The global laser engraving market is experiencing robust growth, driven by increasing demand across industries such as automotive, electronics, jewelry, and personalized consumer goods. According to Grand View Research, the global laser marking and engraving market size was valued at USD 2.27 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This surge is fueled by advancements in fiber and CO2 laser technologies, rising adoption of automation in manufacturing, and the growing need for high-precision, permanent marking solutions. China has emerged as a dominant player in this landscape, housing a concentrated ecosystem of manufacturers that offer cost-effective, technologically advanced laser engraving systems. With over 60% of laser machine production now attributed to Chinese manufacturers, the country has become a go-to hub for businesses seeking scalable and reliable engraving solutions. In this evolving market, identifying the most innovative and performance-driven manufacturers is critical for sourcing partners aiming to stay ahead of the curve.

Top 9 Laser Engraving China Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Demark (Wuhan) Technology Co., Ltd.

Website: demarkchina.cn

Key Highlights: Demark (Wuhan) Technology Co.,ltd has focused on laser technology for over 20 years in China, including laser marking, laser engraving, laser welding and laser ……

#2 International Laser Marking Machine Manufacturer & Supplier …

Website: hunstlaser.com

Key Highlights: Hunst Laser Co., Ltd is one of the leading and top-notch laser marking machine manufacturer and supplier in China. We excel in introducing the innovative and ……

#3 Focus on laser

Founded: 1996

Website: hanslaser.net

Key Highlights: Han’s Laser Technology Industry Group Co., Ltd, a public company which was established in 1996, has now become the flagship of Chinese national laser ……

#4 JPT Laser

Website: en.jptoe.com

Key Highlights: As a leading laser manufacturer in China, JPT offers a full range of lasers, including MOPA laser, CW laser, DPSS laser, and diode lasers. JPT delivers high ……

