The global laser cleaning market is experiencing robust growth, driven by increasing demand for eco-friendly and precision-based surface treatment solutions across industries such as automotive, aerospace, and manufacturing. According to a report by Grand View Research, the global laser cleaning market size was valued at USD 553.7 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 17.4% from 2023 to 2030. This surge is attributed to the rising adoption of laser ablation technologies as a sustainable alternative to chemical and mechanical cleaning methods. As industries prioritize efficiency and regulatory compliance, the demand for advanced laser stripper systems has intensified, fostering innovation among key manufacturers. Below is a data-informed overview of the top 8 laser stripper manufacturers shaping this high-growth sector.

Top 8 Lazer Stripper Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 China Laser Paint Stripper

Website: laserstripper.com

Key Highlights: Leading laser rust stripper manufacturer in China. LASERSTRIPPER delivers efficient pulsed laser cleaning machines for paint & rust removal from metal and ……

#2 P-laser Industrial laser cleaning

Website: p-laser.com

Key Highlights: we engineer and manufacture the most advanced—and most powerful—pulsed industrial laser cleaning systems on the market, built for both manual and automated ……

#3 SFX Laser

Website: sfxlaser.com

Key Highlights: SFX Laser is a 20+ years professional laser equipment manufacturer including laser cleaning machine, laser welding machine, fiber laser engraver, fiber laser…

#4 Clean Laser Systems

Website: cleanlaser.de

Key Highlights: IPG | cleanLASER has been developing and producing high-precision laser systems for cleaning and industrial surface treatment for more than 20 years….

#5 Argento Lux

Website: argentolux.com

Key Highlights: Argento Lux, experts in laser cleaning, utilizing high-powered lasers to remove contamination from various surfaces. Similar to sandblasting without the ……

#6 HGLASER

Website: hglaserglobal.com

Key Highlights: HGLASER is a leading provider of laser cutting machine, laser marking mahcine and laser cleaning machine.Email:[email protected]….

#7 The 4JET Group

Website: 4jet.de

Key Highlights: 4JET develops innovative laser systems for cleaning, patterning, marking, cutting and modifying materials to achieve high-quality component surfaces….

#8 Micro Electronics

Website: micro-strip.com

Key Highlights: Laser fiber manufactures and customers use the Micro-Strip tool to strip a large variety of laser fiber applications. The Micro-Strip tools can strip from 200um ……

Expert Sourcing Insights for Lazer Stripper

H2: 2026 Market Trends for Lazer Stripper

“Lazer Stripper” (commonly spelled “Laser Stripper”) refers to laser-based systems used for precision removal of coatings, paints, oxides, or contaminants from surfaces—commonly in aerospace, automotive, electronics, and cultural heritage restoration. While speculative, the following analysis projects key market trends expected to shape the Laser Stripper industry by 2026, based on technological advancements, regulatory shifts, and industrial demands.

1. Increased Adoption in Aerospace & Defense

By 2026, the aerospace and defense sector is anticipated to be a primary growth driver for laser stripping technology. Stringent regulatory requirements (e.g., REACH, NESHAP) limiting chemical paint stripping are pushing manufacturers toward environmentally compliant alternatives. Laser systems offer precise, non-contact removal of coatings from sensitive components—such as aircraft fuselages and turbine blades—without damaging substrates. OEMs like Boeing and Airbus are expected to expand laser integration into maintenance, repair, and overhaul (MRO) operations, boosting market demand.

2. Advancements in Fiber and Ultrashort Pulse Lasers

Technological innovation will center on fiber lasers and ultrafast (picosecond and femtosecond) pulsed lasers. By 2026, improved efficiency, reduced operational costs, and enhanced portability of fiber-based systems will make laser strippers more accessible to mid-sized manufacturers. Ultrashort pulse lasers will gain traction for high-precision applications in electronics and medical device manufacturing, where minimal heat-affected zones are critical. These lasers enable selective layer removal without damaging underlying materials—a key advantage over mechanical or chemical methods.

