The global fire extinguisher market is experiencing steady growth, driven by increasing fire safety regulations, rising awareness of workplace and residential safety, and stringent building codes across industries. According to a report by Mordor Intelligence, the global fire extinguisher market was valued at USD 3.5 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2029. A significant segment of this demand comes from liquid fire extinguishers—particularly water-based and aqueous film-forming foam (AFFF) variants—due to their effectiveness in combating Class A and Class B fires in commercial, industrial, and residential settings.

With technological advancements enhancing the performance, environmental safety, and shelf life of liquid extinguishing agents, manufacturers are investing heavily in R&D to meet evolving safety standards. This growing market momentum has intensified competition among key players to deliver innovative, reliable, and compliant fire suppression solutions. In this landscape, identifying the top manufacturers becomes essential for procurement managers, safety officers, and facilities planners seeking high-performance, certified products.

Based on market presence, product quality, global reach, compliance certifications, and innovation in liquid fire extinguisher technology, the following list highlights the top 10 manufacturers shaping the future of fire safety.

Top 10 Liquid Fire Extinguisher Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Badger Fire Protection

Domain Est. 1996

Website: badgerfire.com

Key Highlights: Badger Fire Protection offers industrial fire extinguishers and fire suppression systems, in both dry and wet-chemical applications….

#2 Global Fire Suppression Manufacturers

Domain Est. 2016

Website: reactonfire.com

Key Highlights: We manufacture safety critical automatic fire suppression systems for a complete range of assets and industries. Our solutions are backed by our protection ……

#3 ANSUL

Domain Est. 1995

Website: ansul.com

Key Highlights: ANSUL is a fire suppression company that designs and engineers specail hazard fire suppression systems and solutions for many different industries and many ……

#4

Domain Est. 1996

Website: buckeyef.com

Key Highlights: Buckeye Fire offers a complete line of handheld and wheeled fire extinguishers, extinguishing agents, fire suppressing foam concentrates & hardware….

#5 Fire Extinguishers

Domain Est. 1996

Website: amerex-fire.com

Key Highlights: The Amerex model 240 fire extinguisher utilizes the cooling, soaking, and penetrating effect of a 45-55 foot stream of WATER….

#6 Fire Extinguishers for Your

Domain Est. 1996

Website: kidde.com

Key Highlights: Fire extinguishers for the home can help keep your house and family safe from accidental fires. Find Kidde extinguishers for the home, kitchen, car & more….

#7 AKE Safety Equipment: STOP

Domain Est. 1997

Website: ake.com

Key Highlights: STOP-FYRE® is a clean-agent, non-corrosive fire extinguisher that protects equipment, vehicles, and buildings with zero mess and no maintenance….

#8 Fire Extinguishers

Domain Est. 2006

Website: activarcpg.com

Key Highlights: Fire Extinguishers. Multi-purpose, Purple K and BC Dry Chemical, Carbon Dioxide, Water, Class K Wet Chemical, Halotron ……

#9 Fire Extinguishers, Amerex, Security Fire Equipment …

Domain Est. 2007

#10 Fire Extinguisher Depot

Domain Est. 2012

Website: fireextinguisherdepot.com

Key Highlights: Fire Extinguisher Depot stocks the best fire extinguishers, brackets, cabinets, and accessories. We have the lowest prices and industry leading service….

Expert Sourcing Insights for Liquid Fire Extinguisher

H2: 2026 Market Trends for Liquid Fire Extinguishers

The global liquid fire extinguisher market in 2026 is poised for steady growth, driven by heightened safety regulations, technological advancements, and increasing awareness of fire risks across residential, commercial, and industrial sectors. While traditional dry chemical and CO₂ extinguishers remain prevalent, liquid-based agents—particularly water mist and next-generation wet chemical formulations—are gaining significant traction due to their environmental profile, effectiveness, and versatility.

