The global laser cleaning market is experiencing robust growth, driven by increasing demand for eco-friendly and precision cleaning solutions across industries such as automotive, aerospace, manufacturing, and heritage conservation. According to a report by Mordor Intelligence, the market was valued at approximately USD 445 million in 2023 and is projected to grow at a CAGR of over 18% from 2024 to 2029. Factors such as stringent environmental regulations, the shift away from chemical and abrasive cleaning methods, and advancements in fiber laser technology are accelerating adoption. Grand View Research further supports this trajectory, highlighting industrial automation and the rising need for maintenance efficiency as key growth enablers. As the market expands, innovation and scalability have become critical differentiators among manufacturers. Based on market presence, technological capability, and customer reach, the following nine companies have emerged as leading laser cleaning solution providers shaping the future of industrial surface treatment.

Top 9 Laserreinigung Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 P-laser Industrial laser cleaning

Website: p-laser.com

Key Highlights: we engineer and manufacture the most advanced—and most powerful—pulsed industrial laser cleaning systems on the market, built for both manual and automated ……

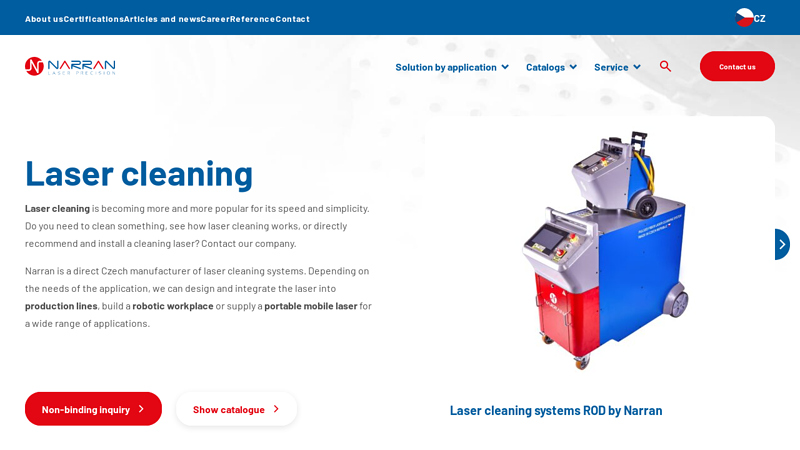

#2 Laser cleaning

Website: narran.cz

Key Highlights: We can design and integrate a laser cleaning system into production, build a robotic workstation or supply a mobile laser for a wide range of applications….

#3 Clean Laser I Hofeditz

Website: hofeditz-baunatal.de

Key Highlights: Based on innovative laser technology, we can offer you completely new solutions, for example in the area of mold cleaning (die casting or forming), paint ……

#4 Cleaning tire molds and segments

Website: cleanlaser.de

Key Highlights: The cleanLASER delivers excellent results when cleaning tire molds. When installed, the molds can be cleaned flexibly and conveniently with the hand-guided ……

#5 Laser Cleaning

Website: eraserlaser.de

Key Highlights: Discover the power of laser cleaning for metal, wood, stone and more. Efficient, residue-free and eco-friendly – precision cleaning made in Germany….

#6 Laser Cleaning

Website: ipgphotonics.com

Key Highlights: Laser cleaning, also known as laser material removal, is an advanced method of eliminating material from a surface achieved through the precise manipulation ……

#7 Die 4JET Gruppe – Innovative Lasersysteme und

Website: 4jet.de

Key Highlights: 4JET entwickelt innovative Lasersysteme zum Reinigen, Strukturieren, Markieren, Schneiden und Modifizieren von Materialien, um hochwertige Bauteiloberflächen zu ……

#8 Huber Lasertec GmbH

Website: huber-lasertec.ch

Key Highlights: Huber Lasertec: Laserreinigung aus der Schweiz: Rost-, Lack-, Fett-, Russ- und Graffitientfernung, sowie Oberflächenaktivierung und Gravuren – ökologisch ……

#9 Laser

Website: laserisse.com

Key Highlights: Die Laserreinigung ist ein aufregendes neues Laserverfahren, bei dem Verunreinigungen (z. B. Kohlenstoff, Silizium und Gummi) durch Laserbestrahlung von der ……

