The lab-grown diamond market is experiencing robust expansion, fueled by increasing consumer demand for sustainable, ethically sourced, and cost-effective alternatives to mined diamonds. According to Grand View Research, the global lab-grown diamond market size was valued at USD 11.1 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 15.5% from 2023 to 2030. Similarly, Mordor Intelligence forecasts a CAGR of approximately 16.1% over the same period, driven by advancements in production technologies and rising adoption in jewelry, industrial, and semiconductor applications. As retail demand surges, the wholesale manufacturing segment has become increasingly competitive, with a growing number of vertically integrated producers ensuring higher quality, scalability, and margin efficiency. This convergence of technological innovation and market demand has given rise to a new generation of lab diamond manufacturers who are redefining supply chain dynamics across the global gemstone industry.

Top 10 Lab Diamonds Wholesale Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

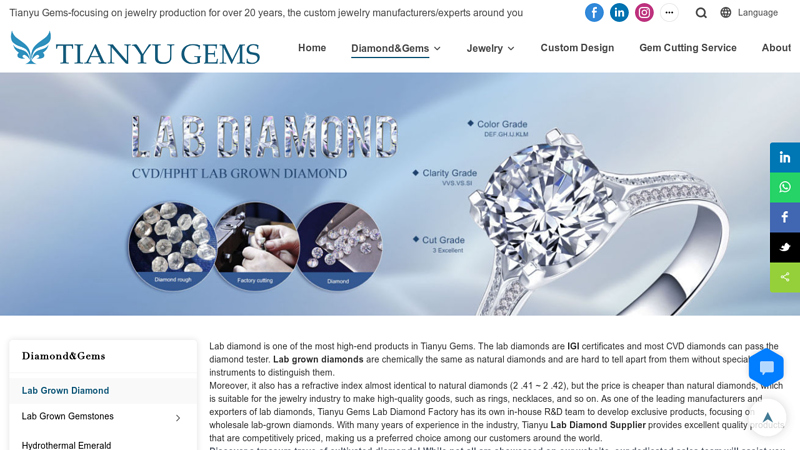

#1 Tianyu Lab Diamond, Wholesale Lab Grown Diamonds Supplier

Domain Est. 2016

Website: tygems.net

Key Highlights: Tianyu Gems Lab Diamond Factory has its own in-house R&D team to develop exclusive products, focusing on wholesale lab-grown diamonds….

#2 lab created diamonds manufacturer UK

Domain Est. 2019

Website: stonelabdiamonds.com

Key Highlights: Stone Lab Diamonds is a wholesaler & manufacturer of IGI Certified lab Created Diamond. We supply across UK, Italy, & Europe. Buy Online Diamonds from Our ……

#3 Craft

Domain Est. 2020

Website: craftdiamonds.co

Key Highlights: Craft Lab Grown Diamonds is a trusted manufacturer and supplier of lab-grown diamonds made sustainably with solar power….

#4 World’s Largest Grower Of CVD Lab Grown Diamonds

Domain Est. 2023

Website: kiradiam.com

Key Highlights: Discover top-quality lab-grown diamonds at Kira, a leading manufacturer and supplier in United States & India. Trusted for excellence in CVD diamond ……

#5 Natural, Lab-Grown & Loose Diamonds

Domain Est. 1995

Website: riogrande.com

Key Highlights: Free delivery over $250 · 30-day returnsExplore a wide selection of wholesale diamonds at Rio Grande. Browse natural, lab-grown, and loose diamonds in various shapes, sizes, and q…

#6 Chatham – Premier Lab

Domain Est. 1995

Website: chatham.com

Key Highlights: Chatham is now recognized worldwide as the industry leader in luxury laboratory grown gemstones and diamond jewelry. SHOP FEATURED CATEGORIES….

#7 Loose Lab

Domain Est. 1996

Website: stuller.com

Key Highlights: Stuller has been dedicated to providing an unmatched assortment of lab-grown diamonds, lab-grown diamond jewelry, and custom solutions….

