The global lead oxide market is experiencing steady growth, driven by rising demand from the lead-acid battery industry, particularly in automotive and industrial applications. According to a report by Mordor Intelligence, the lead oxide market was valued at approximately USD 15.6 billion in 2023 and is projected to grow at a CAGR of over 3.5% from 2024 to 2029. This expansion is fueled by continued reliance on lead-acid batteries for vehicle starting, lighting, and ignition (SLI), as well as backup power systems in telecommunications and energy storage. Despite the emergence of alternative battery technologies, lead oxide remains a critical raw material due to its recyclability, cost-effectiveness, and established manufacturing infrastructure. As production scales to meet regional demand—especially in Asia-Pacific and Latin America—several manufacturers have emerged as key players in ensuring consistent supply and high-quality output. Below are the top 9 lead oxide manufacturers shaping the industry landscape worldwide.

Top 9 Lead Oxide Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Lead Oxide

Domain Est. 2002

Website: penoxgroup.com

Key Highlights: PENOX Group is one of the world’s largest producers of lead oxides, with a clear focus to serve the lead-acid battery sector….

#2 Red Lead

Domain Est. 2013

Website: bindalsmelting.com

Key Highlights: Bindal Smelting Pvt. Ltd. is a leading manufacturer of various types of lead oxides, including Grey Oxide, Red Oxide, and Litharge. These oxides are ……

#3 Lead-Oxide-Red-Powder-Reagent

Domain Est. 1995

Website: spectrumchemical.com

Key Highlights: 15-day returnsLead Oxide, Red, Powder, Reagent ; Molecular Formula: Pb3O ; Catalog Number: L1085 ; Supplier/Brand: Spectrum Chemical ; CAS Number: 1314-41-6….

#4 Lead Oxide, Red Powder, Reagent

Domain Est. 1997

Website: labdepotinc.com

Key Highlights: In stock $30.09 deliverySpectrum’s Lead Oxide, Red Powder, Reagent is a high-grade solution for your most demanding needs. Whether you’re formulating advanced paints with powerful …

#5 Lead Oxide

Domain Est. 1999

Website: colorobbia.com

Key Highlights: High purity Lead Oxide (minio), predominantly used as an essential element to create brightness and transparency in glass….

#6 usantimony

Domain Est. 1999 | Founded: 1969

Website: usantimony.com

Key Highlights: USAC has produced various antimony products since 1969 and is a fully integrated mining, transportation, milling, smelting, and selling company….

#7 Lead Oxide Supplier

Domain Est. 2009

Website: leadoxide.net

Key Highlights: Tradeasia International, one of the emerging lead oxide suppliers in Asia, delivers top-quality lead oxide products globally….

#8 Lead Oxide Evaporation Materials Supplier

Domain Est. 2013

Website: samaterials.com

Key Highlights: Starting from $100.00 In stockStanford Advanced Materials (SAM) specializes in producing high-purity lead oxide (PbO) evaporation materials with high quality for use in semiconduct…

#9 Lead Oxide (Litharge)

Domain Est. 2016

Website: dynakrom.com

Key Highlights: “We are lead oxide (lead litharge) distributors, for mining applications, decorative flooring, PVC stabilization, and more. “…

Expert Sourcing Insights for Lead Oxide

H2: Projected 2026 Market Trends for Lead Oxide

The global lead oxide market is anticipated to experience moderate but steady growth by 2026, driven primarily by sustained demand from key end-use industries, evolving regulatory landscapes, and technological advancements. Below is an analysis of the major market trends expected to shape the lead oxide industry in 2026:

1. Continued Dominance of the Lead-Acid Battery Industry

Lead oxide remains a critical raw material in the production of lead-acid batteries (LABs), which are widely used in automotive, industrial, and backup power applications. Despite increasing competition from lithium-ion batteries, LABs continue to dominate sectors requiring reliable, cost-effective energy storage—particularly in emerging markets. By 2026, the automotive sector, especially in Asia-Pacific and Africa, is expected to sustain demand for lead oxide due to the prevalence of internal combustion engine (ICE) vehicles and the need for affordable starter batteries.

