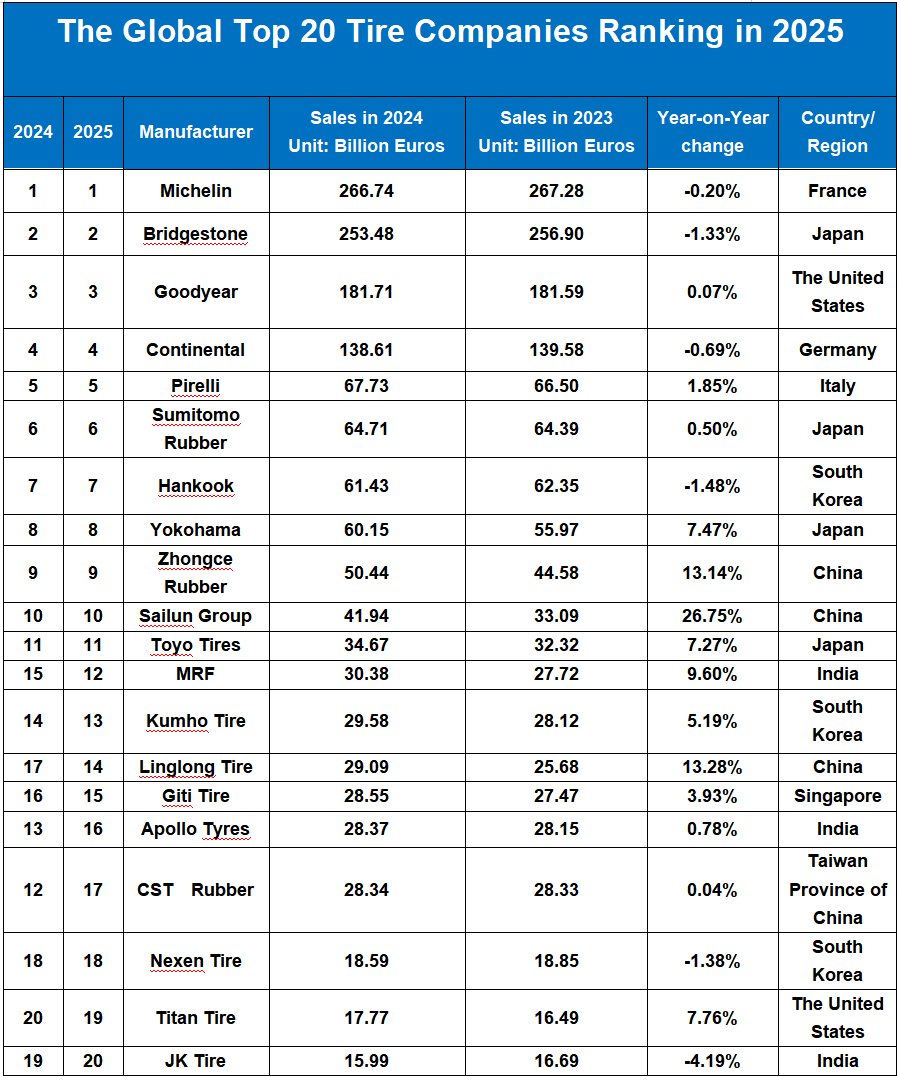

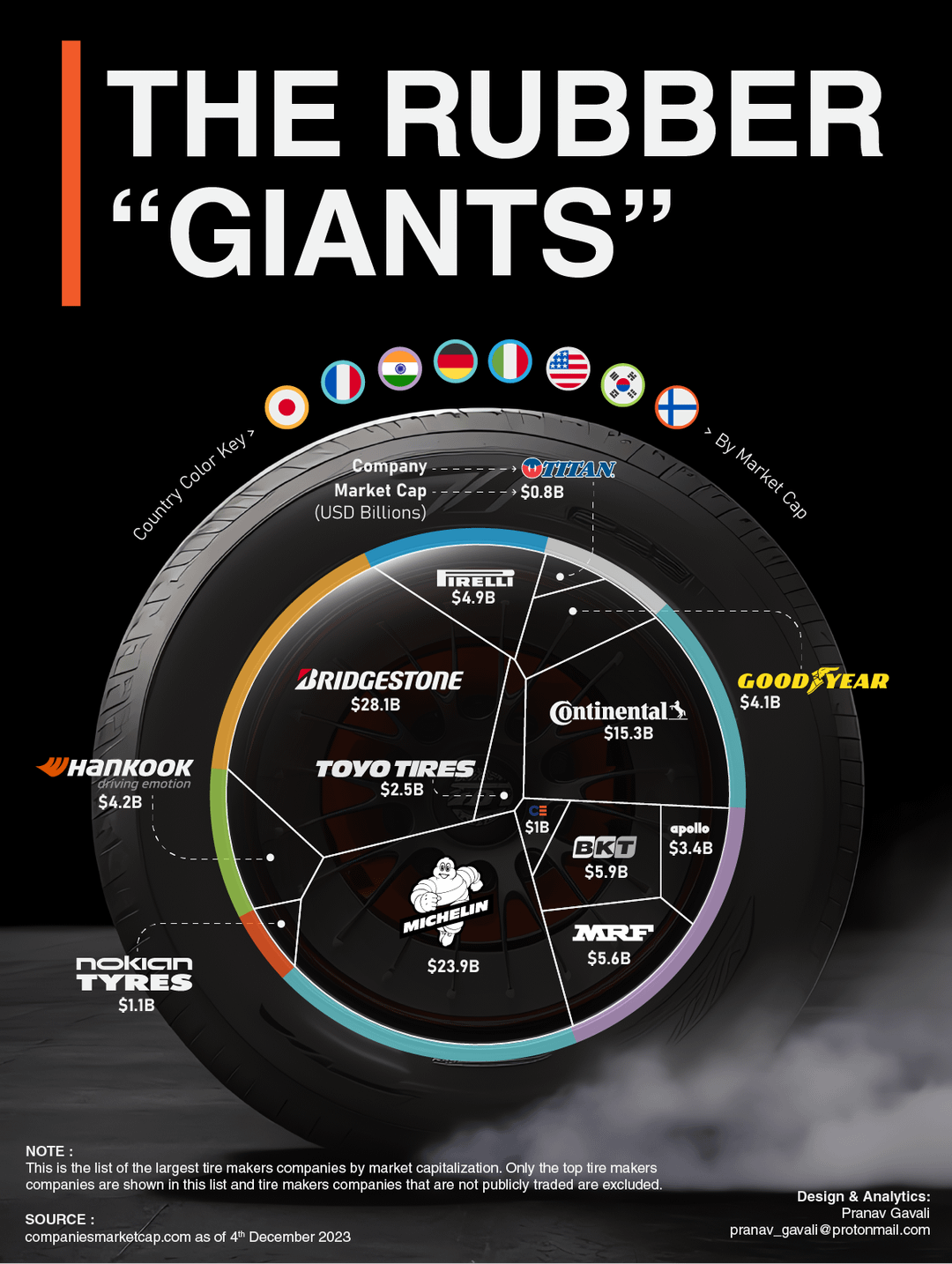

The global tire manufacturing industry is a cornerstone of the automotive sector, supporting everything from passenger vehicles to heavy-duty commercial transport and off-road machinery. Valued at approximately $181 billion in 2023, the market is projected to expand at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2030, according to Grand View Research. This growth is driven by rising vehicle production, increasing demand for replacement tires, and ongoing advancements in tire technology—particularly in fuel efficiency, durability, and sustainability. Additionally, Mordor Intelligence forecasts continued momentum in the Asia-Pacific region, where urbanization and infrastructure development are fueling robust demand. As competition intensifies and environmental regulations tighten, the world’s leading tire manufacturers are investing heavily in research and innovation, including the development of eco-friendly materials and smart tire systems. In this evolving landscape, a select group of companies dominate global production and revenue, shaping the future of mobility through scale, technology, and strategic market presence. Here’s a look at the top 9 largest tire manufacturers in the world, ranked by production volume, revenue, and global influence.

Top 9 Largest Tire Companies In The World Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Michelin Group

Domain Est. 1993

Website: michelin.com

Key Highlights: Pioneering engineered materials for more than 130 years, Michelin is building the world’s leading manufacturer of life-changing composites and experiences….

#2 Hankook Tire is now the sixth largest tire manufacturer in the world

Domain Est. 2000

Website: hankooktire.com

Key Highlights: Hankook Tire is now the sixth largest tire manufacturer in the world ; 1, Michelin, 20,059 ; 2, Bridgestone, 19,649 ; 3, Continental, 10,158 ; 4, Goodyear, 10,040….

#3 The Largest Tire Manufacturers in the World (New)

Domain Est. 2009

Website: carlogos.org

Key Highlights: As of 2021, the Michelin is the world’s largest tire manufacturer, followed by Bridgestone (Japan), Continental (Germany), Goodyear (United States) and ……

#4 2024 Top 75 Tire Manufacturers and Suppliers Leading Tire Industry

Domain Est. 2023

Website: otrtiremanufacturer.com

Key Highlights: The latest global rankings of tire manufacturers have been released for 2024, showcasing the industry’s leaders based on tire business revenue….