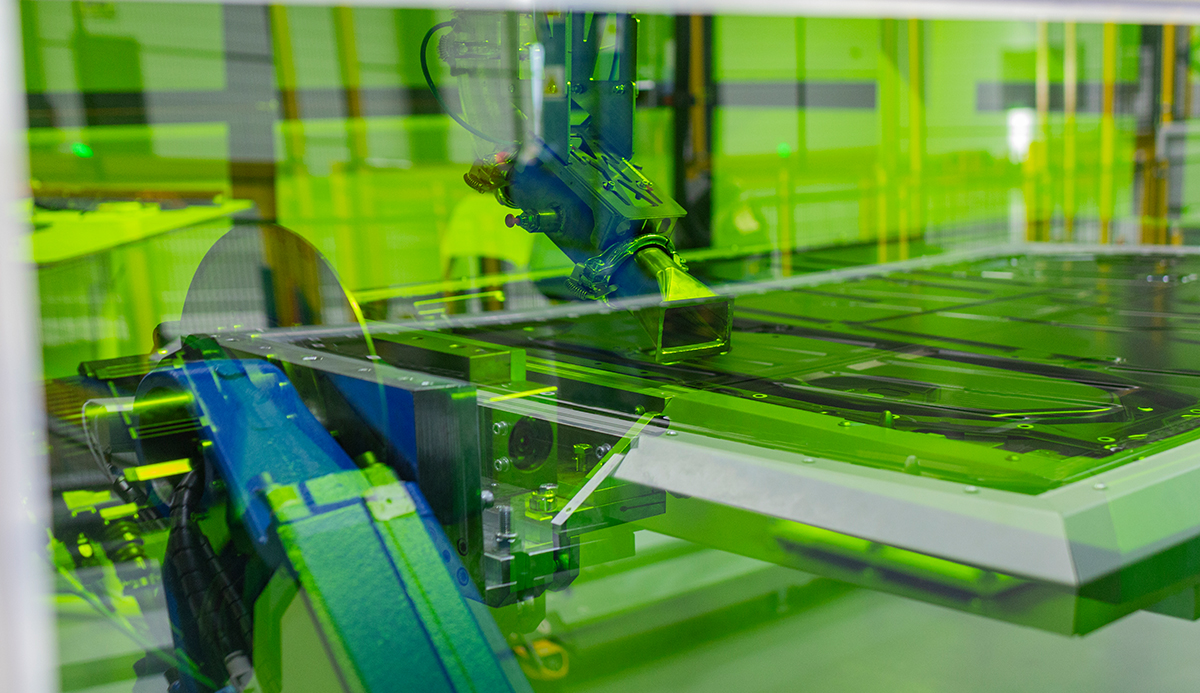

3. Automation and Integration with Robotics

The integration of laser stripping systems with robotic arms and AI-driven vision systems will be a dominant trend. Automated laser stripping cells will allow for consistent, high-throughput surface preparation in automotive and industrial manufacturing. In 2026, smart systems using machine learning algorithms will adapt laser parameters in real-time based on material feedback, improving efficiency and reducing operator dependency. This shift supports Industry 4.0 initiatives and reduces human exposure to hazardous stripping processes.

4. Sustainability and Regulatory Pressure Driving Demand

Environmental regulations restricting volatile organic compounds (VOCs) and hazardous waste from chemical strippers (e.g., methylene chloride) will accelerate adoption of laser technology. Laser stripping generates minimal waste—mostly particulate matter that can be filtered—and eliminates the need for solvent disposal. By 2026, companies seeking ESG (Environmental, Social, and Governance) compliance will favor laser systems as part of green manufacturing strategies, particularly in Europe and North America.

5. Expansion into New Application Areas

Beyond traditional sectors, laser strippers will penetrate emerging markets by 2026:

– Electric Vehicle (EV) Manufacturing: For cleaning battery components and preparing surfaces for bonding.

– Renewable Energy: Maintenance of wind turbine blades and solar panel frames.

– Art Restoration: Gentle removal of grime and varnish from historical artifacts without surface damage.

– Semiconductors: Precision cleaning of wafers and molds.

6. Cost Reduction and Market Democratization

While high initial investment remains a barrier, the total cost of ownership (TCO) of laser strippers is expected to decline by 2026 due to:

– Lower laser source costs (driven by mass production in fiber laser diodes).

