The global LCD panel controller board market is experiencing robust growth, driven by rising demand for displays across consumer electronics, automotive, industrial automation, and healthcare sectors. According to a 2023 report by Mordor Intelligence, the global display market is projected to grow at a CAGR of over 7.5% from 2023 to 2028, with LCD controller boards playing a pivotal role in display interface management and performance optimization. This growth is further fueled by the proliferation of intelligent devices, advancements in display resolutions, and increasing adoption of human-machine interfaces (HMIs) in industrial applications. As the backbone of LCD functionality—managing timing, power, and signal processing—controller boards are critical components that determine display quality and reliability. With market expansion comes heightened competition among manufacturers to innovate and deliver high-performance, cost-efficient solutions. Based on market presence, product range, technological advancement, and global reach, we’ve identified the top 10 LCD panel controller board manufacturers shaping the industry’s future.

Top 10 Lcd Panel Controller Board Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 LCM Display, LCD Panel & Modules Manufacturer & Supplier …

Domain Est. 1998 | Founded: 1998

Website: winstar.com.tw

Key Highlights: Established in 1998, WINSTAR Display Co., Ltd. is a trusted manufacturer and supplier of LCD display modules and panels….

#2 Orient Display

Domain Est. 1999

Website: orientdisplay.com

Key Highlights: Orient Display is a company that specializes in manufacturing custom display technology solutions such as LCD modules, active color TFT LCD displays….

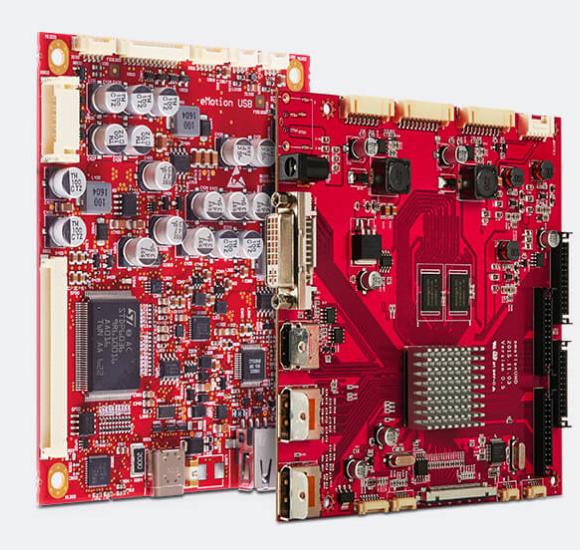

#3 LCD and TFT displays, OLED, HMI with and without touch

Domain Est. 2000

Website: lcd-module.com

Key Highlights: Manufacturer of LCD, TFT, ▷ HMI and ▷ OLED displays for industrial requirements. The focus is on ▷ long availability, high quality and excellent advice….

