The global welding equipment market is undergoing rapid transformation, driven by increasing demand for high-precision, energy-efficient joining technologies in industries such as automotive, aerospace, and heavy manufacturing. According to a 2023 report by Mordor Intelligence, the global welding equipment market was valued at USD 23.8 billion in 2022 and is projected to grow at a CAGR of 5.8% through 2028, fueled by advancements in automation and laser-based technologies. Within this landscape, laser welding is emerging as a disruptive force, with its speed, precision, and minimal heat distortion offering compelling advantages over traditional methods like Tungsten Inert Gas (TIG) welding. Grand View Research noted in 2022 that the laser welding segment alone accounted for over 25% of the welding technology market, with sustained growth expected due to rising adoption in electric vehicle (EV) battery manufacturing and medical device fabrication. As the industry evolves, leading manufacturers are differentiating themselves through innovation in laser and TIG welding systems—balancing performance, cost, and integration with Industry 4.0 standards. This analysis examines the top nine manufacturers shaping the future of laser and TIG welding, evaluating their technological edge, market reach, and strategic positioning in this competitive, data-driven environment.

Top 9 Laser Welding Vs Tig Welding Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Laser Welding vs. TIG Welding

Website: bodor.com

Key Highlights: In terms of welding speeds, laser welding has proven to be at least 3 to 10 times faster than TIG. The laser component is also more compact and ……

#2 MIG & TIG vs. Laser Welding

Website: smacna.org

Key Highlights: Laser welding is an excellent choice for materials from very thin to roughly 5/16” thick. For thicker materials, MIG is generally a better choice….

#3 Laser Welding VS TIG Welding

Website: acctekgroup.com

Key Highlights: This article compares laser welding and TIG welding across key factors, including process, equipment, applications, costs, and suitability for various ……

#4 Laser Welding vs. TIG Welding

Website: megmeet-welding.com

Key Highlights: Laser welding is faster, higher quality, and more automated, but more expensive and less flexible than TIG welding….

#5 Orotig: Laser Machinery

Website: orotig.com

Key Highlights: Orotig, with +30 years of experience, specializes in engineering and manufacturing laser solutions for welding engraving and casting metals….

#6 Laser Welding Services vs. TIG/MIG for Stainless Steel

Website: northernmfg.com

Key Highlights: Discover how laser welding prevents distortion in stainless steel. Our AWS & ASME-certified process delivers superior quality and speed over ……

#7 Laser welders

Website: weldingweb.com

Key Highlights: I’m seeing more and more laser welders being advertised and the prices are coming down. Does anyone here already have a laser welder and what’s your opinion?…

#8 Laser Welding vs. TIG Welding

Website: jqlaser.com

Key Highlights: Longer Welding Times: TIG welding is a slower process compared to laser welding, which can lead to increased production times and costs, ……

#9 Laser Welding vs. Traditional Welding

Website: theo.inc

Key Highlights: Laser welding offers numerous benefits over traditional welding methods, including increased efficiency, precision, and reduced training time….

Expert Sourcing Insights for Laser Welding Vs Tig Welding

2026 Market Trends: Laser Welding vs TIG Welding

Market Growth and Adoption Trends

By 2026, the industrial welding sector is expected to witness a significant shift toward automation and precision manufacturing, favoring advanced joining technologies. Laser welding is projected to experience accelerated market growth, driven by rising demand in high-tech industries such as electric vehicles (EVs), aerospace, medical devices, and consumer electronics. According to market research reports, the global laser welding market is anticipated to grow at a compound annual growth rate (CAGR) of approximately 8–10% from 2022 to 2026, reaching a valuation of over USD 9 billion by 2026.

In contrast, Tungsten Inert Gas (TIG) welding, while remaining a staple in precision manual welding, is expected to see more modest growth—projected at around 3–4% CAGR—due to its labor-intensive nature and slower processing speeds. TIG welding will continue to hold a vital role in niche applications requiring high-quality, low-distortion welds, especially in artisanal metalwork, piping, and repair industries. However, its dependency on skilled labor and lower throughput limits its scalability in mass production environments.

