The global solar photovoltaic (PV) market is undergoing rapid transformation, driven by increasing demand for clean energy and advancements in lightweight, portable solar solutions. According to Mordor Intelligence, the global solar panel market was valued at USD 145.6 billion in 2023 and is projected to grow at a CAGR of over 6.8% from 2024 to 2029. A key segment within this expansion is lightweight PV panels—designed for applications ranging from rooftop installations on low-load buildings to mobile and off-grid systems in remote or disaster-prone areas. As installation flexibility, energy density, and transportation efficiency become critical selection criteria, manufacturers are innovating with thin-film technologies, flexible substrates, and frameless designs to reduce weight without compromising efficiency. With Grand View Research projecting the global solar photovoltaic market to reach USD 304.1 billion by 2030, the demand for lightweight panels is poised to rise in tandem, particularly in aerospace, defense, recreational, and building-integrated applications. This growing landscape has elevated a new cohort of manufacturers specializing in high-performance, low-mass solar modules—merging portability with power in an increasingly solar-driven world.

Top 9 Lightweight Pv Panels Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 PowerFilm Solar

Domain Est. 2005

Website: powerfilmsolar.com

Key Highlights: We design and manufacture custom solar cells, panels, and power solutions using proprietary thin-film or high-efficiency crystalline PV technology….

#2 Bright Solar

Domain Est. 2012

Website: brightsolarpower.net

Key Highlights: We specialize in RV Solar products and manufacturing and are committed to providing the best RV solar products,off grid solar system, and newest technology ……

#3 MiaSolé

Domain Est. 2003

Website: miasole.com

Key Highlights: MiaSolé is the leader in flexible, lightweight, powerful solar, pioneering the shift from rigid solar panels and all their limitations to flexible solar….

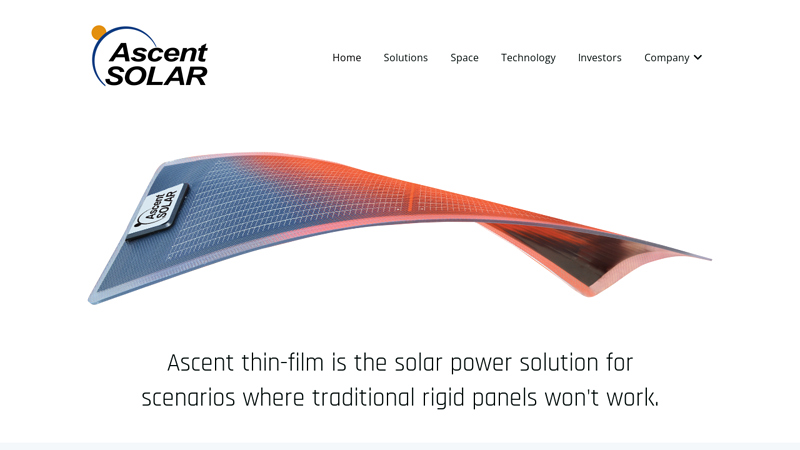

#4 Ascent Solar Technologies

Domain Est. 2005

Website: ascentsolar.com

Key Highlights: Our thin film PV panels are manufactured using cutting-edge CIGS (Copper-Indium-Gallium-Selenide) with patented monolithic integration. Our patent-protected ……

#5 Homepage

Domain Est. 2005

Website: heliatek.com

Key Highlights: Invented, developed, and manufactured by German engineering excellence, the solar films (not panels!), are light-weight, bendable, and truly sustainable….

