The global laser marking machine market is experiencing robust growth, driven by increasing demand for permanent, high-precision marking in industries such as automotive, electronics, medical devices, and aerospace. According to Mordor Intelligence, the market was valued at USD 2.25 billion in 2023 and is projected to reach USD 3.43 billion by 2029, growing at a CAGR of approximately 7.2% during the forecast period. This expansion is fueled by the rising adoption of fiber laser technology, growing automation in manufacturing, and stringent regulatory requirements for product traceability. As demand surges, manufacturers worldwide are competing to offer cost-effective, high-performance laser markers, leading to a diverse landscape of pricing and innovation. This report identifies the top 10 laser marker manufacturers renowned not only for their technological capabilities but also for delivering competitive and transparent pricing in a rapidly evolving market.

Top 10 Laser Marker Price Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Industrial Laser Markers

Website: telesis.com

Key Highlights: Laser marking systems are ideal for manufacturers looking to mark serial numbers, codes, logos and more on their products. Learn more today!…

#2 Laserax

Website: laserax.com

Key Highlights: Laserax works with the world’s leading manufacturers to implement laser cleaning, welding, texturing, and marking solutions….

#3 Laser Marking for All Industries

Website: lasermarktech.com

Key Highlights: Discover innovative laser marking solutions tailored for various industries. Explore our cutting-edge technology as leaders in laser marking and engraving….

#4 LaserStar Technologies

Website: laserstar.net

Key Highlights: LaserStar Technologies designs and manufactures high-performance laser welding, marking, and cutting systems for industrial, jewelry, ……

#5 Laser Marking Systems

Website: datalogic.com

Key Highlights: Our Laser Marking products stand out with a wide variety of industrial laser marking systems, focused on providing top value solutions for automotive, ……

#6 Full Spectrum Laser

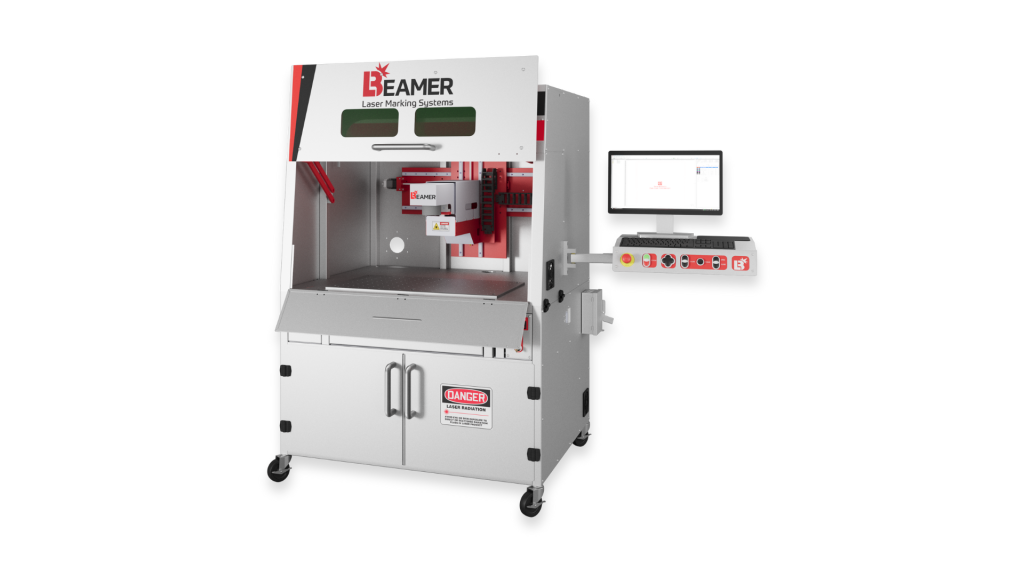

#7 Beamer Laser Marking Systems

Website: beamerlasermarking.com

Key Highlights: DPSS Lasers specializes in manufacturing ultraviolet (UV 355nm) laser markers. With high peak powers, consistent repetition rates, and low thermal damage, DPSS ……

#8 Laser Equipment Supplier

Website: radianlaser.com

Key Highlights: Radian Laser Systems is a laser equipment supplier specializing in high-speed, customizable laser machinery, including fiber, CO2, and galvo lasers….

