The global lithium iron phosphate (LiFePO4) battery market is experiencing robust growth, fueled by rising demand for safe, durable, and high-cycle-life energy storage solutions across electric vehicles (EVs), renewable energy systems, and industrial applications. According to a 2023 report by Mordor Intelligence, the LiFePO4 battery market was valued at USD 11.56 billion in 2022 and is projected to reach USD 28.43 billion by 2028, registering a compound annual growth rate (CAGR) of 16.2% during the forecast period. This expansion is driven by increasing adoption of energy storage systems (ESS), supportive government policies promoting clean energy, and growing concerns over the thermal stability and longevity of alternative lithium-ion chemistries. As demand surges, manufacturers are scaling production, improving energy density, and optimizing cost-efficiency—leading to a competitive landscape dominated by innovative players across Asia, North America, and Europe. In this evolving market, identifying the top nine LiFePO4 battery pack manufacturers provides critical insight into who is leading in technology, scalability, and global reach.

Top 9 Lifepo4 Lithium Iron Phosphate Battery Packs Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 LiFePO4 Battery Manufacturer, Lithium Iron Phosphate Battery …

Domain Est. 2018

Website: lifepo4battery-factory.com

Key Highlights: More than 20 years LiFePO4 (lithium iron phosphate) battery manufacturer, we commit to providing high quality LiFePO4 battery with factory price….

#2 Lithium Iron Phosphate LiFePO4 Battery

Domain Est. 1997

Website: eemb.com

Key Highlights: We manufacture custom battery pack assembly for electronic, industry and OEM business for decades. We are proud to serve our customers….

#3 LiFePO4 Battery

Domain Est. 2017

Website: lifepo4-battery.com

Key Highlights: As a professional lifepo4 batteries and lifepo4 battery cells manufacturer and supplier in China, we offer the best quality and services to our customers ……

#4 SOK BATTERY – LiFePO4 Battery

Domain Est. 2019

Website: us.sokbattery.com

Key Highlights: SOK battery is a leading manufacturer and supplier of lithium iron phosphate batteries (LifePO4). Established five years ago by a team of 3 engineers from CALB ……

#5 Gobel Power

Domain Est. 2021

Website: gobelpower.com

Key Highlights: Gobel Power offers wholesale lithium iron phosphate (LiFePO4) battery cells, as primary agent of several lithium battery cell manufacturers in China….

#6 American Battery Factory

Domain Est. 2021

Website: americanbatteryfactory.com

Key Highlights: American Battery Factory (ABF) focuses exclusively on manufacturing and enhancing high-performance prismatic Lithium Iron Phosphate (LFP) batteries….

#7 Battle Born Batteries

Domain Est. 2016

Website: battlebornbatteries.com

Key Highlights: Free deliveryShop premium LiFePO4 lithium batteries from Battle Born for unmatched power, reliability, and a 10-year warranty. Get started today!…

#8 Vatrer Lithium Batteries

Domain Est. 2021

Website: vatrerpower.com

Key Highlights: Free delivery 30-day returnsVatrer Power delivers high-quality lithium batteries for golf carts, RVs, solar systems and marine trolling motors, ensuring safe, sustainable energy….

#9 Best Lithium Iron Phosphate Batteries

Domain Est. 2014

Website: relionbattery.com

Key Highlights: RELiON’s selection of lithium batteries have the highest standards of safety, performance, and durability for your RV, marine, golf cart and solar needs….

Expert Sourcing Insights for Lifepo4 Lithium Iron Phosphate Battery Packs

H2: 2026 Market Trends for LiFePO4 (Lithium Iron Phosphate) Battery Packs

The LiFePO4 (Lithium Iron Phosphate) battery pack market is poised for significant evolution by 2026, driven by technological advancements, shifting regulatory landscapes, and expanding application demands. This analysis examines the key H2-level trends shaping the market:

1. H2: Accelerated Cost Reductions & Value Chain Optimization

- Trend: Continued pressure on manufacturing costs through economies of scale, process improvements, and potential raw material cost stabilization (particularly iron and phosphate, which are more abundant than cobalt/nickel). Automation in cell and pack assembly will increase.

- Impact: LiFePO4 packs will become increasingly cost-competitive not just against other lithium chemistries (like NMC) in specific applications, but also against legacy technologies like lead-acid, especially in high-cycle applications. This drives adoption in price-sensitive markets.

