The global laser cleaning market is experiencing robust growth, driven by increasing demand for precision, eco-friendly, and efficient surface treatment solutions in metal fabrication and industrial maintenance. According to a 2023 report by Mordor Intelligence, the market was valued at USD 378.5 million in 2022 and is projected to grow at a CAGR of 22.1% from 2023 to 2028, reaching an estimated USD 1.27 billion by the end of the forecast period. This surge is fueled by the adoption of laser cleaning in automotive, aerospace, and heavy manufacturing sectors, where removing rust, oxides, and contaminants from metal surfaces without damage is critical. As industries shift away from traditional abrasive and chemical methods, manufacturers specializing in fiber laser cleaning technology are emerging as key players in enabling sustainable, low-maintenance, and high-precision metal surface preparation. The following list highlights the top 10 laser clean metal manufacturers leveraging this technological shift, combining innovation, market reach, and performance to lead the industry.

Top 10 Laser Clean Metal Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Laserax

Website: laserax.com

Key Highlights: Laserax works with the world’s leading manufacturers to implement laser cleaning, welding, texturing, and marking solutions….

#2 P-laser Industrial laser cleaning

Website: p-laser.com

Key Highlights: we engineer and manufacture the most advanced—and most powerful—pulsed industrial laser cleaning systems on the market, built for both manual and automated ……

#3 Laser Photonics

Website: laserphotonics.com

Key Highlights: Laser Photonics manufactures reliable, safe, and eco-friendly Laser Cleaning, Laser Cutting, Laser Engraving, Laser Marking, and Laser Welding solutions….

#4 SFX Laser

Website: sfxlaser.com

Key Highlights: SFX Laser is a 20+ years professional laser equipment manufacturer including laser cleaning machine, laser welding machine, fiber laser engraver, fiber laser…

#5 HGLASER

Website: hglaserglobal.com

Key Highlights: HGLASER is a leading provider of laser cutting machine, laser marking mahcine and laser cleaning machine.Email:[email protected]….

#6 Full Spectrum Laser

Website: fslaser.com

Key Highlights: 7–15 day delivery 30-day returnsFull Spectrum Laser is a US based company that designs, manufactures, and sells powerful and affordable laser cutting & laser engraving products….

#7 Laser cleaning

Website: p-laserusa.com

Key Highlights: Our laser machines are mainly used to remove the following contaminants: Rust – Paint – Coatings – Release Agents – Grease, Oils – Soot – Rubber- Organic ……

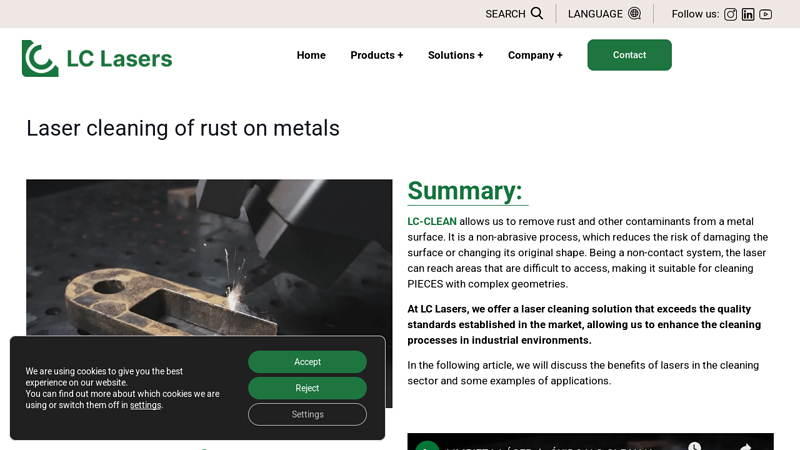

#8 Laser cleaning of rust on metals

Website: lclasers.com

Key Highlights: LC-CLEAN allows us to remove rust and other contaminants from a metal surface. It is a non-abrasive process, which reduces the risk of damaging the surface….

#9 IPG Photonics

Website: ipgphotonics.com

Key Highlights: IPG Photonics manufactures high-performance fiber lasers, amplifiers, and laser systems for diverse applications and industries. Discover your solution….