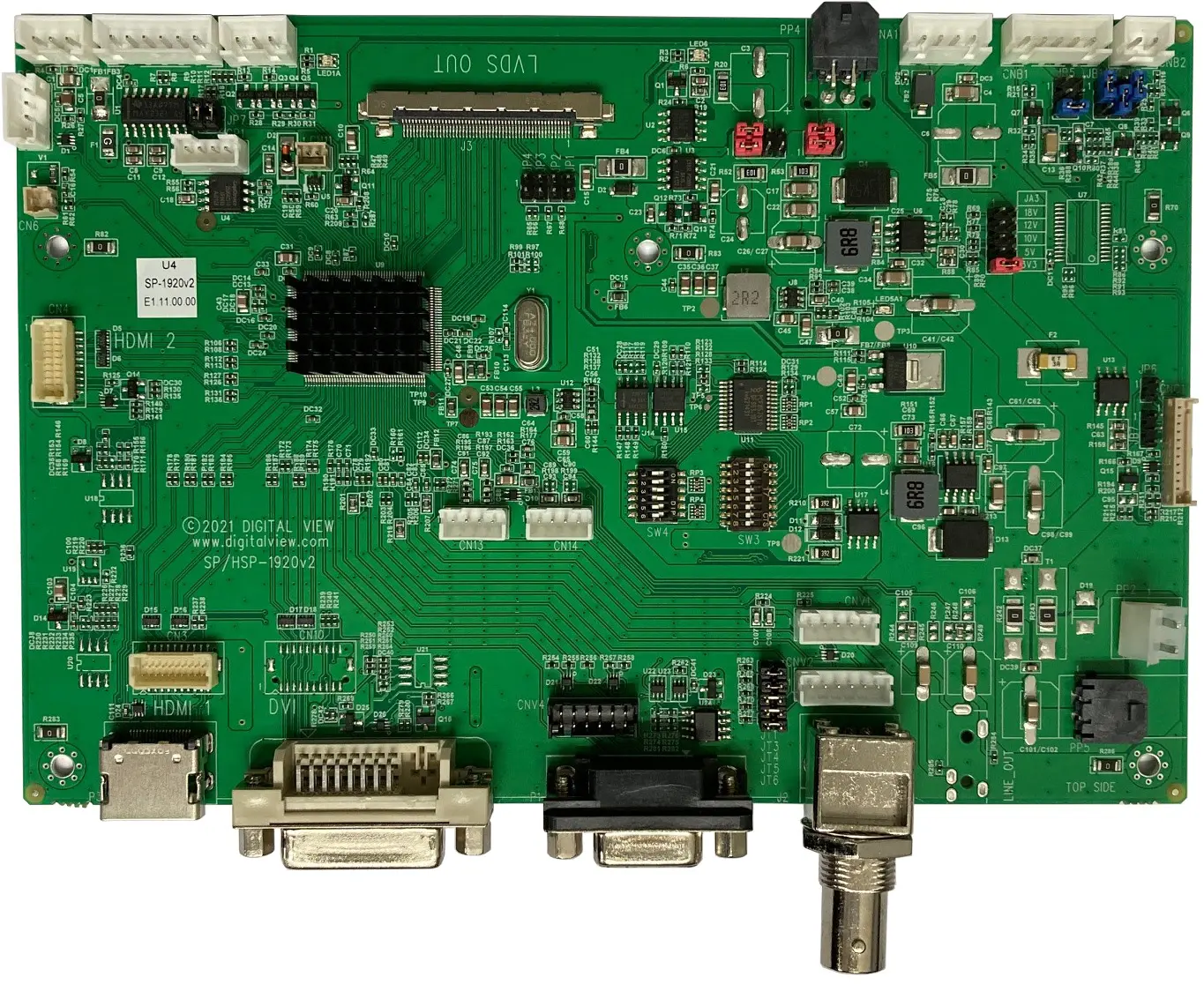

#4 Digital View Page

Domain Est. 1996

Website: digitalview.com

Key Highlights: LCD controller boards for LCD panels of all sizes & resolutions from 640×480 up to 4K for use in all types of commercial & industrial video monitors….

#5 DATA MODUL

Domain Est. 1998

Website: data-modul.com

Key Highlights: DATA MODUL offers innovative display solutions, also with touch technology. From distribution to custom display, touch, monitor & Panel PC solutions….

#6 LCD Controller Boards

Domain Est. 1996

Website: edgeelectronics.com

Key Highlights: As a distributor of LCD controller boards (aka LCD control cards or LCD controllers), we can provide you with the correct controller board for your LCD….

