The global laminated wood market is experiencing robust growth, driven by rising demand for sustainable building materials and advancements in engineered wood technology. According to a recent report by Mordor Intelligence, the global laminated veneer lumber (LVL) and engineered wood products market was valued at USD 19.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.2% through 2029. This expansion is fueled by increased adoption in residential and commercial construction, particularly in regions prioritizing low-carbon materials and efficient use of forest resources. Parallel data from Grand View Research highlights that the global engineered wood market—including laminated wood products—is expected to surpass USD 185 billion by 2030, with cross-laminated timber (CLT) and glued laminated timber (glulam) leading innovation in modular and tall wood buildings. As sustainability becomes a cornerstone of modern construction, manufacturers specializing in high-strength, dimensionally stable laminated wood are well-positioned to meet evolving industry standards and environmental goals.

Top 10 Laminated Wood Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Laminated Wood Systems

Domain Est. 1998

Website: lwsinc.com

Key Highlights: Laminated Wood Systems, Inc. is the world’s leading supplier of engineered laminated wood structures and wood pole management products to the electric utility ……

#2 Unalam: Glulam Beam Manufacturers

Domain Est. 1999 | Founded: 1906

Website: unalam.com

Key Highlights: Since 1906, Unalam has been a leader in custom glulam beam manufacturing and laminated wood solutions for architects, builders, and engineers across the ……

#3 DRJ Wood Innovations

Domain Est. 2019

Website: drjwoodinnovations.com

Key Highlights: DR Johnson Wood Innovations, a division of DR Johnson, specializes in the manufacture of glue-laminated beams from Douglas fir and Alaskan yellow cedar….

#4 Mercer Mass Timber

Domain Est. 2022

Website: mercermasstimber.com

Key Highlights: North America’s leading manufacturer of cross-laminated timber (CLT) and glulam (GL)….

#5 Western Archrib

Domain Est. 1998

Website: westernarchrib.com

Key Highlights: Western Archrib is a leader in the design, manufacture, and custom fabrication of glued-laminated structural wood systems. Our product line includes Spruce Pine ……

#6 Legno group

Domain Est. 1999

Website: gruppolegno.it

Key Highlights: Rating 4.9 (73) Gruppo Legno production of high quality made in Italy laminated wood profiles 40km from Rome. Discover all our products….

#7 Genesis Products

Domain Est. 2002

Website: genesisproductsinc.com

Key Highlights: Genesis Products optimizes design, performance and value by integrating high-performance laminate materials to create smarter solutions for every space….

#8 Timber Technologies

Domain Est. 2003

Website: timber-technologies.com

Key Highlights: Our Titan Timbers® GluLams are straighter, stronger, more reliable, easier to cut, screw and notch because of our glue laminating and finger joint process….

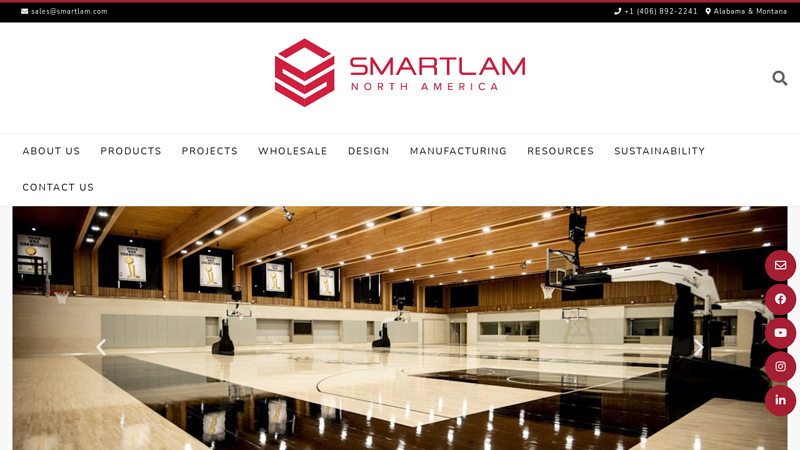

#9 SmartLam North America

Domain Est. 2012

Website: smartlam.com

Key Highlights: SmartLam produces mass timber at our two state of the art facilities. Tour our plants in Columbia Falls, MT and Dothan, AL virtually. MANUFACTURING….

