The global laser cleaning market is experiencing robust expansion, driven by rising demand for eco-friendly, precision-based surface treatment solutions across industries such as automotive, aerospace, electronics, and heritage conservation. According to a report by Mordor Intelligence, the market was valued at USD 531.4 million in 2023 and is projected to reach USD 1.12 billion by 2029, growing at a CAGR of 13.2% during the forecast period. This growth is fueled by advancements in fiber laser technology, increasing regulatory pressure to phase out chemical and abrasive cleaning methods, and greater adoption of automation in manufacturing. As industries prioritize efficiency, sustainability, and minimal substrate damage, laser cleaning has emerged as a preferred alternative. In this competitive landscape, a number of manufacturers have distinguished themselves through innovative engineering, scalable solutions, and strong R&D investments—setting the stage for the following list of the top 10 laser cleaning manufacturers leading the charge in this high-growth sector.

Top 10 Laser-Reinigung Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Industrial cleaning services with laser technology

Website: cleanlaser.de

Key Highlights: As a manufacturer of laser systems, cleanLASER does not offer any industrial cleaning services, but cooperates with competent partners ……

#2 Laser Cleaning Machine Manufacturers, Suppliers, Factory

Website: hglaserglobal.com

Key Highlights: HGLASER is a leading intelligent laser equipment provider of laser cleaning machines. Email:[email protected]….

#3 Laser cleaning

Website: narran.cz

Key Highlights: We can design and integrate a laser cleaning system into production, build a robotic workstation or supply a mobile laser for a wide range of applications….

#4 P-laser Industrial laser cleaning

Website: p-laser.com

Key Highlights: we engineer and manufacture the most advanced—and most powerful—pulsed industrial laser cleaning systems on the market, built for both manual and automated ……

#5 Argento Lux

Website: argentolux.com

Key Highlights: Our company provides state-of-the-art Industrial Laser Equipment Sales and Mobile Laser Cleaning Services for a wide range of applications and industries….

#6 Clean Laser I Hofeditz

Website: hofeditz-baunatal.de

Key Highlights: Based on innovative laser technology, we can offer you completely new solutions, for example in the area of mold cleaning (die casting or forming), paint ……

#7 Netalux

Website: netalux.com

Key Highlights: Discover our award-winning Laser Cleaning Solutions for the world’s most demanding industries. Discover our products and global service now….

#8 Lasercleaning

Website: lasercleaning.eco

Key Highlights: Laser cleaning works by using a high-energy laser beam directed at the surface to be cleaned to precisely remove contaminants, rust, paint, oxides or other ……

#9 Laser Cleaning

Website: ipgphotonics.com

Key Highlights: Laser cleaning, also known as laser material removal, is an advanced method of eliminating material from a surface achieved through the precise manipulation ……

#10 Laser Cleaning

Website: eraserlaser.de

Key Highlights: Discover the power of laser cleaning for metal, wood, stone and more. Efficient, residue-free and eco-friendly – precision cleaning made in Germany….

Expert Sourcing Insights for Laser-Reinigung

H2: Analyse der Markttrends für Laserreinigung im Jahr 2026

Der Markt für Laserreinigung erfährt bis zum Jahr 2026 eine signifikante Dynamik, getrieben durch technologische Fortschritte, steigende Umweltanforderungen und eine zunehmende Nachfrage nach präzisen, berührungslosen Reinigungslösungen in Schlüsselindustrien. Im Folgenden werden die wesentlichen Markttrends identifiziert und analysiert, die den Wachstumspfad der Laserreinigung bis 2026 prägen.

1. Technologische Weiterentwicklung und Kostensenkung

Bis 2026 wird erwartet, dass Laserreinigungssysteme leistungsfähiger, kompakter und wirtschaftlicher werden. Fortschritte in der Pulsed-Laser-Technologie (insbesondere ultrakurze Pulse mit hoher Frequenz) ermöglichen eine effizientere Materialabtragung bei gleichzeitig reduzierten Betriebskosten. Durch die Serienproduktion von Schlüsselkomponenten (z. B. Faserlaser) sinken die Anschaffungskosten, was die Technologie für mittelständische Unternehmen attraktiver macht.

