The global laser cleaning market is experiencing robust growth, driven by increasing demand for eco-friendly and precision-based industrial cleaning solutions. According to a report by Mordor Intelligence, the market was valued at USD 492.8 million in 2023 and is projected to reach USD 1.12 billion by 2029, growing at a CAGR of approximately 14.8% during the forecast period. This expansion is fueled by rising adoption in automotive, aerospace, and manufacturing sectors, where traditional cleaning methods are being replaced by efficient, non-abrasive alternatives. Laser cleaning technology offers advantages such as minimal waste, reduced operational downtime, and compliance with environmental regulations—making it a preferred choice for modern industrial maintenance. As demand surges, multiple manufacturers have emerged to offer high-performance laser cleaning systems. Based on market presence, product innovation, and technical specifications, the following eight manufacturers stand out as leading suppliers of laser cleaners for sale worldwide.

Top 8 Laser Cleaners For Sale Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Laser Cleaning Machine Manufacturers

Website: fortunelaser.com

Key Highlights: … Laser Technology Co., Ltd. is a professional manufacturer of industrial laser equipment, integrated with R&D, production, sales and maintenance services….

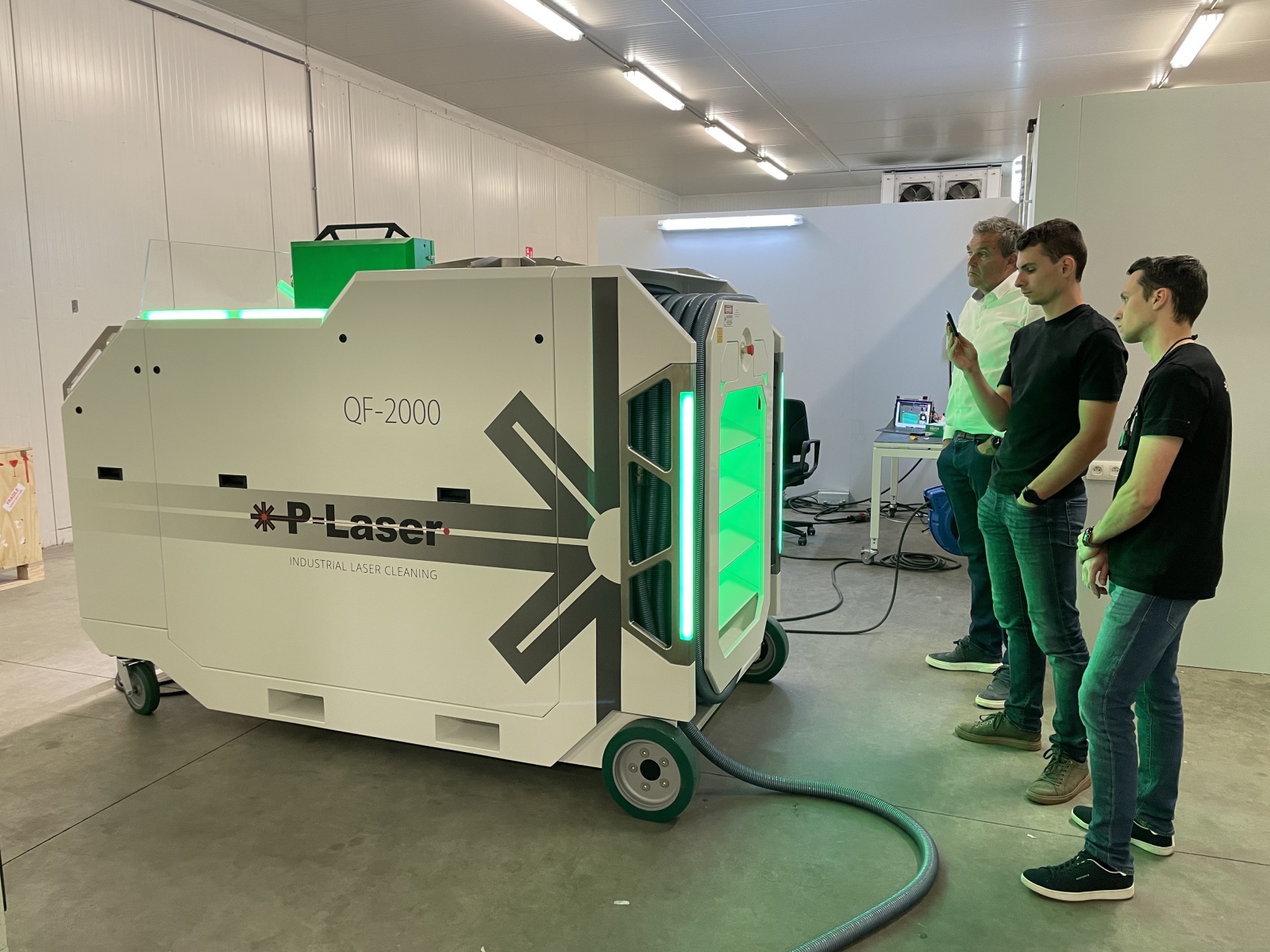

#2 P-laser Industrial laser cleaning

Website: p-laser.com

Key Highlights: we engineer and manufacture the most advanced—and most powerful—pulsed industrial laser cleaning systems on the market, built for both manual and automated ……

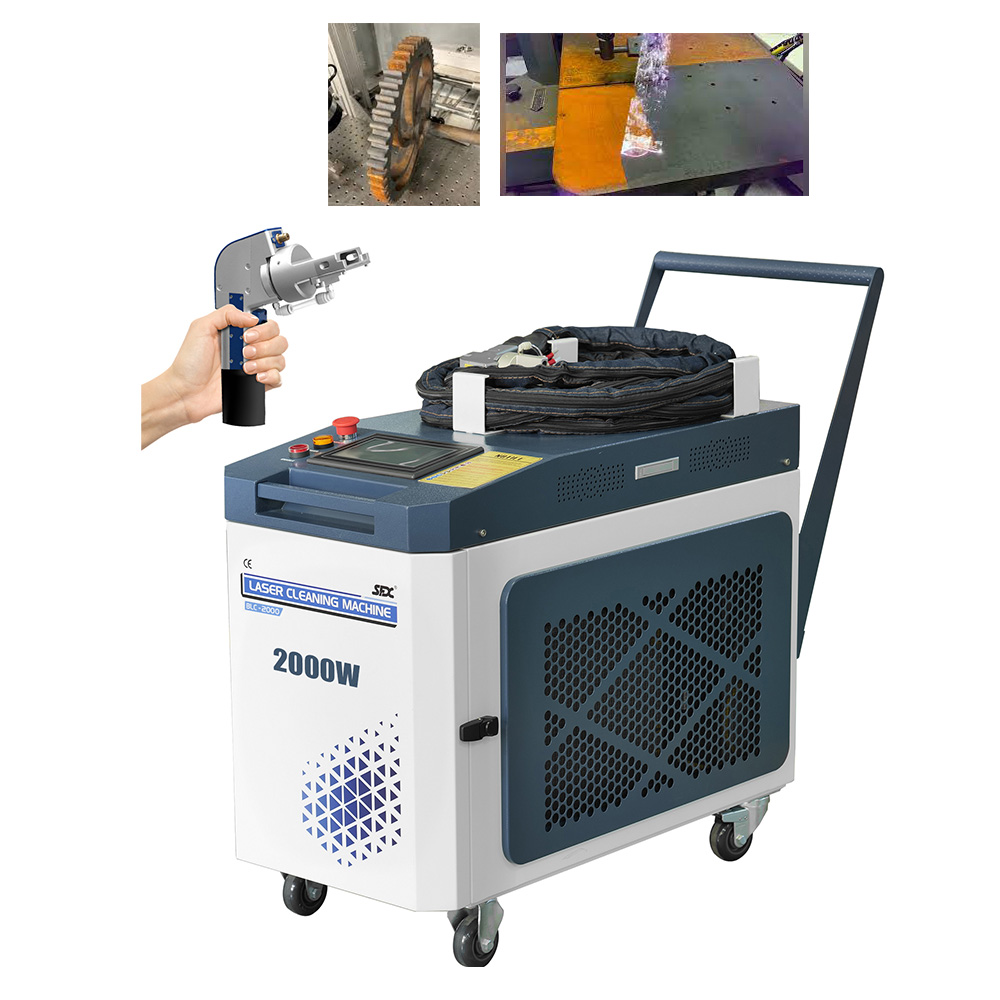

#3 SFX Laser

Website: sfxlaser.com

Key Highlights: SFX Laser is a 20+ years professional laser equipment manufacturer including laser cleaning machine, laser welding machine, fiber laser engraver, ……

#4 Laser Photonics

Website: laserphotonics.com

Key Highlights: Laser Photonics manufactures reliable, safe, and eco-friendly Laser Cleaning, Laser Cutting, Laser Engraving, Laser Marking, and Laser Welding solutions….