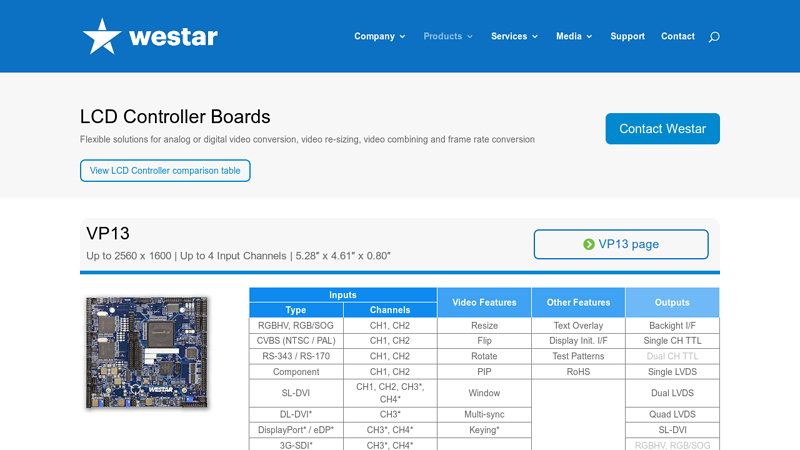

#7 LCD Controller Boards

Domain Est. 2003

Website: westardisplaytechnologies.com

Key Highlights: We offer a broad range of customizable LCD controller boards to meet your needs. Our boards are designed to work with a variety of input video formats and ……

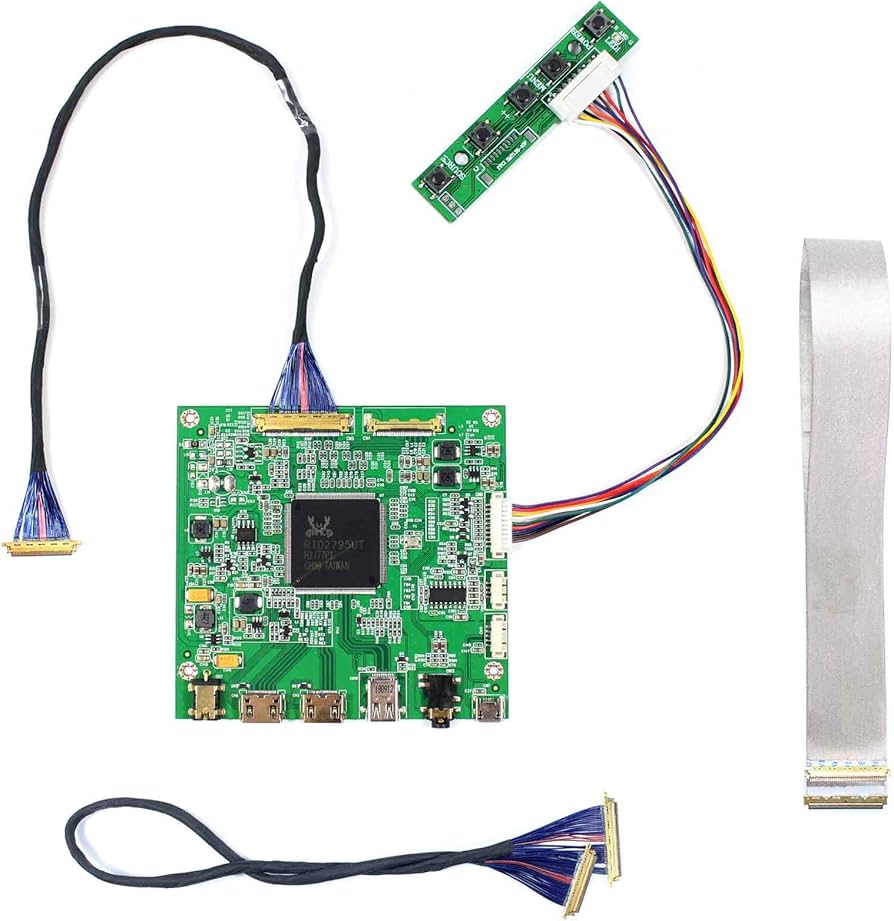

#8 lcd module with controller board

Domain Est. 2009

Website: vslcd.com

Key Highlights: The headquarters is located in Shenzhen. The products include LCD Screen,LCD Display Kits, LCD Controller Board, Touch Panel,TFT LCD Module etc….