- 2026 Outlook: Expect average pack prices to fall further, solidifying LiFePO4’s position as the most cost-effective long-life lithium option. Focus will shift towards total cost of ownership (TCO) optimization.

2. H2: Dominance in Stationary Energy Storage (ESS) & Grid Applications

- Trend: LiFePO4 is the de facto standard for residential, commercial & industrial (C&I), and utility-scale energy storage systems due to its inherent safety, long cycle life (>6,000 cycles), thermal stability, and decreasing cost.

- Impact: Global energy transition policies, renewable integration mandates, and grid resilience needs will massively drive ESS deployment. LiFePO4’s safety profile is critical for densely populated areas and critical infrastructure.

- 2026 Outlook: LiFePO4 will capture an even larger share (likely exceeding 70-80% in new deployments) of the non-utility ESS market. Integration with smart grid technologies and virtual power plants (VPPs) will be a key growth vector.

3. H2: Expansion Beyond ESS into Light & Medium-Duty Transportation

- Trend: While NMC dominates long-range EVs, LiFePO4 is rapidly gaining ground in applications where safety, longevity, and cost are prioritized over maximum energy density.

- Impact:

- EVs: Increased adoption in entry-level/mid-range EVs, city cars, and fleets (taxis, delivery vans). “Blade Battery” and similar structural innovations improve pack energy density.

- E-Bikes & E-Scooters: Dominance continues due to safety and lifespan.

- Marine & RV: Strong growth as users prioritize safety near living spaces and long cycle life.

- Material Handling: AGVs, forklifts, and warehouse automation increasingly use LiFePO4 for fast charging, zero maintenance, and 24/7 operation.

- 2026 Outlook: Significant market share gains in light-duty EV segments and near-total dominance in non-high-performance micromobility and industrial mobility.

4. H2: Intensifying Focus on Safety, Sustainability, and Ethical Sourcing

- Trend: Regulatory scrutiny (fire safety codes for ESS, EV standards) and consumer demand will elevate safety as a non-negotiable requirement. Simultaneously, ESG (Environmental, Social, Governance) factors will gain prominence.

- Impact:

- Safety: LiFePO4’s superior thermal and chemical stability (no oxygen release, higher thermal runaway threshold) will be a major competitive advantage over NMC/NCA, especially in densely populated installations.

- Sustainability: Abundant, non-toxic raw materials (Fe, P) and established recycling pathways give LiFePO4 a strong ESG profile. Demand for recycled content and transparent supply chains will grow.

- Ethics: Avoidance of conflict minerals (Co, Ni) is a key differentiator.

- 2026 Outlook: Safety and sustainability will be primary drivers for LiFePO4 adoption, potentially mandated in specific applications. ESG reporting will become standard.

5. H2: Advancements in Pack Design, Integration, and Smart Features

- Trend: Move beyond basic cells to sophisticated, integrated battery systems with enhanced intelligence and functionality.

- Impact:

- Structural Integration: “Cell-to-Pack” (CTP) and “Cell-to-Chassis” (CTC) designs (e.g., BYD Blade, Tesla structural packs using LFP) will improve volumetric and gravimetric efficiency, reducing pack cost and complexity.

- Smart BMS: Advanced Battery Management Systems (BMS) with AI/ML for predictive maintenance, state-of-health (SoH) estimation, optimized charging, and grid services (frequency regulation).

- Standardization & Modularity: Growth in standardized pack formats for easier integration and replacement, particularly in ESS and industrial applications.

- 2026 Outlook: LiFePO4 packs will be smarter, more integrated, and easier to deploy. The value will increasingly lie in the system-level integration and software, not just the cells.

Conclusion for 2026:

By 2026, the LiFePO4 battery pack market will be characterized by mature cost leadership, dominance in stationary storage, strong growth in light/medium transport and industrial applications, and a heightened focus on safety, sustainability, and system intelligence. While challenges remain (e.g., energy density limitations for premium EVs, recycling scale-up), LiFePO4’s inherent advantages align perfectly with the critical demands of the energy transition and electrification trends, securing its position as a cornerstone technology. Competition will intensify, but innovation will focus on system-level optimization and maximizing the unique value proposition of the chemistry.

