The global laser cleaning market is experiencing robust growth, driven by increasing demand for eco-friendly, precise, and low-maintenance surface treatment solutions in industrial applications. According to Grand View Research, the market was valued at USD 287.4 million in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 21.6% from 2023 to 2030. This surge is largely attributed to the rising adoption of laser cleaning in metal fabrication, automotive, aerospace, and precision manufacturing sectors, where traditional cleaning methods are being phased out in favor of more sustainable alternatives. As industries prioritize efficiency and regulatory compliance, the demand for high-performance laser cleaners tailored for metal surfaces has intensified. In this evolving landscape, a select group of manufacturers have emerged as leaders—combining innovation, reliability, and technological excellence to meet the growing needs of modern industrial cleaning. Below, we spotlight the top 9 laser cleaner manufacturers at the forefront of this transformation.

Top 9 Laser Cleaner Metal Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Laser Machine – Laser Equipment Manufacturer

Website: dplaser.com

Key Highlights: DPLASER is a leading manufacturer & factory of industrial laser welding, laser cutting, laser marking and laser cleaning machines….

#2 Laserax

Website: laserax.com

Key Highlights: Laserax works with the world’s leading manufacturers to implement laser cleaning, welding, texturing, and marking solutions….

#3 P-laser Industrial laser cleaning

Website: p-laser.com

Key Highlights: we engineer and manufacture the most advanced—and most powerful—pulsed industrial laser cleaning systems on the market, built for both manual and automated ……

#4 Laser Photonics

Website: laserphotonics.com

Key Highlights: Laser Photonics manufactures reliable, safe, and eco-friendly Laser Cleaning, Laser Cutting, Laser Engraving, Laser Marking, and Laser Welding solutions….

#5 SFX Laser

Website: sfxlaser.com

Key Highlights: SFX Laser is a 20+ years professional laser equipment manufacturer including laser cleaning machine, laser welding machine, fiber laser engraver, ……

#6 Industrial 1500W 2000W CW Laser Cleaning Machine Rusty Remove

Website: xinglaser.com

Key Highlights: XING Laser (6am Life LLC, DBA XING Laser) specializes in the development and manufacture of high-performance handheld laser cleaning and rust removal equipment….

#7 Laser Cleaning

Website: ipgphotonics.com

Key Highlights: Laser cleaning is used across a variety of industries to remove unwanted surface materials like coatings, paints, rust, oil, and for surface preparation for ……

#8 Vytek Laser Systems

Website: vytek.com

Key Highlights: Vytek designs, builds, and sells a complete line of laser solutions for cleaning, engraving, marking, cutting, and welding, built to exacting standards….

#9 Laser Rust Removal Guide

Website: pulsar-laser.com

Key Highlights: A practical guide for professionals and entrepreneurs using PULSAR Laser systems to remove rust safely, efficiently and without abrasives….

Expert Sourcing Insights for Laser Cleaner Metal

H2: 2026 Market Trends for Laser Cleaner Metal

The global market for laser cleaners in metal surface treatment is poised for significant transformation by 2026, driven by technological advancements, increasing industrial automation, and growing environmental regulations. Key trends shaping the laser cleaner metal market include:

-

Increased Adoption in Manufacturing and Automotive Sectors

By 2026, laser cleaning technology is expected to gain deeper penetration in precision manufacturing, automotive production, and aerospace industries. The demand for non-abrasive, eco-friendly cleaning methods to remove rust, oxides, paints, and contaminants from metal surfaces is accelerating adoption. Manufacturers are prioritizing laser cleaners to enhance product quality and extend equipment lifespan. -

Technological Advancements in Fiber Laser Systems

Fiber laser-based cleaning systems are becoming more efficient, compact, and cost-effective. Continuous improvements in laser power, beam control, and portability are making these systems accessible to small and medium enterprises (SMEs). By 2026, smart integration with IoT and AI is expected to enable predictive maintenance and real-time performance monitoring. -