#5 Goodyear Corporate

Domain Est. 1992

Website: corporate.goodyear.com

Key Highlights: Learn about The Goodyear Tire & Rubber Company’s history and vision, and find the latest career information, corporate reports, company news and more….

#6 About Us

Domain Est. 1995

Website: giti.com

Key Highlights: Giti Tire is one of the largest tire companies worldwide, based in Singapore with US, Indonesia, and China production. Giti Tire offers a complete range of ……

#7 Bridgestone Global Website

Domain Est. 1996

Website: bridgestone.com

Key Highlights: Bridgestone Corporation is the world’s largest tire and rubber company. In addition to tires, Bridgestone manufactures diversified products, which include ……

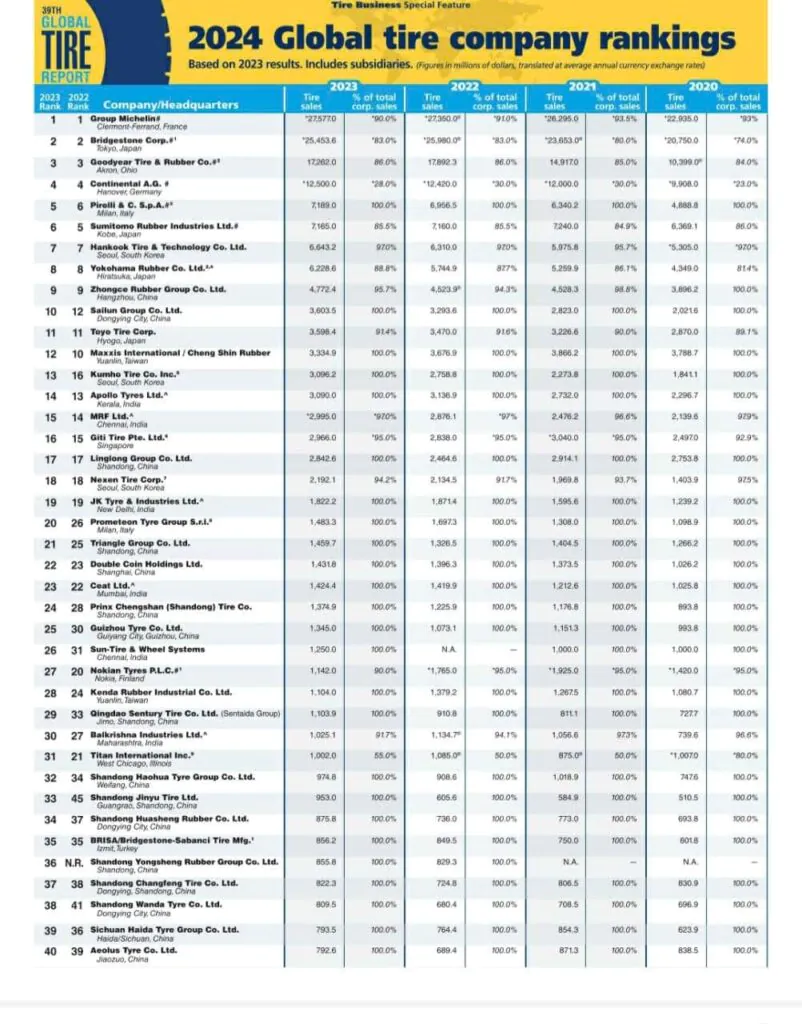

#8 Michelin, Bridgestone, Goodyear again top tire makers

Domain Est. 1997

Website: tirebusiness.com

Key Highlights: Michelin, Bridgestone, Goodyear, Continental and Pirelli are the top tire makers in terms of sales. Sumitomo, Hankook, Yokohama, ZC Rubber and ……

#9 Discover Our Mission, Values

Domain Est. 2001

Website: michelinman.com

Key Highlights: The Michelin brand is the top-selling tire brand worldwide. Michelin is the No. 1 source of innovation in the global tire industry. Leading global brand power ……

Expert Sourcing Insights for Largest Tire Companies In The World

2026 Market Trends for the Largest Tire Companies in the World

As the global automotive industry evolves, the tire manufacturing sector is undergoing significant transformation. By 2026, the world’s largest tire companies—including Bridgestone, Michelin, Goodyear, Continental, and Sumitomo Rubber Industries—are adapting to new technologies, shifting consumer demands, and regulatory pressures. This analysis explores key market trends expected to shape the tire industry in 2026.

Rising Demand for Electric Vehicle (EV) Tires

One of the most influential trends shaping the tire market in 2026 is the accelerating adoption of electric vehicles. EVs present unique requirements for tires due to their heavier weight, instant torque, and noise profiles. Major tire manufacturers are investing heavily in specialized EV tire development.

