The global LCD panel market is witnessing robust expansion, driven by increasing demand across consumer electronics, automotive displays, and industrial applications. According to Mordor Intelligence, the LCD market was valued at USD 118.5 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029. This growth is underpinned by rising adoption of larger-screen devices, advancements in display technologies, and the sustained demand for cost-effective, energy-efficient panels. As legacy and emerging markets continue to rely on LCDs despite the rise of OLED alternatives, the need for reliable LCD panel replacements has surged. This has positioned a select group of manufacturers at the forefront of supply, innovation, and after-sales support. Based on production capacity, market share, technological capabilities, and customer reach, we’ve identified the top 9 LCD panel replacement manufacturers shaping the industry today.

Top 9 Lcd Panel Replacement Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 LCM Display, LCD Panel & Modules Manufacturer & Supplier …

Domain Est. 1998 | Founded: 1998

Website: winstar.com.tw

Key Highlights: Established in 1998, WINSTAR Display Co., Ltd. is a trusted manufacturer and supplier of LCD display modules and panels….

#2 Monitech

Domain Est. 1999

Website: monitech.com

Key Highlights: Find LCD replacements for industrial machines, including PanelView, ProtoTrak, Fanuc, Okuma, and other legacy OEM brands. Search your part number now!…

#3 OEM Touch Screen Solutions (US)

Domain Est. 1996

Website: elotouch.com

Key Highlights: Elo is the perfect one-stop-shop for your next generation Smart Manufacturing / Industry 4.0 or commercial IoT HMI hardware solution….

#4 Phenom XXL LCD Panel Replacement

Domain Est. 2016

Website: peopoly.net

Key Highlights: This 23.8 4k Resolution LCD panel is the OEM part for the Phenom XXL printer. Panel Lifespan: 500 Hours on average (normally varies from 300-800 hours) and ……

#5 Electronica USA

Domain Est. 2003

Website: electronica-usa.com

Key Highlights: At Electronica, we carry replacement parts for all major brands of LCD, LED, PLASMA, DLP, and CRT television sets….

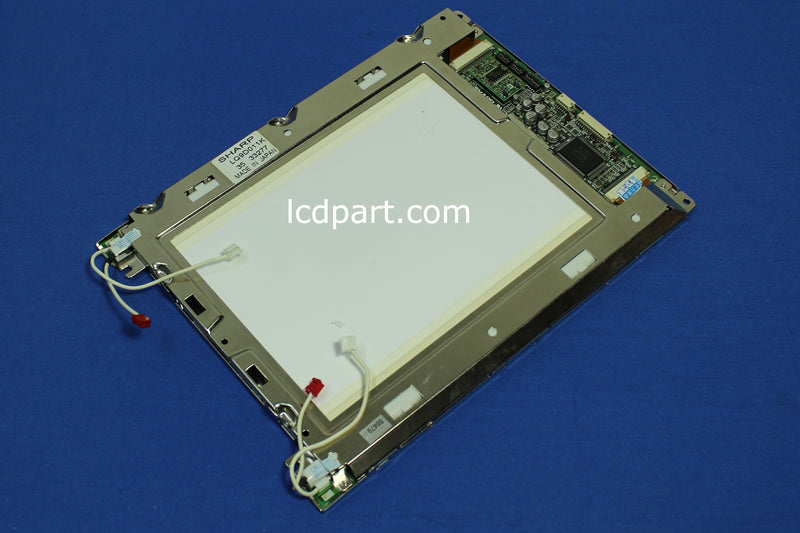

#6 LCDPART.com

Domain Est. 2004

#7 Drop In Replacement

Domain Est. 2007

Website: agdisplays.com

Key Highlights: AGDisplays offers a drop in replacement service for customers who need to replace an LCD or LCD component when their original panel/part is unavailable….

#8 Online shopping for macbook screen ,laptop touch screen and lcd …

Domain Est. 2013

Website: lcdoled.com

Key Highlights: Here is LCDOLED online supplier of macbook screen ,hp screen,lenovo screen ,asus screen and other laptop touch screens 1.More than 10000 models in stock 2….

#9 NCC Prime Incell LCD Screen

Domain Est. 2023

Website: ncc.top

Key Highlights: NCC Prime Incell LCD Screen offers outstanding display quality and easy installation, making it the most popular choice for iPhone screen replacements….

Expert Sourcing Insights for Lcd Panel Replacement

2026 Market Trends for LCD Panel Replacement

The LCD panel replacement market in 2026 is expected to reflect a maturing industry shaped by technological evolution, shifting consumer behaviors, and increasing competition from newer display technologies. While demand remains steady in certain sectors, overall growth is projected to slow compared to previous years. Key trends influencing the market include:

1. Declining Demand in Consumer Electronics

By 2026, the replacement demand for LCD panels in mainstream consumer devices—particularly smartphones and laptops—is anticipated to wane. This decline is driven by the widespread adoption of OLED and emerging microLED displays in premium devices, which offer superior contrast, thinner profiles, and better energy efficiency. As a result, fewer new LCD-based devices are entering the market, reducing the installed base requiring replacements.