Environmental and Regulatory Drivers

Stricter global regulations on chemical waste and abrasive blasting emissions are pushing industries toward sustainable alternatives. Laser cleaning produces no secondary waste and eliminates the need for chemical solvents, aligning with ESG (Environmental, Social, and Governance) goals. This regulatory push is a major growth catalyst, especially in Europe and North America. -

Expansion in Emerging Markets

Asia-Pacific, particularly China, India, and South Korea, is projected to witness rapid market growth due to expanding industrial infrastructure and government support for advanced manufacturing technologies. Local production of laser systems is reducing costs and improving supply chain efficiency. -

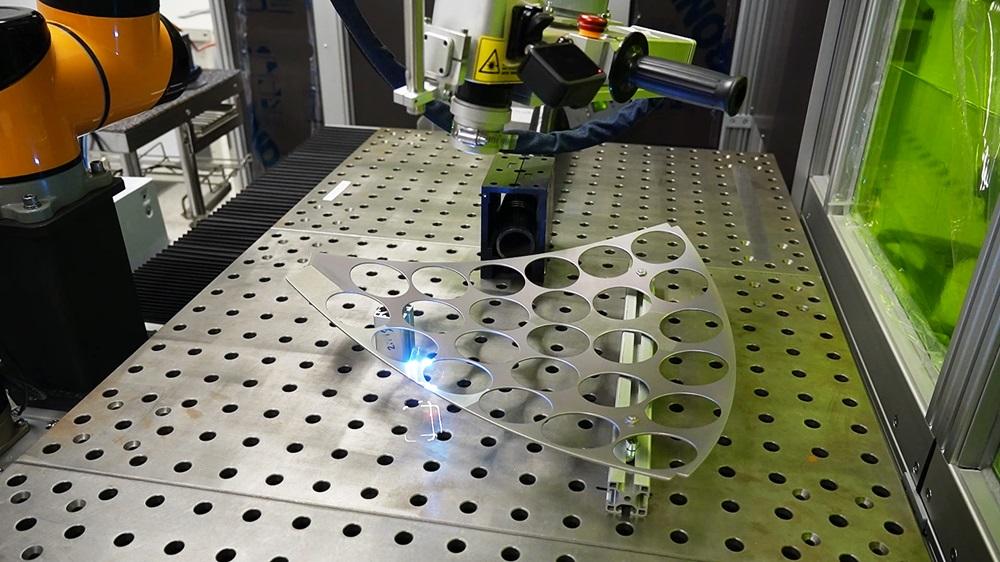

Rising Demand for Automation and Robotics Integration

Laser cleaning systems are increasingly being integrated into robotic arms for automated production lines. This trend is especially prominent in high-volume industries like automotive and shipbuilding. By 2026, fully automated laser cleaning cells are expected to become standard in modern smart factories. -

Cost Reduction and ROI Improvements

As component costs decline and system durability increases, the total cost of ownership for laser cleaning is becoming more competitive with traditional methods. Businesses are recognizing faster return on investment (ROI) due to reduced downtime, lower labor costs, and minimal consumables.

In conclusion, the 2026 outlook for the laser cleaner metal market is highly positive, with strong growth driven by sustainability demands, technological innovation, and industrial digitalization. Companies investing in R&D and strategic partnerships are likely to capture significant market share in this evolving landscape.

