The global peptide therapeutics market is experiencing robust growth, driven by rising demand for targeted treatments in oncology, metabolic disorders, and autoimmune diseases. According to a 2023 report by Grand View Research, the market was valued at USD 48.8 billion and is expected to expand at a compound annual growth rate (CAGR) of 8.9% from 2023 to 2030. This surge is fueled by advancements in peptide synthesis technologies, increased R&D investments, and a growing pipeline of peptide-based drugs. Amid this expansion, Kpv peptides—known for their anti-inflammatory and immunomodulatory properties—are gaining traction in preclinical and therapeutic research. As demand intensifies, a select group of manufacturers have emerged as key players, combining synthesis expertise, stringent quality control, and scalability to meet evolving industry needs. Below are the top seven Kpv peptide manufacturers shaping the landscape of peptide innovation and supply.

Top 7 Kpv Peptides Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

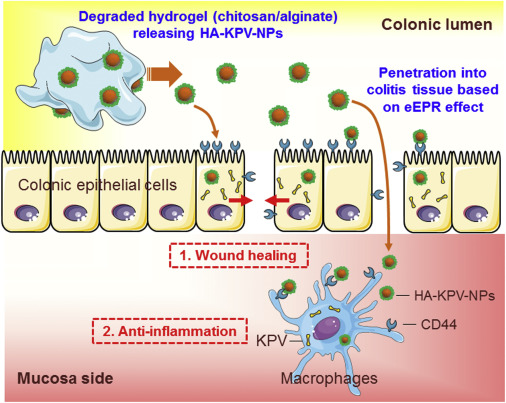

#1 Orally Targeted Delivery of Tripeptide KPV via Hyaluronic Acid …

Domain Est. 1997

Website: pmc.ncbi.nlm.nih.gov

Key Highlights: Interestingly, the KPV peptide was found to exert an even stronger anti-inflammatory effect than α-MSH,9, 10 and we recently demonstrated that KPV could ……

#2 Medical

Domain Est. 1999

Website: docrx.com

Key Highlights: Clinics are adopting peptides to help patients recover faster, improve metabolic health, support body composition changes, and optimize long-term wellness….

#3 Purchase KPV

Domain Est. 2018

Website: integrativepeptides.com

Key Highlights: The information provided on this site is intended for your general knowledge only and is not a substitute for professional medical advice or treatment for ……

#4 KPV Peptide: Anti

Domain Est. 2018

Website: swolverine.com

Key Highlights: KPV has attracted attention because of its wide-ranging effects on inflammation control, tissue repair, and immune balance….

#5 Your Trusted Source for High

Domain Est. 2019

Website: verifiedpeptides.com

Key Highlights: Discover premium, lab-tested peptides from your trusted source. Our products meet rigorous quality standards, ensuring purity, efficacy, and reliability….

#6 Login & Register

Domain Est. 2024

Website: peptidecrafters.com

Key Highlights: Certified Purity | Reference Standards. CHEMICAL SPECIFICATIONS: All reagents are supplied as lyophilized powders (Acetate salts)….

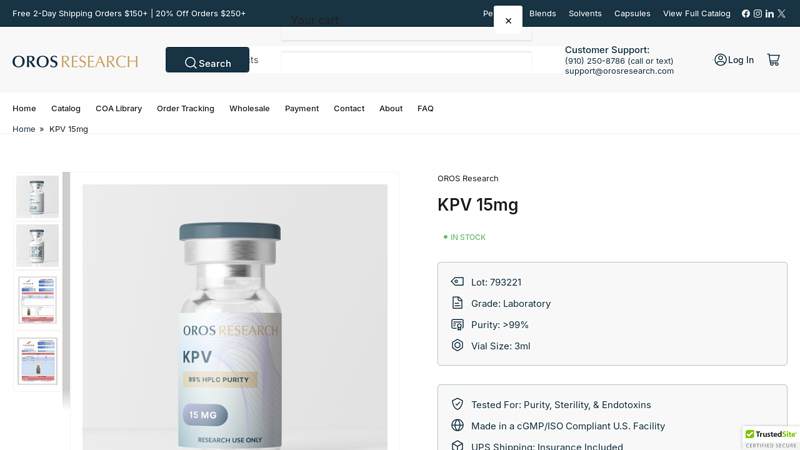

#7 KPV 15mg

Website: orosresearch.com

Key Highlights: Free delivery over $150KPV 15mg – Manufactured in California in a GMP-compliant facility. Each batch is tested for purity, sterility, endotoxins, and net content….