Technological Advancements and Automation

Laser welding technology is advancing rapidly, with key developments in fiber and disk lasers offering improved beam quality, energy efficiency, and integration with robotics and artificial intelligence. By 2026, hybrid laser-arc welding systems and smart laser platforms with real-time monitoring and adaptive control are expected to become more widespread, enhancing weld consistency and reducing defects.

TIG welding, while benefiting from innovations such as pulsed TIG and automated orbital welding systems, still lags in full automation potential. The process inherently requires close operator control and is less compatible with high-speed robotic integration compared to laser methods. However, advancements in plasma arc and digital inverter-based TIG power sources are helping improve arc stability and energy efficiency, prolonging the technology’s relevance in specialized applications.

Industry-Specific Demand Drivers

In the automotive sector—especially with the expansion of EV production—laser welding is becoming the preferred method for battery tab welding, powertrain components, and lightweight aluminum structures due to its speed, precision, and minimal heat input. The need for high-volume, repeatable processes in EV manufacturing is pushing OEMs to adopt laser systems at scale.

Aerospace and defense industries continue to use both methods, but laser welding is gaining traction for turbine blade repair, fuselage assembly, and additive manufacturing integration. Meanwhile, TIG remains dominant in critical structural welding where certification standards and proven reliability are paramount.

In sectors like shipbuilding and heavy fabrication, TIG welding maintains a foothold due to material versatility and deep penetration capabilities on thick sections. However, even here, laser-hybrid processes are being explored to improve productivity.

Cost and Workforce Considerations

Upfront costs for laser welding systems remain high, but total cost of ownership is improving due to declining laser source prices, lower maintenance needs, and reduced labor costs through automation. By 2026, modular and scalable laser systems are expected to make the technology more accessible to small and medium enterprises (SMEs).

TIG welding has lower equipment costs but higher labor expenses due to slower welding speeds and the need for highly trained welders. With a global shortage of skilled welders projected to worsen by 2026, industries are increasingly turning to automation—favoring laser solutions that require less human intervention.

Sustainability and Energy Efficiency

Laser welding systems are becoming more energy-efficient, with modern fiber lasers achieving wall-plug efficiencies of over 40%, compared to TIG’s typical 20–30%. This efficiency, combined with reduced material waste and lower emissions (due to faster processing and less shielding gas usage), positions laser welding as a more sustainable option aligned with global decarbonization goals.

TIG welding, while precise, consumes more energy per weld length and requires continuous shielding gas flow, increasing operational costs and environmental impact. However, its ability to work with a wide range of metals without filler material in some cases supports material conservation.

Conclusion

By 2026, laser welding is expected to outpace TIG welding in market growth, particularly in advanced manufacturing sectors demanding speed, automation, and precision. While TIG welding will remain essential for high-integrity manual applications and certain materials, its market share is likely to plateau or decline in high-volume industries. The convergence of robotics, Industry 4.0 technologies, and sustainability pressures will continue to favor laser-based solutions, making them a cornerstone of next-generation manufacturing.

Common Pitfalls in Sourcing Laser Welding vs. TIG Welding (Quality & IP)

When sourcing laser welding or TIG (Tungsten Inert Gas) welding services or equipment, overlooking critical differences in quality outcomes and intellectual property (IP) considerations can lead to significant project delays, cost overruns, and legal risks. Below are common pitfalls associated with each process.

1. Underestimating Quality Variability and Process Suitability

Laser Welding Pitfalls:

– Overestimating Precision Without Proper Fixturing: Laser welding demands extremely tight tolerances in part fit-up and fixturing. Sourcing without verifying the supplier’s capability to maintain micron-level alignment can result in inconsistent weld quality, including porosity and spatter.

– Ignoring Material Limitations: Not all materials are equally suitable for laser welding. Reflective materials (e.g., copper, aluminum) can cause beam instability and inconsistent penetration. Sourcing without validating the supplier’s experience with your specific alloy can compromise quality.

– Misjudging Heat-Affected Zone (HAZ) Requirements: While laser welding typically produces a smaller HAZ, improper parameter selection can still cause warping or metallurgical changes. Sourcing based solely on speed without assessing thermal management can degrade part performance.