H2: Key Growth Drivers and Market Dynamics

1. Regulatory Push and Safety Standards:

Stricter international fire safety codes (such as NFPA 10, EN 3, and local building regulations) are mandating the installation of fire suppression systems in new constructions and retrofits. Liquid extinguishers, especially water mist systems, are increasingly favored as they meet modern safety standards while minimizing collateral damage. The phase-down of halon and other ozone-depleting agents under the Montreal Protocol continues to drive adoption of eco-friendly liquid alternatives.

2. Environmental and Health Concerns:

Growing demand for sustainable and non-toxic fire suppression solutions is boosting the appeal of liquid agents. Water mist extinguishers use only deionized water, leaving no residue and posing no health hazard. Wet chemical extinguishers, designed for Class K fires (cooking oils), utilize potassium-based solutions that are biodegradable and safe for kitchen environments. This aligns with corporate ESG (Environmental, Social, and Governance) goals and green building certifications like LEED and BREEAM.

3. Technological Innovation:

Advancements in nozzle design and high-pressure delivery systems have enhanced the effectiveness of water mist extinguishers, enabling them to combat Class A, B, and even electrical fires efficiently. Smart integration—such as IoT-enabled monitoring for pressure levels, location tracking, and maintenance alerts—is becoming a differentiating factor, particularly in commercial and industrial applications.

4. Expansion in High-Risk Sectors:

The food service industry remains a critical market for wet chemical extinguishers due to the prevalence of deep-fat fryers. Simultaneously, water mist extinguishers are being adopted in data centers, healthcare facilities, museums, and transportation (e.g., rail and marine) where minimizing water damage and avoiding electrical conductivity are paramount.

5. Regional Market Growth:

Asia-Pacific is expected to lead market expansion by 2026, fueled by rapid urbanization, industrial development, and government-led fire safety initiatives in countries like China, India, and Southeast Asian nations. North America and Europe will sustain steady growth, supported by regulatory enforcement and retrofitting of aging infrastructure.

H2: Challenges and Competitive Landscape

Despite positive momentum, the market faces challenges including higher production and maintenance costs for advanced liquid systems compared to traditional options. Consumer awareness remains uneven, particularly in emerging markets. Additionally, the performance of water-based agents in freezing environments requires additives or insulation, limiting deployment in cold climates.

The competitive landscape is evolving, with established players like Kidde, Amerex, and Ansul investing in R&D for next-gen liquid formulations. Niche innovators are entering with compact, smart-designed extinguishers targeting residential and hospitality sectors.

H2: Outlook for 2026

By 2026, the liquid fire extinguisher market is projected to grow at a CAGR of approximately 5–7%, reaching a global value of over USD 2.5 billion. Water mist and advanced wet chemical agents will account for an increasing share, driven by safety, sustainability, and performance benefits. Integration with smart building systems and continued regulatory support will further solidify liquid extinguishers as a preferred choice in modern fire protection strategies.

Common Pitfalls When Sourcing Liquid Fire Extinguishers (Quality & Intellectual Property)

Sourcing liquid fire extinguishers—whether water-based, foam, or other liquid agents—requires careful attention to both quality assurance and intellectual property (IP) considerations. Overlooking these aspects can lead to safety risks, legal liabilities, and reputational damage. Below are common pitfalls to avoid:

1. Compromising on Quality Standards and Certifications

One of the most critical mistakes is selecting suppliers who do not adhere to recognized safety and performance standards. Liquid fire extinguishers must meet rigorous testing requirements to ensure reliability in emergencies.

- Pitfall: Choosing low-cost suppliers without valid certifications (e.g., UL, FM Global, CE, EN 3, or local fire safety standards).

- Risk: Non-compliant extinguishers may fail during use, endangering lives and property. Regulatory penalties and voided insurance coverage are possible consequences.

Best Practice: Verify that products are independently tested and certified by accredited bodies. Request test reports and certification documentation before procurement.

2. Inadequate Verification of Material and Component Quality

The performance of a liquid fire extinguisher depends heavily on the quality of internal components—such as seals, valves, and nozzles—and the formulation of the extinguishing agent.

