The global laser cleaning market is experiencing robust growth, driven by increasing demand for eco-friendly and precision-based surface treatment solutions across industries such as automotive, aerospace, and manufacturing. According to a report by Mordor Intelligence, the laser cleaning market was valued at USD 758.4 million in 2023 and is projected to reach USD 1,835.2 million by 2029, growing at a CAGR of 15.8% during the forecast period. This surge is attributed to the rising adoption of laser rust cleaning machines, which offer non-abrasive, chemical-free, and highly efficient removal of rust, coatings, and contaminants. With advancements in fiber laser technology and growing emphasis on sustainable industrial practices, manufacturers are intensifying R&D efforts to enhance cleaning speed, portability, and cost-efficiency. As the market expands, a select group of innovators has emerged as leaders in developing high-performance laser rust cleaning systems, shaping the future of industrial maintenance and surface preparation. Below are the top 10 laser rust cleaner machine manufacturers leading this transformation.

Top 10 Laser Rust Cleaner Machine Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 FOX P CL – laser for removing rust

Website: pulsar-laser.com

Key Highlights: An innovative laser cleaner that revolutionizes the maintenance and restoration of large vehicles and industrial equipment….

#2 Laserax

Website: laserax.com

Key Highlights: Laserax works with the world’s leading manufacturers to implement laser cleaning, welding, texturing, and marking solutions….

#3 P-laser Industrial laser cleaning

Website: p-laser.com

Key Highlights: Specializing in the production of premium-quality, Belgian-made industrial laser cleaning equipment, we take great pride in our craftsmanship and innovative ……

#4 Clean Laser Systems

Website: cleanlaser.de

Key Highlights: IPG | cleanLASER has been developing and producing high-precision laser systems for cleaning and industrial surface treatment for more than 20 years….

#5 SFX Laser

Website: sfxlaser.com

Key Highlights: SFX Laser is a 20+ years professional laser equipment manufacturer including laser cleaning machine, laser welding machine, fiber laser engraver, ……

#6 Industrial 1500W 2000W CW Laser Cleaning Machine Rusty Remove

Website: xinglaser.com

Key Highlights: In stockXING Laser (6am Life LLC, DBA XING Laser) specializes in the development and manufacture of high-performance handheld laser cleaning and rust removal equipment….

#7 Argento Lux

Website: argentolux.com

Key Highlights: Laser cleaning removes paint, contaminants, rust, and residues with a high-energy laser beam which leaves the substrate untouched. Our Laser Ablation is the ……

#8 Laser Cleaning and Laser Ablation Systems

Website: laserphotonics.com

Key Highlights: Remove rust and surface contaminants with our laser cleaning & laser ablation systems. Experience superior cleaning tech, automation, and eco-friendly ……

#9 Laser Cleaning

Website: ipgphotonics.com

Key Highlights: Laser cleaning is used across a variety of industries to remove unwanted surface materials like coatings, paints, rust, oil, and for surface preparation for ……

#10 Laser cleaning

Website: p-laserusa.com

Key Highlights: Our laser machines are mainly used to remove the following contaminants: Rust – Paint – Coatings – Release Agents – Grease, Oils – Soot – Rubber- Organic ……

Expert Sourcing Insights for Laser Rust Cleaner Machine

H2: 2026 Market Trends for Laser Rust Cleaner Machines

The global market for Laser Rust Cleaner Machines is poised for significant transformation by 2026, driven by technological advancements, increasing environmental regulations, and growing demand for precision cleaning across key industrial sectors. Here’s a detailed analysis of the key trends shaping the market landscape:

1. Accelerated Adoption in Automotive and Aerospace Industries

By 2026, the automotive and aerospace sectors are expected to be primary drivers of laser rust cleaner adoption. Manufacturers will increasingly turn to laser technology for surface preparation of high-value components due to its precision, consistency, and non-contact nature. In aerospace, the need for non-destructive cleaning of sensitive alloys and composites will make laser systems indispensable for maintenance, repair, and overhaul (MRO) operations. Electric vehicle (EV) manufacturers will also adopt laser cleaning for battery component preparation and corrosion prevention on lightweight materials.

