The global laser beam welding (LBW) and electron beam welding (EBW) markets are experiencing robust growth, driven by rising demand for high-precision joining technologies in aerospace, automotive, and medical device manufacturing. According to Grand View Research, the global industrial laser market—encompassing laser beam welding—was valued at USD 14.5 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2030. Meanwhile, the electron beam welding market, though more niche, is also gaining traction; Mordor Intelligence estimates it will grow at a CAGR of approximately 6.3% during the same period, fueled by advancements in vacuum technology and increasing adoption in defense and nuclear applications. As industries continue to prioritize weld quality, speed, and repeatability, leading manufacturers in both domains are investing heavily in innovation, automation, and hybrid solutions. This evolving landscape has intensified competition among key players, shaping a dynamic market where technical differentiation and application-specific performance are critical. In this context, identifying the top six manufacturers in laser beam and electron beam welding requires a data-driven analysis of market share, technological capabilities, product range, and global footprint.

Top 6 Laser Beam Welding Vs Electron Beam Welding Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Laser Welding vs Electron Beam Welding

Website: ebindustries.com

Key Highlights: Confused about which welding process is best for your application? This article lays out the differences, advantages and disadvantages of both processes….

#2 Electron Beam Welding Vs Laser Welding

Website: ebpglobal.com

Key Highlights: EPglobal’s detailed guide explains the core difference and comparison between Electron Beam Welding and Laser Welding. Find complete details by clicking ……

#3 What is electron

Website: standardbots.com

Key Highlights: While an electron-beam welder can cost over $500,000, a basic laser welding system may only be $150,000 — or less. Lasers also don’t need the ……

#4 Electron Beam Welding Vs. Laser Beam Welding

Website: superiorjt.com

Key Highlights: Electron beam welding and laser beam welding are both fusion welding techniques that use a high energy density beam to melt the joint of two components….

#5 Electron Beam Welding (EBW) and Laser Beam Welding (LBW)

Website: haynesintl.com

Key Highlights: The electron beam welding (EBW) and laser beam welding (LBW) processes are high-energy density welding processes that offer several possible advantages….

#6 Laser Welding Advantages Over Competing Methods

Website: joiningtech.com

Key Highlights: When compared to EB, laser is typically 20-30% less expensive. Further, more complex solutions can be delivered since components can be welded in an open-air ……

Expert Sourcing Insights for Laser Beam Welding Vs Electron Beam Welding

H2: Market Trends in Laser Beam Welding vs Electron Beam Welding for 2026

As the advanced manufacturing sector evolves toward higher precision, automation, and energy efficiency, the competition between Laser Beam Welding (LBW) and Electron Beam Welding (EBW) is intensifying. By 2026, several key market trends are expected to shape the adoption and growth trajectories of these two high-energy beam welding technologies across critical industries such as automotive, aerospace, medical devices, and energy.

-

Growth Trajectory and Market Size

Laser Beam Welding is projected to dominate the high-precision welding market by 2026, with a compound annual growth rate (CAGR) of approximately 7–9% from 2021 to 2026, driven by advancements in fiber laser technology and integration with robotics. The global LBW market is expected to surpass $5.2 billion by 2026. In contrast, the Electron Beam Welding market, while more niche, is anticipated to grow at a moderate CAGR of 4–5%, reaching around $850 million. EBW’s slower growth is attributed to its high operational costs and vacuum chamber requirements, limiting its scalability in high-volume production. -