– Reduced maintenance and consumable expenses.

– Government incentives for clean technology adoption.

This will make laser stripping feasible for small and medium enterprises (SMEs), broadening the market base.

7. Regional Growth Variations

- North America and Europe: Leading adoption due to strict environmental laws and advanced manufacturing ecosystems.

- Asia-Pacific: Fastest growth region, driven by expanding aerospace, automotive, and electronics industries in China, Japan, and South Korea. Local manufacturing of laser systems will reduce costs and increase accessibility.

Conclusion

By 2026, the laser stripper market will be shaped by a confluence of environmental regulation, technological innovation, and industrial automation. The shift toward sustainable, precise, and automated surface treatment solutions will position laser stripping as a critical technology across multiple high-value sectors. Companies investing in R&D, robot integration, and eco-friendly compliance will lead the market, while cost reductions will spur wider adoption across global supply chains.

Common Pitfalls When Sourcing Lazer Stripper (Quality, IP)

Sourcing Lazer Stripper—a specialized laser-based paint and coating removal tool—can present significant challenges, particularly regarding product quality and intellectual property (IP) risks. Being aware of these pitfalls is crucial for making informed procurement decisions and avoiding legal or operational setbacks.

Quality-Related Pitfalls

Inconsistent Performance and Reliability

One of the most frequent issues is variability in performance across different units or batches. Lower-quality Lazer Stripper units may deliver inconsistent power output, leading to incomplete stripping or thermal damage to substrates. Buyers often discover that advertised specifications (e.g., wattage, pulse frequency, duty cycle) do not match real-world performance due to poor calibration or substandard components.

Use of Subpar Components

Some suppliers cut costs by using inferior optical components, cooling systems, or control electronics. This compromises safety, longevity, and precision. For example, inadequate cooling can lead to frequent downtime or premature laser diode failure, increasing total cost of ownership.

Lack of Safety and Compliance Certifications

Reputable Lazer Stripper systems must comply with international safety standards (e.g., FDA/CDRH in the U.S., IEC 60825 for laser safety). Sourcing from non-compliant manufacturers risks workplace hazards and regulatory penalties. Some suppliers may provide falsified or incomplete certification documentation.

Insufficient Support and Documentation

Low-cost vendors may offer little to no technical support, training, or detailed operating manuals. This can result in improper use, reduced effectiveness, and increased risk of accidents or equipment damage.

Intellectual Property (IP) Pitfalls

Risk of Infringing Patented Technology

Laser ablation systems like Lazer Stripper often incorporate patented technologies related to beam delivery, control algorithms, or safety interlocks. Sourcing from manufacturers that do not license these technologies exposes buyers to potential IP litigation, especially in regulated markets like aerospace or defense.

Counterfeit or Clone Products

The market includes counterfeit or reverse-engineered versions of proprietary Lazer Stripper designs. These clones may mimic appearance and specs but lack the innovation, safety, and support of authentic systems. Purchasing them can inadvertently support IP theft and expose the buyer to legal liability.

Unclear or Missing IP Ownership Documentation

Suppliers may fail to provide proof of legitimate IP ownership or licensing agreements. Without proper due diligence, buyers could unknowingly acquire systems built using stolen or unlicensed technology, leading to supply chain disruptions or legal action.

Limited Ability to Innovate or Customize

When sourcing from vendors with weak IP foundations, customers may find themselves restricted from modifying or integrating the system into proprietary workflows due to ambiguous licensing terms or fear of infringing third-party rights.

Mitigation Strategies

- Conduct thorough due diligence on suppliers, including factory audits and verification of certifications.

- Request detailed technical documentation and third-party test reports.

- Engage legal counsel to review IP rights, licensing, and warranty terms before purchase.

- Prioritize suppliers with transparent R&D processes and a track record of innovation and compliance.

Avoiding these pitfalls ensures not only a reliable, high-performing Lazer Stripper system but also protects your organization from legal and operational risks.

