.

2. Growth in Energy Storage Systems (ESS)

Beyond transportation, stationary energy storage systems—used in grid stabilization and renewable energy integration—are expected to become a major consumer of lithium compounds. As solar and wind energy capacity expands globally, the need for reliable storage solutions grows. Lithium iron phosphate (LFP) batteries, which use lithium carbonate, are gaining market share in ESS due to their safety, longevity, and lower cost, further diversifying demand across lithium compound types.

3. Shift Toward Lithium Hydroxide

Lithium hydroxide is expected to outpace lithium carbonate in growth by 2026. This trend is fueled by battery manufacturers’ preference for high-nickel cathodes in premium EVs, which require lithium hydroxide due to its lower processing temperatures and reduced impurity levels. As automakers focus on improving battery performance and reducing charging times, demand for lithium hydroxide is forecast to grow at a CAGR of over 18% from 2023 to 2026.

4. Supply Chain Diversification and Geopolitical Factors

Supply security remains a critical concern. Historically, lithium supply has been concentrated in Australia (hard-rock mining) and the Lithium Triangle (Argentina, Chile, Bolivia; brine extraction). By 2026, new producers in countries such as Canada, the United States, Portugal, and Zimbabwe are expected to enter the market, reducing dependency on traditional sources. Additionally, geopolitical tensions and resource nationalism may prompt countries like China, the U.S., and members of the EU to invest in domestic refining and recycling infrastructure to secure supply chains.

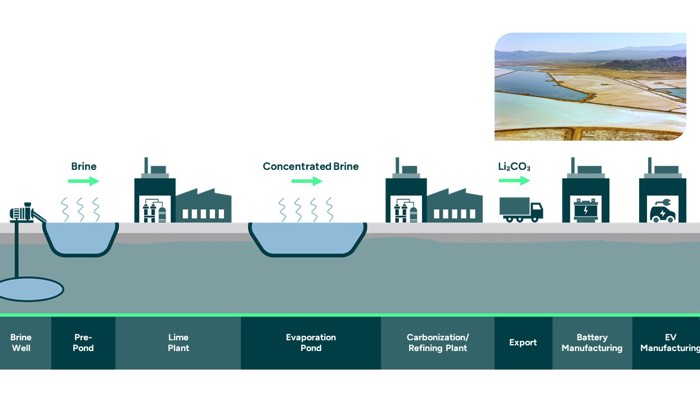

5. Technological Innovation and Extraction Methods

Advancements in extraction technologies—such as direct lithium extraction (DLE)—are expected to gain commercial traction by 2026. DLE offers higher recovery rates, reduced environmental impact, and faster production cycles compared to conventional evaporation ponds. Companies deploying DLE at scale could significantly increase lithium supply while minimizing water usage and land disruption, making brine resources more viable in environmentally sensitive regions.

6. Price Volatility and Market Stabilization

After experiencing extreme price fluctuations in the early 2020s, the lithium compounds market is expected to stabilize by 2026 due to increased production capacity and improved supply-demand alignment. However, short-term volatility may persist due to lead times in mining development, permitting delays, and fluctuating EV adoption rates. Long-term contracts between automakers and lithium producers are becoming more common, providing price predictability and reducing exposure to spot market swings.

7. Sustainability and Environmental, Social, and Governance (ESG) Considerations

By 2026, ESG criteria will play a pivotal role in shaping sourcing decisions. Consumers and regulators are demanding greater transparency in the lithium supply chain, with emphasis on water usage, carbon footprint, and community impacts. Producers adopting low-impact technologies and third-party certifications (e.g., IRMA, LAC) will gain a competitive advantage. Recycling of end-of-life batteries is also expected to contribute up to 10–15% of lithium supply by 2030, with early momentum visible in 2026.

8. Regional Market Dynamics

– Asia-Pacific: China remains the largest consumer and processor of lithium compounds, though India and Southeast Asia are emerging as new growth markets for EVs and ESS.

– North America: The U.S. is investing heavily in domestic lithium production and battery manufacturing under policies like the Inflation Reduction Act (IRA), boosting regional demand.

