The global lasermaschinen (laser machine) market has experienced robust growth, driven by increasing demand for precision cutting, engraving, and welding across industries such as automotive, aerospace, electronics, and medical devices. According to a 2023 report by Mordor Intelligence, the global laser system market was valued at USD 14.63 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2028. Similarly, Grand View Research estimates that the industrial laser market size exceeded USD 7.5 billion in 2022 and is expected to expand at a CAGR of over 7% through 2030, fueled by advancements in fiber laser technology and automation integration. This surge in adoption underscores the critical role of leading lasermaschinen manufacturers in shaping modern manufacturing processes. As innovation accelerates and global competition intensifies, ten manufacturers have emerged as frontrunners in technology, market share, and application versatility.

Top 10 Lasermaschinen Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Universal Laser Systems

Website: ulsinc.com

Key Highlights: Solve Material Processing Challenges. Overcome your most demanding and complex applications. ULS helps companies evaluate the feasibility of laser technology….

#2 Wattsan

Website: wattsan.com

Key Highlights: Wattsan is a manufacturer of laser and cnc milling machines of European quality at affordable prices with worldwide delivery….

#3 ACCURL

Website: accurl.com

Key Highlights: ACCURL CNC machinery executes rapid and precise cuts, angle cuts, undercuts, and finishes, eliminating the necessity for multi-part molds and manual labor….

#4 TRUMPF SE + Co. KG

Website: trumpf.com

Key Highlights: As a high-tech company, TRUMPF provides manufacturing solutions in the fields of machine tools, laser technology, electronics, and Industry 4.0….

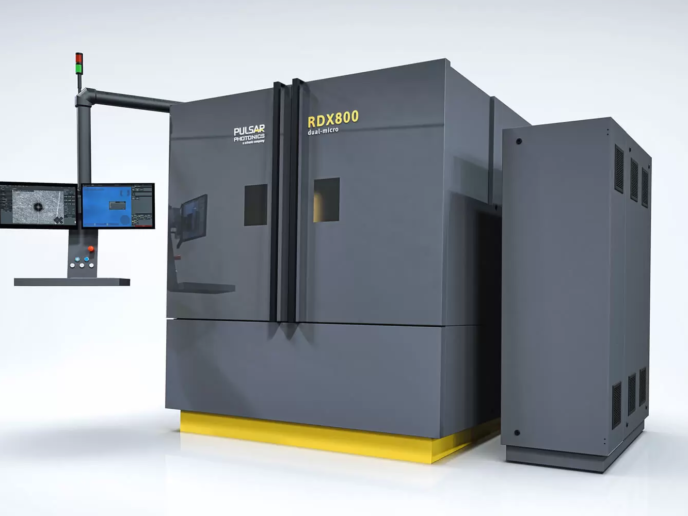

#5 Precision Micro Machining Solutions

Website: posalux.com

Key Highlights: Explore Posalux, a Swiss machine tools manufacturer, leader in micro machining. High-tech solutions for automotive, electronics, medtech, and more….

#6 OMTech Laser

Website: omtech.com

Key Highlights: Turn your creative dreams into reality with our laser engraving and cutting machines, from desktop CO2 lasers to fiber lasers, which are perfect for ……

#7 BRM Lasers

Website: brmlasers.com

Key Highlights: BRM lasers ✓ High quality & affordable laser machines ✓ More than 10 years of experience ✓ Used in many industries ✓ Request a free quote….

#8 Bystronic

Website: bystronic.com

Key Highlights: Metalworking machines ▸Press brakes▸ Laser cutting systems ▸Tube lasers ▸ Automation ▸ Software | Bystronic….

#9 Laser Machines and Systems

Website: coherent.com

Key Highlights: Coherent Laser Machines and Systems enable a diverse range of materials processing tasks from small repair workshops to high-volume production lines….

#10 Frankfurt Laser Company

Website: frlaserco.com

Key Highlights: Frankfurt Laser Company (FLC) is a world leading supplier of FP, DFB and DBR laser diodes, SM individually addressable and broad area laser diode arrays….

Expert Sourcing Insights for Lasermaschinen

H2: 2026 Market Trends for Lasermaschinen (Laser Machines)

The global lasermaschinen (laser machines) market is poised for significant transformation by 2026, driven by rapid technological innovation, increasing automation across industries, and growing demand for precision manufacturing. Several key trends are expected to shape the market landscape in the coming years.

1. Rising Adoption in Industrial Manufacturing

The manufacturing sector, particularly automotive, aerospace, and electronics, is increasingly integrating advanced laser systems for cutting, welding, drilling, and surface treatment. By 2026, fiber lasers are expected to dominate due to their efficiency, lower maintenance, and superior performance in metal processing. The push for lightweight materials and electric vehicles will further accelerate demand for high-precision laser solutions.

2. Growth in Microprocessing and Ultrafast Lasers

Ultrafast lasers (picosecond and femtosecond) are gaining traction in high-precision applications such as medical device manufacturing, semiconductor processing, and consumer electronics. As miniaturization continues, especially in electronics and photonics, the need for non-thermal, clean ablation processes will drive investment in ultrafast lasermaschinen by 2026.

