The global lithium button battery market is experiencing robust expansion, driven by rising demand in consumer electronics, medical devices, and wearable technology. According to Grand View Research, the global primary battery market size was valued at USD 10.9 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030, with lithium-based coin cells representing a significant segment due to their high energy density and extended shelf life. Similarly, Mordor Intelligence forecasts continued growth in lithium battery demand, citing increased adoption in IoT devices and portable medical equipment as key growth catalysts. As industries prioritize compact, reliable power sources, the competition among manufacturers has intensified. In this evolving landscape, eight companies have emerged as leading producers of lithium button batteries, combining technological innovation, global reach, and high-quality standards to dominate the market.

Top 8 Lithium Button Battery Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 East Penn Manufacturing

Domain Est. 2002

Website: eastpennmanufacturing.com

Key Highlights: We are the world’s largest single-site lead-acid battery manufacturer. Explore reliable energy solutions for automotive, industrial, ……

#2 Coin Lithium Technologies

Domain Est. 1990

Website: panasonic.com

Key Highlights: Panasonic Coin Lithium batteries are providing safe power in devices we all depend on for life. High energy density and high 3 V output voltage support the ……

#3 Lithium Battery Manufacturer for EV & ESS Solutions

Domain Est. 2022

Website: reptbattero.com

Key Highlights: REPT BATTERO, a top lithium-ion battery manufacturer, delivers advanced energy storage solutions and EV batteries to support sustainable mobility and ……

#4 Duracell Battery Product Group

Domain Est. 1995

Website: duracell.com

Key Highlights: Duracell has a tradition of investing in the extensive development of features that can help keep children safe, especially for its Lithium Coin batteries….

#5 Energizer

Domain Est. 1995

#6 Lithium batteries

Domain Est. 1997 | Founded: 1982

Website: renata.com

Key Highlights: We have been producing primary lithium coin cells since 1982 and the range of applications has grown dramatically in recent decades since we started. In ……