#9 MECCO

Website: mecco.com

Key Highlights: Our expertise in automated laser engraving and pin marking systems encompasses a comprehensive range of solutions for your industry, materials, and ……

#10 CO2 Laser Cutters and Engravers, Fiber Lasers, and More

Expert Sourcing Insights for Laser Marker Price

H2: Analysis of 2026 Market Trends for Laser Marker Prices

As we approach 2026, the global laser marker market is poised for significant transformation driven by technological advancements, shifting industrial demands, and evolving supply chain dynamics. This analysis explores key trends influencing laser marker pricing in the medium-term forecast, focusing on technological innovation, regional market dynamics, competitive intensity, and macroeconomic factors.

1. Technological Advancements and Cost Pressures

One of the most influential factors shaping laser marker prices in 2026 is the rapid advancement in laser technology. Fiber laser markers—now the dominant segment due to their durability, energy efficiency, and low maintenance—continue to experience downward price pressure as manufacturing processes become more efficient and component costs decline. By 2026, we expect:

- Increased adoption of high-speed, ultra-precise fiber lasers with improved beam quality, which may initially command premium pricing but will gradually see price reductions due to economies of scale.

- Growth in hybrid and smart laser systems integrating IoT, AI-driven diagnostics, and predictive maintenance, potentially increasing average selling prices (ASPs) for high-end models.

- Wider availability of compact, modular laser markers targeting SMEs, leading to intensified competition in the mid-range price segment.

2. Regional Market Dynamics

Regional disparities will continue to influence pricing. In Asia-Pacific—particularly China, India, and Southeast Asia—local manufacturing and rising competition among domestic brands (e.g., Han’s Laser, Raycus) are driving aggressive price undercutting. This is pressuring multinational suppliers to either localize production or adjust pricing strategies.

- In North America and Western Europe, demand for high-reliability, compliant (e.g., FDA, CE) laser marking systems in medical, aerospace, and automotive sectors supports stable or slightly increasing ASPs.

- Emerging markets in Latin America and Africa are expected to see rising demand for cost-effective laser markers, fostering a growing market for refurbished or entry-level systems, which could pull average global prices lower.

3. Supply Chain and Raw Material Costs

By H2 2026, supply chain stabilization post-pandemic and geopolitical tensions (e.g., U.S.-China trade dynamics) will play a crucial role. Key components such as laser diodes, optical lenses, and control systems have seen fluctuating prices due to semiconductor shortages and rare earth material costs.

- Expect moderate price increases if raw material costs (e.g., gallium, indium) rise due to green energy demands competing for resources.

- Conversely, improved logistics and localized sourcing may help offset these increases, especially in regions with strong industrial ecosystems.

4. Competitive Landscape and Pricing Strategies

The laser marker market remains highly fragmented, with both established players (Trumpf, IPG Photonics, Keyence) and emerging low-cost manufacturers competing aggressively. In 2026:

- Price wars are likely in the mid-tier segment, especially for standard 20–50W fiber lasers.

- Premium brands will maintain higher prices by emphasizing precision, integration capabilities, and after-sales service.

- Subscription-based or pay-per-use models may emerge, particularly in industrial automation, altering traditional pricing perceptions.

5. Sustainability and Regulatory Influences

Environmental regulations and corporate sustainability goals are pushing manufacturers toward energy-efficient laser systems. Equipment meeting energy compliance standards may carry a price premium, but government incentives for green manufacturing could stimulate demand and indirectly affect effective pricing.