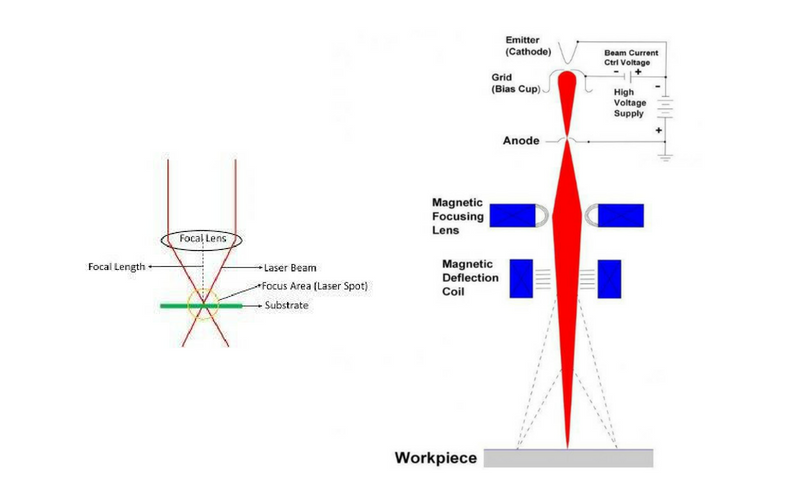

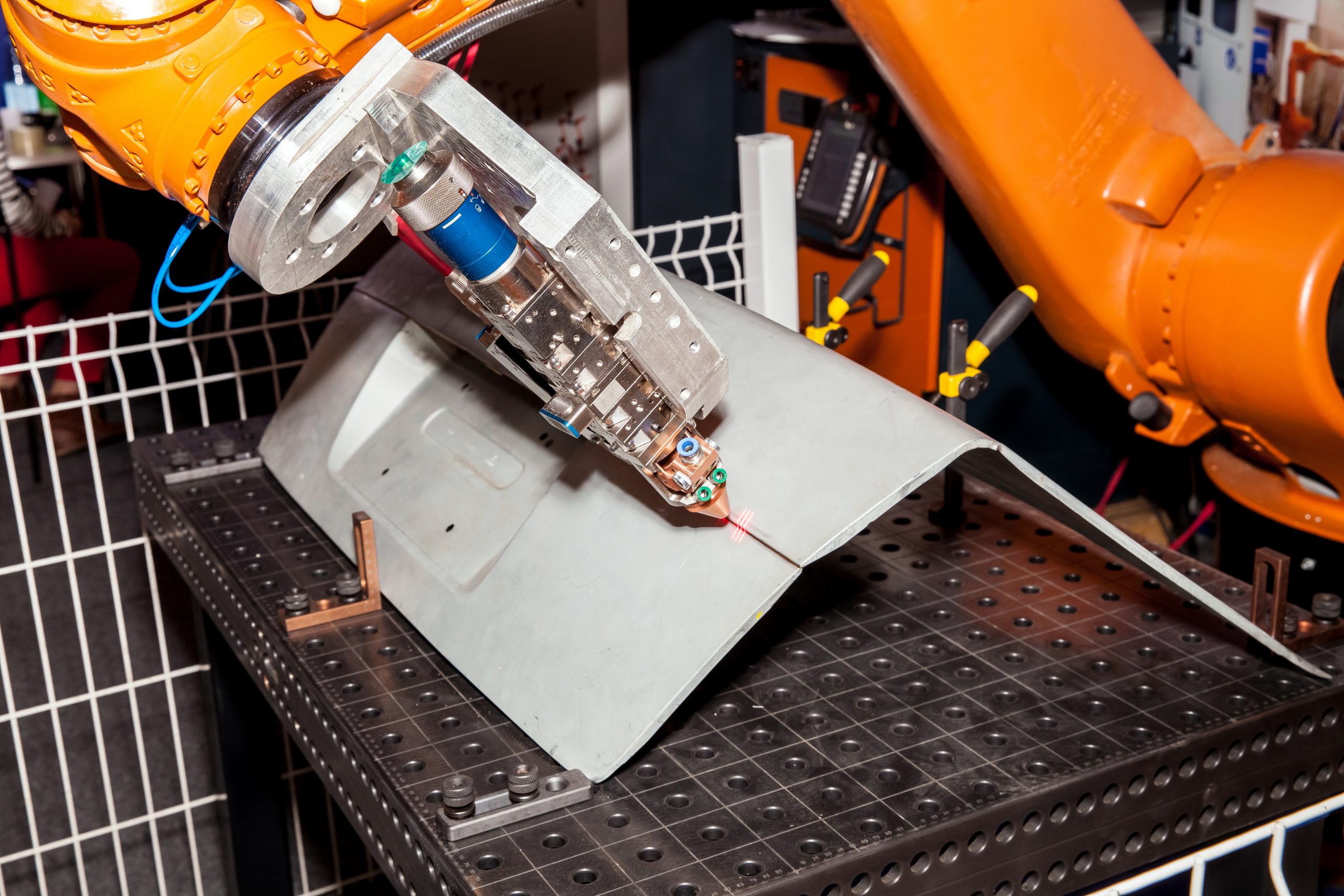

Technological Advancements and Flexibility

LBW benefits significantly from innovations in high-power fiber and disk lasers, enabling faster processing speeds, deeper penetration, and improved weld quality in ambient conditions. The ability to integrate LBW with multi-axis robotic systems and additive manufacturing platforms enhances its appeal for flexible manufacturing environments. Conversely, while EBW offers superior depth-to-width ratios and minimal heat-affected zones, its reliance on vacuum environments restricts real-time process adaptability. However, advancements in localized vacuum EBW systems may improve accessibility by 2026, particularly for aerospace and nuclear applications requiring ultra-high purity welds. -