#10 KLH Massivholz GmbH

Website: klh.at

Key Highlights: KLH Massivholz GmbH is the market leader for large-format cross-laminated timber elements, which are used and distributed worldwide as constructive wall, floor ……

Expert Sourcing Insights for Laminated Wood

H2: Market Trends for Laminated Wood in 2026

The laminated wood market is poised for significant transformation by 2026, driven by advancements in sustainable construction, evolving architectural preferences, and supportive regulatory frameworks. Industry analysis indicates a steady upward trajectory in demand, particularly in residential, commercial, and infrastructure sectors. Below are the key market trends expected to shape the laminated wood industry in 2026:

1. Growth in Sustainable and Green Building Practices

With global emphasis on carbon neutrality and energy-efficient construction, laminated wood—especially cross-laminated timber (CLT) and glued laminated timber (glulam)—is gaining traction as a low-carbon alternative to steel and concrete. Building codes in North America, Europe, and parts of Asia are increasingly recognizing mass timber, enabling taller wooden buildings. By 2026, green certification programs like LEED and BREEAM are expected to further incentivize the use of laminated wood in sustainable developments.

2. Urbanization and Demand for Modular Construction

Rapid urbanization, particularly in emerging economies, is accelerating demand for fast, cost-effective construction methods. Laminated wood components are ideal for prefabricated and modular building systems, offering precision, reduced waste, and shorter construction timelines. The rise of off-site manufacturing is projected to boost laminated wood adoption in mid-rise residential and commercial projects by 2026.

