The global lapidary machines market is experiencing steady growth, driven by rising demand from the gemstone processing, jewelry making, and mineral hobbyist sectors. According to a report by Grand View Research, the global gem and gemstone market—closely linked to lapidary equipment demand—was valued at USD 37.1 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This expansion is fueled by increasing consumer interest in personalized jewelry, a surge in artisanal lapidary work, and advancements in precision cutting and polishing technology. Additionally, Mordor Intelligence projects continued growth in industrial and small-scale gem processing, particularly in emerging markets across Asia-Pacific and Latin America, where raw stone extraction is prominent. As demand for high-quality, efficient, and versatile lapidary equipment rises, manufacturers are innovating to meet diverse needs—from hobbyist-grade models to industrial-scale solutions. In this evolving landscape, the following ten companies stand out as leading lapidary machine manufacturers, combining technological innovation, global reach, and strong customer support to shape the future of stone cutting and polishing.

Top 10 Lapidary Machines Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Lortone

Domain Est. 1996

Website: lortone.com

Key Highlights: At Lortone we’ve been building durable, economical, rock tumblers, saws, polishing arbors, laps, and combination machines, for almost 40 years….

#2 to Raytech Industries

Domain Est. 1997

Website: raytech-ind.com

Key Highlights: Raytech Industries – manufacturers of vibratory tumblers, centrifugal magnetic finishers, and ultrasonic cleaners….

