The global market for laser cleaning devices has experienced robust expansion in recent years, driven by increasing demand for eco-friendly, precision-based surface treatment solutions across industries such as automotive, aerospace, and heritage conservation. According to a report by Mordor Intelligence, the laser cleaning equipment market was valued at USD 387.4 million in 2023 and is projected to grow at a CAGR of over 11.5% from 2024 to 2029. This growth is fueled by rising industrial automation, stringent environmental regulations limiting chemical and abrasive cleaning methods, and advancements in fiber laser technology that enhance cleaning efficiency and reduce operational costs. As manufacturers increasingly prioritize non-contact, residue-free maintenance processes, the competitive landscape is evolving rapidly, with both established players and emerging innovators vying for market share. In this context, identifying the leading laser cleaning device manufacturers becomes essential for businesses seeking reliable, high-performance solutions. The following analysis highlights the top 10 manufacturers based on market presence, technological innovation, product range, and customer adoption trends.

Top 10 Laser Reinigungsgerät Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

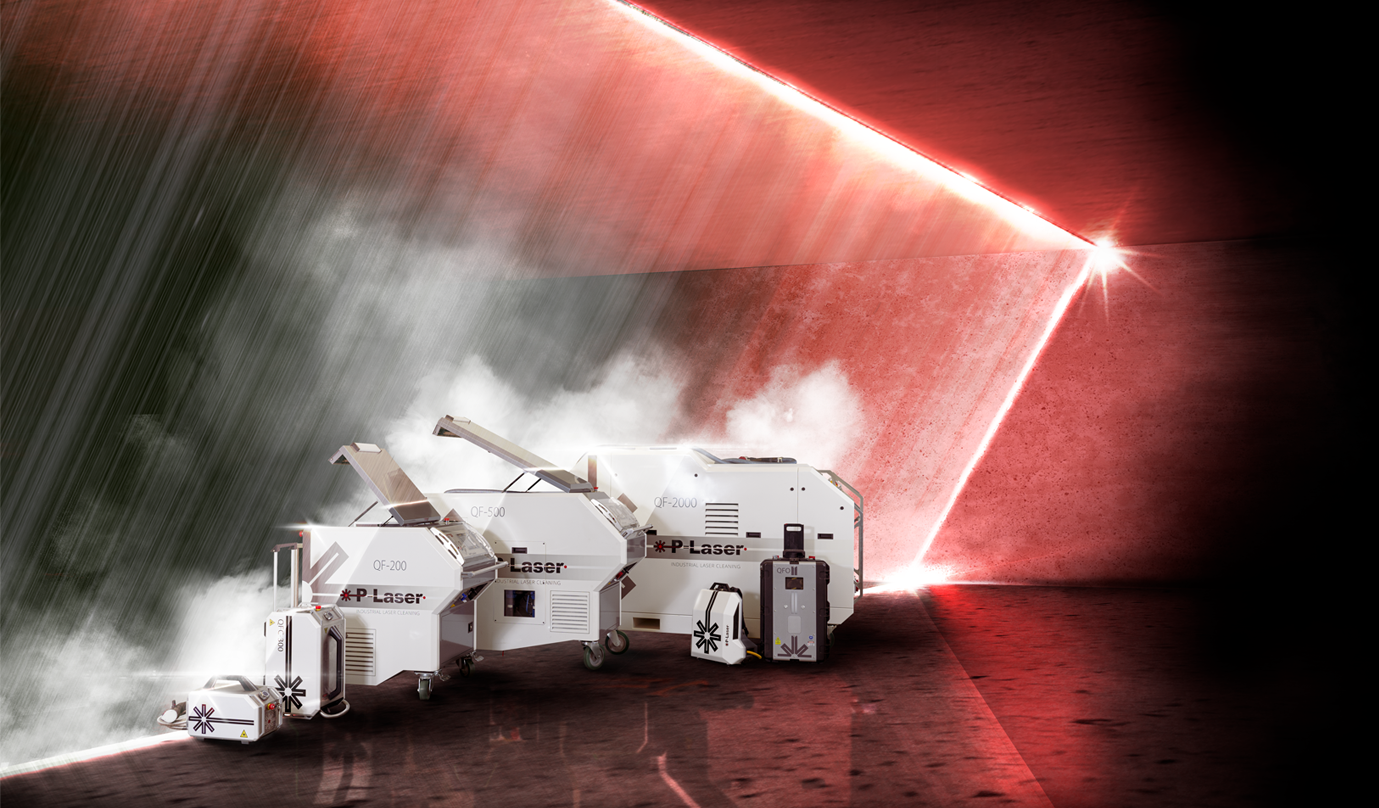

#1 P-laser Industrial laser cleaning

Website: p-laser.com

Key Highlights: we engineer and manufacture the most advanced—and most powerful—pulsed industrial laser cleaning systems on the market, built for both manual and automated ……

#2 Clean Laser Systems

Website: cleanlaser.de

Key Highlights: IPG | cleanLASER has been developing and producing high-precision laser systems for cleaning and industrial surface treatment for more than 20 years….