#5 Laser cleaner machine prices

Website: pulsar-laser.com

Key Highlights: Laser cleaner machine prices and parameters, download our Catalogue….

#6 Argento Lux

Website: argentolux.com

Key Highlights: Our company provides state-of-the-art Industrial Laser Equipment Sales and Mobile Laser Cleaning Services for a wide range of applications and industries….

#7 Netalux

Website: netalux.com

Key Highlights: Discover our award-winning Laser Cleaning Solutions for the world’s most demanding industries. Discover our products and global service now….

#8 Laser Cleaners (Handheld)

Website: laserstar.net

Key Highlights: Free deliveryLaserStar® Portable Laser Cleaner (200W) … $17,950.00 Original price was: $17,950.00. $14,950.00 Current price is: $14,950.00….

Expert Sourcing Insights for Laser Cleaners For Sale

H2: 2026 Market Trends for Laser Cleaners for Sale

As we approach 2026, the global market for laser cleaners for sale is undergoing significant transformation driven by technological innovation, regulatory shifts, and increasing demand across industrial sectors. Laser cleaning technology—once considered a niche alternative to traditional abrasive and chemical cleaning methods—is rapidly gaining mainstream adoption due to its precision, environmental benefits, and cost-efficiency over time. Below are the key market trends shaping the laser cleaner industry in 2026:

1. Rising Demand in Manufacturing and Automotive Sectors

Laser cleaning systems are becoming integral in precision manufacturing, especially in the automotive and aerospace industries. In 2026, manufacturers are increasingly investing in laser cleaners for rust removal, paint stripping, mold cleaning, and surface preparation before welding or coating. The push for higher automation and zero-defect production is accelerating adoption, particularly in electric vehicle (EV) manufacturing, where clean, oxide-free metal surfaces are critical.

2. Advancements in Portable and Handheld Laser Cleaners

The market is seeing a surge in demand for portable and handheld laser cleaning devices, making the technology accessible to small and medium-sized enterprises (SMEs). By 2026, these compact systems offer improved ergonomics, enhanced safety features, and greater power efficiency, enabling broader use in maintenance, restoration, and on-site industrial applications. This trend is expanding the customer base beyond large factories to include contractors, historical restoration experts, and offshore platforms.

3. Environmental and Regulatory Compliance Driving Adoption

With stricter environmental regulations worldwide—particularly in the EU, North America, and parts of Asia—industries are shifting away from chemical solvents and sandblasting due to their hazardous waste and health risks. Laser cleaning, being non-abrasive and chemical-free, aligns with green manufacturing standards. Governments and corporations are offering incentives for adopting eco-friendly technologies, further boosting sales of laser cleaners in 2026.

4. Integration with AI and Smart Manufacturing

In 2026, leading laser cleaning systems are incorporating artificial intelligence (AI) and IoT connectivity. Smart laser cleaners can now detect surface contaminants, adjust power levels automatically, and log cleaning data for quality assurance. This integration supports Industry 4.0 initiatives, enabling predictive maintenance and real-time monitoring in smart factories.

5. Competitive Pricing and Market Expansion

As production scales and component costs decrease—especially in fiber laser technology—laser cleaners are becoming more affordable. Chinese manufacturers, in particular, have expanded their market share by offering cost-effective models, increasing global competition. By 2026, this price democratization is making laser cleaning accessible in emerging markets such as India, Southeast Asia, and Latin America.

6. Focus on Safety and Training

With wider adoption comes increased emphasis on operator safety. In 2026, regulatory bodies and manufacturers are standardizing safety protocols, including mandatory training and protective equipment. New models come with built-in safety interlocks, fume extraction systems, and real-time monitoring to prevent misuse and ensure compliance.

