The global laser welding machine market is experiencing robust growth, driven by increasing demand for precision manufacturing across industries such as automotive, electronics, and medical devices. According to Mordor Intelligence, the market was valued at approximately USD 2.4 billion in 2023 and is projected to grow at a CAGR of over 7.5% from 2024 to 2029. This expansion is fueled by advancements in fiber laser technology, rising adoption of automation in production lines, and the growing need for high-speed, low-distortion welding solutions. As manufacturers seek improved accuracy, energy efficiency, and integration with smart manufacturing systems, the competitive landscape has intensified, with key players investing heavily in R&D and strategic partnerships. In this evolving environment, identifying the leading laser welding machine manufacturers becomes critical for businesses aiming to adopt cutting-edge solutions that deliver reliability and long-term performance.

Top 10 Laser Welding Machine Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 LaserStar Technologies

Website: laserstar.net

Key Highlights: LaserStar Technologies designs and manufactures high-performance laser welding, marking, and cutting systems for industrial, jewelry, ……

#2 Equipment & Systems

Website: amadaweldtech.com

Key Highlights: Manufacturer of equipment and systems for welding, cutting, marking, micromachining, sealing, and bonding. Resistance welding. Laser….

#3 Laser Technology & Laser Machines from ALPHA LASER

Website: alphalaser.eu

Key Highlights: As a pioneer in the field of mobile laser welding, ALPHA LASER GmbH offers a wide range of high-quality laser welding devices. This includes laser welding ……

#4 Denaliweld

Website: denaliweld.com

Key Highlights: We Specialize in Laser Welding & Cleaning. DenaliWeld INC, is a proud employee-owned fiber laser welding machine manufacturer based in Chicago, USA….

#5 Laser Machines

Website: lclasers.com

Key Highlights: Distribution and manufacture of laser machinery. Sales of laser marking, laser cleaning, laser engraving and welding machines….

#6 Everlast Inverter Welders Equipment

Website: everlastgenerators.com

Key Highlights: Everlast Power Equipment, manufacturers of MIG, TIG & Stick welders. For reliable welding machines and supplies shop Everlast Power Equipment….

#7 Laser Welding

Website: ipgphotonics.com

Key Highlights: Laser welding is the process of transferring a laser beam’s energy in the form of heat to fuse or join parts. This transferred heat melts the materials to ……

#8 Orotig: Laser Machinery

Website: orotig.com

Key Highlights: Orotig, with +30 years of experience, specializes in engineering and manufacturing laser solutions for welding engraving and casting metals….

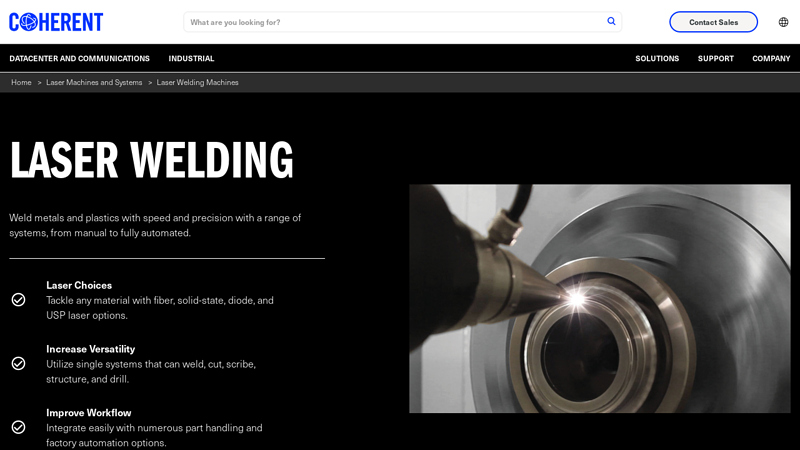

#9 Laser Welding Machines

Website: coherent.com

Key Highlights: Get manual to fully automated laser welding machines that weld plastics and metals with speed and precision while improving throughput….

#10 Han’s Laser

Website: hansme.net

Key Highlights: Han’s Laser Smart Equipment Group has set up 180+ offices around the world and sales and service organizations in more than 100 coun-tries and regions….

