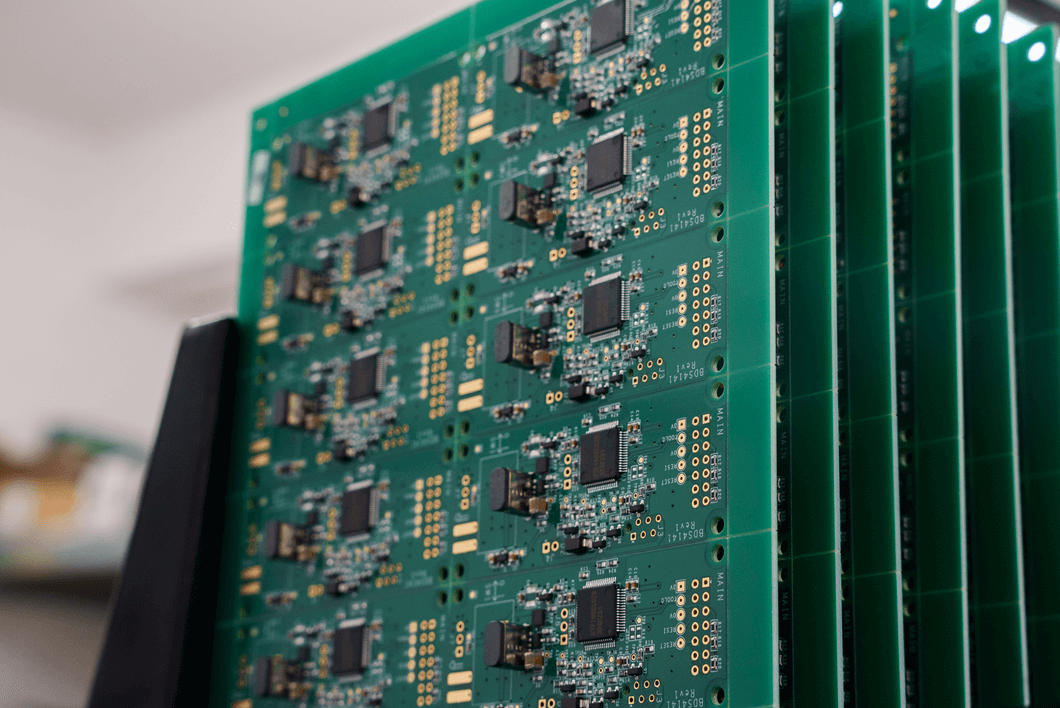

The global printed circuit board (PCB) market continues to expand rapidly, driven by rising demand in electronics, automotive, industrial automation, and telecommunications sectors. According to a report by Mordor Intelligence, the PCB market was valued at USD 80.3 billion in 2023 and is projected to reach USD 101.5 billion by 2029, growing at a CAGR of approximately 3.9% over the forecast period. Similarly, Grand View Research estimates the market value at USD 81.3 billion in 2023, with a projected CAGR of 5.2% from 2024 to 2030, fueled by advancements in high-density interconnect (HDI) boards, miniaturization, and the proliferation of 5G and IoT devices. As demand for reliable, high-performance line boards intensifies, a select group of manufacturers have emerged as leaders in technology, scale, and innovation. The following list highlights the top 10 line board manufacturers shaping the future of electronic interconnectivity.

Top 10 Line Board Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 TTM Technologies

Domain Est. 1995

Website: ttm.com

Key Highlights: TTM Technologies is an advanced Printed Circuit Board (PCB) manufacturer and a leading supplier in technology solutions….

#2 Circuit Board manufacturer

Domain Est. 1997

Website: pnconline.com

Key Highlights: PNC Inc. has been a PC board manufacturer for the past 48 years and specializes in working side-by-side with visionary engineers and buyers….

#3 Summit Interconnect leads Complex Circuits and Rigid Flex PCB

Domain Est. 2016

Website: summitinterconnect.com

Key Highlights: Summit Interconnect is a manufacturer of advanced technology printed circuit boards focused on complex rigid, flex and rigid-flex PCBs….