2. Regional Shifts in Production and Demand

Asia-Pacific, led by China and India, will continue to be the largest producer and consumer of lead oxide in 2026. China’s established battery manufacturing infrastructure and recycling ecosystem support consistent lead oxide demand. Meanwhile, India’s growing automotive industry and government initiatives promoting energy security are expected to boost local LAB production. In contrast, stringent environmental regulations in Europe and North America may constrain primary lead oxide production, shifting focus toward recycled lead sources and closed-loop manufacturing processes.

3. Increasing Emphasis on Recycling and Sustainability

Environmental concerns surrounding lead emissions and waste are prompting stricter regulations globally. In 2026, the lead oxide market is expected to see a stronger shift toward secondary (recycled) lead, driven by sustainability goals and cost efficiency. The recycling rate of lead-acid batteries exceeds 95% in developed regions, and this trend is spreading to developing economies. Companies investing in cleaner production technologies and closed-loop recycling systems are likely to gain a competitive advantage.

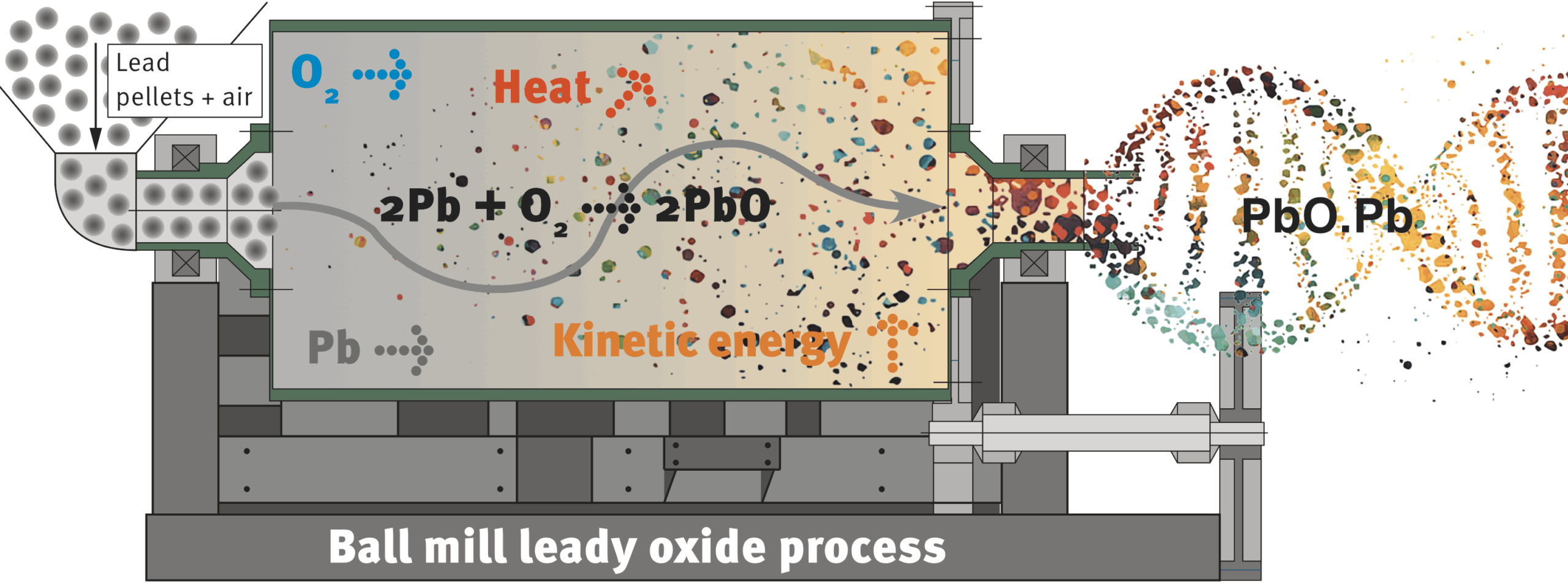

4. Technological Advancements in Manufacturing

Innovations in lead oxide production, such as the Barton pot process optimization and automated reactor systems, are expected to enhance efficiency and reduce environmental impact by 2026. Manufacturers are increasingly adopting digital monitoring systems and AI-driven quality control to ensure consistent product specifications, particularly for high-performance batteries used in renewable energy storage and telecommunications.