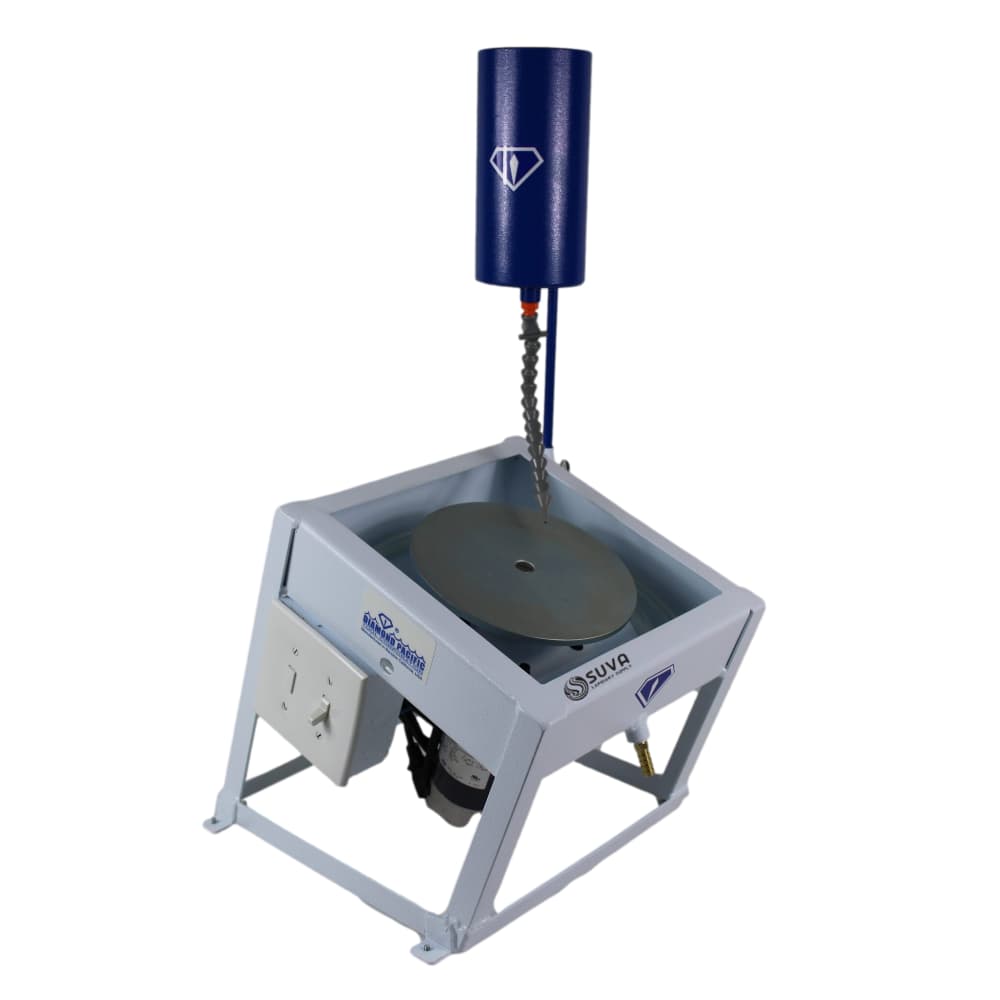

#3 Lapping Machines

Domain Est. 1997

Website: diamondpacific.com

Key Highlights: Diamond Pacific is one of the major manufacturers of lapidary equipment for the rockhound hobbyist, professional gemcutter and jeweler….

#4 Covington Engineering

Domain Est. 1998

Website: covington-engineering.com

Key Highlights: Free delivery 30-day returnsManufacturer of glass and lapidary equipment for hobbyists and professionals….

#5 Crystalite Lapidary Solutions

Domain Est. 1996

Website: abrasive-tech.com

Key Highlights: Precision-engineered diamond solutions for lapidary artists and gemstone professionals. Crystalite has been the trusted name in precision diamond polishing ……

#6 Ultra Tec

Domain Est. 1997

Website: ultratec-facet.com

Key Highlights: Makers of the world’s finest lapidary equipment. Our Faceting Machines are used by amateur & professional cutters to produce beautiful prize-winning gems….

#7 Lapidary Equipment & Supplies

Domain Est. 1997

Website: kingsleynorth.com

Key Highlights: 5-day delivery · 30-day returnsEngrave, cut, or polish your stones and gems with lapidary equipment from trusted brands like Lortone, Cabking, Diamond Pacific, and ……

#8 Minnesota Lapidary Supply page

Domain Est. 2000

Website: lapidarysupplies.com

Key Highlights: “YOUR LAPIDARY GENERAL STORE”. OUR MISSION IS “THAT WITH THE EXCEPTION OF SOME LARGE EQUIPMENT, IF WE HAVE IT IN THE CATALOG, WE HAVE IT IN STOCK” ……

#9 Machines

Domain Est. 2009

Website: hplapidary.com

Key Highlights: Shop lapidary machines at Highland Park Lapidary. From hobbyists to professionals, our lapidary machines for sale offer precision, performance, ……

#10 Lapidary Supply Diamond Tool Manufacture

Domain Est. 2020

Website: gemstonemachine.com

Key Highlights: We are a professional manufacture for lapidary machine and diamond tool, we strive for excellent product quality at affordable prices….

Expert Sourcing Insights for Lapidary Machines

H2: 2026 Market Trends for Lapidary Machines

The global lapidary machines market is poised for steady growth through 2026, driven by increasing demand from hobbyists, professional lapidaries, and the jewelry industry. Key trends shaping the market include technological advancements, rising interest in gemstone crafting, and the expansion of e-commerce platforms.

-

Technological Innovation and Automation

Lapidary machines are becoming more sophisticated with integrated digital controls, precision motors, and automated polishing systems. By 2026, manufacturers are expected to launch smart machines equipped with IoT connectivity, enabling remote monitoring and performance optimization. These innovations reduce human error, increase consistency, and appeal to both amateur and industrial users. -

Growth in DIY and Craft Communities

The surge in do-it-yourself (DIY) culture, particularly in North America and Europe, is fueling demand for entry-level and mid-range lapidary equipment. Online communities, video tutorials, and social media platforms have made lapidary arts more accessible, encouraging more individuals to explore gemstone cutting and polishing as a hobby. -

Expansion of the Gemstone and Jewelry Market

With increasing consumer interest in personalized and ethically sourced jewelry, there is a growing need for small-scale and artisanal gemstone processing. Lapidary machines play a crucial role in shaping raw stones into finished gems. Emerging markets in Asia-Pacific and Latin America are expected to contribute significantly to demand as local artisans adopt modern tools. -

Sustainability and Eco-Friendly Practices

Environmental concerns are prompting manufacturers to develop energy-efficient machines and water-recycling systems. By 2026, eco-conscious design will become a competitive differentiator, particularly in regions with strict environmental regulations. -

E-Commerce and Global Distribution

Online retail platforms are simplifying access to lapidary machines worldwide. Direct-to-consumer sales models, combined with global shipping and multilingual support, are helping brands reach previously underserved markets. This trend is especially beneficial for small and medium-sized enterprises aiming to scale internationally. -

Regional Market Dynamics

North America remains a dominant market due to a strong base of hobbyists and established lapidary associations. Europe follows closely, with Germany and the UK leading in technological adoption. Meanwhile, the Asia-Pacific region is expected to witness the highest growth rate, driven by rising disposable incomes and interest in handcrafted goods in countries like India and China.