Conclusion

The 2026 market for laser cleaners for sale is defined by technological maturity, environmental imperatives, and expanding applications. As industries prioritize sustainability, automation, and precision, laser cleaning is poised to become a standard solution across multiple sectors. Buyers can expect a wider range of models, improved performance, and stronger support ecosystems, making it a strategic investment for future-ready operations.

Common Pitfalls When Sourcing Laser Cleaners For Sale (Quality & Intellectual Property)

Sourcing laser cleaners can be highly rewarding, but it comes with significant risks—particularly regarding quality consistency and intellectual property (IP) protection. Failing to address these pitfalls can lead to operational inefficiencies, legal disputes, and financial losses. Here are key challenges to watch for:

Poor Build Quality and Component Sourcing

Many low-cost laser cleaners, especially from less-reputable suppliers, use substandard materials and components to cut costs. This includes inferior laser diodes, unstable power supplies, and low-grade optical elements. These compromises result in reduced cleaning efficiency, shorter lifespans, and increased maintenance needs. Buyers may receive units that fail prematurely or underperform compared to advertised specifications.

Inaccurate Power Output and Performance Claims

Some suppliers exaggerate laser power output (e.g., claiming 1000W when actual output is significantly lower). This misrepresentation leads to poor cleaning results, especially on tough contaminants like rust or paint. Without independent verification or third-party testing data, it’s difficult to validate performance claims, leaving buyers with equipment that doesn’t meet their industrial requirements.

Lack of Safety Certifications and Compliance

Laser cleaners must comply with international safety standards (e.g., IEC 60825 for laser safety, CE, RoHS). Unverified suppliers may skip proper certifications or provide falsified documentation. This not only poses serious safety risks to operators but also exposes the buyer to regulatory penalties and liability in case of accidents.

Weak or Nonexistent Intellectual Property Protections

When sourcing from manufacturers—particularly in regions with lax IP enforcement—there’s a high risk of purchasing cloned or counterfeit equipment. These units may infringe on patented technologies, placing the buyer in legal jeopardy if the original IP holder pursues action. Additionally, using copied designs often means lower reliability and no access to firmware updates or technical support.

Limited After-Sales Support and Warranty Coverage

Many budget suppliers offer minimal or geographically restricted support. If a laser cleaner fails, obtaining replacement parts or technical assistance can be slow or impossible. Vague warranty terms may exclude critical components like the laser source, leaving buyers responsible for expensive repairs.

Hidden Costs from Poor Integration and Training

Low-cost units may lack compatibility with existing workflows or require custom integration. Additionally, insufficient user training materials or language barriers can lead to improper use, reducing effectiveness and increasing accident risks. These hidden costs erode the initial price advantage.

Conclusion

To avoid these pitfalls, conduct thorough due diligence: request performance test reports, verify certifications, review supplier IP policies, and evaluate long-term support capabilities. Prioritizing quality and legal compliance over upfront cost ensures safer, more reliable, and sustainable operations.

Logistics & Compliance Guide for Laser Cleaners For Sale

Product Classification and Regulatory Overview

Laser cleaners are industrial cleaning devices that use high-intensity laser beams to remove contaminants such as rust, paint, oil, and oxides from metal and other surfaces. Due to their use of Class 4 lasers (typically), these devices are subject to various international, national, and regional regulations concerning safety, export control, and environmental compliance.

Understanding the classification of laser cleaners is critical for legal distribution. In most jurisdictions, laser cleaners fall under industrial laser systems and are regulated by laser safety standards such as IEC 60825 (International) or 21 CFR 1040.10 (U.S. FDA/CDRH). Compliance with these standards is mandatory for market access.

Export Controls and International Trade Compliance

Laser cleaners, particularly those with high power output (typically >500W), may be subject to export control regulations due to their potential dual-use (civilian and military applications). Key regulatory frameworks include:

- U.S. Export Administration Regulations (EAR): Administered by the Bureau of Industry and Security (BIS), certain laser systems are listed under the Commerce Control List (CCL), particularly ECCN 6A003 or 6A005, depending on power, wavelength, and beam characteristics.