Expert Sourcing Insights for Kpv Peptides

H2: Market Trends for KPv Peptides in 2026

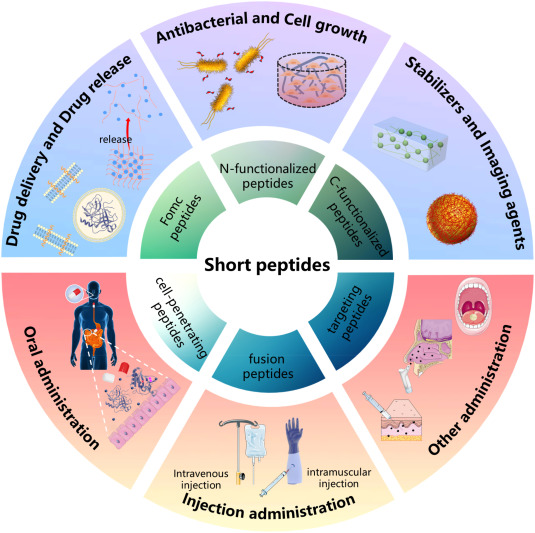

As of 2026, the market for KPv peptides—short bioactive peptides often studied for their immunomodulatory, anti-inflammatory, and potential anti-aging properties—exhibits several emerging trends driven by advancements in biotechnology, increasing demand for peptide-based therapeutics, and growing investment in personalized medicine.

-

Expansion in Therapeutic Applications

KPv peptides, particularly those derived from endogenous proteins such as alpha-melanocyte-stimulating hormone (α-MSH) or related proopiomelanocortin (POMC) fragments, are gaining attention for their role in modulating inflammation and immune responses. By 2026, clinical research has expanded their potential applications beyond dermatology into areas such as autoimmune diseases (e.g., rheumatoid arthritis, inflammatory bowel disease), neurodegenerative conditions (e.g., Alzheimer’s), and metabolic syndrome. Phase II trials for KPv-based formulations in topical and injectable delivery systems show promising results in reducing chronic inflammation with minimal side effects. -

Growth in the Cosmeceutical Sector

The global cosmeceutical market continues to be a major driver for KPv peptides. Their anti-inflammatory and skin-repairing properties make them key ingredients in premium skincare products targeting redness, aging, and barrier repair. Brands are increasingly formulating with stabilized KPv analogs to enhance dermal penetration and bioavailability. In 2026, demand is particularly strong in Asia-Pacific markets, where consumers prioritize science-backed anti-aging solutions. -

Advancements in Peptide Stabilization and Delivery

One of the historical challenges with KPv peptides has been their susceptibility to enzymatic degradation and poor bioavailability. By 2026, innovations in peptide engineering—such as cyclization, PEGylation, and encapsulation in lipid nanoparticles or exosomes—have significantly improved stability and tissue targeting. These delivery enhancements are enabling both topical and systemic applications, broadening the commercial viability of KPv-based products. -

Rise of Personalized Peptide Therapies

With the integration of AI-driven drug discovery and biomarker profiling, personalized peptide medicine is on the rise. KPv peptides are being tailored based on individual inflammatory profiles or genetic predispositions, particularly in dermatology and immunology. This trend is supported by increasing adoption of point-of-care diagnostics and digital health platforms that monitor treatment response in real time. -