#10 Vytek Laser Systems

Website: vytek.com

Key Highlights: Vytek designs, builds, and sells a complete line of laser solutions for cleaning, engraving, marking, cutting, and welding, built to exacting standards….

Expert Sourcing Insights for Laser Clean Metal

H2: Market Trends for Laser Cleaning of Metal in 2026

As the global manufacturing and industrial maintenance sectors continue to prioritize sustainability, precision, and efficiency, laser cleaning of metal is poised to experience significant growth and transformation by 2026. The H2 2026 outlook for the laser cleaning metal market reflects a convergence of technological advancements, regulatory drivers, and expanding industrial applications. Key trends shaping the market include:

-

Increased Adoption Across Heavy Industries

By 2026, laser cleaning is expected to gain deeper penetration in sectors such as automotive, aerospace, shipbuilding, and energy (especially nuclear and renewable infrastructure). The non-abrasive, chemical-free nature of laser cleaning makes it ideal for precision-sensitive components, driving its adoption over traditional methods like sandblasting or chemical stripping. Automotive manufacturers, in particular, are integrating laser systems into production lines for weld preparation and surface treatment, boosting demand. -

Technological Advancements in Fiber Lasers

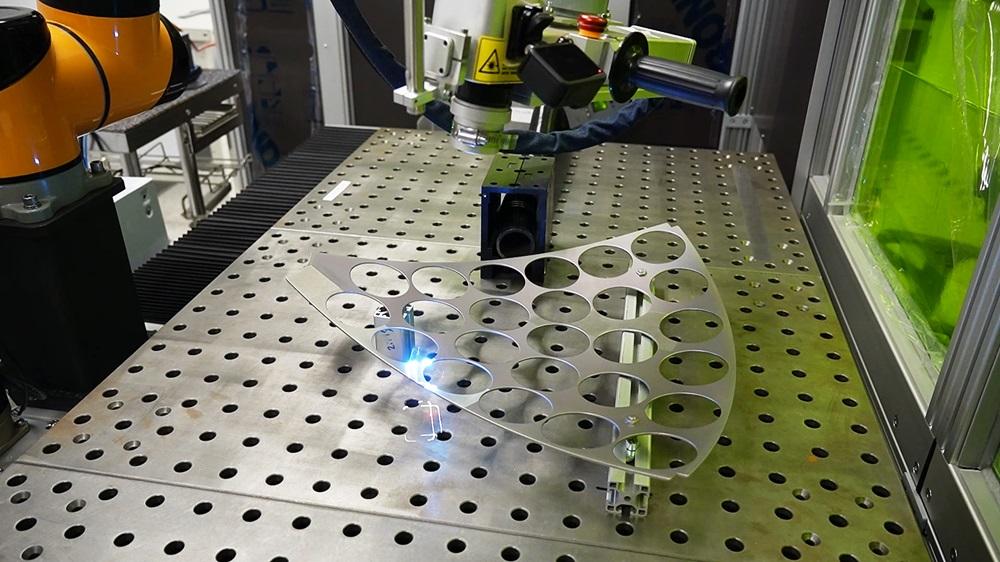

Fiber laser technology continues to dominate the market due to improvements in power efficiency, portability, and cost-effectiveness. By H2 2026, higher-power portable laser cleaning systems (2,000–6,000 W) are expected to become more affordable and widely adopted, enabling use in field applications such as offshore platforms and pipeline maintenance. Innovations in beam control and automation integration (e.g., robotic arms with real-time monitoring) further enhance precision and throughput. -

Environmental and Regulatory Compliance as Growth Catalysts

Stricter environmental regulations across North America, Europe, and parts of Asia are pushing industries to eliminate hazardous cleaning methods. Laser cleaning produces no secondary waste and reduces VOC emissions, aligning with ESG (Environmental, Social, Governance) goals and regulatory standards such as REACH and EPA guidelines. This regulatory tailwind is accelerating adoption, especially in environmentally sensitive regions. -

