The global lecithin market is experiencing robust growth, driven by rising demand in the food & beverage, pharmaceutical, and nutraceutical industries. According to a 2023 report by Mordor Intelligence, the market was valued at USD 3.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.8% from 2024 to 2029. This expansion is fueled by increasing consumer preference for natural emulsifiers and clean-label ingredients, with soy and sunflower lecithin leading in application across health supplements and processed foods. As demand intensifies, innovation in extraction technologies and sustainable sourcing practices has become a key differentiator among manufacturers. In this evolving landscape, seven leading companies have emerged at the forefront—combining scale, R&D investment, and global distribution to meet escalating industry needs. The following overview highlights these top lecithin oil manufacturers shaping the market’s future.

Top 7 Lecithin Oil Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Canola Lecithin

Domain Est. 1994

Website: cargill.com

Key Highlights: A versatile emulsifier and dispersing agent, Cargill’s canola lecithin may be used in a wide variety of food applications, including chocolate and confectionery ……

#2 Food & Beverage Lecithin Emulsifiers

Domain Est. 1994

Website: adm.com

Key Highlights: As a leading bulk ingredient supplier of lecithin emulsifiers, ADM delivers high-quality solutions to improve texture and stability in food and beverages….

#3 Lecithins – Bunge

Domain Est. 1996

Website: bunge.com

Key Highlights: Our lecithins offer a multitude of functional and processing properties. Our company offers the services you need to optimize its usage….

#4 About us

Domain Est. 2004

Website: lecithinworld.com

Key Highlights: Shivam Oils & Proteins Industry Incorporated in 1984. Since then it has made distinguished progress in manufacturing Prestige Soya Lecithin, Malt Extract and ……

#5 National Lecithin

Domain Est. 2005 | Founded: 1976

Website: nationallecithin.com

Key Highlights: Your Trusted Source for Superior Quality Lecithin and Specialty Ingredients. Manufacturing Liquid and Powder Lecithins in USA since 1976. Request Sample….

#6 American Lecithin Company

Domain Est. 2011

Website: americanlecithin.us

Key Highlights: American Lecithin provides soybean lecithins and other phospholipids that perform well in the preparation of emulsions. Lecithins are ideal for developing ……

#7 Fismer Lecithin – Speziallecithine bio, vegan und non-GMO

Domain Est. 2014

Website: fismer-lecithin.com

Key Highlights: We develop and produce lecithins for the food, animal feed, pharmaceutical and cosmetics industries as well as for technical applications….

Expert Sourcing Insights for Lecithin Oil

H2: Projected Market Trends for Lecithin Oil in 2026

By 2026, the global lecithin oil market is expected to experience significant growth, driven by rising consumer demand for natural, plant-based ingredients across multiple industries. Key trends shaping the market include increasing health consciousness, expanding applications in food and pharmaceuticals, and advancements in sustainable sourcing and extraction technologies.

1. Rising Demand in the Food and Beverage Industry

Lecithin oil, valued for its emulsifying, stabilizing, and texturizing properties, will continue to gain traction in the food and beverage sector. With clean-label trends accelerating, manufacturers are substituting synthetic additives with natural alternatives like sunflower and soy lecithin. Growth will be particularly strong in bakery, confectionery, and dairy products, where lecithin improves shelf life and processing efficiency.

2. Expansion in Plant-Based and Vegan Products

The surge in plant-based diets is a major growth driver. Lecithin oil is essential in vegan formulations, such as dairy alternatives and meat substitutes, where it enhances mouthfeel and prevents ingredient separation. Sunflower lecithin, in particular, is gaining preference due to its non-GMO status and allergen-friendly profile, aligning with consumer demand for transparency and sustainability.

3. Pharmaceutical and Nutraceutical Applications

The health benefits of lecithin—such as supporting cognitive function, liver health, and cholesterol management—are fueling its integration into dietary supplements and pharmaceuticals. Phosphatidylcholine, a key component of lecithin, is increasingly featured in brain health and nootropic products, contributing to market expansion in the nutraceutical space.

