The global automotive lighting market is experiencing robust growth, driven by increasing demand for advanced lighting technologies, rising vehicle production, and stringent safety regulations. According to a report by Mordor Intelligence, the automotive lighting market was valued at USD 30.5 billion in 2023 and is projected to grow at a CAGR of over 7.5% from 2024 to 2029. This growth is further fueled by the rising adoption of LED and adaptive lighting systems, particularly in premium and electric vehicles. As a critical component of vehicle safety and design, tail lights have become a focal point for innovation among leading manufacturers. In this evolving landscape, LCI (Lighting Components and Innovations) tail lights have gained prominence for their durability, energy efficiency, and aesthetic appeal. Below is a data-driven look at the top 8 LCI tail lights manufacturers shaping the industry’s future through technological advancement and strategic market expansion.

Top 8 Lci Tail Lights Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 THE BMW M340i

Domain Est. 2005

Website: bmw.in

Key Highlights: The BMW M340i offers outstanding driving dynamics and comprehensive, technologically modern support for the driver in the new sporty design….

#2 My MY2016 F80 has pre

Domain Est. 2006

Website: f80.bimmerpost.com

Key Highlights: Does anyone know what the SOP date was for the LCI? I have a 2016 F80 and have pre LCI tail lights and have the chrome accents on the power ……

#3 Blackline LCI Taillight Group Buy *Feeler*

Domain Est. 2007

Website: 1addicts.com

Key Highlights: This kit will only work for models that already have Xenon Light and Adaptive Headlight options (522A and 524A) already on the vehicle….

#4 Euro turn signals retrofit – Page 3 – XBimmers

Domain Est. 2007

Website: x3.xbimmers.com

Key Highlights: Update on the euro/amber tail lights, got the light from europe and installed, Problem is the hard wiring in the US model is missing the turn signal light….

#5 Black Line LCI Taillights Upgrade Kit for BMW 2 Series

Domain Est. 2010

#6 VLAND – Vland Headlight Assembly, Tail Light

Domain Est. 2021

Website: vlandshop.com

Key Highlights: ️Upgrade your auto’s lighting with vland headlights, tail lights. Our high-quality, durable products are designed to enhance the look and performance of your ……

#7 Top 10 lci tail lights Manufacturers

Domain Est. 2023

Website: pnpcarheadlights.com

Key Highlights: LCI tail lights offer a sleek and modern design, improved visibility, and enhanced safety features. With a wide range of options available for ……

#8 Top 10 lci tail lights Manufacturers

Domain Est. 2023

Website: gr.pnpcarlight.com

Key Highlights: LCI tail lights offer a sleek and modern design, improved visibility, and enhanced safety features. With a wide range of options available for ……

Expert Sourcing Insights for Lci Tail Lights

H2: 2026 Market Trends for LCI Tail Lights

The market for LCI (Life Cycle Impulse or Late Cycle Improvement) tail lights is expected to undergo significant transformation by 2026, driven by advancements in automotive technology, evolving regulatory standards, and shifting consumer preferences. LCI tail lights—typically introduced during the mid-to-late lifecycle of a vehicle model—serve as aesthetic and functional upgrades that enhance safety, efficiency, and brand identity. Here is an analysis of the key market trends expected to shape the LCI tail light industry in 2026:

-

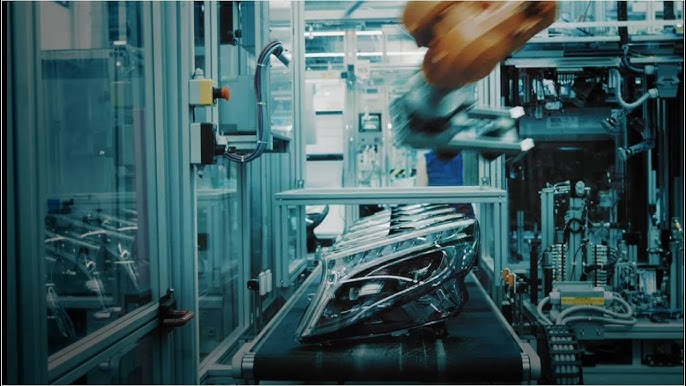

Increased Adoption of LED and Adaptive Lighting Technologies

By 2026, LED-based tail lights will dominate the LCI segment due to their energy efficiency, longevity, and design flexibility. Automakers will increasingly integrate adaptive lighting systems, such as dynamic turn signals and responsive brake lighting, into LCI updates to improve visibility and safety. These technologies not only comply with stricter global safety regulations but also offer a premium aesthetic that appeals to consumers. -

Integration with Vehicle Connectivity and Smart Features

LCI tail lights will become more than just passive safety devices—they will evolve into intelligent components of connected vehicle ecosystems. By 2026, expect widespread integration with vehicle-to-everything (V2X) communication systems, allowing tail lights to convey real-time information such as emergency braking alerts or lane change intentions to surrounding vehicles and infrastructure. -