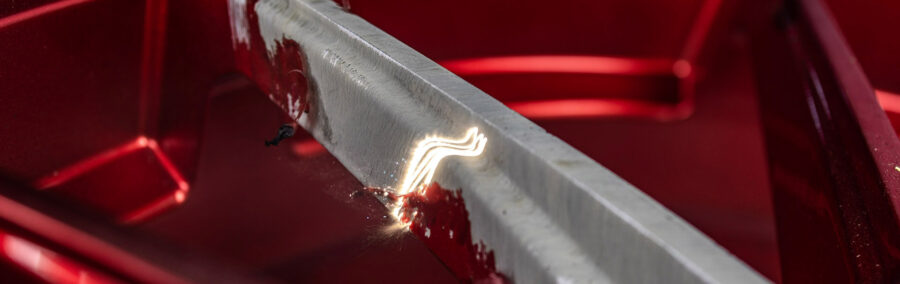

2. Wachstum in der Automobil- und Luftfahrtindustrie

Die Automobil- und Luftfahrtbranche setzt verstärkt auf Laserreinigung zur Vorbereitung von Oberflächen vor Lackierung, Klebung oder Beschichtung. Im Jahr 2026 wird diese Technologie aufgrund ihrer Präzision, Reproduzierbarkeit und Umweltfreundlichkeit in der Serienfertigung noch stärker etabliert sein. Insbesondere im Bereich E-Mobilität (z. B. Reinigung von Batteriekomponenten) wird ein starkes Wachstum prognostiziert.

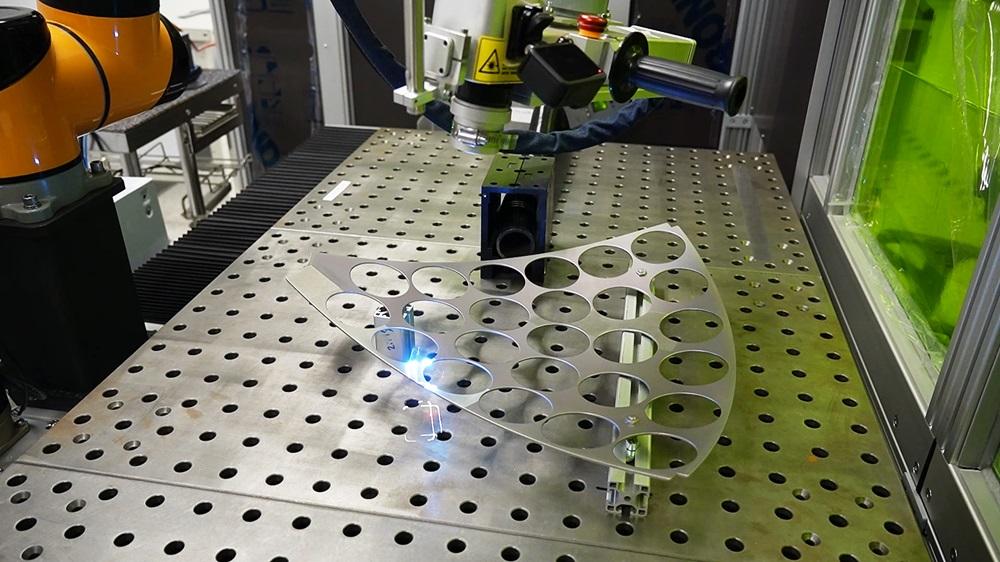

3. Steigende Nachfrage aus dem Bereich Industrie 4.0 und Automatisierung

Die Integration von Laserreinigungssystemen in automatisierte Produktionslinien wird bis 2026 weiter zunehmen. Kombiniert mit Robotik und KI-gestützten Steuerungssystemen ermöglicht dies eine vollständig autonome Oberflächenreinigung mit Echtzeit-Monitoring. Dies erhöht die Effizienz und reduziert Stillstandszeiten in der Produktion.

4. Strengere Umweltvorschriften als Treiber

Aufgrund der zunehmenden Regulierung zu chemischen Reinigungsverfahren (z. B. VOC-Emissionen, Entsorgung von Chemikalien) gewinnt die umweltfreundliche Laserreinigung weiter an Bedeutung. Im Jahr 2026 wird die Technologie als nachhaltige Alternative zu sandstrahlen, chemischem Beizen oder Lösungsmittelreinigung in vielen Ländern zur Standardlösung – besonders in Europa und Nordamerika.

