The global linear accelerator market is undergoing rapid expansion, driven by rising cancer incidence, technological advancements, and increasing demand for precision radiation therapy. According to a report by Mordor Intelligence, the market was valued at USD 6.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.7% through 2028, reaching an estimated USD 9.5 billion. This growth trajectory is further supported by Grand View Research, which highlights continued investments in healthcare infrastructure and a shift toward image-guided and intensity-modulated radiation therapy (IMRT) as key market drivers. As demand surges, manufacturers are scaling production and innovating to balance clinical performance with cost-efficiency. In this evolving landscape, identifying the top eight linear accelerator manufacturers that deliver optimal value—balancing acquisition cost, maintenance, and technological capability—has become critical for healthcare providers seeking to expand oncology services cost-effectively.

Top 8 Linear Accelerator Cost Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Valuation of Linear Accelerators

Domain Est. 1997

Website: stout.com

Key Highlights: The appraisal of these systems is highly dependent on the manufacturer, model number, vintage, and options included with the systems….

#2 Linear Accelerators

Domain Est. 1997

Website: altairusa.com

Key Highlights: We are an experienced and stable contract manufacturer, specializing in RF linear accelerators for a variety of markets, products, and solutions….

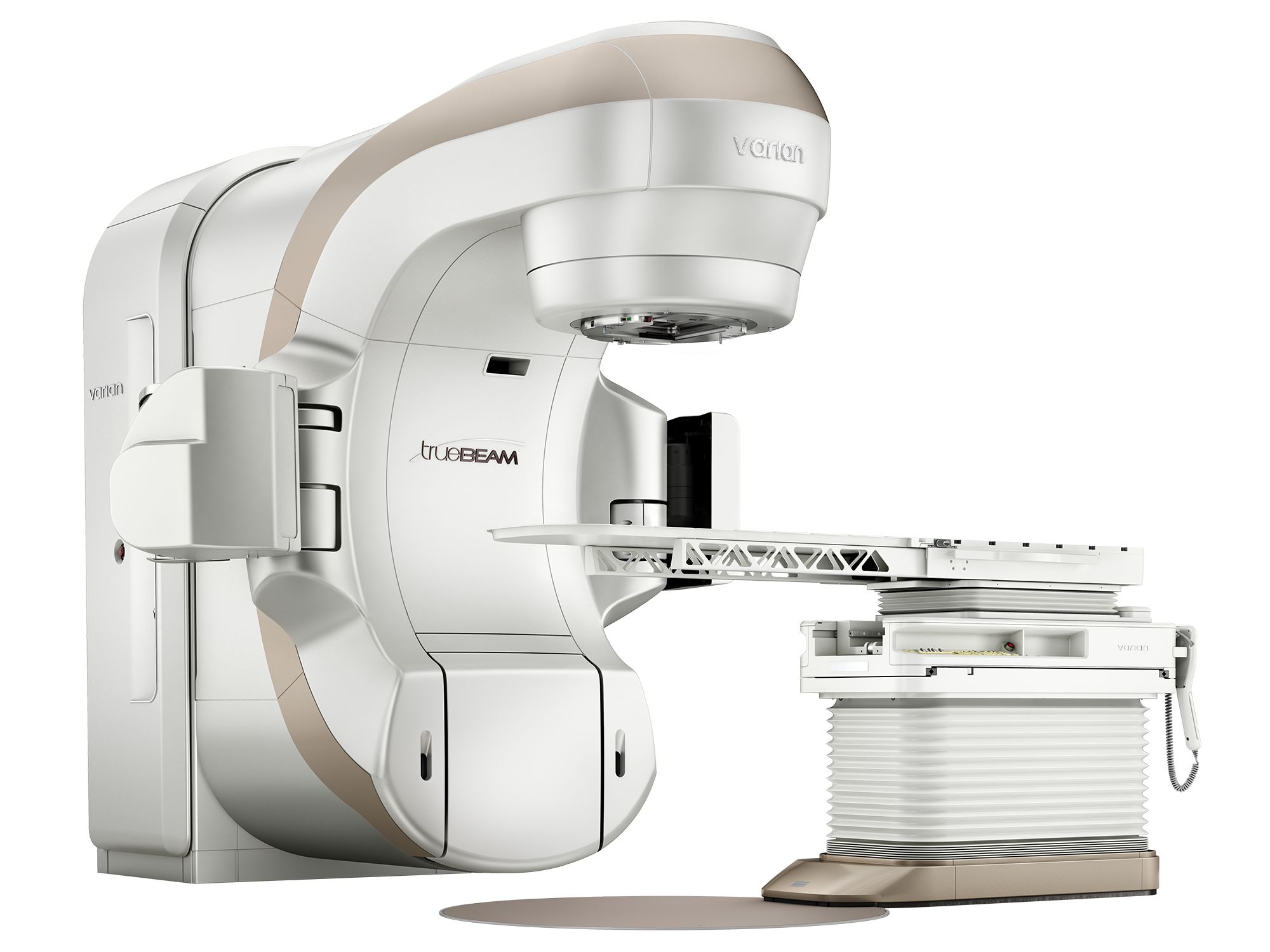

#3 Varian Products

Domain Est. 1991

Website: varian.com

Key Highlights: We’re proud of our efforts to help millions of people worldwide in their fight against cancer. Thousands of Varian linear accelerators, planning sites, and more…

#4 Radiation Therapy

Domain Est. 1993

Website: elekta.com

Key Highlights: Explore Elekta’s radiology oncology systems, making use of digital linear accelerator machines & positioning products for precision radiotherapy treatment….

#5 Linear accelerator maintenance cost analysis

Domain Est. 1997

Website: pmc.ncbi.nlm.nih.gov

Key Highlights: They found a large range of linear accelerator annual maintenance costs, from between $3,000 to $91,740 USD, with a median of $41,390 USD. Van ……