Common Pitfalls Sourcing LiFePO4 (Lithium Iron Phosphate) Battery Packs: Quality and IP Risks

Sourcing LiFePO4 battery packs offers significant advantages in safety, lifespan, and performance, but the market is rife with potential pitfalls, particularly concerning quality and intellectual property (IP). Navigating these challenges is crucial for ensuring reliability, safety, and legal compliance.

Quality-Related Pitfalls

Underperforming or Inconsistent Cells

One of the most prevalent risks is sourcing cells or packs that fail to meet their advertised specifications. This includes:

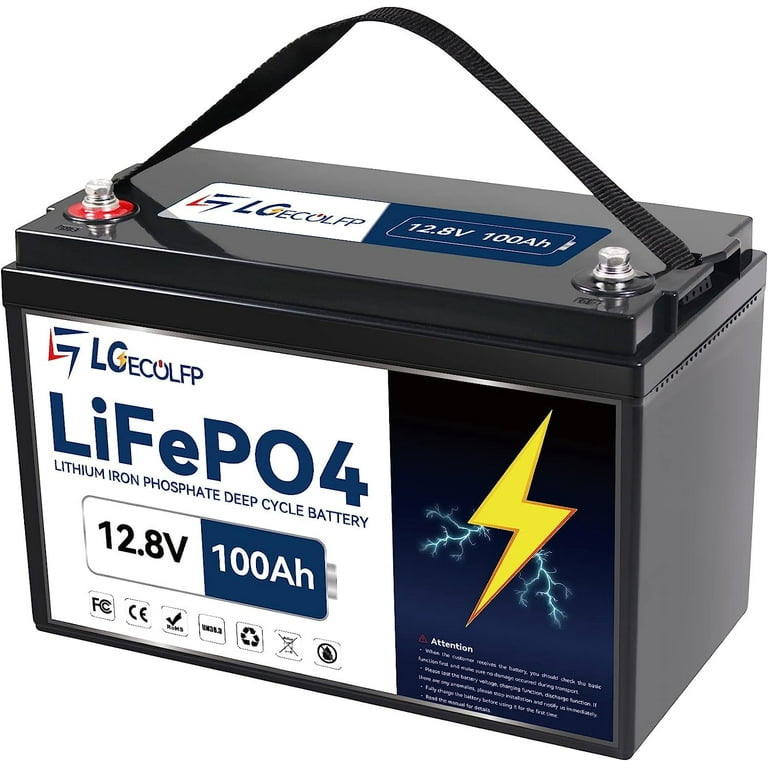

* Capacity Shortfall: Cells may deliver significantly less than the rated capacity (e.g., a claimed 100Ah cell only providing 80Ah), often due to using lower-grade or recycled cells, or inaccurate grading.

* Poor Cycle Life: Packs may degrade rapidly, failing well before the promised 2000+ cycles, indicating the use of substandard cell chemistry or inadequate manufacturing processes.

* Inconsistent Cell Matching: Within a pack, individual cells must be tightly matched in capacity, internal resistance, and voltage. Poor matching leads to imbalanced charging/discharging, reducing overall pack capacity, lifespan, and creating safety hazards.

Substandard Manufacturing and Materials

- Inferior BMS (Battery Management System): A cheap or poorly designed BMS is a major failure point. It may lack essential protections (over-charge, over-discharge, over-current, short-circuit, temperature), have inaccurate state-of-charge (SOC) estimation, or fail to perform proper cell balancing, leading to cell damage and safety risks.

- Poor Welding and Connections: Weak or inconsistent spot welding (especially on cell tabs) or poorly crimped connections create high resistance points. This leads to excessive heat generation, voltage drops, potential hotspots, and connection failures, posing fire risks.

- Inadequate Mechanical Design and Protection: Flimsy casing, insufficient strain relief on cables, or poor shock/vibration resistance can lead to physical damage, internal shorts, or connection issues in real-world applications.

- Use of Recycled or “B-Grade” Cells: Unreliable suppliers may pass off used, damaged, or lower-specification (B-grade) cells as new A-grade cells, drastically compromising performance and safety.

Lack of Safety Certifications and Testing

- Missing or Fake Certifications: Reputable suppliers provide genuine test reports (e.g., UN 38.3 for transport safety, IEC 62133 for safety, CE, UL, etc.). Be wary of suppliers who cannot provide verifiable certificates or whose certificates appear suspicious.