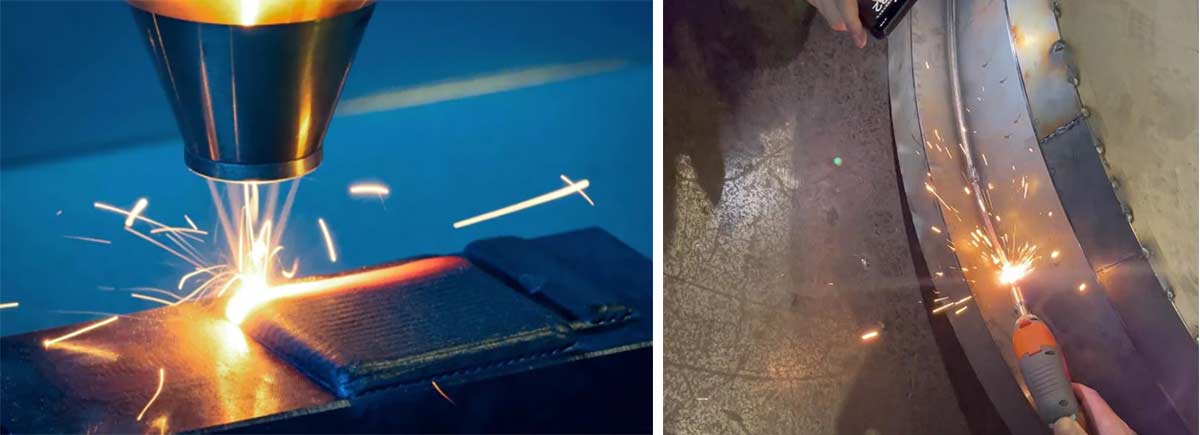

Industry Adoption and Application Focus

By 2026, the automotive and electric vehicle (EV) sectors will remain the primary drivers for LBW adoption, especially in battery fabrication, powertrain assembly, and lightweight material joining (e.g., aluminum and high-strength steels). The scalability and speed of LBW align well with high-volume manufacturing demands. EBW, on the other hand, will maintain a stronghold in aerospace (jet engines, structural components), medical implants, and defense industries, where material integrity and vacuum-compatible processing are non-negotiable. -

