The global laminated MDF (Medium-Density Fiberboard) market is experiencing steady expansion, driven by rising demand from the furniture, construction, and interior design sectors. According to Grand View Research, the global MDF market size was valued at USD 59.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030, with laminated variants gaining traction due to their enhanced durability, moisture resistance, and aesthetic versatility. This growth is further fueled by increasing urbanization, modernization of residential and commercial spaces, and a shift toward ready-to-assemble (RTA) furniture, where laminated MDF is a preferred material. As demand surges across regions like Asia-Pacific, North America, and Europe, manufacturers are scaling production, investing in sustainable sourcing, and enhancing lamination technologies to meet evolving customer expectations. In this competitive landscape, identifying the top 10 laminated MDF manufacturers becomes essential for sourcing partners, builders, and designers seeking quality, reliability, and innovation.

Top 10 Laminated Mdf Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Mohawk Industries, Inc.

Domain Est. 1996

Website: mohawkind.com

Key Highlights: As the world’s largest rug manufacturer, Mohawk creates elegant home fashion crafted with super soft and stain-resistant fibers. Learn More. Laminate Floor ……

#2 Kitchen fronts of laminated MDF from ZOV

Domain Est. 2020

Website: zovofficial.com

Key Highlights: Rating 5.0 (157) Kitchen fronts of of laminated MDF from the Belarusian manufacturer ZOV. A wide range of fronts of laminated MDF for kitchen cabinets….

#3 E3 MDF

Domain Est. 2021

Website: e3mdf.com

Key Highlights: E3 MDF is India’s leading manufacturer of high-quality, durable MDF boards. Our innovative solutions combine strength and versatility, perfect for furniture ……

#4 Pre Laminated MDF Board Manufacturer in Bardoli, India, Plain …

Domain Est. 2023

Website: evergreenboardlampvtltd.com

Key Highlights: We are manufacturing the particle boards in different designs, finishing, texture, colors and dimensions to suit the diverse requirements of multiple ……

#5 Formica Corporation

Domain Est. 1997

Website: formica.com

Key Highlights: Crafted for countertops, cabinets, worktops, wall panels and more. Discover Formica® Laminate for interior spaces. Founded on quality, service and innovative ……

#6 India’s Leading Laminate and MDF Manufacturing Company

Domain Est. 1998

Website: rushil.com

Key Highlights: Rushil Decor Limited. Rushil Décor Ltd. is one of the leading company in Laminate and MDF panel boards industry in India with a global foot print in and around ……

#7 Greenpanel : MDF Ka Doosra Naam

Domain Est. 2000

Website: greenpanel.com

Key Highlights: We manufacture high-performance HDWR boards, MDF, Pre-Laminated MDF, Plywood, and Wooden Flooring, all crafted in our state-of-the-art plants in Uttarakhand and ……

#8 Laminated

Domain Est. 2002

Website: imeca.com

Key Highlights: MDF White Oak Plain Sliced A1 (3/4 in x 4 ft x 8 ft). SKU: MDF13601-ROCK. $203.35. Rockshield. In Stock. Shipping Available. Add to Cart….

#9 High-Quality MDF & Laminated Boards

Domain Est. 2007

Website: zrkgroup.com

Key Highlights: Discover ZRK Group’s premium MDF and laminated boards in Pakistan. Ideal for furniture and interior design, our products combine quality and durability….

#10 MDF Board Manufacturer, MDF Sheet at Best Price in India

Domain Est. 2013

Website: vir-mdf.com

Key Highlights: India’s leading MDF Board manufacturer brand – VIRMDF. We are a supplier of MDF sheets at a competitive price which is available in different styles….

Expert Sourcing Insights for Laminated Mdf

H2 2026 Market Trends for Laminated MDF

The laminated medium-density fiberboard (LMD) market in the second half of 2026 is anticipated to be shaped by a confluence of sustainability imperatives, technological advancements, evolving consumer preferences, and ongoing economic adjustments. Here’s a detailed analysis of the key trends expected to drive the market during this period:

1. Accelerated Shift Toward Sustainable and Low-Carbon Materials

The most dominant trend in H2 2026 will be the intensified demand for eco-friendly laminated MDF. Regulatory pressures, particularly in the EU (e.g., CBAM – Carbon Border Adjustment Mechanism) and North America, are compelling manufacturers to reduce carbon footprints. This is driving innovation in:

– Bio-based resins and adhesives: Increased adoption of formaldehyde-free and soy-based binders to meet green building certifications (e.g., LEED, BREEAM).

