The global LED lighting market is experiencing robust growth, driven by increasing demand for energy-efficient lighting solutions across residential, commercial, and industrial sectors. According to Mordor Intelligence, the LED lighting market was valued at USD 75.78 billion in 2023 and is projected to reach USD 112.34 billion by 2028, growing at a CAGR of 8.27% during the forecast period. This expansion is further supported by government initiatives promoting energy conservation, advancements in solid-state lighting technology, and declining LED production costs. Within this dynamic landscape, LED light piping—also known as light guides or light tubes—has emerged as a critical component for uniform illumination in displays, signage, and architectural lighting. With applications spanning automotive, electronics, and smart infrastructure, the demand for high-quality light piping solutions is rising in tandem. As market competition intensifies, identifying leading manufacturers with technological innovation, superior optical performance, and scalable production becomes essential for OEMs and procurement professionals alike. Here’s a data-driven look at the top 10 LED light piping manufacturers shaping the future of efficient lighting design.

Top 10 Led Light Piping Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

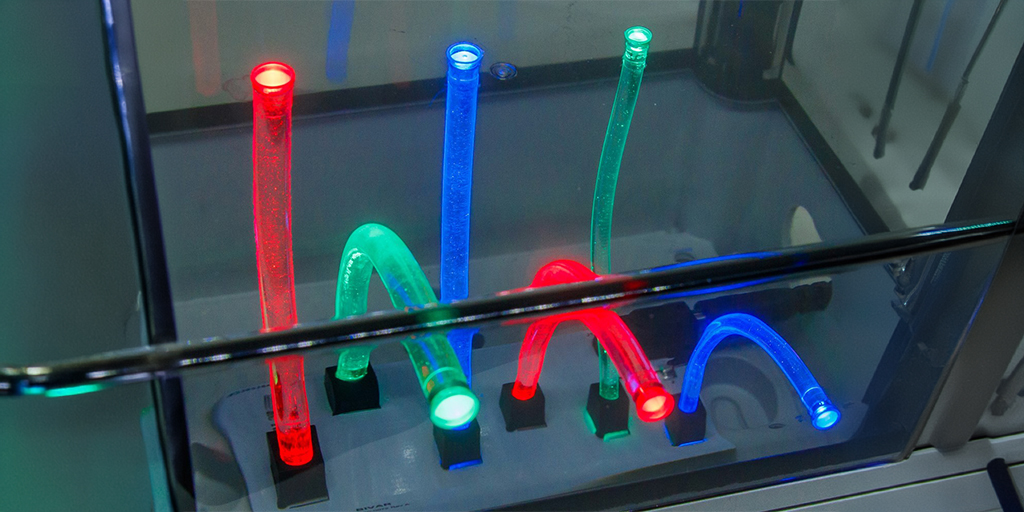

#1 Bivar I Light Pipes and LED Indication

Domain Est. 1995

Website: bivar.com

Key Highlights: Bivar is an Electronics Manufacturer with a specialized engineering approach using light pipes in LED Indication and Illumination….

#2 Products LED

Domain Est. 1995

Website: lumex.com

Key Highlights: LED. LED. Lumex Inc. Our Products · LED · LCD · Switch · ezDisplay · Information · Engineering Solutions · Industries · Resources · Our Company · News · Support….

#3 HDPE Pipe Solutions

Domain Est. 1995

Website: isco-pipe.com

Key Highlights: ISCO is the leading HDPE pipe & fusion equipment supplier in North America, providing expert solutions for municipal, industrial & oil/gas HDPE piping ……

#4 Lumileds LED Lighting

Domain Est. 1998

Website: lumileds.com

Key Highlights: Lumileds is a global leader in led lighting and OEM lighting solutions employing more than 7000 team members operating in over 30 countries….

#5 Orion Energy Systems: Commercial & Industrial Energy

Domain Est. 1999

Website: orionlighting.com

Key Highlights: Orion Energy Systems provides energy-saving LED lighting solutions with an emphasis on sustainability for commercial and industrial lighting needs….

#6 Southwire

Domain Est. 1994

Website: southwire.com

Key Highlights: Choose Southwire for your wire and cable needs – we offer high-performance products that are built to last….

