The global laser welding market is experiencing rapid expansion, driven by increasing demand for high-precision, high-speed joining technologies across advanced manufacturing sectors. According to Grand View Research, the global laser welding market size was valued at USD 6.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.9% from 2024 to 2030. This growth is fueled by rising adoption in automotive, aerospace, electronics, and medical device manufacturing, where consistency, minimal heat distortion, and automation compatibility are critical. Mordor Intelligence also highlights that advancements in fiber laser technology and the push toward electric vehicles are accelerating industry uptake. As demand intensifies, a select group of manufacturers has emerged as leaders, combining innovation, reliability, and scalability to dominate the competitive landscape. Here’s a data-driven look at the top 10 laser welding equipment manufacturers shaping the future of industrial fabrication.

Top 10 Laser Welding Uses Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Laser Technology & Laser Machines from ALPHA LASER

Website: alphalaser.eu

Key Highlights: As a leading manufacturer of mobile, flexible, and high-performance laser systems for laser welding, laser hardening, powder deposit welding and additive metal ……

#2 LaserStar Technologies

Website: laserstar.net

Key Highlights: LaserStar Technologies designs and manufactures high-performance laser welding, marking, and cutting systems for industrial, jewelry, ……

#3 Equipment & Systems

Website: amadaweldtech.com

Key Highlights: Manufacturer of equipment and systems for welding, cutting, marking, micromachining, sealing, and bonding. Resistance welding. Laser….

#4 Denaliweld

Website: denaliweld.com

Key Highlights: A laser welding machine excels at welding thin materials with precision, reducing weight while maintaining integrity. The laser welding process minimizes heat ……

#5 Laser Company for Industrial Laser Solutions

Website: laserline.com

Key Highlights: The leading laser company for integrated & customized diode laser manufacturing solutions for various industries & applications….

#6 Laser Machines

Website: lclasers.com

Key Highlights: We offer comprehensive solutions in cleaning, welding and laser marking. At LC Lasers we seek laser solutions for our customers and distributors….

#7 Ultra

Website: laserphotonics.com

Key Highlights: Laser welding is a non-contact, highly precise process that enables manufacturers of miniature components to create strong, high-quality joints ……

#8 Laser Welding

Website: ipgphotonics.com

Key Highlights: Laser welding is the process of transferring a laser beam’s energy in the form of heat to fuse or join parts. This transferred heat melts the materials to ……

#9 Orotig: Laser Machinery

Website: orotig.com

Key Highlights: We specialise in engineering and manufacturing laser solutions for welding, engraving, casting and cutting precious and non-precious metals….

#10 Laser Plastic Welding

Website: emerson.com

Key Highlights: Laser plastic welding uses no friction, vibration or harsh movement and is the ideal choice for any sized part requiring a precise join….

Expert Sourcing Insights for Laser Welding Uses

2026 Market Trends for Laser Welding Uses

The laser welding market is poised for significant transformation by 2026, driven by technological advancements, evolving industrial demands, and the global push towards automation and sustainability. Here are the key trends shaping its trajectory:

Accelerated Adoption in Electric Vehicle (EV) Manufacturing

The booming electric vehicle sector is a primary catalyst for laser welding growth. By 2026, demand will surge for high-precision, high-speed welding in battery production—including cell tab welding, busbar connections, and battery pack assembly—where laser technology ensures reliability and thermal control. Lightweighting strategies to extend EV range will also increase the use of laser welding for joining dissimilar metals (e.g., aluminum to steel) and advanced high-strength steels, a task where traditional methods struggle.

Integration with Artificial Intelligence and Smart Manufacturing

Laser welding systems will increasingly incorporate AI and machine learning algorithms for real-time process monitoring, defect detection, and adaptive control. By 2026, predictive maintenance and self-optimizing weld parameters will become standard in smart factories, minimizing downtime and enhancing weld consistency. Integration with digital twins and Industry 4.0 platforms will enable end-to-end traceability and quality assurance, particularly in aerospace and medical device manufacturing.