Common Pitfalls in Sourcing Laser Cleaner for Metal: Quality and Intellectual Property (IP) Concerns

When sourcing laser cleaners for metal applications, businesses must navigate several critical pitfalls related to both product quality and intellectual property (IP) protection. Overlooking these aspects can lead to operational inefficiencies, safety risks, legal disputes, and financial losses. Below are the key challenges to watch for:

Quality-Related Pitfalls

-

Inadequate Power and Performance Specifications

Many suppliers exaggerate laser power (e.g., stating peak power instead of average power) or omit key performance metrics like cleaning speed, spot size, and duty cycle. Low-quality units may fail to remove rust, paint, or oxides effectively on metals, especially stainless steel or aluminum, leading to rework or process failure. -

Poor Beam Quality and Stability

Substandard lasers often suffer from inconsistent beam focus and divergence, resulting in uneven cleaning, thermal damage to substrates, or incomplete removal. This is particularly problematic in precision applications where surface integrity is critical. -

Insufficient Cooling and Overheating Issues

Budget laser cleaners may lack effective thermal management systems, causing frequent shutdowns, reduced lifespan, or permanent damage during extended use—especially in industrial environments. -

Lack of Safety Features and Certifications

Non-compliant units may not meet international safety standards (e.g., IEC 60825 for laser safety), missing essential features like emergency stops, key switches, protective housings, or proper labeling. This poses serious risks to operators and liability for the buyer. -

Use of Low-Grade Components

Inferior optics, diodes, and control electronics degrade quickly, leading to frequent maintenance and downtime. Suppliers may source from unverified component manufacturers, compromising reliability and service life. -

Inadequate After-Sales Support and Warranty

Some suppliers offer limited technical support, poor documentation, or unenforceable warranties. This becomes a major issue when troubleshooting or seeking repairs, especially with overseas vendors.

Intellectual Property (IP) Risks

-

Counterfeit or Cloned Technology

Some manufacturers in certain regions reproduce patented laser designs, control software, or optical configurations without authorization. Purchasing such equipment exposes buyers to legal risks, especially in jurisdictions with strict IP enforcement. -

Use of Unlicensed Software or Firmware

Laser control systems often run on proprietary software. Sourcing from vendors who use pirated or reverse-engineered firmware may violate licensing agreements and leave systems vulnerable to bugs, malware, or lack of updates. -

Ambiguous IP Ownership in Custom Solutions

When working with suppliers on customized laser cleaning systems, failure to clearly define IP ownership in contracts can result in disputes over design rights, software, or process innovations developed during collaboration. -

Lack of Transparency in Technology Source

Vendors may obscure the origin of core components (e.g., laser modules, scanners), making it difficult to verify if patented technologies are being used legally. This opacity increases the risk of indirect IP infringement. -

Export/Import Compliance Risks

Some high-power laser technologies are subject to export controls (e.g., under ITAR or EAR regulations). Sourcing from non-compliant suppliers may result in customs seizures or penalties, especially if the equipment incorporates restricted components or software.

Recommendations to Mitigate Risks

- Conduct Technical Due Diligence: Request third-party test reports, demo units, and detailed specifications. Verify performance claims with real-world trials on target materials.

- Audit Supplier Credentials: Check for relevant certifications (CE, FDA, ISO), patent filings, and component traceability.

- Review Legal Agreements: Ensure contracts specify IP ownership, warranty terms, compliance obligations, and liability clauses.

- Engage Reputable Suppliers: Prioritize vendors with established track records, transparent manufacturing practices, and strong R&D investment.

- Consult Legal and Technical Experts: Involve IP attorneys and laser application engineers during the sourcing process to identify red flags early.

By proactively addressing these quality and IP pitfalls, businesses can ensure reliable performance, regulatory compliance, and long-term protection of their investments in laser cleaning technology.

H2: Logistics & Compliance Guide for Laser Cleaner for Metal

Product Overview

The Laser Cleaner for Metal is an industrial cleaning device that uses high-intensity laser beams to remove rust, paint, oxides, oil, and other contaminants from metal surfaces without abrasives or chemicals. It operates on the principle of laser ablation, making it an eco-friendly alternative to traditional cleaning methods.

This guide outlines key logistics, safety, regulatory, and compliance considerations for the transport, storage, use, and maintenance of laser cleaners used in metal cleaning applications.