#7 VCC – HMI Components

Domain Est. 1996

Website: vcclite.com

Key Highlights: VCC manufactures the world’s largest ranges of illuminated HMI products. LED indicators, LED light Pipes, Custom Light pipes, & Custom Solutions. Learn More….

#8 LED Light Pipe

Domain Est. 2012

Website: essentracomponents.com

Key Highlights: Vertical Light Pipes are a type of LED Light Pipe that act as a conduit to transport light from an LED to another location, while minimizing the loss of light….

#9 Pipe Lighting

Domain Est. 2020

Website: pipelighting.com

Key Highlights: Pipe Lighting – innovative inflatable LED lighting solutions for the film, TV, and photo industries. · Designed and built by filmmakers, for filmmakers. · Pipes….

#10 LED & LCD Light Pipes

Domain Est. 2021

Website: jamcorcorp.com

Key Highlights: Welcome to SJS Products, a Jamcor Corporation, the leading provider of innovative LED LCD light pipes, light guides, and optical light conduits….

Expert Sourcing Insights for Led Light Piping

H2: Projected 2026 Market Trends for LED Light Piping

The global LED light piping market is poised for significant transformation by 2026, driven by advancements in optical technologies, rising demand for energy-efficient lighting, and expanding applications across industries. Below is an in-depth analysis of key market trends expected to shape the LED light piping sector in 2026:

1. Surge in Architectural and Interior Design Adoption

LED light piping—also known as light guides or light tubes—is gaining momentum in architectural and interior design due to its sleek, customizable illumination capabilities. By 2026, increased integration into residential, commercial, and hospitality spaces is anticipated, especially in smart buildings where aesthetic appeal meets functionality. Designers are leveraging light piping for cove lighting, signage, and ambient installations, fueling market expansion.

2. Advancements in Material and Optical Efficiency

Innovation in polymer-based optical materials (e.g., PMMA and polycarbonate) is enhancing light transmission efficiency and durability. By 2026, manufacturers are expected to offer high-clarity, UV-resistant light pipes with minimized light loss over longer distances. These improvements will broaden application potential in harsh environments such as outdoor installations and industrial settings.

3. Integration with Smart Lighting and IoT Systems

The convergence of LED light piping with smart lighting ecosystems is a dominant trend. By 2026, light pipes will increasingly be paired with sensors, controls, and IoT platforms, enabling dynamic lighting effects, occupancy-based illumination, and color tuning. This integration supports energy savings and enhances user experience in smart homes and intelligent infrastructure.

4. Growth in Automotive and Transportation Applications

The automotive sector is emerging as a key growth driver. LED light piping is being utilized for interior ambient lighting, dashboard indicators, and exterior design elements (e.g., illuminated grilles and taillights). With the rise of electric vehicles (EVs) and human-machine interface (HMI) innovation, demand for customizable, low-power lighting solutions will escalate through 2026.

5. Sustainability and Energy Efficiency Regulations

Stringent global energy efficiency standards and green building certifications (e.g., LEED, BREEAM) are pushing adoption of low-energy lighting solutions. LED light piping, which consumes minimal power and lasts longer than traditional lighting, aligns with these sustainability goals. Regulatory tailwinds will support market penetration, particularly in Europe and North America.

6. Regional Market Expansion

While North America and Europe lead in technology adoption, the Asia-Pacific region—especially China, India, and South Korea—is expected to witness the fastest growth by 2026. Rapid urbanization, infrastructure development, and government initiatives promoting LED use will drive regional demand. Local manufacturing and cost-effective production will further accelerate market accessibility.

7. Customization and Miniaturization Trends

As consumer and industrial demands for tailored lighting increase, manufacturers are focusing on customizable shapes, colors, and form factors. Miniaturized light pipes for compact electronics, medical devices, and wearable tech are gaining traction. This trend will bolster niche applications and open new revenue streams.

Conclusion

By 2026, the LED light piping market will be shaped by innovation, sustainability, and digital integration. With expanding use cases across design, automotive, and smart environments, the market is projected to experience robust growth, supported by technological advancements and favorable regulatory landscapes. Companies investing in R&D, eco-friendly materials, and smart system compatibility will be well-positioned to lead in this evolving sector.