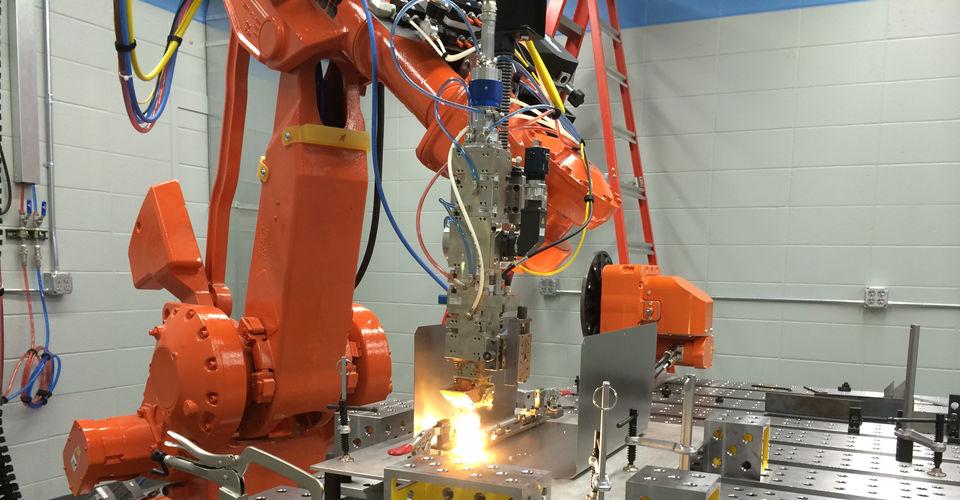

Growth in Portable and Remote Laser Welding Solutions

The demand for flexible and mobile welding systems will rise, especially in construction, shipbuilding, and field repair. By 2026, advancements in fiber laser technology and robotic arms will enable lightweight, portable laser welders capable of high-quality results in non-factory environments. Remote laser welding—where the laser source is separated from the delivery system—will gain traction in confined or hazardous spaces, improving safety and access.

Expansion into New Materials and Industries

Beyond traditional metals, laser welding will see increased use with advanced materials such as high-temperature alloys, ceramics, and composites. Industries like aerospace, defense, and medical implants will benefit from laser welding’s precision and minimal heat-affected zones. Additionally, sectors such as renewable energy (e.g., fuel cells and solar thermal systems) and consumer electronics (e.g., wearables and foldable devices) will adopt laser welding for miniaturized and hermetic sealing applications.

Emphasis on Sustainability and Energy Efficiency

As environmental regulations tighten, manufacturers will favor laser welding for its lower energy consumption and reduced material waste compared to conventional methods. Fiber lasers, with their high wall-plug efficiency, will dominate the market. By 2026, lifecycle assessments will increasingly favor laser processes, and companies will invest in closed-loop systems and recyclable materials compatible with laser joining techniques.

Advancements in Multi-Beam and Hybrid Welding Technologies

To meet the need for higher throughput and deeper penetration, multi-beam laser systems—using multiple laser sources simultaneously—will become more prevalent. Hybrid welding, combining laser with arc or MIG processes, will offer enhanced flexibility for thick-section welding in heavy industries like shipbuilding and construction. These hybrid solutions will deliver improved gap bridging and reduced porosity, expanding the range of applicable use cases.

In summary, by 2026, laser welding will be more intelligent, versatile, and integrated, driven by digitalization, material innovation, and the demands of high-growth industries like electric mobility and sustainable manufacturing.

Common Pitfalls in Sourcing Laser Welding Equipment: Quality and Intellectual Property Concerns

When sourcing laser welding systems—whether for integration into manufacturing lines or for specific production needs—organizations often encounter significant challenges related to quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to operational inefficiencies, legal complications, and compromised product integrity. Below are key pitfalls to avoid in both domains.

Quality-Related Pitfalls

1. Inadequate Vendor Qualification

A common mistake is selecting suppliers based solely on cost or lead time without thoroughly vetting their technical capabilities and quality management systems. Reputable laser welding providers should comply with international standards such as ISO 9001 and have documented processes for design, manufacturing, and after-sales support. Failing to audit suppliers increases the risk of receiving substandard equipment with poor beam stability, inconsistent weld quality, or premature component failure.