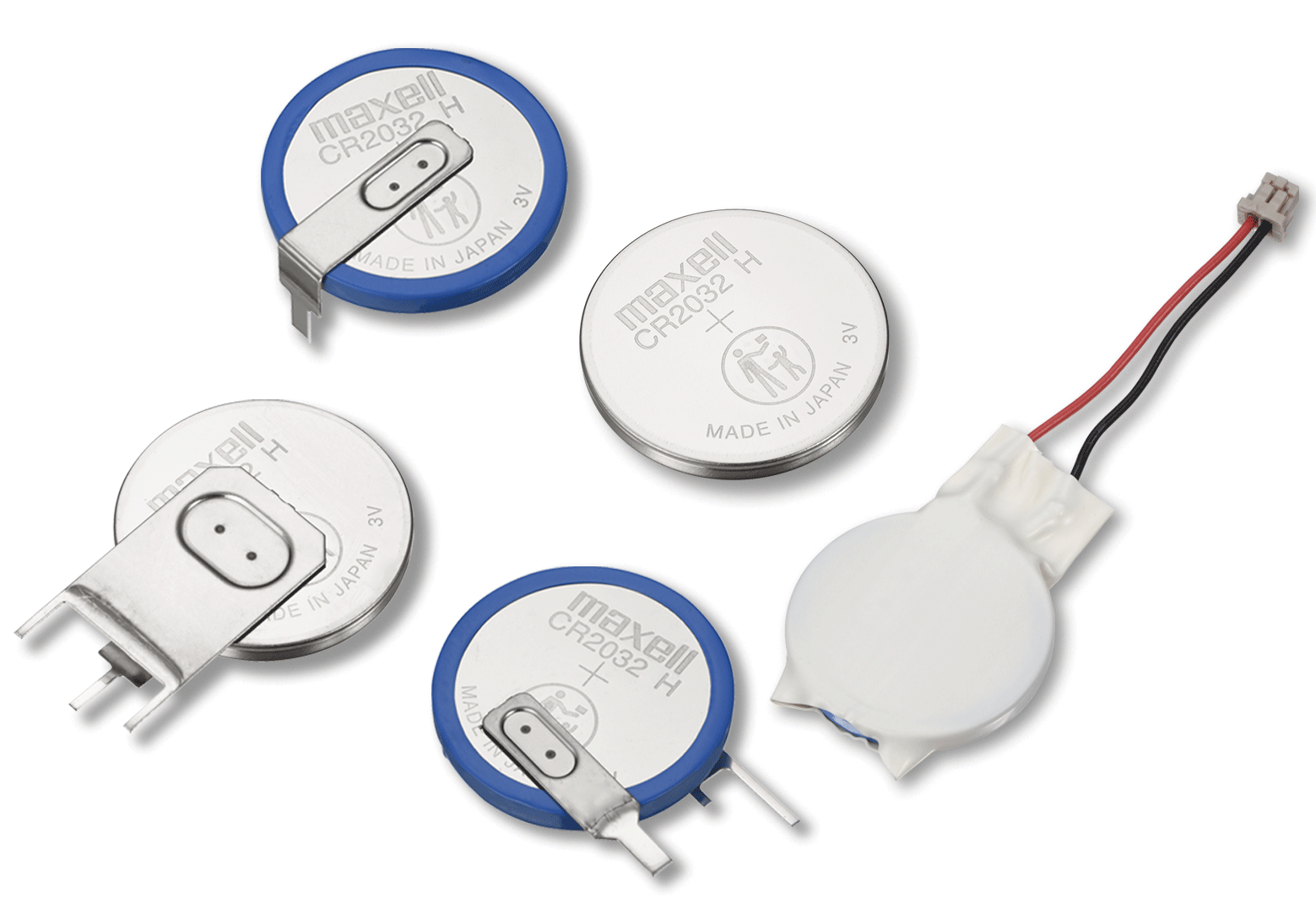

#7 Coin Type Lithium Manganese Dioxide Batteries (CR)

Domain Est. 1998

Website: biz.maxell.com

Key Highlights: The coin type lithium manganese dioxide battery (CR battery) is a small, lightweight battery with an operating voltage of 3 V and the ability to operate ……

#8 VARTA CoinPower

Domain Est. 2015

Website: varta-ag.com

Key Highlights: VARTA offers a range of Lithium-Ion button cells and battery assemblies in diameters from 9.4 – 16.1 mm with 29 mAh to 145 mAh….

Expert Sourcing Insights for Lithium Button Battery

H2: Market Trends for Lithium Button Batteries in 2026

The global lithium button battery market is poised for significant evolution by 2026, driven by increasing demand across consumer electronics, healthcare devices, and IoT (Internet of Things) applications. As miniaturization of electronic devices continues and the need for reliable, long-lasting power sources grows, lithium button batteries—particularly types such as CR2032, CR2025, and BR series—are expected to maintain strong market relevance.

Key trends shaping the lithium button battery market in 2026 include:

-

Rising Adoption in Wearables and Portable Electronics

The proliferation of smartwatches, fitness trackers, hearables, and compact medical devices is a major growth driver. These devices require small, lightweight, and high-energy-density batteries, making lithium button cells ideal. By 2026, advancements in energy efficiency and battery longevity will further solidify their position in next-generation wearables. -

Expansion in Medical and Healthcare Applications

Lithium button batteries power critical devices such as hearing aids, glucose monitors, implantable medical devices, and digital thermometers. With an aging global population and increasing focus on home-based healthcare, demand for reliable and stable power sources in medical devices is expected to grow significantly by 2026. -

Growth of IoT and Smart Home Devices

The IoT ecosystem—including smart sensors, remote controls, security systems, and RFID tags—relies heavily on compact and long-life batteries. Lithium button cells are well-suited for low-power, always-on applications. By 2026, the deployment of smart home and industrial IoT systems will continue to fuel market demand. -

Technological Advancements and Energy Density Improvements

Ongoing R&D efforts are focused on enhancing energy density, shelf life, and temperature tolerance of lithium button batteries. Innovations in cathode materials (e.g., lithium manganese dioxide, lithium carbon monofluoride) and improved sealing technologies will enable better performance, especially in extreme environments. -

Sustainability and Regulatory Pressures

Environmental concerns and stricter regulations on battery disposal are prompting manufacturers to develop more recyclable and eco-friendly lithium button batteries. By 2026, companies may increasingly adopt greener production methods and explore alternatives such as rechargeable lithium button cells, although these remain limited due to size and performance constraints. -

Regional Market Dynamics

Asia-Pacific, particularly China and Japan, is expected to dominate production and consumption due to robust electronics manufacturing and growing healthcare infrastructure. North America and Europe will remain key markets, driven by innovation in medical technology and IoT adoption. Supply chain resilience and localization of battery production may become strategic priorities post-2023. -

Competition and Market Consolidation

The market remains competitive, with key players such as Panasonic, Duracell, Maxell, and Varta leading in innovation and distribution. By 2026, increased competition may lead to consolidation, partnerships, and vertical integration to secure raw materials like lithium and manganese.