- Pitfall: Assuming all extinguishing liquids perform the same, without evaluating chemical stability, corrosion resistance, or shelf life.

- Risk: Poor-quality agents or components can degrade prematurely, leading to leakage, discharge failure, or reduced firefighting effectiveness.

Best Practice: Conduct supplier audits and request material safety data sheets (MSDS) and formulation details. Where possible, perform third-party lab testing on samples.

3. Ignoring Intellectual Property (IP) Rights in Design and Technology

Many liquid fire extinguishers incorporate patented technologies, especially in nozzle design, pressure mechanisms, or agent formulation.

- Pitfall: Sourcing from manufacturers who replicate patented designs or use proprietary chemical formulas without licensing.

- Risk: Importing or distributing counterfeit or IP-infringing products can result in legal action, customs seizures, and supply chain disruptions.

Best Practice: Conduct due diligence on supplier IP compliance. Request proof of IP ownership or licensing agreements for any proprietary technology used in the product.

4. Overlooking Branding and Trademark Infringement

Counterfeit extinguishers often mimic well-known brands to appear legitimate.

- Pitfall: Procuring products with unauthorized logos, brand names, or packaging resembling established brands.

- Risk: Legal liability for trademark infringement and damage to your organization’s reputation if substandard knock-offs are discovered.

Best Practice: Source only from authorized distributors or directly from brand owners. Verify trademarks and distribution rights before placing orders.

5. Failure to Secure IP in Customized or Private-Label Products

If sourcing extinguishers under a private label or with custom formulations, the ownership of new designs or formulations may be unclear.

- Pitfall: Assuming that your company owns the IP when the supplier retains rights to custom designs or formulations.

- Risk: Inability to switch suppliers or protect your product offering from competition.

Best Practice: Use clear contractual agreements that assign IP rights for custom work to your organization. Include clauses on confidentiality, ownership, and usage rights.

6. Insufficient Supply Chain Transparency

Opaque supply chains make it difficult to trace product origins and verify compliance.

- Pitfall: Relying on intermediaries without visibility into the actual manufacturer or production process.

- Risk: Unknowingly sourcing from facilities with poor quality control or IP violations.

Best Practice: Map your supply chain and conduct on-site audits. Require full traceability from raw materials to finished goods.

By addressing these common pitfalls proactively, organizations can ensure they source liquid fire extinguishers that are not only effective and safe but also legally compliant and free from IP risks.

Logistics & Compliance Guide for Liquid Fire Extinguishers

Overview

Liquid fire extinguishers—typically water-based, water with additives (e.g., antifreeze, wetting agents), or aqueous film-forming foam (AFFF)—are essential fire safety tools. Proper logistics and compliance are critical to ensure safety, regulatory adherence, and product effectiveness. This guide outlines key considerations for handling, storing, transporting, and complying with regulations related to liquid fire extinguishers.

Classification and Regulatory Framework

Liquid fire extinguishers are classified based on their contents and intended use, primarily for Class A (ordinary combustibles) and sometimes Class B (flammable liquids) fires. Key regulatory bodies include:

- OSHA (Occupational Safety and Health Administration) – Governs workplace safety, including extinguisher accessibility and maintenance.

- NFPA (National Fire Protection Association) – NFPA 10: Standard for Portable Fire Extinguishers outlines design, installation, and maintenance requirements.

- DOT (Department of Transportation) – Regulates the safe transportation of hazardous materials, including pressurized extinguishers.

- EPA (Environmental Protection Agency) – Applies if extinguishers contain regulated substances (e.g., AFFF with PFAS).

- GHS/SDS (Globally Harmonized System) – Requires proper labeling and safety data sheets for hazardous components.

Packaging and Labeling

Proper packaging and labeling are essential for safety and compliance during storage and transport.

- Pressure Vessel Integrity: Ensure extinguishers are in DOT-approved cylinders with pressure relief devices.

- Hazard Labels: Apply GHS-compliant labels if contents are hazardous (e.g., antifreeze additives, PFAS-containing foam).