2. Lack of Performance Validation and Testing

Procuring laser welding systems without requiring on-site performance testing or sample welding trials can result in mismatched capabilities. Different materials (e.g., stainless steel, aluminum, dissimilar metals) demand specific laser parameters (wavelength, power, pulse duration). Buyers should insist on validation under real-world conditions to confirm weld strength, penetration depth, and repeatability before finalizing purchases.

3. Poor After-Sales Support and Spare Parts Availability

Low-cost suppliers, especially from regions with less mature industrial ecosystems, may lack reliable technical support networks or struggle to provide timely spare parts. This can lead to extended downtime and increased total cost of ownership. Ensure service level agreements (SLAs) and spare parts logistics are clearly defined in procurement contracts.

4. Inconsistent Component Sourcing and Traceability

Some suppliers use non-OEM or counterfeit components (e.g., laser diodes, optics, cooling systems) to reduce costs. This compromises system longevity and safety. Demand full component traceability and insist on OEM-sourced critical parts, particularly for high-power laser systems requiring stable and predictable performance.

Intellectual Property-Related Pitfalls

1. Unprotected Technology Transfer and Reverse Engineering Risks

When sharing proprietary designs, welding parameters, or process know-how with suppliers—especially during system customization—there is a risk of IP leakage. Suppliers in certain jurisdictions may lack strong IP enforcement, making it easier for them to reverse engineer or replicate your processes. Always execute comprehensive non-disclosure agreements (NDAs) and limit data sharing to what is strictly necessary.

2. Ambiguous Ownership of Customized Solutions

If a laser welding system is customized for your specific application (e.g., robotic integration, unique fixturing, or control software), clarify IP ownership upfront. Vendors may retain rights to modifications or software algorithms unless explicitly assigned in the contract. This can restrict your ability to modify, maintain, or replicate the system in the future.

3. Use of Third-Party Patented Technologies Without Licensing

Some laser welding systems incorporate patented technologies (e.g., beam oscillation, real-time monitoring systems) owned by third parties. Sourcing such equipment without verifying proper licensing exposes your organization to infringement claims. Conduct due diligence on the supplier’s use of licensed technologies and request documentation to mitigate legal risks.

4. Inadequate Protection of Process-Specific IP

The welding parameters and sequences you develop (e.g., pulse shaping for heat-sensitive components) represent valuable trade secrets. Ensure control systems do not store or transmit this data without encryption or access controls. Consider contractual clauses that prohibit the supplier from using your process data for other clients or competitive benchmarking.

Conclusion

Sourcing laser welding equipment demands a strategic approach that balances cost considerations with rigorous attention to quality and IP protection. Conduct thorough supplier audits, validate performance under actual operating conditions, and safeguard proprietary knowledge through legal and technical safeguards. Proactively addressing these pitfalls ensures reliable, high-quality welding operations and protects your organization’s competitive advantage.

Logistics & Compliance Guide for Laser Welding Uses

Laser welding is a precise and efficient joining process widely used across industries such as automotive, aerospace, medical devices, and electronics. Ensuring safe, compliant, and efficient implementation requires careful attention to logistics and regulatory standards. This guide outlines key considerations for managing laser welding operations in accordance with industry regulations and best practices.

Regulatory Compliance and Safety Standards

Laser welding systems are subject to numerous safety and compliance regulations, primarily focused on protecting personnel, equipment, and the environment. Key standards include:

- ANSI Z136.1 (Safe Use of Lasers) – Provides comprehensive guidelines for laser safety in industrial settings, including classification, control measures, and training.

- OSHA Regulations (29 CFR 1910) – Addresses workplace safety, including exposure to hazardous energy, electrical safety, and machine guarding.

- IEC 60825-1 (Safety of Laser Equipment) – International standard defining laser classifications and safety requirements for laser products.

- FDA/CDRH (21 CFR 1040.10 & 1040.11) – Regulates laser products in the U.S., requiring manufacturers to certify compliance and provide safety features.

- NFPA 70 (National Electrical Code) – Governs electrical installations to prevent fire and shock hazards associated with laser systems.

