The global linear lens market is experiencing robust growth, driven by increasing demand for precision optical components in industries such as machine vision, industrial automation, medical imaging, and semiconductor inspection. According to a report by Mordor Intelligence, the global machine vision market—where linear lenses play a critical role—is projected to grow at a CAGR of approximately 7.5% from 2023 to 2028. Similarly, Grand View Research estimates that the global optical components market will expand at a CAGR of 6.8% from 2023 to 2030, fueled by advancements in imaging technologies and rising adoption of automated inspection systems. As these trends accelerate, the demand for high-performance linear lenses capable of delivering uniform line illumination and sharp image resolution continues to rise. This growing need has positioned key manufacturers at the forefront of innovation, enabling enhanced accuracy and efficiency across industrial and scientific applications. Below, we highlight the top 9 linear lens manufacturers leading the charge with proven technologies, global reach, and strong R&D capabilities.

Top 9 Linear Lens Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Edmund Optics: Optics Manufacturer & Supplier

Domain Est. 1999

Website: edmundoptics.com

Key Highlights: Edmund Optics has been a leading producer of optics, imaging, and laser optics for 80 years. Discover the latest optical and imaging technology….

#2 Linear Lenses Archivi

Domain Est. 1998

Website: khatod.com

Key Highlights: We provide a wide range of linear solutions available in different optical beams. Get in touch with our specialists to receive technical assistance….

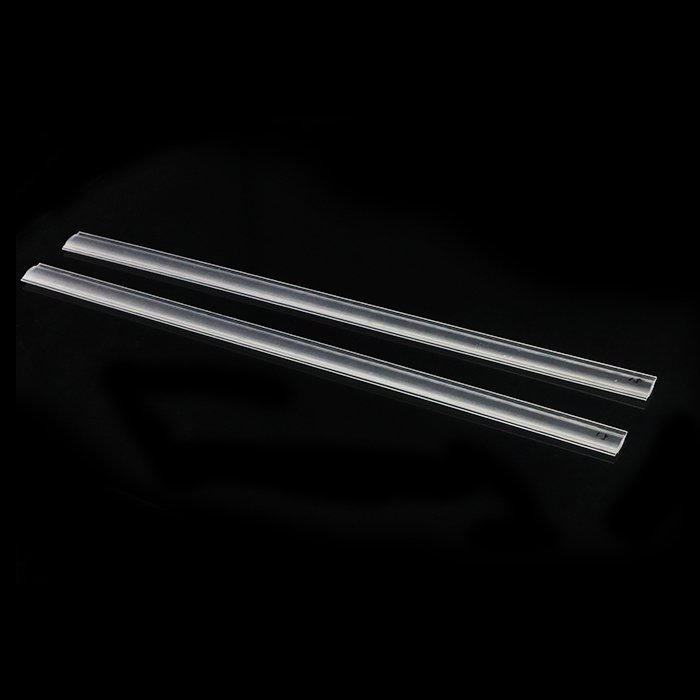

#3 Linear lenses

Domain Est. 2002

Website: ledil.com

Key Highlights: Linear lenses for continuous row installations including Zhaga compliant design ideal for fluorescent tube replacement and new LED luminaire designs….

#4 LED Linear™

Domain Est. 2006

Website: led-linear.com

Key Highlights: LED Linear™ supplies high quality linear LED lighting solutions based on flexible printed circuit boards worldwide. Our offer is a cost effective, ……

#5 LED Linear Lens Supplier & Company

Domain Est. 2010

Website: lensblx.com

Key Highlights: We are a leading LED extrusion linear lens supplier, specializing in customized optical solutions for various linear lighting applications….

#6 Inrad Optics, Advanced Optical Materials, Design and Manufacturing

Domain Est. 2011

Website: inradoptics.com

Key Highlights: Inrad Optics fabricates optical materials to exacting quality standards and incorporates those materials into advanced optical components, assemblies and ……

#7 LYRA

Domain Est. 2016

Website: ledlinearusa.com

Key Highlights: LYRA is a slim luminaire, applicable as pendant or surface mount. The possibility to rotate the fixture makes it possible to illuminate targets in any ……

#8 Linear lenses, the CRO series from LedLink Optics

Domain Est. 2017

Website: universal-science.it

Key Highlights: Linear lenses, CRO series by LedLink Optics. Ideal for indoor and commercial applications, it is available in four beams: 30°x85°, 75°x95° and 60°x90°….