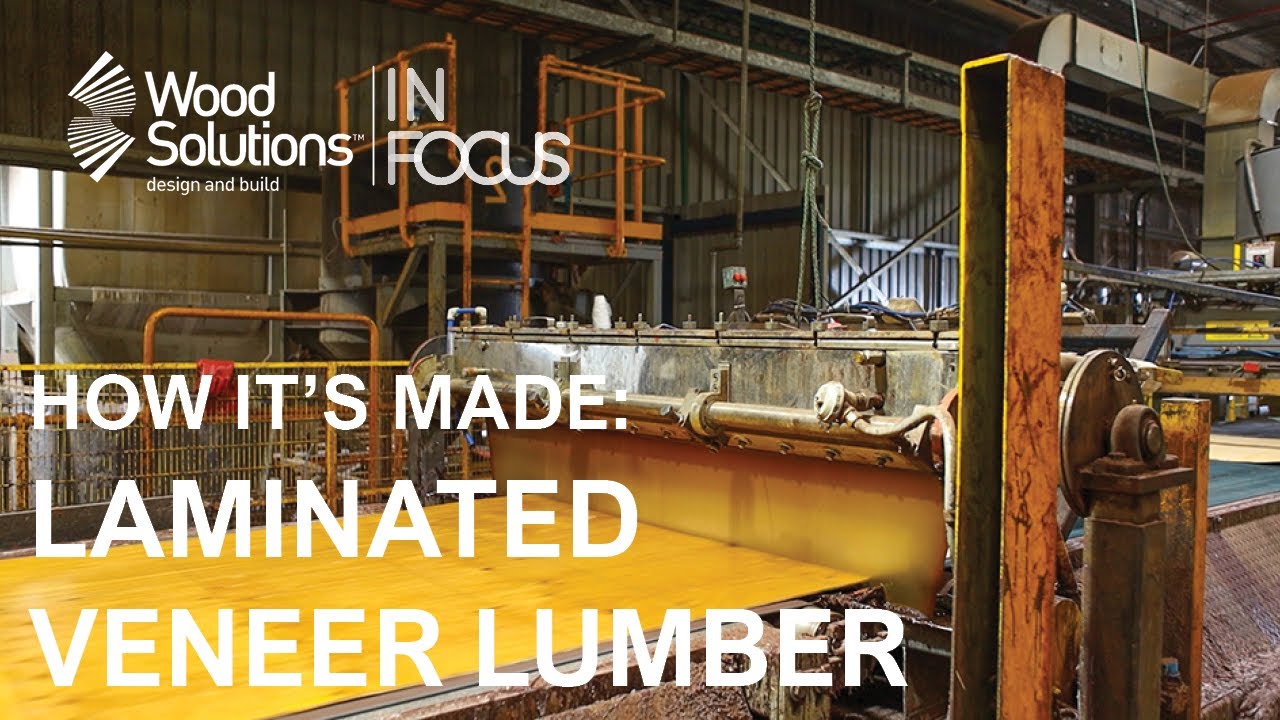

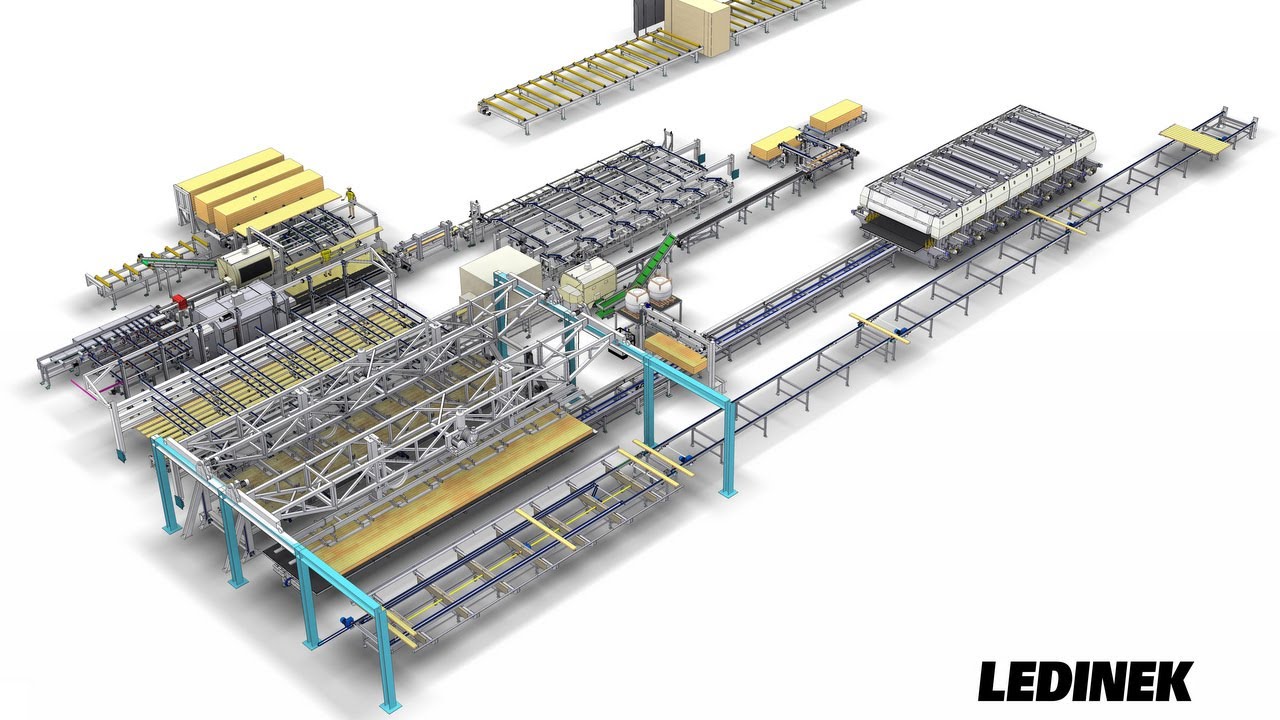

3. Technological Advancements in Manufacturing

Innovations in adhesive technologies and digital fabrication (e.g., CNC machining, BIM integration) are enhancing the strength, durability, and design flexibility of laminated wood products. These improvements are expanding applications beyond structural beams and columns to include façades, flooring, and interior design elements. By 2026, smart factories leveraging automation and IoT are expected to increase production efficiency and reduce costs.

4. Regional Market Shifts

While North America and Europe remain dominant markets due to mature supply chains and supportive policies, the Asia-Pacific region—especially Japan, South Korea, and Australia—is emerging as a high-growth area. Government initiatives promoting wood utilization in public infrastructure are fueling regional demand. In contrast, supply chain constraints in certain regions may prompt investment in local timber processing facilities.

5. Focus on Circular Economy and Certification

Consumers and regulators are increasingly demanding transparency in sourcing. By 2026, certified sustainable wood (e.g., FSC, PEFC) is expected to become a standard requirement in public and private projects. The industry is also exploring reuse and recycling of laminated wood components, aligning with circular economy principles.

6. Competitive Landscape and Investment

Major players in the laminated wood sector are expanding production capacities and forming strategic partnerships with architects and developers. Increased venture capital and government funding for mass timber research are expected to spur innovation and market penetration by 2026.