Expert Sourcing Insights for Laser Welding Machine

H2: 2026 Market Trends for Laser Welding Machines

As we approach 2026, the global laser welding machine market is poised for significant transformation driven by technological advancements, shifting industrial demands, and an increasing focus on automation and precision manufacturing. Several key trends are shaping the trajectory of this high-growth sector.

1. Surge in Demand from Automotive and EV Manufacturing

The automotive industry, particularly electric vehicle (EV) production, is a primary driver of laser welding adoption. In 2026, manufacturers are increasingly relying on laser welding for its ability to join lightweight materials like aluminum and high-strength steel with high precision and minimal distortion. Battery pack assembly—especially in lithium-ion cells and busbar connections—requires the consistent, clean welds that only fiber and disk lasers can deliver. As EV production scales globally, the demand for high-speed, automated laser welding systems is expected to grow at a compound annual growth rate (CAGR) exceeding 10% through 2026.

2. Advancements in Fiber and Pulsed Laser Technologies

Fiber laser welding systems continue to dominate the market due to their superior energy efficiency, lower maintenance, and compact design. Innovations in high-power single-mode fiber lasers are enabling deeper penetration and faster welding speeds, especially in thick materials. Pulsed laser welding is also gaining traction in micro-welding applications across electronics and medical device manufacturing, where thermal control is critical. By 2026, integration of AI-driven pulse shaping and real-time monitoring will further enhance weld quality and process repeatability.

3. Integration of AI and Smart Manufacturing (Industry 4.0)

Laser welding machines are increasingly becoming smarter through integration with Industry 4.0 technologies. In 2026, predictive maintenance, real-time weld monitoring via sensors (e.g., spectroscopy, seam tracking), and AI-based quality assurance systems are standard in high-end systems. Cloud-connected machines allow remote diagnostics and process optimization, reducing downtime and improving yield. This digital integration is especially prevalent in smart factories in North America, Europe, and East Asia.

4. Expansion in Aerospace and Defense Applications

The aerospace sector is adopting laser welding for critical components such as turbine blades, fuel systems, and structural assemblies. The ability to weld dissimilar metals and high-performance alloys (e.g., titanium, Inconel) with minimal heat-affected zones makes laser welding indispensable. With increased defense spending and next-generation aircraft development, the aerospace segment is projected to account for a growing share of the laser welding market by 2026.

5. Regional Market Shifts and Supply Chain Localization

Asia-Pacific, led by China, Japan, and South Korea, remains the largest market for laser welding machines, driven by robust manufacturing ecosystems and government support for advanced manufacturing. However, in response to global supply chain disruptions, North America and Europe are investing in localized production, boosting domestic demand for laser welding solutions. U.S. initiatives under the CHIPS and Science Act and European Green Deal are accelerating automation and clean tech manufacturing, further fueling laser welding adoption.

6. Sustainability and Energy Efficiency as Competitive Advantages

As manufacturers prioritize ESG (Environmental, Social, and Governance) goals, the energy efficiency of laser welding—especially fiber lasers—offers a compelling advantage over traditional welding methods. Lower power consumption, reduced material waste, and elimination of consumables (e.g., electrodes, shielding gases in some hybrid processes) align with sustainability targets. By 2026, eco-friendly laser systems with energy recovery features are expected to gain market preference.

7. Rising Adoption in Emerging Applications

Beyond traditional sectors, laser welding is expanding into new domains such as renewable energy (solar panel frames, battery storage systems), consumer electronics (wearables, foldable devices), and medical implants. The precision and non-contact nature of laser welding make it ideal for miniaturized and high-reliability applications, further broadening its market potential.

Conclusion

By 2026, the laser welding machine market will be defined by smarter, faster, and more sustainable solutions tailored to the evolving needs of advanced manufacturing. Continued innovation, coupled with cross-industry demand and digital integration, positions laser welding as a cornerstone technology in the future of industrial production.

Common Pitfalls When Sourcing Laser Welding Machines: Quality and Intellectual Property Risks

Sourcing laser welding machines, especially from new or lower-cost suppliers, carries significant risks related to both quality consistency and intellectual property (IP) protection. Overlooking these pitfalls can lead to production delays, increased costs, legal disputes, and damage to brand reputation.