Emphasis on Design Differentiation and Branding

As automakers face growing competition, especially in the electric vehicle (EV) market, LCI tail lights will serve as key branding tools. Signature lighting designs—such as sequential turn signals, animated sequences, and illuminated brand logos—will become standard in LCI packages, helping manufacturers reinforce brand identity and deliver a distinctive visual experience. -

Sustainability and Lightweight Materials

Environmental regulations and consumer demand for sustainable vehicles will push manufacturers to use recyclable materials and reduce the carbon footprint of LCI tail light production. Lightweight composite materials and modular designs will gain traction, supporting fuel efficiency and EV range while simplifying end-of-life recycling. -

Growth in the Aftermarket and Retrofit Markets

The aftermarket for LCI-style tail light upgrades is projected to expand by 2026, fueled by consumers seeking modern aesthetics for older vehicles. Retrofit kits featuring LED technology and OEM-inspired designs will become more accessible, supported by e-commerce platforms and specialized automotive customization shops. -

Regional Regulatory Influence

Stricter safety and emissions standards in Europe, North America, and parts of Asia will drive innovation in LCI tail light design. For example, the EU’s General Safety Regulation (GSR) mandates advanced safety features, prompting automakers to include enhanced tail lighting in LCI updates to meet compliance deadlines. -

Cost Optimization and Scalable Platforms

As automakers streamline production across global platforms, LCI tail light designs will increasingly leverage modular architectures. This enables cost-effective updates across multiple models while maintaining brand consistency, particularly important for volume manufacturers updating mid-cycle vehicles.

Conclusion:

By 2026, LCI tail lights will transcend their traditional role, becoming integral to vehicle safety, connectivity, and brand expression. The convergence of technology, regulation, and consumer expectations will drive innovation in design, functionality, and sustainability, positioning LCI lighting as a critical component in the evolving automotive landscape.

Common Pitfalls When Sourcing LCI Tail Lights (Quality, IP)

Sourcing LCI (Last Characteristic Inspection) tail lights—often referring to updated or revised versions of automotive taillight assemblies—can present several challenges, particularly concerning quality consistency and intellectual property (IP) risks. Being aware of these common pitfalls helps mitigate supply chain disruptions, legal issues, and customer dissatisfaction.

Quality Inconsistencies and Defects

One of the most frequent issues when sourcing LCI tail lights is inconsistent product quality. Suppliers may claim compliance with OEM specifications, but actual units often exhibit defects such as poor lens clarity, uneven light distribution, color mismatches, or premature failure due to substandard materials. These inconsistencies can stem from unverified manufacturing processes, lack of rigorous quality control, or use of non-approved components. Buyers may receive batches that pass basic visual inspection but fail under real-world conditions or regulatory testing, leading to costly returns or warranty claims.

Intellectual Property and Legal Risks

Sourcing LCI tail lights, especially from third-party or aftermarket suppliers, carries significant IP risks. Many tail light designs are protected by patents, trademarks, and design rights owned by OEMs. Using or distributing look-alike or reverse-engineered versions—even if technically labeled as “compatible”—can result in legal action, customs seizures, or product recalls. Buyers may unknowingly source products that infringe on IP, particularly when suppliers provide misleading documentation or falsify compliance certifications. This not only exposes the buyer to litigation but can also damage brand reputation and market access.

Lack of Certification and Compliance Documentation

Many suppliers of LCI tail lights fail to provide valid certification for photometric performance, ingress protection (IP) ratings, or regulatory compliance (e.g., ECE, DOT, or SAE standards). A claimed IP67 rating, for instance, may not be backed by independent testing, leaving the product vulnerable to moisture ingress and failure in the field. Without proper documentation, buyers risk non-compliance with regional safety and environmental regulations, potentially resulting in fines or distribution bans.

Supply Chain Transparency and Traceability Gaps

Opaque supply chains make it difficult to verify the origin of components, manufacturing practices, and adherence to ethical standards. Some suppliers may source LCI tail lights from unauthorized subcontractors or gray market channels, increasing the risk of counterfeit or refurbished units being passed off as new. Without traceability, it becomes challenging to address quality issues, conduct recalls, or ensure long-term reliability.

Inadequate Testing and Validation Processes

Many sourced LCI tail lights lack proper environmental and durability testing—such as thermal cycling, vibration resistance, and UV exposure—critical for automotive applications. Suppliers may skip these tests to reduce costs, leading to premature failures once installed. Buyers assuming that “LCI” implies improved reliability may overlook the need for independent validation, only to discover performance gaps post-deployment.

Avoiding these pitfalls requires thorough due diligence, including supplier audits, independent product testing, verification of IP rights, and clear contractual quality assurance terms.

Logistics & Compliance Guide for LCI Tail Lights

This guide provides essential information for the logistics and regulatory compliance associated with shipping, storing, and distributing LCI (Late Change Implementation) tail lights for vehicles. Adhering to these guidelines ensures safe, efficient operations and legal conformity across regions.