#3 Laser cleaning

Website: narran.cz

Key Highlights: Narran is a direct Czech manufacturer of laser cleaning systems. Depending on the needs of the application, we can design and integrate the laser into ……

#4 Laser Cleaning Systems

Website: laserphotonics.com

Key Highlights: Our most powerful metal laser cleaning machine, the CleanTech Industrial Roughening Laser 3050, offers top speed and efficiency for surface treatment and more….

#5 Argento Lux

Website: argentolux.com

Key Highlights: Our company provides state-of-the-art Industrial Laser Equipment Sales and Mobile Laser Cleaning Services for a wide range of applications and industries….

#6 Netalux

Website: netalux.com

Key Highlights: Discover our award-winning Laser Cleaning Solutions for the world’s most demanding industries. Discover our products and global service now….

#7 Laser Cleaning Machine

Website: baikeopto.com

Key Highlights: Backpack laser cleaning machine Pulse Laser Cleaning Machine Continuous Laser Cleaning Machine. 01|Backpack cleaner. BK-FLC50SC Max 50W Backpack Pulse Laser ……

#8 Laser Cleaning Machine

Website: sltl.com

Key Highlights: This futuristic laser cleaning solution can capably remove rust, oil, paint, grease, colour and other particles from the surface of the metals….

#9 ALR Equipment LLC

Website: alrequipment.com

Key Highlights: ALR Equipment LLC offers a range of powerful laser cleaning solutions, featuring options from 300 to 2000 Watts….

#10 Laser Cleaning

Website: eraserlaser.de

Key Highlights: Discover the power of laser cleaning for metal, wood, stone and more. Efficient, residue-free and eco-friendly – precision cleaning made in Germany….

Expert Sourcing Insights for Laser Reinigungsgerät

H2: Market Trends for Laser Cleaning Devices in 2026

By 2026, the global market for laser cleaning devices (Laser Reinigungsgerät) is expected to witness substantial growth, driven by increasing industrial automation, stringent environmental regulations, and the rising demand for non-abrasive, eco-friendly cleaning solutions. Below are the key market trends shaping the landscape:

-

Increased Adoption in Manufacturing and Automotive Industries

The manufacturing and automotive sectors are projected to be the largest end-users of laser cleaning technology. The ability of laser devices to remove rust, paint, oxides, and contaminants without damaging the substrate makes them ideal for precision cleaning in engine components, molds, and production lines. As industries prioritize quality control and maintenance efficiency, laser cleaning is becoming a standard process in preventive maintenance routines. -

Environmental and Regulatory Drivers

With global emphasis on sustainable practices and the reduction of chemical waste, laser cleaning offers a dry, non-toxic alternative to traditional methods such as sandblasting and chemical solvents. Stricter environmental regulations in Europe, North America, and parts of Asia-Pacific are pushing companies to adopt green technologies, accelerating the shift toward laser-based solutions. -