#4 Belden

Domain Est. 1997

Website: belden.com

Key Highlights: We design, manufacture and market networking, connectivity, cable products and solutions for industrial automation, smart buildings and broadcast markets….

#5 buy it now! The perfect tool for the printer.

Domain Est. 2000

Website: thelineboard.com

Key Highlights: The Line Board, designed by printers, is used to check alignment of originals and finished printed products. Also manufacturer of the Perf-it Score Board….

#6 Rogers Corporation

Domain Est. 2003

Website: rogerscorp.com

Key Highlights: Explore insights for PCB manufacturers and users into material selection, fabrication techniques, and design considerations that enhance circuit performance….

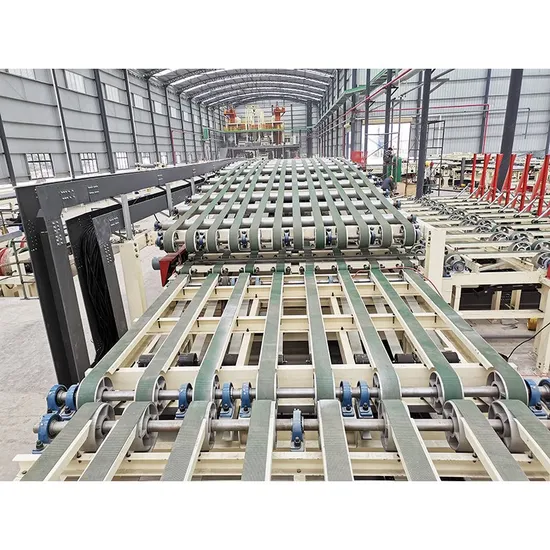

#7 Printed circuit board industry

Domain Est. 2020

Website: burkle.tech

Key Highlights: BÜRKLE has been serving PCB manufacturers worldwide as a line manufacturer with advanced laminating technologies and is always one step ahead of the times….

#8 Supermicro Data Center Server, Blade, Data Storage, AI System

Domain Est. 1996

Website: supermicro.com

Key Highlights: Industry’s broadest selection of high quality hardware for fully application optimized server, storage, embedded/IoT, and workstation solutions….

#9 Würth Elektronik

Domain Est. 1998

Website: we-online.com

Key Highlights: What does Würth Elektronik produce? Würth Elektronik manufactures electronic components, printed circuit boards and intelligent power and control systems….

#10 ABL Circuits: PCB Manufacturing Experts

Domain Est. 2000

Website: ablcircuits.co.uk

Key Highlights: ABL Circuits is a UK based PCB manufacture with expertise in PCB prototyping. We can produce your order in 24 hours. Get a quote online today….

Expert Sourcing Insights for Line Board

H2 2026 Market Trends for Line Boards

As the electronics manufacturing and printed circuit board (PCB) industries evolve, Line Boards—referring to high-density interconnect (HDI) and standard multilayer PCBs used in telecommunications, consumer electronics, automotive, and industrial applications—are expected to undergo significant transformation in the second half of 2026. The H2 2026 outlook reveals key drivers shaped by technological innovation, supply chain maturation, and shifting end-market demands.

1. Increased Demand from 5G and Edge Computing Infrastructure

By H2 2026, global rollout of 5G-Advanced networks and early 6G trials will drive robust demand for high-frequency, low-loss line boards. Base stations, edge data centers, and small cells require advanced line boards with tighter impedance control, improved thermal management, and enhanced signal integrity. Manufacturers are increasingly adopting modified semi-additive process (mSAP) and embedded passives to meet these performance needs, particularly in mmWave applications.

2. Growth in Automotive Electronics and ADAS

The automotive sector is a major growth vector for line boards. With increasing electrification and the deployment of Level 3+ autonomous driving systems, H2 2026 will see rising demand for high-reliability, multi-layer line boards in advanced driver assistance systems (ADAS), infotainment, and vehicle-to-everything (V2X) modules. PCBs must meet stringent AEC-Q200 standards, prompting investments in automotive-grade materials and automated optical inspection (AOI) to ensure quality.