- Insufficient Internal Testing: Reliable manufacturers conduct rigorous internal testing (cycle testing, abuse testing, environmental testing). Suppliers cutting corners often skip these costly steps, resulting in unpredictable real-world performance.

- Poor Thermal Management: Inadequate design for heat dissipation, especially in high-power applications, can lead to thermal runaway, even with the inherently safer LiFePO4 chemistry.

Intellectual Property (IP) Related Pitfalls

Counterfeit and Clone Products

- Direct Counterfeiting: Some suppliers blatantly copy established brand logos, packaging, and documentation, selling inferior products as genuine. This directly infringes on trademarks and potentially design patents.

- Circuit Cloning: The BMS circuit design, a critical component often protected by design patents or copyright, is frequently copied. A cloned BMS may look identical but use lower-quality components or have undetected flaws, compromising safety and performance.

- Firmware Copying: The software running on the BMS (firmware) controlling balancing algorithms, protection logic, and communication protocols may be reverse-engineered and copied, potentially violating copyright.

Design and Technology Infringement

- Patented Cell Formats or Chemistries: While the core LiFePO4 chemistry is widely available, specific cell formats (e.g., certain prismatic or pouch designs), electrode formulations, or manufacturing processes may be protected by patents. Sourcing cells from suppliers using such protected technology without a license risks infringement.

- Proprietary Pack Designs: The mechanical design of the battery pack, its assembly method, or integrated features (like specific mounting systems or communication interfaces) might be patented. Copying these designs infringes on the patent holder’s rights.

- Trade Secrets: Manufacturing processes, quality control procedures, or specific cell grading methods might be trade secrets. Suppliers acquiring this information improperly or through reverse engineering create legal exposure for their customers.

Legal and Reputational Risks

- Supply Chain Liability: Purchasing infringing products can expose the buyer to legal action, especially if they are integrating the packs into their own products and selling them. Liability for contributory infringement is a real concern.

- Product Recalls and Seizures: Customs authorities or market regulators can seize shipments containing counterfeit or infringing goods. Found infringing products in a customer’s final product can lead to costly recalls and brand damage.

- Reputational Damage: Being associated with counterfeit or IP-infringing products, even unknowingly, severely damages a company’s reputation for quality, ethics, and reliability.

Mitigation Strategies

- Thorough Due Diligence: Vet suppliers rigorously. Visit factories if possible, request detailed certifications, and conduct independent third-party testing on samples.

- Demand Transparency: Require clear information on cell manufacturers (e.g., CATL, EVE, CALB, Lishen – not just “A-grade”), BMS specifications (including IC model), and testing protocols.

- Verify Certifications: Independently verify the authenticity of provided safety and quality certificates.

- Prioritize Established Brands and Authorized Distributors: Source directly from well-known cell manufacturers or their authorized partners to minimize IP and quality risks.

- Include IP Warranties in Contracts: Require suppliers to warrant that their products do not infringe on any third-party IP and agree to indemnify the buyer against related claims.

- Conduct IP Searches: For critical components or designs, consider preliminary patent and trademark searches to identify potential infringement risks.

By understanding and actively addressing these common pitfalls in quality and IP, buyers can source LiFePO4 battery packs that are safe, reliable, high-performing, and legally sound.

H2: Logistics & Compliance Guide for LiFePO4 (Lithium Iron Phosphate) Battery Packs

Transporting LiFePO4 (Lithium Iron Phosphate) battery packs, while generally safer than other lithium chemistries, is still heavily regulated due to their classification as dangerous goods. Non-compliance can lead to severe consequences including shipment rejection, fines, delays, accidents, and legal liability. This guide outlines key logistics and compliance requirements.

H2.1 Regulatory Framework & Classification

- Primary Regulation: LiFePO4 batteries are classified as Dangerous Goods under international transport regulations:

- Air: IATA Dangerous Goods Regulations (IATA DGR) – Most stringent.

- Sea: IMDG Code (International Maritime Dangerous Goods).

- Land (International): ADR (Europe), TDG (Canada), 49 CFR (USA – DOT/PHMSA).

- UN Number & Proper Shipping Name:

- UN 3480: “LITHIUM ION BATTERIES” (Applies to LiFePO4 as it is a lithium-ion chemistry).