In conclusion, the lithium button battery market in 2026 will be characterized by steady growth, technological refinement, and expanding applications across high-tech and healthcare sectors. While challenges related to raw material availability and environmental impact persist, the market is expected to adapt through innovation and strategic positioning.

Common Pitfalls When Sourcing Lithium Button Batteries (Quality & Intellectual Property)

Sourcing lithium button batteries—commonly used in watches, medical devices, IoT sensors, and consumer electronics—requires careful attention to both quality assurance and intellectual property (IP) concerns. Overlooking these aspects can lead to product failures, safety risks, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Quality-Related Pitfalls

1. Inconsistent Performance and Capacity

Many low-cost suppliers offer batteries that claim high capacity (e.g., 245 mAh for CR2032) but fail to deliver under real-world conditions. Inconsistent discharge curves, premature voltage drops, or reduced cycle life can result in unreliable device operation. Always verify performance through independent testing and request detailed discharge reports.

2. Poor Manufacturing Standards

Reputable manufacturers adhere to ISO standards and implement strict quality controls. However, unverified suppliers—especially those from regions with lax oversight—may use substandard materials and processes. This increases risks of leakage, swelling, or even rupture, especially under high-drain or extreme temperature conditions.

3. Lack of Safety Certifications

Ensure batteries comply with international safety standards such as IEC 60086, UN 38.3 (for transportation), and RoHS/REACH. Counterfeit or uncertified batteries often omit these certifications or provide falsified documentation. Always verify certification authenticity through third-party labs or authorized representatives.

4. Inadequate Sealing and Leakage Issues

Lithium button cells are sensitive to moisture ingress. Poorly sealed units may leak electrolyte over time, damaging connected electronics. Look for hermetic sealing and stainless-steel casing, and test samples under temperature cycling and humidity stress.

5. Shelf Life and Storage Conditions

Low-quality batteries may degrade faster during storage due to impurities or poor sealing. Reputable brands typically guarantee a 5–10 year shelf life. Confirm storage recommendations (e.g., cool, dry environments) and ensure suppliers provide batch-specific manufacturing and expiry dates.

Intellectual Property (IP) Pitfalls

1. Trademark and Brand Infringement

Some suppliers sell counterfeit versions of well-known brands (e.g., Energizer, Panasonic, Sony) using similar packaging or logos. These violate trademark laws and may mislead customers. Always source from authorized distributors and verify brand authenticity through official channels.

2. Copying Proprietary Designs

Original manufacturers invest in research to optimize battery chemistry, internal structure, and safety mechanisms. Unauthorized clones may replicate patented designs, exposing buyers to IP litigation if incorporated into commercial products. Conduct due diligence on supplier R&D capabilities and patent portfolios.

3. Lack of Licensing for Technology

Certain advanced lithium chemistries (e.g., Lithium Manganese Dioxide, Li-MnO₂) or safety features (e.g., current interrupt devices, PTC) are protected by patents. Sourcing batteries that use such technology without proper licensing can result in legal exposure, especially in regulated industries like healthcare.

4. Misrepresentation of Origin and Compliance

Some suppliers falsely claim their batteries are “original equipment manufacturer (OEM)” or “genuine” when they are not. This constitutes misrepresentation and can breach supply contracts or regulatory requirements. Maintain transparency in sourcing documentation and audit trails.

5. Supply Chain Transparency Gaps

Complex supply chains may obscure the true origin of batteries. Components or finished cells might pass through multiple intermediaries, increasing the risk of IP violations. Demand full traceability, including country of manufacture and component sourcing, to mitigate legal and compliance risks.

Best Practices to Avoid Pitfalls

- Engage Reputable Suppliers: Work with manufacturers or distributors with verifiable track records and certifications.

- Conduct Sample Testing: Perform electrical, environmental, and safety testing before mass procurement.

- Review Legal Agreements: Include IP indemnification clauses and quality warranties in contracts.

- Audit Supply Chains: Perform on-site audits or request third-party audit reports (e.g., ISO, SQF).