#8 Grown Diamond Corporation

Domain Est. 2015

Website: growndiamondcorp.com

Key Highlights: A members-only world of lab grown diamonds, CRBN is for merchants, retailers, and jewelers to access, explore, and purchase lab-grown diamonds and jewelry….

#9 Loose Grown Diamond

Domain Est. 2018

Website: loosegrowndiamond.com

Key Highlights: Lab-grown diamonds are environmentally friendly and cost-efficient. They undergo the same processing and grading standards as mined diamonds….

#10 Sustainable Lab-Grown Diamond Jewelry

Domain Est. 2023

Website: stienhardt.com

Key Highlights: Stienhardt offers a wide range of engagement rings featuring certified lab-grown diamonds, perfect for modern couples seeking ethical and high-quality options….

Expert Sourcing Insights for Lab Diamonds Wholesale

2026 Market Trends for Lab-Grown Diamond Wholesale

The wholesale market for lab-grown diamonds is poised for significant transformation by 2026, driven by technological advancements, shifting consumer preferences, and evolving supply chain dynamics. As sustainability and cost-efficiency become central to jewelry retail strategies, lab-grown diamonds are increasingly capturing market share from mined diamonds. This analysis explores key trends shaping the lab diamond wholesale landscape in 2026.

Rising Consumer Acceptance and Demand

By 2026, consumer perception of lab-grown diamonds is expected to shift decisively in favor of acceptance and preference. Younger demographics, particularly Millennials and Gen Z, are driving demand due to their emphasis on ethical sourcing, environmental responsibility, and value for money. Wholesale distributors are seeing increased orders from retailers who are expanding their lab-grown diamond offerings to meet this demand. Market research suggests that lab diamonds could represent up to 20% of the global diamond jewelry market by 2026, significantly influencing wholesale volume and pricing strategies.

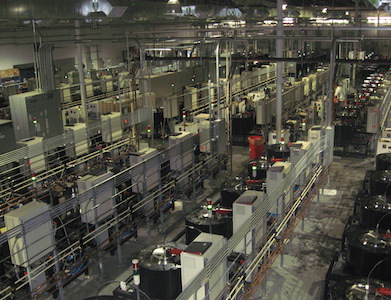

Price Compression and Competitive Pressures

Technological improvements in chemical vapor deposition (CVD) and high-pressure high-temperature (HPHT) methods continue to reduce production costs. As a result, wholesale prices for lab-grown diamonds have declined steadily and are expected to stabilize at 60–80% below mined diamond equivalents by 2026. This price compression pressures wholesalers to differentiate through quality grading transparency, certification, and supply chain traceability rather than price alone. Consolidation among manufacturers and distributors is likely as smaller players struggle to compete.

Expansion of B2B Platforms and Digital Procurement

Digital wholesale platforms are transforming how retailers source lab diamonds. By 2026, the majority of wholesale transactions are expected to occur through online marketplaces offering real-time inventory, AI-powered matching tools, and blockchain-verified certification. These platforms reduce transaction friction, enable global reach for smaller manufacturers, and allow retailers to customize orders with greater speed. Wholesalers who invest in seamless digital integration and data transparency will gain a competitive edge.

Emphasis on Certification and Traceability

As the market matures, trust in origin and quality becomes paramount. By 2026, industry standards for lab diamond certification—such as those from the IGI and GIA—are expected to be universally adopted in wholesale channels. Blockchain technology is increasingly used to provide immutable records of a diamond’s creation, grading, and journey through the supply chain. Wholesalers offering fully traceable, certified stones will be preferred partners for ethical retailers and major brands.

Regional Shifts in Manufacturing and Demand

Asia, particularly India and China, remains the dominant hub for lab diamond manufacturing, benefiting from skilled labor and lower production costs. India alone accounts for over 80% of global lab-grown diamond polishing. However, by 2026, North America and Europe are expected to see growth in regional wholesale distribution centers, driven by demand for faster delivery and localized inventory. Additionally, emerging markets in Southeast Asia and the Middle East are showing increased appetite for lab-grown diamonds, creating new wholesale export opportunities.