3. Miniaturization and HDI Adoption in Consumer Electronics

Smartphones, wearables, and augmented reality (AR) devices continue to push the limits of component density. In H2 2026, HDI line boards featuring microvias, stacked vias, and sequential lamination will dominate premium consumer devices. The integration of AI processors and 5G modems into compact form factors necessitates finer line widths (<30µm) and higher layer counts (10–16 layers), driving innovation among PCB fabricators in Asia and North America.

4. Sustainability and Regulatory Pressures

Environmental regulations, particularly in the EU (e.g., revised RoHS and upcoming Ecodesign for Sustainable Products Regulation), are pushing line board manufacturers toward lead-free, halogen-free, and recyclable materials. H2 2026 will see increased adoption of bio-based substrates, water-soluble solder masks, and closed-loop chemical recovery systems. ESG compliance is becoming a competitive differentiator, especially among Tier 1 suppliers.

5. Supply Chain Resilience and Regionalization

Geopolitical tensions and past disruptions have accelerated regionalization efforts. In H2 2026, North America and Europe are expected to expand domestic PCB production capacity, supported by government incentives (e.g., U.S. CHIPS Act, EU Chips Act). Nearshoring benefits reduce lead times and mitigate risks, though cost premiums remain a challenge. Meanwhile, Southeast Asia (Vietnam, Malaysia) continues to grow as a high-volume manufacturing hub.

6. AI-Driven Manufacturing and Smart Factories

The integration of AI and machine learning in PCB fabrication is maturing. By H2 2026, smart factories will leverage predictive maintenance, real-time defect detection, and digital twins to optimize yield and reduce waste. Advanced analytics enable dynamic routing and adaptive plating, improving line board consistency and throughput—especially critical for high-mix, low-volume (HMLV) production.

7. Material Innovation and Cost Pressures

High-performance materials (e.g., low-Dk/Df laminates like Panasonic Megtron 7 or Isola I-Tera) remain in high demand but face cost and availability constraints. In response, H2 2026 will see broader adoption of mid-tier materials offering a balance between performance and cost. Additionally, copper foil thinning and resin-coated copper (RCC) technologies are gaining traction for ultra-thin line boards.

Conclusion:

The H2 2026 line board market is characterized by technological sophistication, regional diversification, and sustainability imperatives. Growth will be led by 5G infrastructure, automotive electrification, and AI-enabled consumer devices. While material and supply chain challenges persist, advancements in HDI fabrication, automation, and eco-design are positioning the industry for resilient, innovation-driven expansion. Companies that invest in R&D, vertical integration, and sustainable practices are likely to capture the most value in this evolving landscape.

Common Pitfalls Sourcing Line Boards (Quality, IP)

Sourcing Line Boards—especially for telecom, networking, or high-speed applications—comes with significant risks if not managed carefully. Two of the most critical areas where companies encounter problems are quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to production delays, product failures, legal disputes, and reputational damage.

Quality-Related Pitfalls

1. Inadequate Supplier Vetting

Choosing a supplier based solely on cost or lead time without thoroughly auditing their manufacturing capabilities, quality management systems (e.g., ISO 9001 certification), and track record can result in inconsistent board performance. Poor soldering, incorrect layer alignment, or substandard materials may go undetected until late in the integration phase.

2. Lack of Rigorous Testing Protocols

Failing to define and enforce comprehensive testing—such as electrical continuity tests, signal integrity validation, thermal stress testing, and environmental reliability—can allow defective boards to pass initial inspection. This increases field failure rates and warranty costs.

3. Inconsistent Component Sourcing

Line boards often integrate high-speed components (e.g., FPGAs, optical transceivers). If the supplier sources components from unauthorized or gray-market distributors, counterfeit or out-of-spec parts may be used, compromising functionality and reliability.

4. Poor Documentation and Traceability

Without detailed manufacturing records, batch tracking, and test reports, diagnosing quality issues becomes nearly impossible. This lack of traceability can delay root cause analysis and corrective actions during failure investigations.