- Monitor Regulatory Updates: Stay informed about evolving battery regulations and IP rulings globally.

By addressing both quality and IP concerns proactively, businesses can ensure reliable performance, regulatory compliance, and legal safety in their lithium button battery sourcing.

H2: Logistics & Compliance Guide for Lithium Button Batteries

Lithium button batteries (also known as lithium coin cells) are widely used in consumer electronics, medical devices, and industrial applications. Due to their chemical composition and potential fire hazard if damaged or improperly handled, they are strictly regulated for transport. This guide outlines the key logistics and compliance requirements based on international standards, primarily the UN Recommendations on the Transport of Dangerous Goods (UN Model Regulations) and IATA Dangerous Goods Regulations (air), IMDG Code (sea), and ADR (road in Europe).

H2.1: Classification & Identification

- UN Number: UN 3090 (for lithium metal batteries, including button cells)

- Proper Shipping Name: “LITHIUM METAL BATTERIES”

- Class: 9 (Miscellaneous Dangerous Substances and Articles)

- Packing Group: Not applicable (N/A) – assigned based on testing, but typically handled as such.

- Hazard Label: Class 9 Miscellaneous Dangerous Goods label (black and white vertical stripes on upper half, black seven-pointed star on lower half).

- Lithium Battery Mark: Mandatory for most shipments (see H2.4). This mark includes the “Lithium Battery” symbol, UN number (3090), consignee/consignor info, and telephone number.

Note: Batteries installed in equipment (e.g., a watch) or packed with equipment (e.g., a replacement battery in the same box as a device) have different, often less stringent, requirements than batteries shipped alone.

H2.2: Applicable Regulations by Mode

-

Air Transport (IATA DGR):

- Strictest regulations.

- Passenger Aircraft: Prohibited for bulk shipments of loose batteries.

- Cargo Aircraft: Permitted under specific conditions.

- Packing Instructions: PI 969 (batteries), PI 970 (in equipment), PI 968 (packed with equipment) – Section II or IB apply based on quantity per package.

- Quantity Limits: Strict limits on net lithium content per cell (≤ 1g) and per package. Most button cells are below thresholds, but aggregation matters.

- State of Charge: Batteries must be at ≤30% state of charge for air shipment unless proven safe at higher levels (rare for button cells).

- Documentation: Shipper’s Declaration for Dangerous Goods usually required for larger quantities (Section I), often not required for small quantities (Section II).

-

Sea Transport (IMDG Code):

- Packing Instructions: P908 (batteries), P909 (in equipment), P910 (packed with equipment).

- Stowage: Generally “Stowage Category A” (anywhere in cargo transport unit). Segregation from flammable solids, oxidizing substances, and Class 8 materials required.

- Documentation: Dangerous Goods Declaration required.

- Quantity Limits: Less restrictive than air, but still subject to reporting and container placarding for large quantities.

-

Road Transport (ADR – Europe):

- Packing Instructions: Similar structure to IMDG (P908, P909, P910).

- Tunnel Restrictions: Generally Tunnel Code “C” (all tunnels allowed).

- Documentation: Transport Document required.

- Vehicle Placarding: Required for large limited quantities or specific quantities exceeding thresholds.

-

Rail Transport (RID): Follows ADR principles closely.

H2.3: Packaging Requirements

- Prevention of Short Circuit: Essential. Terminals must be protected (e.g., by non-conductive caps, individual packaging, placement within equipment, or packing so terminals cannot contact other batteries or conductive materials).

- Robustness: Packaging must withstand normal transport conditions (vibration, pressure, temperature changes) without damage or movement causing short circuits.

- Containment: Must contain any potential leakage or rupture. Inner packaging (e.g., plastic bags, blister packs) within a strong outer box.

- Absorbent Material: Recommended (not always mandatory for small cells) if batteries are not in equipment.

- Stacking Strength: Outer packaging must support expected stacking loads.

- Packing Instructions: Must strictly follow the relevant PI (e.g., IATA PI 969, IMDG P908) for the mode and shipment type (loose, in equipment, with equipment).

H2.4: Marking & Labeling

- Lithium Battery Mark: Mandatory on the outer packaging for shipments of loose batteries (UN 3090) and often for batteries packed with equipment.

- Black symbol on white background (top half: “Lithium Battery” symbol; bottom half: 7 vertical stripes).

- UN Number (3090) & Proper Shipping Name (“LITHIUM METAL BATTERIES”).

