The global LED display market is experiencing robust expansion, driven by rising demand across consumer electronics, automotive, and industrial applications. According to Grand View Research, the market was valued at USD 9.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 10.7% from 2023 to 2030. A key contributor to this growth is the increasing adoption of LED tabs—essential components in backlights for LCDs and flexible circuitry—which are seeing heightened demand due to their efficiency, compact size, and reliability. Mordor Intelligence further supports this outlook, forecasting continued momentum in the LED sector, particularly in Asia-Pacific, where consumer electronics manufacturing and smart device penetration are surging. As production scales and innovation accelerates, a select group of manufacturers has emerged at the forefront of LED tab technology, combining precision engineering with cost-effective solutions to meet evolving industry standards. Here, we identify the top 10 LED tab manufacturers shaping this growing market.

Top 10 Led Tab Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

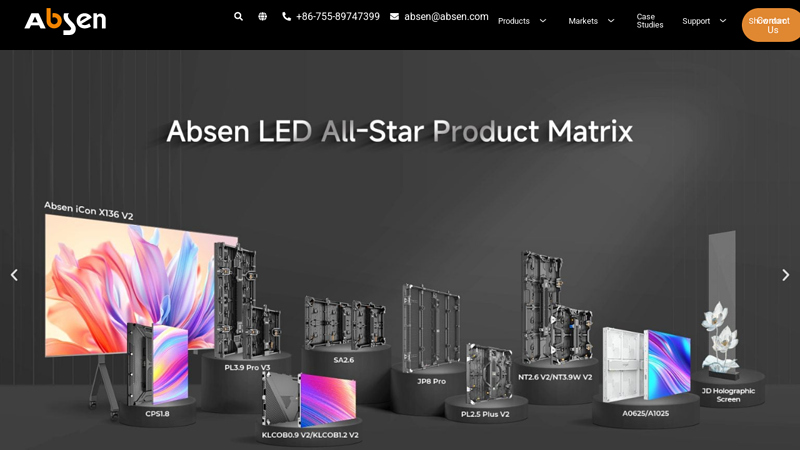

#1 Absen

Domain Est. 2003

Website: absen.com

Key Highlights: Absen is the world’s leading LED display products and service supplier. Absen’s products are exported to more than 140 countries and regions in America, ……

#2 LED chip

Domain Est. 2004

Website: semileds.com

Key Highlights: SemiLEDs is a manufacturer of ultra-high brightness LED chips with state of the art fabrication facilities in Hsinchu Science Park, Taiwan….

#3 INFiLED

Domain Est. 2009

Website: infiled.com

Key Highlights: INFiLED designs and manufactures world-leading LED displays for events, advertising, broadcast and more….

#4 Lectrotab Trim Tab Systems

Domain Est. 1996

Website: lectrotab.com

Key Highlights: Lectrotab designs and manufactures premium quality electromechanical trim tab systems for the leisure and commercial marine markets….

#5 Signify, leader in lighting

Domain Est. 1996

Website: signify.com

Key Highlights: Signify is the world leader in connected LED lighting systems, software and services. Our global brands include Philips, Interact, Color Kinetics, Dynalite….

#6 Aputure: LED Lighting for Film and Video

Domain Est. 2007

Website: aputure.com

Key Highlights: Aputure is a global leader in cutting-edge LED cinema lighting and software control solutions….

#7 TAB

Domain Est. 2012

#8 Huion Kamvas Drawing Tablet with Screen

Domain Est. 2012

Website: store.huion.com

Key Highlights: Free delivery 7-day returnsDiscover the perfect Huion Kamvas drawing tablet with screen at the official store, catering to both beginners and professional artists….

#9 Pen Tablet Medium

Domain Est. 2019

#10 Tripltek

Domain Est. 2020

Website: tripltek.com

Key Highlights: Designed in USA. Engineered and designed in the United States with rigorous quality control and manufacturing standards….

Expert Sourcing Insights for Led Tab

2026 Market Trends for LED Tapes: A H2 Analysis

As we approach 2026, the LED tape (or LED strip) market is poised for significant evolution, driven by technological innovation, shifting consumer demands, and broader sustainability goals. Here’s a breakdown of key trends expected to shape the market, analyzed through the lens of major drivers (H2 – Hydrogen, often used as a metaphor for “drivers” or “fuel” in trend analysis, though in this context interpreted as key catalysts or growth engines):

1. H2: Hyper-Efficiency & Performance (The “Hydrogen” of Energy Density)

- Trend: Continued push for higher luminous efficacy (lumens per watt) and longer lifespans. 2026 will likely see widespread adoption of advanced chip-on-board (COB) and high-density (HD) SMD (e.g., 5050, 7070) technologies, offering brighter, more uniform light with lower power consumption.