#9 LCD Controller Board

Domain Est. 2021

Website: tailorpixels.com

Key Highlights: Tailor Pixels’ LCD controller boards are designed to support LCD panels used in display, touch interaction, and other functions for various application ……

#10 LCD Controller Board & LCD Kit

Domain Est. 2023

Website: santekdisplay.com

Key Highlights: Free shipping nationwide. Orders placed before 12:00 will be shipped the same day. (Excluding Sat., Sun. and holidays)…

Expert Sourcing Insights for Lcd Panel Controller Board

H2: 2026 Market Trends for LCD Panel Controller Boards

The global market for LCD panel controller boards is poised for significant transformation by 2026, driven by advancements in display technology, increasing demand for smart devices, and the integration of automation across industries. These small but critical components, responsible for managing signal processing and image rendering on LCD panels, are evolving to meet the demands of higher resolutions, faster refresh rates, and energy efficiency.

-

Rising Demand from Consumer Electronics

The proliferation of high-resolution displays in smartphones, tablets, laptops, and televisions continues to fuel demand for advanced LCD controller boards. By 2026, manufacturers are expected to shift toward integrated controllers capable of supporting 4K and even 8K resolutions with low latency, particularly in premium consumer devices. Mini-LED backlighting and enhanced local dimming features are also increasing the complexity and functionality of controller boards. -

Growth in Automotive Applications

The automotive sector is emerging as a key growth driver. With the rise of digital dashboards, infotainment systems, and heads-up displays (HUDs), LCD controller boards are becoming essential in modern vehicle designs. Trends toward electric vehicles (EVs) and autonomous driving systems are accelerating adoption, as these vehicles require more sophisticated, reliable, and temperature-resistant control electronics. By 2026, automotive-grade LCD controllers are projected to account for a growing share of the market. -

Expansion in Industrial and Medical Displays

Industrial automation, smart manufacturing, and medical imaging devices are increasingly reliant on high-performance displays. LCD controller boards tailored for rugged environments, wide operating temperatures, and long-term reliability are seeing heightened demand. In healthcare, diagnostic monitors and portable medical devices require precise color reproduction and real-time responsiveness—capabilities that next-gen controllers are being optimized to deliver. -

Integration with IoT and Smart Technologies

The Internet of Things (IoT) is enabling smarter displays across retail, hospitality, and public infrastructure. Interactive kiosks, digital signage, and smart home interfaces depend on efficient LCD controllers that support wireless connectivity, remote updates, and adaptive brightness. By 2026, controller boards with built-in IoT compatibility and edge processing capabilities are expected to become standard in many applications. -

Technological Convergence and Miniaturization

As space constraints grow in compact devices, LCD controller boards are trending toward higher integration and miniaturization. System-on-Board (SoB) and System-in-Package (SiP) solutions that combine timing controllers (TCON), power management, and interface logic are gaining traction. This consolidation reduces component count, improves energy efficiency, and enhances overall system reliability. -

Regional Market Dynamics

Asia-Pacific, particularly China, South Korea, and Taiwan, remains the dominant hub for both manufacturing and consumption of LCD controller boards. However, increasing investments in display technologies in North America and Europe—especially in the automotive and medical sectors—are expected to diversify the market landscape by 2026. -

Competitive Landscape and Innovation

Key players such as Novatek, Himax Technologies, and Samsung are investing heavily in R&D to develop controllers with AI-driven image enhancement, dynamic power optimization, and support for emerging interface standards like V-by-One US and DisplayPort 2.0. These innovations are setting new benchmarks for performance and scalability.

In conclusion, the 2026 market for LCD panel controller boards will be shaped by a confluence of technological innovation, sector-specific demands, and global supply chain dynamics. While competition from OLED and micro-LED technologies persists, LCDs—especially in cost-sensitive and high-volume applications—will continue to rely on increasingly intelligent and efficient controller solutions, ensuring sustained relevance and growth in the display ecosystem.

Common Pitfalls When Sourcing LCD Panel Controller Boards

Quality-Related Pitfalls

Inconsistent Component Sourcing

Suppliers may use varying grades of components (e.g., capacitors, drivers, PCB materials) across production batches, leading to inconsistent performance and reduced reliability. This often occurs with low-cost manufacturers who prioritize cost over consistency.

Lack of Environmental and Durability Testing

Many budget controller boards are not subjected to rigorous testing for temperature extremes, humidity, vibration, or long-term operation. This can result in premature failures, especially in industrial or outdoor applications.