Growth in Asia-Pacific Markets

China, Japan, and South Korea remain key growth engines, with government support for smart manufacturing and Industry 4.0 initiatives. Chinese manufacturers are increasingly producing cost-competitive laser cleaning systems, which are being exported globally. India is also emerging as a new market, driven by infrastructure development and modernization of industrial maintenance practices. -

Integration with Industry 4.0 and AI

By 2026, smart laser cleaning systems equipped with IoT sensors, AI-driven defect detection, and predictive maintenance algorithms are becoming standard. These systems can adapt cleaning parameters in real time based on surface condition, improving efficiency and reducing operator dependency. This digital integration enhances process traceability and quality control, especially in high-reliability industries like aerospace. -

Cost Reduction and ROI Focus

While initial investment remains higher than traditional methods, the total cost of ownership for laser cleaning is improving due to longer component lifespan, reduced consumables, and lower labor costs. By H2 2026, more mid-sized enterprises are expected to adopt laser cleaning as payback periods shorten—often under two years in high-frequency use cases. -

Expansion into New Applications

Beyond rust and oxide removal, laser cleaning is being used for mold decontamination, historical metal restoration, and pre-treatment for coating and bonding. The versatility of the technology is opening niche markets, including cultural heritage preservation and defense equipment maintenance.

Conclusion

By H2 2026, the laser cleaning of metal market is projected to grow at a CAGR of approximately 18–22% since 2022, reaching a global market value exceeding $1.8 billion. The confluence of environmental mandates, technological maturity, and industrial digitization will solidify laser cleaning as a mainstream surface preparation method. Companies investing in scalable, intelligent, and eco-friendly laser systems are likely to gain a competitive edge in this rapidly evolving landscape.

H2: Common Pitfalls When Sourcing Laser Cleaning Machines for Metal (Quality and Intellectual Property Risks)

Sourcing laser cleaning machines for metal applications offers significant advantages in precision, efficiency, and environmental safety. However, businesses often encounter critical pitfalls related to quality inconsistencies and intellectual property (IP) concerns—especially when procuring from overseas or less-regulated suppliers. Being aware of these risks is essential to ensuring long-term operational success and legal compliance.

-

Inconsistent Quality and Performance

A major challenge in sourcing laser cleaning machines is variability in build quality and technical performance. Many suppliers, particularly low-cost manufacturers, may use substandard components such as underpowered laser sources, poor beam delivery systems, or inadequate cooling mechanisms. This results in inconsistent cleaning efficiency, shorter machine lifespan, and increased maintenance costs. Buyers may also face a lack of standardized testing or certification, making it difficult to verify claims about power output, cleaning speed, or material compatibility. -

Misleading Specifications and “Paper Performance”

Some suppliers exaggerate technical specifications—such as laser wattage, pulse frequency, or cleaning area coverage—without real-world validation. These “paper performance” metrics can mislead buyers into believing they are acquiring high-performance equipment. In practice, the machines may fail to meet expected cleaning standards on industrial metal surfaces, especially for tough contaminants like rust, paint, or oxides. -

Lack of After-Sales Support and Spare Parts Availability

Even if a machine performs well initially, sourcing from suppliers without reliable technical support or local service networks can lead to costly downtimes. Spare parts may be difficult or expensive to obtain, and firmware/software updates may not be provided, leaving the equipment obsolete or non-compliant with evolving safety standards. -

Intellectual Property (IP) Infringement Risks

When sourcing from certain regions, particularly where IP enforcement is weak, there is a significant risk of purchasing machines that infringe on patented technologies. Some manufacturers reverse-engineer or clone designs from established brands without authorization. Buyers who unknowingly import such equipment may face legal exposure, including customs seizures, lawsuits, or reputational damage. Additionally, cloned machines often lack innovation and reliability, further compounding performance issues. -

Absence of IP Protection in Supplier Agreements

Many procurement contracts fail to include clear IP indemnification clauses. Without these, buyers bear the legal and financial risk if the sourced equipment is found to violate third-party patents. It is critical to conduct due diligence on the supplier’s R&D capabilities and request documentation proving original design and compliance with international IP standards. -

Compliance and Certification Gaps

Laser systems are subject to strict safety regulations (e.g., IEC 60825 for laser safety). Sourcing machines without proper certification can expose companies to regulatory fines, workplace safety violations, and liability in case of accidents. Some suppliers provide falsified or incomplete compliance documentation, increasing legal and operational risks.