In conclusion, the 2026 lapidary machines market will be characterized by innovation, accessibility, and globalization. Companies that invest in user-friendly designs, sustainable manufacturing, and digital engagement are likely to capture significant market share in the evolving landscape.

Common Pitfalls When Sourcing Lapidary Machines: Quality and Intellectual Property Concerns

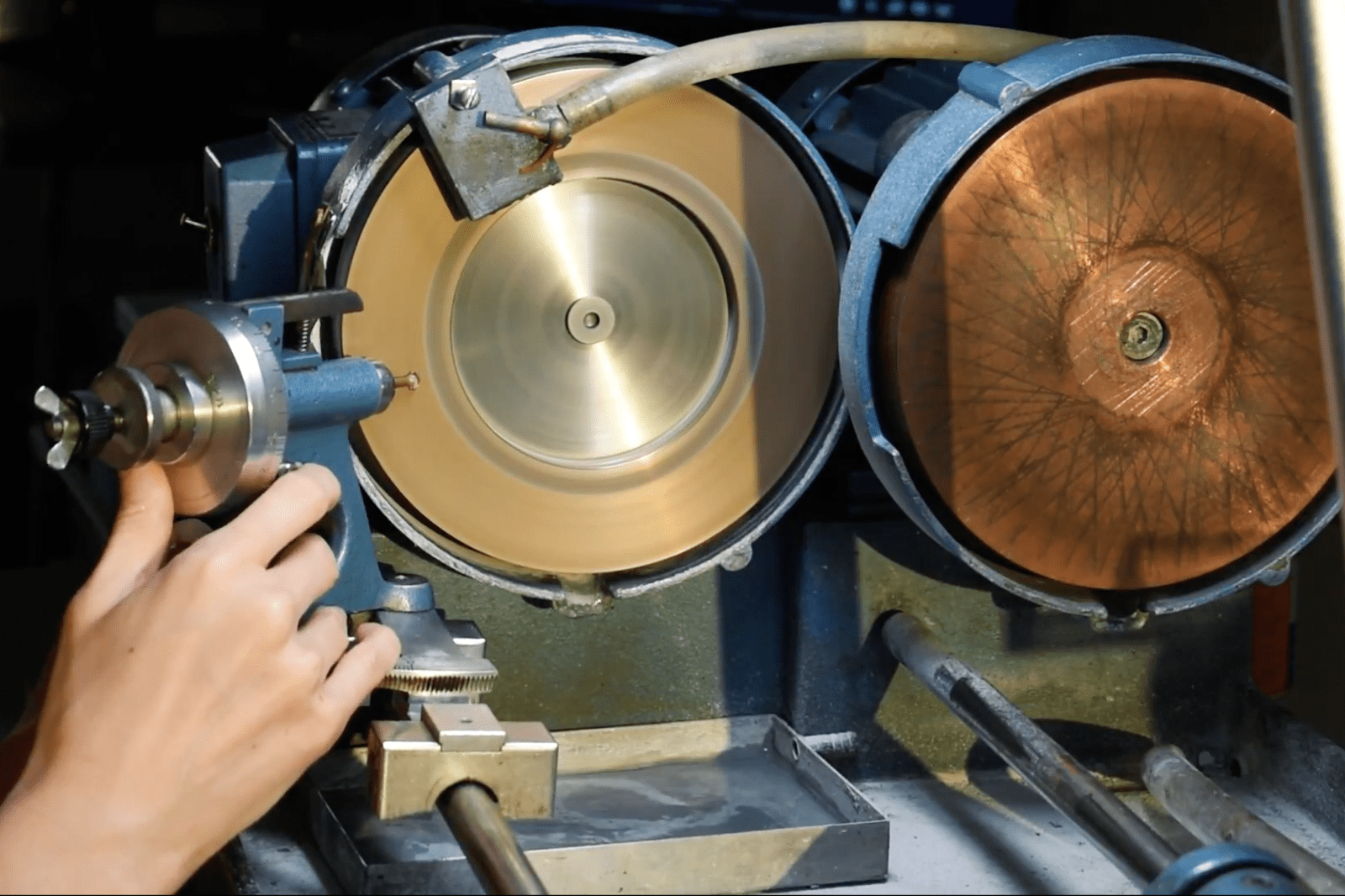

Sourcing lapidary machines—such as slab saws, trim saws, grinders, and polishers—can be a complex process, especially when balancing cost, performance, and legal compliance. Two major areas where buyers often encounter issues are machine quality and intellectual property (IP) risks. Awareness of these pitfalls is crucial for making informed procurement decisions.

Quality-Related Pitfalls

Inadequate Build Materials and Component Quality

Many low-cost lapidary machines, particularly those from less reputable manufacturers, use substandard materials such as thin-gauge steel, low-grade motors, or inferior bearings. This leads to premature wear, vibration, reduced accuracy, and safety hazards. Always verify material specifications and request third-party test reports or certifications.

Poor Precision and Calibration

Lapidary work demands high precision. Machines that lack proper calibration out of the factory—or that cannot maintain alignment over time—can result in inconsistent cuts and wasted materials. Buyers should insist on factory calibration certificates and evaluate the ease of in-house adjustments.

Lack of Safety Features

Some imported machines, especially those from regions with lax safety regulations, may not include critical safety components such as emergency stops, blade guards, or splash shields. Non-compliance with international safety standards (e.g., CE, UL) can expose businesses to liability and workplace hazards.

Insufficient After-Sales Support and Spare Parts Availability

Even high-quality machines require maintenance. Sourcing from suppliers without a reliable supply chain for spare parts or technical support can lead to prolonged downtime. Ensure the supplier offers a clear warranty and has a responsive service network.

Intellectual Property (IP) Pitfalls

Counterfeit or Knockoff Machines