- Impact: Drives adoption in energy-sensitive applications (commercial, industrial, large-scale architectural lighting) and reduces total cost of ownership. Enables thinner, more flexible designs for intricate applications. Competition will focus intensely on efficiency benchmarks.

2. H2: Human-Centric & Health-Integrated Lighting (The “Hydrogen” of Biological Impact)

- Trend: Integration of tunable white and full-color spectrum (RGBIC, RGBWW) LED tapes designed to mimic natural daylight cycles. Focus on circadian rhythm support, improved well-being, and enhanced productivity in homes, offices, healthcare, and education.

- Impact: Moves LED tape beyond simple illumination to a wellness tool. Increased demand for smart controls (app, voice, sensors) to automate dynamic lighting scenes. Requires deeper collaboration with health and design experts.

3. H2: Hyper-Connectivity & Smart Integration (The “Hydrogen” of Data Flow)

- Trend: Seamless integration into broader IoT ecosystems. LED tapes will act as nodes in smart homes/buildings, communicating with HVAC, security, and entertainment systems via standards like Matter, Thread, and Wi-Fi 6E/7.

- Impact: Enables complex automation (e.g., “wake-up” lighting sequences, occupancy-based dimming, mood lighting synced to music). Drives demand for standardized, secure, and interoperable control protocols. Data from occupancy/motion sensors within strips will become valuable.

4. H2: Hyper-Personalization & Aesthetic Innovation (The “Hydrogen” of Creative Expression)

- Trend: Explosion of customizable form factors, colors, and effects. Expect ultra-thin, bendable, even stretchable tapes; improved IP ratings for diverse environments; and innovative diffusers for unique beam angles and visual effects (e.g., glitter, pixel-mapping).

- Impact: Fuels growth in consumer DIY, high-end retail, hospitality, and automotive interior lighting. Demand for easy-to-install, cuttable, and reconfigurable solutions will surge. Focus on aesthetics as a primary selling point.

5. H2: Hyper-Sustainability & Circularity (The “Hydrogen” of Green Energy Transition)

- Trend: Intensified focus on eco-design: lead-free solder, reduced rare earth elements, recyclable materials (aluminum, copper), and modular designs for easier repair/recycling. Transparency in supply chains and carbon footprint labeling will become crucial.

- Impact: Driven by regulations (e.g., EU Ecodesign, extended producer responsibility) and consumer demand. Manufacturers investing in circular economy models (take-back programs, refurbishment) will gain competitive advantage. Compatibility with renewable energy sources (solar, battery storage) increases.