TIG Welding Pitfalls:

– Assuming Consistent Manual Skill Levels: TIG welding is highly operator-dependent. Sourcing from vendors without rigorous welder certification programs (e.g., ASME, AWS) risks inconsistent bead quality, undercut, and incomplete fusion.

– Overlooking Slower Throughput Impacts: TIG is significantly slower than laser welding. Sourcing without considering production volume can lead to bottlenecks and increased labor costs, indirectly affecting quality due to operator fatigue.

– Neglecting Shielding Gas Purity and Flow: Poor gas shielding leads to oxidation and porosity. Suppliers with inadequate gas delivery systems or lax monitoring can compromise weld integrity, especially in critical applications.

2. Overlooking Intellectual Property and Technology Transfer Risks

Laser Welding Pitfalls:

– Dependency on Proprietary Equipment and Software: Laser systems often use closed-source control software and specialized optics. Sourcing from a vendor who retains exclusive rights to process parameters or software can limit your ability to replicate or scale the process independently, creating IP vulnerability.

– Lack of Process Documentation Ownership: Automated laser processes generate digital weld recipes and monitoring data. Failing to contractually secure ownership or usage rights to this data may prevent future optimization or auditing, exposing IP gaps.

– Reverse Engineering Risks: High-precision laser welds can be reverse-engineered more easily due to their repeatability and fine features. Sourcing without IP protection agreements (e.g., NDAs, IP assignment clauses) increases the risk of technology replication by suppliers.

TIG Welding Pitfalls:

– Underestimating Tacit Knowledge as IP: The expertise of a skilled TIG welder—such as hand movements, arc control, and timing—constitutes valuable tacit knowledge. Sourcing from contract welders without work-for-hire agreements may mean losing ownership of process know-how critical to product quality.

– Inadequate Protection of Custom Fixtures and Procedures: Custom jigs or welding sequences developed during TIG process optimization may not be formally documented or protected. Vendors may claim ownership unless contracts explicitly assign IP rights to the buyer.

– Difficulty in Standardizing and Transferring Processes: Unlike laser welding, TIG processes are harder to codify. Sourcing without detailed procedural documentation and training protocols can hinder IP transfer and lead to quality drift across production sites.

3. Failure to Align Sourcing Strategy with Application Requirements

Choosing between laser and TIG based on upfront cost alone—without evaluating long-term quality needs and IP strategy—can backfire. For high-volume, precision applications (e.g., medical devices, batteries), laser welding may offer better consistency but requires stronger IP safeguards. For low-volume, high-variability jobs (e.g., custom aerospace repairs), TIG may be preferable, but welder qualification and knowledge retention become critical.

Best Practice: Conduct a thorough technical and legal due diligence—assess supplier capabilities, review process documentation, and ensure contracts clearly define quality standards, data ownership, and IP rights for both welding methods.

Logistics & Compliance Guide: Laser Welding vs. Tig Welding

Overview of Laser and TIG Welding Technologies

Laser welding and Tungsten Inert Gas (TIG) welding are two distinct joining processes used across industries such as automotive, aerospace, medical device manufacturing, and industrial fabrication. While both produce high-quality welds, they differ significantly in operation, equipment requirements, safety considerations, and regulatory compliance. Understanding these differences is essential for effective logistics planning, operational safety, and adherence to industry standards.

Equipment and Facility Requirements

Laser Welding:

– Requires high-power laser sources (fiber or CO₂ lasers), precision optics, robotic arms or CNC systems, and cooling units.

– Needs a controlled environment with temperature and humidity regulation to ensure beam stability and component accuracy.

– Demands significant floor space for integration with automation systems and safety enclosures.

– Power requirements are high, often necessitating three-phase electrical connections and backup power systems.

TIG Welding:

– Utilizes a non-consumable tungsten electrode, inert shielding gas (typically argon), a welding power supply, and filler metal (if needed).

– Equipment is generally portable and modular, allowing use in workshops, field sites, and production lines.

– Requires less infrastructure; standard electrical outlets often suffice for manual operations.

– Shielding gas cylinders must be stored and handled according to compressed gas safety codes.

Logistics Implication: Laser welding systems require long lead times for procurement, specialized installation, and facility modifications. TIG welding setups are easier to deploy and scale, making them more flexible for mobile or remote operations.

