The global laser machinery market is experiencing robust expansion, driven by increasing industrial automation, rising demand for precision manufacturing, and advancements in laser technology across sectors such as automotive, electronics, and medical devices. According to Grand View Research, the global laser system market size was valued at USD 14.9 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of over 7% during the forecast period 2023–2028, fueled by adoption in microfabrication, additive manufacturing, and clean energy production. As demand intensifies, a select group of manufacturers have emerged as leaders in innovation, reliability, and market share. Based on revenue, technological capabilities, global reach, and industry recognition, the following analysis ranks the top 10 laser machine manufacturers shaping the future of industrial and scientific applications.

Top 10 Lasermaschinen Hersteller Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Wattsan

Website: wattsan.com

Key Highlights: Wattsan is a manufacturer of laser and cnc milling machines of European quality at affordable prices with worldwide delivery….

#2 TRUMPF SE + Co. KG

Website: trumpf.com

Key Highlights: As a high-tech company, TRUMPF provides manufacturing solutions in the fields of machine tools, laser technology, electronics, and Industry 4.0….

#3 ACCURL

Website: accurl.com

Key Highlights: ACCURL delivers advanced sheet metal machinery · CNC Press Brakes, Fiber Laser Cutters, and Shearing Machines engineered for precision and efficiency ……

#4 Universal Laser Systems

Website: ulsinc.com

Key Highlights: Solve Material Processing Challenges. Overcome your most demanding and complex applications. ULS helps companies evaluate the feasibility of laser technology….

#5 Precision Micro Machining Solutions

Website: posalux.com

Key Highlights: Explore Posalux, a Swiss machine tools manufacturer, leader in micro machining. High-tech solutions for automotive, electronics, medtech, and more….

#6 Bystronic

Website: bystronic.com

Key Highlights: Metalworking machines ▸Press brakes▸ Laser cutting systems ▸Tube lasers ▸ Automation ▸ Software | Bystronic….

#7 Frankfurt Laser Company

Website: frlaserco.com

Key Highlights: Frankfurt Laser Company (FLC) is a world leading supplier of FP, DFB and DBR laser diodes, SM individually addressable and broad area laser diode arrays….

#8 OMTech Laser

Website: omtech.com

Key Highlights: Turn your creative dreams into reality with our laser engraving and cutting machines, from desktop CO2 lasers to fiber lasers, which are perfect for ……