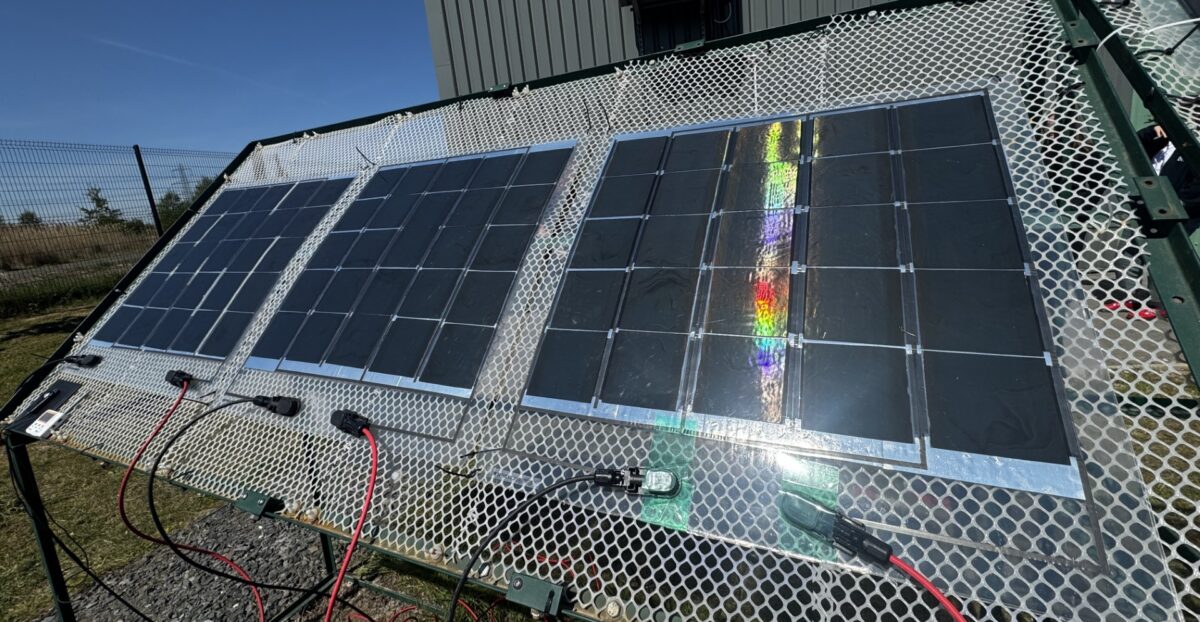

#6 Saule Technologies – Inkjet

Domain Est. 2014

Website: sauletech.com

Key Highlights: Saule Technologies is a high-tech company that develops innovative solar cells based on perovskite materials … lightweight, ultrathin, and semi-transparent…

#7 Lightweight Solar Specialists

Domain Est. 2016

Website: solivus.com

Key Highlights: Solivus London are lightweight solar specialists, creating lightweight solar panel systems for large commercial buildings where traditional solar panels ……

#8 Bila Solar

Domain Est. 2022

Website: bilasolar.com

Key Highlights: Bila Solar is redefining the industry with high-performance panels proudly manufactured in Indiana and ready to power your projects today….

#9 Power Roll

Website: powerroll.solar

Key Highlights: We’re building the next generation of solar PV modules. Our patented solar film combines thousands of mighty Microgrooves with Perovskites….

Expert Sourcing Insights for Lightweight Pv Panels

H2: Market Trends for Lightweight PV Panels in 2026

By 2026, the global market for lightweight photovoltaic (PV) panels is poised for significant transformation, driven by technological innovation, expanding applications, and supportive policy landscapes. Here’s an in-depth analysis of the key trends expected to shape this dynamic sector:

1. Accelerated Adoption in Building-Integrated and Retrofit Applications

Lightweight PV panels are expected to become the preferred solution for building-integrated photovoltaics (BIPV) and rooftop retrofits, especially on structures with weight limitations (e.g., older buildings, metal roofs, and commercial warehouses). Their reduced structural load allows for solar deployment without costly reinforcements, driving growth in urban and residential markets. By 2026, BIPV installations using lightweight modules are projected to grow at a CAGR exceeding 15%, particularly in Europe and Japan where building codes increasingly emphasize energy efficiency.

2. Technological Advancements Driving Efficiency and Durability

In 2026, thin-film technologies—especially advanced CIGS (Copper Indium Gallium Selenide) and perovskite-silicon tandem cells—will dominate the lightweight PV segment. These technologies offer higher power-to-weight ratios and improved performance in low-light and high-temperature conditions. Manufacturers are also investing in robust encapsulation materials to enhance durability without adding weight, addressing previous concerns about lifespan. Efficiency levels for commercial lightweight panels are expected to reach 18–22% by 2026, narrowing the gap with traditional silicon modules.

