The global window film market is experiencing robust growth, driven by rising demand for energy-efficient building solutions and increased awareness of UV protection. According to a report by Mordor Intelligence, the market was valued at USD 8.7 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2029. A significant segment of this growth is attributed to light-sensitive and smart window films, which dynamically adjust to changing light conditions to optimize indoor comfort and reduce energy consumption. These advanced films are particularly gaining traction in both residential and commercial sectors, especially in regions with high solar exposure. As sustainability and smart building technologies become key priorities, manufacturers are innovating with photochromic and electrochromic solutions that respond to natural light. With technological advancements and supportive regulatory frameworks for energy conservation, the light-sensitive window film industry is poised for accelerated expansion. Here are the top six manufacturers leading this transformation through cutting-edge materials, scalable production, and strategic global outreach.

Top 6 Light Sensitive Window Film Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 ams OSRAM is a global leader in innovative light and sensor …

Domain Est. 2019

Website: ams-osram.com

Key Highlights: Headquartered in Austria and Germany, ams OSRAM has deep engineering expertise and dedicated experts to help you be at the forefront to technology advancement….

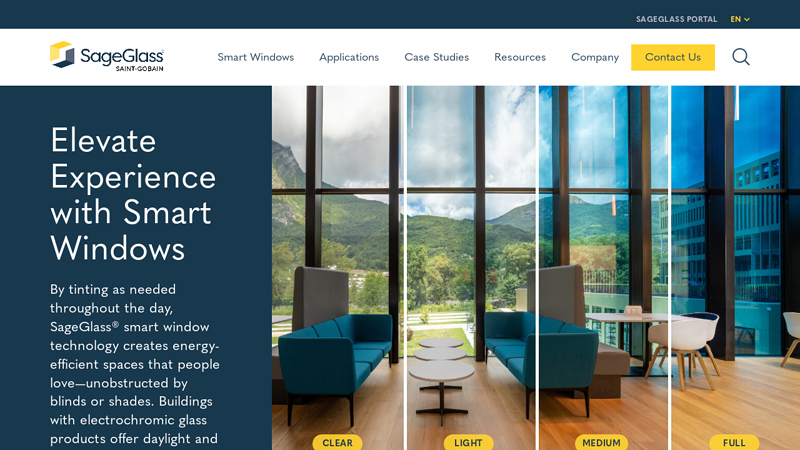

#2 SageGlass

Domain Est. 1999

Website: sageglass.com

Key Highlights: See how SageGlass electrochromic glass works! Our dynamic glass is the industry-leading smart glass solution to help make buildings more sustainable….

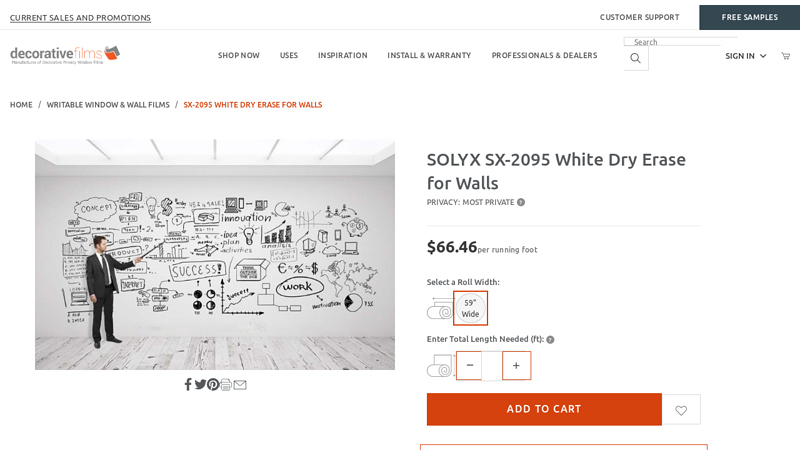

#3 SOLYX SX

Domain Est. 2002

Website: decorativefilm.com

Key Highlights: In stock Free delivery over $159A 4.3 mil White Opaque film coated with a premium dry erase surface and a high-tack acrylic, pressure-sensitive, grooved adhesive for dry installs….

