The global laser cutting equipment market is undergoing rapid expansion, driven by increasing demand for precision manufacturing across industries such as automotive, aerospace, and electronics. According to Grand View Research, the market was valued at USD 6.17 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. Similarly, Mordor Intelligence estimates a CAGR of approximately 6.5% over the forecast period (2023–2028), underscoring the sustained adoption of laser cutting technologies due to advancements in fiber laser systems, automation integration, and cost efficiency. As manufacturers seek higher accuracy, faster processing speeds, and reduced material waste, competition among key players has intensified. This environment has elevated a select group of innovators leading the charge in laser cutting process technology—companies that combine engineering excellence with scalable, energy-efficient solutions. Below are the top 10 laser cutting process manufacturers shaping the future of industrial fabrication.

Top 10 Laser Cutting Process Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Focus on laser

Website: hanslaser.net

Key Highlights: Laser cutting is the process of cutting material by means of electron discharge as the energy source. The following diagram describe the principle of Laser ……

#2 Universal Laser Systems

Website: ulsinc.com

Key Highlights: Discover our process and products to build your ideal laser system. Learn More. Begin exploring what’s possible with advanced laser technology. Contact us….

#3 Laser Photonics

Website: laserphotonics.com

Key Highlights: Laser Photonics manufactures reliable, safe, and eco-friendly Laser Cleaning, Laser Cutting, Laser Engraving, Laser Marking, and Laser Welding solutions….

#4 Fiber Laser Cutting Machine and CO2 Laser Cutter Manufacturer …

Website: gwklaser.com

Key Highlights: Leading manufacturer of laser cutting machine, CO2 laser cutter, laser welding machine, laser bending machine and laser cleaning machine, etc….

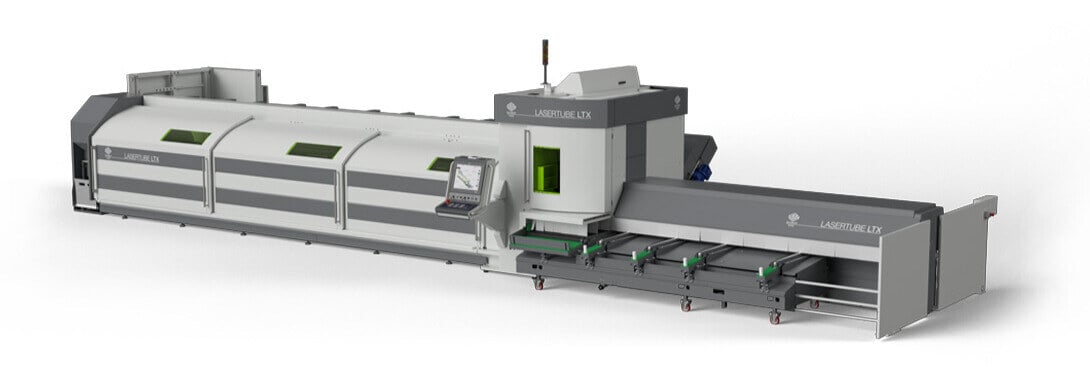

#5 BLM GROUP

Website: blmgroup.com

Key Highlights: BLM GROUP is a world leading manufacturer of high precision and high performance laser cutting and sawing machines, CNC bending and end-forming machines….

#6 Full Spectrum Laser

#7 Laser Cutting, Engraving & Marking Machines

Website: thunderlaser.com

Key Highlights: Thunder Laser offers high-quality, reliable laser machines to meet the needs of a variety of industries. ThunderLaser has become a well-recognized icon in ……

#8 Laser cutting

Website: trumpf.com

Key Highlights: TRUMPF lasers perform a wide variety of cutting and drilling work in metal, plastic, paper, and stone using a non-contact processing method….

#9 IPG Photonics

Website: ipgphotonics.com

Key Highlights: IPG Photonics manufactures high-performance fiber lasers, amplifiers, and laser systems for diverse applications and industries. Discover your solution….

#10 Custom Online Laser Cutting Services

Website: xometry.com

Key Highlights: Xometry offers an online custom laser cutting service in metal, plastic, rubber, foam, and wood. Xometry’s laser cutting offers a cost-effective, on-demand ……

Expert Sourcing Insights for Laser Cutting Process

H2: Market Trends in the Laser Cutting Process for 2026

By 2026, the global laser cutting process market is poised for significant transformation, driven by technological innovation, increasing automation, and rising demand across key industries such as automotive, aerospace, electronics, and renewable energy. This analysis highlights the major trends shaping the laser cutting landscape in 2026.