Sustainability as a Core Value Proposition

Environmental impact is a key factor in wholesale purchasing decisions. By 2026, leading lab diamond wholesalers are expected to publish detailed ESG (Environmental, Social, and Governance) reports, showcasing carbon footprint reductions, renewable energy usage, and ethical labor practices. Retailers are increasingly requiring such documentation, making sustainability a critical differentiator in wholesale partnerships.

Conclusion

The 2026 wholesale market for lab-grown diamonds will be defined by digital transformation, price transparency, and ethical accountability. Wholesalers who adapt to these trends—by embracing technology, ensuring quality and traceability, and aligning with sustainability goals—will be well-positioned to thrive in an increasingly competitive and conscious marketplace.

Common Pitfalls Sourcing Lab Diamonds Wholesale (Quality, IP)

Sourcing lab-grown diamonds wholesale offers significant cost advantages, but it comes with critical risks related to quality consistency and intellectual property (IP) that buyers must navigate carefully. Falling into these common traps can damage your brand reputation, lead to legal issues, and erode profit margins.

Inconsistent or Misrepresented Quality

One of the biggest challenges in the wholesale lab diamond market is ensuring consistent, accurate quality across large volumes. Unlike natural diamonds with established grading systems, lab diamonds can vary significantly in characteristics even within the same batch.

- Inaccurate or Inflated Grading: Some suppliers may provide certificates from less reputable grading labs or even issue their own unverified reports, overstating the diamond’s color, clarity, or cut. Relying solely on supplier-provided grading without independent verification is a major risk.

- Lack of Standardization: While major labs like GIA, IGI, and GCAL grade lab diamonds, standards and reporting nuances can differ. Assuming all “D-color, VVS1” lab diamonds are equivalent regardless of the issuing lab can lead to quality discrepancies in your inventory.

- Hidden Treatments or Imperfections: Some lab diamonds may undergo post-growth treatments to improve color or clarity. These treatments might not be fully disclosed, or the stones might have internal laser drill holes or other growth-related inclusions not always visible to the naked eye but affecting durability and value.

- Batch Variability: Slight variations in the growth process (HPHT vs. CVD) or equipment calibration can result in color tints (e.g., brownish or grayish hues) or clarity differences within a single shipment, even if all stones are graded similarly.

Mitigation: Always insist on independent, reputable lab certification (GIA, IGI, GCAL) for every significant parcel. Conduct your own quality spot checks upon receipt. Build relationships with suppliers known for stringent quality control and transparent grading practices.

Intellectual Property (IP) Infringement Risks

The lab-grown diamond industry is heavily driven by proprietary technology and branding. Sourcing wholesale carries significant IP risks that can lead to costly legal battles and product seizures.

- Counterfeit or Unlicensed Stones: The market includes stones produced using technology patented by major players (e.g., WD Lab Grown Diamonds, De Beers’ Lightbox, or specific HPHT/CVD methods). Sourcing from unauthorized manufacturers or distributors may mean you’re selling diamonds that infringe on core patents, making you liable for infringement.

- Brand Confusion and “Look-Alike” Designs: Some suppliers offer diamonds cut or marketed to deliberately mimic the appearance or branding of well-known patented diamond cuts (like certain proprietary fancy cuts) or even the visual style of leading brands. Selling these can lead to trademark or design patent infringement claims.

- Unclear Supply Chain Transparency: If your supplier cannot definitively trace the origin of the diamonds back to a legitimate, licensed manufacturer, you have no way to verify if IP rights have been respected. Opaque supply chains are a major red flag.

- Misuse of Brand Names and Logos: Using trademarks like “Forevermark,” “Tolkowsky,” or specific patented cut names (e.g., “Hearts & Arrows” with specific proportions) without authorization on your marketing or packaging, even if the diamond quality is high, is a direct IP violation.

Mitigation: Demand full supply chain transparency from your supplier. Ask for proof of licensing or authorization if sourcing from known branded producers. Avoid stones or designs that appear to copy patented cuts or branding. Consult with legal counsel familiar with jewelry IP to review supplier agreements and product offerings. Prioritize suppliers who operate with ethical and legal compliance.