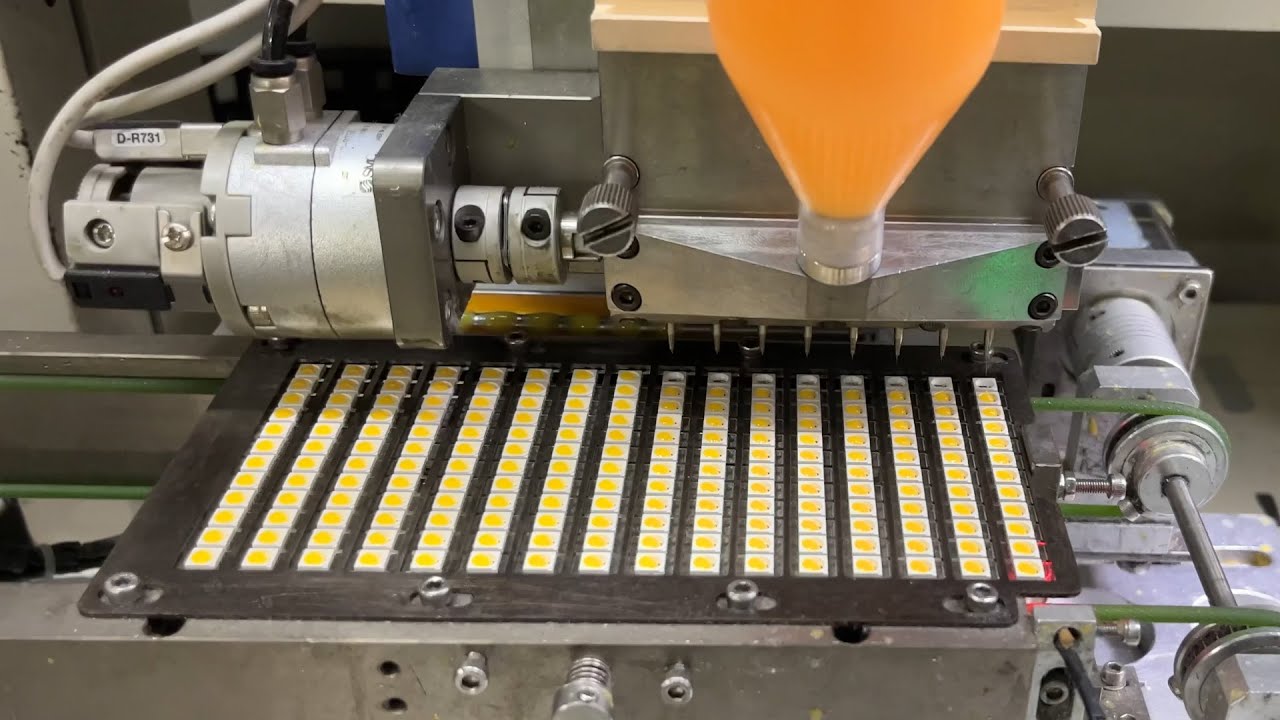

6. H2: Hyper-Industrialization & Automation (The “Hydrogen” of Manufacturing Scale)

- Trend: Automation in manufacturing (robotics, AI-driven quality control) will lower costs and improve consistency, especially for high-volume segments. Roll-to-roll production methods may mature further.

- Impact: Increases accessibility for price-sensitive markets and large-scale projects. Enables faster innovation cycles but may pressure smaller manufacturers. Focus shifts to differentiation through design, software, and service.

Conclusion:

By 2026, the LED tape market will be fueled not just by basic illumination needs, but by the powerful “H2” drivers of Hyper-Efficiency, Human-Centricity, Hyper-Connectivity, Hyper-Personalization, Hyper-Sustainability, and Hyper-Industrialization. Success will depend on manufacturers’ ability to innovate across these dimensions, offering integrated solutions that deliver value beyond light – enhancing well-being, enabling smart environments, expressing individuality, and contributing to a sustainable future. The market will become increasingly segmented, with distinct product and strategy requirements for consumer, commercial, industrial, and specialized applications.

Common Pitfalls When Sourcing LED TABs: Quality and Intellectual Property Risks

Sourcing LED TABs (Tape Automated Bonding) for advanced display or lighting applications presents several critical challenges, particularly concerning quality consistency and intellectual property (IP) protection. Overlooking these aspects can lead to production delays, product failures, or legal complications.

Quality-Related Pitfalls

Inconsistent Material Specifications

One of the most frequent issues is variability in substrate materials, copper thickness, and adhesive quality. Suppliers may claim compliance with specifications but deliver subpar materials that affect thermal performance, electrical conductivity, or long-term reliability. Without rigorous incoming inspection and material certification, this can result in high field failure rates.

Poor Bonding and Alignment Accuracy

LED TABs require micron-level precision in pad placement and bond integrity. Low-tier manufacturers may lack the advanced photolithography or inspection equipment needed, leading to misalignment, short circuits, or weak bonds that degrade under thermal cycling. Always verify supplier capabilities with sample testing and process audits.

Insufficient Environmental and Reliability Testing

Many suppliers skip or inadequately perform essential tests such as thermal shock, humidity resistance, and high-temperature storage. This increases the risk of premature LED failure in real-world conditions. Ensure suppliers provide full reliability test reports (e.g., JEDEC standards) before scaling production.

Intellectual Property-Related Pitfalls

Unlicensed or Infringing Designs

Some suppliers may offer LED TABs that replicate patented designs or layouts without authorization. Sourcing from such vendors exposes your company to IP infringement claims, especially when entering regulated markets like the U.S. or EU. Always require IP indemnification clauses in contracts and verify design originality.

Lack of Design Ownership and Documentation

Ambiguity around who owns the TAB design files—especially custom layouts—can cause disputes. Suppliers might retain design rights or reuse your specifications for other clients. Ensure contracts clearly state that design IP developed for your project belongs to your company and is not shared.

Reverse Engineering Risks

When working with offshore manufacturers, there’s a risk that your TAB design could be reverse-engineered and sold to competitors. Implement strict NDAs, limit access to sensitive data, and consider splitting manufacturing steps across trusted partners to reduce exposure.

By proactively addressing these quality and IP pitfalls, businesses can secure reliable LED TAB supply chains while protecting innovation and brand integrity.

Logistics & Compliance Guide for LED T8 Tubes

Product Overview and Specifications

LED T8 tubes are energy-efficient lighting solutions designed to replace traditional fluorescent tubes. They operate on direct current (DC) and typically require compatibility with electronic ballasts or direct-wire installation (ballast bypass). Key specifications include voltage range (e.g., 100–277V AC), lumen output, color temperature (e.g., 3000K–5000K), and lifespan (typically 50,000 hours). Ensure product datasheets are available and accurate for compliance and shipping documentation.