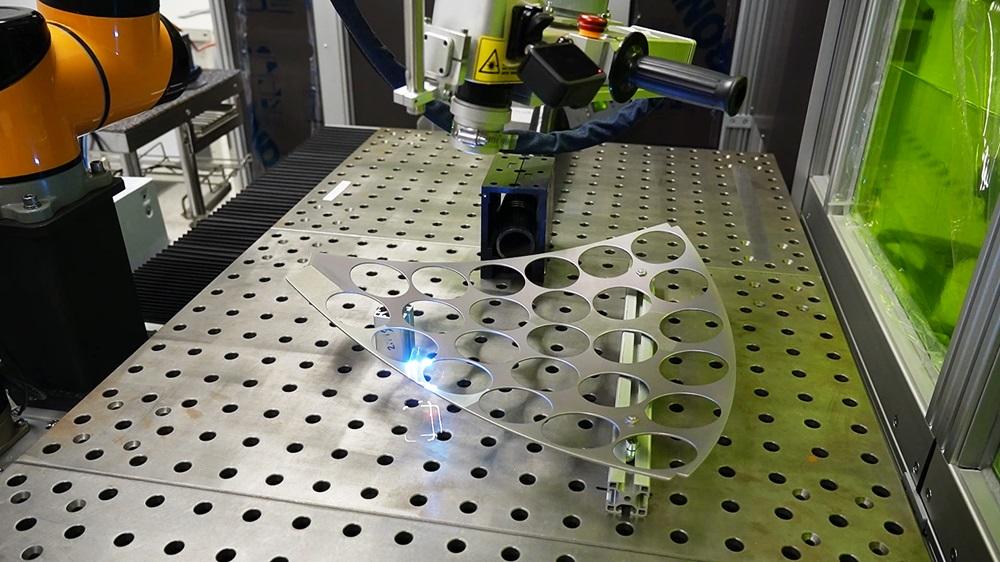

Technological Advancements and Cost Reductions

By 2026, continued improvements in fiber laser efficiency, portability, and user interface are making laser cleaning devices more accessible to small and medium enterprises (SMEs). The average cost per watt of laser systems has decreased steadily, enhancing ROI and shortening payback periods. Integration with robotics and AI for automated cleaning paths further boosts productivity and precision. -

Expansion in Aerospace and Cultural Heritage Applications

The aerospace industry is increasingly using laser cleaning for turbine blade maintenance and surface preparation due to its precision and non-contact nature. Additionally, the preservation of historical artifacts and monuments is emerging as a niche but growing application, particularly in Europe, where regulatory bodies favor non-invasive restoration techniques. -

Regional Market Growth

Asia-Pacific, led by China, Japan, and South Korea, is expected to dominate the market due to rapid industrialization and government support for advanced manufacturing. Europe maintains a strong presence due to its early adoption and strict environmental policies. North America is witnessing steady growth, particularly in defense and energy sectors. -

Competitive Landscape and Market Consolidation

The market is becoming increasingly competitive, with both established players (e.g., IPG Photonics, CleanLasers, Laser Photonics) and new entrants launching compact, user-friendly models. Strategic partnerships, mergers, and R&D investments are expected to intensify, leading to product differentiation and broader market penetration. -

Growing Focus on Safety and Training

As laser cleaning becomes more widespread, there is an increasing emphasis on operator safety, certification, and training programs. Manufacturers are investing in integrated safety features (e.g., fume extraction, beam shielding) and educational resources to ensure compliance with international laser safety standards (IEC 60825).

In summary, by 2026, the Laser Reinigungsgerät market will be characterized by technological innovation, environmental compliance, and expanding applications across diverse industries. The convergence of efficiency, sustainability, and precision positions laser cleaning as a transformative solution in industrial maintenance and surface treatment.

Common Pitfalls When Sourcing Laser Reinigungsgerät (Quality, IP)

Sourcing a Laser Reinigungsgerät (laser cleaning device) involves several critical considerations, particularly concerning quality and intellectual property (IP). Failing to address these aspects can lead to operational inefficiencies, legal risks, and financial losses. Below are some common pitfalls to watch for:

Quality-Related Pitfalls

Inadequate Performance Specifications

Many suppliers, especially from less-regulated markets, may exaggerate technical capabilities such as cleaning speed, power output, or material compatibility. Without third-party verification or testing protocols, the delivered device might not meet the required industrial standards.

Poor Build Quality and Component Sourcing

Low-cost devices often use substandard components (e.g., diodes, cooling systems, optics), which reduce device lifespan and reliability. Inconsistent manufacturing processes can lead to frequent breakdowns and high maintenance costs.

Lack of Safety Certifications

Reputable laser cleaning devices must comply with international safety standards (e.g., CE, FDA, IEC 60825). Sourcing from suppliers without proper certification exposes users to safety hazards and potential non-compliance with workplace regulations.

Insufficient After-Sales Support

Buyers often overlook the importance of technical support, spare parts availability, and software updates. A lack of service infrastructure can result in prolonged downtime and increased total cost of ownership.

Intellectual Property (IP) Concerns

Risk of IP Infringement

Some manufacturers may produce devices that replicate patented technologies or designs from established brands. Purchasing such equipment can expose the buyer to legal liability, especially in jurisdictions with strict IP enforcement.

Unclear Ownership of Custom Solutions

When working with suppliers on customized laser cleaning systems, failure to define IP ownership in contracts may result in disputes. The buyer may not retain rights to modifications or improvements developed during collaboration.

Use of Open-Source or Unlicensed Software

Some devices rely on unlicensed or improperly used software for control systems. This poses cybersecurity risks and potential legal issues, particularly in regulated industries.

Lack of Transparency in Design Origin

Suppliers may obscure the true origin of technology, presenting rebranded or reverse-engineered products as original innovations. Due diligence is essential to verify R&D capabilities and original design documentation.

Conclusion

To avoid these pitfalls, buyers should conduct thorough supplier evaluations, request performance testing, verify certifications, and ensure legal agreements address IP rights. Partnering with reputable manufacturers and consulting technical experts can significantly reduce risks when sourcing Laser Reinigungsgeräte.