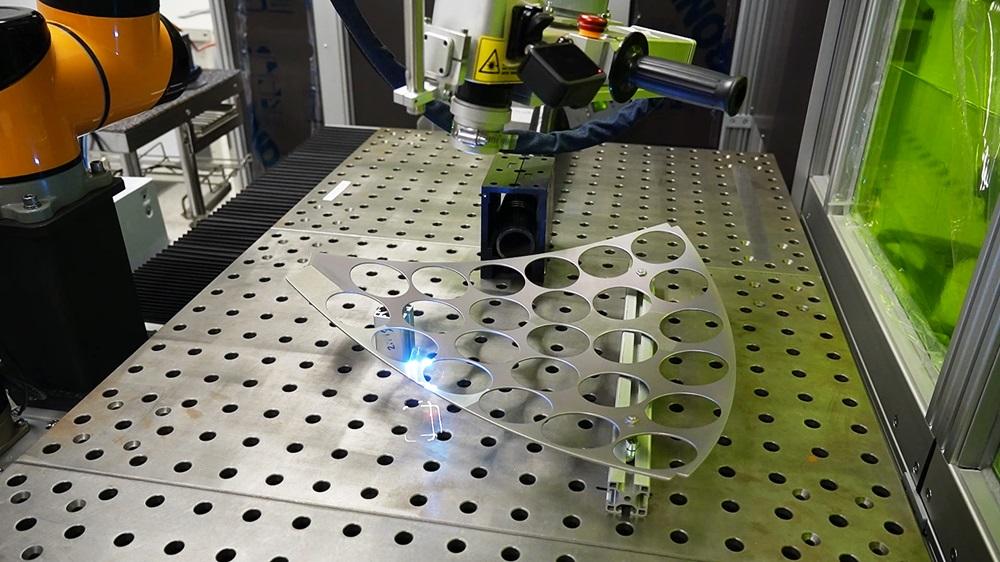

2. Integration with Robotics and Automation

A dominant trend by 2026 will be the integration of laser rust cleaners with robotic arms and automated production lines. This synergy enables fully autonomous cleaning processes, improving throughput, worker safety, and repeatability. Smart factories will deploy laser cleaning cells that communicate with manufacturing execution systems (MES) for real-time monitoring and adaptive control, minimizing human intervention and reducing operational costs.

3. Technological Advancements: Portability and Efficiency

Laser systems will become more compact, energy-efficient, and user-friendly by 2026. Portable handheld laser cleaners will gain market share, especially in field applications such as shipbuilding, infrastructure maintenance, and heritage restoration. Advancements in fiber laser technology will deliver higher pulse energies and faster cleaning speeds, reducing cycle times and expanding applicability to thicker rust layers and larger surface areas.

4. Stringent Environmental Regulations Driving Shift from Chemical Methods

With global emphasis on sustainability and pollution control, regulations restricting the use of chemical solvents and abrasive blasting (e.g., silica sand) will intensify. Laser cleaning, being a dry, chemical-free, and waste-minimizing process, will become a preferred alternative. Industries seeking compliance with REACH, RoHS, and local environmental standards will increasingly invest in laser systems, boosting market growth.

5. Growing Demand in Renewable Energy and Infrastructure Sectors

The renewable energy sector—particularly wind turbine maintenance and solar panel frame cleaning—will drive demand for laser rust removal. Similarly, aging infrastructure projects (bridges, pipelines, rail systems) will adopt laser technology for corrosion control due to its precision and minimal substrate damage. Governments investing in infrastructure renewal programs will accelerate adoption.

6. Cost Reduction and Improved ROI

While laser cleaning systems currently carry a higher upfront cost, prices are expected to decline by 2026 due to economies of scale, competition, and technological maturity. Concurrently, total cost of ownership (TCO) will improve with lower maintenance, consumable, and disposal costs compared to traditional methods. This improved ROI will make laser cleaning financially viable for small and medium-sized enterprises (SMEs).

7. Regional Market Expansion

Asia-Pacific—especially China, Japan, and South Korea—will lead market growth due to rapid industrialization, strong manufacturing bases, and government support for green technologies. North America and Europe will maintain steady growth, driven by aerospace, automotive, and stringent environmental policies. Emerging markets in Latin America and the Middle East will begin adopting laser cleaning for oil & gas and construction applications.

