The global container manufacturing market is experiencing steady growth, driven by rising demand for efficient logistics solutions and the expansion of international trade. According to Mordor Intelligence, the container market is projected to grow at a CAGR of approximately 5.8% from 2023 to 2028, fueled by increased industrial output and infrastructure development. As supply chains evolve, regional manufacturers—particularly in logistics hubs like Lancaster, Pennsylvania—are playing a pivotal role in meeting the demand for durable, customized, and sustainable container solutions. Leveraging local expertise and proximity to key transportation networks, top-tier manufacturers in Lancaster are positioning themselves as leaders in innovation and reliability. Based on production capacity, customer reviews, and industry recognition, the following three manufacturers stand out in the region’s competitive landscape.

Top 3 Lancaster Container Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

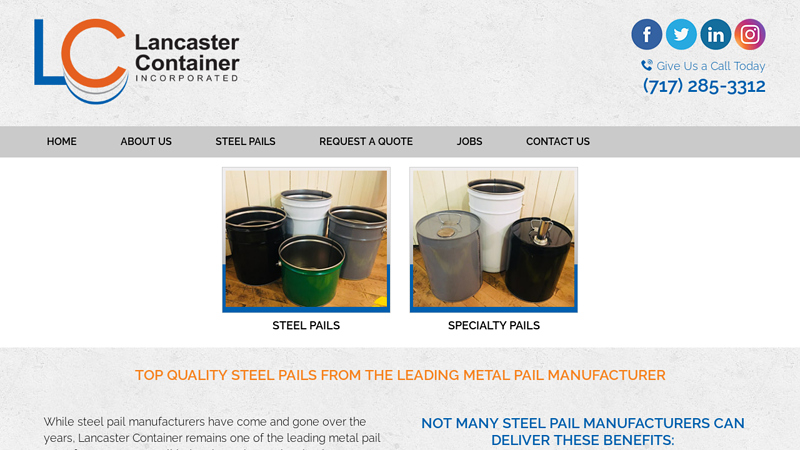

#1 Lancaster Container, Inc.

Domain Est. 2004

Website: lancastercontainer.com

Key Highlights: As one of the leading metal bucket manufacturers we offer a complete line of steel pails, any size, any height, any color!…

#2 Lancaster Container Has Been Acquired By CSC

Domain Est. 2000

Website: cscpails.com

Key Highlights: We are pleased to share that Cleveland Steel Container (CSC) has officially acquired Lancaster Container, Inc., a trusted name in the steel pail industry since ……

#3 Beverage & Food Packaging

Domain Est. 1995

Website: dartcontainer.com

Key Highlights: From to-go containers and dinnerware to tamper-evident food packaging, our products have been keeping people on the go and having fun for 60+ years….

Expert Sourcing Insights for Lancaster Container

H2: Market Trends Shaping Lancaster Container in 2026

As we approach 2026, Lancaster Container is poised to navigate a dynamic and evolving market landscape influenced by sustainability mandates, supply chain resilience, technological innovation, and shifting customer demands. The following key trends are expected to define the container manufacturing and logistics industry, directly impacting Lancaster Container’s strategic positioning and growth trajectory.

-

Accelerated Shift Toward Sustainable Packaging Solutions

Environmental regulations and consumer preferences are driving demand for eco-friendly container solutions. By 2026, governments at both federal and state levels are expected to enforce stricter recycling and single-use plastic bans. Lancaster Container will need to expand its portfolio of recyclable, biodegradable, and compostable containers—particularly in foodservice, e-commerce, and retail packaging. Investment in lightweight, high-performance materials derived from renewable sources (e.g., molded fiber, PLA bioplastics) will be critical to remain competitive. -

Digitalization and Smart Packaging Integration

The rise of IoT-enabled packaging and traceability tools is transforming logistics and brand engagement. By 2026, demand for “smart containers” with embedded sensors, QR codes, or RFID tags is projected to grow, especially in cold chain logistics and premium consumer goods. Lancaster Container can differentiate itself by offering value-added digital features such as freshness monitoring, tamper detection, and consumer engagement platforms, aligning with clients in pharmaceuticals, perishables, and luxury goods. -

Resilient and Regionalized Supply Chains

Ongoing geopolitical tensions and supply disruptions have prompted companies to regionalize manufacturing and distribution. In 2026, nearshoring and onshoring trends will benefit U.S.-based manufacturers like Lancaster Container. Proximity to key markets in the Mid-Atlantic and Midwest will enhance lead times and reduce carbon emissions. Strategic partnerships with regional logistics providers and investments in automation to boost domestic production capacity will be essential. -