3. Integration with Industry 4.0 and Smart Manufacturing

Lasermaschinen are becoming smarter, with embedded sensors, IoT connectivity, and AI-driven process optimization. By 2026, predictive maintenance, real-time monitoring, and adaptive control systems will be standard features, enhancing productivity and reducing downtime. Integration with digital twins and cloud-based platforms will enable remote operation and data analytics.

4. Expansion in Emerging Markets

While Europe, North America, and China remain key markets, regions such as Southeast Asia, India, and Latin America are expected to witness strong growth in lasermaschinen adoption. Rising industrialization, government support for advanced manufacturing, and growing small-to-medium enterprises (SMEs) will fuel demand for cost-effective and scalable laser solutions.

5. Sustainability and Energy Efficiency Focus

Environmental regulations and corporate sustainability goals are pushing manufacturers to adopt energy-efficient laser systems. By 2026, there will be increased emphasis on recyclable components, reduced power consumption, and closed-loop cooling systems in lasermaschinen design, aligning with global green manufacturing initiatives.

6. Advancements in Software and User Interfaces

Improved CAD/CAM integration, intuitive user interfaces, and AI-assisted programming will lower the skills barrier for operating lasermaschinen. This trend will democratize access to laser technology, enabling broader use in education, prototyping, and artisanal manufacturing sectors.

In conclusion, the 2026 lasermaschinen market will be characterized by smarter, faster, and more sustainable systems, deeply integrated into digital manufacturing ecosystems. Companies investing in innovation, automation, and global market expansion are best positioned to capitalize on these evolving trends.

Common Pitfalls When Sourcing Lasermaschinen: Quality and Intellectual Property Risks

Sourcing laser machines (Lasermaschinen) from international suppliers—especially from regions with less stringent regulatory oversight—can present significant challenges. While cost savings may be attractive, buyers often encounter critical pitfalls related to product quality and intellectual property (IP) protection. Being aware of these risks is essential to avoiding costly mistakes, operational downtime, and legal complications.

Quality-Related Pitfalls

1. Inconsistent Manufacturing Standards

Many low-cost suppliers may not adhere to international quality standards such as ISO 9001, CE, or IEC 60825 for laser safety. This can result in machines that vary significantly in performance, durability, and safety between production batches. Components like laser diodes, cooling systems, and control software may be substandard, leading to premature failures.

2. Misrepresented Technical Specifications

Suppliers may exaggerate key performance metrics such as laser power output, cutting precision, or beam quality. For example, a machine advertised as a “1000W fiber laser” might deliver significantly less actual output due to poor component integration or inadequate cooling. This misrepresentation often only becomes evident after installation and testing.

3. Lack of After-Sales Support and Spare Parts Availability

Many overseas suppliers offer limited technical support, making troubleshooting difficult. Spare parts may be hard to obtain or incompatible with international safety standards. Extended downtime can severely impact production schedules, eroding any initial cost advantage.

4. Poor Integration and Software Limitations

Imported laser machines may come with proprietary software that lacks compatibility with common CAD/CAM systems or does not support updates. Poor user interfaces, undocumented bugs, and limited automation capabilities can hinder integration into existing manufacturing workflows.

Intellectual Property-Related Pitfalls

1. Risk of IP Infringement

Some low-cost laser machines are reverse-engineered or outright copies of patented designs from established European or American manufacturers. Purchasing such equipment—even unknowingly—can expose the buyer to legal liability, especially in jurisdictions with strong IP enforcement. Customs authorities may seize infringing equipment, and competitors may initiate legal action.

2. Use of Unlicensed Software and Firmware

Many budget machines run on pirated or unlicensed control software (e.g., unauthorized versions of CypCut, LaserCut, or proprietary OEM firmware). This not only violates copyright laws but also poses cybersecurity risks and limits the ability to receive official updates or technical support.

3. Lack of Transparency in Component Sources

Suppliers may obscure the origin of critical components, such as laser sources (e.g., IPG, Raycus, nLight). Using counterfeit or declassified industrial lasers in lower-tier machines can lead to performance issues and void warranties. It also complicates compliance with industry regulations and traceability requirements.

4. Weak Contracts and IP Clauses

Purchase agreements with some suppliers lack clear terms on IP ownership, warranty enforcement, and liability in case of infringement. Without proper legal safeguards, buyers have little recourse if the machine is found to violate patents or incorporate stolen technology.

Mitigation Strategies

To minimize these risks, buyers should:

– Conduct thorough due diligence on suppliers, including factory audits and reference checks.

– Require certification documentation (CE, FDA, ISO) and verify compliance independently.

– Test machines under real-world conditions before full acceptance.

– Engage legal counsel to review contracts for IP indemnification clauses.

– Prioritize suppliers with transparent supply chains and a track record of IP compliance.

By proactively addressing quality and IP concerns, companies can ensure reliable performance, regulatory compliance, and long-term operational success when sourcing Lasermaschinen.

Logistics & Compliance Guide for Lasermaschinen

Overview

The international shipment and operation of Lasermaschinen (laser machines) require adherence to a complex framework of logistics, safety, and regulatory standards. This guide outlines key considerations for transporting and deploying laser systems across global markets, ensuring compliance with technical, environmental, and safety regulations.