Quality-Related Pitfalls

Inconsistent Component Quality and Build Standards

Many suppliers, particularly in competitive price-driven markets, may use substandard optical components, power supplies, or motion systems to reduce costs. This leads to machines with poor beam quality, unstable output, and higher failure rates. Inconsistent manufacturing processes can result in unit-to-unit variations, making process validation difficult and impacting weld repeatability.

Inadequate Calibration and Testing Procedures

Reputable manufacturers perform rigorous factory acceptance testing (FAT), including beam profiling, power calibration, and cycle testing. Some suppliers may skip or minimize these steps, delivering machines that appear functional but fail under real production conditions. Without proper documentation and traceability, diagnosing performance issues becomes challenging.

Lack of Technical Support and Spare Parts Availability

Even a well-built machine requires ongoing maintenance and expert support. Sourcing from suppliers with limited local presence or poor service infrastructure can result in extended downtime. Unavailability of critical spare parts or firmware updates further compounds operational risks, especially for automated or integrated systems.

Overstated Performance Specifications

Some suppliers exaggerate key metrics such as maximum laser power, welding speed, or depth of penetration. These inflated claims may not reflect real-world performance under continuous operation or with specific materials. Buyers should demand independent test reports or conduct on-site validation before finalizing purchases.

Intellectual Property (IP) Risks

Use of Counterfeit or Unlicensed Laser Sources

A major concern is the unauthorized use of branded laser components (e.g., IPG, Trumpf) or firmware. Some machines may feature counterfeit modules or cloned control systems that infringe on patents and software copyrights. Purchasing such equipment exposes the end-user to legal liability, including customs seizures, infringement lawsuits, and voided warranties.

Lack of IP Transparency in Control Software

Proprietary control software often contains patented algorithms for beam modulation, seam tracking, or process monitoring. Suppliers may use unlicensed or reverse-engineered software, putting buyers at risk of secondary infringement. Without clear documentation of software licensing and origin, companies may unknowingly adopt illegal technology.

Weak or Ambiguous IP Clauses in Contracts

Many procurement agreements fail to include explicit warranties regarding IP ownership and freedom to operate. Without contractual safeguards, buyers have little recourse if the machine is later found to infringe third-party rights. This can result in costly redesigns, operational shutdowns, or indemnification disputes.

Reverse Engineering and Technology Leakage

When working with contract manufacturers or OEM suppliers, especially in regions with weaker IP enforcement, there is a risk that design specifications or integration details could be copied or resold. This is particularly critical for custom-engineered solutions or proprietary welding processes.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct thorough due diligence on suppliers, including site audits and reference checks.

– Require third-party verification of key performance metrics and component authenticity.

– Include strong IP indemnification clauses in purchase agreements.

– Prioritize suppliers with established brand reputations and transparent supply chains.

– Engage legal counsel to review software licenses and patent landscapes.

Proactively addressing quality and IP concerns ensures long-term reliability, legal compliance, and protection of innovation investments.

Logistics & Compliance Guide for Laser Welding Machine

Product Classification and Regulatory Overview

Laser welding machines are classified as industrial machinery and laser products, subject to various international and regional regulations. Key classifications include:

– HS Code: Typically 8515.21 (resistance welding machines) or 8515.80 (other welding equipment), though specific models may vary. Confirm with local customs authorities.

– Laser Safety Classification: Most industrial laser welding machines fall under Class 4 (IEC 60825-1), indicating high-power lasers capable of causing skin and eye injuries and posing fire hazards.

– Electromagnetic Compatibility (EMC): Must comply with EMC directives (e.g., EU EMC Directive 2014/30/EU) to prevent interference with other electronic devices.

Export and Import Requirements

Export Documentation

- Commercial Invoice: Must include full product description, model number, HS code, value, and technical specifications.

- Packing List: Detailed list of contents, weights, dimensions, and serial numbers.

- Certificate of Origin: Required by some countries for tariff assessment.