Expert Sourcing Insights for Laserreinigung

H2: Market Trends in Laser Cleaning for 2026

By 2026, the global laser cleaning market is poised for significant transformation, driven by technological advancements, environmental regulations, and expanding industrial adoption. Key trends shaping this growth include:

1. Accelerated Adoption Across Heavy Industries:

The automotive, aerospace, and maritime sectors will increasingly adopt laser cleaning as a primary surface preparation method. In 2026, demand will be fueled by the need for precise, non-destructive rust, paint, and coating removal—especially in maintenance and reconditioning operations. Automotive OEMs will leverage laser systems for engine part refurbishment and weld zone preparation, enhancing efficiency and part longevity.

2. Stricter Environmental Regulations as a Growth Catalyst:

With tightening global environmental standards (e.g., EU Green Deal, U.S. EPA guidelines), industries are moving away from chemical solvents and abrasive blasting. Laser cleaning—being dry, chemical-free, and generating minimal waste—will be favored as a sustainable alternative. By 2026, compliance requirements will make laser cleaning a strategic necessity, particularly in regions with stringent emissions and waste disposal rules.

3. Technological Advancements Driving Accessibility:

Continuous improvements in fiber laser efficiency, handheld system ergonomics, and automation integration will lower operational costs and expand usability. Expect wider availability of compact, portable laser cleaners with enhanced safety features and AI-assisted process control. These innovations will make the technology accessible to SMEs and field service providers, broadening the market beyond large industrial players.

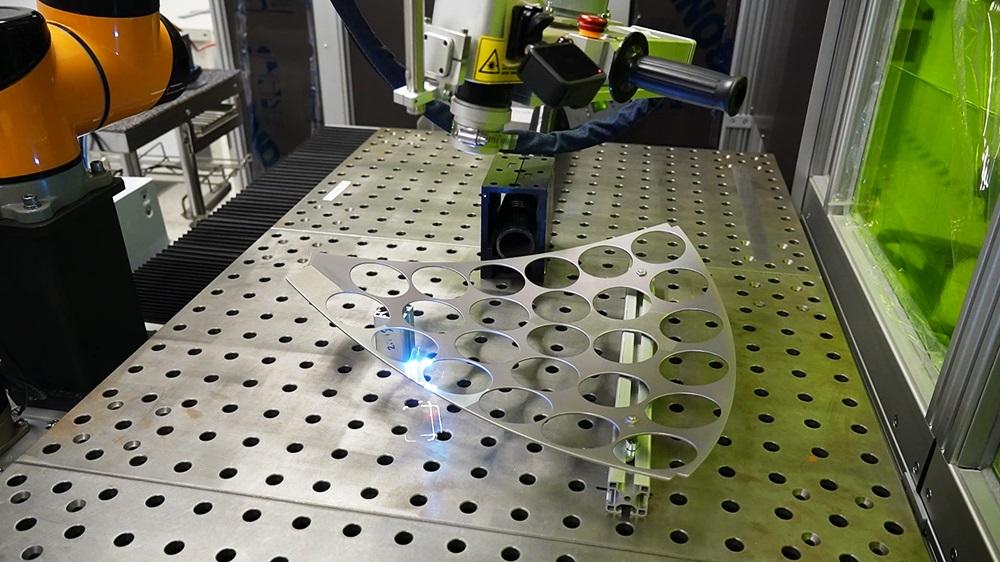

4. Integration with Industry 4.0 and Robotics:

Laser cleaning systems will increasingly be integrated into smart manufacturing environments. By 2026, we will see widespread use of robotic arms equipped with laser heads, guided by real-time sensors and machine vision for adaptive cleaning. This integration will improve consistency, reduce human error, and enable predictive maintenance workflows in automated production lines.

5. Rising Demand in Niche and Emerging Applications:

Beyond traditional industrial uses, laser cleaning will gain traction in cultural heritage restoration, nuclear decommissioning, and electronics manufacturing. Museums and conservation agencies will adopt lasers for delicate artifact cleaning, while the semiconductor industry will use ultra-precise lasers for contaminant removal without damaging sensitive components.