Conclusion

By H2 2026, the laser marker price landscape will reflect a dual trend: downward pressure in the mid-to-low end due to commoditization and regional competition, and modest ASP growth in the high-performance segment driven by smart features and industry-specific compliance. Overall, the global average price of laser markers is expected to decline slightly (estimated -2% to -4% CAGR from 2023–2026), with regional and application-specific variations playing a critical role. Companies that balance cost efficiency with innovation and service differentiation will be best positioned to navigate this evolving pricing environment.

Common Pitfalls When Sourcing Laser Marker Price (Quality, IP)

Sourcing laser markers based solely on price can lead to significant long-term costs and operational challenges. Overlooking quality and intellectual property (IP) considerations often results in subpar performance, legal risks, and unexpected downtime. Below are key pitfalls to avoid:

Prioritizing Low Upfront Cost Over Total Cost of Ownership

Focusing only on the initial purchase price can be misleading. Cheaper laser markers may use lower-grade components, leading to frequent breakdowns, higher maintenance costs, and shorter lifespans. Evaluate reliability, service availability, and consumable costs to assess true value.

Ignoring Build Quality and Component Reliability

Low-cost suppliers may cut corners on critical components like laser sources, cooling systems, or motion controls. Poor build quality affects marking consistency, precision, and uptime. Always request sample markings and verify component brands (e.g., IPG or SPI lasers vs. unbranded alternatives).

Overlooking Intellectual Property (IP) Risks

Some budget laser markers use firmware or software that infringes on patented technologies. Using such equipment may expose your company to legal liability, especially in regulated industries or export markets. Ensure the supplier can provide proof of legitimate IP rights and software licensing.

Assuming All Lasers Meet Industry Standards

Not all laser markers comply with safety and regulatory standards (e.g., FDA, CE, RoHS). Non-compliant systems may fail inspections or pose safety hazards. Confirm certifications and ask for documentation before purchase.

Underestimating After-Sales Support and Service

Cheap lasers often come from suppliers with limited technical support or spare parts availability. Delays in service can halt production lines. Evaluate the supplier’s service network, response time, and availability of local technicians.

Falling for Inflated Specifications

Some vendors exaggerate power output, marking speed, or durability. Verify claims with third-party test results or on-site demonstrations. Request customer references to confirm real-world performance.

Neglecting Software Compatibility and Updates

Proprietary software with no update path or integration capability can become obsolete. Ensure the system supports standard file formats, offers regular updates, and integrates with your existing production software.

By addressing these pitfalls, buyers can make informed decisions that balance cost, quality, and IP compliance—leading to reliable, legally safe, and cost-effective laser marking solutions.

Logistics & Compliance Guide for Laser Marker Price

When sourcing, shipping, or selling laser markers internationally, understanding the logistics and compliance aspects is critical to avoid delays, fines, or legal issues. These factors directly impact the final landed cost and pricing strategy. Below is a structured guide to help navigate these considerations.

Understanding Product Classification and HS Codes

Laser markers fall under specific Harmonized System (HS) codes, which determine import/export duties, taxes, and regulatory requirements. Accurate classification is essential for correct pricing and compliance.

- Typical HS Code: 8515.31 (Machines for laser working of metals) or 8456.11 (Machines for laser working of non-metals), depending on application.

- Importance: Misclassification can lead to customs delays, penalties, and incorrect duty calculations.

- Action: Confirm the correct HS code with customs authorities or a licensed customs broker based on the laser marker’s specifications (wavelength, power, application).

Import/Export Regulations and Licensing

Laser markers are often subject to export controls due to their potential dual-use (industrial and military applications).

- Export Controls:

- ITAR/EAR (U.S.): Check if the laser falls under the Export Administration Regulations (EAR) or International Traffic in Arms Regulations (ITAR). High-power lasers may require an export license.

- Wassenaar Arrangement: Many countries adhere to this multilateral export control regime; compliance is mandatory.

- Import Restrictions:

- Some countries (e.g., China, Russia, UAE) require import permits or pre-approval for laser equipment.

- Power thresholds often trigger additional scrutiny (>1mW may require registration).

- Action: Consult with export compliance officers or legal advisors before shipping. Include licensing costs and timelines in price quotes.