By proactively addressing these quality and IP pitfalls, wholesalers can build a reliable, reputable, and legally sound lab diamond sourcing operation that protects both their business and their customers.

Logistics & Compliance Guide for Lab Diamonds Wholesale

Overview

Wholesaling lab-grown diamonds involves a complex network of logistics, regulatory compliance, and ethical sourcing. This guide outlines best practices and essential requirements for efficiently and legally distributing lab diamonds at scale.

International Shipping & Logistics

Lab diamonds are globally traded, requiring careful planning for cross-border transportation. Partner with freight forwarders experienced in high-value goods. Use secure, insured air freight with real-time tracking. Ensure all shipments include detailed commercial invoices, packing lists, and certificates of origin. Consider bonded warehouses for duty deferral and inventory management across regions.

Regulatory Compliance

Compliance with international and local regulations is critical. Key frameworks include:

– FTC Guidelines (U.S.): Accurately disclose diamonds as “lab-grown” or “synthetic” in all marketing and labeling. Avoid deceptive terms like “real” without qualification.

– Kimberley Process (KP): While primarily for natural diamonds, understand KP requirements as some jurisdictions conflate reporting. Lab diamonds must be clearly differentiated in documentation.

– Customs Regulations: Classify lab diamonds correctly under HS codes (e.g., 7102.39 for synthetic diamonds). Misclassification can lead to penalties or shipment delays.

– Country-Specific Rules: Some markets (e.g., India, EU) have additional labeling, import licensing, or environmental disclosure requirements for synthetic gemstones.

Certification & Traceability

Require all lab diamonds to come with grading reports from reputable labs (e.g., GIA, IGI, GCAL). These reports verify quality, origin (lab-based), and carat weight. Implement a digital traceability system to track each diamond from manufacturer to customer. This supports compliance, reduces fraud risk, and meets increasing demand for transparency.

Anti-Money Laundering (AML) & Know Your Customer (KYC)

As high-value goods, lab diamonds can be vulnerable to financial crime. Establish AML/KYC protocols:

– Verify buyer identities and business legitimacy.

– Monitor transactions for unusual patterns.

– Maintain records for at least five years.

– Report suspicious activity per local financial regulations (e.g., FinCEN in the U.S.).

Packaging & Security

Use tamper-evident, discreet packaging to prevent theft and ensure chain of custody. Employ GPS-enabled tracking for high-value shipments. Store inventory in secure, insured vaults with restricted access and 24/7 surveillance.

Environmental & Ethical Compliance

Although lab diamonds have a lower environmental impact than mined stones, communicate sustainability claims responsibly. Avoid unsubstantiated “eco-friendly” claims. Disclose energy sources used in diamond growth (e.g., renewable vs. grid power) where possible. Adhere to labor standards in manufacturing hubs.

Recordkeeping & Audit Readiness

Maintain meticulous records of all transactions, certifications, shipping documents, and compliance checks. Regular internal audits ensure readiness for regulatory inspections. Use cloud-based inventory and compliance software for real-time oversight and reporting.

Conclusion

Success in lab diamond wholesale depends on seamless logistics and strict adherence to global compliance standards. By prioritizing transparency, security, and regulatory accuracy, wholesalers can build trust, reduce risk, and scale sustainably in this evolving market.

In conclusion, sourcing lab-grown diamonds wholesale offers a smart, sustainable, and cost-effective solution for retailers, designers, and jewelry businesses aiming to meet the growing consumer demand for ethical and affordable luxury. With advancements in technology ensuring high-quality, visually identical diamonds to their mined counterparts, lab-grown diamonds provide excellent value without compromising on beauty or durability. By partnering with reputable suppliers who prioritize transparency, certification, and consistent quality, businesses can secure competitive pricing, reliable supply chains, and a differentiated market advantage. As the industry continues to evolve, establishing strong wholesale relationships now positions companies at the forefront of a shifting diamond market—driven by innovation, sustainability, and conscious consumerism.