Regulatory and Manufacturing Developments

Regulatory bodies such as the FDA and EMA have introduced more defined pathways for peptide-based drugs, including KPv derivatives, streamlining approvals for well-characterized synthetic peptides. Concurrently, the cost of manufacturing KPv peptides has decreased due to advances in solid-phase peptide synthesis (SPPS) and continuous-flow production, making them more accessible for both research and commercial use. -

Increased Investment and Partnerships

Biotech firms and pharmaceutical companies are increasingly partnering with academic research institutions to accelerate KPv peptide development. Venture capital funding in peptide therapeutics reached record highs in 2025–2026, with several startups focusing on KPv analogs entering clinical development. Collaborations between peptide manufacturers and delivery technology firms are also common, aiming to bring next-generation KPv formulations to market. -

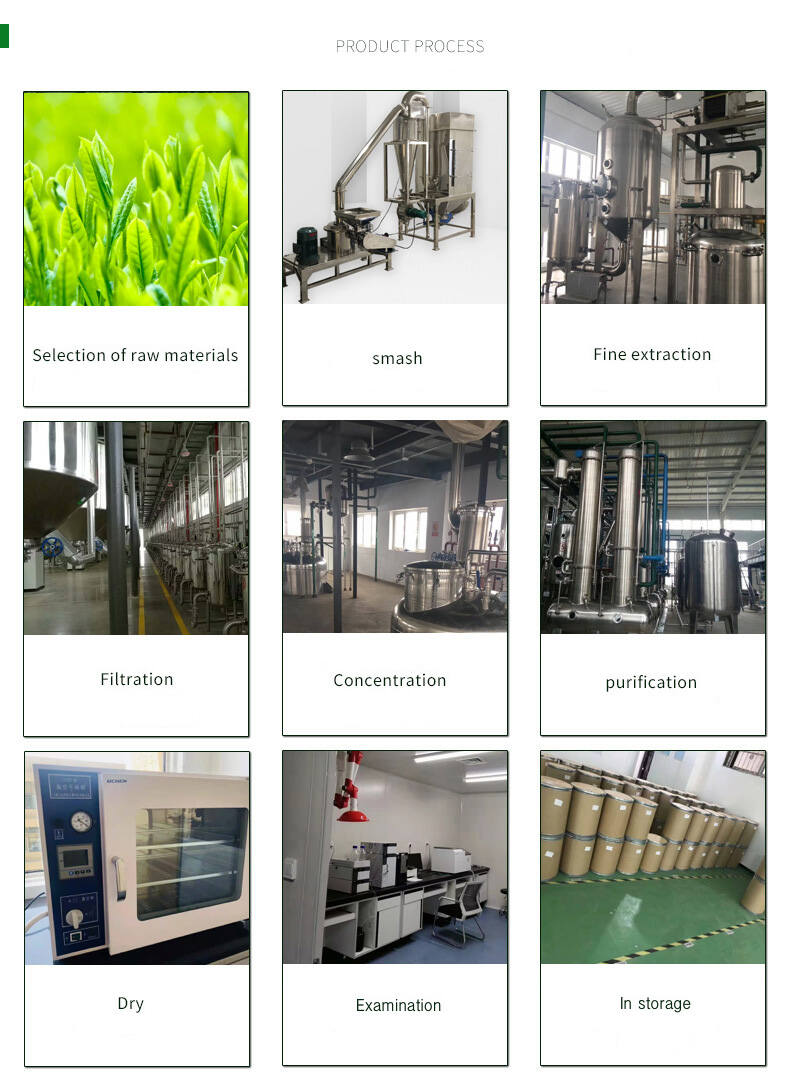

Sustainability and Ethical Sourcing

There is a growing emphasis on sustainable peptide production. In 2026, manufacturers are adopting greener synthesis methods, reducing solvent waste, and using recombinant expression systems to produce KPv peptides more ethically and at scale. This aligns with consumer and investor demands for environmentally responsible biopharmaceutical practices.