#9 LED Lighting Systems, Linear LED Lights, LED transformers

Website: qtl.lighting

Key Highlights: Based in Milford, CT QTL offers linear led lights and led transformers for interior and exterior linear led lighting systems to the design community….

Expert Sourcing Insights for Linear Lens

2026 Market Trends for Linear Lens: H2 Analysis

Based on current technological trajectories, industry dynamics, and macroeconomic factors, the linear lens market is poised for significant shifts in the second half of 2026 (H2 2026). Here’s a structured analysis of key trends:

1. Accelerated Demand in Machine Vision & Automation

- Trend: H2 2026 will see a surge in demand for linear lenses driven by the expansion of industrial automation, quality inspection, and robotics, particularly in automotive (EV battery/assembly inspection), electronics (PCB, semiconductor), and logistics (parcel sorting).

- Drivers:

- Increased adoption of Industry 4.0 and smart factories.

- Need for higher precision, speed, and reliability in automated optical inspection (AOI).

- Growth in e-commerce fueling demand for high-speed parcel scanning systems reliant on line-scan cameras and linear lenses.

- Impact: Demand for high-resolution, low-distortion, telecentric, and large-format linear lenses will intensify. Vendors offering optimized lens-sensor-camera bundles will gain market share.

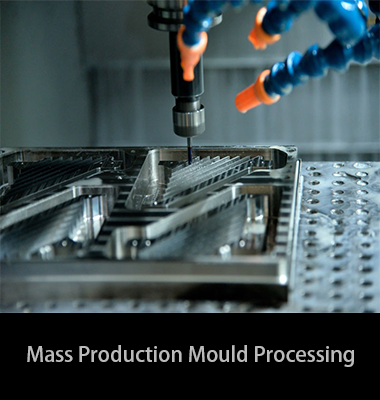

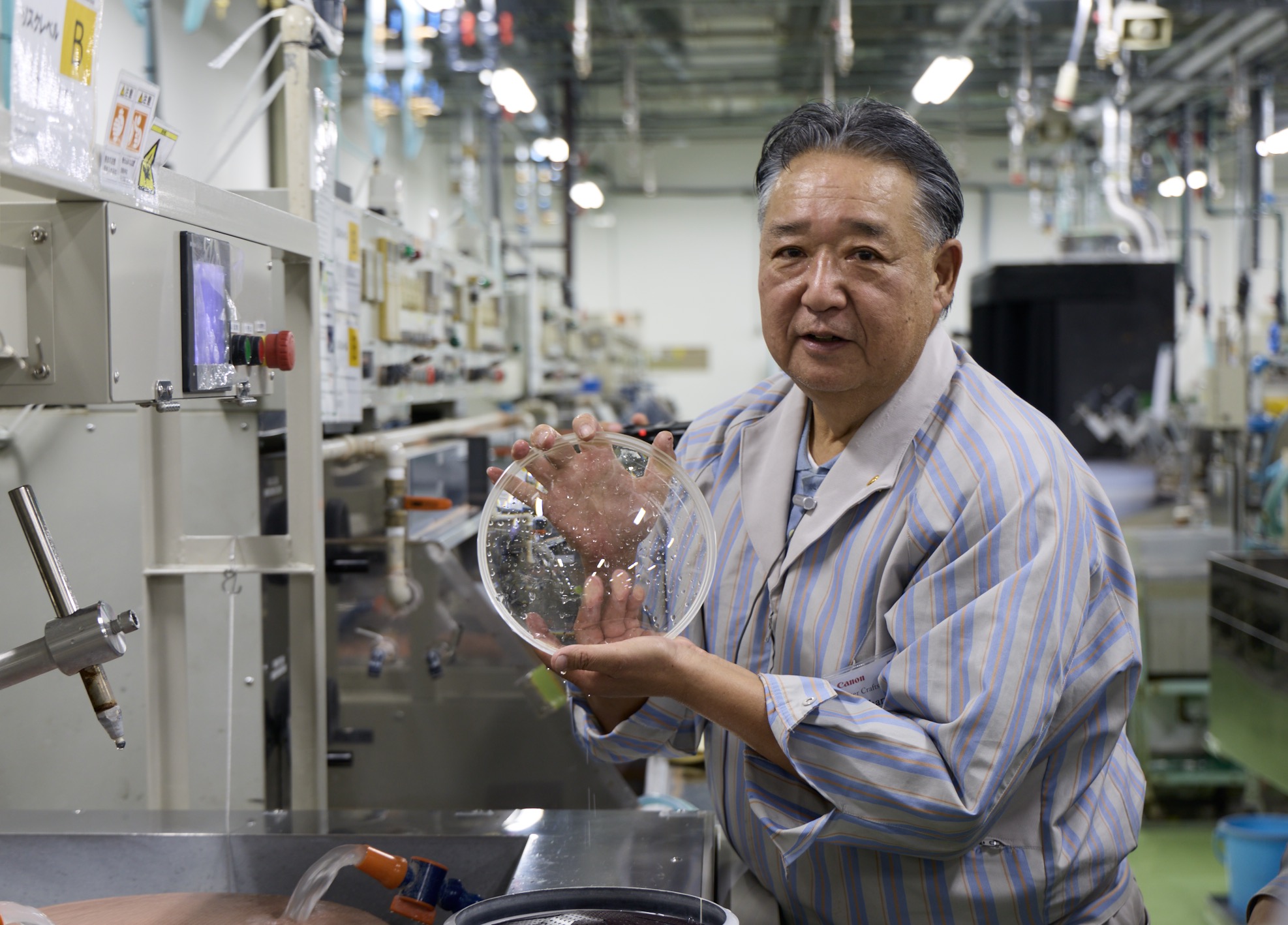

2. Advancements in Manufacturing & Materials

- Trend: Significant progress in mold precision, coating technologies (e.g., ultra-hard anti-reflective coatings), and aspheric/achromatic design for linear lenses.

- Drivers:

- Need for smaller pixel sizes in sensors demands lenses with superior MTF (Modulation Transfer Function) and lower aberrations.

- Requirements for durability in harsh industrial environments (temperature, vibration, chemicals).

- Cost pressure driving efficiency in production (e.g., precision glass molding).