3. Expansion into Transportation and Mobility Applications

Lightweight PV panels will see growing integration into electric vehicles (EVs), buses, trains, and even drones and recreational vehicles (RVs). Automakers are exploring solar roofs to extend battery range and reduce charging frequency. By 2026, lightweight solar-integrated EVs could represent a $1.2 billion niche market, supported by advancements in flexible, impact-resistant PV materials and vehicle electrification mandates.

4. Growth in Off-Grid and Portable Energy Solutions

Demand for portable and deployable solar solutions will surge due to rising interest in outdoor recreation, disaster relief, and military applications. Lightweight, rollable, and foldable PV panels will become more efficient and affordable, enabling broader use in camping, emergency power, and remote telecommunications. The global portable solar market is expected to grow by over 12% annually, with lightweight PV at its core.

5. Supply Chain Maturation and Cost Reduction

As production scales and manufacturing processes improve (e.g., roll-to-roll processing for thin-film), costs for lightweight PV panels are projected to decline by 20–25% between 2023 and 2026. Increased competition among key players in Asia, Europe, and North America will further drive down prices, improving accessibility. However, supply chain vulnerabilities—particularly for rare materials like indium—may prompt investment in recycling and alternative materials.

6. Regulatory Support and Incentive Programs

Government policies aimed at decarbonizing buildings and expanding renewable energy access will continue to favor lightweight PV adoption. Incentives such as tax credits, feed-in tariffs, and streamlined permitting for solar retrofits will be critical drivers. Regions like the EU and California are expected to implement mandates for solar-ready buildings, creating a favorable environment for lightweight solutions.

7. Sustainability and End-of-Life Management

With growing emphasis on circular economy principles, manufacturers will face pressure to improve recyclability of lightweight PV modules. By 2026, industry leaders are expected to offer take-back programs and design panels with modular, recyclable components. Environmental certifications and transparent life-cycle assessments will become key differentiators.

Conclusion

By 2026, lightweight PV panels will transition from a niche alternative to a mainstream energy solution, underpinned by performance improvements, cost competitiveness, and diverse applications. The convergence of technological innovation, policy support, and evolving energy needs will solidify their role in the global energy transition—particularly in urban, mobile, and off-grid contexts. Companies that invest in R&D, scalable manufacturing, and sustainable practices will lead this high-growth segment.

Common Pitfalls Sourcing Lightweight PV Panels (Quality, IP)

When sourcing lightweight photovoltaic (PV) panels—often used in applications such as building-integrated PV (BIPV), transportation, portable systems, or structures with weight limitations—buyers must navigate several critical pitfalls related to both product quality and intellectual property (IP). Overlooking these can lead to performance issues, safety risks, legal liabilities, and financial losses.

1. Overlooking Durability and Long-Term Performance

Lightweight PV panels often use alternative substrates (e.g., polymers, thin-film materials, or flexible composites) instead of traditional glass and aluminum frames. This can compromise mechanical strength and environmental resistance. Common issues include:

- Delamination and moisture ingress due to inferior encapsulation.

- UV degradation leading to rapid power output decline.

- Poor adhesion of active layers, especially in flexible modules.

- Reduced lifespan compared to standard rigid panels (e.g., 5–10 years vs. 25+).

Solution: Request full IEC 61215 / IEC 61646 certification data, including damp heat, thermal cycling, and humidity freeze tests. Verify real-world performance data and warranty terms (e.g., linear power warranty).

2. Inadequate Power Output and Efficiency Claims

Suppliers may exaggerate power ratings or efficiency, particularly in low-light or non-standard conditions. Lightweight panels—especially thin-film or organic PV—often underperform relative to silicon-based panels.

- Misleading STC (Standard Test Conditions) ratings not reflective of real-world use.

- Lack of NOCT (Nominal Operating Cell Temperature) data**, critical for understanding real performance.

- Inconsistent cell-to-module (CTM) ratios due to poor manufacturing processes.

Solution: Demand third-party test reports (e.g., from TÜV, UL, or PV Evolution Labs) and compare independently verified performance metrics.