#4 Temporary Protection Films

Domain Est. 2004

Website: pregis.com

Key Highlights: Temporary protection films are designed to protect critical surfaces from scratching & contamination. These pressure sensitive adhesive films adhere to ……

#5 Window Tint Near Me

Domain Est. 2013

Website: kickincustoms.com

Key Highlights: Ceramic Window Film (Xpel XR Black & XR Plus). ✓Strong heat rejection for real cabin comfort. ✓Noticeable glare reduction for easier driving….

#6 1 Provider of Window Film in Kansas City

Domain Est. 2014

Website: customtintsolutions.com

Key Highlights: Quality window films block over 99% of destructive UV rays while maintaining brilliant natural light transmission, creating healthier indoor environments for ……

Expert Sourcing Insights for Light Sensitive Window Film

H2: 2026 Market Trends for Light Sensitive Window Film

The light sensitive window film market is poised for significant transformation and growth by 2026, driven by converging technological advancements, evolving consumer demands, and increasing global focus on energy efficiency and smart building integration. Here are the key trends shaping the market:

1. Accelerated Adoption in Smart Buildings and IoT Integration

By 2026, light sensitive window films—particularly photochromic and electrochromic variants—will be increasingly embedded into smart building ecosystems. Integration with IoT platforms will allow films to respond not only to ambient light but also to occupancy sensors, weather forecasts, and user preferences via mobile apps or voice assistants. This seamless automation enhances comfort and energy savings, making such films a standard feature in new commercial constructions and high-end residential renovations.

2. Dominance of Electrochromic Technology

While photochromic films (which darken automatically in sunlight) remain popular for residential use, electrochromic smart films will dominate the premium and commercial sectors by 2026. Electrochromic films offer greater control (user-adjustable tint levels), faster response times, and improved durability. Advancements in nanomaterials and transparent conductive coatings will reduce manufacturing costs, making them more accessible beyond niche markets.

3. Sustainability and Energy Efficiency as Primary Drivers

With stricter global building energy codes (e.g., EU’s Energy Performance of Buildings Directive, U.S. Energy Code updates), light sensitive films will be recognized as critical tools for reducing HVAC loads. By dynamically managing solar heat gain and natural light, these films can cut cooling energy consumption by up to 20–30%. This positions them as essential components in net-zero energy buildings, boosting demand in both retrofit and new build projects.

4. Expansion Beyond Traditional Windows

Light sensitive films will expand into non-residential applications such as automotive sunroofs, aircraft windows, skylights, and greenhouses. In the automotive sector, smart tinted glass improves passenger comfort and reduces reliance on air conditioning, aligning with electric vehicle (EV) range optimization goals. In agriculture, tunable light transmission films will be used in vertical farms to optimize plant growth cycles.

5. Material Innovation and Cost Reduction

R&D efforts will yield films with improved performance: faster switching speeds, greater UV stability, and enhanced clarity in both clear and tinted states. Use of low-cost conductive polymers and roll-to-roll manufacturing techniques will help lower prices. By 2026, mid-tier pricing is expected to make smart films viable for broader residential markets, especially in sun-intensive regions.

6. Increased Focus on Health and Well-being

Human-centric design trends will drive demand for films that regulate not just brightness but also blue light and glare. Light sensitive films that mimic natural daylight cycles (circadian lighting support) will gain traction in offices, healthcare facilities, and homes, promoting occupant well-being and productivity.

7. Regulatory Support and Incentives

Government incentives for energy-efficient building materials—such as tax credits, rebates, and green certification points (e.g., LEED, BREEAM)—will further stimulate adoption. Countries with high solar insolation (e.g., Australia, Middle East, Southern U.S.) will emerge as key growth regions.