– Recycled content: Growth in MDF made with high percentages of post-industrial and post-consumer recycled wood fiber.

– Low-emission laminates: Popularity of PVC-free, melamine-free, and paper-based decorative surfaces with certified low VOC emissions.

– Transparency and traceability: Consumers and B2B buyers will demand full supply chain visibility, supported by blockchain and digital product passports.

2. Expansion of Premium and Design-Driven Products

As residential and commercial interiors prioritize aesthetics and durability, laminated MDF will see rising demand for high-end finishes. Key developments include:

– Hyper-realistic textures and patterns: Advances in digital printing and embossing technology will enable woodgrain, stone, and textured finishes indistinguishable from natural materials.

– Customization and personalization: Growth in on-demand manufacturing allowing for bespoke colors, patterns, and sizes, particularly in cabinetry and retail fit-outs.

– High-pressure laminate (HPL) adoption: Increased use of HPL over standard melamine for enhanced scratch, heat, and moisture resistance in kitchens and high-traffic areas.

3. Geopolitical and Supply Chain Resilience

Ongoing global supply chain volatility and regional trade policies will influence sourcing strategies:

– Nearshoring and regionalization: Manufacturers in North America and Europe will increasingly source laminated MDF locally or from trusted regional partners to mitigate risks from long-haul shipping and tariffs.

– Diversification of raw material suppliers: Companies will reduce reliance on single-source fiber or resin suppliers to avoid disruptions.

– Inventory optimization: Adoption of AI-driven demand forecasting tools will help balance inventory levels amid fluctuating input costs.

4. Digital Integration and Smart Manufacturing

The laminated MDF industry will continue its digital transformation in H2 2026:

– Industry 4.0 implementation: Smart factories using IoT sensors and AI will improve production efficiency, reduce waste, and ensure consistent quality.

– BIM and CAD integration: Seamless compatibility with Building Information Modeling (BIM) software will streamline design-to-production workflows in construction and furniture sectors.

– AR/VR for visualization: Retailers and designers will use augmented reality to help customers preview laminated MDF products in real environments before purchase.

5. Growth in Non-Residential Applications

Beyond furniture and cabinetry, laminated MDF will gain traction in commercial and institutional sectors:

– Healthcare and education: Demand for hygienic, durable, and easy-to-clean surfaces in hospitals and schools will boost usage.

– Retail and hospitality: Custom laminated MDF solutions for fixtures, partitions, and wall cladding will support brand-specific interior designs.

– Modular and prefabricated construction: As off-site construction grows, laminated MDF panels will be used in factory-built interior modules due to their dimensional stability and ease of installation.

6. Price Volatility and Cost Management

While input costs (especially energy and resins) are expected to stabilize compared to 2022–2024, inflationary pressures will persist:

– Strategic pricing models: Manufacturers will increasingly adopt value-based pricing over cost-plus, especially for premium and sustainable products.

– Energy efficiency investments: Plants will continue upgrading to energy-efficient presses and drying systems to reduce long-term operational costs.

Conclusion:

In H2 2026, the laminated MDF market will be characterized by a strong emphasis on sustainability, digital innovation, and design excellence. Companies that invest in eco-friendly materials, adopt smart manufacturing, and align with circular economy principles will gain competitive advantage. While economic and supply chain challenges remain, the overall trajectory points toward a more resilient, innovative, and customer-centric industry.

Common Pitfalls When Sourcing Laminated MDF: Quality and Intellectual Property Concerns

Logistics & Compliance Guide for Laminated MDF

Laminated Medium Density Fiberboard (MDF) is widely used in furniture, cabinetry, and interior design due to its smooth surface and durability. However, transporting and importing/exporting laminated MDF requires adherence to specific logistics and compliance standards. This guide outlines the key considerations for safe, efficient, and legally compliant handling and shipment.