Regulatory Compliance Requirements

LED T8 tubes must comply with regional and international regulations. Key standards include:

– UL 1598 / UL 8750 (North America): Safety standards for luminaires and LED equipment.

– Energy Star (if applicable): Efficiency and performance certification.

– RoHS (EU): Restriction of Hazardous Substances — limits lead, mercury, cadmium, etc.

– CE Marking: Required for sale in the European Economic Area, indicating conformity with health, safety, and environmental standards.

– REACH: Registration, Evaluation, Authorization, and Restriction of Chemicals (EU).

– FCC Part 15 (USA): Electromagnetic interference compliance.

Ensure all certifications are current and documentation is readily available for customs and audits.

Packaging and Labeling Standards

Proper packaging protects LED tubes during shipping and ensures regulatory compliance:

– Use anti-static, crush-resistant packaging with individual tube separators.

– Label each package with product name, model number, voltage, wattage, and safety warnings.

– Include compliance marks (e.g., CE, UL, RoHS) on the product and packaging.

– Provide multilingual labeling if shipping internationally.

– Add fragile and orientation indicators (e.g., “This Side Up”) to prevent damage.

Shipping and Transportation Guidelines

- Mode of Transport: LED T8 tubes can be shipped via air, sea, or ground. Air freight is preferred for urgency; sea freight for bulk shipments.

- Hazard Classification: LED tubes are generally non-hazardous but may contain electronic components regulated under certain conditions. Confirm with IATA/IMDG as needed.

- Temperature and Humidity: Store and transport in dry, temperature-controlled environments (typically 0°C to 40°C). Avoid condensation.

- Stacking and Handling: Do not exceed maximum stack height; use pallets with secure strapping. Avoid dropping or impact.

Import/Export Documentation

Ensure all shipments include:

– Commercial invoice with detailed product description, HS code (e.g., 8539.50 for discharge lamps), quantity, value, and country of origin.

– Packing list with weight, dimensions, and item breakdown.

– Certificate of Compliance or Conformity (e.g., DoC for CE).

– Bill of Lading or Air Waybill.

– Import permits or energy efficiency declarations if required by destination country (e.g., MEPS in Australia, NOM in Mexico).

Customs Clearance and Duties

- Accurately classify products using the Harmonized System (HS) code to determine applicable tariffs.

- Be aware of duty exemptions for energy-efficient products in certain regions (e.g., GSP benefits).

- Prepare for possible customs inspections; have technical specifications and test reports available.

- Use a licensed customs broker for complex markets to ensure smooth clearance.

Warranty, Returns, and End-of-Life Management

- Provide clear warranty terms (typically 3–5 years) and return procedures.

- Establish a reverse logistics process for defective units, including return authorization (RMA) and inspection.

- Comply with WEEE (Waste Electrical and Electronic Equipment) Directive in the EU: offer take-back or recycling options.

- Partner with certified e-waste recyclers to manage end-of-life products responsibly.

Supplier and Quality Assurance

- Audit suppliers regularly to ensure consistent product quality and compliance.

- Require test reports (e.g., LM-79, LM-80, TM-21) for photometric and lifetime claims.

- Implement incoming inspection procedures for batch sampling and safety checks.

- Maintain traceability through lot numbering and supply chain documentation.

Risk Mitigation and Contingency Planning

- Diversify logistics providers to avoid disruptions.

- Keep safety stock in key distribution hubs.

- Monitor regulatory changes in target markets (e.g., updated energy efficiency standards).

- Maintain product liability insurance covering defects, recalls, or non-compliance issues.

Training and Documentation Control

- Train logistics and compliance staff on updated regulations, packaging standards, and documentation requirements.

- Maintain a centralized document management system for certificates, test reports, and shipping records.

- Conduct periodic internal audits to verify compliance with this guide.

Conclusion for Sourcing LED Tapes:

Sourcing LED tapes requires a strategic approach that balances quality, cost, performance, and supplier reliability. After evaluating various suppliers, product specifications, and market options, it is clear that selecting the right LED tape involves careful consideration of key factors such as luminous efficacy, color rendering index (CRI), color temperature, longevity, flexibility, and compliance with safety and environmental standards (e.g., RoHS, UL, CE).

Partnering with reputable suppliers who offer consistent product quality, technical support, and scalability is essential for long-term success. Additionally, bulk purchasing and long-term agreements can yield cost savings without compromising on performance. It is also important to conduct sample testing and on-site audits when possible to ensure product reliability and compliance.

In conclusion, a well-informed sourcing strategy for LED tapes—rooted in thorough due diligence, clear technical requirements, and strong supplier relationships—will ensure optimal lighting solutions that meet both performance expectations and budget constraints, while supporting sustainability and innovation goals.