#6 Linear Accelerator Tube for Radiation Therapy

Domain Est. 2010

Website: usa.united-imaging.com

Key Highlights: Discover mass-produced accelerator tubes developed by United Imaging Healthcare. Look into the manufacturing process and why it brings hope….

#7 Linear Accelerator Price Guide

Domain Est. 1999

Website: oncologysystems.com

Key Highlights: $750,000 to $1,500,000. The linear accelerators in this price range are the newest of the pre-owned equipment models. Because of the long useful lives of most ……

#8 TOP Best Linear Accelerator in 2025

Domain Est. 2012

Website: bimedis.com

Key Highlights: A linear accelerator is a radiotherapeutic device used for the irradiation of both benign and malignant tumors….

Expert Sourcing Insights for Linear Accelerator Cost

2026 Market Trends for Linear Accelerator Cost

The global linear accelerator (LINAC) market is poised for significant evolution by 2026, with cost dynamics shaped by technological advancements, shifting healthcare demands, and economic pressures. While the upfront capital cost of LINAC systems remains substantial, several key trends are expected to influence pricing and total cost of ownership.

Consolidation Around High-End, Feature-Rich Systems Driving Base Prices Upward: The market is increasingly dominated by advanced LINACs incorporating sophisticated capabilities like volumetric modulated arc therapy (VMAT), stereotactic body radiotherapy (SBRT), stereotactic radiosurgery (SRS), real-time tumor tracking (e.g., Calypso, Surface Guided Radiation Therapy – SGRT), and integrated MRI (MR-LINACs). These high-end systems, essential for delivering precise, efficient, and adaptive treatments demanded by modern oncology, command premium prices. By 2026, the base cost for a new, standard high-energy LINAC with advanced imaging (CBCT) and motion management is projected to remain in the $2.5 million to $4.5+ million USD range. Entry-level or refurbished models will be available at lower points, but the trend favors investment in comprehensive platforms, pushing the average selling price (ASP) higher. The emergence and gradual adoption of MR-LINACs, offering unparalleled soft-tissue visualization for adaptation, represent a significant cost tier, with systems potentially exceeding $5 million, further inflating the market’s high-end price spectrum.