- Transport Labels: Use DOT hazard class labels when shipping (typically Class 2.2: Non-flammable, non-toxic gas for pressurized units).

- SDS Availability: Maintain Safety Data Sheets for all extinguisher formulations, especially for additives or foams.

Storage Requirements

Safe storage prevents degradation, leakage, and accidental discharge.

- Temperature Control: Store between 40°F and 120°F (4°C to 49°C). Avoid freezing conditions unless antifreeze is present.

- Ventilation: Store in well-ventilated areas to prevent pressure build-up in case of leaks.

- Orientation: Store upright to prevent valve damage and internal component displacement.

- Separation: Keep away from oxidizers, flammable materials, and corrosive substances.

- Shelving: Use non-combustible, corrosion-resistant shelving with adequate support.

Transportation Guidelines

Transporting liquid fire extinguishers must comply with DOT and international standards (e.g., IMDG for sea, IATA for air).

- Hazard Class: Most liquid extinguishers fall under UN1044, COMPRESSED GAS, OXIDIZING, N.O.S. (e.g., nitrogen-charged units) or UN2012, FIRE EXTINGUISHERS.

- Packaging: Use original or equivalent protective packaging to prevent damage during transit.

- Securement: Secure extinguishers in vehicles to prevent movement; use restraints and cushioning.

- Documentation: Include shipping papers, SDS, and proper hazard declarations if required.

- Air Transport Restrictions: Some extinguishers are prohibited or restricted on aircraft—verify IATA Dangerous Goods Regulations.

Handling and Maintenance

Routine handling and maintenance ensure operational readiness and compliance.