Best Practices to Avoid Pitfalls:

– Conduct on-site factory audits or request third-party quality inspections.

– Require performance testing under real-world conditions before finalizing orders.

– Verify supplier IP ownership through patent searches and technical disclosures.

– Include IP indemnity clauses in procurement contracts.

– Prioritize suppliers with international certifications (CE, FDA, ISO) and proven after-sales support networks.

By addressing quality and IP concerns proactively, businesses can mitigate risks and ensure they invest in reliable, legally sound laser cleaning solutions for metal applications.

H2: Logistics & Compliance Guide for Laser Clean Metal

This guide outlines the essential logistics and compliance considerations for handling, transporting, storing, and disposing of Laser Clean Metal, a surface treatment byproduct resulting from the laser ablation process used to remove rust, paint, oxides, or contaminants from metal substrates.

H2: Key Characteristics of Laser Clean Metal Residue

- Physical Form: Typically a fine, dry powder or particulate dust. May contain a mix of ablated contaminants (rust, paint flakes, oils, oxides) and minute vaporized metal particles.

- Composition: Highly variable depending on the base metal (steel, aluminum, etc.), the original coating/contaminant, and the laser parameters.

- Potential Hazards: May contain regulated heavy metals (e.g., lead, chromium, cadmium – especially in older paints or certain alloys), hazardous air pollutants (HAPs), or combustible dust. Always analyze the specific waste stream.

- Regulatory Status: Usually classified as Hazardous Waste under RCRA (Resource Conservation and Recovery Act) in the US and similar frameworks globally, requiring strict management. May also be regulated as Industrial Waste or Special Waste.

H2: On-Site Handling & Collection

- Capture at Source: Use integrated, high-efficiency fume extraction systems (HEPA filters) on the laser cleaning equipment to capture >99.9% of generated particulates immediately.

- Containment: Collect residue in sealed, labeled containers (e.g., UN-rated drums, DOT-approved bulk bags) compatible with the waste composition. Prevent spills and dust dispersion.

- Secondary Containment: Store full containers on impervious surfaces within spill containment pallets or berms.

- Labeling: Clearly label all containers with:

- “Laser Clean Metal Residue – HAZARDOUS WASTE”

- Accumulation Start Date

- Hazardous Waste Codes (e.g., D008 for Lead, D004 for Chromium, D018 for Silver – based on TCLP testing)

- Generator Name, Address, EPA ID Number (US)

- Employee Training: Train personnel on safe handling procedures, PPE requirements, spill response, and hazard communication (GHS/SDS).

H2: Storage Requirements

- Designated Area: Store in a secure, well-ventilated, weatherproof, and fire-resistant area (e.g., flammable liquids storage cabinet if applicable, or dedicated hazardous waste storage building).

- Compatibility: Segregate from incompatible wastes (e.g., acids, oxidizers, flammables).

- Inspection: Conduct weekly inspections of storage areas and containers for leaks, deterioration, or improper labeling. Document inspections.

- Accumulation Time Limits:

- Large Quantity Generator (LQG): ≤ 90 days

- Small Quantity Generator (SQG): ≤ 180 days (≤ 270 days if transport >200 miles)

- Exceeding limits requires a RCRA permit. Strictly adhere to local regulations.

H2: Transportation & Shipping

- Waste Characterization: CRITICAL. Conduct TCLP (Toxicity Characteristic Leaching Procedure) or equivalent testing to determine hazardous constituents and assign correct EPA Hazardous Waste Codes (e.g., D0XX series).

- Proper Packaging: Use UN/DOT-certified packaging appropriate for the waste form and hazard class (e.g., 4GV for solids). Ensure containers are in good condition, properly closed, and secured.

- Labeling & Marking: Affix correct DOT hazard class labels (e.g., Class 9 – Miscellaneous Hazardous Material), UN number (e.g., UN 3077 – Environmentally hazardous substance, solid, n.o.s.), proper shipping name (“Residues, toxic, n.o.s.”), and hazard communication labels.