Poor PCB Design and Manufacturing

Issues such as inadequate thermal management, improper trace routing, or substandard soldering can cause overheating, signal interference, or intermittent connections. These flaws may not be visible during initial inspection but lead to field failures.

Absence of Quality Certifications

Reputable suppliers typically provide evidence of compliance with standards such as ISO 9001, RoHS, or CE. Sourcing from vendors without these certifications increases the risk of receiving non-compliant or unreliable products.

Intellectual Property (IP) and Compliance Risks

Use of Unlicensed Firmware or IP

Some controller boards incorporate firmware or design elements protected by intellectual property rights without proper licensing. This exposes the buyer to legal risks, especially if the product is sold in regulated markets.

Counterfeit or Cloned Designs

Low-cost suppliers may offer boards that mimic well-known reference designs or branded products without authorization. These clones often lack proper validation and may infringe on patents or copyrights.

Lack of Transparency in Design Origins

Suppliers may not disclose the original source of the controller board design or firmware, making it difficult to assess IP compliance or support long-term maintenance and updates.

Inadequate Documentation and Support

Poor or missing technical documentation—including datasheets, schematics, and programming guides—can hinder integration and troubleshooting. It may also indicate that the supplier is not the legitimate designer, raising concerns about IP legitimacy.

Logistics & Compliance Guide for LCD Panel Controller Board

Overview

This guide provides essential information for the safe, efficient, and compliant international logistics and regulatory compliance of LCD Panel Controller Boards. These electronic components are subject to various transportation, customs, and environmental regulations due to their technical nature, materials, and global supply chain requirements.

Product Classification and Identification

LCD Panel Controller Boards are typically classified under the Harmonized System (HS) code 8543.70 or 8542.31, depending on function and integration level. Accurate classification is critical for customs clearance, duty assessment, and trade compliance. Ensure datasheets and technical specifications are available to support classification.

Packaging and Labeling Requirements

- Use anti-static packaging to prevent electrostatic discharge (ESD) damage.

- Include moisture barrier bags (MBB) if components are moisture-sensitive (check MSD level on datasheet).

- Label each package with:

- Product name and part number

- Electrostatic-sensitive device (ESD) warning symbol

- Country of origin

- Handling instructions (e.g., “Fragile,” “Do Not Stack”)

- RoHS and REACH compliance marks (if applicable)

Transportation and Shipping

- Mode of Transport: Suitable for air, sea, and ground freight. Air freight is recommended for high-value or time-sensitive shipments.

- Temperature and Humidity: Maintain storage and transport conditions between 10°C–30°C and 30%–60% relative humidity. Avoid condensation.

- Shock and Vibration: Use cushioned packaging and avoid extreme physical stress during transit.

- UN/DOT Regulations: Not classified as hazardous under IATA/IMDG unless containing restricted batteries or hazardous substances. Confirm with Safety Data Sheet (SDS) if applicable.

Export Controls and Trade Compliance

- ECCN (Export Control Classification Number): Typically classified under 3A999 (less commonly 3A001) in the U.S. EAR, indicating minimal export restrictions for most destinations.

- License Requirements: Generally no license required for most end-users and destinations, but validate based on:

- End-use (military applications may require authorization)

- Destination country (check U.S. Commerce Country Chart or EU dual-use list)

- End-user (screen against denied parties lists such as BIS Denied Persons List)

- Maintain export records for at least 5 years.

Regulatory Compliance

- RoHS (EU Directive 2011/65/EU): Ensure lead-free construction and compliance with restricted substances (Pb, Cd, Hg, etc.). Provide RoHS compliance declaration.

- REACH (EC 1907/2006): Confirm absence of Substances of Very High Concern (SVHC) above threshold levels.

- WEEE (EU Directive 2012/19/EU): Applicable at product end-of-life; ensure proper labeling and registration if sold in EU as part of finished goods.

- China RoHS: Labeling required if exported to China; provide environmental protection use period and substance information.