Intensifying Cost Pressure and Value-Based Care Driving Demand for Cost-Effective Solutions: Simultaneously, healthcare systems globally face intense financial pressure. Reimbursement rates for radiation therapy are under scrutiny, and payers increasingly demand proof of value. This environment fuels demand for solutions that reduce the total cost of ownership (TCO) and improve operational efficiency. Vendors are responding by emphasizing:

* Enhanced Reliability and Reduced Service Costs: Marketing systems with improved component longevity, predictive maintenance features, and remote diagnostics to minimize costly downtime and service calls. Service contracts, a major component of TCO (often 10-15% of purchase price annually), are a key negotiation point.

* Increased Throughput and Efficiency: Features enabling faster treatment delivery (e.g., faster gantry rotation, advanced MLCs) allow clinics to treat more patients per day, improving revenue generation and amortizing the high capital cost more effectively. Automation in QA and workflow is also a focus.

* Software-as-a-Service (SaaS) and Subscription Models: While not yet mainstream for the hardware itself, there’s a growing trend towards subscription-based pricing for advanced software modules (e.g., AI-driven planning, adaptive workflow, specific tracking tools). This shifts some cost from a large upfront capital expenditure (CapEx) to ongoing operational expenditure (OpEx), potentially improving budget predictability but adding long-term costs. By 2026, expect more flexible pricing models incorporating software subscriptions.

Growth of the Refurbished and Pre-Owned Market as a Cost Mitigation Strategy: To access advanced technology at a lower capital outlay, the refurbished and pre-owned LINAC market will remain a significant segment by 2026. Reputable third-party vendors and original equipment manufacturers (OEMs) offering certified pre-owned programs provide systems with updated software, components, and warranties at considerably lower prices (often 30-60% less than new). This market is crucial for community hospitals, clinics in emerging economies, and budget-constrained departments, acting as a major cost-containment factor and increasing overall market accessibility, albeit potentially creating a market for older technology support.

Regional Disparities and Emerging Market Dynamics: Cost trends will not be uniform globally. In mature markets (North America, Western Europe), high ASPs driven by demand for the latest technology will persist, though competition and value pressure will keep growth in check. In high-growth emerging markets (Asia-Pacific, Latin America, parts of Africa), cost sensitivity is paramount. Vendors may introduce simplified, more affordable LINAC configurations or offer aggressive financing/leasing options to penetrate these markets. Local manufacturing or assembly in some regions could eventually emerge as a cost-reduction strategy, though likely not dominant by 2026.

Conclusion: The 2026 LINAC cost landscape presents a dichotomy: rising base prices for cutting-edge technology driven by innovation and clinical demand, countered by intense pressure to reduce total cost of ownership through efficiency, reliability, and alternative financing/procurement models (refurbished, subscriptions). Healthcare providers will increasingly evaluate LINAC purchases not just on upfront cost, but on the value proposition – balancing advanced capabilities, operational efficiency, service costs, and long-term sustainability. Expect continued innovation in pricing models as vendors adapt to the value-based care environment.

Common Pitfalls in Sourcing Linear Accelerator Cost (Quality, IP)

When sourcing linear accelerators—especially for medical, industrial, or research applications—organizations often focus heavily on upfront cost, overlooking critical factors related to quality and intellectual property (IP). Neglecting these aspects can lead to long-term financial, operational, and legal risks. Below are key pitfalls to avoid.

Underestimating Total Cost of Ownership Due to Quality Compromises

Prioritizing initial purchase price over quality can result in higher long-term expenses. Lower-cost linear accelerators may use inferior components, leading to increased downtime, higher maintenance costs, and reduced treatment or operational accuracy. Poor beam stability, calibration drift, or mechanical failures compromise performance and safety, especially in medical radiotherapy. Cutting corners on quality may also shorten equipment lifespan, necessitating premature replacement.