8. Competitive Landscape and Market Consolidation

The market will see increased competition between specialized material science companies, glass manufacturers, and tech startups. Strategic partnerships (e.g., film producers with window OEMs or smart home platforms) will be common. Some consolidation is expected as larger players acquire innovative startups to broaden their smart glass portfolios.

Conclusion:

By 2026, light sensitive window film will transition from a niche product to a mainstream solution in the global push for intelligent, sustainable, and human-focused environments. Driven by technology maturation, cost reduction, and regulatory tailwinds, the market will experience robust growth, with electrochromic and IoT-integrated systems leading innovation across residential, commercial, and transportation sectors.

Common Pitfalls When Sourcing Light Sensitive Window Film (Quality & IP Risks)

Sourcing light sensitive window film—such as photochromic or thermochromic films that darken in response to sunlight—can be complex due to technical quality demands and intellectual property (IP) considerations. Buyers often encounter several recurring pitfalls that can lead to subpar performance, legal exposure, or supply chain disruptions. Below are key risks categorized under quality and IP concerns.

Quality-Related Pitfalls

Inconsistent Performance and Durability

Many low-cost suppliers offer films that initially appear functional but degrade quickly under UV exposure, heat, or moisture. Buyers may experience inconsistent color change speed, incomplete darkening, or failure to return to a clear state. Poor adhesion, delamination, or yellowing over time are also common, especially in films lacking UV stabilizers or protective coatings.

Lack of Standardized Testing Data

Suppliers may overstate performance metrics (e.g., transition time, lifespan, optical clarity) without providing independent test reports. Absence of compliance with industry standards (e.g., ASTM, ISO) or real-world performance data can lead to mismatched expectations and unsuitable film deployment in architectural or automotive applications.

Poor Manufacturing Consistency

Batch-to-batch variation is a major concern with manufacturers lacking strict quality control (QC) processes. This can result in visible inconsistencies in tint levels, activation thresholds, or film thickness, especially problematic for large-scale installations requiring uniform appearance.

Inadequate Environmental Suitability

Some films are not engineered for extreme climates. Sourcing films without verifying performance in target environments (e.g., high humidity, intense solar radiation) can result in premature failure. For example, thermochromic films may activate at unintended temperatures, reducing effectiveness.

Intellectual Property (IP) Risks

Use of Counterfeit or Reverse-Engineered Technology

Unverified suppliers may offer films that mimic patented technologies (e.g., photochromic molecules or nano-coating processes) without proper licensing. These products often infringe on IP held by innovators like Transitions Optical, Gentex, or major chemical companies, exposing buyers to legal liability and product recalls.

Unclear IP Ownership and Licensing

When working with OEMs or contract manufacturers, buyers may assume they have freedom to use or resell the product globally. However, without clear contractual terms on IP rights and territorial licensing, companies risk violating patents in specific regions or facing disputes over product ownership.

Limited Innovation and Technical Support

Generic suppliers may lack R&D capabilities, resulting in obsolete or low-performance formulations. Without access to proprietary advancements or technical support, buyers are left troubleshooting compatibility, installation, or performance issues independently.

Hidden Supply Chain IP Violations

Even if a supplier appears legitimate, their raw materials (e.g., photochromic dyes or polymer substrates) may originate from unauthorized sources. This creates downstream risk, as end users can still be implicated in IP infringement regardless of direct intent.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Request third-party performance certifications and accelerated aging test results.

– Conduct factory audits to assess QC and R&D capabilities.

– Perform due diligence on supplier IP, including patent landscape reviews.

– Include IP indemnification clauses in procurement contracts.

– Partner with reputable manufacturers who openly disclose technology origins and licensing.

Proactively addressing quality and IP concerns ensures reliable performance and legal safety when integrating light sensitive window films into commercial or consumer applications.