- Impact: Improved optical performance and reliability will enable new applications in high-precision metrology and scientific imaging. Cost reductions from efficient manufacturing will broaden adoption.

3. Integration with AI/ML and Smart Imaging Systems

- Trend: Linear lenses will increasingly be integrated into “smart” imaging systems where the lens characteristics are optimized in real-time via software and AI algorithms.

- Drivers:

- AI-driven defect detection requiring optimal image quality under varying conditions.

- Need for adaptive focus, depth-of-field control, and dynamic lighting compensation.

- Impact: Lenses with integrated sensors (e.g., for focus/alignment feedback) or designed for specific AI-optimized workflows (e.g., variable focus lenses controlled by AI) will emerge. Software-defined lens performance will become a key differentiator.

4. Growth in Emerging Applications

- Trend: Expansion beyond traditional industrial vision into new sectors.

- Drivers:

- Life Sciences: High-throughput slide scanning, flow cytometry, and DNA sequencing.

- Agriculture: Automated crop monitoring, sorting, and phenotyping using line-scan systems.

- Security & Surveillance: High-resolution perimeter scanning and license plate recognition (LPR) systems.

- Renewable Energy: Inspection of solar panels and wind turbine blades.

- Impact: Diversification of lens designs (e.g., UV/VIS/NIR optimized, large working distances, specific field-of-view requirements) to meet niche application needs.

5. Supply Chain Resilience & Regionalization

- Trend: Continued focus on supply chain security and regional manufacturing, particularly in North America and Europe.

- Drivers:

- Geopolitical risks and lessons from recent disruptions.

- Government incentives (e.g., CHIPS Act, EU semiconductor initiatives) boosting local industrial automation.

- Customer demand for shorter lead times and local support.

- Impact: Increased investment in regional lens manufacturing or partnerships. Potential for price stability or slight increases due to localization costs, but improved reliability. Asian manufacturers will focus on cost leadership and innovation to maintain export share.