6. Regional Market Expansion:

While North America and Europe remain strong markets due to early adoption and regulatory support, Asia-Pacific—particularly China, India, and South Korea—will experience the highest growth rates. Government initiatives promoting green manufacturing and digitalization will drive investment in laser cleaning technologies across emerging economies.

In summary, by 2026, the laser cleaning market will be characterized by broader industrial integration, stronger environmental drivers, and smarter, more user-friendly technology—solidifying its role as a cornerstone of sustainable and precision surface treatment.

Common Pitfalls When Sourcing Laserreinigung (Quality, IP)

Sourcing laser cleaning solutions involves significant technical and legal considerations. Overlooking key aspects can lead to subpar performance, intellectual property (IP) risks, and financial losses. Below are common pitfalls to avoid.

Unclear Quality Standards and Specifications

One of the most frequent issues is the lack of precise technical specifications in procurement. Laser cleaning effectiveness depends on parameters such as wavelength, pulse duration, power density, and beam quality. Vendors may promise “high-quality” systems without providing measurable performance data, leading to inconsistent cleaning results or equipment that fails under real-world conditions. Always demand detailed technical documentation, performance test reports, and third-party certifications.

Inadequate Testing and Validation

Purchasers often skip on-site or lab testing before full procurement. Assuming that a laser cleaner works based on vendor demonstrations alone—often conducted under ideal conditions—can be misleading. Real-world contaminants, surface materials, and environmental factors can drastically affect performance. Conducting pilot tests with your actual components ensures the system meets your operational needs.

Overlooking Intellectual Property (IP) Rights

Laser cleaning technology often incorporates proprietary software, optical designs, or process know-how. When sourcing from OEMs or third-party suppliers, especially from regions with weaker IP enforcement, there’s a risk of unintentionally acquiring systems that infringe on existing patents. This can result in legal disputes, shipment seizures, or forced equipment decommissioning. Always perform due diligence on the supplier’s IP portfolio and request proof of ownership or licensing for critical components.

Hidden Costs and Lack of After-Sales Support

Initial price quotes may exclude essential costs such as maintenance, spare parts, training, or software updates. Some suppliers offer low upfront prices but charge premium rates for service contracts. Additionally, limited local support can lead to prolonged downtime. Ensure service-level agreements (SLAs), spare parts availability, and technical training are clearly defined and contractually guaranteed.

Insufficient Focus on Safety and Compliance

Laser systems must comply with international safety standards (e.g., IEC 60825). Some low-cost suppliers may cut corners on safety features like interlocks, beam enclosures, or fume extraction integration. Non-compliant systems pose serious risks to operators and can lead to regulatory penalties. Verify that the supplied equipment meets relevant CE, FDA, or other regional compliance requirements.

Supply Chain and Vendor Reliability Risks

Relying on a single or unproven supplier—especially for custom-built systems—exposes buyers to delivery delays, quality inconsistencies, or even vendor insolvency. Conduct supplier audits, check client references, and consider dual sourcing for critical applications to mitigate disruption risks.

By addressing these pitfalls proactively, organizations can ensure they source reliable, compliant, and IP-secure laser cleaning solutions that deliver long-term value.

Logistics & Compliance Guide for Laserreinigung (Laser Cleaning)

Laserreinigung, or laser cleaning, is an advanced, eco-friendly surface cleaning method that uses pulsed laser beams to remove contaminants such as rust, paint, oxides, and coatings from various materials. While highly effective, the logistics and compliance aspects of deploying laser cleaning systems—whether for in-house use, on-site services, or international operations—require careful planning and adherence to regulations. This guide outlines key considerations under logistics and compliance.

Equipment Logistics

Transporting laser cleaning equipment requires attention to safety, fragility, and regulatory standards. Most systems include high-power lasers, power supplies, cooling units, and control interfaces.

- Packaging and Handling: Use shock-absorbing, anti-static packaging. Clearly label sensitive components and include handling instructions.

- Transport Regulations: Comply with IATA/IMDG regulations if shipping internationally, especially for systems containing batteries or pressurized cooling units.

- Import/Export Controls: Check for dual-use technology regulations (e.g., EU Dual-Use Regulation) as high-power lasers may be classified under specific export control lists (e.g., Wassenaar Arrangement).