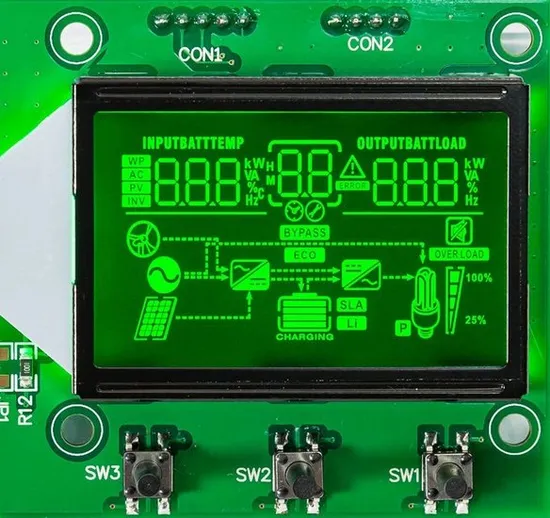

2. Growth in Niche and Industrial Applications

Despite reduced consumer demand, the LCD panel replacement market will maintain relevance in niche and industrial sectors. Applications such as medical monitors, industrial control systems, automotive dashboards (especially in non-luxury vehicles), and legacy retail kiosks continue to rely on LCD technology due to cost-effectiveness, reliability, and long product lifecycles. These sectors will sustain replacement needs through 2026, particularly as older systems remain in operation.

3. Price Pressure and Component Availability

As LCD production shifts focus toward larger panels (e.g., TVs and digital signage) and away from smaller displays, the availability of smaller replacement panels (such as those used in laptops and tablets) may decline. This scarcity could lead to price volatility and supply chain challenges. Service providers and repair shops may face higher costs and longer lead times, pushing some toward refurbished or alternative display solutions.

4. Rise of Refurbished and Recycled Panels

To counter rising prices and supply constraints, the market for refurbished and recycled LCD panels is expected to grow. Refurbishers will play a key role in extending the lifecycle of existing LCD devices, especially in cost-sensitive markets and developing regions. This trend supports circular economy initiatives and appeals to environmentally conscious consumers.

5. Integration with Advanced Repair Ecosystems

By 2026, the LCD replacement market will increasingly integrate with professional repair networks, third-party service providers, and authorized repair programs expanded under Right-to-Repair legislation. Improved access to tools, training, and spare parts will empower independent repair shops, fostering competition and potentially stabilizing prices.

6. Competition from Alternative Technologies

Although OLED and microLED are replacing LCDs in new devices, their higher repair costs and sensitivity to burn-in mean LCDs will remain a cost-effective repair solution. However, as OLED repair techniques improve and become more accessible, the long-term viability of LCD replacements may face further pressure beyond 2026.

In conclusion, the LCD panel replacement market in 2026 will be characterized by declining consumer relevance but sustained demand in industrial and specialized applications. Success in this market will depend on adaptability, supply chain resilience, and the ability to serve legacy systems efficiently.

Common Pitfalls When Sourcing LCD Panel Replacements: Quality and IP Risks

Sourcing LCD panel replacements—whether for consumer electronics repair, industrial equipment maintenance, or OEM manufacturing—can be fraught with challenges. Two major areas of concern are product quality and intellectual property (IP) compliance. Overlooking these can lead to performance issues, legal exposure, and reputational damage.

Poor Quality and Counterfeit Components

One of the most prevalent pitfalls is receiving substandard or counterfeit LCD panels. These may appear identical to genuine parts but fail prematurely or underperform.

- Inconsistent Performance: Low-quality panels may exhibit color inaccuracies, uneven backlighting, dead pixels, or reduced brightness. These issues compromise user experience and increase return rates.

- Short Lifespan: Panels from unverified suppliers often use inferior materials and manufacturing processes, resulting in faster degradation and higher failure rates.

- Lack of Testing and Certification: Reputable suppliers provide panels tested for reliability (e.g., temperature, humidity, vibration). Off-market replacements often skip these steps, leading to field failures.

- Counterfeit or Refurbished Panels: Some suppliers sell used or salvaged panels as new. These may have hidden physical damage or wear that affects performance.

To mitigate this, always source from authorized distributors or manufacturers with verifiable quality control processes. Request datasheets, certifications (e.g., ISO, RoHS), and batch testing reports.

Intellectual Property (IP) and Legal Risks

Using unauthorized or cloned LCD panels can expose businesses to serious legal consequences.