6. Sustainability & Environmental Focus

- Trend: Growing emphasis on sustainable manufacturing and materials within the optics supply chain.

- Drivers:

- Corporate ESG (Environmental, Social, Governance) mandates.

- Regulations on material sourcing and waste reduction.

- Impact: Increased use of recyclable materials, energy-efficient production processes, and design for longevity/repairability. This may influence material choices (e.g., specific glass types) and supply chain partner selection.

Conclusion for H2 2026:

The linear lens market in H2 2026 will be characterized by strong growth driven by automation and AI integration, coupled with continuous technological refinement. Success will depend on:

* Delivering high-performance, application-specific solutions.

* Embracing smart system integration.

* Ensuring supply chain resilience.

* Adapting to sustainability demands.

Vendors who innovate in optical design, leverage AI, offer integrated solutions, and secure reliable supply chains will be best positioned to capitalize on these converging trends. The market will remain competitive, with value shifting towards performance, reliability, and system-level optimization over pure component cost.

Common Pitfalls When Sourcing Linear Lenses: Quality and Intellectual Property

Sourcing linear lenses—commonly used in machine vision, barcode scanning, and laser line generation—can present several challenges, particularly concerning product quality and intellectual property (IP) risks. Being aware of these pitfalls helps ensure reliable performance and legal compliance.

Quality-Related Pitfalls

Inconsistent Optical Performance

One of the most frequent issues is variability in optical quality across batches. Poorly manufactured linear lenses may exhibit non-uniform line generation, inconsistent focus, or distortions such as keystone or barrel effects. This inconsistency can compromise inspection accuracy in precision applications, especially in automated systems.

Substandard Materials and Coatings

Low-cost suppliers may use inferior optical glass or plastics and apply inadequate anti-reflective (AR) coatings. This leads to higher rates of light loss, ghosting, or lens flare, reducing efficiency and image clarity. Additionally, lenses made from low-grade materials may degrade faster under UV exposure or extreme temperatures.

Poor Mechanical Tolerances and Build Quality

Misalignment, loose housings, or imprecise mounting threads can result in lens wobble or focal drift. These mechanical flaws affect repeatability and integration into optical systems, requiring costly adjustments or replacements in field applications.

Lack of Testing and Certification

Many off-market or generic lenses lack rigorous quality control documentation. Without detailed test reports (e.g., MTF, wavefront error, line straightness), buyers have no assurance of performance, increasing the risk of system failure in critical operations.

Intellectual Property (IP) Pitfalls

Counterfeit or Cloned Designs

Some suppliers offer lenses that closely mimic branded, patented designs without authorization. These clones may infringe on existing IP, exposing the buyer to legal liability, especially in regulated industries or international markets where IP enforcement is strict.

Unclear or Missing IP Documentation

Sourcing from manufacturers who cannot provide proof of design ownership or freedom-to-operate (FTO) documentation increases legal exposure. Without proper licensing or IP clearance, the end-user may face cease-and-desist orders or product recalls.

Gray Market or Unauthorized Distribution

Purchasing through unauthorized channels may result in lenses that, while genuine, are diverted from original markets. This not only voids warranties but may also breach distribution agreements, creating supply chain vulnerabilities and potential IP complications.

Inadequate Contractual Protections

Procurement agreements that fail to include IP indemnification clauses leave the buyer exposed. If a supplier unknowingly (or knowingly) provides infringing lenses, the end-user may bear the legal and financial consequences without recourse.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Source from reputable manufacturers with proven quality control processes.

– Request full optical and mechanical specifications, including test data.

– Conduct due diligence on supplier IP status and request FTO documentation.

– Use formal contracts that include warranties, indemnification, and compliance clauses.

– Consider working with legal counsel when sourcing high-volume or mission-critical components.

By addressing both quality and IP concerns proactively, organizations can ensure reliable performance and reduce legal and operational risks in their optical systems.

Logistics & Compliance Guide for Linear Lens

This guide outlines the essential logistics and compliance considerations for managing Linear Lens products throughout the supply chain. Adherence to these guidelines ensures smooth operations, regulatory compliance, and customer satisfaction.