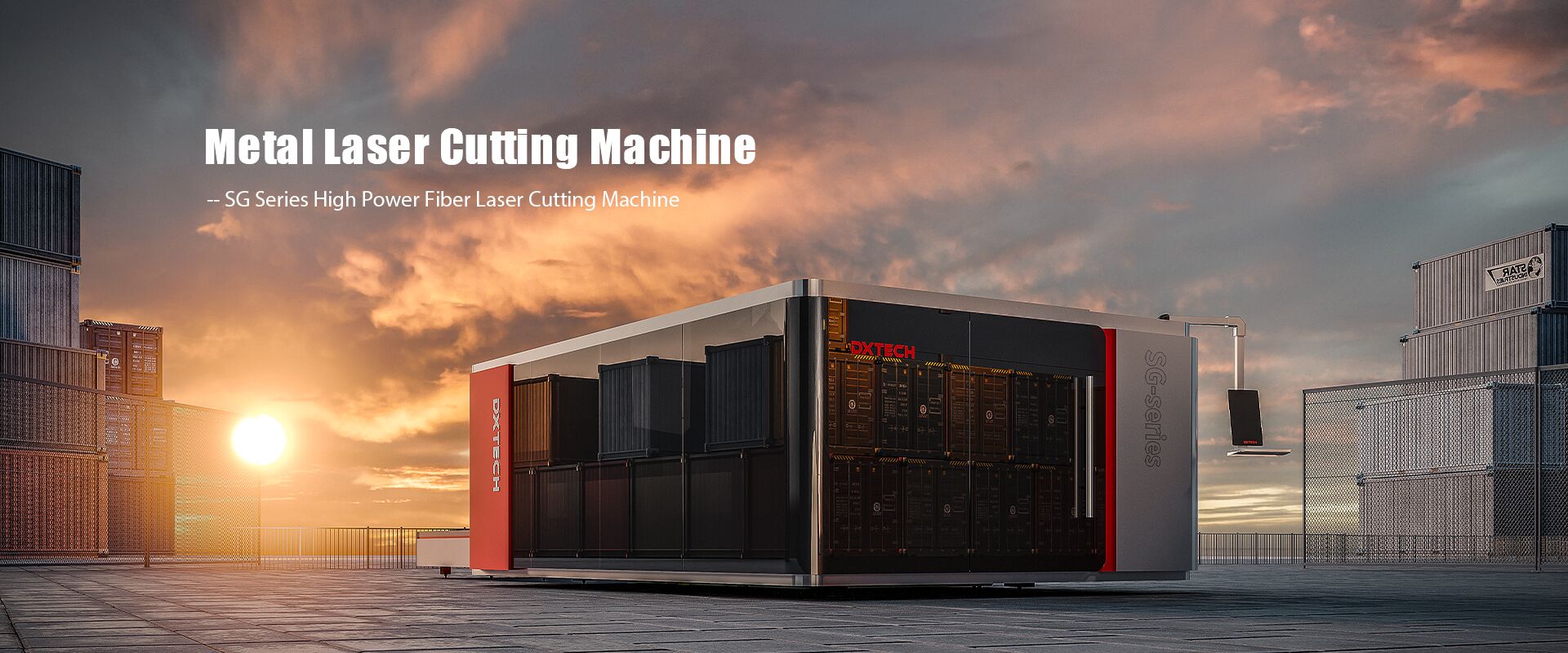

#5 DXTECH Official

Website: dxtech.com

Key Highlights: DXTECH, as the advanced CNC laser machine manufacturer, mainly manufactures and supplies the laser cutting machines, laser welding machines, laser engraving ……

#6 Wuhan Raycus Fiber Laser Technologies Co., Ltd.

Website: en.raycuslaser.com

Key Highlights: (hereinafter referred to as “Wuhan Raycus”) is the first Chinese enterprise engaged in the research, development and scale production of high-power fiber lasers ……

#7 Wattsan

Website: wattsan.com

Key Highlights: Wattsan is a manufacturer of laser and cnc milling machines of European quality at affordable prices with worldwide delivery….

#8 Laser engraving machine manufacturers

Website: en.founderlaser.com

Key Highlights: Fangde Laser is one of the small and medium-sized laser equipment manufacturers in China with 108 employees. MORE+….

#9 Best Fiber Laser Engraver

Website: laserchina.com

Key Highlights: Powered by 50W 60W 100W 200W fiber laser, fiber laser engraver delivers precise and permanent etching or engraving on various metal surfaces….

Expert Sourcing Insights for Laser Engraving China

H2: 2026 Market Trends for Laser Engraving in China

The laser engraving market in China is poised for significant transformation by 2026, driven by technological advancements, expanding industrial applications, and increasing demand for precision manufacturing. This analysis explores key trends shaping the industry landscape in China over the coming years.

1. Rising Demand Across Diverse Industries

By 2026, demand for laser engraving solutions in China is expected to grow robustly across sectors such as electronics, automotive, consumer goods, medical devices, and aerospace. The need for permanent, high-precision marking on metals, plastics, ceramics, and composites is fueling adoption. Particularly, the booming electric vehicle (EV) and semiconductor industries are driving the need for reliable laser marking in component traceability and branding.

2. Technological Advancements and Automation Integration

Chinese manufacturers are increasingly investing in fiber, UV, and ultrafast (picosecond/femtosecond) laser technologies that offer higher precision, speed, and minimal thermal damage. By 2026, integration with Industry 4.0 systems—such as IoT-enabled monitoring, AI-driven quality control, and automated robotic handling—will become standard in mid-to-high-end laser engraving systems. This shift enhances efficiency and reduces operational costs, especially in smart factory environments.

3. Growth of Domestic Innovation and Local Supply Chains

China is rapidly reducing reliance on imported laser components. Domestic firms like Han’s Laser, JPT Opto-electronics, and Raycus are leading the way in developing core technologies, including high-performance laser sources and galvanometer scanners. By 2026, China’s self-sufficiency in key subsystems is expected to exceed 80%, making Chinese-made laser engraving machines more competitive globally in terms of price and performance.