Overlooking Regulatory and Compliance Risks

Linear accelerators used in healthcare must meet stringent regulatory standards (e.g., FDA, CE, IEC). Sourcing from suppliers with inadequate quality management systems (e.g., non-compliance with ISO 13485) increases the risk of failed audits, delayed installations, or even non-approval for clinical use. Choosing a lower-cost vendor without proven regulatory track records can result in costly retrofitting, legal liabilities, or operational shutdowns.

Inadequate Supplier Vetting and After-Sales Support

Many low-cost suppliers, particularly from emerging markets, lack robust technical support, training, and spare parts availability. This leads to prolonged downtimes when maintenance is needed. Service contracts may be limited or prohibitively expensive. Ensure the supplier offers comprehensive documentation, on-site service, remote diagnostics, and software updates—critical for maintaining quality and performance over time.

Ignoring Intellectual Property (IP) Risks

Sourcing from vendors with unclear or contested IP ownership poses serious legal exposure. Some manufacturers may use patented technologies (e.g., beam shaping, imaging integration, control algorithms) without proper licensing. Purchasing such equipment could expose the buyer to infringement claims, especially in litigious markets. Always verify that the supplier holds legitimate IP rights or proper licensing for core technologies.

Lack of Transparency in Software and Firmware

Modern linear accelerators rely heavily on proprietary software for treatment planning, delivery, and safety interlocks. Sourcing equipment with closed or undocumented software may limit customization, integration with hospital systems (e.g., oncology information systems), and independent verification. Hidden software defects or lack of update policies can impair functionality and compromise patient safety. Ensure access to software validation reports and update roadmaps.

Assuming All Components Are Original or Certified

Counterfeit or reverse-engineered parts may be used in lower-cost systems, affecting reliability and safety. These components often lack certification and fail under sustained operation. Verify component traceability and insist on documentation showing OEM sourcing for critical subsystems like RF generators, waveguides, and detectors.

Overlooking Data Rights and Interoperability

Some vendors restrict access to machine data or require proprietary interfaces, limiting the buyer’s ability to analyze performance, conduct research, or integrate with third-party tools. This can hinder innovation and increase dependency on the vendor. Clarify data ownership and ensure open or standardized communication protocols (e.g., DICOM, HL7) are supported.

Conclusion

To avoid costly missteps, organizations must look beyond the sticker price when sourcing linear accelerators. A comprehensive evaluation of quality assurance processes, regulatory compliance, after-sales support, and intellectual property integrity is essential. Due diligence in these areas protects long-term operational efficiency, legal standing, and patient or process safety.

Logistics & Compliance Guide for Linear Accelerator Cost

When acquiring a linear accelerator (LINAC) for radiation therapy, understanding the full logistics and compliance requirements is essential to accurately estimate and manage total costs. Beyond the initial purchase price, numerous logistical and regulatory factors significantly impact budgeting, timelines, and long-term operational expenses. This guide outlines key considerations to ensure a compliant and efficient installation.

Site Preparation and Facility Modifications

Installing a LINAC demands extensive site preparation to meet safety, structural, and operational standards. Costs include:

– Radiation shielding: Concrete walls, lead-lined doors, and maze design to comply with NRC or state regulations (ALARA principles).

– Reinforced flooring: To support the machine’s weight (typically 5,000–10,000 lbs).

– HVAC and electrical upgrades: Dedicated power supply (480V, 3-phase), cooling systems, and backup generators.

– Room dimensions: Minimum clearances for gantry rotation, patient access, and emergency egress as per manufacturer specs.

– Regulatory approvals: Submission of room design and shielding plans to state radiation control programs for licensing.