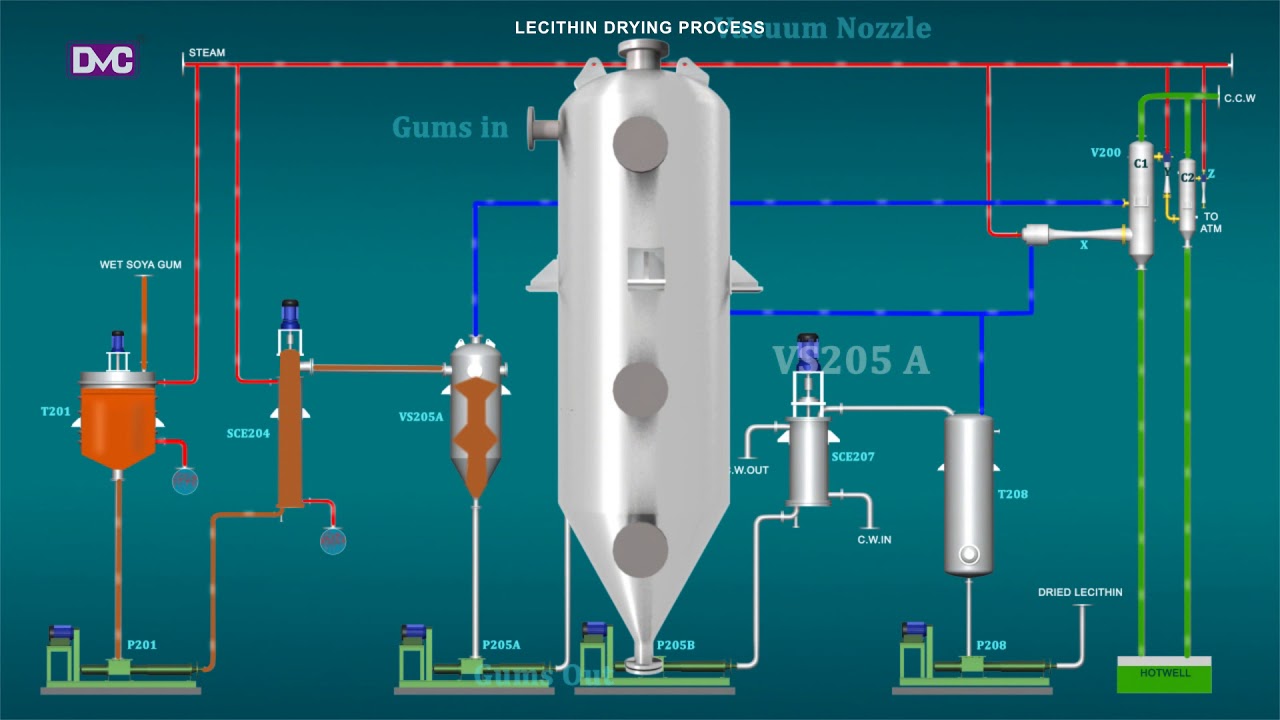

4. Shift Toward Non-GMO and Sustainable Sourcing

By 2026, ethical sourcing and environmental impact are expected to heavily influence procurement decisions. Producers are investing in sustainable farming practices and non-GMO certification, especially for soy and sunflower lecithin. Additionally, enzymatic extraction methods are being adopted to reduce solvent use and improve product purity, meeting both regulatory standards and consumer expectations.

5. Regional Market Dynamics

North America and Europe will remain dominant markets due to stringent food safety regulations and high health awareness. However, the Asia-Pacific region is anticipated to register the highest growth rate, driven by increasing urbanization, rising disposable incomes, and expanding food processing industries in countries like China and India.