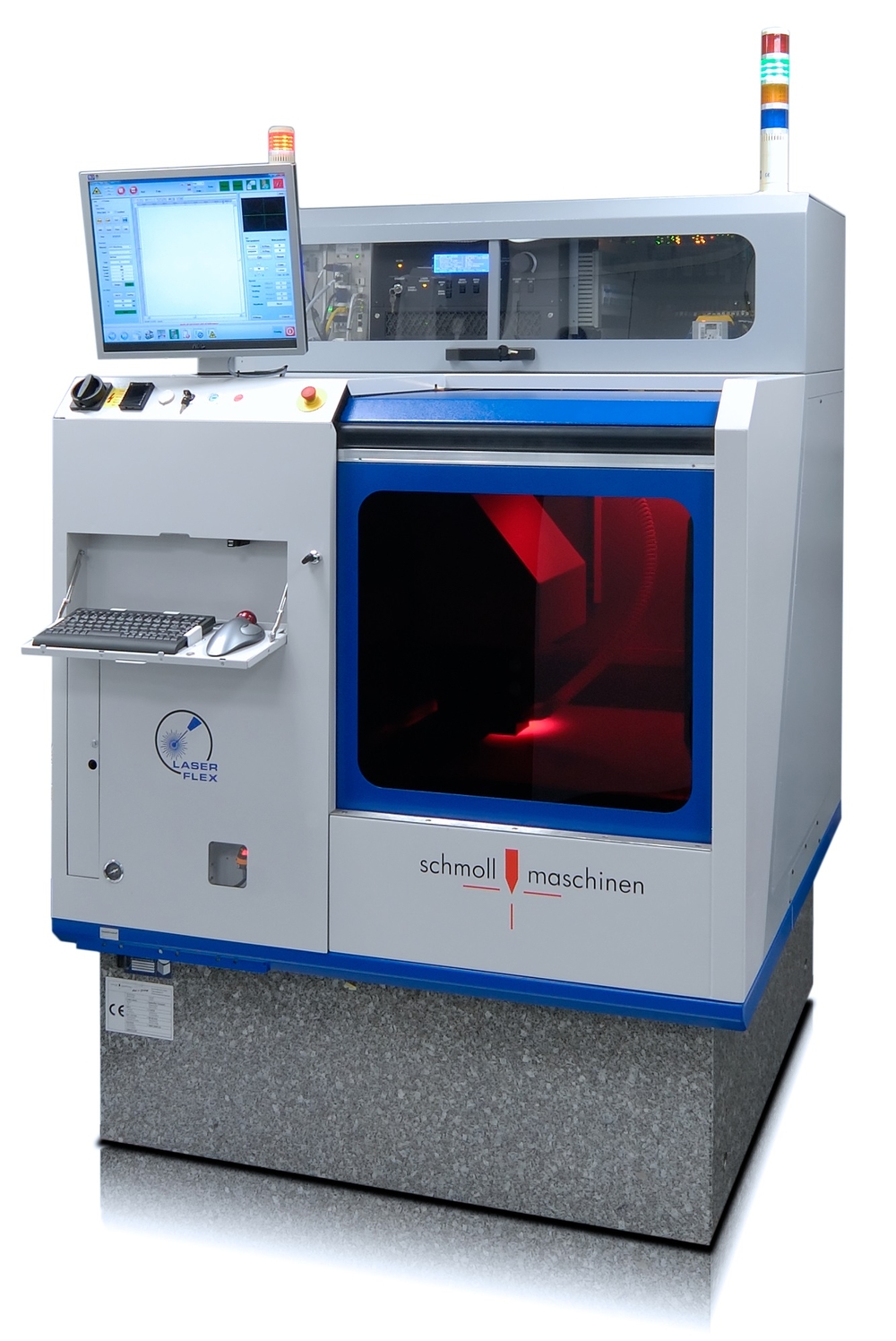

#9 Schmoll Maschinen GmbH

Website: schmoll-maschinen.de

Key Highlights: Schmoll Maschinen offers a range of mechanical drilling and routing machines tailored to the needs of high-volume PCB manufacturing. These machines are ……

#10 ACSYS Lasertechnik GmbH

Website: acsyslaser.com

Key Highlights: Laser systems – Made in Germany. Hardware, software and processes. ACSYS is a leading supplier of high-precision standard and special machines in the field of ……

Expert Sourcing Insights for Lasermaschinen Hersteller

H2: Market Trends for Laser Machine Manufacturers in 2026

By 2026, the global market for laser machine manufacturers is expected to undergo significant transformation driven by technological innovation, increasing industrial automation, and expanding applications across diverse sectors. Key trends shaping the industry include advancements in laser technology, rising demand in high-growth industries, regional market shifts, and a growing emphasis on sustainability and smart manufacturing.

-

Advancements in Laser Technology

Fiber lasers continue to dominate the market due to their efficiency, reliability, and lower maintenance costs compared to CO₂ and solid-state lasers. In 2026, manufacturers are increasingly integrating ultrafast lasers (picosecond and femtosecond) into industrial applications, enabling high-precision machining in electronics, medical devices, and aerospace. Additionally, developments in beam shaping, power scalability, and AI-driven process optimization are enhancing cutting, welding, and additive manufacturing capabilities. -

Growth in Industrial Automation and Smart Manufacturing

The integration of laser systems into Industry 4.0 ecosystems is accelerating. Laser machine manufacturers are embedding IoT connectivity, real-time monitoring, and predictive maintenance features into their equipment. This enables seamless data exchange with digital twins and MES (Manufacturing Execution Systems), improving productivity and reducing downtime. Collaborative robots (cobots) equipped with laser tools are also gaining traction, especially in small and medium enterprises seeking flexible automation solutions. -

Rising Demand Across Key Sectors

Automotive and e-mobility industries are major drivers, with increasing demand for laser welding and cutting in battery production for electric vehicles (EVs). The aerospace and defense sectors are adopting high-power lasers for lightweight material processing, such as titanium and composites. Meanwhile, the medical device industry relies on precision lasers for manufacturing implants and surgical tools. Consumer electronics continue to fuel demand for micro-laser processing in displays, sensors, and semiconductors. -

Regional Market Dynamics

Asia-Pacific remains the fastest-growing region, led by China, Japan, and South Korea, due to strong manufacturing bases and government support for advanced technologies. Europe maintains a strong position in high-end laser systems, supported by innovation hubs in Germany and Scandinavia. North America sees growth in defense and aerospace applications, while emerging markets in Southeast Asia and India are investing in laser-based manufacturing infrastructure. -

Sustainability and Energy Efficiency

Environmental regulations and corporate sustainability goals are pushing manufacturers to develop energy-efficient laser systems with lower carbon footprints. Innovations in cooling systems, power consumption optimization, and recyclable components are becoming standard. Additionally, remanufacturing and retrofitting of older laser machines are gaining popularity as cost-effective and eco-friendly alternatives. -

Competitive Landscape and Strategic Partnerships

The market is witnessing increased consolidation, with key players such as TRUMPF, IPG Photonics, Bystronic, and Han’s Laser expanding through acquisitions and R&D investments. Strategic partnerships between laser manufacturers and software companies are emerging to deliver integrated digital manufacturing platforms. Open-architecture systems allowing third-party integration are becoming more common, fostering innovation and customization.