– Europe: Stringent green energy targets and a growing EV market are driving demand, supported by new gigafactories and local refining initiatives.

Conclusion

By 2026, the lithium compounds market will be shaped by robust demand from EVs and energy storage, technological innovation in extraction and recycling, and increasing emphasis on sustainability and supply chain resilience. While challenges around supply scalability and environmental impact persist, strategic investments and policy support are expected to drive a more balanced and sustainable market. Companies that adapt to these evolving trends—particularly in lithium hydroxide production, DLE adoption, and ESG compliance—will be well-positioned to lead in the next phase of the energy transition.

Common Pitfalls in Sourcing Lithium Compounds: Quality and Intellectual Property (IP) Risks

Sourcing lithium compounds—such as lithium carbonate, lithium hydroxide, or specialized derivatives like lithium hexafluorophosphate—is critical for industries ranging from electric vehicles to consumer electronics. However, procurement teams and manufacturers frequently encounter significant challenges related to quality consistency and intellectual property (IP) protection. Overlooking these pitfalls can lead to supply chain disruptions, product failures, legal disputes, and reputational damage.

Quality-Related Pitfalls

-

Inconsistent Purity and Contaminant Levels

Lithium compounds used in battery-grade applications require extremely high purity (often >99.5%). A common pitfall is sourcing from suppliers who cannot consistently meet these specifications. Trace contaminants like sodium, potassium, calcium, or sulfates can degrade battery performance, reduce cycle life, or even create safety hazards. Without rigorous and standardized testing protocols (e.g., ICP-MS, XRD), buyers may receive batches that vary significantly in quality. -

Lack of Traceability and Process Control

The origin of lithium (e.g., brine vs. spodumene) and the manufacturing process (e.g., roasting, precipitation methods) directly impact compound quality. Suppliers without robust traceability systems may obscure the source or processing history, increasing the risk of supply variability. This lack of transparency makes it difficult to diagnose quality issues or ensure ethical and sustainable sourcing. -

Inadequate Certifications and Testing Documentation

Many suppliers provide certificates of analysis (CoA), but these may not reflect independent testing or may be outdated. Relying solely on supplier-provided data without third-party verification or on-site audits can result in accepting substandard material. Ensuring adherence to international standards (e.g., ISO 9001, ASTM) is essential but often overlooked. -

Storage and Handling Risks

Lithium compounds are hygroscopic and reactive. Poor packaging, improper storage, or extended logistics times can degrade material quality before it reaches the end user. Buyers may not account for these factors in supplier evaluations, leading to unexpected performance issues.

Intellectual Property (IP) Risks

-

Unlicensed Use of Proprietary Production Methods

Advanced lithium refining and conversion processes are often protected by patents. Sourcing compounds produced using patented technologies without proper licensing can expose the buyer to indirect infringement claims. For example, a supplier might use a proprietary low-energy lithium hydroxide process protected by IP, and purchasing from them could implicate downstream users in legal disputes if the supplier lacks legitimate rights. -

Ambiguous or Absent IP Clauses in Supply Agreements

Contracts that fail to clearly define ownership of process improvements, formulations, or application-specific modifications can lead to disputes. Buyers contributing technical feedback or co-developing materials may inadvertently relinquish IP rights if agreements are not carefully drafted. -

Reverse Engineering and Trade Secret Exposure

When working with new or unfamiliar suppliers, there is a risk that proprietary formulations or application methods could be reverse-engineered or disclosed. Without strong confidentiality agreements (NDAs) and controls over technical data sharing, companies risk losing competitive advantages. -

Geopolitical and Regulatory IP Challenges

Some regions have weaker IP enforcement, increasing the risk of technology leakage or counterfeit production. Additionally, export controls or local content requirements may restrict the transfer of certain lithium technologies, complicating global sourcing strategies and exposing companies to compliance risks.

Mitigation Strategies

- Implement rigorous supplier qualification programs, including on-site audits and independent lab verification.

- Require full material traceability and adherence to international quality standards.

- Include clear IP ownership, indemnification, and confidentiality clauses in supply contracts.

- Conduct IP due diligence on suppliers’ manufacturing processes to avoid infringement.