H2: 1. Classification and Regulatory Identification

Product Type:

- Industrial Laser System (Class 4 Laser Product, per IEC 60825-1)

- Non-contact surface cleaning equipment

- Typically powered by electricity (e.g., 220–400 V AC)

Key Regulatory Standards:

| Standard | Description |

|——–|————-|

| IEC 60825-1 | Safety of laser products – Equipment classification and requirements |

| ANSI Z136.1 | Safe Use of Lasers (U.S.) |

| CE Marking | Compliance with EU directives (e.g., Machinery Directive 2006/42/EC, EMC Directive 2014/30/EU, LVD 2014/35/EU) |

| FDA/CDRH (21 CFR 1040.10) | U.S. regulatory compliance for laser products |

| RoHS & REACH | Restriction of hazardous substances (EU) |

✅ Important: Always verify the laser class (typically Class 4) and ensure proper labeling per IEC 60825.

H2: 2. Packaging and Shipping Requirements

Packaging:

- Use rigid, shock-resistant packaging with internal foam or cushioning to protect optics and electronics.

- Include desiccants if shipping to humid environments.

- Seal all openings to prevent dust or moisture ingress.

Labeling:

- Laser Radiation Warning Label (Caution: Class 4 Laser – Avoid Eye and Skin Exposure)

- Fragile / Handle with Care

- This Side Up

- Keep Dry

- CE / FCC / RoHS marks (as applicable)

Shipping Documentation:

- Commercial Invoice

- Packing List

- Certificate of Conformity (CoC)

- Safety Data Sheet (SDS) – if applicable (e.g., for batteries or cooling agents)

- Laser Product Report (per FDA requirement for U.S. imports)

Transport:

- Air Freight (IATA): Class 4 lasers are generally not restricted as dangerous goods unless they contain rechargeable lithium batteries.

- If batteries are installed: Comply with IATA DGR Section II or III, depending on battery size.

- Sea Freight (IMO): No special hazardous classification unless batteries are present.

- Ground Transport: Follow national regulations (e.g., ADR in Europe).

⚠️ Note: Lithium batteries (if used for control systems or portable units) must be shipped per UN 3481 (PI 966/967) guidelines.

H2: 3. Import and Export Compliance

Export Controls:

- ECCN (U.S. Commerce Control List): Typically 3A992.b or 3B992.b (Lasers and related equipment – may require license depending on power and destination).

- ITAR: Not applicable unless military-grade specifications are used.

- Dual-Use Goods: Monitor export to embargoed countries (e.g., Iran, North Korea, Crimea).

Import Requirements (Examples):

| Region | Requirements |

|——-|————–|

| United States | FDA/CDRH registration; import entry via CBP; possible bond requirement |

| European Union | CE Declaration of Conformity; notified body involvement if applicable; customs duty based on HS code |

| China | CCC certification may not apply, but customs clearance requires technical docs and conformity proof |

| Canada | Health Canada compliance under Radiation Emitting Devices Act (REDA) |

🔑 HS Code Suggestion: 8515.80 (Other industrial laser machines) or 8479.89 (Machines for specific uses, n.e.s.)

H2: 4. On-Site Handling and Storage

Storage Conditions:

- Temperature: 5°C to 40°C

- Humidity: < 80% non-condensing

- Environment: Dry, dust-free, vibration-free area

- Orientation: Store upright; do not stack heavy items on top

Unpacking:

- Inspect for shipping damage before installation.

- Retain packaging for future transport.

H2: 5. Installation and Operational Compliance

Installation:

- Requires stable power supply with proper grounding.

- Ensure adequate ventilation and cooling (check manufacturer’s specs).

- Install in a controlled access area to prevent unauthorized exposure.

Safety Measures:

- Laser Safety Officer (LSO) recommended for Class 4 lasers.

- Use of interlocks, warning lights, and emergency stop buttons.

- Protective barriers or enclosures to contain beam and plume.