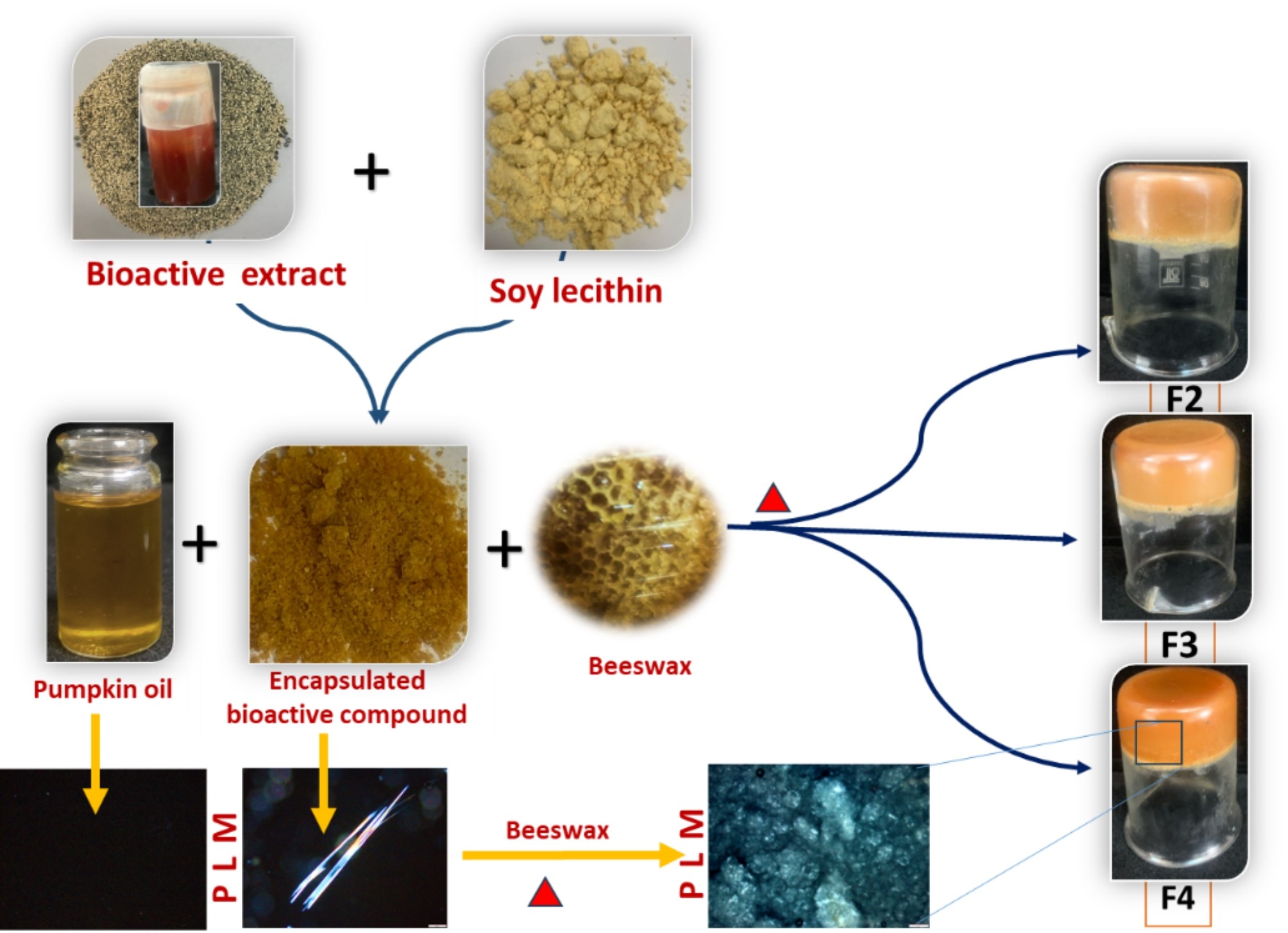

6. Innovation and Product Diversification

Manufacturers are investing in R&D to develop specialized lecithin formulations—such as de-oiled, fluid, and organic variants—to meet specific industrial needs. Customized solutions for encapsulation, infant nutrition, and functional foods are expected to open new revenue streams.

In conclusion, the lecithin oil market in 2026 will be characterized by innovation, sustainability, and diversification, supported by strong underlying demand from health-focused consumers and evolving industry applications. Strategic investments in clean production and marketing of premium, transparently sourced lecithin will be key to competitive advantage.

Common Pitfalls in Sourcing Lecithin Oil: Quality and Intellectual Property (IP) Concerns

Sourcing lecithin oil effectively requires careful attention to both quality specifications and intellectual property (IP) considerations. Overlooking these areas can lead to product failures, regulatory issues, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Quality-Related Pitfalls

1. Inadequate Specification of Lecithin Type and Source

Lecithin varies significantly based on its origin (soy, sunflower, rapeseed, egg) and processing method (crude, deoiled, fractionated, hydrolyzed). Sourcing without clearly defining the required type can result in receiving a product unsuitable for the intended application (e.g., emulsification efficiency, allergen profile, or oxidative stability). For example, sunflower lecithin is often preferred in clean-label or non-GMO applications, while soy lecithin may pose allergen or GMO concerns in certain markets.