Common Pitfalls When Sourcing LED Light Piping (Quality and IP)

Sourcing LED light piping—also known as light guides or light pipes—can present several challenges, particularly concerning product quality and intellectual property (IP) protection. Being aware of these pitfalls helps ensure reliability, compliance, and long-term success in your supply chain.

Quality-Related Pitfalls

Inconsistent Optical Performance

One of the most frequent issues is inconsistent light transmission, brightness, or color uniformity across batches. Lower-quality piping may use impure or poorly formulated materials, leading to light loss, yellowing over time, or uneven illumination. Always specify optical clarity, refractive index, and transmission efficiency in your technical requirements and request sample testing.

Substandard Material Durability

Cheaply sourced light pipes often use inferior plastics that degrade under UV exposure, heat, or mechanical stress. This can result in brittleness, cracking, or reduced lifespan—especially in outdoor or high-temperature environments. Verify that the material meets environmental ratings (e.g., UV resistance, thermal stability) and request aging or stress test reports.

Poor Manufacturing Tolerances

Precision is critical in light piping; even minor dimensional inaccuracies can affect coupling efficiency with LEDs or cause light leakage. Suppliers with inadequate tooling or quality control may deliver parts with inconsistent diameters, lengths, or surface finishes. Insist on dimensional inspection reports and use first-article inspections (FAI) before full production.

Lack of IP65/IP67 Certification Compliance

Many applications require LED light piping to be part of an IP-rated (Ingress Protection) assembly. A common mistake is assuming the piping itself provides the seal. In reality, the overall design—including housing, gaskets, and installation—determines the IP rating. Ensure the supplier understands the full system context and can support integration into IP65/IP67-rated fixtures.

Intellectual Property (IP) Pitfalls

Unauthorized Design Copying

Custom-designed light pipes are vulnerable to reverse engineering, especially when sourced from regions with weaker IP enforcement. Suppliers may replicate your design for other clients or sell it independently. To mitigate this risk, use strong NDAs, register design patents where applicable, and limit technical disclosure to only what’s necessary.

Unclear Ownership of Tooling and Molds

Molds for injection-molded light pipes represent significant investment. A common pitfall is not securing legal ownership or exclusive usage rights to these molds. Always clarify in contracts whether you own the tooling, have exclusive rights, or are sharing it—this affects cost, control, and scalability.

Insufficient Legal Protections in Contracts

Generic supply agreements may lack specific clauses on IP ownership, confidentiality, and infringement liability. Ensure your contracts explicitly state that all custom designs, modifications, and tooling developed for your project are your sole property and that the supplier cannot use them for third parties.

Risk of Component-Level IP Infringement

Some LED light pipe designs incorporate patented optical technologies (e.g., micro-prismatic structures, gradient diffusion). Sourcing from suppliers who use such features without licensing can expose your company to infringement claims. Conduct due diligence on the supplier’s design sources and request IP warranties.

By proactively addressing these quality and IP pitfalls, buyers can secure reliable, high-performance LED light piping while protecting their innovations and reducing long-term risks.

Logistics & Compliance Guide for LED Light Piping

Product Overview and Classification

LED light piping, also known as light guides or light pipes, refers to transparent or semi-transparent components designed to transmit and distribute light from LED sources in applications such as automotive lighting, consumer electronics, architectural features, and industrial equipment. These components are typically made from plastics like PMMA (acrylic), polycarbonate, or optical-grade resins. Understanding the product composition and intended use is critical for determining correct logistics handling and compliance requirements.

International Shipping and Classification

When shipping LED light piping internationally, accurate classification under the Harmonized System (HS) is essential. While the final classification depends on specific design and application, common HS codes include:

- 3926.30: Other articles of plastics, for optical or photographic purposes (may apply to raw optical guides).

- 9001.10: Optical fibers and optical fiber bundles.

- 8539.50: Parts of electric filament or discharge lamps, including LED lamps.

- 8543.70: Electrical machines and apparatus having individual functions, not specified elsewhere (for integrated LED piping systems).

Consult a customs expert to confirm the correct HS code based on material, function, and end use. Misclassification can result in delays, fines, or shipment rejection.

Packaging and Handling Requirements

LED light piping is often sensitive to scratches, static, and physical damage. Proper packaging ensures product integrity during transit:

- Use anti-static packaging materials if the components are used in electronics.

- Wrap individual pieces in protective film or foam inserts.