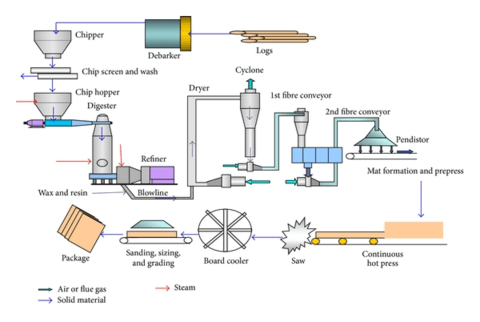

Definition and Composition

Laminated MDF consists of an MDF core bonded with a decorative or protective laminate layer, typically made of melamine, PVC, or wood veneer. The lamination process enhances moisture resistance and surface durability but introduces specific handling and regulatory considerations.

Packaging and Handling Requirements

Proper packaging is essential to prevent damage during transit. Laminated MDF panels should be:

– Wrapped in protective film (e.g., PE film) to guard against moisture and scratches.

– Secured on wooden or plastic pallets with edge protectors to prevent chipping.

– Banded or shrink-wrapped to maintain stability.

– Stored and transported in dry, well-ventilated environments to avoid warping or delamination.

Handle panels with care using mechanical aids (e.g., forklifts, panel lifters) to avoid surface damage and ensure worker safety.

Transportation and Storage Conditions

- Temperature & Humidity: Maintain storage and transport temperatures between 10°C and 30°C with relative humidity below 65% to prevent swelling or adhesive failure.

- Stacking: Limit stack height to prevent pressure damage; use spacers between layers if stacked vertically.

- Loading: Ensure even weight distribution in containers or trucks; avoid overhang to prevent edge damage.

International Trade Regulations

Laminated MDF may be subject to import/export controls, depending on destination and raw material origin.

- ISPM 15 Compliance: If shipped on wooden pallets, pallets must be heat-treated and marked according to ISPM 15 standards to prevent pest spread.

- Country-Specific Requirements: Verify regulations in the destination country (e.g., EPA TSCA Title VI compliance in the U.S. for formaldehyde emissions).

- Customs Documentation: Provide accurate HS codes (typically 4411.13 or 4411.14, depending on lamination type), commercial invoices, packing lists, and certificates of origin.

Environmental and Safety Compliance

- Formaldehyde Emissions: Laminated MDF must comply with formaldehyde emission standards such as CARB Phase 2 (U.S.), E1 or E0 (Europe), or F**** (Japan). Suppliers should provide test reports or certifications.

- REACH & RoHS: Ensure compliance with EU regulations regarding restricted substances (e.g., phthalates in PVC laminates).

- Sustainable Sourcing: Verify that wood fibers originate from sustainably managed forests (FSC or PEFC certification recommended).

Labeling and Traceability

Panels and packaging should include:

– Product identification (type, thickness, dimensions)

– Batch/lot numbers for traceability

– Compliance marks (e.g., CE, FSC, CARB)

– Handling instructions (e.g., “This Side Up,” “Protect from Moisture”)

Returns and Damage Claims

Establish clear procedures for handling damaged shipments:

– Document damage upon delivery with photos and inspection reports.

– Retain packaging for carrier inspection.

– Follow supplier return policies and insurance claims protocols.

Summary

Successful logistics and compliance for laminated MDF require attention to packaging, environmental conditions, regulatory standards, and documentation. Partnering with certified suppliers and experienced freight forwarders ensures adherence to international standards and reduces risks of delays or rejections.

Conclusion for Sourcing Laminated MDF

Sourcing laminated MDF requires a strategic approach that balances quality, cost, sustainability, and supply chain reliability. As a versatile and widely used material in furniture, cabinetry, and interior design, laminated MDF offers a smooth, durable surface with excellent aesthetic appeal. When selecting suppliers, it is essential to evaluate factors such as consistency in lamination quality, range of finishes and thicknesses, compliance with environmental standards (e.g., CARB, FSC, or PEFC), and the ability to meet volume and delivery requirements.

Building relationships with reputable manufacturers—whether local or international—can ensure long-term cost efficiency and product reliability. Additionally, considering sustainability certifications and low-emission materials supports environmentally responsible sourcing and meets growing market demand for eco-friendly products.

In conclusion, successful sourcing of laminated MDF hinges on thorough supplier vetting, clear specifications, and ongoing quality control. By prioritizing these elements, businesses can secure a reliable supply of high-quality laminated MDF that supports both performance and sustainability goals in their end products.