- UN 3090: “LITHIUM METAL BATTERIES” (Does NOT apply to LiFePO4).

- Packing Group: Typically PG II (Medium Danger).

- Class 9 Hazard: LiFePO4 batteries are Class 9 Miscellaneous Dangerous Goods due to their potential to generate heat, catch fire, or explode under certain conditions (e.g., short circuit, damage, overcharging).

- State of Charge (SOC) Limitation: Critical for air transport.

- IATA: Batteries must not exceed 30% State of Charge when shipped alone (not packed with/in equipment).

- IMDG & Land: While not always mandated at 30%, shipping at lower SOC is strongly recommended for safety and may be required by specific carriers or national regulations. Always verify carrier requirements.

H2.2 Packaging Requirements

Packaging is paramount for safety and compliance. It must prevent short circuits and physical damage.

- Robust Outer Packaging: Use strong, undamaged boxes (e.g., double-wall corrugated cardboard, wood, or plastic) suitable for the weight and mode of transport. Must pass drop and stack tests.

- Internal Protection:

- Individual Protection: Each battery terminal must be protected against short circuit. Methods include:

- Non-conductive caps or tape over terminals.

- Individual plastic bags (e.g., polyethylene).

- Spacing within packaging to prevent contact.

- Immobilization: Batteries must be securely packed to prevent movement within the outer packaging during transit (e.g., using foam, bubble wrap, dividers, void fill).

- Individual Protection: Each battery terminal must be protected against short circuit. Methods include:

- Separation: Avoid contact between batteries and conductive materials (metal, other batteries) within the package. Keep batteries away from metal parts of the outer packaging.

- Packaging Instructions (IATA DGR Specific):

- PI 965: For batteries shipped alone (Section IA, IB, or II based on watt-hour rating and quantity).

- PI 966: For batteries packed with equipment.

- PI 967: For batteries contained in equipment.

- PI 968: For lithium metal batteries (Not applicable to LiFePO4).

- Select the correct PI based on battery configuration (watt-hour rating per cell/pack, total quantity, shipment type).

H2.3 Marking & Labeling

Clear, accurate, and durable markings and labels are mandatory.

- Proper Shipping Name: “LITHIUM ION BATTERIES” (must be clearly visible).

- UN Number: “UN 3480”.

- Class 9 Hazard Label: Diamond-shaped label with “9” and “Class 9” text. Mandatory for all shipments.

- Lithium Battery Handling Label: Mandatory for air transport. Features a flame symbol and text “LITHIUM BATTERIES – FORBIDDEN FOR TRANSPORT ABOARD AIRCRAFT IF DAMAGED OR DEFECTIVE” and “Class 9”. Must be at least 120mm x 110mm.

- Shipper’s Declaration: Required for air transport (and often for sea/land for larger quantities). Must be completed accurately by a certified dangerous goods specialist.

- Addressing: Full shipper and consignee addresses.

- Orientation Arrows: If the battery has a specific orientation requirement (e.g., vent up), mark the package accordingly.

- “Cargo Aircraft Only” Label: May be required for large shipments exceeding certain watt-hour limits per package or for PI 965 Section IA (check regulations).

- Net Quantity: Clearly state the total number of batteries and/or total watt-hours (Wh) if required by the specific PI.

H2.4 Documentation

Accurate documentation is critical for safe and legal transport.

- Dangerous Goods Declaration (Shipper’s Declaration for Dangerous Goods – DGD): Mandatory for air transport. Must be completed, signed, and accompany the shipment. Requires details like UN number, PSN, class, packing group, quantity, packaging type, emergency contact, and certification statement. Must be prepared by a trained and certified person.

- Commercial Invoice & Packing List: Must include clear description (“Lithium Iron Phosphate Battery Pack, UN 3480, Class 9”) and technical details (model, voltage, capacity in Ah or Wh, quantity).

- Material Safety Data Sheet (MSDS/SDS): Often requested by carriers or authorities, providing safety and handling information.

- Test Summary: Increasingly required, especially for larger batteries or new designs. Documents compliance with UN Manual of Tests and Criteria (Part III, Sub-section 38.3 – see H2.5).