- Export License: May be required for high-power laser systems under dual-use regulations (e.g., EU Dual-Use Regulation 2021/821).

Import Compliance

- Customs Clearance: Submit all documentation to local customs. Duties and VAT rates vary by country.

- Product Certification: Verify compliance with local standards (e.g., CE in Europe, FCC in the U.S., CCC in China).

- Restricted Markets: Some countries regulate or restrict high-power laser equipment; pre-shipment verification is recommended.

Transportation and Handling

Packaging

- Use shock-resistant, moisture-proof packaging with internal bracing to secure the machine.

- Clearly label with “Fragile,” “This Side Up,” and “Do Not Stack” indicators.

- Include desiccants if shipping to humid environments.

Shipping Modes

- Air Freight: Suitable for urgent deliveries; ensure compliance with IATA Dangerous Goods Regulations if batteries or laser components are included.

- Sea Freight: Cost-effective for heavy machinery; use containerized shipping with climate control if necessary.

- Land Transport: Use cushioned, vibration-dampened vehicles; secure load to prevent shifting.

Hazardous Materials

- Laser welding machines typically do not contain hazardous materials but may include:

- Laser Gases (e.g., in fiber or CO2 lasers) – classified under UN 1005 (Compressed Gas).

- Batteries (for backup systems) – may require UN 3480 labeling if lithium-based.

Regulatory Certifications and Standards

Ensure the machine complies with the following:

– CE Marking (Europe):

– Machinery Directive 2006/42/EC

– Laser Product Safety: EN 60825-1

– EMC Directive 2014/30/EU

– Low Voltage Directive 2014/35/EU

– FDA/CDRH (USA):

– 21 CFR 1040.10 and 1040.11 – Laser product reporting and safety requirements.

– Registration of the manufacturer and product with the FDA.

– Other Regions:

– Canada: ICES-003 (EMC), compliance with Health Canada laser regulations.

– China: CCC certification for certain components.

– Australia/New Zealand: RCM mark, compliance with AS/NZS IEC 60825.1.

Installation and Site Compliance

- Ventilation: Ensure proper fume extraction systems are installed (required by OSHA, EU Directive 2004/37/EC for hazardous substances).

- Laser Safety Zone: Define and mark a controlled area with interlocks, warning signs (e.g., “Laser Radiation – Avoid Eye or Skin Exposure”), and emergency stop systems.

- Electrical Requirements: Confirm local voltage, frequency, and grounding standards. Use qualified electricians for installation.

- Training: Provide operator and maintenance personnel with laser safety training (e.g., ANSI Z136.1 in the U.S.).

After-Sales and Maintenance Compliance

- Service Logs: Maintain records of maintenance, repairs, and safety inspections.

- Spare Parts: Use only manufacturer-approved components to maintain compliance.

- Regulatory Updates: Monitor changes in local and international regulations; update equipment documentation and safety measures accordingly.

Environmental and Disposal Considerations

- End-of-Life Disposal: Follow WEEE (Waste Electrical and Electronic Equipment) Directive in the EU or equivalent local regulations.

- Hazardous Waste: Components such as laser tubes or capacitors may require special disposal procedures.

- Recycling: Partner with certified e-waste recyclers for proper component recovery.

Summary and Best Practices

- Verify all certifications before shipment.

- Use certified freight forwarders experienced in handling industrial laser equipment.

- Provide end-users with full compliance documentation, user manuals, and safety instructions.

- Maintain a compliance checklist for each destination country to prevent delays or penalties.

In conclusion, sourcing a laser welding machine requires a strategic and thorough approach to ensure the selection of a reliable and suitable supplier. Key factors such as machine specifications, technological capabilities, after-sales service, cost-effectiveness, and supplier reputation must be carefully evaluated. It is essential to conduct comprehensive market research, compare multiple suppliers, and consider long-term support and integration needs. By prioritizing quality, technical expertise, and reliability, businesses can make an informed decision that enhances manufacturing efficiency, ensures consistent weld quality, and supports sustainable growth. Ultimately, partnering with the right laser welding machine supplier is a critical investment that can significantly impact production performance and competitiveness in the industry.