- Personal Protective Equipment (PPE):

- Laser safety goggles (wavelength-specific, e.g., 1064 nm for fiber lasers)

- Respiratory protection (if fumes are generated)

- Flame-resistant clothing (if spatter risk exists)

Fume Extraction:

- Mandatory when cleaning coated or contaminated metals.

- Use HEPA-filtered extraction systems to capture particulate matter and hazardous fumes (e.g., metal oxides, paint residues).

H2: 6. Environmental and Waste Compliance

Emissions:

- Laser plume may contain hazardous airborne contaminants (e.g., Cr(VI), Pb, ZnO).

- Conduct air quality assessment per OSHA PELs or EU REACH guidelines.

- Monitor with real-time particulate sensors if needed.

Waste Disposal:

- Collected debris (e.g., rust, paint dust) may be classified as hazardous waste depending on composition.

- Test debris per EPA TCLP or EU Waste Framework Directive.

- Dispose through licensed hazardous waste handlers.

H2: 7. Training and Documentation

Required Training:

- Laser safety training (based on ANSI Z136.1 or equivalent)

- Equipment operation and emergency procedures

- PPE and fume extraction use

- Regulatory compliance awareness

Documentation to Maintain:

- Laser safety program

- Maintenance logs

- Operator training records

- Risk assessments and Safety Data Sheets (SDS) for materials being cleaned

- Compliance certificates (CE, FDA, etc.)

H2: 8. Maintenance and Servicing

- Perform preventive maintenance as per manufacturer’s schedule.

- Only trained personnel should service laser optics or power systems.

- Replace consumables (e.g., filters, nozzles) regularly.

- Recalibrate safety interlocks and beam alignment periodically.

🔧 Tip: Keep spare parts inventory for critical components (e.g., scanning heads, cooling units).

H2: Summary Checklist

| Task | Status |

|——|——–|

| Confirm laser class and labeling | ☐ |

| Verify export controls and obtain licenses if needed | ☐ |

| Package with shock protection and proper labels | ☐ |

| Prepare shipping docs (CoC, invoice, laser report) | ☐ |

| Comply with battery transport rules (if applicable) | ☐ |

| Register with FDA/CDRH (for U.S. market) | ☐ |

| Install with fume extraction and safety barriers | ☐ |

| Train operators and appoint LSO (if required) | ☐ |

| Test waste for hazardous content | ☐ |

| Maintain compliance documentation | ☐ |

By following this Logistics & Compliance Guide, businesses can ensure safe, legal, and efficient deployment of Laser Cleaners for Metal across global markets. Always consult local regulations and the equipment manufacturer for model-specific requirements.

Conclusion for Sourcing Laser Cleaner for Metal

Sourcing a laser cleaner for metal applications requires careful consideration of technical specifications, application requirements, budget constraints, and supplier reliability. Laser cleaning has emerged as an efficient, eco-friendly, and precise alternative to traditional methods such as sandblasting, chemical cleaning, or mechanical abrasion. It offers significant advantages including minimal substrate damage, no media consumption, reduced waste, and improved worker safety.

When selecting a laser cleaner, key factors to evaluate include laser power (typically 100W to 1000W+ for industrial metal cleaning), wavelength (commonly fiber lasers at 1064 nm), pulse frequency, cleaning speed, portability, and integration capabilities with robotic systems. The specific metal type, level of contamination (e.g., rust, paint, oxide layers), and production environment also influence the ideal system choice.

It is essential to source from reputable suppliers with proven experience in industrial laser cleaning, offering comprehensive technical support, training, and after-sales service. Conducting on-site demonstrations or pilot testing can help validate performance before full-scale procurement.

In conclusion, investing in a high-quality laser cleaning system tailored to your metal cleaning needs can lead to long-term cost savings, enhanced cleaning precision, and compliance with environmental and safety standards. Strategic sourcing ensures optimal return on investment and supports sustainable manufacturing practices.