- Bridgestone launched its “EP500” EV-specific tire line in 2023 and plans to expand its sustainable EV tire portfolio by 2026.

- Michelin is focusing on low rolling resistance and noise reduction, with its e.PRIMACY series gaining traction in European and North American EV markets.

- Goodyear has partnered with EV manufacturers like Tesla and Polestar to co-develop tires that enhance range and performance.

By 2026, analysts project that over 35% of new tire sales will be EV-optimized, driving innovation and premium pricing in the segment.

Sustainability and Circular Economy Initiatives

Environmental regulations and consumer demand are pushing tire giants toward sustainable practices. The European Union’s upcoming End-of-Life Tire (ELT) Directive and carbon footprint labeling will influence product development and supply chains globally.

- Michelin aims for 100% sustainable materials in tires by 2050 and plans to reach 40% by 2030, with bio-sourced rubber and recycled carbon black already in pilot production.

- Continental is using sustainable natural rubber and increasing its use of recycled materials, targeting carbon neutrality in manufacturing by 2030.

- Bridgestone is investing in tire retreading and recycling technologies, with a goal to recycle 100% of end-of-life tires by 2050.

By 2026, sustainability certifications and eco-labeling are expected to become standard market entry requirements, impacting brand positioning and pricing strategies.

Smart Tires and IoT Integration

Digitalization is transforming tire performance monitoring. The integration of sensors, data analytics, and connectivity—known as smart tires—is gaining momentum.

- Goodyear and Bridgestone have developed airless tire concepts (e.g., Goodyear Oxygene, Bridgestone Air-Free) combined with embedded sensors to monitor wear, pressure, and road conditions in real time.

- Continental’s ContiConnect and Michelin’s Tires & Beyond platforms offer fleet operators predictive maintenance insights, reducing downtime and improving safety.

By 2026, it is estimated that over 25% of new commercial vehicle tires will be equipped with IoT-enabled monitoring systems, enhancing the value proposition for B2B customers.

Expansion in Emerging Markets

Growth in Asia-Pacific, Latin America, and Africa is driving expansion strategies for global tire companies. Rising vehicle ownership, infrastructure development, and urbanization are increasing tire demand.

- Sumitomo Rubber Industries is expanding production in India and Southeast Asia to meet regional demand.

- Michelin has increased investments in Vietnam and China, targeting both OEM and replacement markets.

- Goodyear is forming joint ventures in India and Brazil to localize manufacturing and reduce costs.

These efforts aim to capture market share in high-growth regions, where demand for affordable, durable tires remains strong.

Consolidation and Competitive Pressures

The tire industry is experiencing consolidation as companies seek economies of scale and innovation advantages. Smaller players are being acquired or forming alliances with larger manufacturers.

- In 2024, Michelin acquired Fenner PLC, strengthening its industrial and off-the-road tire segment.

- Bridgestone has been actively acquiring fleets and service networks to enhance its aftermarket presence.

By 2026, the top five tire manufacturers are expected to control over 50% of the global market, intensifying competition and driving R&D spending.

Conclusion

The tire industry in 2026 will be defined by electrification, digitalization, sustainability, and geographic expansion. The largest tire companies are positioning themselves as technology and mobility partners, not just component suppliers. Those who successfully integrate innovation with environmental responsibility and global reach are likely to lead the market in the coming years.

Common Pitfalls When Sourcing from the Largest Tire Companies in the World (Quality, IP)

Logistics & Compliance Guide for the Largest Tire Companies in the World

Supply Chain Management and Global Distribution

For the world’s leading tire manufacturers—such as Bridgestone, Michelin, Goodyear, Continental, and Sumitomo Rubber—efficiency in supply chain management is critical. These companies operate vast global networks involving raw material sourcing, manufacturing, warehousing, and last-mile delivery. Implementing just-in-time (JIT) inventory systems, strategic regional distribution centers, and multi-modal transportation (road, rail, sea, and air) helps reduce lead times and inventory costs. Advanced logistics platforms leveraging IoT, GPS tracking, and predictive analytics enable real-time visibility across the supply chain, ensuring timely delivery to OEMs and aftermarket retailers.

Raw Material Procurement and Supplier Compliance

Top tire companies rely on a consistent supply of natural rubber, synthetic rubber, steel, carbon black, and other specialty chemicals. Procurement strategies must include supplier vetting for sustainability, ethical sourcing, and quality assurance. Compliance with standards such as ISO 26000 (Social Responsibility) and adherence to the Sustainable Natural Rubber Initiative (SNR-i) are increasingly essential. Companies must also monitor supply chain transparency to meet ESG (Environmental, Social, and Governance) reporting requirements and mitigate risks related to deforestation, labor practices, and geopolitical instability in rubber-producing regions.