Some suppliers offer machines that closely mimic well-known branded models but are unauthorized copies. These knockoffs often infringe on design patents, trademarks, or technical innovations. Purchasing such equipment may expose the buyer to legal risk, particularly in jurisdictions with strong IP enforcement.

Use of Unauthorized Software or Control Systems

Modern lapidary machines may include proprietary control software or digital interfaces. Sourcing machines with pirated or reverse-engineered software not only violates copyright laws but can also lead to operational instability and lack of updates or support.

Ambiguous IP Ownership in Custom-Built Machines

When commissioning custom lapidary equipment, failure to clearly define IP ownership in the contract can result in disputes. For example, if a supplier develops a unique feature based on your specifications, it may retain rights to that innovation, limiting your ability to replicate or modify the design.

Risk of Infringement in Export Markets

If the sourced machine incorporates patented technology (e.g., a specific motor design or cutting mechanism), importing or reselling it in certain countries could trigger infringement claims. Conduct due diligence on the machine’s components and obtain IP indemnification from the supplier when possible.

Conclusion

To avoid these pitfalls, conduct thorough due diligence on suppliers, verify certifications, request references, and consult legal experts when dealing with custom or high-value equipment. Prioritizing quality and IP compliance from the outset protects both operational efficiency and long-term business integrity.

Logistics & Compliance Guide for Lapidary Machines

Lapidary machines—used for cutting, grinding, and polishing stones—require careful handling during shipping and strict adherence to regulatory standards due to their weight, size, components, and electrical specifications. This guide outlines key logistics considerations and compliance requirements for manufacturers, distributors, and importers/exporters.

Shipping and Handling Requirements

Lapidary machines are typically heavy, contain precision components, and may include sharp tools or abrasives. Proper packaging and handling are crucial to ensure safety and prevent damage.

- Use robust wooden crates or heavy-duty pallets with corner protectors for structural support.

- Secure all moving parts (e.g., spindles, motors) with locking brackets or foam inserts to prevent internal shift during transit.

