The global lithium-ion (Li-ion) car battery market is undergoing rapid expansion, driven by the accelerating adoption of electric vehicles (EVs) and increasing investments in clean energy technologies. According to a report by Mordor Intelligence, the Li-ion battery market for automotive applications was valued at USD 45.6 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 18.7% from 2024 to 2029, reaching an estimated USD 129.4 billion. Similarly, Grand View Research forecasts the broader automotive Li-ion battery market to expand at a CAGR of 19.1% over the same period, underpinned by stringent emission regulations, government incentives, and advancements in battery energy density and cost efficiency. As demand surges, a select group of manufacturers are leading the charge in innovation, scale, and strategic partnerships with major automakers. The following list highlights the top 10 lithium-ion car battery manufacturers shaping the future of sustainable transportation.

Top 10 Li-Ion Car Battery Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 ProLogium Technology Co., Ltd

Domain Est. 2014

Website: prologium.com

Key Highlights: ProLogium is a lithium ceramic battery manufacturer that is leading in the commercialization of safer EV batteries with higher energy density and superior ……

#2 The Future of Energy

Domain Est. 2018

Website: im3ny.com

Key Highlights: iM3NY is an independent lithium-ion cell manufacturer that is commercializing cell chemistry developed in the USA….

#3 American Battery Technology Company

Domain Est. 2020

Website: americanbatterytechnology.com

Key Highlights: ABTC is an advanced technology, first-mover lithium-ion battery recycling and primary battery metal extraction company that utilizes internally developed ……

#4 Lithium Pros

Domain Est. 2011

Website: lithiumpros.com

Key Highlights: Free delivery 60-day returnsLithium Pros is a group of enthusiasts who are focused on bringing the highest performance, ultra lightweight lithium-ion batteries to the marine, racin…

#5 Battle Born Batteries

Domain Est. 2016

Website: battlebornbatteries.com

Key Highlights: Free delivery · 30-day returnsShop premium LiFePO4 lithium batteries from Battle Born for unmatched power, reliability, and a 10-year warranty. Get started today!…

#6 Lithion Battery

Domain Est. 2020

Website: lithionbattery.com

Key Highlights: Lithion keeps homes, businesses, and industries running with dependable lithium-ion batteries and energy storage systems for nearly every application….

#7 Automotive Cells Company

Domain Est. 2020

Website: acc-emotion.com

Key Highlights: High performance lithium-ion batteries produced at a price that makes green automotive accessible to everyone. Find out more. Our ambitions. Compared to ……

#8 Ascend Elements

Domain Est. 2021

Website: ascendelements.com

Key Highlights: Ascend Elements manufactures advanced battery materials using valuable elements reclaimed from discarded lithium-ion batteries….

#9 Lithion Technologies

Domain Est. 2022

Website: lithiontechnologies.com

Key Highlights: Lithion Technologies sustainably produces strategic materials from lithium-ion batteries. The future is Lithion. The energy transition relies on lithium-ion ……

#10 QuantumScape

Domain Est. 2010

Website: quantumscape.com

Key Highlights: Next-Generation Mobility QuantumScape’s lithium-metal solid-state batteries will charge faster, go farther, last longer and operate more safely than today’s ……

Expert Sourcing Insights for Li-Ion Car Battery

2026 Market Trends for Li-Ion Car Battery

Global Demand and Market Growth

The lithium-ion (Li-ion) car battery market is projected to experience robust growth by 2026, driven by the accelerating global transition to electric vehicles (EVs). According to industry forecasts, the market is expected to reach over $150 billion by 2026, expanding at a compound annual growth rate (CAGR) of approximately 18–22% from 2021 to 2026. This surge is fueled by increasing government support for electrification, stricter emissions regulations, and declining battery costs.

Major economies including China, the European Union, and the United States are implementing aggressive EV adoption targets. For example, the EU’s “Fit for 55” package aims for a 100% reduction in CO₂ emissions from new cars by 2035, effectively mandating full electrification. These policies are creating sustained demand for high-performance Li-ion batteries.

Technological Advancements and Chemistries

By 2026, advancements in Li-ion battery chemistry are expected to focus on increasing energy density, reducing charging times, and improving safety and longevity. Key trends include:

-

Nickel-Rich Cathodes (NMC 811 and NCA): These chemistries offer higher energy density, enabling longer driving ranges. Automakers are increasingly adopting NMC 811 (80% nickel, 10% manganese, 10% cobalt) to reduce cobalt dependency and lower costs.