Environmental Regulations and Sustainability Compliance

Environmental compliance is a cornerstone of global tire manufacturing. Companies must adhere to strict emissions standards (e.g., EU’s REACH and EPA regulations), manage hazardous waste, and reduce carbon footprints across production facilities. Regulations such as the EU Tire Labeling Regulation mandate disclosure of fuel efficiency, wet grip, and noise levels. Additionally, Extended Producer Responsibility (EPR) laws in the EU, North America, and parts of Asia require tire manufacturers to manage end-of-life tire recycling. Investment in circular economy initiatives—such as retreading, recycling technologies, and bio-based materials—helps meet compliance targets and enhances brand reputation.

International Trade and Customs Compliance

Given their multinational footprint, leading tire companies must navigate complex international trade regulations. This includes understanding and complying with tariffs, import/export controls, and anti-dumping duties—particularly in markets like the U.S., EU, and China. Accurate classification under the Harmonized System (HS Code), proper country-of-origin labeling, and adherence to Free Trade Agreements (FTAs) are essential to avoid penalties and delays. Robust customs compliance programs, including Automated Export System (AES) filings and Importer Security Filings (ISF), ensure smooth cross-border logistics.

Transportation Safety and Hazardous Materials Handling

While tires are generally non-hazardous, certain components (e.g., solvents, adhesives, and curing agents) may be classified as dangerous goods under regulations such as ADR (Europe), IMDG (maritime), and 49 CFR (U.S.). Proper packaging, labeling, documentation, and employee training are required when shipping these materials. For bulk tire transport, compliance with load securement standards (e.g., CTU Code) prevents accidents and cargo damage. Fire safety protocols in warehouses storing large tire inventories are also crucial due to the flammability of rubber.

Product Certification and Market Access

To sell tires globally, manufacturers must obtain region-specific certifications. Examples include:

- DOT (U.S. Department of Transportation) certification for safety standards

- ECE (Economic Commission for Europe) approval for the EU and associated markets

- INMETRO certification in Brazil

- CCC (China Compulsory Certification) for the Chinese market

These certifications verify performance, durability, and compliance with local safety and environmental laws. Failure to meet certification requirements can result in product recalls, fines, or market exclusion.

Data Compliance and Cybersecurity in Logistics

With increasing digitization of logistics operations—through Transportation Management Systems (TMS), Electronic Data Interchange (EDI), and cloud-based platforms—data security is paramount. Tire companies must comply with data protection regulations such as GDPR (EU) and CCPA (California), especially when handling customer, shipment, or supplier data. Implementing cybersecurity protocols, access controls, and regular audits helps protect sensitive information across the logistics chain.

Labor and Safety Compliance in Warehousing and Distribution

Compliance with occupational health and safety standards (e.g., OSHA in the U.S., RoHS in the EU) is vital in manufacturing plants and distribution centers. Employee training on material handling, forklift operation, and emergency procedures reduces workplace incidents. Ergonomic practices and automation integration further enhance safety and efficiency in high-volume tire handling environments.

Conclusion

For the largest tire companies, excellence in logistics is inseparable from rigorous compliance. A proactive approach to regulatory requirements, sustainability goals, and supply chain resilience not only mitigates risk but also supports long-term competitiveness in a highly regulated global market. Continuous investment in technology, supplier partnerships, and compliance infrastructure ensures these industry leaders maintain operational integrity across every continent.

In conclusion, sourcing from the largest tire companies in the world offers numerous advantages, including access to high-quality, innovative products, global supply chain reliability, and strong brand reputation. Leading manufacturers such as Bridgestone, Michelin, Goodyear, Continental, and Kumho Tires dominate the market through technological advancements, extensive R&D investments, and sustainable manufacturing practices. These companies serve diverse sectors including automotive, aviation, mining, and agriculture, ensuring a wide range of product availability for various applications.

When sourcing from these industry leaders, businesses can benefit from consistent performance, comprehensive warranties, and global support networks. However, it is essential to conduct due diligence, evaluate pricing structures, and consider logistics when entering partnerships. Additionally, emerging competitors from regions like China and India are gaining market share, offering cost-effective alternatives without compromising quality.

Ultimately, aligning with top-tier tire manufacturers enhances product reliability and customer satisfaction, contributing to long-term business success. Strategic sourcing decisions should balance quality, cost, and sustainability goals—ensuring resilience and competitiveness in a dynamic global market.