8. Rise of Service-Based Business Models

By 2026, equipment-as-a-service (EaaS) and cleaning-as-a-service (CaaS) models will gain traction. Instead of purchasing expensive machinery, companies will opt for on-demand laser cleaning services, lowering entry barriers and enabling broader market penetration across diverse sectors.

Conclusion

By 2026, the laser rust cleaner machine market will evolve into a mainstream industrial solution, characterized by smarter, faster, and more sustainable cleaning technologies. Driven by automation, environmental compliance, and cross-sector demand, the market is expected to experience robust CAGR, with innovation focusing on accessibility, efficiency, and integration into digital manufacturing ecosystems.

Common Pitfalls When Sourcing a Laser Rust Cleaner Machine (Quality, IP)

Sourcing a laser rust cleaner machine, particularly from international suppliers, involves significant risks related to product quality and intellectual property (IP). Being aware of these pitfalls is crucial to making a sound investment and protecting your business.

Poor Build Quality and Substandard Components

Many suppliers, especially those offering low-cost machines, use inferior materials and components to cut costs. This can result in machines with weak structural frames, unreliable laser sources, or inadequate cooling systems. Such shortcomings lead to frequent breakdowns, reduced cleaning efficiency, and shortened operational lifespan, ultimately increasing total cost of ownership.

Inaccurate or Exaggerated Performance Specifications

A common issue is suppliers overstating key performance metrics such as laser power, cleaning speed, or effective working area. A machine advertised as 1000W might actually deliver significantly less effective power due to inefficient optical components or poor calibration. This misrepresentation can lead to disappointing on-site performance and an inability to meet project requirements.

Lack of Safety Features and Regulatory Compliance

Laser systems pose serious safety risks, including eye and skin hazards. Some sourced machines—particularly from unverified vendors—may lack essential safety features such as emergency stop buttons, protective enclosures, or proper laser shielding. They may also fail to comply with international safety standards (e.g., FDA, CE, IEC 60825), exposing buyers to legal liabilities and workplace safety risks.

Inadequate or Non-Existent Intellectual Property Protection

Many low-cost laser cleaning machines are reverse-engineered or produced without proper licensing of core technologies. Using such equipment could expose your business to IP infringement claims, especially if the machine incorporates patented beam delivery systems, control software, or optical designs. This risk is heightened when suppliers are unwilling or unable to provide documentation on IP ownership.

Limited or No After-Sales Support and Spare Parts Availability

Suppliers based overseas may offer little to no technical support, training, or timely access to spare parts. When a critical component fails, long shipping times and language barriers can result in extended downtime. Machines without readily available service networks become costly liabilities rather than productive tools.

Hidden Software Limitations and Proprietary Lock-ins

Some laser cleaners come with proprietary software that limits functionality or requires expensive upgrade fees. Others may lack essential features like process logging, parameter optimization, or remote diagnostics. In extreme cases, suppliers may retain control over software updates or even disable machines remotely, creating operational vulnerabilities.

Insufficient Testing and Lack of Real-World Validation

Many sourced machines are sold without rigorous field testing. Suppliers may provide only lab-condition demonstrations that don’t reflect real-world industrial environments. Without third-party validation or customer references, it’s difficult to assess true reliability and performance under practical operating conditions.

Failure to Verify Supplier Authenticity and Track Record

Buyers often rely on online marketplaces or brokers without verifying the supplier’s legitimacy. Fake certifications, fabricated client lists, and recycled marketing materials are common. Engaging with such suppliers increases the risk of receiving non-compliant, low-quality, or even counterfeit equipment.

Avoiding these pitfalls requires thorough due diligence, including on-site factory audits, third-party testing, review of IP documentation, and clear service level agreements. Investing time upfront can prevent costly issues down the line.

Logistics & Compliance Guide for Laser Rust Cleaner Machine

This guide outlines essential logistics and compliance considerations for the safe, legal, and efficient transportation and operation of a Laser Rust Cleaner Machine. Adherence to these guidelines ensures regulatory compliance, protects personnel, and avoids shipment delays.

Regulatory Classification & Documentation

Identify and prepare accurate regulatory documentation for international and domestic shipments. Laser rust cleaners are complex devices with potential hazards, requiring specific classifications.

- HS Code Determination: Obtain the correct Harmonized System (HS) code for customs clearance. Common classifications include:

- 8515.80: Other apparatus for electric (including electric induction or dielectric) or laser welding, brazing, cutting or surface treatment.