Safety and Hazard Management

Laser Welding:

– Presents hazards including high-intensity laser radiation (Class 4), eye and skin exposure risks, and fumes from vaporized metals.

– Requires engineering controls such as interlocked enclosures, beam shutters, and fume extraction systems.

– Operators must wear laser-protective eyewear specific to the laser wavelength.

– Compliance with ANSI Z136.1 (Safe Use of Lasers) and IEC 60825 (Laser Safety) is mandatory.

TIG Welding:

– Hazards include intense UV/IR radiation, electric shock, hot surfaces, and inhalation of welding fumes (e.g., hexavalent chromium in stainless steel).

– Requires local exhaust ventilation (LEV), welding screens, flame-resistant PPE, and proper grounding.

– Shielding gas poses asphyxiation risks in confined spaces; gas monitoring may be required.

– Must comply with OSHA 29 CFR 1910.254 (Welding, Cutting, and Brazing) and ANSI Z49.1 (Safety in Welding).

Compliance Note: Laser welding operations typically require a designated Laser Safety Officer (LSO) and formal hazard evaluations. TIG welding safety programs focus more on general industrial hygiene and electrical safety.

Environmental and Regulatory Compliance

Laser Welding:

– Generates minimal spatter and lower fume volume compared to arc processes, reducing air quality concerns.

– However, metal vapor byproducts may contain regulated substances (e.g., nickel, manganese); fume extraction systems must meet local emission standards (e.g., EPA, EU Directive 2004/40/EC).

– Equipment disposal involves handling optical components and electronic waste in accordance with WEEE (EU) or state-level e-waste regulations.

TIG Welding:

– Produces consistent but manageable levels of welding fumes; compliance with permissible exposure limits (PELs) per OSHA or ACGIH is essential.

– Shielding gases are not typically hazardous but must be handled under DOT (US) or ADR (EU) regulations during transport.

– Spent tungsten electrodes may contain thorium (in older electrodes), a radioactive material regulated by NRC (US) or equivalent bodies.

Environmental Logistics: Laser welding may offer advantages in cleanroom or environmentally sensitive environments due to precision and low emissions. TIG welding requires ongoing monitoring of air quality and PPE usage.

Training and Certification Requirements

Laser Welding:

– Operators require specialized training in laser systems, robotics, and CNC programming.

– Certification may follow internal company standards or OEM-specific programs.

– Laser safety training per ANSI Z136.1 is required for all personnel in the nominal hazard zone.

TIG Welding:

– Welders must be certified to standards such as AWS D1.1 (Structural Welding), ASME Section IX, or ISO 9606.

– Certification involves practical weld tests and periodic requalification.

– Training focuses on manual dexterity, arc control, and metallurgy.

Workforce Planning: TIG welding benefits from a larger pool of certified welders. Laser welding requires investment in upskilling or hiring technicians with advanced automation expertise.

Maintenance and Operational Downtime

Laser Welding:

– Optics and laser sources require regular cleaning, alignment, and scheduled maintenance.

– Downtime can be significant if critical components (e.g., laser diodes) fail; spare parts may have long lead times.

– Preventive maintenance contracts with OEMs are common and costly.

TIG Welding:

– Maintenance includes electrode sharpening, torch inspection, gas line checks, and power supply servicing.

– Repairs are typically faster, with widely available consumables and parts.

– Downtime is minimal for manual operations.

Logistical Impact: Laser systems demand higher maintenance logistics and inventory of specialized parts. TIG welding supports rapid turnaround with standard spare kits.

Conclusion: Selecting the Right Process for Compliance and Efficiency

Choosing between laser and TIG welding depends on production volume, precision requirements, material type, and regulatory environment. Laser welding offers speed and accuracy for high-volume, automated applications but demands rigorous safety and facility controls. TIG welding provides flexibility and compliance with established welding codes, making it ideal for low-volume, high-integrity joints. A comprehensive logistics and compliance strategy should evaluate both upfront investments and long-term operational needs to ensure safety, quality, and regulatory adherence.

Conclusion: Sourcing Laser Welding vs. TIG Welding

When deciding between sourcing laser welding and TIG (Tungsten Inert Gas) welding for a manufacturing or fabrication application, the optimal choice depends on specific project requirements, including precision, production volume, material type, cost constraints, and desired weld quality.