1. Advancements in Fiber Laser Technology

Fiber lasers continue to dominate the market due to their superior energy efficiency, lower maintenance requirements, and higher cutting speeds compared to traditional CO₂ lasers. By 2026, fiber lasers are expected to account for over 70% of industrial laser cutting systems, particularly in metal fabrication. Innovations such as multi-kilowatt power outputs (up to 30 kW) enable faster processing of thick metals, expanding applications in heavy machinery and shipbuilding.

2. Integration of Artificial Intelligence and Machine Learning

AI-driven laser cutting systems are becoming standard in smart factories. In 2026, predictive maintenance, real-time defect detection, and adaptive cutting path optimization powered by machine learning algorithms will enhance precision and reduce material waste. These intelligent systems also improve operational efficiency by minimizing downtime and optimizing energy consumption.

3. Growth in Automation and Industry 4.0 Integration

The push toward fully automated manufacturing is accelerating the adoption of robotic laser cutting cells. Seamless integration with CAD/CAM software, IoT-enabled monitoring, and digital twin technologies allows manufacturers to achieve end-to-end digital workflows. Companies are increasingly investing in modular and scalable laser systems that can adapt to fluctuating production demands.

4. Rising Demand in Electric Vehicles (EVs) and Renewable Energy

The rapid expansion of the EV market is creating new opportunities for laser cutting in battery component manufacturing, lightweight chassis fabrication, and precision cutting of electric motor parts. Similarly, the solar and wind energy sectors require high-precision cutting for panels, inverters, and turbine components, boosting demand for reliable and scalable laser solutions.

5. Sustainability and Energy Efficiency Focus

As environmental regulations tighten, manufacturers are prioritizing sustainable production methods. Laser cutting offers advantages such as reduced material waste, lower energy consumption per part, and minimal need for secondary finishing. By 2026, eco-conscious procurement policies will favor laser systems with energy recovery features and recyclable component designs.

6. Regional Market Dynamics

Asia-Pacific remains the fastest-growing region, led by China, India, and South Korea, due to expanding manufacturing infrastructure and government support for advanced industrial technologies. North America and Europe are focusing on high-precision applications and custom fabrication, with strong growth in aerospace and medical device manufacturing.

7. Price Optimization and Accessibility

Increased competition and technological maturity are driving down the cost of mid-range laser cutting systems, making them accessible to small and medium-sized enterprises (SMEs). Cloud-based laser cutting services and on-demand manufacturing platforms are also emerging, enabling cost-effective access to high-end capabilities without large capital investments.

In conclusion, the 2026 laser cutting process market will be defined by smarter, faster, and more sustainable solutions. As industries embrace digital transformation and clean energy, laser cutting will remain a cornerstone technology in modern manufacturing—offering precision, flexibility, and scalability for evolving production needs.

Common Pitfalls in Sourcing Laser Cutting Processes (Quality and IP)

Sourcing laser cutting services can offer efficiency and precision, but businesses often encounter significant challenges related to quality consistency and intellectual property (IP) protection. Overlooking these aspects can lead to production delays, increased costs, and legal vulnerabilities.

Quality Inconsistencies and Process Control

One of the most frequent pitfalls when sourcing laser cutting is inconsistent cut quality across batches or suppliers. Differences in machine calibration, operator skill, and material handling can result in variations in edge finish, dimensional accuracy, and kerf width. Suppliers may use different types of lasers (CO₂, fiber, or Nd:YAG), each with distinct capabilities and limitations, which can affect precision—especially with thin or reflective materials. Without clear quality standards and inspection protocols in the sourcing agreement, clients risk receiving parts that don’t meet design specifications, leading to rework or assembly failures.

Additionally, inadequate process documentation and lack of traceability make it difficult to diagnose quality issues. Suppliers might not provide detailed records of laser parameters (power, speed, assist gas), making replication or troubleshooting problematic. It’s essential to define acceptance criteria upfront and conduct regular audits or sample testing to ensure ongoing compliance.

Intellectual Property Exposure and Lack of Protection

Outsourcing laser cutting often requires sharing detailed CAD files, technical drawings, and proprietary designs, exposing sensitive intellectual property. A major pitfall arises when contracts lack robust IP clauses, non-disclosure agreements (NDAs), or data handling policies. Without these safeguards, there’s a risk that the supplier could misuse designs, replicate products, or inadvertently leak information to competitors.

Furthermore, digital files used in laser cutting (e.g., DXF, SVG) are easily copied and transferred. If the supplier stores or backs up data on unsecured servers, it increases the risk of unauthorized access. Clients should ensure that data ownership is explicitly stated in contracts, specify secure file transfer methods, and require data deletion after project completion. Failing to establish these protections can result in long-term competitive disadvantages and potential legal disputes.

Logistics & Compliance Guide for Laser Cutting Process

This guide outlines the essential logistical considerations and compliance requirements for implementing and operating a laser cutting process in manufacturing or fabrication environments. Adherence ensures safety, quality, regulatory alignment, and operational efficiency.