Logistics & Compliance Guide for Light Sensitive Window Film

Product Overview

Light Sensitive Window Film is a dynamic architectural film designed to darken or lighten in response to changing light conditions, offering glare reduction, UV protection, and energy efficiency. Proper logistics handling and regulatory compliance are essential to maintain product integrity and ensure safe, legal distribution.

Storage Requirements

Store light sensitive window film in a cool, dry environment with temperatures between 10°C and 25°C (50°F–77°F). Keep rolls sealed in original packaging to protect against dust, moisture, and direct sunlight. Store horizontally on racks to prevent deformation or edge damage. Avoid storage near heat sources or in high-humidity areas such as basements or outdoor sheds.

Packaging & Handling

Handle film rolls with clean gloves to prevent fingerprints or contamination. Use mechanical aids (e.g., hand trucks or forklifts) when moving large rolls to avoid physical stress. Always lift by the core, not the outer film layer. During transit, secure packaging with edge protectors and pallet straps to prevent shifting or impact damage.

Transportation Guidelines

Ship in temperature-controlled vehicles whenever possible, especially in extreme climates. Avoid prolonged exposure to temperatures below 5°C (41°F) or above 35°C (95°F) during transport. Use moisture-resistant wrapping and palletized loads to minimize risk of water damage. Ensure carriers are aware of the product’s sensitivity to temperature and light fluctuations.

Regulatory Compliance

Ensure product complies with regional safety and environmental standards. In the United States, verify conformity with FTC labeling requirements and CPSC safety guidelines for window films. In the European Union, adhere to REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives. Provide Safety Data Sheets (SDS) compliant with GHS (Globally Harmonized System) standards.

Import/Export Documentation

For international shipments, include detailed commercial invoices, packing lists, and certificates of origin. Light sensitive window films may require customs classification under HS Code 3919.90 (self-adhesive plates, sheets, film, foil, tape, etc., of plastics). Confirm specific import regulations with destination country authorities—some regions may require product testing or certification (e.g., CE marking in the EU).

Installation & End-User Compliance

Provide installers with technical data sheets and application guidelines. Recommend professional installation to ensure optimal performance and warranty validity. Inform end-users that film application may be subject to local building codes, particularly in commercial or high-rise structures. Some jurisdictions regulate window tinting on safety glazing or emergency exits.

Warranty & Returns

Clearly communicate warranty terms covering film performance, delamination, and discoloration. Returns must be in original, undamaged packaging and initiated within the specified return window. Damaged or installed film is typically non-returnable. Establish a process for handling compliance-related claims or product recalls.

Environmental & Disposal Considerations

Dispose of off-cut or waste film in accordance with local waste management regulations. While most window films are non-hazardous, recycling options may be limited. Encourage responsible disposal practices and consult with waste management providers on proper handling of polyethylene-based laminates.

Conclusion: Sourcing Light-Sensitive Window Film

Sourcing light-sensitive window film presents a strategic opportunity to enhance energy efficiency, occupant comfort, and aesthetic appeal in both residential and commercial spaces. These intelligent films automatically adjust their tint in response to sunlight intensity, effectively reducing glare, minimizing UV exposure, and lowering cooling costs—offering a sustainable and cost-effective alternative to traditional window treatments.

When sourcing, it is essential to consider factors such as responsiveness, durability, clarity, and ease of installation. Evaluating suppliers based on product quality, certifications, warranty offerings, and technical support ensures long-term performance and return on investment. Additionally, understanding the specific needs of the application—whether for health care facilities, offices, or homes—helps in selecting the most suitable technology, such as photochromic or electrochromic films.

As demand for smart building materials grows, light-sensitive window films represent a forward-thinking solution that combines innovation with practical benefits. By carefully vetting suppliers and staying informed about technological advancements, stakeholders can successfully integrate this dynamic glazing solution into modern architectural designs, contributing to more adaptive, energy-efficient, and comfortable environments.