Safety and Certification Requirements

Laser markers must meet safety standards in the destination market to be legally sold.

- Laser Safety Standards:

- IEC 60825-1: International standard for laser product safety.

- FDA 21 CFR 1040.10 (U.S.): Requires product registration, certification, and labeling.

- CE Marking (EU): Compliance with the Machinery Directive and EN standards (e.g., EN 60825).

- Required Documentation:

- Declaration of Conformity (DoC)

- Laser classification label (e.g., Class 1, Class 4)

- User manuals in local language

- Action: Budget for third-party testing and certification. Non-compliance can lead to product seizure or fines.

Shipping and Handling Considerations

Laser markers are precision instruments requiring careful logistics planning.

- Packaging: Use shock-absorbent, moisture-resistant materials; include desiccants for long sea freight.

- Shipping Modes:

- Air Freight: Faster but expensive—recommended for urgent or high-value units.

- Sea Freight: Cost-effective for bulk orders but longer transit times.

- Insurance: Cover full value against damage, theft, or delay.

- Incoterms: Clearly define responsibilities using standard terms (e.g., FOB, CIF, DDP). DDP shifts logistics burden to the seller but increases price transparency.

- Action: Factor in freight, insurance, and handling in the final laser marker price.

Duties, Taxes, and Landed Cost Calculation

The final price of a laser marker includes more than the unit cost—logistics and compliance fees add up.

- Components of Landed Cost:

- Product price

- Shipping and insurance

- Import duties (based on HS code and country)

- VAT/GST (typically 5–20% depending on region)

- Customs clearance fees

- Compliance and certification costs

- Example: A $10,000 laser marker shipped to Germany may incur:

- 3% import duty

- 19% VAT on (product + shipping + duty)

- €200 customs broker fee

→ Total landed cost ≈ $12,500 - Action: Use a landed cost calculator and provide transparent pricing to customers.

End-Use and End-User Compliance

Some countries require end-user statements or end-use monitoring.

- Restricted End-Uses: Military, surveillance, or weapons manufacturing may trigger red flags.

- End-User Certifications: Required in countries like India, Saudi Arabia, and Turkey.

- Action: Obtain signed end-use declarations from buyers to prevent export violations.

Documentation Checklist

Ensure all necessary documents accompany every shipment:

- Commercial Invoice (with full product description and value)

- Packing List

- Bill of Lading or Air Waybill

- Certificate of Origin

- Export License (if applicable)

- Safety Certifications (CE, FDA, etc.)

- End-User Statement (if required)

Final Recommendations

- Consult Experts: Work with freight forwarders and compliance consultants familiar with laser equipment.

- Update Pricing Regularly: Changes in tariffs, regulations, or freight rates should be reflected in quoted prices.

- Build Compliance into Price Quotes: Transparent pricing that includes logistics and regulatory costs builds trust and avoids surprises.

By proactively addressing logistics and compliance, businesses can ensure smooth international trade operations and maintain competitive, accurate laser marker pricing.

Conclusion on Sourcing Laser Marker Price:

After evaluating various suppliers, models, and specifications, it is evident that laser marker prices vary significantly based on factors such as laser type (fiber, CO2, UV), power output, marking speed, software capabilities, brand reputation, and after-sales support. Entry-level models are available at competitive prices for small-scale operations, while industrial-grade systems with advanced features command higher investments due to their precision, durability, and integration capabilities.

Sourcing from reputable manufacturers—whether domestic or international—requires a balance between cost-efficiency and long-term reliability. While some suppliers offer lower upfront costs, hidden expenses related to maintenance, training, and spare parts may impact the total cost of ownership. Therefore, it is recommended to prioritize suppliers offering comprehensive warranties, technical support, and scalable solutions.

In conclusion, a thorough comparison of technical specifications, total cost of ownership, and supplier reliability is essential when sourcing a laser marker. Choosing the right machine involves aligning the investment with specific application needs, ensuring optimal performance, and maximizing return on investment over time.