Product Specifications & Handling

LCI tail lights are automotive components designed to meet updated design, safety, and performance standards following a manufacturer’s mid-cycle refresh. Key handling considerations include:

- Fragility: Tail lights are made of polycarbonate lenses and electronic components; handle with care to prevent cracking or internal damage.

- Packaging: Use manufacturer-approved packaging with cushioning materials (e.g., foam inserts, corrugated dividers) to prevent movement during transit.

- Orientation: Store and transport in upright position as indicated on packaging to avoid lens deformation or seal compromise.

- Environmental Conditions: Store in dry, temperature-controlled environments (ideally 10°C to 30°C); avoid direct sunlight and high humidity to prevent fogging or material degradation.

International Shipping & Customs Compliance

Shipping LCI tail lights internationally requires strict adherence to customs and trade regulations.

- HS Code Classification: Use Harmonized System (HS) code 8512.20 (Electric lighting equipment for vehicles) for accurate tariff application. Confirm country-specific sub-codes with local customs authorities.

- Documentation: Provide complete export documentation including commercial invoice, packing list, bill of lading/air waybill, and Certificate of Origin.

- Marking Requirements: Each unit or outer carton must display:

- Manufacturer part number

- E-mark (if compliant with UNECE Regulations)

- DOT or SAE certification (for U.S. market)

- Country of manufacture

- Restricted Materials: Confirm absence of hazardous substances (e.g., lead, mercury) per RoHS (EU) or similar regional regulations.

Regulatory & Safety Standards

LCI tail lights must comply with regional vehicle safety standards:

- European Union: Must carry E-mark certification per UNECE Regulations (e.g., R7 for front/rear lamps, R87 for rear fog lamps). Compliance verified through EU-type approval.

- United States: Must meet FMVSS (Federal Motor Vehicle Safety Standards) Part 108. Units must display DOT certification and be compliant with SAE performance standards.

- Canada: Comply with CMVSS 108; units require a National Safety Mark (NSM).

- Other Regions: Verify local requirements (e.g., ADR in Australia, INMETRO in Brazil) prior to import.

Import/Export Licensing & Restrictions

- Export Controls: LCI tail lights are generally not subject to export licenses under EAR (U.S. Export Administration Regulations), but confirm with legal counsel for dual-use concerns.

- Import Duties & Taxes: Calculate duties based on declared value and HS code. Utilize Free Trade Agreements (e.g., USMCA, CETA) where applicable to reduce tariffs.

- Prohibited Destinations: Screen all shipments against OFAC (U.S.), EU sanctions lists, and UN embargoes.

Storage & Inventory Management

- Warehouse Standards: Store on pallets in clean, dry areas; avoid floor contact to prevent moisture damage.

- First-Expired, First-Out (FEFO): Track production dates if LEDs or seals have shelf-life limits.

- Security: Implement inventory controls to prevent theft or substitution; tail lights are high-value automotive parts.

Reverse Logistics & Warranty Returns

- Defective Returns: Establish a clear process for handling customer returns, including inspection for damage, compliance verification, and data logging.

- Recall Preparedness: Maintain traceability (batch/serial numbers) to facilitate rapid response in case of safety recalls.

- End-of-Life Disposal: Recycle materials per WEEE (EU) or state-level e-waste regulations. Partner with certified e-waste handlers.

Carrier & Transport Requirements

- Mode Selection: Use ground freight for domestic shipments; air freight for urgent international deliveries.

- Insurance: Ship with all-risk cargo insurance covering breakage, theft, and environmental damage.

- Carrier Compliance: Partner with carriers experienced in automotive parts logistics and familiar with IMDG (for battery-equipped units) or ADR (road) regulations if applicable.

Adherence to this guide ensures safe, compliant, and efficient handling of LCI tail lights throughout the supply chain. Regularly review updates from regulatory bodies and OEM specifications to maintain compliance.

Conclusion for Sourcing LCI Tail Lights:

After a comprehensive evaluation of various suppliers, pricing models, quality standards, and lead times, sourcing LCI (Late Change Instruction) tail lights requires a strategic approach that balances cost-efficiency with compliance and reliability. Key factors such as OEM specifications, certification requirements (e.g., DOT, SAE, or E-mark), and compatibility with vehicle models must be prioritized to ensure both regulatory compliance and customer satisfaction.

Sourcing from reputable manufacturers—whether original suppliers, certified aftermarket producers, or authorized distributors—reduces the risk of counterfeit or substandard components. Additionally, considering total landed costs, including shipping, tariffs, and potential warranty liabilities, is critical in determining long-term viability.

In conclusion, successful sourcing of LCI tail lights hinges on building strong supplier relationships, conducting thorough quality audits, and maintaining supply chain transparency. By aligning procurement strategies with technical and regulatory demands, businesses can ensure reliable, high-quality lighting solutions that support vehicle performance, safety, and brand integrity.