Facility and Site Requirements

Laser cleaning systems have specific operational requirements that influence logistics planning.

- Power Supply: Ensure access to stable electrical supply (typically 208–480 V AC, 3-phase). Mobile units may require generators.

- Ventilation and Fume Extraction: Install HEPA-filtered fume extraction systems to capture particulate matter generated during cleaning, especially when removing hazardous coatings (e.g., lead-based paint).

- Space and Accessibility: Allow sufficient workspace for operator movement, equipment setup, and beam safety zones.

Safety Compliance

Laser safety is paramount. Compliance with international and local safety standards is mandatory.

- Laser Classification: Most industrial laser cleaning systems fall under Class 4 (IEC 60825-1), requiring strict control measures.

- Protective Measures:

- Use of laser safety enclosures or barriers.

- Mandatory personal protective equipment (PPE) including laser safety goggles with appropriate optical density (OD).

- Interlocks and emergency stop systems.

- Training: Operators must be certified in laser safety (e.g., according to ANSI Z136.1 in the U.S. or DGUV Rule 119-105 in Germany).

- Workplace Safety Documentation: Maintain a Laser Safety Program, including risk assessments and standard operating procedures (SOPs).

Environmental and Health Regulations

Laser cleaning produces airborne particulates and ablation byproducts, triggering environmental and occupational health regulations.

- Emissions Control: Use certified filtration systems to capture hazardous particulates. Regularly maintain and inspect filters.

- Waste Disposal: Classified waste (e.g., lead, cadmium, or radioactive contaminants) must be disposed of according to local hazardous waste regulations (e.g., EPA in the U.S., ECHA in the EU).

- Air Quality Monitoring: Conduct periodic air monitoring in work areas, especially during prolonged operations.

Regulatory Compliance

Ensure adherence to regional and industry-specific standards.

- Europe:

- Machinery Directive (2006/42/EC) for equipment safety.

- ATEX Directive (2014/34/EU) if used in explosive atmospheres.

- REACH and RoHS compliance for materials used in equipment.

- United States:

- FDA/CDRH regulations for laser products (21 CFR 1040.10).

- OSHA standards for workplace safety (e.g., 29 CFR 1910.97 for non-ionizing radiation).

- Other Regions: Check local standards (e.g., CSA in Canada, PSE in Japan).

Documentation and Recordkeeping

Maintain comprehensive records to demonstrate compliance.

- Equipment manuals, CE/UKCA markings, and conformity declarations.

- Laser safety officer (LSO) appointments and training records.

- Maintenance logs, emission test results, and waste disposal certificates.

- Incident reports and corrective actions.

Mobile and On-Site Operations

For field-based laser cleaning (e.g., infrastructure, shipyards), additional logistical planning is required.

- Permits: Obtain site access and operational permits, especially in regulated environments (e.g., airports, chemical plants).

- Mobile Units: Ensure transport vehicles are equipped with secure mounting, power generation, and safety signage.

- Site Risk Assessments: Conduct pre-operation assessments for each location, considering ambient light, nearby personnel, and reflective surfaces.

By addressing these logistics and compliance aspects, organizations can safely and legally deploy laser cleaning technology while minimizing risks and ensuring operational efficiency. Always consult local authorities and certified safety professionals when implementing laser cleaning systems.

Conclusion for Sourcing Laser Cleaning Equipment

Sourcing laser cleaning technology represents a forward-thinking investment in sustainable, efficient, and precise cleaning solutions. As industries increasingly prioritize environmental compliance, operational safety, and cost-effective maintenance, laser cleaning stands out as a non-abrasive, chemical-free alternative to traditional methods. When sourcing this technology, it is essential to evaluate suppliers based on equipment performance, technical support, scalability, safety certifications, and total cost of ownership.

Key considerations include the laser’s power output, wavelength, portability, ease of integration into existing workflows, and after-sales service. Selecting a reputable supplier with a proven track record ensures reliability and long-term viability. Additionally, understanding training requirements and maintenance needs will help maximize return on investment.

In conclusion, sourcing laser cleaning systems should align with both immediate operational needs and long-term sustainability goals. With the right partner and technology, organizations can enhance productivity, reduce environmental impact, and position themselves at the forefront of industrial innovation.