5. Impact of Alternative Energy Storage Technologies

The rise of renewable energy systems and grid storage solutions presents both challenges and opportunities. While lithium-ion and other advanced batteries are gaining ground, lead-carbon and advanced lead-acid batteries (enhanced with lead oxide formulations) are emerging as cost-effective alternatives for stationary storage. These hybrid systems may extend the relevance of lead oxide in the energy transition, especially in markets where safety, recyclability, and low cost are prioritized.

6. Price Volatility and Supply Chain Dynamics

Lead oxide prices are closely tied to primary lead markets and are subject to fluctuations due to geopolitical factors, mining output, and trade policies. In 2026, supply chain resilience will be critical, with manufacturers favoring local sourcing and strategic partnerships to mitigate risks. Regulatory compliance, particularly regarding transportation and handling of hazardous materials, will also influence market dynamics.

Conclusion

By 2026, the lead oxide market is expected to remain resilient, underpinned by enduring demand from the lead-acid battery sector and growth in emerging economies. However, long-term sustainability will depend on the industry’s ability to adapt to environmental regulations, embrace recycling, and innovate in response to evolving energy storage needs. Companies that prioritize eco-efficiency, regulatory compliance, and technological integration are poised to lead the market in this transitional phase.

H2: Common Pitfalls in Sourcing Lead Oxide – Quality and Intellectual Property (IP) Concerns

Sourcing lead oxide, particularly for specialized industrial applications such as lead-acid batteries, ceramics, or electronics, involves several critical challenges related to quality consistency and intellectual property (IP) risks. Understanding these pitfalls is essential for ensuring supply chain reliability, product performance, and legal compliance.

1. Quality-Related Pitfalls

a. Inconsistent Purity and Composition

Lead oxide is available in different forms (e.g., litharge – PbO, red lead – Pb₃O₄), and variations in stoichiometry, particle size, and surface area significantly impact performance. A common pitfall is receiving material with inconsistent purity due to unregulated production processes, especially from low-cost suppliers. Impurities such as arsenic, cadmium, or sulfur can degrade product performance and pose regulatory issues.

Best Practice: Require detailed material certifications (e.g., COA – Certificate of Analysis) and conduct third-party testing to verify elemental composition, particle size distribution, and moisture content.

b. Variable Physical Properties

The reactivity and performance of lead oxide in battery paste formulation depend on physical characteristics like surface area and bulk density. Suppliers may not control these parameters uniformly, leading to batch-to-batch variability.

Best Practice: Define strict technical specifications and conduct incoming quality control checks using BET surface area analysis and sieve testing.

c. Poor Manufacturing Controls and Traceability

Some suppliers—particularly in regions with less stringent environmental and safety regulations—may lack robust quality management systems (e.g., ISO 9001). This increases the risk of contamination, improper handling, and inadequate traceability.

Best Practice: Audit suppliers for compliance with international standards and environmental regulations (e.g., REACH, RoHS).

2. Intellectual Property (IP) Risks

a. Reverse Engineering and Technology Leakage

When sourcing lead oxide for proprietary formulations (e.g., advanced battery pastes), sharing detailed technical requirements with suppliers may expose sensitive IP. Unscrupulous suppliers could reverse-engineer formulations or replicate processes for competitive use.

Best Practice: Use non-disclosure agreements (NDAs) and limit technical disclosures to only what is essential. Consider working with trusted, long-term partners under clearly defined IP clauses.

b. Lack of IP Ownership Clarity in Joint Development

If a supplier co-develops a customized lead oxide product (e.g., doped or nanostructured variants), ambiguity in IP ownership can lead to disputes. Without a clear contractual agreement, the supplier may claim rights to improvements or derivatives.