In summary, by 2026, laser machine manufacturers will be at the forefront of advanced manufacturing, propelled by technological breakthroughs, digital integration, and expanding industrial applications. Success in this evolving market will depend on agility, innovation, and the ability to deliver sustainable, intelligent laser solutions tailored to diverse customer needs.

Common Pitfalls When Sourcing Laser Machine Manufacturers (Quality, IP)

Sourcing laser machine manufacturers, especially from international markets, can offer cost advantages and access to innovative technology. However, buyers often encounter significant challenges related to quality control and intellectual property (IP) protection. Being aware of these common pitfalls is crucial for mitigating risk and ensuring a successful procurement strategy.

Quality-Related Pitfalls

Inconsistent Manufacturing Standards

Many manufacturers, particularly in emerging markets, may not adhere to internationally recognized quality standards such as ISO 9001 or laser-specific certifications (e.g., IEC 60825 for laser safety). This can lead to inconsistent product performance, unreliable machine uptime, and safety hazards.

Lack of Transparent Quality Control Processes

Some suppliers may claim high-quality production but lack verifiable QC procedures. Without access to detailed inspection reports, test logs, or third-party audits, it’s difficult to confirm consistency in components, calibration accuracy, and overall build quality.

Use of Substandard Components

To reduce costs, manufacturers might substitute critical components (e.g., laser sources, optics, motion systems) with lower-grade alternatives. These parts often degrade faster, reduce machine precision, and increase maintenance costs over time.

Inadequate After-Sales Support and Service

Even if the initial product is reliable, poor technical support, delayed spare parts delivery, and lack of trained local service engineers can severely impact machine uptime and productivity.

Intellectual Property (IP)-Related Pitfalls

Risk of IP Infringement

Sourcing from manufacturers with weak IP compliance may expose buyers to legal risks. Some suppliers use reverse-engineered designs or incorporate patented technologies without proper licensing, potentially leading to customs seizures or lawsuits in target markets.

Lack of IP Ownership Clarity

If customizations or OEM designs are involved, contracts may not clearly specify IP ownership. Without explicit agreements, the buyer may lose control over design specifications, software, or branding developed for the laser machines.

Technology Copying and Unauthorized Replication

Partnering with a manufacturer that lacks strong ethical or legal IP practices increases the risk that your design or machine specifications could be copied and sold to competitors, especially in regions with lax enforcement of IP laws.

Insufficient Protection in Contracts

Many sourcing agreements fail to include robust IP clauses, non-disclosure agreements (NDAs), or restrictions on manufacturing for third parties. This leaves the buyer vulnerable to misuse or leakage of proprietary information.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct thorough due diligence, including factory audits and reference checks.

– Request certification documentation and perform independent product testing.

– Use clear contracts with enforceable quality standards, warranty terms, and IP protection clauses.

– Work with legal experts familiar with international trade and IP law.

– Consider partnering with manufacturers that have a proven track record in export markets and strong compliance policies.

By proactively addressing quality and IP concerns, businesses can reduce risk and build sustainable, trustworthy relationships with laser machine suppliers.

Logistics & Compliance Guide for Lasermaschinen Hersteller

Producing and distributing laser machines involves complex logistics and stringent compliance requirements. This guide outlines key considerations for laser machine manufacturers to ensure safe, legal, and efficient operations across global markets.

Product Classification and Regulatory Compliance

Laser machines are subject to international safety and technical regulations. Proper classification is foundational for compliance.

- Laser Safety Standards (IEC 60825-1): Ensure all products comply with IEC 60825-1 for laser radiation safety, including proper classification (Class 1 to Class 4), labeling, and user safeguards.

- CE Marking (EU): Comply with the EU Machinery Directive (2006/42/EC), Electromagnetic Compatibility (EMC) Directive (2014/30/EU), and Low Voltage Directive (2014/35/EU). Maintain a Technical File and issue an EU Declaration of Conformity.

- FDA/CDRH Compliance (USA): Register with the U.S. FDA’s Center for Devices and Radiological Health (CDRH). Submit a pre-market report (including product classification, performance standards, and labeling) under 21 CFR 1040.10 and 1040.11.