Equipment & Facility Requirements

Ensure that the laser cutting machine and its installation meet manufacturer specifications and relevant safety standards (e.g., ISO 11553, ANSI Z136.1). The facility must provide adequate space for machine operation, material handling, exhaust systems, and safe access. Environmental conditions such as temperature, humidity, and ventilation should align with equipment requirements to maintain precision and prevent component degradation.

Material Handling & Inventory Management

Implement standardized procedures for receiving, storing, and transporting raw materials (e.g., sheet metal, acrylic, wood). Materials should be stored in a dry, organized area to prevent warping, contamination, or damage. Use inventory tracking systems to monitor stock levels, material certifications, and traceability, especially for regulated industries (e.g., aerospace, medical devices).

Safety & Personal Protective Equipment (PPE)

Laser cutting operations present hazards including intense optical radiation, fumes, fire risk, and moving parts. Operators must be trained and equipped with appropriate PPE, including laser safety goggles (with correct wavelength filtration), flame-resistant clothing, gloves, and respiratory protection where fumes are present. Install safety interlocks, emergency stops, and warning signs in compliance with OSHA and local regulations.

Fume Extraction & Environmental Compliance

Laser cutting generates hazardous fumes and particulates, particularly when processing coated metals, plastics, or composites. Install and maintain an industrial-grade fume extraction system with HEPA and/or activated carbon filtration. Ensure emissions comply with local air quality regulations (e.g., EPA, EU Directive 2004/42/EC). Conduct regular maintenance and filter replacements, and perform air quality monitoring as needed.

Waste Management & Disposal

Classify and segregate waste generated during laser cutting, including metal slag, dross, filter residues, and off-cuts. Follow local, state, and federal environmental regulations (e.g., RCRA in the U.S.) for hazardous waste disposal. Maintain records of waste disposal activities and partner with certified waste management providers to ensure proper handling and documentation.

Regulatory & Industry Standards Compliance

Adhere to applicable standards and certifications, such as:

– ISO 9001 (Quality Management)

– ISO 14001 (Environmental Management)

– ISO 45001 (Occupational Health & Safety)

– CE Marking (for EU markets)

– FDA or aerospace-specific requirements (where applicable)

Maintain documentation for machine calibration, operator training, risk assessments, and process validation to support audits and certifications.

Operator Training & Certification

All personnel operating or maintaining laser cutting equipment must complete formal training programs covering machine operation, safety protocols, emergency procedures, and compliance responsibilities. Maintain training records and conduct periodic refresher courses. Certification may be required depending on regional regulations or industry standards.

Process Documentation & Traceability

Establish documented work instructions, standard operating procedures (SOPs), and quality control checkpoints for each laser cutting job. Implement a traceability system that logs material batch numbers, machine settings, operator IDs, and inspection results. This supports quality assurance and enables root cause analysis in case of non-conformance.

Maintenance & Calibration Schedules

Follow manufacturer-recommended maintenance routines for optics, lenses, nozzles, motion systems, and cooling units. Perform regular calibration of laser power, focus position, and alignment to ensure cut quality and dimensional accuracy. Keep detailed maintenance logs and schedule preventive maintenance to minimize downtime and comply with quality system requirements.

Transportation & Shipping of Cut Parts

After processing, ensure finished parts are properly cleaned, inspected, and packaged to prevent damage during transit. Use protective materials (e.g., foam, corner guards) and secure packaging methods. Label shipments with relevant handling instructions, material certifications, and compliance marks as required by customers or regulatory bodies.

Conclusion for Sourcing the Laser Cutting Process:

Sourcing the laser cutting process offers a strategic advantage for manufacturing and fabrication needs, combining precision, speed, and versatility across a wide range of materials. By leveraging external laser cutting services, companies can reduce capital expenditure on equipment, lower operational costs, and gain access to advanced technology and expertise without the burden of maintenance and training.

When selecting a laser cutting vendor, key considerations include machine capability (CO2 vs. fiber laser), material compatibility, precision requirements, production volume, lead times, and cost-efficiency. A thorough evaluation of potential suppliers—assessing quality standards, certifications, capacity, and track record—ensures reliable and consistent output.

Outsourcing this process also allows businesses to focus on core competencies, enhance scalability, and respond more quickly to market demands. As advancements in laser technology continue, partnering with specialized service providers enables access to innovation and improved manufacturing capabilities.

In conclusion, sourcing laser cutting is a cost-effective, efficient, and high-quality solution for modern fabrication needs. With the right supplier partnership, companies can achieve superior product quality, faster time-to-market, and greater operational flexibility in a competitive manufacturing landscape.