- 9013.20: Laser diodes and other lasers.

- Note: The final code depends on the machine’s primary function and specifications. Consult with a freight forwarder or customs broker.

- Laser Product Classification (IEC 60825-1): Confirm the laser safety class (typically Class 4 for industrial rust cleaners). This classification is crucial for labeling and safety requirements.

- Required Documentation:

- Commercial Invoice (detailing value, description, HS code).

- Packing List.

- Certificate of Origin.

- Laser Safety Compliance Certificate: Proof of conformity to IEC 60825-1 or FDA 21 CFR 1040.10/1040.11 (for shipments to the USA).

- Technical Specifications Sheet (highlighting laser wavelength, power, pulse duration, beam characteristics).

- Safety Data Sheet (SDS) for any consumables (e.g., assist gases like nitrogen, compressed air).

- Bill of Lading (Air Waybill for air freight, Sea Waybill for ocean freight).

Packaging & Handling Requirements

Robust packaging is critical to protect sensitive optical and electronic components during transit.

- Original Manufacturer Packaging: Use the original crate or packaging designed by the manufacturer whenever possible. It provides optimal protection.

- Custom Crating (if OEM unavailable):

- Use strong, multi-ply wooden crates with internal bracing.

- Securely anchor the machine to the base of the crate using bolts or straps to prevent movement.

- Fill all voids with high-density foam, bubble wrap, or void fill to immobilize components and absorb shocks.

- Protect optical components (lens, scanner head) with additional internal packaging or covers.

- Clearly mark fragile components.

- Labeling:

- “FRAGILE”

- “THIS SIDE UP” (on all relevant sides)

- “LASER RADIATION – DO NOT STARE INTO BEAM OR VIEW DIRECTLY WITH OPTICAL INSTRUMENTS” (Class 4 warning label, often required)

- “DO NOT DROP”

- Proper orientation arrows.

- HS Code and Product Description.

- Handling: Use mechanical handling equipment (forklifts, pallet jacks). Never drag or drop the crate. Lift by the base, not handles or protrusions.

Transportation Modes & Restrictions

Choose the appropriate transport method based on urgency, cost, and destination.

- Air Freight:

- Strictest Regulations: IATA Dangerous Goods Regulations (DGR) apply due to laser classification and potential battery power sources.

- Laser Classification: Class 4 lasers are generally PROHIBITED as cargo on passenger aircraft due to radiation hazard. They may be permitted on cargo-only aircraft under specific conditions (e.g., proper packaging, labeling, documentation, operator knowledge). Obtain explicit approval from the airline and freight forwarder.

- Batteries: If the machine contains lithium batteries (common for portable units), they fall under IATA DGR (UN 3480, 3481). They may need to be shipped separately, at <30% charge, and with specific packaging/labeling.

- Lead Times: Faster but significantly more expensive and heavily regulated.

- Ocean Freight (FCL/LCL):

- Preferred for Heavy/Industrial Machines: More cost-effective for large, heavy equipment.

- IMDG Code: Marine Transport Dangerous Goods Code may apply, especially if batteries are included. Class 4 lasers are generally not classified as dangerous goods under IMDG solely for the laser radiation, but batteries are. Verify classification.

- Packaging: Must withstand long-term exposure to humidity, salt spray, and potential stacking.

- Lead Times: Longer transit times but lower cost per kg.

- Ground Freight (Domestic/Regional):

- ADR/RID (Europe), 49 CFR (USA): Apply for road/rail transport, primarily concerning batteries. The laser itself is typically not regulated as dangerous goods for ground transport, but secure packaging and handling are still paramount.

- Best Practice: Use enclosed, climate-controlled trailers if possible to protect from weather and temperature extremes.

Import/Export Compliance

Navigate customs procedures efficiently by ensuring all compliance requirements are met.

- Laser Product Regulations:

- USA: Comply with FDA/CDRH regulations (21 CFR 1040.10/1040.11). An FDA Accession Number or proof of product listing may be required for import. The importer is responsible for ensuring compliance.

- Canada: Comply with Health Canada’s Radiation Emitting Devices Act (REDA) and associated regulations. A Compliance Certificate or Declaration of Conformity may be needed.