E-Commerce and Direct-to-Consumer (DTC) Packaging Growth

The continued expansion of e-commerce, especially in grocery, health & beauty, and home delivery, is increasing demand for durable, shippable, and brand-enhancing containers. Lancaster Container should focus on innovative designs that ensure product protection during transit, minimize dimensional weight, and elevate unboxing experiences. Customizable, scalable packaging solutions will be in high demand from DTC brands seeking to differentiate themselves. -

Labor and Automation in Manufacturing

With persistent labor shortages in manufacturing, automation and AI-driven production systems will become standard by 2026. Lancaster Container will benefit from adopting robotics in molding, stacking, and quality inspection processes to improve efficiency, reduce costs, and maintain consistent output. Additionally, predictive maintenance powered by AI can minimize downtime and extend equipment life. -

Regulatory and Compliance Pressures

Food-grade safety standards, chemical leaching regulations (e.g., PFAS restrictions), and evolving FDA guidelines will require ongoing compliance investments. Lancaster Container must demonstrate rigorous quality control and transparency in sourcing and manufacturing, particularly for clients in food, beverage, and medical sectors. -

Consolidation and Strategic Partnerships

The packaging industry is seeing increased consolidation as larger players acquire niche innovators. To remain agile, Lancaster Container may explore strategic partnerships or joint ventures focused on R&D, material innovation, or market expansion. Collaborations with universities or green tech startups could accelerate access to next-generation materials and processes.

Conclusion

By 2026, Lancaster Container’s success will hinge on its ability to balance innovation with operational efficiency while responding to environmental, technological, and economic shifts. Emphasizing sustainability, digital integration, and regional agility will position the company as a forward-looking leader in the evolving container industry. Proactive investment in these H2 trends will not only mitigate risks but unlock new revenue streams and strengthen customer loyalty.

Common Pitfalls When Sourcing Lancaster Containers (Quality, IP)

Sourcing Lancaster containers—whether referring to specialized packaging, industrial components, or branded products—can present significant challenges, particularly concerning quality assurance and intellectual property (IP) protection. Being aware of these common pitfalls helps mitigate risks and ensures reliable, compliant procurement.

Quality Inconsistencies and Lack of Certification

One of the most frequent issues in sourcing Lancaster containers is variability in product quality. Suppliers may claim compliance with industry standards (e.g., ISO, FDA, or ASTM), but actual production batches often fall short. Without rigorous quality control processes, containers may exhibit defects such as weak seals, inconsistent wall thickness, or material impurities that compromise integrity—especially critical for food, pharmaceutical, or chemical applications. Additionally, lack of third-party certification or verifiable test reports increases the risk of receiving substandard products.

Counterfeit or Unauthorized Replicas

Lancaster-branded or Lancaster-design containers may be subject to counterfeiting, especially when sourcing from third-party manufacturers or overseas suppliers. Unauthorized replicas not only undermine brand value but may also use inferior materials or fail to meet safety regulations. These knockoffs often mimic legitimate designs but lack proper engineering, leading to performance failures. Buyers may inadvertently purchase counterfeit goods without proper verification of supplier authenticity and official distribution rights.

Intellectual Property Infringement Risks

Sourcing containers with designs, logos, or technical specifications associated with Lancaster can expose buyers to IP infringement if proper licensing is not obtained. Using patented container designs, proprietary closure mechanisms, or trademarked branding without authorization may result in legal action, shipment seizures, or financial penalties. Even if the supplier claims legitimacy, the responsibility often falls on the buyer to ensure compliance with IP laws, particularly across international jurisdictions.

Inadequate Supplier Vetting and Traceability

Many sourcing failures stem from insufficient due diligence. Suppliers may present misleading credentials or lack transparency in their manufacturing processes. Without on-site audits, material traceability, or documented quality management systems, it’s difficult to verify claims. This opacity increases the risk of supply chain disruptions, contamination, or exposure to unethical labor practices, all of which reflect poorly on the buyer’s brand.

Poor Communication and Specification Misalignment

Misunderstandings about technical specifications—such as dimensions, material grade, colorfastness, or load-bearing capacity—can lead to incorrect deliveries. Language barriers, ambiguous contracts, or lack of detailed product documentation often result in containers that don’t meet functional or regulatory requirements. Clear, written specifications and regular communication with suppliers are essential to avoid costly rework or rejection of shipments.