Cost and Operational Efficiency

LBW systems are becoming increasingly cost-effective due to falling laser component prices and lower maintenance needs. Their operation in open air reduces setup time and energy consumption compared to EBW, which requires vacuum pumps and specialized infrastructure. For small and medium enterprises (SMEs), LBW offers a lower entry barrier, contributing to broader market penetration. EBW remains constrained to specialized facilities with trained personnel, limiting its diffusion despite superior weld quality in certain applications. -

Sustainability and Energy Consumption

Environmental considerations are influencing technology choices. LBW systems, particularly fiber lasers, demonstrate higher wall-plug efficiency (up to 50%) compared to older laser types and EBW systems, which typically operate at 10–20% efficiency due to vacuum pump demands. As manufacturers prioritize carbon footprint reduction, LBW’s energy efficiency will further boost its market position by 2026. -

Geographic Trends

Asia-Pacific, led by China, Japan, and South Korea, will account for the largest share of LBW adoption due to robust investments in automotive and electronics manufacturing. North America and Europe will continue to support EBW demand, particularly in high-reliability sectors governed by strict quality standards (e.g., ASME, ISO). However, regional R&D initiatives in hybrid welding techniques may blur the lines between the two technologies.

In summary, by 2026, Laser Beam Welding is expected to outpace Electron Beam Welding in terms of market growth, versatility, and industrial adoption due to its compatibility with automation, lower operational costs, and energy efficiency. Electron Beam Welding will retain critical relevance in high-integrity, low-volume applications where its technical advantages are indispensable. The divergence in application focus and cost dynamics will define their complementary rather than competitive roles in the advanced manufacturing ecosystem.

Common Pitfalls in Sourcing Laser Beam Welding vs Electron Beam Welding (Quality, IP)

When sourcing either Laser Beam Welding (LBW) or Electron Beam Welding (EBW), overlooking critical quality and intellectual property (IP) considerations can lead to significant project delays, cost overruns, and compromised product performance. Understanding the distinct pitfalls associated with each technology is essential for making informed procurement decisions.

Quality-Related Pitfalls

For Laser Beam Welding (LBW):

- Inadequate Assessment of Joint Fit-Up Tolerances: LBW requires very precise joint alignment (typically tight gaps < 10% of material thickness). Sourcing a service without verifying the supplier’s capability to handle part tolerances or their process for ensuring consistent fit-up (fixturing, automation) can result in frequent weld defects like porosity, lack of fusion, and inconsistent penetration.

- Underestimating Reflectivity and Thermal Conductivity Challenges: High-power lasers can be reflected by materials like aluminum, copper, and their alloys, leading to process instability and inconsistent weld quality. Sourcing without confirming the supplier’s experience with specific reflective materials, use of appropriate laser wavelengths (e.g., green or blue lasers for copper), and process parameter optimization can yield unreliable results.

- Neglecting Atmospheric Control Needs: While LBW can be done in air, oxidation-sensitive materials (e.g., titanium, reactive alloys) require local shielding gas (e.g., argon, helium). Failing to specify and verify the adequacy of the supplier’s gas shielding setup (coverage, flow rates, purity) risks weld contamination, embrittlement, and reduced mechanical properties.

- Overlooking Process Monitoring and Control: High-quality LBW demands robust real-time monitoring (e.g., melt pool monitoring, seam tracking, plasma monitoring). Sourcing based solely on equipment presence without evaluating the supplier’s monitoring systems, data logging practices, and feedback control loops increases the risk of undetected defects and inconsistent output.

For Electron Beam Welding (EBW):

- Ignoring Vacuum Chamber Limitations: EBW requires a vacuum environment. Sourcing without carefully evaluating the size, pumping speed, and achievable base pressure of the supplier’s chamber can lead to bottlenecks. Large or complex parts may not fit, or long pump-down times can drastically reduce throughput and increase costs. Residual gases can also affect weld quality.

- Underestimating Sensitivity to Vaporizable Contaminants: Oils, greases, moisture, or surface coatings can outgas violently in the vacuum, contaminating the electron gun, degrading vacuum quality, and potentially causing weld defects (porosity, spatter). Sourcing without strict requirements and verification of the supplier’s cleaning procedures and part handling protocols is a major quality risk.