Regulatory Licensing and Permits

Compliance with federal, state, and local regulations is mandatory and time-sensitive:

– Radioactive materials license: Required if using radioactive sources (e.g., for calibration); issued by the NRC or Agreement State.

– Equipment registration: LINACs must be registered with state health departments or radiation control agencies.

– Building and fire codes: Permits for construction, electrical work, and fire suppression systems.

– Inspection fees: Pre-occupancy and post-installation inspections by regulatory bodies.

– Compliance timelines: Delays in permitting can extend project timelines by weeks or months, increasing indirect costs.

Transportation and Installation Logistics

Transporting and installing a LINAC involves specialized handling:

– Freight and rigging: Cranes, flatbed trucks, and rigging crews to move the gantry and components through tight spaces.

– White-glove delivery: Climate-controlled transport to protect sensitive components.

– Installation labor: Manufacturer engineers or certified technicians for assembly, calibration, and integration with treatment planning systems.

– Crane and site access fees: Temporary road closures or structural modifications for delivery.

Quality Assurance and Commissioning

Before clinical use, rigorous testing ensures safety and accuracy:

– Acceptance testing: Performed by physicists to verify manufacturer specifications.

– Commissioning: Beam data collection and integration into treatment planning software—requires medical physicists and dosimetrists.

– Regulatory documentation: Submission of QA results to state and accrediting bodies (e.g., ACR, ASTRO).

– Cost of personnel and equipment: Includes physicist time, ion chambers, phantoms, and software tools.

Ongoing Compliance and Maintenance

Long-term costs extend beyond installation:

– Annual inspections: Required by regulatory agencies and accreditation organizations.

– Preventive maintenance contracts: Typically 10–15% of equipment cost per year, covering parts, labor, and software updates.

– Dosimetry audits: Participation in programs like RPC or IROC for quality assurance.

– Regulatory renewals: Annual license fees and compliance reporting.

Staff Training and Credentialing

Compliance includes human factors:

– Initial training: Manufacturer-led training for therapists, physicists, and engineers.

– Credentialing: Documentation for staff certification (e.g., ABR, ARRT) to meet accreditation standards.

– Safety training: Radiation safety officer (RSO) programs and emergency procedures.

Conclusion

A comprehensive understanding of logistics and compliance is critical when evaluating the total cost of ownership for a linear accelerator. Failure to account for site modifications, permitting delays, transportation challenges, and ongoing regulatory requirements can lead to significant budget overruns and operational disruptions. Engaging physicists, regulatory consultants, and project managers early in the process ensures a smooth, compliant, and cost-effective implementation.

Conclusion on Sourcing Linear Accelerator Costs

Sourcing a linear accelerator (LINAC) involves a comprehensive evaluation of both direct and indirect costs, as well as multiple procurement options such as new purchases, refurbished systems, leasing, or vendor service agreements. The total cost of ownership extends well beyond the initial acquisition price and includes installation, training, maintenance, quality assurance, facility modifications, and ongoing operational expenses.

After evaluating various suppliers, models, and financing options, it is evident that while new LINACs from leading manufacturers offer advanced features and longer warranties, they come with a significantly higher upfront investment—typically ranging from $2 million to over $5 million. Alternatively, purchasing a certified refurbished system can reduce costs by 30–50% while still providing reliable performance, especially when backed by comprehensive service agreements.

Key factors influencing cost-effectiveness include vendor reputation, service and support availability, warranty terms, system compatibility with current infrastructure (e.g., treatment planning systems), and total lifecycle costs. Institutions should also consider technological advancements, such as automation and imaging integration, which may justify higher initial expenditures through improved patient outcomes and operational efficiency.

In conclusion, a strategic sourcing approach that balances clinical needs, budget constraints, and long-term sustainability is critical. Establishing clear procurement criteria, engaging in competitive vendor negotiations, and considering total cost of ownership will enable healthcare providers to make a financially sound and clinically effective decision when acquiring a linear accelerator.