3. Risk of Sourcing Counterfeit or IP-Infringing Products

The growing demand for lightweight PV has led to a surge in manufacturers, particularly in regions with lax IP enforcement. Common IP-related pitfalls include:

- Unauthorized replication of patented cell architectures (e.g., CIGS, perovskite, or tandem designs).

- Use of protected manufacturing processes without licensing.

- Mislabeling of technology origin, such as falsely claiming proprietary efficiency breakthroughs.

Solution: Conduct IP due diligence:

– Verify patent ownership and licensing status.

– Use legal counsel to assess freedom-to-operate (FTO).

– Require suppliers to provide IP indemnification in contracts.

4. Inconsistent Manufacturing Quality and Lack of Traceability

Many lightweight PV producers, especially startups or low-cost manufacturers, lack robust quality control systems. This results in:

- High variance in module performance within the same batch.

- Defective interconnects or bypass diodes leading to hotspots and failures.

- Absence of serialization or traceability, complicating warranty claims and recalls.

Solution: Audit manufacturing facilities, require batch testing reports, and insist on full product traceability (e.g., QR codes per module).

5. Incomplete or Misleading Certifications

Some suppliers list certifications that are outdated, self-declared, or issued by unrecognized bodies. This is especially risky for safety and compliance.

- Missing critical certifications like IEC 61730 (safety), UL 1703, or fire ratings (e.g., Class A).

- Use of expired or fraudulent certificates.

Solution: Validate certifications through official databases (e.g., UL Product iQ, TÜV certificates) and require test reports from accredited labs.

6. Underestimating Installation and Integration Risks

Lightweight panels may require specialized mounting systems, adhesives, or electrical integration. Poor compatibility can lead to:

- Structural failure due to improper load distribution.

- Water leakage in BIPV applications.

- Electrical safety hazards from non-compliant connectors or insulation.

Solution: Engage system integrators early and ensure compatibility with mounting solutions and local building codes.

7. Supply Chain Instability and Technology Obsolescence

Many lightweight PV technologies (e.g., perovskite, organic PV) are still emerging. Suppliers may go out of business or discontinue products, leaving buyers stranded.

- Lack of long-term support for spare parts or replacements.

- Rapid technology turnover making current products obsolete.

Solution: Choose suppliers with proven track records, stable funding, and clear technology roadmaps. Negotiate long-term supply agreements if possible.

Conclusion:

Sourcing lightweight PV panels requires careful due diligence beyond price and specs. Evaluating both technical quality and IP integrity is essential to avoid operational failures, legal exposure, and reputational damage. Always verify performance data, certifications, and IP status—and consider partnering with independent technical and legal experts during procurement.

Logistics & Compliance Guide for Lightweight PV Panels

Lightweight photovoltaic (PV) panels offer advantages in transportation, handling, and installation due to their reduced weight and often flexible or semi-flexible design. However, their unique physical characteristics and emerging technology status require specific considerations in logistics and regulatory compliance. This guide outlines key aspects to ensure safe, efficient, and compliant handling of lightweight PV panels throughout the supply chain.

Transportation & Handling

Lightweight PV panels—commonly made with thin-film technology or ultra-light crystalline modules on composite backsheets—require delicate handling despite their reduced mass. Their flexibility or thin construction makes them susceptible to bending stresses, creasing, or micro-cracking.

- Packaging: Use specialized packaging with reinforced edge protection, internal dividers, and moisture-resistant wrapping. Avoid stacking heavy items on top. Vacuum-sealed or rigid clamshell packaging is recommended for flexible modules.

- Loading & Unloading: Train personnel to handle panels horizontally, avoiding vertical tilting that may induce stress. Use pallet jacks or forklifts with appropriate support; never drag or drop packages.

- Stacking: Follow manufacturer guidelines for maximum stacking height. Exceeding limits may deform lower units, especially in humid or hot conditions.

- Climate Control: Avoid prolonged exposure to extreme temperatures (>60°C or < -20°C) and high humidity during transit, which may degrade adhesives or substrates. Use climate-controlled containers when necessary.

Storage Requirements

Improper storage can compromise the integrity and performance of lightweight PV panels.

- Indoor Storage Preferred: Store panels in a dry, temperature-controlled indoor environment, away from direct sunlight and dust.