- Misjudging X-Ray Shielding and Safety Compliance: EBW generates X-rays requiring significant radiation shielding. Sourcing from a facility that lacks proper certification, inadequate shielding, or has poor safety protocols not only poses health risks but can lead to regulatory shutdowns and project delays. Verify compliance rigorously.

- Overlooking Beam Alignment and Focusing Precision: EBW relies on precise electromagnetic beam focusing and deflection. Sourcing without assessing the supplier’s beam calibration, alignment verification procedures, and maintenance schedules risks beam drift, leading to inconsistent penetration depth, poor weld geometry, and potential part damage.

Intellectual Property (IP)-Related Pitfalls

For Both LBW and EBW:

- Failure to Establish Clear IP Ownership Agreements: The welding process development (specific parameters, fixturing designs, monitoring algorithms) often generates valuable IP. Sourcing without a clear contract defining ownership (especially for custom-developed processes) can lead to disputes. Assume the supplier might claim ownership of process know-how unless explicitly assigned to the client.

- Inadequate Confidentiality (NDA) Coverage: Welding parameters, material specifications, and part geometries are often highly sensitive. Using a weak or absent Non-Disclosure Agreement (NDA) before sharing technical details exposes critical IP to potential misuse or leakage by the supplier or their subcontractors.

- Lack of Control Over Process Documentation: Detailed process records (parameter logs, inspection reports, calibration data) constitute valuable IP and are crucial for traceability and quality audits. Sourcing without contractual rights to access, audit, and retain copies of all relevant process documentation leaves the client vulnerable.

- Overlooking “Background IP” Usage: Suppliers often use proprietary software, fixturing, or control systems (“background IP”). Sourcing without clarifying the license terms for using this background IP in the specific project can lead to unexpected fees, restrictions on product use, or inability to transfer the process elsewhere.

Specific to EBW:

- Dependency on Supplier-Specific Equipment/Software: EBW systems often have highly integrated, proprietary control software and hardware. Sourcing can create lock-in, making it extremely difficult (and costly) to transfer the qualified process to another supplier later, even if ownership of the parameters is clear. This dependency is a significant IP and supply chain risk.

Specific to LBW:

- Ambiguity Around Sensor Data and AI/ML Models: Advanced LBW often uses sophisticated sensors and AI-driven process control. Sourcing without defining ownership of the training data collected on the client’s parts and any resulting machine learning models can result in the supplier owning valuable predictive analytics IP derived from the client’s products.

Mitigation: Always conduct thorough due diligence on potential suppliers, demand transparency on quality systems (e.g., ISO 3834, AS9100), and negotiate robust contracts with explicit clauses covering IP ownership, confidentiality, data rights, and audit access before sharing sensitive information or committing to a project.

Logistics & Compliance Guide: Laser Beam Welding vs Electron Beam Welding

Understanding the logistical requirements and compliance considerations for Laser Beam Welding (LBW) and Electron Beam Welding (EBW) is crucial for selecting the appropriate technology and ensuring safe, efficient, and regulatory-compliant operations. This guide outlines key differences in logistics and compliance between the two processes.

Equipment & Facility Requirements

Laser Beam Welding (LBW):

– Space & Layout: LBW systems, especially fiber and disk lasers, are generally compact and do not require vacuum chambers. They can be integrated into standard manufacturing floors, robotic cells, or automated production lines with minimal footprint.

– Power Supply: Requires stable electrical power, typically 3-phase input. High-power lasers may need cooling systems (chillers) with adequate water flow and temperature control.

– Ventilation & Fume Extraction: Mandatory local exhaust ventilation (LEV) systems are required to capture metal fumes and particulates generated during welding, particularly when processing coated or alloyed materials.