- Establish dual sourcing or strategic partnerships to reduce dependency and enhance supply chain resilience.

Proactively addressing these quality and IP pitfalls is essential to ensuring a reliable, secure, and legally compliant supply of lithium compounds in a rapidly evolving market.

H2: Logistics & Compliance Guide for Lithium Compounds

Lithium compounds (e.g., lithium carbonate, lithium hydroxide, lithium chloride, lithium metal) are critical materials for batteries, pharmaceuticals, glass, and ceramics. Their transportation and handling are subject to stringent international and national regulations due to their chemical reactivity, flammability (especially lithium metal), toxicity, and environmental hazards. This guide outlines key logistics and compliance requirements.

H2.1 Classification & Hazard Identification

- Primary Hazards:

- Lithium Metal (UN 1323, Class 4.3, Division 4.3): Reacts violently with water, releasing flammable hydrogen gas. Spontaneously flammable in air (pyrophoric) when finely divided. Requires Division 4.3 (Dangerous When Wet) classification.

- Lithium Compounds (e.g., Li2CO3, LiOH, LiCl): Generally classified as Class 9 (Miscellaneous Dangerous Goods) under UN numbers like:

- UN 3082: ENVIRONMENTALLY HAZARDOUS SUBSTANCE, LIQUID, N.O.S. (Lithium Hydroxide Solution)

- UN 3077: ENVIRONMENTALLY HAZARDOUS SUBSTANCE, SOLID, N.O.S. (Lithium Hydroxide Monohydrate, Lithium Carbonate)

- UN 1718: LITHIUM HYDROXIDE, ANHYDROUS (Class 8 – Corrosive)

- UN 2727: LITHIUM BROMIDE, SOLID (Class 8 – Corrosive)

- Toxicity: Many lithium compounds (especially chlorides, hydroxides) are toxic if ingested, inhaled, or absorbed through skin (Acute Toxicity, Skin Corrosion/Irritation, Serious Eye Damage/Irritation).

- Environmental Hazard: Highly toxic to aquatic life (Aquatic Toxicity).

- Reactivity: Can react vigorously with acids, strong oxidizing agents, and water (especially lithium metal).

- Critical Step: Accurate classification based on the specific compound, concentration, physical state (solid, liquid, solution), and purity is paramount. Consult Safety Data Sheets (SDS) and official classification databases (e.g., UN Model Regulations, ADR/RID/ADN, IMDG Code, IATA DGR).

H2.2 Regulatory Frameworks

- International:

- UN Recommendations on the Transport of Dangerous Goods (UN Model Regulations): The foundation for all transport modes.

- IMDG Code (International Maritime Dangerous Goods): Mandatory for sea transport. Published by IMO.

- IATA Dangerous Goods Regulations (DGR): Mandatory for air transport. Published by IATA (stricter than IMDG).

- ADR (Europe)/RID (Rail)/ADN (Inland Waterways): Mandatory for road, rail, and inland waterways in Europe.

- National/Regional: Regulations often adopt or mirror international codes but may have specific national variations (e.g., 49 CFR in the USA, TDG in Canada, ADR national provisions in EU states). Always check local requirements.

- Other Relevant Regulations:

- REACH (EU): Registration, Evaluation, Authorisation and Restriction of Chemicals.

- TSCA (USA): Toxic Substances Control Act.

- GHS (Globally Harmonized System): For hazard communication (SDS, labeling).

- Customs Regulations: Duty rates, import/export licenses, controlled substance lists (lithium metal may have specific controls).

H2.3 Packaging Requirements

- Performance: Packaging must meet UN performance standards (tested and certified – e.g., 1A1, 4G, 3H2) appropriate for the hazard class, packing group (I, II, III – based on degree of danger), and quantity.

- Lithium Metal (UN 1323):

- Primary Receptacle: Must be hermetically sealed (welded, screwed with gasket) to exclude air and moisture. Often double-walled or vacuum-sealed.

- Absorbent/Immobilizing Material: Required inside the inner packaging if in solution or if there’s a risk of liquid formation.

- Inert Atmosphere: May require packaging under inert gas (e.g., Argon).