- Name and address of consignor/consignee.

- Telephone number for emergency contact.

- Note: The “CAUTION” text and “This package contains lithium metal batteries…” statement are required on the mark for IATA Section II shipments.

- Class 9 Hazard Label: Required on the outer packaging (diamond-shaped, black and white stripes on top, black 7-pointed star on bottom).

- Orientation Arrows: Required if inner packaging contains liquid (not typical for button cells, but check).

- Gross Weight: Required for sea and road shipments over certain limits.

H2.5: Documentation

- Air (IATA):

- Shipper’s Declaration for Dangerous Goods (required for Section I, often not for Section II under 2.4.3).

- Dangerous Goods Transport Document (required by carriers even if not a full declaration).

- Sea (IMDG): Dangerous Goods Declaration (DGD) required.

- Road (ADR): Transport Document required (includes key info like UN number, proper shipping name, class, packing group, quantity, tunnel code, emergency contact).

- Common Elements: Shipper/Consignee name & address, UN Number, Proper Shipping Name, Class, Packing Group (if applicable), Number and Type of Packages, Net Quantity of Dangerous Goods.

H2.6: Training & Certification

- Mandatory: All personnel involved in preparing, offering, or transporting lithium batteries must be trained and certified according to the relevant mode’s regulations (IATA, IMDG, ADR).

- Training Content: Classification, packaging, marking, labeling, documentation, emergency procedures.

- Validity: Training certificates are typically valid for 2 years (IATA) and must be kept on file.

H2.7: Special Considerations

- Damaged/Defective Batteries: Classified as UN 3480 (lithium ion) or UN 3091 (lithium metal) and shipped under strict, special provisions (e.g., IATA PI 970, IMDG P909). Often requires approval from authorities and specialized packaging. Never ship damaged batteries in regular consignments.

- Recycling/Return Shipments: Subject to the same dangerous goods regulations as new batteries unless specifically classified and approved otherwise.

- State of Charge (SoC): Critical for air transport. Ensure batteries are shipped at ≤30% SoC unless proven otherwise.

- Local Regulations: Always check destination country regulations (e.g., FAA, ECHA, national transport authorities), which may impose additional requirements.

H2.8: Key Compliance Checklist

- ✅ Correctly classified as UN 3090, Class 9.

- ✅ Appropriate Packing Instruction followed (PI 969, P908, etc.).

- ✅ Terminals protected against short circuit (individual packaging, caps, secure placement).

- ✅ Robust, undamaged outer packaging meeting performance standards.

- ✅ Lithium Battery Mark applied correctly to outer packaging.

- ✅ Class 9 Hazard Label applied correctly.

- ✅ Correct documentation prepared and available (DGD, Transport Document, or Shipper’s Declaration as required).

- ✅ Personnel involved are trained and certified.

- ✅ State of Charge verified for air shipments (≤30%).

- ✅ Carrier notified and acceptance confirmed (especially for air).

- ✅ Emergency contact information available.

Disclaimer: Regulations are complex and updated frequently. This guide provides a general overview. Always consult the latest official regulations (IATA DGR, IMDG Code, ADR) and seek advice from a certified dangerous goods safety advisor (DGSA) or freight forwarder specializing in dangerous goods before shipping.

Conclusion for Sourcing Lithium Button Batteries

In conclusion, sourcing lithium button batteries requires a strategic approach that balances quality, cost, reliability, and compliance with safety and environmental standards. As critical components in a wide range of applications—including consumer electronics, medical devices, and IoT sensors—selecting the right supplier is essential to ensure consistent performance and longevity.

Key considerations include verifying supplier credentials, assessing manufacturing standards (such as ISO certifications), and ensuring compliance with global regulations like RoHS and REACH. Battery chemistry (e.g., CR2032, CR2025) and technical specifications must align with the intended application, while supply chain resilience and lead times should be evaluated to prevent operational disruptions.

Additionally, prioritizing suppliers who demonstrate ethical sourcing practices and environmental responsibility supports sustainable business operations. Establishing long-term partnerships with reputable manufacturers or distributors, particularly those with proven experience in high-reliability sectors, can provide a competitive advantage through improved product quality and technical support.

Ultimately, a well-structured sourcing strategy for lithium button batteries not only mitigates risks related to performance and supply continuity but also enhances the overall reliability and market reputation of the end product.