Customs Documentation

Ensure the following are prepared for international shipments:

– Commercial Invoice (with detailed description, HS code, value, and origin)

– Packing List

– Certificate of Origin (preferably Form A or EUR.1 for preferential treatment)

– Bill of Lading or Air Waybill

– RoHS/REACH Compliance Certificate (when requested)

– Export Declaration (e.g., AES filing in the U.S.)

Import Regulations by Key Markets

- United States: No import license required for standard controller boards. CBP may inspect for HTSUS classification accuracy and IPR compliance.

- European Union: Subject to CE marking if integrated into a final product. Ensure conformity with EMC and Low Voltage Directives if applicable.

- China: Requires CCC certification only if part of a regulated end product (e.g., display equipment). Otherwise, general import procedures apply.

- India: May require BIS registration depending on end product classification. Check latest EPCA regulations.

Reverse Logistics and End-of-Life

- Establish take-back procedures in compliance with local WEEE or e-waste regulations.

- Partner with certified e-waste recyclers for safe disposal or refurbishment.

- Avoid landfill disposal; recover valuable components and metals responsibly.

Best Practices

- Conduct regular audits of compliance documentation and shipping procedures.

- Train logistics and procurement staff on ESD handling and regulatory updates.

- Use a certified 3PL provider with expertise in electronics logistics.

- Monitor regulatory changes (e.g., new RoHS exemptions, export rule updates).

Conclusion

Proper logistics planning and compliance adherence are essential to ensure uninterrupted supply chain operations and legal market access for LCD Panel Controller Boards. Maintain accurate records, stay updated on international regulations, and work closely with customs brokers and compliance experts to mitigate risks.

Conclusion for Sourcing LCD Panel Controller Board:

After evaluating various suppliers, technical specifications, and cost considerations, sourcing an LCD panel controller board requires a balanced approach that prioritizes compatibility, reliability, and long-term support. It is essential to select a controller board that matches the exact interface, resolution, and timing requirements of the LCD panel to ensure optimal performance. Additionally, choosing suppliers with proven track records, responsive technical support, and compliance with industry standards (such as RoHS and CE) minimizes integration risks and potential downtime.

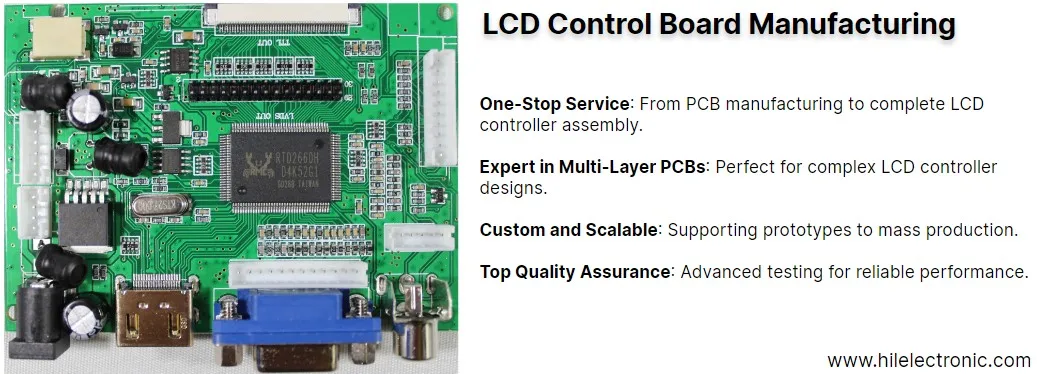

Sourcing from manufacturers or distributors offering scalable solutions and future-proof designs—such as boards supporting multiple input formats (HDMI, LVDS, RGB) and firmware updates—can enhance flexibility across different applications. While cost is a consideration, it should not compromise quality or support, especially for mission-critical or high-volume deployments.

Ultimately, a successful sourcing strategy involves thorough technical due diligence, evaluation of sample units, and establishing strong supplier relationships to ensure consistent supply, timely technical assistance, and access to firmware or hardware revisions as needed. By focusing on these factors, organizations can ensure reliable integration and sustained operation of their display systems.