- Wassenaar Arrangement: An international export control regime that many countries follow to prevent the proliferation of conventional weapons and dual-use goods, including high-power lasers.

- Customs Documentation: Accurate HS (Harmonized System) codes are essential. Laser cleaning equipment often falls under HS Code 8515.21 or 8479.89, depending on design and function. Misclassification can lead to delays, fines, or seizure.

Exporters must obtain proper export licenses when required and ensure end-user verification to comply with anti-diversion policies.

Safety and Certification Requirements

Laser cleaners must meet stringent safety standards to protect operators and comply with local market regulations. Key certifications include:

- CE Marking (European Union): Requires compliance with the Machinery Directive (2006/42/EC), Electromagnetic Compatibility (EMC) Directive, and the Laser Product Safety standard (EN 60825-1). A Declaration of Conformity and technical file are mandatory.

- FDA/CDRH Registration (United States): All laser products must be registered with the Center for Devices and Radiological Health. Manufacturers must file a product report and comply with variance requirements for Class 4 lasers.

- Laser Safety Officer (LSO): Facilities using laser cleaners may require an appointed LSO to oversee safety protocols, especially in industrial settings.

Additional certifications such as ISO 9001 (quality management) and ISO 14001 (environmental management) can enhance market credibility.

Packaging, Shipping, and Handling

Due to the sensitive and high-value nature of laser cleaners, proper packaging and shipping protocols are essential:

- Protective Packaging: Use shock-absorbent materials and secure internal bracing to prevent damage during transit. Include humidity control (desiccants) for long sea shipments.

- Labeling Requirements: Clearly mark packages with “Fragile,” “This Side Up,” and “Laser Radiation” warning labels as per IEC 60825. Include compliance labels (CE, FDA, etc.) on the product.

- Transport Regulations: Laser cleaners are generally not classified as hazardous materials unless they contain regulated batteries or coolants. However, international carriers may require a safety data sheet (SDS) or non-hazardous declaration.

- Insurance and Tracking: High-value shipments should be insured and tracked in real-time. Provide customers with tracking details and import documentation promptly.

Import Compliance and Duties

Importing laser cleaners into any country requires adherence to local customs and technical regulations:

- Import Licenses: Some countries (e.g., China, Russia, India) require import permits or pre-shipment inspections for industrial laser equipment.

- Duties and Taxes: Tariff rates vary by country and HS code. Use free trade agreements (e.g., USMCA, RCEP) where applicable to reduce costs.

- Local Testing and Certification: Countries such as South Korea (KC Mark), Japan (PSE), and Australia (RCM) require local testing and certification even if CE or UL marks are present.

- Language Requirements: User manuals and safety warnings must often be translated into the local language (e.g., French in Canada, Spanish in Latin America).

Environmental and End-of-Life Compliance

Laser cleaners may contain components subject to environmental regulations:

- RoHS (EU): Restricts hazardous substances like lead, mercury, and cadmium in electrical equipment.

- WEEE (EU): Requires producers to register and provide take-back options for end-of-life equipment.

- Battery and Coolant Disposal: If the unit includes lithium batteries or coolant fluids, disposal must follow local hazardous waste regulations.

Sellers should provide end-of-life guidance to customers and consider offering recycling programs to support compliance.

Conclusion

Successfully selling laser cleaners across international markets requires a comprehensive understanding of logistics, safety certifications, and regulatory compliance. By adhering to export controls, obtaining necessary certifications, ensuring safe shipping, and meeting import requirements, sellers can minimize risks, avoid penalties, and build trust with global customers. Always consult with legal and compliance experts when entering new markets.

In conclusion, sourcing laser cleaners for sale requires careful consideration of several key factors to ensure you select reliable, high-performance equipment that meets your specific industrial or commercial needs. Evaluating suppliers based on technical specifications, build quality, safety certifications, and after-sales support is essential. Additionally, understanding the total cost of ownership—including maintenance, training, and energy consumption—can help maximize long-term value. With growing demand for eco-friendly and efficient cleaning solutions, laser cleaning technology presents a sustainable alternative to traditional methods. By partnering with reputable manufacturers and staying informed about industry advancements, businesses can successfully integrate laser cleaning systems into their operations, enhancing productivity, reducing environmental impact, and gaining a competitive edge in the market.