In conclusion, the 2026 laminated wood market will be defined by sustainability, technological integration, and global expansion. As climate goals and urban development converge, laminated wood is set to play a pivotal role in the future of construction.

Common Pitfalls When Sourcing Laminated Wood (Quality, IP)

Sourcing laminated wood—such as glued laminated timber (glulam) or laminated veneer lumber (LVL)—requires careful consideration to ensure structural integrity, aesthetic consistency, and protection of intellectual property (IP). Overlooking key aspects can lead to project delays, safety risks, and legal complications. Below are common pitfalls to avoid.

Inconsistent Material Quality

One of the most frequent issues in sourcing laminated wood is inconsistent quality across batches. Variations in wood species, adhesive type, lamination pressure, and moisture content can compromise strength and durability. Poor quality control during manufacturing may result in delamination, warping, or weak bonds. Always verify that suppliers adhere to recognized standards (e.g., ANSI, EN, or ISO) and request third-party certification and test reports.

Lack of Traceability and Certification

Without proper documentation, it’s difficult to verify the origin, species, and treatment of laminated wood. This increases the risk of sourcing illegal or non-compliant timber, which may violate environmental regulations (e.g., Lacey Act, EUTR). Ensure suppliers provide chain-of-custody certifications (e.g., FSC or PEFC) and batch-specific mill test reports to confirm compliance and material integrity.

Inadequate Structural Performance Verification

Assuming laminated wood meets design specifications without verified engineering data is risky. Some suppliers may provide misleading strength ratings or use substandard adhesives unsuitable for exterior or high-load applications. Require performance data, such as modulus of elasticity (MOE) and bending strength (Fb), backed by accredited laboratory testing. Confirm that the product is rated for the intended application (interior, exterior, structural, etc.).

Intellectual Property (IP) Infringement Risks

Laminated wood systems—especially engineered profiles, connection details, or proprietary manufacturing processes—may be protected by patents, trademarks, or design rights. Sourcing from unauthorized manufacturers or copying patented designs can lead to legal disputes, shipment seizures, or project shutdowns. Always conduct due diligence on supplier legitimacy and verify that designs or products do not infringe on existing IP. Use licensing agreements where necessary.

Poor Communication of Custom Design Specifications

Custom laminated wood components require precise technical drawings, tolerances, and finish requirements. Miscommunication or vague specifications can result in incorrect fabrication, leading to costly rework or installation failures. Clearly define all requirements in writing, including dimensional tolerances, surface finish, glue line visibility, and handling instructions. Use detailed BIM models or technical submittals to reduce ambiguity.

Overlooking Environmental and Moisture Resistance

Using laminated wood in inappropriate environments without proper treatment or adhesive selection can cause swelling, fungal decay, or bond failure. Standard interior-grade laminates are not suitable for exterior or high-humidity conditions. Ensure the adhesive used (e.g., phenol-resorcinol formaldehyde) is rated for wet use and that the wood has been properly dried and sealed according to environmental exposure class.

Failure to Audit Manufacturing Facilities

Relying solely on paper certifications without verifying actual production conditions can be dangerous. Unannounced audits or site visits help confirm that quality control systems, worker training, and equipment maintenance meet required standards. This is especially important when sourcing from offshore or low-cost suppliers where oversight may be minimal.

By addressing these pitfalls proactively—through rigorous vetting, clear specifications, and legal diligence—buyers can ensure they source high-quality, compliant, and IP-safe laminated wood products.

Logistics & Compliance Guide for Laminated Wood

Laminated wood, including products such as glued laminated timber (glulam), cross-laminated timber (CLT), and laminated veneer lumber (LVL), is widely used in construction and manufacturing. Proper logistics and compliance management are essential to ensure product quality, safety, and legal adherence throughout the supply chain.

Classification and HS Code

Laminated wood is typically classified under the Harmonized System (HS) codes based on composition, dimensions, and end use. Common classifications include:

- HS 4412: Plywood, veneered panels, and similar laminated wood

- HS 4418: Assembled parquet panels; wood blocks, strips, and friezes

- HS 4407: Sawn or chipped wood (may apply to raw components)

Verify the precise HS code with local customs authorities, as regional variations and product specifics (e.g., treatment, adhesive type) can affect classification.