-

Lithium Iron Phosphate (LFP) Resurgence: Once considered less powerful, LFP batteries are gaining traction due to their lower cost, enhanced thermal stability, and longer cycle life. Chinese EV manufacturers like BYD and Tesla (for standard-range models) are widely deploying LFP batteries, a trend expected to expand globally by 2026.

-

Solid-State Battery Development: While full commercialization may extend beyond 2026, significant R&D investments are expected to yield hybrid or semi-solid-state prototypes entering niche markets. These promise higher energy density and improved safety, potentially revolutionizing the EV landscape post-2026.

Supply Chain and Raw Material Challenges

The Li-ion battery supply chain will face increasing pressure by 2026 due to surging demand for critical raw materials such as lithium, cobalt, nickel, and graphite.

-

Lithium Supply Constraints: Despite new mining projects in Australia, Chile, and emerging sources in Argentina and Nevada, lithium supply may struggle to keep pace with demand. This could lead to price volatility and intensified competition for resources.

-

Cobalt Reduction Strategies: Ethical and supply concerns around cobalt mining (particularly in the Democratic Republic of Congo) are pushing manufacturers to develop cobalt-free or ultra-low cobalt batteries. LFP and high-nickel NMC chemistries are central to this shift.

-

Recycling and Circular Economy: By 2026, battery recycling is expected to become more economically viable and regulated. The EU’s new battery regulations mandate minimum recycled content in new batteries, spurring investment in closed-loop recycling infrastructure.

Regional Market Dynamics

-

China: Remains the largest EV and Li-ion battery market, home to dominant manufacturers like CATL and BYD. China’s control over battery material processing gives it a strategic advantage, though efforts to diversify supply chains are growing globally.

-

Europe: Local gigafactories from companies like Northvolt, ACC (Stellantis/TotalEnergies), and Samsung SDI are scaling up to meet regional demand and reduce reliance on Asian imports. The EU’s Battery Passport initiative, launching in 2026, will enhance transparency and sustainability tracking.

-

North America: The Inflation Reduction Act (IRA) in the U.S. is reshaping the landscape by incentivizing domestic battery production and requiring local sourcing of materials and components for tax credits. This is accelerating investments from companies like Tesla, LG Energy Solution, and GM.

Cost Trends and Energy Density Improvements

Li-ion battery pack prices are expected to continue declining, reaching an average of $80–$90 per kWh by 2026, down from around $130/kWh in 2023. This cost reduction is driven by economies of scale, manufacturing improvements, and innovations in cell design (e.g., cell-to-pack and cell-to-chassis technologies).

Concurrently, average energy density is projected to increase to over 300 Wh/kg for premium EVs, enabling ranges exceeding 500 miles on a single charge. This will enhance consumer appeal and accelerate mass adoption.

Conclusion

By 2026, the Li-ion car battery market will be defined by rapid growth, technological innovation, and strategic competition over supply chains. While challenges remain in securing raw materials and scaling sustainable practices, the momentum toward electrification is unstoppable. The convergence of policy support, cost reductions, and performance improvements will solidify Li-ion batteries as the dominant power source for electric vehicles in the coming decade.

Common Pitfalls When Sourcing Li-Ion Car Batteries: Quality and Intellectual Property Risks

Sourcing lithium-ion (Li-ion) car batteries presents significant challenges beyond cost and logistics. Two critical pitfalls—quality inconsistencies and intellectual property (IP) infringement—can severely impact product performance, safety, brand reputation, and legal compliance. Understanding and mitigating these risks is essential for OEMs, Tier 1 suppliers, and aftermarket providers.

H2: Quality-Related Pitfalls

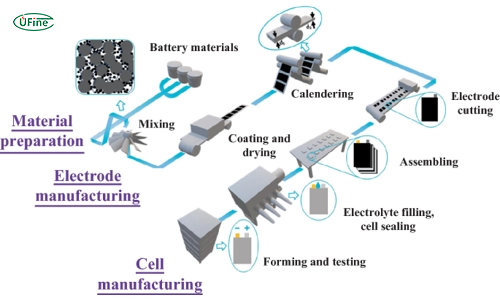

Li-ion batteries are complex electrochemical systems where minor deviations in materials, manufacturing, or assembly can lead to catastrophic failures. Common quality pitfalls include:

Inconsistent Cell Performance and Reliability

Many suppliers, particularly from less-regulated markets, use recycled, regraded, or mixed-grade cells. This inconsistency results in variable capacity, internal resistance, and cycle life across cells within the same battery pack. Unbalanced cells accelerate degradation, reduce usable energy, and increase the risk of thermal runaway.