– Laser Safety Enclosures: Class 1 safety enclosures with interlocks are essential to prevent exposure to direct or reflected laser beams. Windows must have appropriate laser-blocking filters.

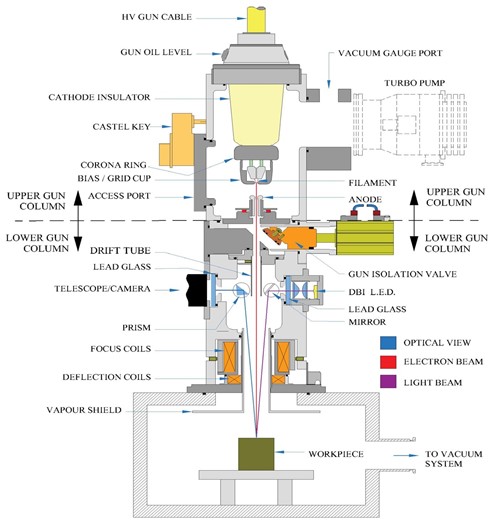

Electron Beam Welding (EBW):

– Vacuum Chamber: Requires a sealed vacuum chamber (typically 10⁻³ to 10⁻⁶ mbar), necessitating larger floor space and robust structural support. Chamber size limits the maximum part dimensions.

– Vacuum System: Includes roughing pumps (mechanical) and high-vacuum pumps (diffusion or turbomolecular), which require regular maintenance and generate heat and vibration.

– Radiation Shielding: High-voltage electron guns (typically 30–150 kV) emit X-rays. Lead-lined chambers or external shielding and interlocks are mandatory to meet radiation safety standards.

– Utilities: High electrical demand due to vacuum pumps and high-voltage power supplies. Cooling systems are critical for both the electron gun and power electronics.

Material Handling & Throughput

Laser Beam Welding (LBW):

– Loading/Unloading: Fast cycle times with no vacuum pump-down or venting. Suitable for high-volume production and integration with automated material handling systems.

– Fixturing: Standard fixturing suffices in atmospheric conditions. Minimal constraints on part geometry related to vacuum compatibility.

– Multi-Part Processing: Easily adapted to continuous or batch processing with robotic part handling.

Electron Beam Welding (EBW):

– Cycle Time Impact: Vacuum pump-down and venting cycles add significant time (minutes to tens of minutes), reducing throughput unless using multi-chamber systems.

– Fixturing: Must be vacuum-compatible (low outgassing materials like stainless steel or aluminum). Non-metallic components must not release gases under vacuum.

– Part Size & Weight: Limited by chamber dimensions and handling systems inside vacuum. Large or heavy parts require specialized cranes or manipulators.

Safety & Regulatory Compliance

Laser Beam Welding (LBW):

– Laser Safety (ANSI Z136.1, IEC 60825): Requires laser safety officers (LSO), controlled access zones, warning signs, beam path containment, and personal protective equipment (PPE) such as laser-safe eyewear.

– Fume & Particulate Control (OSHA, ISO 15011): LEV systems must be regularly tested and maintained to control exposure to hazardous airborne contaminants (e.g., Cr(VI), Mn, Ni).

– Electrical Safety (NFPA 70, IEC 60204): Standard industrial electrical codes apply to power and control systems.

Electron Beam Welding (EBW):

– Radiation Safety (NRC, IEC 60529, local regulations): Requires radiation surveys, shielding verification, safety interlocks, and potentially licensing depending on jurisdiction. Operators may need dosimetry badges.

– High-Voltage Safety: Strict lockout/tagout (LOTO) procedures and insulated tools are mandatory due to high-voltage components.

– Vacuum System Hazards: Risk of implosion or sudden air inrush; pressure relief mechanisms and safety interlocks are essential.

– Material Outgassing: Volatile materials (plastics, oils, adhesives) can compromise vacuum and create contamination or safety hazards—strict cleaning and material compatibility checks required.