- Air Waybill (AWB) / Bill of Lading (BOL): Must clearly state “LITHIUM ION BATTERIES UN 3480” in the “Nature and Quantity of Goods” section. Class 9 must be declared.

H2.5 Safety & Testing Requirements

- UN 38.3 Testing: Mandatory. All LiFePO4 cells and batteries must pass the series of tests outlined in the UN Manual of Tests and Criteria, Part III, Sub-section 38.3. This includes vibration, shock, thermal cycling, altitude simulation, external short circuit, impact/crush, overcharge, and forced discharge tests.

- Manufacturer’s Responsibility: The battery manufacturer must ensure cells/packs pass UN 38.3 and provide a Test Summary upon request. Shippers are responsible for verifying this.

- Short Circuit Prevention: The core design principle during packaging (H2.2).

- Thermal Management: Packaging should not impede the battery’s inherent thermal management, but must protect it from external heat sources.

- Damage/Defects: NEVER ship batteries that are damaged, defective, or recalled. They pose a significantly higher risk. Specific, stricter regulations apply to damaged/defective batteries (often prohibited on passenger aircraft).

H2.6 Carrier & Mode-Specific Considerations

- Air Transport (IATA DGR): Most restrictive.

- Strict SOC limits (≤30% for standalone batteries).

- Mandatory DGD and Lithium Battery Handling Label.

- Quantity limits per package and per aircraft (passenger vs. cargo).

- Passenger aircraft restrictions for large standalone shipments (PI 965 IA).

- Always notify the airline in advance.

- Sea Transport (IMDG Code):

- Generally allows higher SOC than air (often 100% for some configurations, but lower is safer).

- Requires DGD (Dangerous Goods Note – DGN) for larger shipments.

- Specific stowage and segregation requirements on vessels.

- Container ventilation considerations.

- Land Transport (ADR/TDG/49 CFR):

- ADR (Europe): Requires driver training (ADR certificate), specific vehicle markings for larger quantities, placarding, and transport documents.

- TDG (Canada): Similar requirements to ADR, with specific Canadian regulations.

- 49 CFR (USA): Requires training, shipping papers (similar to DGD), placarding for larger quantities, and compliance with DOT regulations. FMCSA regulations apply to drivers/vehicles.

- Carrier Policies: ALWAYS check with your specific carrier (e.g., FedEx, UPS, DHL, Maersk, specific trucking company) for their specific requirements, limitations, and acceptance policies. They can be stricter than the base regulations.

H2.7 Key Responsibilities

- Shipper (Offeror): Bears primary responsibility. Must:

- Correctly classify, package, mark, label, and document the shipment.

- Ensure personnel are trained and certified.

- Provide accurate information to the carrier.

- Verify UN 38.3 compliance.

- Carrier: Must accept shipments only if properly prepared, provide appropriate handling, and ensure their personnel are trained.

- Manufacturer: Must design and build batteries compliant with UN 38.3 and provide necessary safety information.

Critical Reminder: Regulations change frequently. Always consult the latest editions of IATA DGR, IMDG Code, ADR, TDG, or 49 CFR, and your chosen carrier’s specific guidelines immediately before shipping. Utilize trained and certified dangerous goods professionals for preparation and declaration. When in doubt, seek expert advice.

Conclusion: Sourcing LiFePO4 (Lithium Iron Phosphate) Battery Packs

Sourcing LiFePO4 battery packs offers a strategic advantage for applications requiring safe, long-lasting, and thermally stable energy storage solutions. With superior cycle life, enhanced safety due to chemical stability, and a lower environmental impact compared to other lithium-ion chemistries, LiFePO4 technology is increasingly becoming the preferred choice for use in renewable energy systems, electric vehicles, marine applications, and off-grid power solutions.

When sourcing these batteries, it is essential to carefully evaluate suppliers based on quality certifications, cell origins, manufacturing standards (such as ISO and UL certifications), and warranty terms. Prioritizing reputable manufacturers or authorized distributors helps ensure product reliability and performance consistency. Additionally, considering factors such as battery management system (BMS) integration, scalability, and technical support enables optimal system performance and longevity.

In conclusion, while cost remains an important consideration, it should not outweigh quality and safety when selecting LiFePO4 battery packs. A well-informed sourcing strategy—focused on performance, durability, and supplier credibility—will result in a sound investment that delivers sustainable, efficient, and reliable power for years to come.