- European Union: Requires CE Marking based on the Machinery Directive (2006/42/EC) and potentially the Radio Equipment Directive (RED) if wireless. Technical File and EC Declaration of Conformity are mandatory.

- Other Countries: Research specific national regulations (e.g., KC Mark for South Korea, CCC for China – though laser cleaners may fall under specific CCC rules, check carefully). Always verify local requirements.

- Restricted Parties Screening: Ensure the end-user is not on any government denied persons lists (e.g., OFAC, BIS).

- End-Use Certification: Be prepared to provide documentation stating the machine will be used for legitimate industrial purposes (rust cleaning) and not for prohibited military or other restricted applications (dual-use concern).

- Customs Broker: Engage a licensed customs broker familiar with machinery and laser products in the destination country.

Installation & Operational Compliance

Ensure safety and legality after delivery.

- Site Assessment: Verify the installation site meets requirements:

- Adequate power supply (voltage, phase, amperage).

- Sufficient space for operation, maintenance, and safety zones.

- Proper ventilation, especially if fumes are generated.

- Stable, level, vibration-free floor.

- Laser Safety Program (Mandatory for Class 4):

- Designated Laser Area: Establish a controlled area with appropriate barriers (curtains, walls) and interlocks if possible.

- Warning Signs: Post “Laser Radiation” warning signs at all entrances to the laser area.

- Personal Protective Equipment (PPE): Provide and mandate the use of Laser Safety Glasses with the correct Optical Density (OD) for the specific laser wavelength and power. Also provide protective clothing as needed.

- Training: Train all operators and personnel on laser hazards, safety procedures, emergency shutdown, and proper use of PPE.

- Standard Operating Procedures (SOPs): Develop and implement written SOPs for safe operation and maintenance.

- Laser Safety Officer (LSO): Appoint a qualified LSO, especially in larger facilities, to oversee the laser safety program.

- Environmental Regulations: Comply with local regulations regarding fume extraction and particulate matter generated during laser cleaning. Use appropriate fume extraction systems.

- Electrical Safety: Ensure the machine is properly grounded and connected according to local electrical codes.

- Maintenance Records: Keep detailed records of maintenance, safety checks, and operator training.

Key Contacts & Resources

- Manufacturer’s Technical Support

- Reputable Freight Forwarder (Specializing in Machinery/Dangerous Goods)

- Licensed Customs Broker (Destination Country)

- Legal/Compliance Department

- Regulatory Bodies:

- FDA/CDRH (USA)

- Health Canada (Canada)

- Notified Bodies (EU CE Marking)

- Local OSHA/EHS Authorities

Disclaimer: Regulations vary significantly by country and are subject to change. This guide provides general information. Always consult with qualified experts (freight forwarders, customs brokers, legal counsel, safety officers) and the relevant regulatory authorities in your specific shipment origin, transit, and destination countries before shipping or operating a Laser Rust Cleaner Machine.

Conclusion for Sourcing a Laser Rust Cleaner Machine

Sourcing a laser rust cleaning machine represents a strategic investment in advanced, eco-friendly, and efficient surface cleaning technology. As industries increasingly prioritize sustainability, precision, and reduced operational downtime, laser rust cleaning offers a compelling alternative to traditional methods such as sandblasting, chemical stripping, or mechanical grinding. The absence of consumables, minimal waste generation, and non-abrasive nature of laser cleaning contribute to lower long-term operational costs and improved workplace safety.

When sourcing such a machine, it is essential to evaluate key factors including laser power (measured in watts), beam quality, portability, ease of integration with existing workflows, and after-sales support. Reputable suppliers should provide technical documentation, safety certifications, and demonstration units to ensure compatibility with specific industrial applications—ranging from automotive restoration and shipbuilding to historical artifact preservation.

Additionally, considering total cost of ownership—not just the initial purchase price—enables a more accurate assessment of ROI. While upfront costs may be higher than conventional tools, the durability, efficiency, and environmental benefits of laser cleaning often justify the investment over time.

In conclusion, sourcing a laser rust cleaner machine should be approached with careful vendor evaluation, clear understanding of operational needs, and a forward-looking perspective on industrial maintenance. By selecting the right system, businesses can enhance cleaning precision, reduce environmental impact, and position themselves at the forefront of modern, sustainable surface treatment technology.