Regulatory Compliance

International Standards and Certifications

- ISO 139: Conditioning and testing of wood-based panels

- EN 14080: Structural glued laminated timber – Requirements

- ANSI A190.1: American National Standard for glued laminated timber

- CARB Phase 2 / EPA TSCA Title VI: Formaldehyde emission standards (USA)

- FSC® / PEFC™ Certification: Sustainable forest management and chain-of-custody

Ensure product documentation includes test reports, conformity declarations, and certification labels where applicable.

Phytosanitary Requirements

Laminated wood may be subject to phytosanitary regulations, especially when exported:

– ISPM 15 (International Standards for Phytosanitary Measures No. 15): Required for wood packaging materials (pallets, crates), not typically for the laminated product itself if processed beyond threshold dimensions.

– Verify if the product contains raw wood components that require heat treatment and marking.

Chemical and Emission Regulations

- REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals – ensure adhesives and treatments comply.

- Formaldehyde Limits: Comply with EU E1 or E0 standards, or U.S. TSCA Title VI for indoor air quality.

Packaging and Handling

- Protective Wrapping: Use weather-resistant plastic films to prevent moisture absorption and surface damage during transit.

- Edge Protection: Apply corner boards or edge guards to prevent chipping and crushing.

- Securing on Pallets: Use strapping or shrink-wrapping to stabilize loads. Avoid over-compression.

- Labeling: Include product type, dimensions, batch number, handling instructions (e.g., “Protect from Moisture,” “Do Not Stack”), and certification marks.

Storage Conditions

- Indoor Storage: Store in dry, well-ventilated areas with controlled humidity (ideally 35–65% RH).

- Elevation: Keep products off the ground using pallets or supports to prevent moisture wicking.

- Covering: Use breathable covers if stored temporarily outdoors; avoid direct exposure to rain or sunlight.

- Stacking: Limit stack height to prevent deformation; follow manufacturer guidelines.

Transportation Guidelines

Domestic Transport

- Secure loads with straps or load bars to prevent shifting.

- Use flatbed or enclosed trailers, depending on weather and distance.

- Avoid exposure to extreme temperatures that may affect adhesive integrity.

International Shipping

- Containerized Shipping: Use dry van containers with desiccants to control humidity.

- Documentation: Include commercial invoice, packing list, bill of lading, certificate of origin, and compliance certificates.

- Customs Clearance: Provide accurate HS codes, valuation, and proof of origin. Pre-clearance may reduce delays.

Import/Export Documentation

Mandatory documents may include:

– Commercial Invoice

– Packing List

– Bill of Lading / Air Waybill

– Certificate of Origin

– Test Reports (e.g., formaldehyde, structural performance)

– FSC®/PEFC™ Chain-of-Custody Certificate (if applicable)

– Phytosanitary Certificate (if required)

Check destination country requirements—some (e.g., China, Australia) have stringent import controls on wood products.

Risk Mitigation

- Moisture Damage: Monitor humidity levels during storage and transport; use moisture barriers.

- Mechanical Damage: Train handling personnel; use proper lifting equipment (e.g., forklifts with soft forks).

- Compliance Audits: Regularly review supplier certifications and regulatory updates.

- Insurance: Cover for transit, storage, and product liability, especially for high-value structural components.

Sustainability and ESG Considerations

- Source materials from certified sustainable forests.

- Maintain transparent chain-of-custody documentation.

- Minimize waste in packaging and optimize load efficiency to reduce carbon footprint.

By adhering to this guide, stakeholders can ensure the safe, compliant, and efficient movement of laminated wood products across global supply chains. Always consult local regulations and industry standards for the most current requirements.

Conclusion for Sourcing Laminated Wood:

Sourcing laminated wood presents a sustainable, durable, and aesthetically versatile solution for a wide range of applications, from structural elements in construction to high-end furniture and interior design. Its engineered composition offers enhanced strength, dimensional stability, and resistance to warping and moisture compared to solid timber, making it a reliable choice in diverse environments.

When sourcing laminated wood, it is essential to prioritize suppliers who adhere to responsible forestry practices, certifications such as FSC or PEFC, and transparent supply chains to ensure environmental and ethical accountability. Additionally, considering factors such as glue type (e.g., non-toxic, formaldehyde-free adhesives), customization options, lead times, and cost-effectiveness contributes to a successful procurement strategy.

In conclusion, laminated wood is a high-performance material that combines sustainability with structural integrity. By carefully selecting reputable suppliers and evaluating product specifications, businesses can achieve long-term value, reduce environmental impact, and meet the demands of modern construction and design standards.