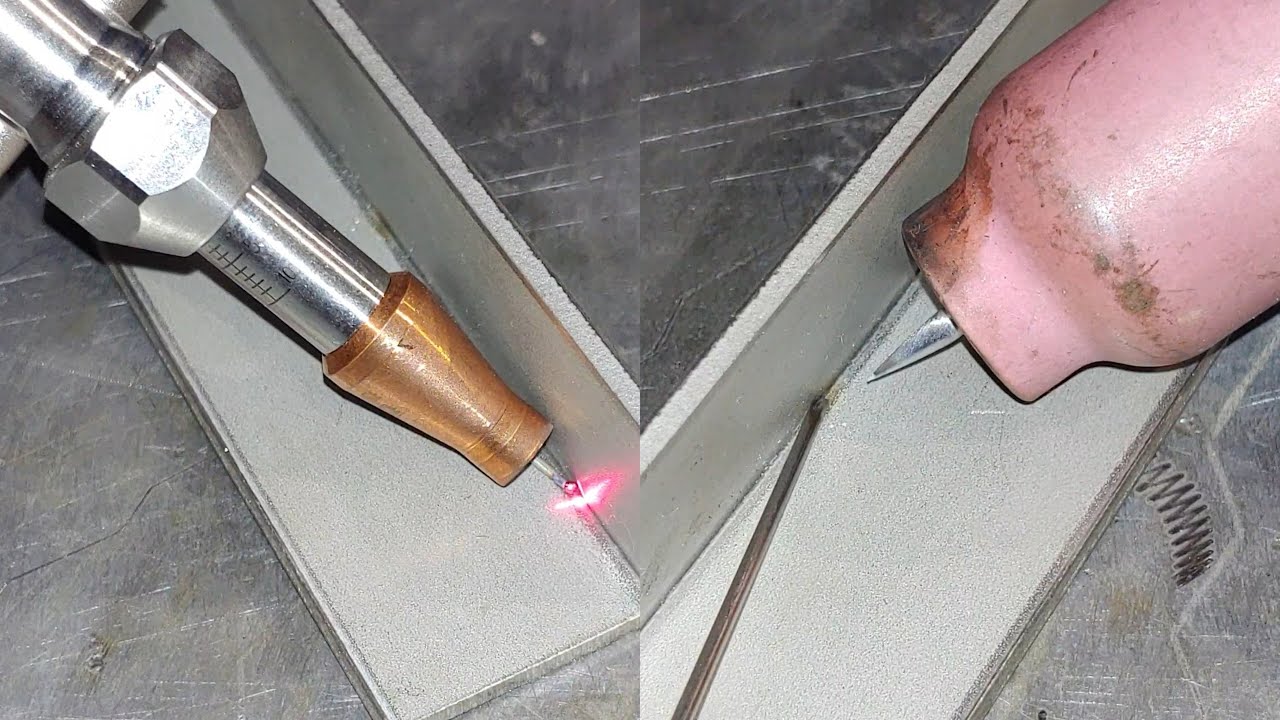

Laser welding offers high precision, deep penetration, minimal heat-affected zones, and fast processing speeds, making it ideal for high-volume production, automation, and applications requiring tight tolerances—such as in the automotive, aerospace, and electronics industries. While the initial investment in laser welding equipment is significantly higher, its efficiency, consistency, and reduced post-processing needs can lead to lower long-term operational costs.

In contrast, TIG welding is a versatile, manually operated process well-suited for low- to medium-volume production, intricate or custom welds, and a wide range of metals—including thin materials and exotic alloys. It provides excellent weld quality and control, making it favorable in industries like art fabrication, aerospace, and repair work. TIG welding has lower equipment costs and is easier to implement for small-scale operations, but it is slower and more labor-intensive, requiring highly skilled operators.

In summary, laser welding is the preferred choice for high-precision, high-throughput applications where automation and repeatability are critical, while TIG welding remains the go-to solution for manual, custom, or low-volume jobs demanding operator control and versatility. The sourcing decision should align with the company’s production goals, technical specifications, and financial capabilities—often leading to a complementary use of both technologies in advanced manufacturing environments.