Intellectual Property-Related Pitfalls

1. Unprotected Design Files

Sharing PCB layout files, schematics, or firmware without proper non-disclosure agreements (NDAs) or legal safeguards exposes proprietary designs. Suppliers—especially in regions with weak IP enforcement—may replicate or sell the design to competitors.

2. Lack of IP Clauses in Contracts

Failing to clearly define IP ownership in supply agreements can result in disputes. For example, if a supplier contributes to design optimization, they may claim partial ownership unless explicitly stated otherwise in the contract.

3. Reverse Engineering Risks

Line boards with visible, unguarded circuitry can be easily reverse-engineered. Without design obfuscation or legal recourse, competitors may produce functionally identical products, undermining market exclusivity.

4. Insecure Firmware and Software Integration

If the Line Board includes programmable logic or embedded software, inadequate protection (e.g., unencrypted code, lack of secure boot mechanisms) may allow unauthorized access, cloning, or malicious tampering.

Mitigating these pitfalls requires a structured sourcing strategy that includes supplier due diligence, robust quality control processes, and strong legal protections for intellectual property. Engaging trusted partners, using escrow for critical designs, and conducting regular audits can significantly reduce risk.

Logistics & Compliance Guide for Line Board

This guide outlines the essential logistics and compliance considerations for managing Line Board operations effectively, ensuring smooth supply chain execution and adherence to regulatory requirements.

Supply Chain Coordination

Coordinate with suppliers, manufacturers, and distribution partners to maintain accurate Line Board data reflecting real-time inventory and production status. Establish clear communication protocols for updates on material availability, lead times, and potential disruptions. Utilize integrated planning systems to align procurement, production scheduling, and delivery timelines.

Inventory Management

Maintain accurate inventory records through regular cycle counts and reconciliation with Line Board data. Implement FIFO (First-In, First-Out) or FEFO (First-Expired, First-Out) practices where applicable to reduce obsolescence and ensure product quality. Monitor stock levels against demand forecasts to prevent overstocking or stockouts.

Transportation & Distribution

Select carriers based on reliability, cost-efficiency, and compliance with transportation regulations. Ensure proper packaging and labeling for all shipments, including hazardous materials if applicable. Track shipments in real time and update the Line Board accordingly to maintain visibility across the supply chain.

Regulatory Compliance

Adhere to local, national, and international regulations governing product safety, labeling, import/export, and environmental standards. Maintain documentation such as Material Safety Data Sheets (MSDS), Certificates of Compliance, and export licenses. Conduct regular audits to verify compliance and update Line Board records with relevant certification statuses.

Documentation & Traceability

Ensure all logistics activities are supported by accurate documentation, including bills of lading, packing lists, and customs forms. Implement traceability systems that link products to batches, serial numbers, or production dates, enabling quick response to recalls or quality issues. Update the Line Board to reflect traceability data and compliance milestones.

Risk Management

Identify potential supply chain risks—such as geopolitical issues, natural disasters, or supplier failures—and develop mitigation strategies. Use the Line Board to monitor risk indicators and trigger contingency plans when thresholds are breached. Maintain safety stock and alternative sourcing options where critical.

Performance Monitoring & Reporting

Define key performance indicators (KPIs) such as on-time delivery rate, inventory accuracy, and compliance audit scores. Generate regular reports from Line Board data to assess performance and identify improvement opportunities. Share insights with stakeholders to drive continuous improvement in logistics and compliance processes.

Certainly! Here’s a professional conclusion for sourcing a line board:

Conclusion:

In conclusion, sourcing the line board requires a strategic approach that balances cost, quality, reliability, and supply chain efficiency. After evaluating potential suppliers, technical specifications, lead times, and long-term scalability, it is evident that selecting a qualified and experienced manufacturer is critical to ensuring seamless production and product performance. Establishing strong supplier relationships, implementing rigorous quality control measures, and maintaining supply chain transparency will be key to minimizing risks and supporting continuous operations. Ultimately, a well-executed sourcing strategy for the line board will contribute significantly to overall product reliability, cost-effectiveness, and time-to-market success.