Conclusion

By 2026, KPv peptides are positioned at the forefront of innovation in both therapeutic and consumer health markets. Their versatility, combined with technological advances in formulation and delivery, is driving strong market growth. Continued clinical validation and regulatory support are expected to further solidify their role in treating chronic inflammatory conditions and enhancing skin health, making KPv peptides a key segment within the broader peptide therapeutics landscape.

Common Pitfalls When Sourcing KPv Peptides: Quality and Intellectual Property Concerns

Sourcing KPv (Lys-Pro-Val) peptides, particularly for research or therapeutic development, presents several critical challenges. Overlooking these pitfalls can compromise experimental outcomes, regulatory compliance, and commercial viability. Two major areas of concern are peptide quality and intellectual property (IP) risks.

Quality-Related Pitfalls

Ensuring the purity, identity, and stability of KPv peptides is paramount. Common quality issues include:

-

Insufficient Purity Levels: KPv peptides sourced from low-tier suppliers may contain significant impurities such as truncated sequences, deletion peptides, or residual solvents. Without high-performance liquid chromatography (HPLC) validation confirming ≥95% purity, biological activity and reproducibility can be severely compromised.

-

Lack of Comprehensive Characterization: Reputable suppliers should provide full analytical data, including mass spectrometry (MS) for identity confirmation, HPLC for purity, and potentially NMR for structural verification. Omitting these data increases the risk of working with incorrect or degraded material.

-

Inadequate Handling and Storage: KPv peptides are susceptible to degradation from moisture, light, and temperature fluctuations. Suppliers who do not provide lyophilized peptides under inert conditions or fail to specify proper storage (e.g., -20°C, desiccated) may deliver compromised products.

-

Batch-to-Batch Variability: Inconsistent synthesis and purification processes can lead to variable peptide quality across different lots, undermining long-term research reproducibility and scalability.

Intellectual Property (IP) Risks

Neglecting IP considerations when sourcing KPv peptides can lead to legal challenges and commercial roadblocks:

-

Infringement of Patented Sequences or Uses: While KPv itself is a naturally occurring tripeptide, specific formulations, delivery methods, or therapeutic applications may be protected by patents. Sourcing peptides for commercial development without conducting a freedom-to-operate (FTO) analysis risks infringing third-party IP.

-

Unclear IP Ownership from CROs or Suppliers: When peptides are custom-synthesized by a contract research organization (CRO) or vendor, the transfer of IP rights—especially regarding modifications or process innovations—may not be clearly defined in the service agreement, potentially limiting future use or patentability.

-

Use of Proprietary Synthesis Methods: Some suppliers may employ patented peptide synthesis or purification technologies. Unknowingly using such services could expose the buyer to indirect infringement claims, even if the peptide sequence itself is unpatented.

-

Publication and Disclosure Risks: Early sourcing or collaboration without appropriate confidentiality agreements (CDAs) can lead to premature public disclosure, jeopardizing the ability to file patents on novel KPv-based inventions.

To mitigate these risks, researchers and developers should source KPv peptides only from reputable suppliers with transparent quality control practices and engage legal counsel early to conduct thorough IP due diligence.

Logistics & Compliance Guide for KPV Peptides

Overview of KPV Peptides

KPV (Lysine-Proline-Valine) is a tripeptide fragment derived from α-melanocyte-stimulating hormone (α-MSH) with demonstrated anti-inflammatory and wound-healing properties. Due to its research-focused applications, handling, transporting, and storing KPV peptides require strict adherence to regulatory and logistical best practices to ensure safety, efficacy, and legal compliance.

Regulatory Classification

KPV peptides are generally classified as research chemicals or investigational compounds, not approved for human or veterinary therapeutic use by regulatory bodies such as the FDA, EMA, or MHRA. They are not listed as controlled substances under the Controlled Substances Act (CSA), but their sale and distribution are restricted to laboratory and research settings only. Suppliers must ensure compliance with local and international regulations governing peptide substances.

Storage Requirements

KPV peptides should be stored under controlled conditions to maintain stability:

– Temperature: Store lyophilized KPV at -20°C in a dry, airtight container.