4. Expansion in Small and Medium Enterprise (SME) Adoption

Lower-cost desktop and compact fiber laser systems are enabling widespread adoption among SMEs and creative industries such as personalized gifts, jewelry, and signage. Government support for digital manufacturing and innovation subsidies is accelerating this trend. By 2026, the SME segment is projected to account for over 40% of total laser engraving equipment sales in China.

5. Sustainability and Energy Efficiency Focus

Environmental regulations are pushing manufacturers to adopt greener production methods. Laser engraving, being a non-contact and waste-minimizing process, aligns with China’s carbon neutrality goals. Expect increased emphasis on energy-efficient lasers and recyclable materials, with manufacturers highlighting eco-friendly features in their marketing and compliance strategies by 2026.

6. Export Growth and Global Market Penetration

China remains the world’s largest exporter of laser engraving machines. By 2026, Chinese brands are expected to strengthen their presence in Southeast Asia, Africa, Latin America, and Eastern Europe through cost-effective solutions and localized service networks. Trade agreements and digital platforms like Alibaba and Made-in-China.com will continue to drive international sales.

7. Regulatory and Standardization Developments

As the market matures, China is likely to implement stricter safety, quality, and performance standards for laser equipment. Compliance with GB (Guobiao) standards and international certifications (such as CE and FDA) will become more critical, especially for exporters. This will encourage consolidation among smaller, non-compliant manufacturers.

Conclusion

By 2026, the laser engraving market in China will be characterized by technological maturity, broader industrial integration, and strong domestic innovation. With supportive policies, growing export momentum, and increasing adoption across sectors, China is set to maintain its leadership in the global laser processing industry. Companies that prioritize R&D, automation, and sustainability will be best positioned to capitalize on these evolving trends.

Common Pitfalls When Sourcing Laser Engraving Machines from China

Quality Inconsistencies

One of the most frequent challenges is inconsistent product quality. Chinese manufacturers often produce machines with varying build standards, where components like laser tubes, optics, and control systems may differ significantly between units—even within the same model. Buyers might receive a well-functioning machine in one shipment and a poorly calibrated or underperforming unit in the next. This inconsistency stems from fragmented supply chains, use of substandard parts to cut costs, or lack of rigorous quality control processes. To mitigate this, conduct thorough factory audits, request third-party inspections, and insist on sample testing before placing bulk orders.

Intellectual Property (IP) Risks

Sourcing laser engraving technology from China carries significant IP exposure. Some manufacturers may reverse-engineer proprietary designs, replicate custom software, or sell similar machines to competitors without authorization. There have been cases where OEMs or private-label buyers discovered their designs being marketed by the same supplier to other clients. Weak enforcement of IP laws in certain regions increases vulnerability. To protect your IP, use strong legal agreements (NDAs, IP ownership clauses), limit technical disclosures, work with reputable partners, and consider registering patents or trademarks in China if long-term market presence is planned.

Logistics & Compliance Guide for Laser Engraving Services in China

Understanding Export Regulations for Laser Equipment

When sourcing or exporting laser engraving machines from China, compliance with international export control regulations is critical. Many high-powered laser systems fall under dual-use regulations due to potential military applications. The primary framework governing this is the Wassenaar Arrangement, which China adheres to through its national export control laws. Exporters must determine if the laser engraving machine requires an export license based on specifications such as laser power (typically above 500W for certain wavelengths), beam quality, and application. Failure to comply may result in shipment seizures, fines, or legal action.

Classification Under HS Codes

Proper Harmonized System (HS) code classification is essential for smooth customs clearance. Laser engraving machines are generally classified under HS code 8456.11 or 8456.12, depending on the type (e.g., laser-cutting vs. engraving) and application. Accessories such as chiller units, rotary attachments, or control software may have separate classifications. Accurate coding ensures correct duty rates and avoids delays. It is recommended to work with a licensed customs broker in both China and the destination country to verify the applicable HS code and any tariff exemptions.