Classification and Legal Framework

Lasermaschinen are typically classified under specific categories based on their power, wavelength, and intended application. Key international standards include:

- IEC 60825-1: Safety of laser products – Equipment classification and requirements.

- FDA 21 CFR Part 1040.10/1040.11 (USA): Performance standards for laser products.

- CE Marking (EU): Compliance with the Machinery Directive (2006/42/EC), Electromagnetic Compatibility (EMC) Directive (2014/30/EU), and Laser Products under the Low Voltage Directive (LVD) where applicable.

- GB Standards (China): GB 7247.1 – Safety of laser products (aligned with IEC 60825-1).

Ensure that the laser system is properly classified (Class 1 to Class 4) and documented accordingly for customs and market entry.

Export Controls and Trade Compliance

Lasermaschinen may be subject to export controls due to dual-use potential (civilian and military applications). Key compliance steps:

- Identify ECCN (Export Control Classification Number) in the U.S. Commerce Control List (CCL) – e.g., 6A003.b or 6A005 for certain high-power lasers.

- Check dual-use regulations under the EU Dual-Use Regulation (EU) 2021/821.

- Obtain necessary export licenses if the machine exceeds power, precision, or wavelength thresholds.

- Screen end-users and destinations against denied parties lists (e.g., BIS, EU Consolidated List).

Packaging and Transport Requirements

Proper packaging ensures equipment integrity and regulatory compliance during transit:

- Use custom-engineered crates with shock absorption and climate control if needed.

- Clearly label packages with:

- Laser warning symbols (IEC 60825-1 compliant).

- Fragile and orientation indicators.

- Handling instructions (e.g., “Do Not Invert”).

- Secure mirrors, lenses, and moving parts to prevent internal damage.

- Include moisture-absorbing desiccants for long ocean freight.

Shipping and Customs Documentation

Accurate documentation is essential for smooth customs clearance:

- Commercial Invoice: Detailed description of the Lasermaschinen, value, and end-use.

- Packing List: Itemized contents, weights, dimensions.

- Certificate of Conformity (CoC): Proof of compliance with target market standards (e.g., CE, FDA).

- Laser Safety Report: Summarizing classification, emissions, and protective measures.

- Export License (if applicable).

- Bill of Lading / Air Waybill.

Include technical specifications to avoid misclassification (e.g., distinguishing industrial cutters from military-grade systems).

Import Regulations by Region

European Union

- CE marking mandatory; technical file must be available.

- Notify national authorities if Class 3B or Class 4 lasers are imported.

- Compliance with REACH and RoHS directives for materials used.

United States

- FDA registration of laser product manufacturer and reporting via FDA’s CDRH.

- Form FDA 2877 (Report of Imported Device) may be required.

- CBP may inspect shipments at port of entry.

China

- CCC certification may be required depending on application.

- Import license for high-power lasers.

- Compliance with Chinese laser safety standards (GB 7247.1).

Other Regions

- Canada: Compliance with Health Canada’s Radiation Emitting Devices Act (REDA).

- Japan: Compliance with the Electrical Appliance and Material Safety Law (DENAN) and laser safety standards (JIS C 6802).

On-Site Installation and Operational Compliance

After delivery:

- Conduct a laser safety audit per ANSI Z136.1 (USA) or EN 12254 (EU).

- Install interlocks, emergency stops, and beam enclosures.

- Provide operator training and safety documentation in local language.

- Register high-power lasers with national radiation protection authorities if required.

Maintenance and End-of-Life Compliance

- Maintain service logs for compliance audits.

- Dispose of laser components (e.g., laser diodes, capacitors) per WEEE (EU) or EPA (USA) regulations.

- Return or recycle hazardous materials through certified e-waste handlers.

Summary

Transporting and deploying Lasermaschinen demands meticulous attention to international compliance, safety standards, and documentation. Partner with certified logistics providers and regulatory consultants to ensure seamless global operations and avoid shipment delays or penalties. Always verify requirements specific to the destination country and application sector (e.g., medical, industrial, research).

Conclusion for Sourcing Laser Machines

Sourcing laser machines is a strategic decision that requires careful evaluation of technical specifications, application requirements, supplier reliability, and long-term cost efficiency. Whether for cutting, engraving, welding, or marking, selecting the right laser machine involves aligning the technology—such as CO2, fiber, or diode lasers—with specific production needs. Key considerations include machine precision, power output, automation capabilities, maintenance demands, and safety features.

A successful sourcing process emphasizes due diligence in supplier assessment, including certifications, after-sales support, training availability, and global service networks. Additionally, evaluating total cost of ownership, rather than initial purchase price alone, ensures sustainable operational efficiency. With the laser technology market rapidly evolving, integrating future-proof machines that support scalability and technological upgrades is essential.

Ultimately, effective sourcing of laser machines enhances manufacturing capabilities, improves product quality, and strengthens competitiveness. By partnering with reputable suppliers and staying informed about technological advancements, organizations can maximize return on investment and maintain a leading edge in their respective industries.