- Shipping Papers: Prepare a fully compliant Uniform Hazardous Waste Manifest (US) or equivalent international document (e.g., EWC in EU). Include:

- Generator & Transporter Information

- EPA ID Numbers

- Waste Description, Quantity, EPA Hazard Codes

- DOT Proper Shipping Name, UN Number, Hazard Class

- Destination Facility (TSDF) Information

- Signatures (Generator, Transporter, TSDF)

- Licensed Transporter: Use only carriers with valid DOT Hazardous Materials permits and appropriate insurance.

- Emergency Response Information: Ensure shipping papers include emergency contact information.

H2: Disposal & Treatment

- Authorized Facility: Ship waste exclusively to a permitted Treatment, Storage, and Disposal Facility (TSDF) with the correct RCRA permits (US) or equivalent authorization (e.g., EPR permit in EU) to handle the specific waste codes.

- Treatment Methods: Common methods include:

- Stabilization/Solidification: Encapsulating metals to prevent leaching before landfill disposal.

- Incineration: For organic contaminants (paints, oils) – requires air emission controls.

- Recycling: Potential, but challenging. Requires specialized separation of metals from contaminants. Not common for mixed residues without advanced sorting.

- Landfill Disposal: Only permitted in Subtitle C Hazardous Waste Landfills designed to prevent leachate migration. Prohibited in municipal landfills.

H2: Regulatory Compliance & Documentation

- Waste Determination: Generator is legally responsible for properly characterizing waste (knowledge of process + testing). Document the basis.

- Manifest System: Track waste from “cradle-to-grave” using the manifest. Retain copies for minimum 3 years (US).

- Biennial Report (US LQGs): File EPA Form 8700-13A/B every two years reporting hazardous waste generation and management.

- Recordkeeping: Maintain all records (TCLP results, manifests, training logs, inspections, waste profiles) for minimum 3 years (US).

- Permits: Ensure facility has required environmental permits (e.g., Air Quality, Hazardous Waste Generator).

- International Regulations: Comply with ADR (Europe), IMDG Code (sea), IATA DGR (air), and local national regulations (e.g., Canada’s TDG, UK’s Hazardous Waste Regulations).

H2: Best Practices & Risk Mitigation

- Minimize Waste: Optimize laser parameters to reduce ablation depth and residue generation.

- Pre-Treatment Analysis: Test base metal and coatings before large-scale cleaning to anticipate hazardous constituents.

- Recycling Feasibility Study: Investigate if separation/recycling is viable for your specific residue stream (e.g., high-value metals).

- Contract Review: Scrutinize TSDF and transporter contracts for liability, acceptance criteria, and performance guarantees.

- Spill Kit: Maintain a hazardous waste spill kit (PPE, absorbents, containment) readily available at storage and handling points.

- Consult Experts: Engage environmental consultants or hazardous waste management companies for complex waste streams or regulatory interpretation.

Disclaimer: Regulations vary significantly by country, state/province, and locality. This guide provides a general framework. Always consult with qualified environmental professionals and regulatory authorities for site-specific compliance.

Conclusion for Sourcing Laser Cleaning for Metal:

Sourcing laser cleaning technology for metal surface preparation and maintenance offers a highly efficient, environmentally friendly, and cost-effective alternative to traditional methods such as sandblasting, chemical cleaning, or mechanical abrasion. Its precision, minimal substrate damage, and ability to remove rust, paint, oxides, and contaminants without media or waste make it ideal for industries requiring high standards, such as aerospace, automotive, and precision manufacturing.

When sourcing laser cleaning systems, key factors to consider include power output, portability, safety features, ease of integration into existing workflows, and supplier support. Investing in reputable suppliers with proven track records ensures reliability, optimal performance, and long-term return on investment.

In conclusion, laser cleaning represents a forward-thinking solution for metal cleaning needs—combining sustainability with advanced technology. As the technology becomes more accessible and affordable, sourcing laser cleaning systems positions businesses at the forefront of innovation, efficiency, and environmental responsibility.