- Prohibition: Must NOT be packed with materials that generate moisture (e.g., certain plastics, damp wood).

- Lithium Compounds (Class 9/8):

- Corrosion Resistance: Packaging must resist corrosion by the contents (e.g., polyethylene liners for hygroscopic solids like LiOH).

- Moisture Protection: Hygroscopic compounds require packaging that prevents moisture ingress (e.g., sealed plastic bags inside fiberboard drums).

- Leak Prevention: Drums, jerricans, or boxes must be securely closed. Liquids require leak-proof packaging.

- Strength: Must withstand normal transport conditions (stacking, vibration, pressure changes for air).

- Overpacks: May be used for convenience or additional protection, but must not compromise the integrity of the inner packages.

H2.4 Labeling & Marking

- Proper Shipping Name (PSN): Must be clearly displayed (e.g., “LITHIUM CARBONATE”, “LITHIUM HYDROXIDE, ANHYDROUS”, “LITHIUM METAL”).

- UN Number: Preceded by “UN” (e.g., UN 3077, UN 1718, UN 1323).

- Hazard Class Labels: Diamond-shaped labels affixed to at least two opposite sides of the package.

- Class 9 (Miscellaneous) – Black symbol on white background with vertical red stripe (top).

- Class 8 (Corrosive) – Black symbol on white background with top half black/red.

- Class 4.3 (Dangerous When Wet) – Blue symbol (flame over water) on white background with top half blue.

- Subsidiary Risk Labels: If applicable (e.g., Class 8 for corrosive lithium hydroxide).

- Orientation Arrows: Required for liquid packages.

- “Cargo Aircraft Only” Label: Often required for lithium metal shipments by air (IATA DGR Special Provision A152).

- “Environmentally Hazardous” Mark: Fish and tree symbol required for substances meeting criteria (UN 3082, UN 3077).

- Shipper/Consignee Information: Full names and addresses.

H2.5 Documentation

- Dangerous Goods Declaration (DGD): Mandatory for all modes. Must include:

- Shipper/Consignee details.

- UN Number, Proper Shipping Name, Hazard Class, Packing Group.

- Number and type of packages.

- Total quantity (net mass for solids, net quantity for liquids).

- Emergency contact number (available 24/7).

- Signatures (Shipper and, sometimes, Carrier).

- Safety Data Sheet (SDS): Required (GHS compliant, Section 14 crucial). Must accompany shipment or be readily available.

- Transport Documents: Commercial Invoice, Packing List, Bill of Lading/Air Waybill – must reference the DGD and include hazard information.

- Special Permits/Approvals: May be required for specific packaging, quantities, or routes (e.g., for large lithium metal shipments).

- Export/Import Licenses: Check if required for the specific compound and destination country.

H2.6 Handling & Stowage

- Training: Personnel involved in handling, packing, loading, and transport MUST be trained and certified according to relevant regulations (e.g., IATA, IMDG, ADR).

- PPE: Mandatory use of appropriate PPE: chemical-resistant gloves (nitrile, neoprene), safety goggles/face shield, lab coat/apron, respiratory protection (if dust/aerosol risk). Specific PPE depends on compound and form.

- Segregation: CRITICAL. Lithium compounds must be segregated from incompatible materials:

- Lithium Metal: Keep AWAY from water, moisture, acids, oxidizing agents (Class 5), halogens, ammonium compounds, combustible materials. Store under inert oil or dry inert atmosphere.

- General Lithium Compounds: Segregate from acids (Class 8), oxidizing agents (Class 5), foodstuffs, animal feed.

- Stowage (Transport):

- Air: Strictly follow IATA DGR stowage requirements. Lithium metal (UN 1323) often has quantity limits per aircraft and may be restricted to cargo aircraft only. Avoid proximity to Class 4.1 (flammable solids), Class 5.1 (oxidizers), Class 8 (acids).

- Sea: Follow IMDG Code segregation tables. Generally stow away from acids, oxidizers, and foodstuffs. Consider ventilation.

- Road/Rail: Follow ADR/RID segregation rules. Use dedicated vehicles if possible, or ensure thorough cleaning between incompatible cargoes.