- Trademark and Patent Infringement: Many LCD panels incorporate proprietary technology protected by patents or design rights. Sourcing non-licensed replacements may infringe on these rights, especially if the panel closely mimics a branded component.

- Use of Unauthorized Clones: Some third-party panels are reverse-engineered copies of original designs. While technically functional, their production and sale may violate IP laws, leading to cease-and-desist letters or litigation.

- Lack of Licensing Agreements: Original Equipment Manufacturers (OEMs) often license panel designs to specific suppliers. Using panels from suppliers without proper licensing increases legal exposure.

- Supply Chain Liability: Even if your company didn’t manufacture the infringing part, purchasing and integrating it into your product may still implicate you in IP violations under certain jurisdictions.

To avoid IP issues, conduct due diligence on suppliers. Ask for proof of licensing, request legal documentation, and consider consulting IP counsel when sourcing critical components.

Conclusion

Sourcing LCD panel replacements requires careful attention to both quality assurance and IP compliance. Prioritize suppliers with transparent manufacturing practices, verifiable certifications, and proper licensing. Investing time in due diligence helps prevent costly failures, legal disputes, and damage to brand reputation.

Logistics & Compliance Guide for LCD Panel Replacement

This guide outlines the essential logistics and compliance considerations for the successful and safe replacement of LCD panels across various industries, including consumer electronics, industrial equipment, medical devices, and commercial displays.

Inventory Management & Procurement

Maintain accurate records of LCD panel models, specifications (size, resolution, interface type, backlight), and supplier details. Implement a procurement strategy that ensures timely availability of replacement panels while minimizing overstocking. Utilize barcode or RFID tracking for efficient inventory control and traceability throughout the supply chain.

Supplier Qualification & Component Sourcing

Only source LCD panels from vetted suppliers who comply with relevant industry standards. Verify that panels meet required specifications and are free from known defects. Ensure suppliers provide necessary documentation, including RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) compliance certificates where applicable.

Transportation & Handling Requirements

Package LCD panels in anti-static, shock-absorbent materials to prevent physical damage during transit. Clearly label packages as “Fragile” and “Handle with Care.” Maintain proper orientation during transportation to avoid pressure on the display surface. Control environmental conditions (temperature, humidity) to within manufacturer-specified ranges, especially for sensitive or high-resolution panels.

Storage Conditions

Store replacement LCD panels in a clean, dry, temperature-controlled environment, away from direct sunlight and sources of electromagnetic interference. Keep panels in their original packaging until ready for installation. Avoid stacking or placing heavy objects on stored panels to prevent mechanical stress or cracking.

Installation & Technical Compliance

Ensure only trained and authorized personnel perform LCD panel replacements. Follow manufacturer-recommended installation procedures precisely, including proper grounding to prevent electrostatic discharge (ESD) damage. Verify compatibility with existing hardware and firmware before installation. Document all replacements, including serial numbers, dates, and technician information.

Waste Disposal & Environmental Compliance

Dispose of removed LCD panels in accordance with local, national, and international environmental regulations. LCDs may contain hazardous materials such as mercury (in CCFL backlights) or lead. Partner with certified e-waste recyclers who adhere to WEEE (Waste Electrical and Electronic Equipment) directives or equivalent frameworks. Maintain records of disposal for audit and compliance purposes.

Regulatory & Safety Documentation

Keep comprehensive documentation for audit readiness, including:

– Bill of Materials (BOM) with component origins

– Compliance certificates (RoHS, REACH, WEEE)

– Installation logs and service records

– Risk assessments for handling and disposal

Ensure adherence to OSHA (Occupational Safety and Health Administration) or equivalent workplace safety regulations during handling and installation.

Quality Assurance & Traceability

Implement a quality control process post-replacement, including visual inspection and functional testing. Use serialized tracking to maintain full traceability from procurement through installation and disposal. This supports root cause analysis in case of field failures and ensures regulatory compliance during audits.

Training & Personnel Certification

Provide regular training for technical staff on proper LCD handling, ESD prevention, and compliance protocols. Maintain certification records to demonstrate workforce competency, especially in regulated industries such as healthcare or aerospace where display integrity is critical.

Conclusion for Sourcing LCD Panel Replacement:

Sourcing an LCD panel replacement requires careful consideration of compatibility, quality, supplier reliability, and cost-effectiveness. It is essential to accurately identify the original panel specifications—including size, resolution, connector type, and model number—to ensure a seamless fit and optimal performance. While OEM panels offer the highest compatibility and quality, aftermarket alternatives can provide cost savings if sourced from reputable suppliers. Evaluating vendor credibility through reviews, warranties, and return policies helps mitigate risks associated with defective or counterfeit parts. Additionally, considering repair versus replacement costs, and factoring in labor and availability, ensures a sustainable and economical decision. Ultimately, a thorough and informed sourcing strategy minimizes downtime, extends the device’s lifespan, and maintains display performance standards.