5. Expansion in neue Anwendungsbereiche

Neben den klassischen Einsatzfeldern (Metallbearbeitung, Restaurierung) expandiert die Laserreinigung in neue Märkte:

– Medizintechnik: Reinigung von chirurgischen Instrumenten und Implantaten.

– Energie: Entfernung von Oxidschichten und Verunreinigungen an Solarpanelen und Turbinen.

– Denkmalpflege: Schonende Entfernung von Verkrustungen an historischen Gebäuden.

6. Geografische Marktentwicklung

Während Europa und Nordamerika weiterhin führend in der Technologieadoption sind, zeigt der asiatisch-pazifische Raum (insbesondere China, Japan und Südkorea) das stärkste Wachstumspotenzial. Dies wird durch staatliche Förderprogramme für saubere Technologien und den Ausbau der Hochtechnologie-Industrie getrieben.

7. Wettbewerbslandschaft und Marktkonsolidierung

Bis 2026 wird eine zunehmende Marktkonsolidierung erwartet, da große Industriekonzerne mittelständische Laseranbieter übernehmen, um ihre Automatisierungskapazitäten auszubauen. Gleichzeitig entstehen neue Nischenanbieter, die auf spezialisierte Anwendungen (z. B. mobile Reinigungslösungen oder KI-gestützte Prozessoptimierung) setzen.

Fazit:

Der Laserreinigungsmarkt wird sich bis 2026 zu einer Schlüsseltechnologie in der industriellen Oberflächenbearbeitung entwickeln. Getrieben durch Umweltvorschriften, Automatisierung und technologische Innovationen wird die Marktdurchdringung weiter steigen. Unternehmen, die früh in diese Technologie investieren, können sich einen Wettbewerbsvorteil im Bereich Nachhaltigkeit, Effizienz und Prozesssicherheit sichern.

Common Pitfalls When Sourcing Laser Cleaning Equipment (Quality and Intellectual Property)

Sourcing laser cleaning machines, especially from international suppliers, involves significant risks related to product quality and intellectual property (IP) protection. Being aware of these pitfalls is crucial for making informed procurement decisions and safeguarding your business interests.

Quality-Related Pitfalls

Misrepresented Laser Specifications

Suppliers may exaggerate key performance metrics such as laser power (e.g., claiming 1000W when actual output is significantly lower), pulse energy, or cleaning speed. These misrepresentations can lead to underperforming equipment that fails to meet production requirements, resulting in inefficiencies and increased operational costs.

Use of Substandard Components

Lower-cost machines often incorporate inferior optical components, cooling systems, or motion controls. These compromises can reduce equipment lifespan, increase maintenance frequency, and compromise cleaning consistency—particularly in industrial environments requiring high reliability.

Lack of Certification and Compliance

Some suppliers offer machines that do not meet international safety standards (e.g., IEC 60825 for laser safety) or lack necessary certifications (CE, FDA, RoHS). This creates liability risks, may prevent deployment in regulated industries, and can lead to legal or regulatory penalties.

Inadequate Technical Support and Training

After-sales service is often underestimated. Distant or under-resourced suppliers may provide insufficient installation guidance, operator training, or troubleshooting support. This can result in prolonged downtime and reduced return on investment.

Intellectual Property-Related Pitfalls

Risk of IP Infringement

Sourcing from manufacturers with unclear IP ownership increases the risk of purchasing equipment that infringes on patented technologies (e.g., specific laser control algorithms, beam delivery systems). Buyers could face legal action or be forced to discontinue use, disrupting operations.

Limited or Ambiguous Licensing Agreements

When software or firmware is integral to the machine’s functionality, unclear licensing terms may restrict your ability to modify, service, or integrate the system. This can create dependency on the supplier and limit scalability or customization.

Exposure of Proprietary Processes

During customization or integration phases, revealing your specific cleaning applications or production workflows to the supplier may expose sensitive operational knowledge—especially if non-disclosure agreements (NDAs) are weak or absent.

Counterfeit or Clone Equipment

Some suppliers offer “white label” or reverse-engineered systems that mimic reputable brands. These clones may lack performance reliability and expose your business to legal and reputational risks, particularly if they carry misleading branding or certifications.