2. Poor Control of Key Quality Parameters

Failing to set and verify critical quality attributes such as:

– Phospholipid content: Impacts functionality in emulsification and stability.

– Moisture levels: High moisture can promote microbial growth and reduce shelf life.

– Peroxide value and free fatty acids: Indicators of oxidation and rancidity.

– Color and odor: Important for consumer-facing products.

Without rigorous testing and certificates of analysis (CoA), suppliers may deliver substandard material that compromises final product quality.

3. Inconsistent Batch-to-Batch Quality

Lecithin is a natural product subject to variability based on raw material harvests and processing conditions. Suppliers without robust quality management systems (e.g., ISO 22000, HACCP) may deliver inconsistent products, leading to formulation challenges and production delays. Regular third-party audits and batch testing are essential to ensure consistency.

4. Contamination Risks (Allergens, Solvents, Heavy Metals)

Soy lecithin is a major allergen, and cross-contamination during processing can trigger regulatory non-compliance or recalls. Additionally, residual solvents (e.g., hexane in solvent-extracted lecithin) or heavy metals (e.g., from contaminated raw materials) must be monitored. Sourcing from suppliers with strict Good Manufacturing Practices (GMP) and transparent supply chains mitigates these risks.

Intellectual Property (IP)-Related Pitfalls

1. Unlicensed Use of Patented Lecithin Formulations or Processes

Certain modified lecithins (e.g., enzymatically hydrolyzed or acetylated lecithin) are protected by patents. Sourcing and using such specialized lecithins without proper licensing can expose a company to infringement claims. For example, specific process-protected lecithins used in pharmaceutical or high-performance food applications may be covered by method or composition patents.

2. Failure to Verify Supplier IP Ownership or Freedom to Operate

Suppliers may claim proprietary formulations but lack clear IP rights or freedom to operate. This can lead to downstream liability if the lecithin infringes third-party patents. Conducting due diligence on the supplier’s IP portfolio and obtaining IP warranties in supply agreements is crucial.

3. Misrepresentation of “Natural” or “Clean Label” Claims

Some suppliers may market lecithin as “natural” or “non-GMO” without adequate certification or traceability. If these claims are challenged (e.g., by regulators or competitors), the buyer may face legal action or reputational harm. Ensuring suppliers provide verifiable documentation (e.g., Non-GMO Project certification, organic certification) protects against false advertising claims.

4. Inadequate Protection of Buyer’s Own Formulations

When custom lecithin blends are developed in collaboration with a supplier, failing to establish clear IP ownership through contracts can result in loss of proprietary rights. Suppliers might reuse or resell formulations to competitors unless confidentiality agreements (NDAs) and IP assignment clauses are in place.

Conclusion

To mitigate these risks, sourcing professionals should:

– Define precise technical and regulatory specifications.

– Require comprehensive CoAs and conduct independent testing.

– Audit suppliers for quality systems and IP compliance.

– Include strong IP and confidentiality clauses in contracts.

– Stay informed on patent landscapes relevant to lecithin applications.

Proactive management of quality and IP issues ensures reliable supply, regulatory compliance, and protection of innovation.

H2: Logistics & Compliance Guide for Lecithin Oil

Lecithin oil, a versatile emulsifier and stabilizer derived from sources like soy, sunflower, or rapeseed, is widely used in food, pharmaceutical, and cosmetic industries. Ensuring compliant and efficient logistics is critical for maintaining product quality, meeting regulatory requirements, and avoiding supply chain disruptions. This guide outlines key logistics and compliance considerations.

H2: Regulatory Compliance

1. Classification and Identification

– CAS Number: Verify the specific CAS number based on the source (e.g., Soy Lecithin: 8030-76-0).

– HS Code: Common HS codes include 1521.10 (for lecithins), but verify based on composition and form (liquid, powder).

– GHS/SDS Compliance: Ensure a current Safety Data Sheet (SDS) is available, classifying lecithin oil according to GHS. Typically non-hazardous, but verify for additives or processing aids.

2. Food Safety & Labeling

– FDA (USA): Must comply with 21 CFR §172.840 (food additives). GRAS (Generally Recognized As Safe) status applies for food-grade lecithin.