Technical Documentation and Certification Requirements

Chinese manufacturers must provide comprehensive technical documentation to meet international compliance standards. This includes CE certification (for export to the EU), FCC certification (for the U.S.), and RoHS compliance for hazardous substance restrictions. Additionally, laser safety certifications such as IEC 60825-1 are mandatory. Documentation should include user manuals in the destination country’s language, circuit diagrams, and conformity declarations. Ensure the supplier provides original, verifiable certificates, as counterfeit documents are a known issue in some regions.

Shipping and Freight Considerations

Laser engraving machines are often heavy, bulky, and sensitive to shock and moisture. Choose reliable shipping methods—typically sea freight for cost efficiency or air freight for urgency. Crating must meet ISPM 15 standards for wooden packaging to prevent pest infestation. Include desiccants and shock indicators inside the packaging. Work with freight forwarders experienced in handling industrial machinery to arrange proper insurance, Incoterms (e.g., FOB, CIF), and door-to-door logistics. Confirm whether the supplier offers DDP (Delivered Duty Paid) to minimize import responsibilities.

Import Duties and Taxes

Importers are responsible for duties, VAT, and other taxes upon arrival in the destination country. Rates vary significantly—for example, the U.S. typically applies a 2.5%–3.5% duty on laser engraving machines under HTS 8456.11. The EU may apply 0%–4% depending on the member state. Accurate commercial invoices stating full value, including shipping and insurance (under CIF terms), are required. Under-declaring value to reduce duties is illegal and can result in penalties. Consider using a customs broker to calculate landed costs accurately.

End-Use and End-User Verification

Due to dual-use concerns, Chinese export authorities and foreign customs agencies may require end-use statements or end-user undertakings. These documents confirm that the laser equipment will not be used for military, nuclear, or prohibited applications. Some countries also require end-user certificates, especially for high-power systems. Be prepared to provide detailed information about your company and intended use to avoid export license denials or shipment holds.

After-Sales Support and Warranty Compliance

Ensure the supplier provides clear warranty terms compliant with international standards. Service support, spare parts availability, and software updates should be outlined in the contract. Note that some Chinese warranties may require return to China for repairs, which can be costly and time-consuming. Clarify responsibilities for maintenance and technical support prior to purchase. Also, verify software licensing compliance—some laser control software may have export restrictions due to encryption features.

Environmental and Safety Compliance

Laser engraving operations produce fumes and particulate matter. Machines exported from China should include or be compatible with certified fume extraction systems that meet OSHA (U.S.) or EN (EU) standards. Verify that the equipment complies with local workplace safety regulations. Additionally, ensure disposal of consumables (e.g., filters, waste materials) follows environmental guidelines in your country to avoid liability.

Conclusion: Sourcing Laser Engraving Services from China

Sourcing laser engraving services from China presents a compelling opportunity for businesses seeking high-quality, cost-effective manufacturing solutions. With advanced technological infrastructure, a wide range of material capabilities, and competitive pricing, Chinese suppliers offer scalable production capacity that meets both small-batch customization and large-scale industrial demands.

Key advantages include access to state-of-the-art CNC and fiber laser systems, skilled technical labor, and flexible OEM/ODM services that support branding and design customization. Additionally, the extensive supply chain ecosystem in regions like Guangdong and Zhejiang ensures faster turnaround times and integrated logistics support.

However, successful sourcing requires due diligence in supplier verification, clear communication of technical specifications, and attention to quality control—possibly through third-party inspections or on-site audits. Intellectual property protection and consistent post-production support should also be considered.

In conclusion, when managed strategically, sourcing laser engraving from China can significantly enhance product quality and production efficiency while reducing overall costs, making it a smart choice for businesses worldwide aiming to remain competitive in precision manufacturing and custom fabrication markets.