Logistics & Compliance Guide for Lazer Stripper

Product Classification and Regulatory Overview

Lazer Stripper is classified as a chemical product designed for surface treatment and coating removal. Depending on its formulation, it may contain hazardous substances regulated under various international, national, and regional frameworks. Prior to shipping or handling, confirm the exact chemical composition and review the Safety Data Sheet (SDS) to determine applicable regulations.

Hazard Communication and Labeling

Ensure all containers are labeled in accordance with the Globally Harmonized System of Classification and Labelling of Chemicals (GHS). Labels must include hazard pictograms, signal words (e.g., “Danger”), hazard statements, precautionary statements, and supplier identification. The SDS must be readily available to handlers, distributors, and emergency responders.

Transportation Regulations

Lazer Stripper may be subject to hazardous materials transportation rules, including but not limited to:

– DOT (U.S. Department of Transportation): If shipped within or through the United States, compliance with 49 CFR is required. Packaging, labeling, and documentation must align with the material’s hazard class (e.g., flammable liquid, corrosive).

– ADR (Europe): For road transport in Europe, adhere to ADR regulations based on UN classification.

– IATA/ICAO: For air freight, follow IATA Dangerous Goods Regulations, which may restrict or require special packaging and declarations.

– IMDG Code: For sea transport, comply with the International Maritime Dangerous Goods Code.

Packaging and Containment

Use UN-certified packaging suitable for the chemical’s hazard class. Containers must be leak-proof, compatible with the product’s formulation, and secured against movement during transit. Outer packaging should protect inner containers and display all required hazard labels and handling instructions.

Storage Requirements

Store Lazer Stripper in a cool, dry, well-ventilated area away from direct sunlight, heat sources, and incompatible materials (e.g., oxidizers, strong bases). Use secondary containment to prevent environmental contamination in case of leaks. Ensure storage areas are compliant with local fire and safety codes.

Import and Export Compliance

Verify import/export controls for each destination country. Required documentation may include:

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– SDS

– Export declaration (e.g., U.S. Electronic Export Information via AES)

– Import permits (if required by destination country)

Check for restrictions under programs such as REACH (EU), TSCA (U.S.), or other national chemical inventories.

Environmental and Disposal Compliance

Dispose of Lazer Stripper and contaminated packaging in accordance with local, state, and federal environmental regulations (e.g., EPA in the U.S.). Do not pour down drains or release into the environment. Use licensed hazardous waste disposal services and maintain records of disposal activities.

Training and Personnel Safety

Ensure all personnel involved in handling, storing, or transporting Lazer Stripper are trained in hazardous material safety, emergency response, and proper use of personal protective equipment (PPE), including gloves, goggles, and respirators if necessary.

Incident Response and Emergency Procedures

Maintain spill response kits and emergency procedures on site. In case of spill, fire, or exposure:

– Evacuate non-essential personnel

– Contain spill using inert absorbents

– Refer to SDS for first aid and firefighting measures

– Report incidents to relevant authorities as required by law

Recordkeeping and Audits

Retain shipping documents, SDS versions, training records, and disposal manifests for a minimum of three to five years, depending on jurisdiction. Conduct periodic internal audits to ensure ongoing compliance with all applicable regulations.

Conclusion on Sourcing a Laser Stripper:

After evaluating various suppliers, technical specifications, cost implications, and service support, sourcing a laser stripper presents a strategic opportunity to enhance precision, efficiency, and consistency in wire stripping processes—especially for delicate or high-reliability applications. While the initial investment is higher compared to traditional mechanical strippers, the long-term benefits, including reduced material waste, minimal conductor damage, and compatibility with a wide range of wire types and gauges, justify the cost.

It is recommended to partner with a reputable manufacturer that offers robust technical support, training, and warranty options. Key considerations for final selection include laser power and wavelength suitability, integration capabilities with existing production lines, ease of maintenance, and compliance with safety standards.

In conclusion, sourcing a laser wire stripping system is a forward-thinking decision for companies aiming to improve product quality, support miniaturization trends, and remain competitive in high-tech manufacturing sectors such as aerospace, medical devices, and electronics. Proper due diligence in supplier selection and system validation will ensure a successful implementation and a strong return on investment.