– EU Regulations: Comply with Regulation (EC) No 1333/2008 on food additives (E322). Non-GMO labeling may be required for soy lecithin under EU legislation.

– Labeling Requirements: Include product name, allergen declarations (e.g., “Contains: Soy”), net weight, batch number, and storage instructions.

3. Allergen & GMO Compliance

– Allergens: Soy-based lecithin must be labeled as a soy allergen in most jurisdictions.

– GMO Status: For non-GMO or organic claims, ensure certification (e.g., Non-GMO Project, USDA Organic) and maintain documentation throughout the supply chain.

4. International Trade

– Import/Export Permits: Check destination country requirements (e.g., China may require special food import licenses).

– Phytosanitary Certificates: May be needed depending on origin and destination, especially for agricultural-derived products.

H2: Storage & Handling

1. Storage Conditions

– Temperature: Store between 10°C and 25°C (50°F–77°F). Avoid freezing and prolonged exposure to high heat.

– Humidity: Keep in a dry environment to prevent moisture absorption.

– Light: Protect from direct sunlight; store in opaque or amber containers.

– Shelf Life: Typically 12–24 months; monitor and rotate stock using FIFO (First In, First Out).

2. Container Requirements

– Use food-grade drums (e.g., steel or HDPE), totes (IBCs), or tankers lined with compatible materials.

– Ensure seals are intact to prevent oxidation and contamination.

3. Segregation

– Store away from strong-smelling or hazardous chemicals to avoid cross-contamination.

– Separate non-GMO and GMO batches if both are handled.

H2: Transportation

1. Mode of Transport

– Road/Rail: Use temperature-controlled or shaded vehicles, especially in extreme climates.

– Sea Freight: Containerized shipment in dry or reefer containers if temperature-sensitive. Monitor humidity.

– Air Freight: Suitable for small, urgent shipments; ensure packaging meets IATA standards.

2. Packaging & Palletization

– Drums or IBCs must be securely palletized and shrink-wrapped.

– Use moisture-resistant pallets and avoid open-top containers in humid conditions.

3. Hazard Classification

– Lecithin oil is generally non-hazardous for transport under ADR, IMDG, or IATA regulations.

– Always confirm with SDS and consult local regulations—some formulations may require special handling.

H2: Documentation & Traceability

1. Required Documents

– Commercial Invoice

– Packing List

– Bill of Lading/Air Waybill

– Certificate of Analysis (CoA)

– Certificate of Origin

– SDS (if required by carrier or jurisdiction)

– Non-GMO or Organic Certificates (as applicable)

2. Traceability

– Maintain batch-level traceability from raw material to final product.

– Implement a recall plan and retain records for a minimum of 3–5 years, depending on jurisdiction.

H2: Quality Assurance & Audits

- Conduct regular supplier audits to ensure compliance with GMP (Good Manufacturing Practices).

- Test incoming and outgoing shipments for key parameters (color, odor, acidity, peroxide value, moisture).

- Comply with ISO 22000, FSSC 22000, or equivalent food safety management systems.

By adhering to this logistics and compliance framework, businesses can ensure the safe, legal, and efficient movement of lecithin oil across global supply chains while maintaining product integrity and consumer trust.

Conclusion for Sourcing Lecithin Oil

Sourcing lecithin oil requires a strategic approach that balances quality, cost, sustainability, and regulatory compliance. As a versatile emulsifier and stabilizer widely used in food, pharmaceutical, and cosmetic industries, lecithin must meet stringent purity and performance standards. The sourcing decision should consider the origin (soy, sunflower, or other plant sources), extraction method (chemical vs. physical), and the supplier’s adherence to ethical and environmental practices.

Sunflower lecithin is increasingly preferred due to its non-GMO status and cleaner label appeal, while soy lecithin remains cost-effective and widely available, albeit with potential allergen and GMO concerns. A thorough evaluation of suppliers—assessing certifications (such as organic, non-GMO, Kosher, or Halal), traceability, and consistency—is critical to ensuring product integrity.

Ultimately, successful lecithin oil sourcing hinges on building strong partnerships with reliable suppliers, maintaining supply chain transparency, and staying informed about market trends and regulatory changes. By prioritizing sustainability and quality, organizations can secure a stable supply of lecithin oil that supports both product excellence and long-term business goals.