Poor Manufacturing and Assembly Practices

Substandard welding, inadequate insulation, improper electrolyte filling, and contamination during assembly can compromise safety and longevity. Weak thermal management design or integration further exacerbates risks under high load or extreme temperatures.

Inadequate Testing and Certification

Reputable suppliers conduct extensive testing (e.g., cycle life, thermal shock, overcharge/discharge, crush tests) and comply with international standards (UN 38.3, IEC 62133, GB/T 31485). Sourcing from vendors who skip or falsify testing exposes buyers to non-compliant, dangerous products.

Lack of Traceability and Documentation

Without full cell and pack traceability (batch numbers, material sourcing, production data), identifying failure root causes or managing recalls becomes nearly impossible. This lack of transparency undermines quality assurance and regulatory compliance.

H2: Intellectual Property (IP) Risks

The Li-ion battery sector is highly innovation-driven, with extensive IP protection covering cell chemistry, electrode design, battery management systems (BMS), and manufacturing processes. Sourcing from unverified suppliers increases exposure to IP-related issues.

Use of Counterfeit or Reverse-Engineered Technology

Some suppliers illegally replicate patented technologies—such as NMC or LFP cathode formulations, silicon-anode designs, or proprietary BMS algorithms—without licensing. Purchasing such batteries may expose the buyer to contributory infringement claims, especially in jurisdictions with strict IP enforcement (e.g., the U.S., EU, Japan).

Unlicensed Software and Firmware

Battery Management Systems (BMS) often contain copyrighted firmware and algorithms critical for safety and performance. Unauthorized copying or modification of BMS code can violate software IP rights, leading to legal liability and operational vulnerabilities.

Supply Chain Transparency Gaps

Suppliers may subcontract to third parties without disclosing the actual manufacturers. This opacity makes it difficult to verify whether components are produced under valid IP licenses or whether the supply chain involves infringing entities.

Risk of Seizures and Litigation

Importing batteries that infringe on active patents or trademarks can result in customs seizures, product recalls, injunctions, and lawsuits. High-profile cases (e.g., LG Chem vs. SK Innovation) demonstrate the severe financial and reputational consequences of IP violations.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct thorough supplier audits and request full material disclosures.

– Require independent third-party certifications and test reports.

– Perform incoming quality control and destructive testing.

– Conduct IP due diligence, including patent landscape analysis and supplier licensing verification.

– Include IP indemnification clauses in procurement contracts.

By proactively addressing quality and IP concerns, organizations can ensure safer, more reliable, and legally sound sourcing of Li-ion car batteries.

H2: Logistics & Compliance Guide for Lithium-Ion Car Batteries

Handling, transporting, and storing lithium-ion (Li-ion) car batteries requires strict adherence to international, national, and regional regulations due to their classification as hazardous materials. This guide outlines key logistics and compliance considerations.

H2.1 Classification & Regulatory Framework

Li-ion car batteries are classified as Dangerous Goods under:

* UN Number: UN 3480 (Lithium ion batteries, contained in equipment or packed with equipment) or UN 3171 (for batteries installed in vehicles).

* Class: 9 – Miscellaneous Dangerous Substances and Articles.

* Packing Group: Typically PG II (Medium danger).

* Primary Regulations:

* UN Recommendations on the Transport of Dangerous Goods (UN TDG): The global standard.

* IMDG Code: For international maritime transport.

* IATA DGR: For international air transport (highly restrictive).

* ADR: For road transport in Europe.

* 49 CFR (DOT): For transport within the USA.

* National Regulations: Always check specific country requirements (e.g., ADR in Europe, TDG in Canada).

H2.2 Packaging & Marking Requirements

- Robust Packaging: Must be strong enough to prevent movement, short circuits, and damage. Use UN-certified packaging designed for Class 9 batteries.

- Prevent Short Circuits: Terminals must be protected (e.g., insulated caps, individual containment within non-conductive material, taping). Batteries must be secured to prevent contact with conductive materials.

- State of Charge (SoC): Air transport (IATA DGR) typically requires batteries to be at ≤30% SoC for safety. Road and sea may have different or no specific limits, but lower SoC is always safer. Always confirm carrier and mode-specific rules.

- Marking & Labeling:

- Proper Shipping Name: “LITHIUM ION BATTERIES, CONTAINED IN VEHICLE” or “LITHIUM ION BATTERIES, PACKED WITH VEHICLE” (UN 3480) / “VEHICLE, LITHIUM BATTERY POWERED” (UN 3171).