- Warehousing: Store in a cool, dry, well-ventilated area. Use non-combustible flooring. Protect from moisture. Clearly label storage areas. Keep away from incompatible materials. Use secondary containment for liquids.

H2.7 Emergency Response

- Spills:

- Lithium Metal: EXTREME HAZARD. DO NOT USE WATER. Evacuate area. Use dry Class D fire extinguisher (e.g., Met-L-X) or copious amounts of dry sand, dry graphite powder, or dry sodium chloride. Cover spill to exclude air. Contact emergency services immediately.

- Lithium Compounds (Solids): Wear full PPE. Avoid creating dust. Scoop up using non-sparking tools. Place in suitable container for disposal. Ventilate area.

- Lithium Compounds (Liquids): Wear full PPE (include acid-resistant gear if corrosive). Contain spill with inert absorbent (vermiculite, sand). Place in suitable container. Neutralize if appropriate and safe (consult SDS). Ventilate area.

- Fire:

- Lithium Metal Fire: DO NOT USE WATER, CO2, OR HALON. Use Class D extinguisher or dry sand/salt. Evacuate and call emergency services immediately. Fire can be intense and generate toxic fumes.

- Other Lithium Compound Fires: Use water spray, alcohol-resistant foam, dry chemical, or CO2. Wear self-contained breathing apparatus (SCBA). Fight fire from a distance if possible. Be aware of toxic fumes (e.g., lithium oxide).

- First Aid:

- Inhalation: Move to fresh air. Give oxygen if breathing is difficult. Seek medical attention.

- Skin Contact: Remove contaminated clothing. Wash skin thoroughly with soap and water. Seek medical attention, especially for corrosive compounds.

- Eye Contact: Immediately flush eyes with copious amounts of water for at least 15 minutes. Seek immediate medical attention.

- Ingestion: Rinse mouth. Do NOT induce vomiting. Seek immediate medical attention. Show SDS to medical personnel.

- Emergency Contacts: Ensure 24/7 emergency contact number is on DGD and readily available at all points in the supply chain. Have spill kits and appropriate fire extinguishers accessible.

H2.8 Key Compliance Considerations

- Specificity is Crucial: Regulations depend entirely on the exact compound, form, concentration, and quantity. Never assume.

- Training: Non-negotiable. Use certified training providers.

- Packaging Certification: Ensure packaging is UN-certified for the specific substance and packing group.

- Documentation Accuracy: Errors in the DGD can lead to rejection, delays, fines, or safety incidents.

- Carrier Approval: Confirm the carrier is approved and equipped to handle the specific lithium compound and hazard class.

- Regulatory Updates: Regulations (especially IATA/IMDG) are updated annually. Stay current.

- Record Keeping: Maintain records of training, DGDs, SDS, inspections, and incidents for the required period (often 3-5 years).

Disclaimer: This guide provides a general overview. Regulations are complex and subject to change. Always consult the latest official regulatory texts (IATA DGR, IMDG Code, ADR, 49 CFR, etc.), Safety Data Sheets, and qualified dangerous goods professionals before shipping lithium compounds.

In conclusion, sourcing lithium compounds requires a comprehensive approach that balances economic, environmental, geopolitical, and technological considerations. As global demand for lithium continues to rise—driven by the expansion of electric vehicles, renewable energy storage, and consumer electronics—securing reliable and sustainable supplies of lithium compounds such as lithium carbonate and lithium hydroxide has become a strategic priority.

Key sourcing strategies include diversifying supply chains across multiple geographic regions, investing in both brine-based and hard-rock mining operations, and exploring emerging technologies like direct lithium extraction (DLE) to improve efficiency and reduce environmental impact. Additionally, partnerships with responsible producers, adherence to ESG (Environmental, Social, and Governance) standards, and support for recycling initiatives are essential to ensure long-term sustainability and supply security.

Ultimately, a resilient lithium sourcing strategy must integrate traditional supply options with innovation and ethical practices to meet growing demand while minimizing ecological and social impacts. As the global energy transition accelerates, proactive and responsible sourcing of lithium compounds will play a pivotal role in enabling a cleaner, more sustainable future.