Lack of Legal Recourse in International Sourcing

When sourcing globally, enforcing quality standards or IP rights can be challenging. Jurisdictional limitations, weak legal frameworks, or difficulty in pursuing claims abroad may leave buyers with little recourse if containers are defective or infringing. Contracts should include clear terms for quality assurance, IP indemnification, and dispute resolution to protect the buyer’s interests.

Avoiding these pitfalls requires thorough supplier evaluation, legal compliance checks, and investment in quality assurance protocols. Partnering with authorized distributors, demanding verifiable certifications, and conducting regular audits can significantly reduce risks in sourcing Lancaster containers.

Logistics & Compliance Guide for Lancaster Container

This comprehensive guide outlines the key logistics and compliance procedures for Lancaster Container to ensure efficient operations, regulatory adherence, and customer satisfaction.

Overview of Logistics Operations

Lancaster Container manages the transportation, warehousing, and distribution of shipping containers and related equipment. Our logistics network includes inbound and outbound freight coordination, inventory management, ground transportation, and port coordination. We utilize a combination of company-owned and third-party carriers to maintain service reliability and cost-efficiency.

Transportation Management

All container movements—whether full truckload (FTL), less-than-truckload (LTL), or intermodal—are tracked using our Transportation Management System (TMS). Dispatchers are responsible for load planning, carrier selection, route optimization, and real-time tracking. Drivers and third-party carriers must comply with Department of Transportation (DOT) regulations and provide up-to-date documentation, including valid licenses and vehicle inspection reports.

Warehousing and Inventory Control

Containers stored at Lancaster Container facilities are managed through a Warehouse Management System (WMS) that tracks location, condition, and availability. Regular audits ensure inventory accuracy. All containers undergo visual and structural inspections upon intake and prior to dispatch. Proper stacking, labeling, and segregation by type (dry, refrigerated, open-top, etc.) are required to prevent damage and ensure quick retrieval.

Regulatory Compliance

Lancaster Container adheres to all federal, state, and international regulations governing container handling and transportation. Key compliance areas include:

- FMCSA Regulations: Compliance with Hours of Service (HOS), vehicle maintenance, and driver qualification standards.

- Customs-Trade Partnership Against Terrorism (C-TPAT): Security protocols for containers entering or leaving the U.S. border.

- ISPM 15: International standards for wood packaging materials used in container shipments.

- EPA and DOT Environmental Standards: Proper handling of hazardous materials and emissions control for company vehicles.

Safety and Training

All employees and contractors must complete mandatory safety training, including OSHA-compliant programs for forklift operation, hazardous material handling, and workplace safety. Safety data sheets (SDS) are maintained for any hazardous substances on-site. Incident reporting and investigation procedures are enforced to promote continuous improvement.

Documentation and Recordkeeping

Accurate documentation is critical for compliance and traceability. Required records include:

- Bills of Lading (BOL)

- Container condition reports

- Maintenance logs

- Driver logs and inspection reports

- Customs documentation for international shipments

All records are retained for a minimum of three years in accordance with DOT and IRS requirements.

Customer and Carrier Onboarding

New carriers must submit proof of insurance, MC/DOT numbers, and complete a carrier agreement before conducting business with Lancaster Container. Customers are provided with service level agreements (SLAs), rate sheets, and clear instructions for booking and tracking shipments.

Sustainability and Environmental Responsibility

Lancaster Container is committed to reducing its environmental impact through fuel-efficient routing, regular vehicle maintenance, recycling programs, and participation in EPA SmartWay Transport Partnership. We continuously evaluate opportunities to improve energy efficiency and reduce carbon emissions across our operations.

Audit and Continuous Improvement

Internal compliance audits are conducted quarterly to assess adherence to policies and regulations. Findings are reported to management, and corrective action plans are implemented promptly. Feedback from customers, carriers, and employees is used to refine processes and enhance service delivery.

For questions or reporting concerns, please contact the Compliance Department at [email protected] or (555) 123-4567.

Conclusion for Sourcing Lancaster Container

In conclusion, sourcing containers from Lancaster Container presents a viable and strategic option for businesses seeking reliable, high-quality shipping and storage solutions. With a strong reputation for customer service, a diverse inventory of new and used containers, and nationwide availability, Lancaster Container offers flexibility and scalability to meet various logistical and operational needs. Their commitment to sustainability through container reconditioning aligns with growing environmental considerations in supply chain management. While pricing and lead times should be evaluated against specific project requirements, the overall value proposition—supported by industry experience and customer satisfaction—makes Lancaster Container a competitive and dependable supplier. Businesses looking to optimize their storage or shipping infrastructure should consider Lancaster Container as a trusted partner in their procurement strategy.