Mitigating these pitfalls requires thorough due diligence, including independent verification of technical specifications, review of IP documentation, and legal assessment of supply agreements. Partnering with reputable suppliers and involving technical and legal experts in the procurement process is essential for long-term success.

Logistics & Compliance Guide for Laser Cleaning

This guide outlines the essential logistics considerations and compliance requirements for the safe, efficient, and legally compliant handling, transportation, and operation of laser cleaning equipment.

Equipment Handling and Transportation

Laser cleaning systems are precision instruments requiring careful handling. Always use original packaging or equivalent protective materials during transport. Secure equipment in vehicles to prevent movement, and avoid exposure to extreme temperatures, moisture, and dust. For international shipments, ensure compliance with IATA/ICAO regulations for machinery containing batteries or electronic components. Provide clear labeling indicating “Fragile” and “This Side Up.”

Regulatory Compliance and Safety Standards

Laser cleaning devices are classified as Class 4 lasers and must comply with international and regional safety standards, including IEC 60825-1 (laser safety) and applicable machinery directives such as the EU’s Machinery Directive 2006/42/EC. Ensure all systems have valid CE, UKCA, or other required regional markings. Operators must adhere to local occupational health and safety regulations, including OSHA (US) or the Provision and Use of Work Equipment Regulations (PUWER) in the UK.

Laser Safety and Operational Protocols

Implement a Laser Safety Program in accordance with ANSI Z136.1 (US) or EN 60825 (EU). This includes designating a Laser Safety Officer (LSO), conducting risk assessments, and establishing controlled access zones. Mandatory use of appropriate laser safety eyewear with the correct optical density (OD) for the laser wavelength is required. Install interlocks, warning signs, and beam enclosures where feasible to minimize exposure risks.

Environmental and Waste Management

Laser cleaning produces particulate matter, including potentially hazardous fumes and debris, depending on the substrate (e.g., lead-based paint, coatings with heavy metals). Use high-efficiency particulate air (HEPA) filtration systems and local exhaust ventilation (LEV) to capture contaminants at the source. Dispose of collected waste in accordance with local environmental regulations, such as RCRA (US) or the Waste Electrical and Electronic Equipment (WEEE) Directive in the EU. Maintain records of waste disposal for compliance audits.

Documentation and Training Requirements

Maintain up-to-date technical documentation, including user manuals, safety data sheets (SDS) for treated materials, and maintenance logs. Provide comprehensive training for all operators and maintenance personnel, covering laser hazards, emergency procedures, equipment operation, and PPE usage. Document training completion and conduct periodic refresher courses to ensure ongoing compliance.

Import/Export and Customs Compliance

For cross-border movement of laser equipment, classify the product under the correct Harmonized System (HS) code—typically 8543.70 or 9013.20, depending on configuration. Comply with export control regulations such as the US Export Administration Regulations (EAR) or EU Dual-Use Regulation, as high-powered lasers may be subject to restrictions. Prepare commercial invoices, packing lists, and certificates of origin accurately to avoid customs delays.

Conclusion on Sourcing Laser Cleaning Equipment

Sourcing laser cleaning technology represents a strategic investment in sustainable, efficient, and high-precision cleaning solutions. As industries increasingly prioritize environmental compliance, labor safety, and operational efficiency, laser cleaning emerges as a superior alternative to traditional methods such as sandblasting, chemical treatment, or mechanical abrasion. The non-contact, eco-friendly nature of laser cleaning—requiring no consumables or secondary waste treatment—aligns well with green manufacturing principles.

When sourcing laser cleaning systems, it is essential to evaluate key factors including laser power, wavelength suitability for target materials, portability, ease of integration into existing workflows, and after-sales support. Suppliers should offer proven performance data, industry-specific applications, and comprehensive training. Additionally, considering total cost of ownership—factoring in maintenance, energy consumption, and longevity—reveals long-term cost advantages despite higher initial investment.

In conclusion, sourcing laser cleaning equipment is a forward-thinking decision that enhances productivity, supports sustainability goals, and improves workplace safety. With advancements in technology making these systems more accessible and user-friendly, their adoption across automotive, aerospace, heritage conservation, and manufacturing sectors is set to grow. Careful vendor selection and proper application assessment will ensure maximum return on investment and operational success.