Logistics & Compliance Guide for Laser Reinigungsgerät (Laser Cleaning Device)

Product Classification & Regulatory Overview

Laser Reinigungsgeräte fall under both industrial equipment and laser safety regulations. Key regulatory frameworks include the European Union’s Machinery Directive (2006/42/EC), the Low Voltage Directive (2014/35/EU), and the Electromagnetic Compatibility Directive (2014/30/EU). Additionally, laser products must comply with IEC 60825-1 (Safety of Laser Products) and the corresponding national transpositions such as EN 60825-1 in the EU. Classification of the laser (typically Class 4 for industrial cleaning devices) dictates specific safety requirements, labeling, and user documentation.

Technical Documentation & CE Marking

Manufacturers must prepare comprehensive technical documentation including design drawings, risk assessments (per EN ISO 12100), circuit diagrams, and test reports. A Declaration of Conformity (DoC) must be issued, confirming compliance with all applicable EU directives. The CE marking must be visibly affixed to the device along with essential information such as manufacturer name, address, device model, serial number, and the relevant warning labels for laser radiation (e.g., “Laserstrahlung – Nicht in den Strahl blicken”).

Packaging & Transportation Requirements

Laser Reinigungsgeräte must be packaged to prevent physical damage during transit. Use shock-absorbent materials and secure internal bracing. The packaging must clearly display handling symbols (e.g., “Fragile,” “This Side Up”) and include waterproof protection if shipping in variable climates. For international transport, ensure compliance with IATA (air) or IMDG (sea) regulations if batteries or hazardous components are included. Class 4 lasers are not classified as dangerous goods for transport under UN Model Regulations, but proper documentation and manufacturer declarations may still be required by carriers.

Import & Customs Compliance (EU Focus)

When importing into the EU, ensure the product is registered in the EU’s Import Control System (ICS) if applicable. Provide a commercial invoice, packing list, bill of lading/airway bill, and the CE Declaration of Conformity. Harmonized System (HS) code 8543 70 90 typically applies to laser systems. Verify national requirements of the destination country—some may require additional conformity assessments or market surveillance notifications.

User Documentation & Language Requirements

Supply user manuals and safety instructions in the official language(s) of the destination country. Documentation must include laser safety warnings, operating procedures, maintenance guidelines, and emergency shutdown instructions. For multi-country distribution within the EU, provide documentation in all required national languages. The manual must reference compliance with relevant standards and include the CE mark details.

Post-Market Surveillance & Incident Reporting

Manufacturers are responsible for post-market surveillance under the EU Market Surveillance Regulation (2019/1020). Establish a system to collect user feedback, report field failures, and manage product recalls if necessary. In case of a safety incident involving the laser device (e.g., eye injury or fire hazard), notify the relevant national authority (e.g., BSI in the UK, BAuA in Germany) within the required timeframe (typically 10 days).

Environmental & End-of-Life Compliance

Comply with the EU Waste Electrical and Electronic Equipment (WEEE) Directive (2012/19/EU). Affix the crossed-out wheeled bin symbol on the device and ensure take-back and recycling arrangements are available in each market. Also adhere to the Restriction of Hazardous Substances (RoHS) Directive (2011/65/EU), confirming the device contains no restricted substances above permitted levels.

Summary of Key Actions

- Verify laser classification and ensure compliance with IEC 60825-1

- Compile full technical file and issue CE Declaration of Conformity

- Label device with CE mark, warnings, and manufacturer details

- Package securely with appropriate handling symbols

- Prepare import documentation including DoC and commercial invoice

- Supply multilingual user manuals with safety instructions

- Implement post-market surveillance and incident reporting

- Comply with WEEE and RoHS for environmental obligations

Conclusion for Sourcing a Laser Cleaning Device

After a thorough evaluation of the market, technical requirements, and supplier options, sourcing a laser cleaning device proves to be a strategic investment for improving efficiency, precision, and sustainability in industrial cleaning processes. Laser cleaning offers significant advantages over traditional methods—such as reduced environmental impact, no media waste, and minimal substrate damage—making it ideal for sensitive or high-precision applications in sectors like automotive, aerospace, heritage conservation, and mold maintenance.

Key considerations in the sourcing process include laser power, portability, safety features, after-sales support, and total cost of ownership. It is essential to select a supplier that provides reliable technical documentation, comprehensive training, and responsive service support. Additionally, verifying certifications (e.g., CE, FDA, RoHS) ensures compliance with safety and environmental regulations.

In conclusion, by carefully selecting a high-quality laser cleaning device from a reputable supplier, organizations can achieve long-term operational benefits, reduce maintenance downtime, and support sustainability goals. The initial investment is justified by lower operating costs, enhanced cleaning performance, and alignment with future-oriented, eco-friendly manufacturing practices.