- Other Markets (e.g., Canada, China, Japan): Adhere to country-specific regulations such as Health Canada’s ROPES, China’s CCC mark, or Japan’s METI/SOR requirements.

Export Controls and Dual-Use Regulations

Laser systems may be subject to export control due to their potential dual-use (civilian and military applications).

- Identify Dual-Use Status: Determine if your laser system falls under dual-use regulations (e.g., EU Dual-Use Regulation (EU) 2021/821 or U.S. Export Administration Regulations (EAR)).

- Check ECCN/USML: Classify your product using Export Control Classification Numbers (ECCN) under the EAR or confirm if it falls under the U.S. Munitions List (USML). High-power lasers may require licenses.

- Obtain Export Licenses: Apply for necessary export authorizations from national authorities (e.g., BIS in the U.S., BAFA in Germany) before shipping to restricted destinations.

- Maintain Compliance Records: Retain documentation of classifications, licenses, and customer due diligence for audits.

Packaging, Handling, and Transportation

Laser machines are precision and often heavy equipment requiring specialized logistics.

- Robust Packaging: Use custom wooden crates or reinforced containers with shock-absorbing materials to protect sensitive optical and electronic components.

- Labeling Requirements: Clearly label packages with:

- Handling instructions (e.g., “Fragile,” “This Side Up”)

- Laser safety warnings

- Proper shipping names and UN numbers (if batteries or hazardous components are included)

- Hazardous Materials (if applicable): Declare and comply with IATA/IMDG/ADR regulations if packaging includes lithium batteries or laser coolants.

- Carrier Coordination: Work with freight forwarders experienced in heavy machinery and hazardous goods. Ensure carriers are compliant with ADR (road), IMDG (sea), or IATA (air) regulations.

Customs Clearance and Documentation

Efficient customs processing requires accurate and complete documentation.

- Commercial Invoice: Include detailed product description, HS code, value, country of origin, and Incoterms® (e.g., FOB, DDP).

- Packing List: Specify weight, dimensions, and contents of each package.

- Certificate of Origin: Required for preferential tariffs under trade agreements (e.g., EU-UK Trade Agreement).

- Compliance Certificates: Provide CE Declaration of Conformity, FDA registration, or test reports as needed.

- HS Code Classification: Assign correct Harmonized System (HS) codes (e.g., 8456.11 or 8456.12 for laser cutting machines) to determine tariffs and import rules.

After-Sales Support and Field Service Logistics

Ensure compliance and serviceability post-delivery.

- On-Site Installation & Training: Deploy certified technicians for setup and safety training. Maintain service records.

- Spare Parts Management: Establish a global spare parts supply chain with customs-optimized warehousing.

- Remote Diagnostics Compliance: If offering remote monitoring, ensure compliance with data privacy laws (e.g., GDPR, CCPA) and cybersecurity standards.

Environmental and Sustainability Compliance

Address end-of-life and environmental impact.

- WEEE Directive (EU): Register as a producer and provide take-back solutions for electrical and electronic components.

- RoHS Compliance: Ensure all electronic components are free from restricted substances (e.g., lead, cadmium).

- Battery Regulations: Comply with local battery disposal and recycling laws if machines include rechargeable batteries.

Continuous Monitoring and Updates

Regulatory landscapes evolve; manufacturers must stay informed.

- Regulatory Watch: Monitor changes in laser safety standards, trade policies, and sanctions lists.

- Internal Audits: Conduct regular compliance audits across production, logistics, and export departments.

- Training Programs: Train staff on export controls, safety standards, and logistics protocols.

By adhering to this logistics and compliance framework, laser machine manufacturers can mitigate risks, avoid penalties, and ensure reliable delivery of high-quality, legally compliant products worldwide.

Conclusion: Sourcing Laser Machine Manufacturers

Sourcing laser machine manufacturers requires a strategic approach that balances quality, cost, technical capabilities, and long-term reliability. After thorough evaluation of potential suppliers, key factors such as manufacturing expertise, technological innovation, certifications, after-sales support, and production capacity should guide the decision-making process.

German and European manufacturers are often recognized for precision engineering, high-quality standards, and robust machine durability, making them ideal partners for applications requiring accuracy and reliability. However, manufacturers from China and other Asian countries offer competitive pricing and rapid technological advancements, which can be advantageous for cost-sensitive or high-volume projects—provided due diligence on quality control is performed.

Ultimately, the optimal sourcing decision depends on the specific application (e.g., cutting, welding, engraving), required service and maintenance support, and integration needs. Establishing long-term partnerships with manufacturers who demonstrate transparency, innovation, and responsiveness ensures sustainable value, operational efficiency, and a reliable supply chain in the dynamic laser technology market.