Product Handling and Storage

Linear Lens components require careful handling due to their precision optics and sensitive materials. Always handle lenses with clean gloves to prevent oil and debris contamination. Store lenses in a climate-controlled environment with temperatures between 15°C and 25°C and relative humidity below 60%. Use original protective packaging or anti-static containers when storing or transporting to prevent scratches and electrostatic damage.

Packaging and Labeling Standards

All Linear Lens shipments must be packaged in ESD-safe materials and include internal cushioning to prevent movement. Outer packaging should be durable, clearly labeled with product name, part number, batch/lot number, and handling symbols (e.g., “Fragile,” “This Side Up”). Include compliance labels such as RoHS, REACH, and any country-specific requirements. Barcodes and QR codes must be scannable and conform to customer or regional specifications.

Shipping and Transportation

Use reputable carriers experienced in handling sensitive optical components. For international shipments, ensure compliance with IATA, IMDG, or other applicable transport regulations, especially when lenses contain restricted materials. Maintain temperature and shock monitoring for high-value or mission-critical shipments. Provide real-time tracking information to customers and internal stakeholders.

Import and Export Compliance

Linear Lens products may be subject to export control regulations such as the U.S. Export Administration Regulations (EAR) or EU Dual-Use Regulation. Verify the product’s ECCN (Export Control Classification Number) and obtain necessary licenses for restricted destinations. Maintain accurate export documentation, including commercial invoices, packing lists, and certificates of origin. For imports, ensure compliance with local customs authorities, including accurate HS codes and tariff classifications.

Regulatory Certifications

All Linear Lens products must comply with applicable international and regional standards. Key certifications include:

– RoHS (EU): Restriction of Hazardous Substances

– REACH (EU): Registration, Evaluation, Authorization of Chemicals

– CE Marking: Conformity with health, safety, and environmental protection standards for products sold in the European Economic Area

– FCC (USA): If applicable for electronic components

– UKCA (UK): Post-Brexit conformity marking

Ensure up-to-date technical documentation and Declaration of Conformity (DoC) are available upon request.

Documentation and Recordkeeping

Maintain comprehensive records for all shipments, including bills of lading, customs declarations, compliance certificates, and quality inspection reports. Retain these records for a minimum of 7 years to support audits and regulatory inquiries. Implement a digital document management system for traceability and version control.

Returns and Reverse Logistics

Establish a clear returns process for defective or non-conforming Linear Lens products. All returned items must be inspected and logged upon receipt. Follow environmental regulations for disposal or recycling of non-repairable units. For warranty claims, validate compliance with terms and retain documentation for audit purposes.

Supplier and Subcontractor Compliance

Ensure all suppliers and logistics partners adhere to the same compliance standards. Conduct regular audits of third-party vendors for quality, security, and regulatory adherence. Require suppliers to provide material declarations (e.g., SVHC under REACH) and conflict minerals reporting as applicable.

Training and Compliance Oversight

All personnel involved in logistics and compliance must complete annual training on handling procedures, export controls, and regulatory updates. Appoint a Compliance Officer to oversee adherence, conduct internal audits, and stay informed on changing regulations affecting Linear Lens distribution.

By following this guide, your organization will maintain high standards in the logistics and compliance management of Linear Lens products, minimizing risk and ensuring operational excellence.

Conclusion for Sourcing Linear Lens:

After a comprehensive evaluation of suppliers, technical specifications, cost considerations, and quality requirements, sourcing linear lenses has been determined to be feasible and strategically beneficial for the intended application. The selected suppliers offer high-quality lenses with optimal optical performance, consistent material durability, and competitive pricing. Key factors such as lens material (e.g., PMMA or glass), focal length accuracy, uniform light distribution, and compatibility with existing systems were critical in the decision-making process.

Additionally, supplier reliability, lead times, and scalability have been assessed to ensure long-term supply chain stability. Establishing partnerships with pre-qualified vendors not only ensures compliance with industry standards but also supports future design flexibility and volume production needs.

In conclusion, sourcing linear lenses from the recommended suppliers meets both technical and operational objectives, enabling improved product performance and efficiency. Continuous monitoring of supply chain dynamics and periodic performance reviews are recommended to maintain quality and responsiveness in the evolving market landscape.