- UN Number: Clearly displayed (e.g., UN3480).

- Class 9 Hazard Label: Diamond-shaped label (black on white with vertical stripes).

- “Lithium Battery Mark”: Mandatory for packages containing Li-ion batteries (including those in equipment). Must include the UN number, telephone number, and a symbol of a battery.

- Orientation Arrows: If required by packaging design.

- “CARGO AIRCRAFT ONLY” Label: Required for most large Li-ion batteries shipped by air.

- Documentation: A Dangerous Goods Declaration (DGD) is mandatory for all modes, signed by a trained and certified person. Includes sender/recipient details, proper shipping name, UN number, class, packing group, quantity, and emergency contact.

H2.3 Transport Mode Specifics

- Air Transport (IATA DGR):

- Most Restrictive. Generally, Li-ion batteries cannot be shipped as cargo on passenger aircraft if installed in a vehicle or as standalone units above certain capacities.

- Often restricted to Cargo Aircraft Only.

- Strict SoC limits (≤30%).

- Requires prior carrier approval.

- Detailed DGD and special handling instructions are critical.

- Maritime Transport (IMDG Code):

- Generally allows transport, but batteries must be adequately protected and secured.

- Specific stowage and segregation requirements apply (e.g., keep away from heat sources, other hazardous materials).

- Requires DGD and vessel stowage plan.

- Road Transport (ADR in Europe / 49 CFR in USA):

- Most common for car batteries (in vehicles or as spares).

- Requires proper packaging, marking, labeling, and documentation (DGD/Shipper’s Declaration).

- Vehicles carrying large quantities may need orange placards.

- Driver must have ADR/49 CFR training (Dangerous Goods Safety Advisor/Driver Training).

- Rail Transport: Follows RID (Europe) or national regulations, often aligned with ADR/IMDG.

H2.4 Storage & Handling

- Storage Location: Store in a cool, dry, well-ventilated area away from direct sunlight, heat sources, flammable materials, and high traffic areas. Use non-conductive shelving.

- Prevent Damage: Avoid dropping, crushing, or puncturing batteries. Handle with care using appropriate equipment (e.g., battery carts).

- Temperature: Store and transport within manufacturer’s specified temperature range (typically -20°C to +50°C). Avoid extreme cold or heat.

- Fire Risk: Have appropriate fire extinguishers (Class D or specialized Li-ion battery extinguishers) readily available. Water can be used but may not fully extinguish deep-seated thermal runaway.

- Segregation: Store away from incompatible materials (e.g., oxidizers, flammables).

H2.5 Training & Certification

- Mandatory Training: Personnel involved in preparing, offering, handling, or transporting Li-ion batteries must receive regular, mode-specific dangerous goods training (e.g., IATA, IMDG, ADR, 49 CFR).

- Certification: Training must be provided by certified instructors and result in valid certificates (typically valid for 2-3 years).

- Responsibility: The shipper (offerer) bears ultimate responsibility for correct classification, packaging, marking, labeling, documentation, and declaration.

H2.6 End-of-Life & Reverse Logistics

- Damaged/Defective Batteries: Classified as UN 3481 (Lithium ion batteries contained in equipment, damaged or untested) or UN 3536 (Battery-powered vehicle or equipment, damaged or untested). Subject to even stricter regulations (e.g., special packaging, “Damaged/Defective” mark, often “Cargo Aircraft Only” for air). Requires expert assessment.

- Recycling/Disposal: Follow local WEEE (Waste Electrical and Electronic Equipment) and hazardous waste regulations. Use authorized recyclers with specific Li-ion battery handling capabilities. Documentation for disposal is required.

- Return Shipments: Treat returned batteries as dangerous goods. Follow the same classification, packaging, marking, labeling, and documentation rules as for new batteries.

Key Takeaway: Compliance is non-negotiable. Always consult the latest edition of the relevant regulations (IATA DGR, IMDG Code, ADR, 49 CFR) and your freight forwarder/carrier before shipping. Utilize trained dangerous goods experts within your organization or consult a specialist compliance service. Safety and regulatory adherence are paramount.