Environmental & Waste Management

Laser Beam Welding (LBW):

– Waste Streams: Primarily metal fumes captured in filters, which may be classified as hazardous waste depending on base material (e.g., lead, cadmium). Spent filters require proper disposal.

– Energy Use: Generally more energy-efficient than EBW for comparable welds, especially with modern solid-state lasers.

Electron Beam Welding (EBW):

– Waste Streams: Used vacuum pump oils and contaminated components (e.g., diffusion pump fluids) may require special handling as hazardous waste.

– Energy Use: Higher overall energy consumption due to vacuum pumping and high-voltage operations.

– Coolant Management: Thermal load from electron gun and pumps may require closed-loop cooling systems with proper heat dissipation.

Maintenance & Operational Compliance

Laser Beam Welding (LBW):

– Optical Maintenance: Regular inspection and cleaning of lenses, mirrors, and protective windows. Automated cleaning systems can reduce downtime.

– Compliance Documentation: Recordkeeping for laser safety audits, fume extraction performance, and PPE usage.

Electron Beam Welding (EBW):

– Vacuum System Maintenance: Frequent oil changes (for mechanical pumps), cleaning of diffusion pumps, and leak testing are critical. Downtime for maintenance is typically higher.

– Electron Gun Alignment: Periodic realignment and filament replacement required.

– Compliance Documentation: Radiation safety logs, vacuum integrity tests, pump maintenance records, and high-voltage inspection reports are essential for compliance audits.

Summary & Selection Guidance

Choose Laser Beam Welding for:

– High-speed production in atmospheric conditions.

– Flexible integration with automation.

– Lower infrastructure and operational costs.

– Applications where vacuum is impractical.

Choose Electron Beam Welding for:

– Deep-penetration, high-precision welds in reactive or high-purity materials (e.g., Ti, Nb, refractory metals).

– Applications requiring minimal heat-affected zone and distortion.

– Situations where atmospheric contamination must be avoided.

Both technologies require rigorous compliance programs, but EBW demands additional regulatory oversight due to vacuum and radiation hazards. Conduct a thorough risk assessment and consult local regulatory bodies before installation.

Conclusion: Laser Beam Welding vs. Electron Beam Welding

Both laser beam welding (LBW) and electron beam welding (EBW) are advanced high-energy density welding processes suitable for precision applications across industries such as aerospace, automotive, medical devices, and electronics. However, the choice between the two depends on specific application requirements, material types, joint configurations, production volume, and cost considerations.

Laser beam welding offers significant advantages in terms of flexibility and ease of integration into automated production lines. It operates at atmospheric pressure, eliminating the need for vacuum chambers, which reduces cycle time and operational complexity. LBW is well-suited for high-speed welding, remote processing, and applications requiring complex 3D welding paths. It performs well on a wide range of materials, including dissimilar metals, and is ideal for high-volume manufacturing where throughput and accessibility are critical.

In contrast, electron beam welding delivers superior depth-to-width ratios and exceptional precision, especially for deep, narrow welds in thick materials. Its operation in a vacuum environment prevents contamination and allows for welding of reactive and high-purity materials, such as titanium and certain superalloys. EBW is unmatched in applications demanding extreme weld quality and minimal heat-affected zones, particularly in critical aerospace and defense components.

However, EBW’s requirement for a vacuum chamber increases equipment cost, maintenance, and processing time, limiting its suitability for large or complex geometries and high-throughput environments.

Final Recommendation:

Choose laser beam welding for high-speed, flexible, and cost-effective production in atmospheric conditions, especially with thin to medium thickness materials and complex joint paths. Opt for electron beam welding when welding thick sections, reactive metals, or where the highest weld integrity and deep penetration are required, and when vacuum processing is feasible.

Ultimately, the decision should be driven by technical performance needs, production constraints, and total cost of ownership. In many cases, a holistic evaluation of design, materials, quality standards, and lifecycle costs will determine the most effective welding solution.