Best Practice: Define IP ownership, usage rights, and data confidentiality in supplier contracts before collaboration begins.

c. Infringement Risks from Supplier Processes

The method used by a supplier to produce lead oxide (e.g., Barton pot process, ball milling) may be covered by third-party patents. Sourcing from such suppliers could inadvertently expose the buyer to patent infringement claims, especially in regulated markets.

Best Practice: Conduct due diligence on supplier manufacturing methods and require indemnification clauses in procurement contracts.

Conclusion

To mitigate risks when sourcing lead oxide, companies must prioritize supplier qualification, enforce rigorous quality controls, and implement strong IP protection strategies. Partnering with reputable suppliers, conducting regular audits, and establishing clear contractual terms are essential steps in safeguarding both product quality and intellectual assets.

H2: Logistics & Compliance Guide for Lead Oxide

Lead oxide (PbO), also known as litharge (when in the red form) or massicot (when in the yellow form), is a hazardous chemical compound widely used in industrial applications such as lead-acid batteries, ceramics, glass, and pigments. Due to its toxicity and environmental risks, the logistics and compliance requirements for transporting, storing, and handling lead oxide are strictly regulated. This guide outlines key considerations under H2 (Health, Safety, and Environmental Hazards) to ensure safe and compliant operations.

1. Hazard Classification (GHS & Regulatory Frameworks)

Lead oxide is classified under the Globally Harmonized System (GHS) as:

- H331: Toxic if inhaled

- H360: May damage fertility or the unborn child

- H373: May cause damage to organs through prolonged or repeated exposure

- H410: Very toxic to aquatic life with long-lasting effects

- H302: Harmful if swallowed

It is also listed under various regulatory frameworks, including:

– OSHA Hazard Communication Standard (29 CFR 1910.1200) – Requires proper labeling, SDS, and employee training

– EPA Toxic Substances Control Act (TSCA) – Regulates manufacturing, import, and processing

– REACH (EU) – Requires registration, evaluation, and restriction of chemicals

– DOT (49 CFR) – Governs transportation of hazardous materials in the U.S.

2. Packaging and Labeling Requirements

Packaging:

– Must be in UN-certified, leak-proof, and tightly sealed containers (e.g., HDPE drums, lined fiber drums)

– Inner liners (e.g., polyethylene) recommended to prevent contamination and leakage

– Packaging must pass drop, leakproofness, and stacking tests per UN performance standards

Labeling:

– UN Number: UN 2291 (Lead compounds, inorganic, toxic, N.O.S.)

– Proper Shipping Name: LEAD COMPOUNDS, INORGANIC, TOXIC, N.O.S. (Lead oxide)

– Hazard Class: 6.1 (Toxic Substances)

– Packing Group: II (Medium Danger)

– GHS Pictograms: Skull and crossbones, health hazard, environmental hazard

– Precautionary Statements (P-codes) must be included on labels and SDS

3. Transportation Regulations

Road (DOT – U.S.):

– Requires placarding for shipments over 1,001 lbs gross weight

– Vehicle must carry emergency response information (e.g., shipping papers, emergency contact)

– Drivers must have HazMat endorsement and training

Air (IATA):

– Subject to IATA Dangerous Goods Regulations (DGR)

– Limited to cargo aircraft only if quantity exceeds passenger aircraft allowances

– Must be packaged in combination packaging with inner leak-proof containers

Sea (IMDG Code):

– Classified under IMDG Code Class 6.1, PG II

– Requires proper stowage and segregation from foodstuffs, acids, and oxidizers

– Documentation: Dangerous Goods Declaration, Container/Packing Certificate

4. Storage Requirements

- Store in a cool, dry, well-ventilated area away from direct sunlight

- Keep containers tightly closed when not in use

- Use dedicated storage area, isolated from incompatible materials (e.g., acids, reducing agents)

- Secondary containment (e.g., spill pallets) required to prevent environmental contamination

- Label all storage areas with appropriate hazard signs (e.g., “Toxic,” “Do Not Ingest”)

5. Handling and Worker Protection

Engineering Controls:

– Use local exhaust ventilation or fume hoods when handling powders

– Enclosed transfer systems recommended to minimize dust generation

Personal Protective Equipment (PPE):

– Respiratory protection (NIOSH-approved N95 or P100 respirator for dust)

– Chemical-resistant gloves (e.g., nitrile or neoprene)

– Safety goggles or face shield

– Protective clothing (coveralls, shoe covers) to prevent skin contact

Hygiene Practices:

– Prohibit eating, drinking, or smoking in handling areas

– Provide emergency eyewash stations and safety showers

– Implement routine cleaning with HEPA vacuum (do not dry sweep)

6. Environmental and Waste Management

- Lead oxide is a RCRA Hazardous Waste (EPA Waste Code D008 due to lead content)

- Spills must be cleaned immediately using wet methods or HEPA vacuum

- Contaminated materials (e.g., PPE, absorbents) must be disposed of as hazardous waste

- Wastewater runoff must be captured and treated to prevent environmental release

- Comply with local, state, and federal environmental regulations (e.g., Clean Water Act, Resource Conservation and Recovery Act)

7. Emergency Response

Spill Response:

– Evacuate non-essential personnel

– Wear full PPE including respiratory protection

– Dampen spill to suppress dust, collect with non-sparking tools, and place in labeled, sealed container

– Report spills exceeding reportable quantities (RQ = 1 lb for lead compounds) to local and federal authorities (e.g., NRC, SERC)

Exposure:

– Inhalation: Move to fresh air, seek medical attention immediately

– Skin contact: Wash with soap and water; remove contaminated clothing

– Ingestion: Do NOT induce vomiting; seek immediate medical help

Fire:

– Lead oxide is non-combustible but may release toxic fumes (e.g., lead oxide fumes) when heated

– Use Class D fire extinguisher for metal fires; otherwise, water spray to cool containers

8. Documentation and Training

- Maintain Safety Data Sheets (SDS) compliant with GHS (16-section format)

- Provide HazCom training to all employees handling or storing lead oxide

- Conduct regular refresher training on emergency procedures and PPE use

- Keep records of exposure monitoring, medical surveillance, and waste disposal

9. Regulatory Compliance Summary

| Requirement | Applicable Regulation |

|———–|————————|

| Worker Exposure Limits | OSHA PEL: 0.05 mg/m³ (8-hr TWA); ACGIH TLV: 0.15 mg/m³ |

| Transport (Land) | 49 CFR (DOT) |

| Transport (Air) | IATA DGR |

| Transport (Sea) | IMDG Code |

| Hazard Communication | OSHA HCS, CLP (EU) |

| Environmental Reporting | CERCLA, EPCRA (SARA Title III) |

| Waste Disposal | RCRA, DOT |

Conclusion

Safe and compliant handling of lead oxide requires strict adherence to health, safety, and environmental regulations throughout its lifecycle—from transport and storage to use and disposal. Employers must ensure proper training, engineering controls, and documentation to minimize risks to human health and the environment. Regular audits and emergency preparedness are essential to maintain compliance and operational safety.

Note: Always consult local regulations, as requirements may vary by jurisdiction.

Conclusion on Sourcing Lead Oxide

Sourcing lead oxide requires careful consideration of multiple factors including supplier reliability, product quality, regulatory compliance, environmental and health safety standards, and cost-effectiveness. Due to the hazardous nature of lead compounds, it is essential to partner only with reputable suppliers who adhere to international safety and environmental regulations such as REACH, RoHS (where applicable exemptions are granted), OSHA, and local environmental protection guidelines.

Supply chain transparency, proper documentation, and secure handling and transportation protocols are critical to ensure safe and responsible sourcing. Additionally, companies should evaluate alternatives or consider recycling lead oxide from spent batteries or industrial by-products as a more sustainable and cost-efficient option.

In conclusion, a strategic and compliant approach to sourcing lead oxide—emphasizing safety, sustainability, and regulatory adherence—is vital for minimizing risks and ensuring long-term operational efficiency, particularly in industries such as battery manufacturing, glass production, and electronics.