– Humidity: Maintain low humidity to prevent hydrolysis.

– Light Exposure: Protect from light by using amber vials or storing in dark containers.

– Reconstituted Solutions: If reconstituted, store at 2–8°C and use within 7–14 days; longer storage may require freezing at -20°C with sterile buffers.

Packaging and Labeling

All shipments must follow Good Distribution Practices (GDP):

– Primary Packaging: Use sterile, inert vials with secure seals.

– Secondary Packaging: Include temperature-monitoring devices (e.g., cold chain indicators) when required.

– Labeling: Clearly mark containers with:

– Product name (e.g., “KPV Peptide – For Research Use Only”)

– Batch/lot number

– Expiry date

– Storage conditions

– Hazard warnings (if applicable)

– Supplier contact information

Shipping and Transportation

- Domestic Shipments: Use validated cold or ambient shipping methods depending on formulation. Ensure tracking and delivery confirmation.

- International Shipments: Comply with IATA Dangerous Goods Regulations if applicable. Most KPV peptides are non-hazardous but must be declared accurately on customs forms. Include a Certificate of Analysis (CoA) and Material Safety Data Sheet (MSDS/SDS).

- Export Controls: Verify compliance with export laws (e.g., U.S. Department of Commerce, EAR). Some peptide sequences may be subject to biological research export restrictions.

Documentation and Traceability

Maintain comprehensive records for regulatory audits:

– Certificate of Analysis (CoA) for each batch

– Batch production records

– Shipping manifests with chain-of-custody tracking

– Customer acknowledgments confirming research-use-only status

– Regulatory compliance declarations (e.g., REACH, RoHS if applicable)

Import Compliance

Importers must:

– Confirm local regulatory status of KPV in the destination country

– Obtain necessary import permits or notifications

– Provide accurate HS (Harmonized System) codes (e.g., 2937.22 for synthetic polypeptides)

– Ensure customs declarations reflect “For Research Use Only – Not for Human Use”

Quality Assurance and Audits

- Conduct regular internal audits of storage, labeling, and shipping procedures

- Source peptides from ISO 9001 or GMP-compliant manufacturers

- Perform stability testing to validate shelf life claims

- Implement corrective and preventive action (CAPA) systems for compliance deviations

Restricted Jurisdictions

Exercise caution when shipping to regions with strict peptide regulations (e.g., Australia, Canada, parts of the EU). Always verify local guidelines and consider legal consultation when expanding distribution.

Conclusion

Proper logistics and compliance management are essential for the responsible distribution of KPV peptides. Adherence to storage protocols, accurate documentation, and regulatory awareness ensures product integrity and minimizes legal risk. All stakeholders must uphold the principle that KPV peptides are strictly for non-clinical research applications.

Conclusion on Sourcing KPV Peptides

Sourcing KPV peptides (Lys-Pro-Val), a naturally occurring tripeptide with demonstrated anti-inflammatory and potential therapeutic properties, requires careful consideration of several key factors. Due to their increasing interest in research related to dermatology, gastroenterology, and immunomodulation, ensuring high purity, authenticity, and quality is paramount.

Reliable sourcing begins with selecting reputable suppliers who adhere to Good Manufacturing Practices (GMP), provide Certificates of Analysis (CoA), and offer transparent information about peptide purity (typically ≥95% for research use). It is essential to verify synthesis methods (e.g., solid-phase peptide synthesis), proper lyophilization, and endotoxin testing, particularly for in vivo or preclinical applications.

Additionally, researchers and developers must remain mindful of regulatory guidelines, as KPV peptides may fall under specific controls depending on jurisdiction and intended use. While generally recognized as safe in research contexts, proper handling, storage (e.g., -20°C, desiccated), and solubility testing are critical for maintaining peptide stability and efficacy.

In conclusion, successful sourcing of KPV peptides involves balancing quality assurance, regulatory compliance, and supplier credibility. Due diligence in vetting vendors and understanding product specifications ensures reliable results in both research and potential future therapeutic development.