Conclusion: Sourcing Lithium-Ion Car Batteries

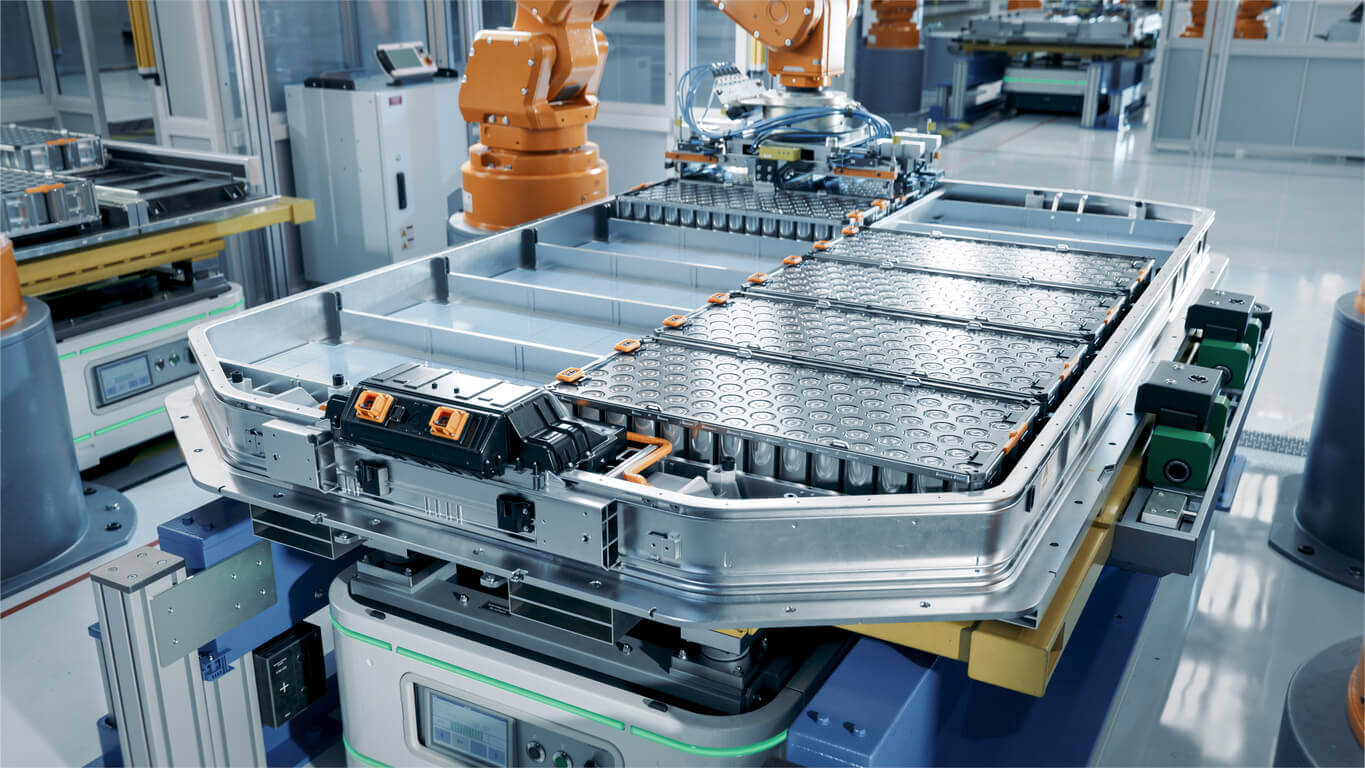

Sourcing lithium-ion (Li-ion) car batteries is a critical component in the development and scaling of electric vehicles (EVs), directly impacting performance, cost, sustainability, and supply chain resilience. As global demand for EVs continues to rise, securing a reliable, ethical, and efficient supply of Li-ion batteries has become a strategic priority for automakers and energy companies alike.

Key considerations in sourcing include ensuring access to raw materials such as lithium, cobalt, nickel, and graphite—many of which are geographically concentrated and subject to market volatility. Diversifying supply chains, investing in recycling technologies, and forming strategic partnerships with mining companies and battery manufacturers can mitigate risks related to supply disruption and price fluctuations.

Additionally, sustainability and ethical sourcing are increasingly important. The environmental impact of mining and the labor practices in certain regions necessitate transparent and responsible supply chains. Certifications and traceability initiatives are emerging to support due diligence and consumer confidence.

Vertical integration, regional manufacturing (e.g., through gigafactories in North America and Europe), and advancements in battery chemistry (e.g., solid-state or cobalt-free batteries) present opportunities to reduce dependency on critical materials and lower production costs.

In conclusion, successful sourcing of Li-ion car batteries requires a holistic approach—balancing cost-efficiency, technological innovation, environmental responsibility, and geopolitical awareness. Companies that proactively address these challenges will be better positioned to lead in the rapidly evolving electric mobility landscape.