Facilities must conduct a laser hazard evaluation, designate a Laser Safety Officer (LSO), and implement engineering controls (e.g., interlocks, enclosures) and administrative controls (e.g., standard operating procedures, training).

Facility Requirements and Layout Planning

Proper facility planning is essential for safe and efficient laser welding operations:

- Controlled Access Areas – Laser operation zones must be clearly marked with warning signs and restricted to authorized personnel.

- Ventilation and Fume Extraction – Local exhaust ventilation (LEV) systems are required to remove hazardous fumes and particulates generated during welding (e.g., metal oxides).

- Lighting and Visibility – Adequate ambient lighting outside the laser enclosure is necessary; viewing windows must incorporate appropriate laser protective filters.

- Space and Ergonomics – Ensure sufficient space for equipment maintenance, material handling, and operator movement. Integrate ergonomic workstations to reduce fatigue.

Material Handling and Supply Chain Logistics

Efficient logistics for raw materials, workpieces, and finished goods are critical:

- Material Compatibility – Verify that base metals and coatings are suitable for laser welding (e.g., clean, oxide-free surfaces).

- Incoming Inspection – Implement quality checks for dimensional accuracy and surface condition to prevent weld defects.

- Work-in-Process (WIP) Flow – Optimize workflow to minimize handling and reduce cycle times. Use automation (e.g., robotic loaders) where feasible.

- Inventory Management – Maintain accurate records of consumables (e.g., shielding gases, nozzles) and implement just-in-time (JIT) delivery to reduce waste.

Equipment Maintenance and Calibration

Regular maintenance ensures consistent weld quality and compliance:

- Scheduled Servicing – Follow manufacturer-recommended maintenance plans for lasers, optics, cooling systems, and motion components.

- Optical Alignment and Cleaning – Keep lenses and mirrors clean and properly aligned to maintain beam quality and power.

- Calibration Records – Maintain logs for laser power meters, safety interlocks, and fume extraction systems to demonstrate compliance during audits.

- Spare Parts Inventory – Stock critical spare parts to minimize downtime.

Environmental and Waste Management

Laser welding generates byproducts that require proper management:

- Hazardous Waste Disposal – Collect and dispose of metal particulates, used filters, and contaminated consumables according to EPA and local regulations.

- Recycling Programs – Recycle scrap metal and packaging materials where possible.

- Noise Control – Monitor and mitigate noise levels from auxiliary equipment (e.g., chillers, pumps) in accordance with OSHA limits.

Training and Documentation

Comprehensive training and documentation are essential for compliance and operational efficiency:

- Operator Training – Train personnel on safe operation, emergency procedures, and hazard recognition.

- Laser Safety Training – Required for all personnel working near Class 3B and Class 4 lasers.

- Standard Operating Procedures (SOPs) – Document welding parameters, inspection criteria, and maintenance routines.

- Audit Readiness – Maintain records of training, inspections, maintenance, and incident reports for regulatory audits.

By adhering to this logistics and compliance framework, organizations can ensure the safe, efficient, and legally compliant use of laser welding technology across their operations.

Conclusion on Sourcing Laser Welding Services

Sourcing laser welding services offers numerous advantages for manufacturers seeking high precision, speed, and quality in joining materials. The technology enables deep, narrow welds with minimal heat input, resulting in reduced distortion and excellent repeatability—making it ideal for industries such as automotive, aerospace, medical devices, and electronics. By outsourcing laser welding to specialized providers, companies can access advanced equipment and technical expertise without the significant capital investment required for in-house setups. This approach also allows for scalability, flexibility, and faster time-to-market.

However, successful sourcing depends on selecting qualified partners with proven experience, stringent quality control processes, and the ability to handle specific material and design requirements. Factors such as geographic proximity, production capacity, certification standards (e.g., ISO, AS9100), and communication efficiency must be carefully evaluated.

In conclusion, sourcing laser welding services is a strategic decision that enhances manufacturing capabilities, improves product quality, and supports innovation—provided that supplier selection is thorough and aligned with project needs. As demand for precision welding continues to grow, leveraging external laser welding expertise will remain a competitive advantage in modern manufacturing.