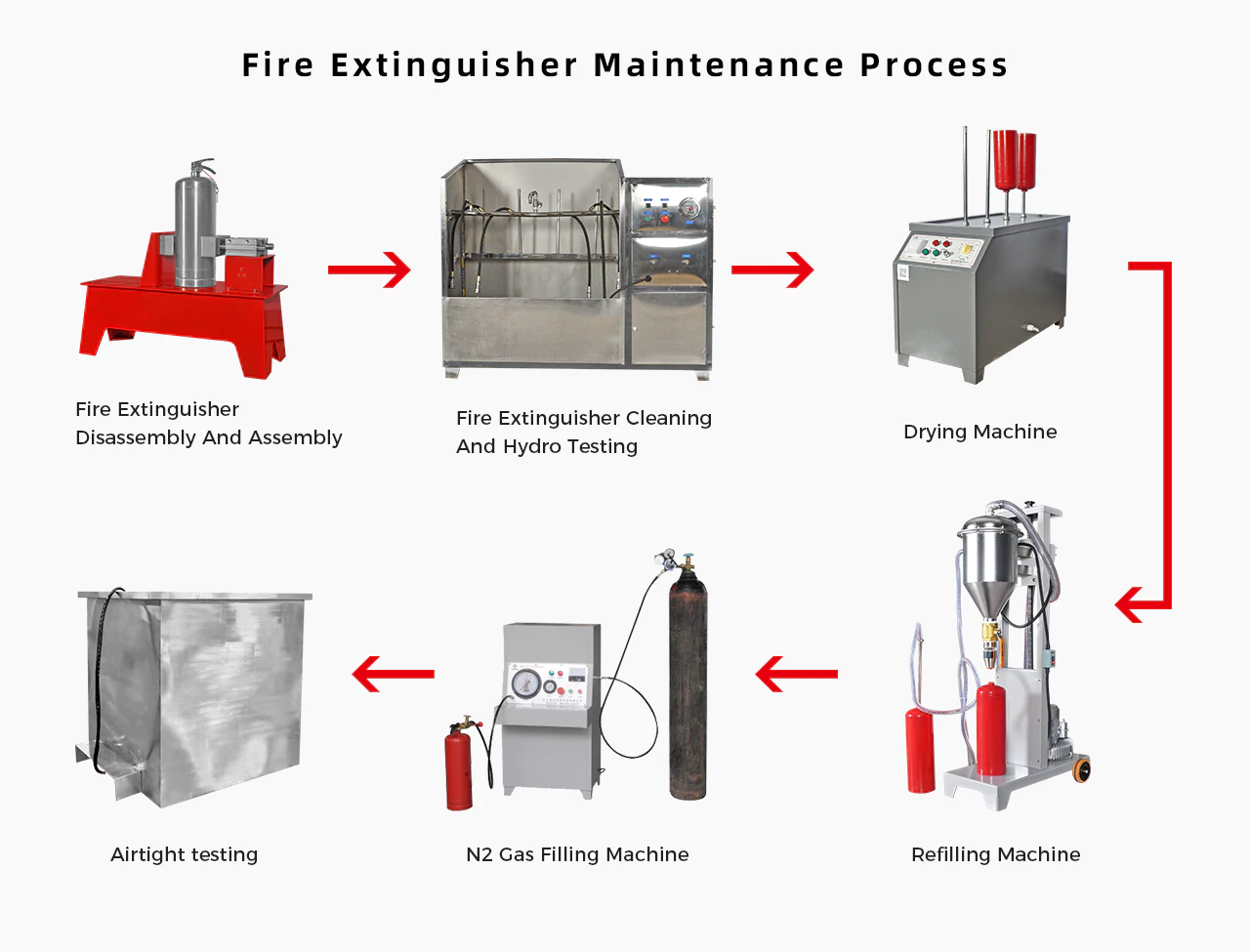

- Inspection Frequency: Conduct monthly visual inspections (per NFPA 10) for damage, pressure, and corrosion.

- Hydrostatic Testing: Perform periodic hydrostatic testing as per manufacturer and NFPA guidelines (typically every 5–12 years).

- Recharging: Recharge after any use or pressure loss by certified personnel.

- Disposal: Dispose of expired or damaged units through certified hazardous waste handlers, especially if containing PFAS or other regulated chemicals.

Environmental and Disposal Compliance

Environmental regulations are increasingly stringent, particularly for extinguishers with fluorinated surfactants.

- PFAS Restrictions: Many AFFF formulations contain per- and polyfluoroalkyl substances (PFAS), now regulated by EPA and state laws. Phasing out and proper disposal are mandatory.

- Spill Response: Have spill kits and response plans for leaks. Report significant spills per local and federal regulations.

- Recycling Programs: Use manufacturer or third-party take-back programs for end-of-life extinguishers.

Training and Documentation

Personnel involved in logistics and use must be trained and records maintained.

- Employee Training: Train staff on handling, inspection, emergency response, and regulatory requirements.

- Recordkeeping: Maintain logs of inspections, maintenance, training, and disposal activities for audit purposes.

- Compliance Audits: Conduct regular internal audits to verify adherence to OSHA, NFPA, and DOT standards.

Summary

Effective logistics and compliance for liquid fire extinguishers require a proactive approach to safety, environmental responsibility, and regulatory alignment. By following established standards from OSHA, NFPA, DOT, and EPA—and maintaining rigorous handling, storage, and documentation practices—organizations can ensure fire protection readiness while minimizing legal and environmental risk.

Conclusion for Sourcing Liquid Fire Extinguishers

In conclusion, sourcing liquid fire extinguishers requires a comprehensive approach that balances safety, compliance, cost-effectiveness, and operational needs. Water-based or liquid extinguishers, particularly those with additives for enhanced performance, are highly effective for Class A fires involving combustible materials such as wood, paper, and textiles. When sourcing these systems, it is essential to evaluate supplier reliability, product certifications (such as UL, CE, or local fire safety standards), maintenance requirements, and environmental impact.

Additionally, the specific application environment—whether industrial, commercial, or residential—will influence the type and specifications of the extinguisher needed. Conducting thorough market research, obtaining competitive quotes, and consulting with fire safety professionals can ensure the selection of high-quality, reliable equipment. Ultimately, investing in properly sourced liquid fire extinguishers not only enhances fire protection but also contributes to regulatory compliance and long-term safety for people and property.