- Horizontal Positioning: Always store panels horizontally on flat, level surfaces. Avoid leaning or vertical storage, which may cause warping.

- Ventilation: Ensure adequate air circulation to prevent condensation, especially in high-humidity regions.

- Duration: Limit storage duration per manufacturer recommendations—typically no more than 6–12 months—to avoid material degradation.

Regulatory & Safety Compliance

Lightweight PV panels must meet international and regional standards for electrical safety, environmental impact, and performance, despite their non-traditional design.

- Electrical Safety Certifications: Ensure panels are certified to IEC 61215 (crystalline) or IEC 61646 (thin-film) for performance and IEC 61730 for safety. In North America, UL 1703 certification is mandatory.

- Fire Safety: Comply with local building codes (e.g., NFPA 70 in the U.S., EN 13501-1 in EU). Flexible modules may require additional fire retardant testing due to polymer substrates.

- RoHS & REACH Compliance: Verify that materials used (e.g., cadmium in CdTe thin-film) comply with Restriction of Hazardous Substances (RoHS) and REACH regulations in target markets.

- Transportation Regulations: For air freight, classify panels according to IATA Dangerous Goods Regulations if they contain hazardous materials (e.g., lead, cadmium). Most lightweight panels are non-hazardous but require proper documentation.

Import & Customs Considerations

Cross-border movement of lightweight PV panels involves tariff classifications and documentation.

- HS Code Classification: Typically classified under HS 8541.40 (photovoltaic generators). Confirm with local customs authorities, as subcategories may vary by region.

- Country-Specific Requirements: Some countries (e.g., India, Brazil) impose anti-dumping duties or require BIS, INMETRO, or other local certifications.

- Documentation: Provide commercial invoice, packing list, certificate of origin, and test reports (IEC/UL). Include technical datasheets highlighting weight, dimensions, and material composition.

End-of-Life & Environmental Compliance

Lightweight panels may contain materials requiring special recycling procedures.

- WEEE Compliance (EU): Producers must register and provide take-back solutions for end-of-life modules under the Waste Electrical and Electronic Equipment Directive.

- Recycling Infrastructure: Collaborate with certified PV recyclers familiar with thin-film or composite materials. Avoid landfill disposal where regulated.

- Material Disclosure: Maintain records of panel composition to support compliance with environmental regulations and customer sustainability reporting.

Best Practices Summary

- Partner with experienced logistics providers familiar with solar shipments.

- Conduct periodic audits of handling and storage practices.

- Maintain up-to-date compliance documentation for all target markets.

- Train installers on proper handling to avoid on-site damage.

By adhering to this guide, stakeholders can ensure the safe, compliant, and efficient deployment of lightweight PV panels, maximizing their benefits while minimizing risks across the supply chain.

Conclusion on Sourcing Lightweight PV Panels

Sourcing lightweight photovoltaic (PV) panels presents a strategic opportunity for projects where structural limitations, installation flexibility, or aesthetic considerations are key concerns. These panels offer significant advantages over traditional glass-based modules, including reduced structural load, easier transportation, and simplified mounting—making them ideal for applications on lightweight roofs, portable systems, vehicles, and building-integrated photovoltaics (BIPV).

When sourcing lightweight PV panels, it is essential to balance performance, durability, and cost. While they generally have slightly lower efficiency and shorter lifespans compared to conventional panels, ongoing advancements in thin-film and heterojunction technologies are narrowing this gap. Key considerations during procurement include the manufacturer’s reputation, warranty terms, efficiency ratings, temperature coefficients, and resistance to environmental stressors such as UV exposure and humidity.

Moreover, sourcing from suppliers with proven quality control, certifications (e.g., IEC 61215, IEC 61646), and strong technical support ensures reliability and long-term performance. As the market for lightweight PV solutions expands, competitive pricing and greater availability are expected, further enhancing their viability.

In conclusion, lightweight PV panels are a promising solution for specialized applications where traditional panels are impractical. With careful supplier selection and a clear understanding of technical trade-offs, stakeholders can successfully integrate lightweight solar technology into innovative and sustainable energy projects.