- Clearly label packages with “Fragile,” “This Side Up,” and “Heavy Equipment” indicators.

- Include handling instructions and weight specifications on the exterior of the packaging.

- Coordinate with freight carriers experienced in handling industrial machinery to avoid delays or mishandling.

International Shipping & Import/Export Compliance

When shipping lapidary machines across borders, adherence to international trade regulations is essential.

- Obtain and provide accurate Harmonized System (HS) codes. Common classifications include 8465.99 (machining tools for stone) or 8464 (machines for working stone, ceramics, or concrete).

- Prepare complete export documentation: commercial invoice, packing list, bill of lading/airway bill, and certificate of origin.

- Comply with export control regulations; verify if the machine contains dual-use components (e.g., high-speed motors) that may require export licenses.

- Ensure compliance with destination country’s import regulations, including customs duties, value-added taxes (VAT), and product standards.

Electrical Safety and Certification

Lapidary machines often operate on specific voltage and frequency requirements, making electrical compliance critical.

- Machines must meet the electrical standards of the target market (e.g., UL/CSA in North America, CE in the European Union, RCM in Australia).

- Include voltage and frequency ratings on nameplates (e.g., 120V/60Hz or 230V/50Hz).

- Equip machines with proper grounding, emergency stop features, and overload protection.

- Provide power adapters or transformers if the machine is not compatible with local grid specifications.

- Ensure compliance with IEC 60204-1 (Safety of Machinery – Electrical Equipment of Machines).

Machinery Safety and CE Marking (EU)

For sales in the European Economic Area (EEA), lapidary machines must comply with the EU Machinery Directive (2006/42/EC).

- Perform a risk assessment to identify hazards (e.g., rotating parts, electrical shock, dust emission).

- Implement safety measures such as machine guarding, emergency stops, and warning labels.

- Compile a Technical File including design drawings, risk assessment, user manuals, and test reports.

- Issue an EU Declaration of Conformity and affix the CE mark to the machine.

- If applicable, involve a Notified Body for conformity assessment.

Dust and Environmental Compliance

Lapidary operations generate fine particulate matter, primarily silica dust, presenting health and environmental risks.

- Equip machines with dust collection systems compliant with local air quality regulations (e.g., OSHA PEL in the U.S., COSHH in the UK).

- Ensure compliance with permissible exposure limits (PELs) for respirable crystalline silica.

- Provide user instructions on safe operation, including use of personal protective equipment (PPE) and ventilation.

- Consider machines with water-fed grinding systems to suppress dust at the source.

Labeling and User Documentation

Clear labeling and comprehensive documentation are required for safe operation and regulatory compliance.

- Permanent labels must include: manufacturer name, model number, serial number, electrical ratings, CE/UL marks, and safety warnings.

- Provide multilingual user manuals covering assembly, operation, maintenance, and safety procedures.

- Include a parts list and troubleshooting guide.

- Highlight compliance with relevant standards (e.g., ISO 12100 for machinery safety, ANSI B11 series where applicable).

Warranty, Service, and After-Sales Support

Ensure logistics planning includes provisions for serviceability and customer support.

- Stock critical spare parts in regional distribution centers to reduce downtime.

- Offer remote diagnostics and technical support to assist users.

- Train local service technicians or partner with certified repair agents in key markets.

- Maintain service records and track machine compliance throughout the product lifecycle.

Adhering to this guide ensures that lapidary machines are transported safely, meet all legal requirements, and operate reliably in diverse global markets. Always consult local regulatory authorities and legal experts to confirm compliance with evolving standards.

In conclusion, sourcing lapidary machines requires careful consideration of several key factors including the intended application, machine quality and durability, supplier reliability, after-sales support, and cost-effectiveness. Whether for hobbyist use or professional lapidary work, selecting the right equipment involves balancing performance, precision, and long-term value. Researching reputable suppliers, reading customer reviews, and comparing technical specifications can help ensure a successful purchase. Additionally, sourcing from manufacturers or distributors that offer warranties, spare parts, and technical assistance enhances operational efficiency and minimizes downtime. Ultimately, a well-informed sourcing decision will support consistent results, improve productivity, and contribute to the long-term success of lapidary endeavors.