- Use rigid outer cartons with sufficient cushioning to prevent movement.

- Clearly label packages with “Fragile,” “This Side Up,” and “Protect from Moisture” as needed.

- Avoid extreme temperature exposure during storage and transport, especially for optical-grade plastics.

Regulatory Compliance (Regional)

European Union (EU)

- REACH (EC 1907/2006): Ensure that all plastic materials comply with restrictions on SVHCs (Substances of Very High Concern). Provide a Declaration of Conformity if required.

- RoHS (2011/65/EU): If the light piping is part of an electronic assembly, confirm that any accompanying electrical components comply with restrictions on hazardous substances (lead, cadmium, etc.).

- WEEE (2012/19/EU): Applicable if the product is part of electrical/electronic equipment; producers may need to register and contribute to recycling schemes.

United States

- TSCA (Toxic Substances Control Act): Verify that plastic materials are compliant with EPA regulations on chemical substances.

- CPSC Guidelines: While not always directly applicable, ensure materials meet flammability and safety standards if used in consumer products.

- Customs-Trade Partnership Against Terrorism (C-TPAT): Recommended for importers to ensure secure supply chain practices.

China

- China RoHS (Management Methods for the Restriction of Pollution by Electronic Information Products): Applicable if the light piping is integrated into electronic devices.

- CCC Mark: Not typically required for passive optical components unless part of a certified end product.

Other Markets

- Canada: Comply with RoHS-like regulations under the Canadian Environmental Protection Act (CEPA).

- Japan: Follow JIS standards for optical materials and ensure compliance with J-MOSS (Japan RoHS).

- UK: Post-Brexit, UKCA marking may be required for certain integrated systems; UK REACH applies.

Import/Export Documentation

Ensure all shipments are accompanied by accurate documentation, including:

– Commercial Invoice (with detailed product description, value, and HS code)

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin (especially for preferential trade agreements)

– Material Safety Data Sheet (MSDS/SDS), if requested

– Compliance Declarations (RoHS, REACH, etc.)

Transportation Modes and Considerations

- Air Freight: Preferred for high-value or time-sensitive shipments; subject to IATA regulations for plastics and electronic components.

- Ocean Freight: Cost-effective for bulk shipments; protect from humidity and condensation using desiccants and moisture barriers.

- Ground Transport: Use climate-controlled trucks if transporting through extreme environments.

Storage and Warehousing

- Store in a dry, temperature-controlled environment (typically 15–25°C, 40–60% RH).

- Keep away from direct sunlight to prevent UV degradation.

- Stack packages properly to avoid pressure damage.

- Implement FIFO (First In, First Out) inventory practices.

End-of-Life and Sustainability

- Design for recyclability where possible, using mono-material construction.

- Provide customers with guidance on proper disposal or recycling.

- Participate in take-back programs if required by regional legislation (e.g., WEEE in EU).

Summary and Best Practices

To ensure smooth logistics and compliance for LED light piping:

– Confirm accurate HS classification before shipping.

– Use protective, anti-static packaging.

– Maintain up-to-date compliance documentation for target markets.

– Monitor regulatory changes in key regions.

– Partner with experienced freight forwarders and customs brokers familiar with optical and electronic components.

By proactively addressing logistics and compliance, manufacturers and distributors can minimize delays, reduce risk, and ensure market access for LED light piping products globally.

Conclusion for Sourcing LED Light Piping

Sourcing LED light piping involves a comprehensive evaluation of product quality, technical specifications, supplier reliability, cost-efficiency, and long-term performance. As an energy-efficient and versatile lighting solution, LED light piping is increasingly in demand across architectural, commercial, and decorative applications. To ensure optimal results, it is essential to partner with reputable suppliers who offer durable materials—such as high-grade PMMA or optical-grade polymers—consistent light transmission, and compliance with international safety and environmental standards.

Additionally, considerations such as customization options, lead times, certifications (e.g., CE, RoHS), and after-sales support play a crucial role in the sourcing decision. Conducting thorough due diligence, requesting samples, and comparing multiple vendors can significantly reduce risks and enhance the value of procurement. Ultimately, strategic sourcing of LED light piping not only ensures superior illumination and design flexibility but also contributes to long-term energy savings and sustainability goals.